How much does an average child cost per year

The Cost of Raising a Child

Posted by Mark Lino, Economist at the Center for Nutrition Policy and Promotion in Food and Nutrition

Feb 18, 2020

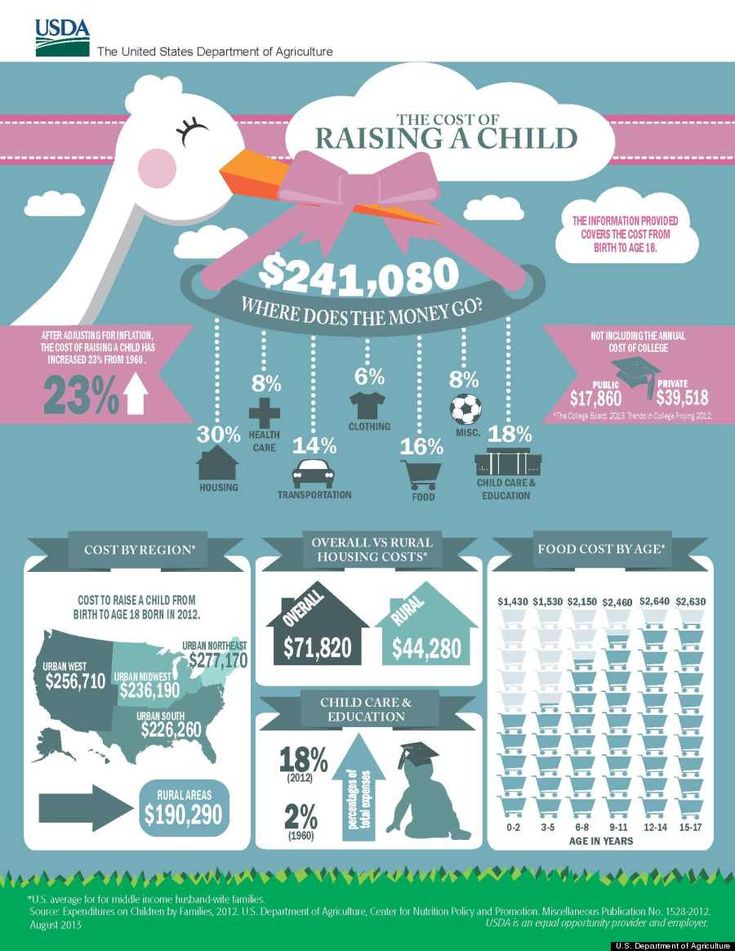

Families Projected to Spend an Average of $233,610 Raising a Child Born in 2015.USDA recently issued Expenditures on Children by Families, 2015. This report is also known as “The Cost of Raising a Child.” USDA has been tracking the cost of raising a child since 1960 and this analysis examines expenses by age of child, household income, budgetary component, and region of the country.

Based on the most recent data from the Consumer Expenditures Survey, in 2015, a family will spend approximately $12,980 annually per child in a middle-income ($59,200-$107,400), two-child, married-couple family. Middle-income, married-couple parents of a child born in 2015 may expect to spend $233,610 ($284,570 if projected inflation costs are factored in*) for food, shelter, and other necessities to raise a child through age 17. This does not include the cost of a college education.

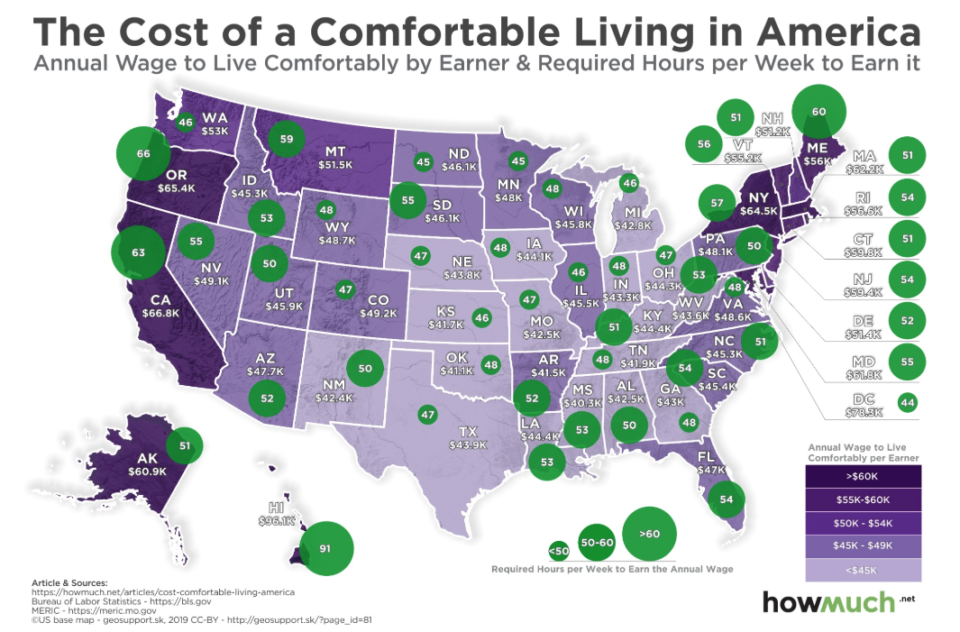

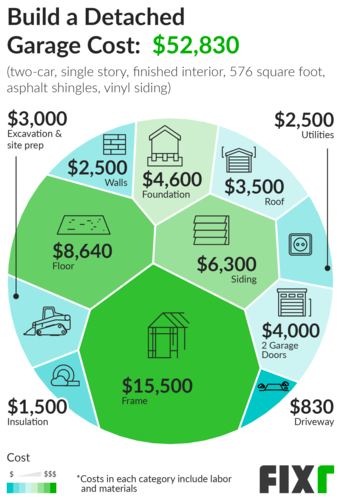

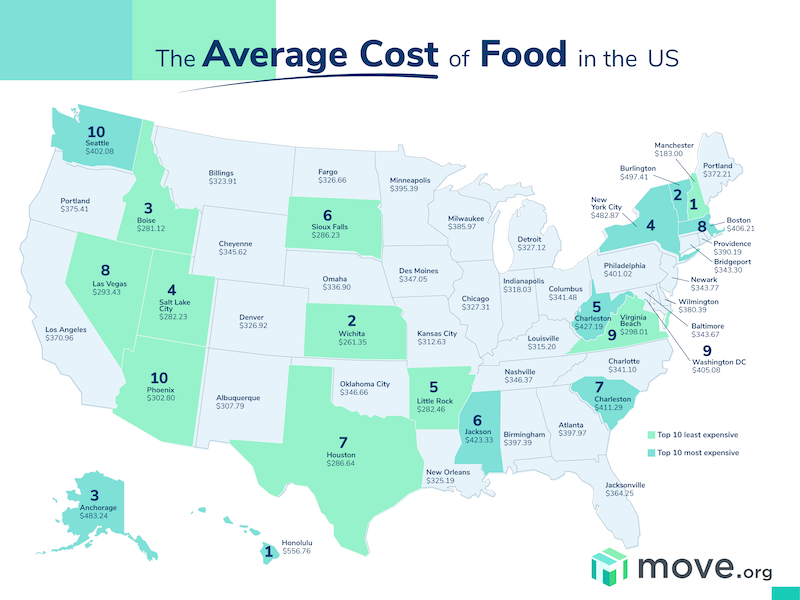

Where does the money go? For a middle-income family, housing accounts for the largest share at 29% of total child-rearing costs. Food is second at 18%, and child care/education (for those with the expense) is third at 16%. Expenses vary depending on the age of the child.

As families often need more room to accommodate children, housing is the largest expense.We did the analysis by household income level, age of the child, and region of residence. Not surprising, the higher a family’s income the more was spent on a child, particularly for child care/education and miscellaneous expenses.

Expenses also increase as a child ages. Overall annual expenses averaged about $300 less for children from birth to 2 years old, and averaged $900 more for teenagers between 15-17 years of age. Teenagers have higher food costs as well as higher transportation costs as these are the years they start to drive so insurance is included or a maybe a second car is purchased for them.

Teenagers have higher food costs as well as higher transportation costs as these are the years they start to drive so insurance is included or a maybe a second car is purchased for them.

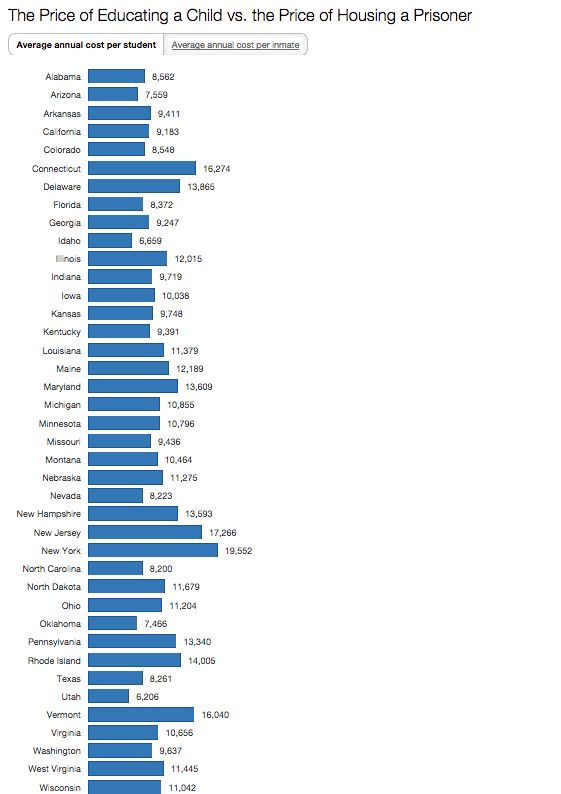

Regional variation was also observed. Families in the urban Northeast spent the most on a child, followed by families in the urban West, urban South, and urban Midwest. Families in rural areas throughout the country spent the least on a child—child-rearing expenses were 27% lower in rural areas than the urban Northeast, primarily due to lower housing and child care/education expenses.

Child-rearing expenses are subject to economies of scale. That is, with each additional child, expenses on each declines. For married-couple families with one child, expenses averaged 27% more per child than expenses in a two-child family. For families with three or more children, per child expenses averaged 24% less on each child than on a child in a two-child family. This is sometimes referred to as the “cheaper by the dozen” effect. Each additional child costs less because children can share a bedroom; a family can buy food in larger, more economical quantities; clothing and toys can be handed down; and older children can often babysit younger ones.

Each additional child costs less because children can share a bedroom; a family can buy food in larger, more economical quantities; clothing and toys can be handed down; and older children can often babysit younger ones.

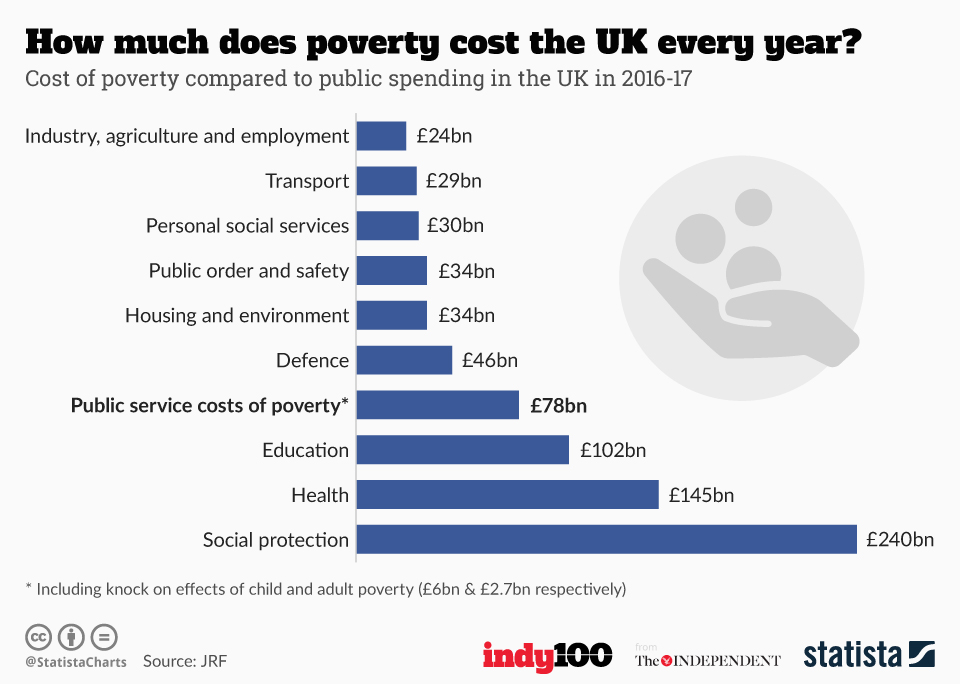

This report is one of many ways that USDA works to support American families through our programs and work. It outlines typical spending by families from across the country, and is used in a number of ways to help support and education American families. Courts and state governments use this data to inform their decisions about child support guidelines and foster care payments. Financial planners use the information to provide advice to their clients, and families can access our Cost of Raising a Child calculator, which we update with every report on our website, to look at spending patterns for families similar to theirs. This Calculator is one of many tools available on MyMoney. gov, a government research and data clearinghouse related to financial education.

gov, a government research and data clearinghouse related to financial education.

This year we released the report at a time when families are thinking about their plans for the New Year. We’ve been focusing on nutrition-related New Year’s resolutions – or what we are referring to as Real Solutions - on our MyPlate website, ChooseMyPlate.gov. This report and the updated calculator can help families as they focus on financial health resolutions. This report will provide families with a greater awareness of the expenses they are likely to face while raising children.

In addition to the report and the calculator, we also have a dedicated section on ChooseMyPlate.gov that provides tips and tools to aid families and individuals in making healthy choices while staying on a budget. For strategies beyond food, our friends at MyMoney.gov offer a wealth of information to help Americans plan for their financial future.

For more information on the Annual Report on Expenditures on Children by Families, also known as the cost of raising a child, go to: www. fns.usda.gov/resource/expenditures-children-families-reports-all-years.

fns.usda.gov/resource/expenditures-children-families-reports-all-years.

*Projected inflationary costs are estimated to average 2.2 percent per year. This estimate is calculated by averaging the rate of inflation over the past 20 years.

Editor’s Note (March 8, 2017): The comparison of rural vs. urban northeast child care and education value has been updated.

Visit the U.S. Department of the Treasury’s MyMoney.gov for more resources to ensure financial well-being this New Year’s season!Category/Topic: Food and Nutrition

Tags: children choosemyplate. gov CNPP Cost of Raising a Child economics Expenditures on Children by Families Food and Nutrition mymoney.gov MyPlate Research

gov CNPP Cost of Raising a Child economics Expenditures on Children by Families Food and Nutrition mymoney.gov MyPlate Research

How much does it cost to raise a child?

The average cost of raising a child from birth to age 17 has increased by 16% since 1960 — when data was first collected. In 1960, the average total expenditures on a child in a middle-income, married-couple family was $202,020, adjusted for inflation. By 2015 — the latest data available on child-rearing costs — these estimated expenditures increased to $233,610.

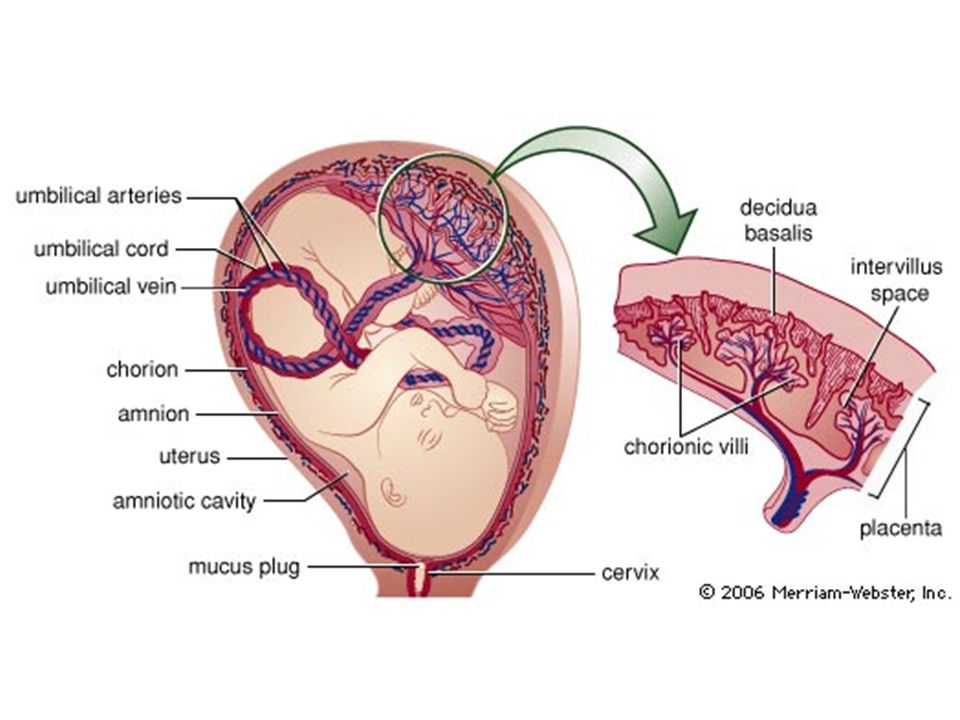

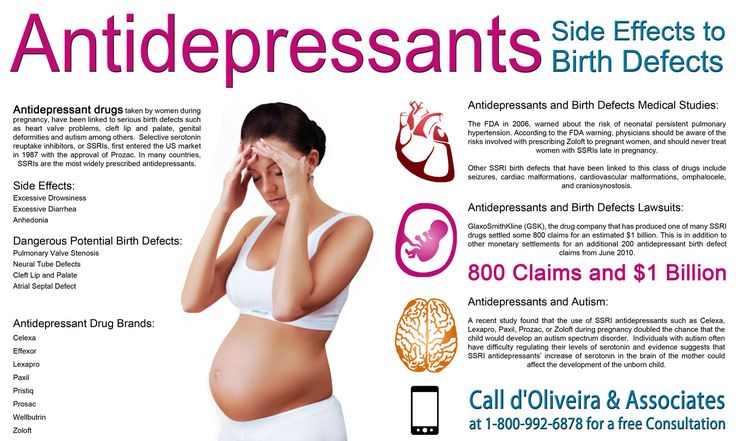

But childbirth costs alone have steadily increased over the last two decades. In 2019 — the most recent data available — hospitals in the US charged[1] patients an average of $22,876 for birthing procedures. That is more than three times what was charged in 2000 ($6,340), according to data from The Department of Health and Human services. While this is what a hospital bills for the stay, how much of that is paid by the family depends on what kind of insurance they have, among other factors.

That is more than three times what was charged in 2000 ($6,340), according to data from The Department of Health and Human services. While this is what a hospital bills for the stay, how much of that is paid by the family depends on what kind of insurance they have, among other factors.

Hospitals charged three times more for childbirth procedures in 2019 than in 2000.

Embed on your website

Copy

According to data from the US Department of Agriculture (USDA), a child born in 2015 to a middle-income family costs approximately $12,980 to $13,900 annually[2] (depending on the age of the child). Inflation adjustments boost those costs by 23% in 2022, ranging from $16,007 to $17,141 per child.

The USDA publishes a report on child expenditures by family, reporting expenses by age of child, household income, family budgets, and region of the country. Its latest report analyzes data from 2015 and prior.

Where do child-raising costs go?For a middle-income family, housing accounts for the largest share of child costs at 29%. Food is the second largest cost to raise children at 18%. Childcare and education is the third largest expense at 16%.

Food is the second largest cost to raise children at 18%. Childcare and education is the third largest expense at 16%.

Embed on your website

Copy

According to USDA, housing costs include any form of shelter (mortgage payments, property taxes, rent, or insurance), utilities (gas, electricity, fuel, cellphone, and water), and house furnishings and equipment.

Transportation expenses include vehicle payments, down payments, gas expenses, maintenance and repairs, insurance, and public transportation costs.

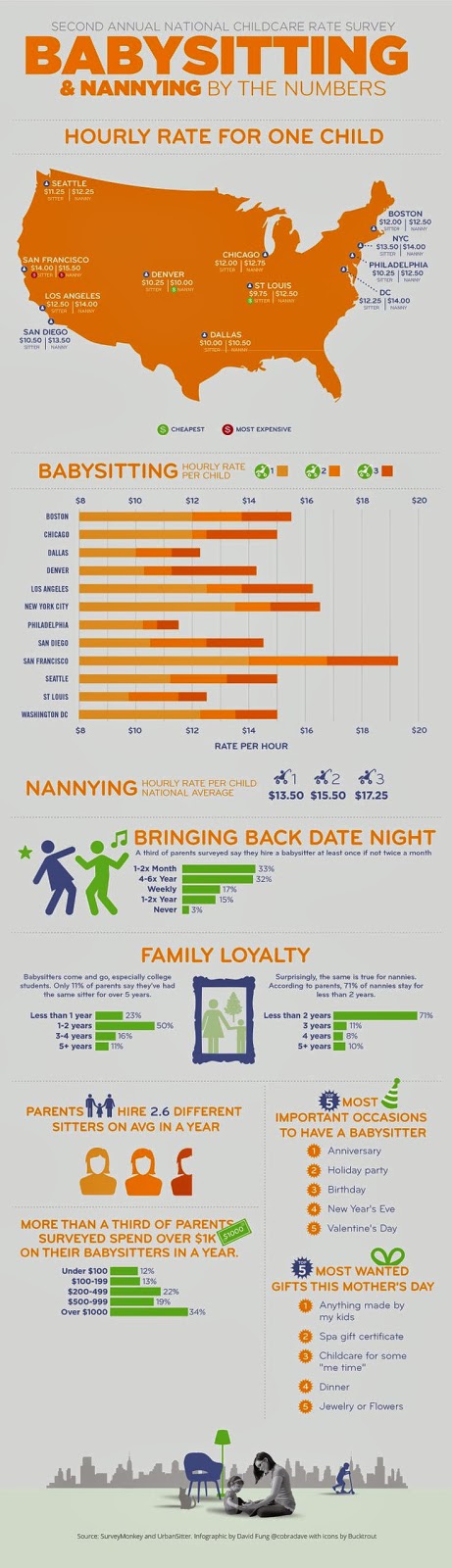

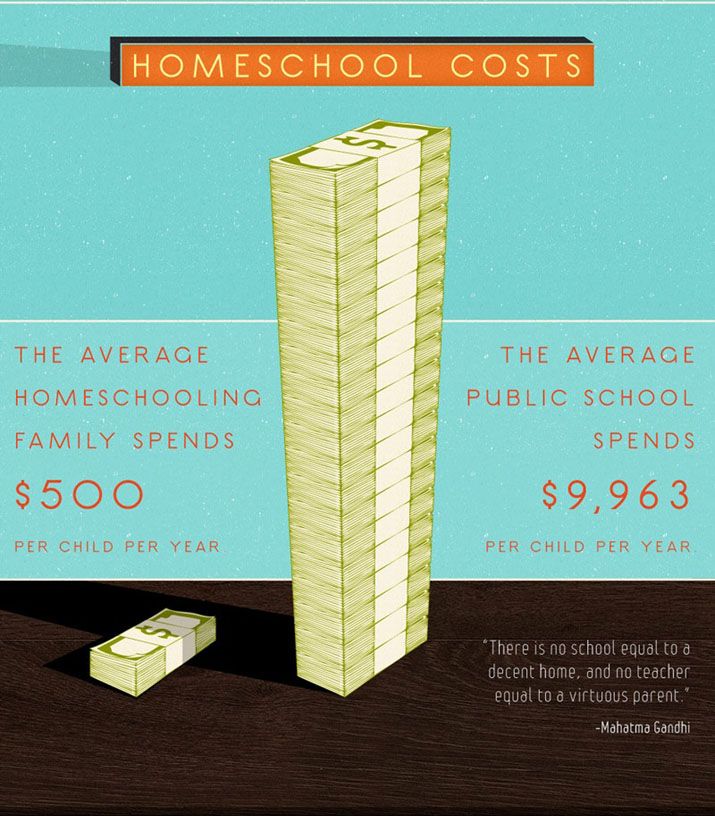

Childcare and education expenses include day care tuition, other forms of childcare such as babysitting costs, and elementary and high school tuition for private schools. One of the largest excluded expenses is the cost of a college education. According to the National Center for Education Statistics in 2020 annual average undergraduate tuition was $25,281, adjusted for inflation.

Raising children in the US has changed in many ways since 1960. For example, back then, childcare costs were mostly for in-the-home babysitting. But as more women joined the labor force, demand for outside care increased. Childcare and education went from 2% of the cost to raise children in 1960 to 16% in 2015, the biggest increase of any expense category.

For example, back then, childcare costs were mostly for in-the-home babysitting. But as more women joined the labor force, demand for outside care increased. Childcare and education went from 2% of the cost to raise children in 1960 to 16% in 2015, the biggest increase of any expense category.

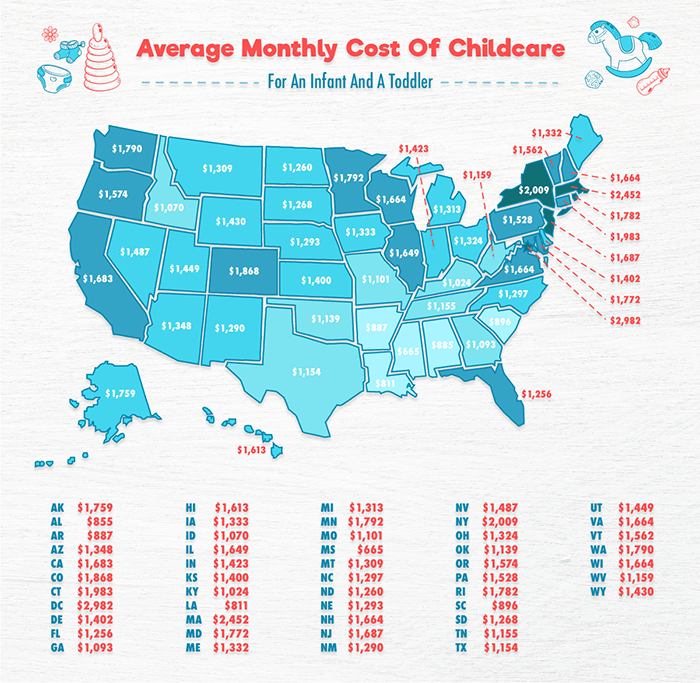

The costs of childcare kept going up in more recent years as well. According to Census Bureau data, family childcare costs increased 25% between 2015 and 2020. And low-income families were more likely to be cost-burdened by childcare expenses.

Families spend more money on raising children as household income goes up.The USDA reports child costs by the lower, middle, and upper thirds of the income distribution. As household income rises, so does the average amount spent on raising children.

For example, families that make less than $59,200 a year in a married-couple, two-child household, spend a range of $9,330 to $9,980 per child.

Families making more than $107,400 spend more than twice that amount per child.

Costs to raise a child increase as age increasesNo matter what a household’s income is, child-rearing costs shift depending on the age of the children.

Early in life, childcare expenses are a larger share of the costs. Childcare and education expenses were generally highest for children 6 and younger due to the cost of preschool and private daycare.

As children reach school age, childcare costs go down, but food, healthcare and clothing costs trend upwards

And once children reach their teenage years the cost equation shifts again. Transportation expenses were highest for children aged 15-17. Because teenagers are beginning to drive, transportation expenses such as insurance and vehicle purchases can affect the costs of raising a child for some families.

Overall annual expenses averaged about $300 less for children from birth to 2 years old and averaged $900 more for teenagers between 15 and 17 years old.

Families in the Northeast spend more on child-rearing costsFamilies in the urban Northeast spent the most on children, followed by families in the urban West. Child costs for families in rural areas throughout the country were 27% lower than the urban Northeast, primarily due to lower costs of living for categories such as housing and childcare expenses.

To learn more about the costs of raising a child, see how much are families spending on childcare at USAFacts.org.

Sources & Footnotes

US Department of Agriculture

Expenditure on children by families

Last updated

- [1]

According to the Department of Health and Human services, costs tend to reflect the actual costs of production, whereas charges represent what the hospital billed for the stay.

Total charges were converted to costs using cost-to-charge ratios based on hospital accounting reports from the Centers for Medicare and Medicaid Services (CMS).

Total charges were converted to costs using cost-to-charge ratios based on hospital accounting reports from the Centers for Medicare and Medicaid Services (CMS).- [2]

The annual cost per child is estimated for a middle-income ($59,200-$107,400), two-child, married-couple family.

Share On

Explore more of USAFacts

Related Articles

View AllHow much child support do parents actually receive?

How much are families spending on childcare?

Who does the child tax credit benefit the most?

Related Data

View AllBirths per 1,000 people

10.97

2020

Explore the data

People covered by public or private health insurance

297.68 million

2020

Explore the data

Children under 18

73.54 million

2021

Explore the data

Newsletter

Data delivered to your inbox

Keep up with the latest data and most popular content.

SEB survey: how much does it cost to raise one child

40 per cent. of interviewed parents, who calculated how much it costs to support a child under 18, indicated that the amount ranges from 3,000 to 5,000 euros per year. Another 13 percent indicated that the costs amounted to more than 5,000 euros per year. With monthly expenses of 500 euros or more for 18 years, an amount of more than 100,000 euros is generated, SEB said in a statement.

True, if the child attends a private school, these amounts can increase significantly. A year of education in a private school costs an average of about 6,000 euros per year. And this is without taking into account school meals, which average 5.5-6.5 euros per day, additional paid circles, expenses for excursions, etc. In this case, the amount for raising a child can reach 200 thousand euros.

These expenses increase every year due to inflation. Especially they jumped this year. According to the Department of Statistics in July, the prices of almost all goods and services related to the upbringing of children increased: school meals (17 percent), stationery (14 percent), recreation and culture services, mugs (11 percent), books (5. 9 percent), shoes (3.9 percent), clothes (0.9 percent). Many parents have already felt this when in September the children returned to educational institutions and circles.

9 percent), shoes (3.9 percent), clothes (0.9 percent). Many parents have already felt this when in September the children returned to educational institutions and circles.

If the family has not one, but two or more children, the costs will be even higher. True, it’s not worth multiplying by two, because raising a second or third child usually costs parents less than the first - and because of the necessary things already available, clothes, furniture that can be reused, and because of the increase in benefits, discounts.

Mugs are an investment in future abilities

Mugs, whose prices have increased by at least one tenth, according to statistics, are an important part of raising a child. According to the study, half of the parents send their children to one paid circle, a quarter - to two paid circles, and only 7 percent. three of those surveyed. Almost a fifth say they cannot afford to send their children to children's clubs.

"Although education should not be saved, as it is one of the most important areas to invest in when thinking about the future of the child, circles, especially paid ones, should be chosen responsibly so that they not only do not create a financial burden, but also in fact in fact, were related to the child's abilities that you want to develop and which will be useful in the future, "says S. Strotskite-Varne.

Strotskite-Varne.

In addition to clubs, don't forget about additional expenses for concerts, performances, special equipment or clothing, etc.

Food to school from home is still rare

On average, a student spends about 3 euros a day on food at school. However, lately a lunch for one child has risen in price by about 30 percent due to rising food prices. and reaches up to 4 euros (the specific cost of lunch, of course, depends on the school and the dish chosen). Therefore, for a family, meals for a child cost about 60-70 euros per month. If a child stays at school all day and eats several times, expenses can increase by a third.

Half of the parents surveyed say that their children always buy food at school, a third say they occasionally bring food from home, and only 13 percent. always wears his food.

Children are indifferent to fashion - let's use it

Although according to statistics, the prices of clothes and shoes have increased relatively the least, children grow up very quickly, so spending on their clothes and shoes always makes up a large part of the family budget.

More than half of the parents surveyed say they need to update their children's wardrobe every month, a third say they make such purchases three to four times a year, but in this case they spend more money.

Clothing is one of those categories on which we often spend more than we should. According to the study "Household Budget 2021" published by the Department of Statistics, a statistical family of four spends about 104 euros per month on clothes and shoes, and the amount of clothes thrown into textile containers reaches about 1,800 tons in Vilnius alone.

"Young children often don't care what they look like, whether they're wearing new clothes or second-hand clothes, which in many cases can cost five or even ten times less than new," says the SEB expert.

By saving money in this area, we could spend more money on clubs and education, which can have a much greater impact on a child's future than just another new sweater or blouse, emphasizes S. Strockite-Varne.

Commissioned by SEB Bank, the study was conducted by Norstat. In August of this year, 300 parents raising children aged 7-17 (inclusive) were surveyed throughout Lithuania.

Costs per child in the first year of life

What is the cost of the first year of a child's life

Even when preparing for a joyful event, you will have to spend money on clothes for the expectant mother and the necessary "dowry" for the baby in the first months of life.

Clothing and footwear

You should buy clothes in advance: sliders, bodysuits, undershirts, blouses, socks. Do not forget about warm clothes: the child needs warm overalls, hats and booties. Around the age of 11-12 months, it will be time to choose the first shoes.

Furniture

When planning the cost of money for a child in the first year of life, do not forget about furniture. Buy a crib with an orthopedic mattress and a set of linen. A changing chest or board will help to remove the extra load from the back of a young mother. A high chair makes life much easier, but it will come in handy from about six months. This purchase can be postponed a little, but it is not worth saving on it.

A high chair makes life much easier, but it will come in handy from about six months. This purchase can be postponed a little, but it is not worth saving on it.

Stroller and car seat

To ensure the comfort of your child on a walk, be careful when choosing a stroller. Modern 2 in 1 models combine a bassinet and seat unit, and a car seat has also been added to the 3 in 1 set. Please note that it is not allowed to transport children in a car without a restraint, so a car seat is a mandatory purchase. You can buy it separately or together with the stroller, but don't skimp on safety.

Care and hygiene

For a newborn, you will need to purchase an impressive list of hygiene products: diapers, wet wipes, powders, creams and ointments, bathing foam and baby soap. For bathing, you will need a baby bath and a special water thermometer.

Nutrition

When you calculate how much money you need for a child under 1 year old, do not forget to take into account the cost of baby food. Breastfeeding your baby can help save money.

Breastfeeding your baby can help save money.

Starting from six months, complementary foods in the form of cereals and mashed potatoes are introduced into the diet. Since it is optimal to feed with special baby purees of industrial production, this will become a separate item of expenditure for a child.

Toys

Do not rush to buy expensive mechanized toys or a children's play center - a newborn will do without them. However, it should still be borne in mind that several bright comfortable rattles will be needed already in the first half of the year - by about the fourth or fifth months of the baby's life.

How to budget for a baby in the first year of life

Use common sense. Choose quality products, but do not overpay. On the Internet, it is easy to find a calculator in which you can select expense items at your discretion. The cost calculator for a child in the first year of life will help you calculate how much you will spend on a child. If you are just planning a pregnancy, start saving money for upcoming expenses in advance.

How you can save money

Saving money smartly will help reduce the cost of a child in the first year of life.

- Some things can be bought from advertisements or "wear" for acquaintances, of course, subject to hygienic safety measures.

- If you think over your purchases in advance, you can save a lot by buying on sales.

- Do not buy a lot of clothes and shoes. Toddlers grow up fast and don't have time to try on the whole wardrobe.

- Plan your budget. Make a list of everything you need in advance and gradually enter the prices in the table.

- Shop while pregnant. At this stage, you can pick up things with pleasure and leisurely. Moreover, purchases cheer up, and this is so important for a future mother. It is possible that after the birth of the baby there will be no time for a thoughtful choice.

- Make a list of things your baby needs. Relatives and friends who want to make a useful present for you or a child will be happy to choose something from your wish list.