How long can a child collect social security benefits

Parents and Guardians | SSA

With you through life’s journey...

The makeup of American families has changed in the last 20 to 30 years. Today, family units are diverse, rich in culture, and may include two parents, same-sex parents, only one parent, grandparents, and other relatives. Social Security knows that whether single parent, blended, diverse, small or large, every family is important.

For more than 80 years, Social Security has helped families secure today and tomorrow by providing financial benefits, tools, and programs that help support millions throughout life’s journey. Our programs and services have evolved to meet your unique family needs and especially the children in your care.

We are there from day one

Getting your child a Social Security number should be near the top of the list of things you need to do as a new parent or guardian. Your child's Social Security number is the first step in ensuring valuable protection for any benefits they may be eligible for in the future.

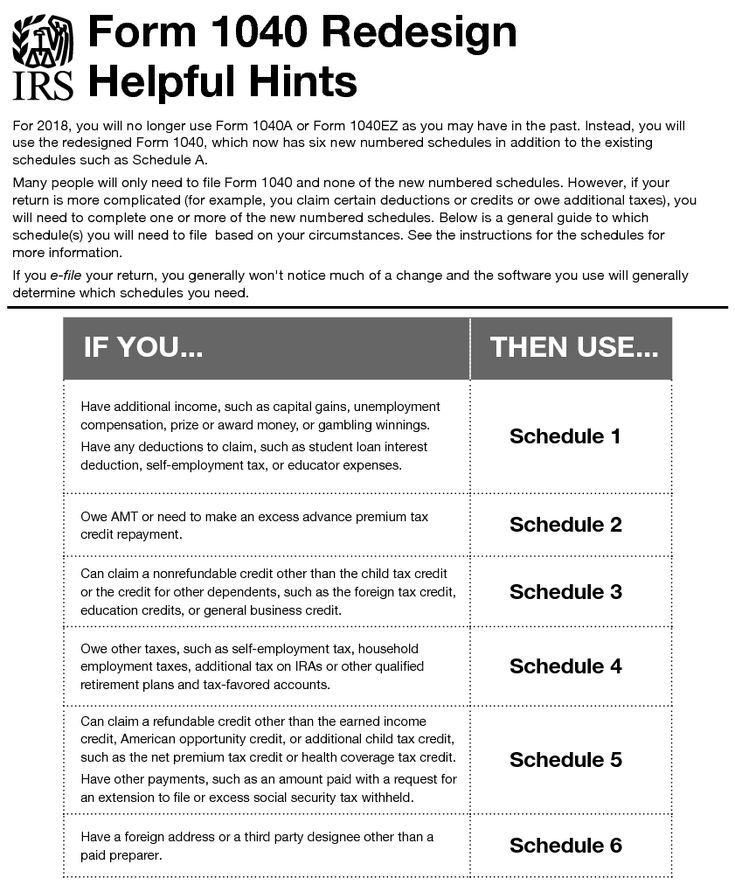

You’ll need your child’s Social Security number to claim them as a dependent on your income tax return or open a bank account in the child’s name and buy savings bonds. Your child’s Social Security number is also necessary to obtain medical coverage or apply for any kind of government services for your child.

Most people apply for their child’s Social Security number at birth, usually at the hospital. When the time comes for your child’s first job, the number is already in place. For more information on getting your child a Social Security number and card, check out Social Security Numbers for Children.

A fun bonus of assigning Social Security numbers at birth is that we know the most popular baby names, which we announce each year. On our website, you can find the top baby names for the last 100 years.

We’re there with support if you’re raising a grandchild…

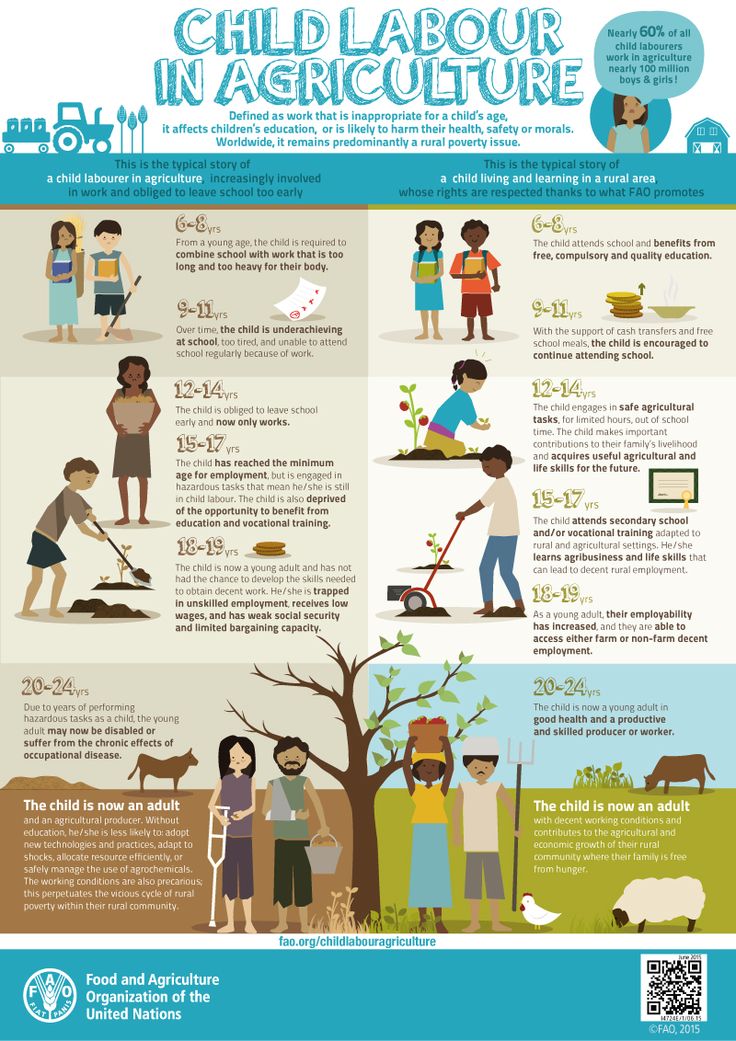

More and more grandparents are finding themselves raising their grandchildren. Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

Social Security will pay benefits to grandchildren when the grandparent retires, becomes disabled, or dies, if certain conditions are met. Generally, the biological parents of the child must be deceased or disabled, or the grandparent must legally adopt the grandchild.

To receive this benefit, your grandchild must have begun living with you before age 18 and received at least one half of his or her support from you for the year before the month you became entitled to retirement or disability insurance benefits, or died. Also, the natural parent(s) of the child must not be making regular contributions to his or her support.

If your grandchild was born during the one-year period, you must have lived with and provided at least one-half of the child's support for substantially the entire period from the date of birth to the month you became entitled to benefits.

Your grandchild may qualify for benefits under these circumstances, even if he or she is a step-grandchild. However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

However, if you and your spouse are already receiving benefits, you would need to adopt the child for them to qualify for benefits.

We’re there when they get their first job

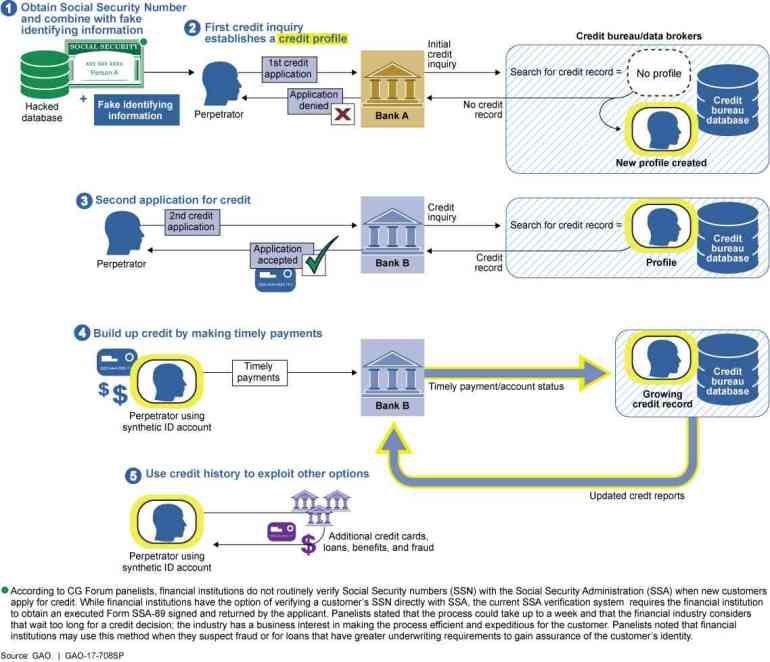

Once your child starts working and throughout their career, employers will verify their Social Security number to help reduce fraud and improve the accuracy of their earnings records.

Employers collect FICA, or Federal Insurance Contributions Act withholdings, and report earnings electronically. This is how we verify earnings and is how your child earns Social Security retirement, disability, and survivors coverage.

Once they turn 18, they can open a my Social Security account and watch their personal earnings and future benefits grow over time.

We’re there to help if disability strikes…

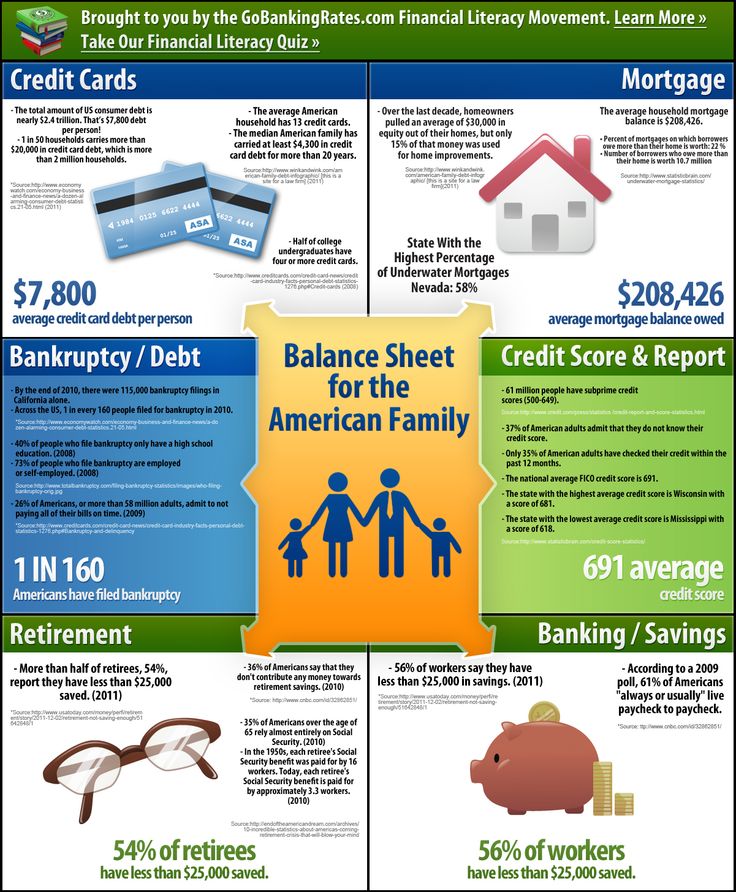

As a working parent, your earnings can become a source of Social Security protection for your family. If you retire or become disabled and unable to work, your earnings would be partially replaced by your monthly Social Security benefit payments.

A child who is disabled may depend on your help for a lifetime. When you start receiving Social Security retirement or disability benefits, your family members also may be eligible for payments. If you are a parent, caregiver, or representative of a child younger than age 18 who has a disability, your child may be eligible for Supplemental Security Income (SSI) payments. More information is provided in the Benefits for Children with Disabilities booklet.

For children 18 years or older who have been disabled before the age of 22 and continue to be disabled, Social Security benefits may be paid to them if you retire, become disabled, or die. Social Security benefits for disabled children may continue as long as they are unable to work because of their disability.

Additionally, you can find information on the specific benefits and qualifications in the Disability Benefits publication.

We’re there to provide comfort during difficult times…

The loss of a parent or guardian can be both emotionally and financially difficult. Social Security helps by providing benefits to help stabilize the family’s financial future. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits.

Social Security helps by providing benefits to help stabilize the family’s financial future. Widows, widowers, and their dependent children may be eligible for Social Security survivors benefits.

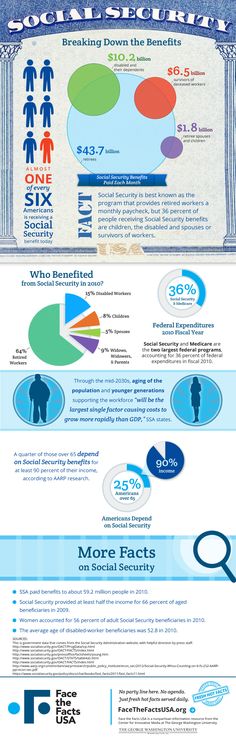

In fact, 98 of every 100 children could get benefits if a working parent dies. And Social Security pays more benefits to children than any other federal program.

Providing protection for parents too…

Even if you have never worked in a job covered by Social Security, as a parent, there are two ways that you may still qualify for benefits.

- If you are a parent and take care of your child who receives Social Security benefits and is under age 18, you can get benefits until your child reaches age 16. Your child's benefit will continue until he or she reaches age 18, or 19 if he or she is still in school full time. Your monthly payments stop with the child’s 16th birthday, unless your child is disabled and stays in your care.

- If you are a parent who receives most of your support from your adult child, and your child dies, Social Security also pays monthly benefits to you under the following conditions:

- You must be at least 62 years old and must not have remarried since the worker (your child)'s death

- You cannot be entitled to your own, higher Social Security benefit; and

- You must be able to show that you received one-half of your financial support from the worker at the time of their death. You must submit this proof of support to Social Security within two years of the worker's death.

We are there for those who need it most…

The Supplemental Security Income (SSI) program helps children with qualifying disabilities by providing critical financial assistance. Children and youth with specific medical conditions—whose families meet certain income and resource limits—can receive SSI from birth until age 18.

If you think your child or someone you know could be eligible for SSI, visit our webpage SSI Eligibility for Children to learn more and apply.

Assisting Youths with Disabilities Transition to Adulthood

The transition to adulthood is one of the most important periods in life’s journey. For foster children living with a disability, it can be even more challenging. Turning 18 triggers an important change in SSI benefits: Social Security must make a new determination on their SSI eligibility using the adult disability standards. About one-in-three such beneficiaries lose their SSI benefits.

For more information, please visit our spotlight page.

Social Security Children's Benefits: How They Work

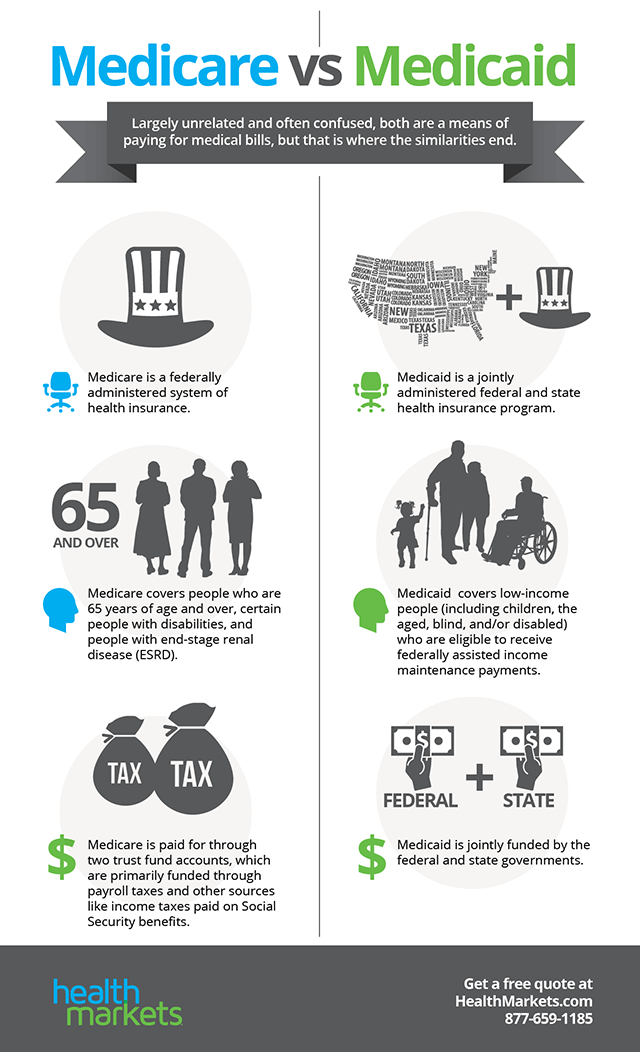

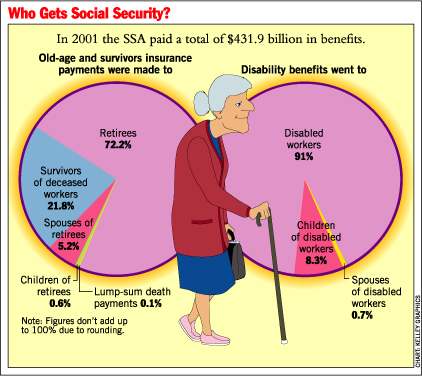

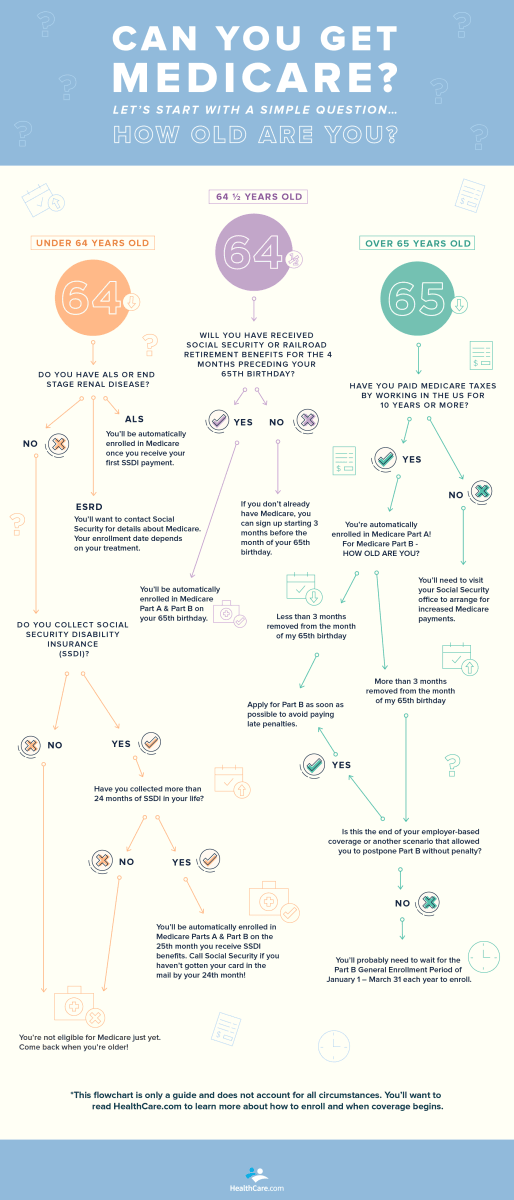

Social Security is usually associated with monthly payments to retirees. However, there is another important facet of Social Security benefits—providing financial assistance to children. Children may qualify for benefits if a parent is retired, disabled, or deceased.

Children who are disabled may be eligible for Supplemental Security Income (SSI), a separate program that's also run by the Social Security Administration (SSA). Here's the lowdown on who qualifies for what.

Key Takeaways

- Children may be eligible for Social Security payments based on a parent's work record.

- For a child to qualify, the parent must be retired, disabled, or deceased.

- Children who are disabled may be eligible for Supplemental Security Income, a separate program that's also run by the Social Security Administration.

- Children can receive survivor benefits until the age of 18 or 19 if still in primary or secondary school.

- The maximum family Social Security benefit ranges from 150% to 180% of the original payee's benefit.

How Children Qualify for Social Security Benefits

Eligible children can collect Social Security benefits based on a parent's work record. The parent must have earned enough Social Security credits. Biological or adopted children or stepchildren can be eligible for Social Security benefits if they meet the following criteria:

Biological or adopted children or stepchildren can be eligible for Social Security benefits if they meet the following criteria:

- Have a parent who is disabled or retired and eligible for Social Security benefits

- Are unmarried

- Are younger than 18 or are between ages 18 and 19 and are full-time high school students

- Are 18 or older and disabled (as long as the disability began before they turned age 22)

The requirements for Social Security survivor benefits are similar, except that the parent must be deceased for the child to qualify.

Grandchildren or step-grandchildren can sometimes collect survivor benefits under certain circumstances.

SSI Benefits for Children

Supplemental Security Income is a separate program for Americans with limited incomes and few other resources. Recipients must generally be 65 or older, blind, or disabled. But SSI is also available to children under age 18 in certain cases. To qualify for SSI benefits:

- The child must have a physical or mental impairment (or impairments) that results in marked and severe functional limitations.

- The impairment or impairments must have lasted or be expected to last for a continuous period of at least 12 months or be expected to result in death. In the case of blindness, that duration requirement doesn't apply.

- A child who isn't blind must not earn more than $1,350 per month. A child who is blind must not earn more than $2,260 per month.

Decisions for granting SSI can take time. However, if a child has qualifying conditions, the Social Security Administration may begin making payments while an application is under review.

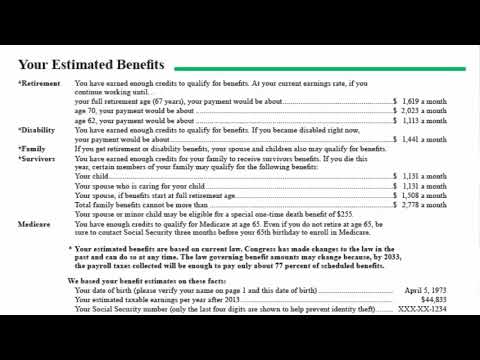

How Much Do Children Receive in Social Security Benefits?

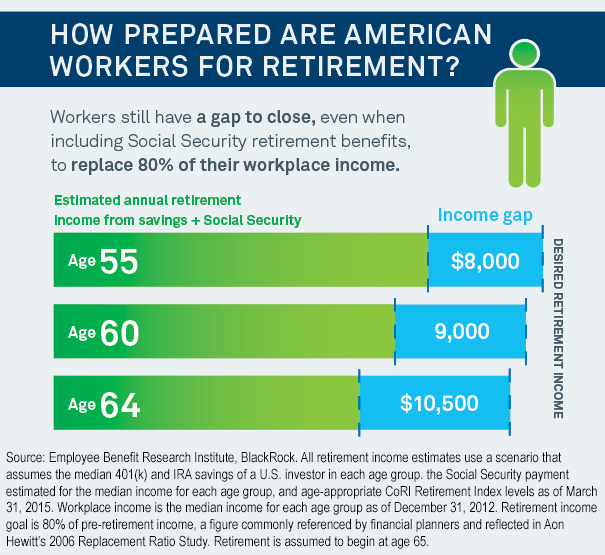

A child may receive a Social Security benefit equal to 50% of the parent’s full retirement benefit or disability benefit. If the parent is deceased, the child is eligible to receive up to 75% of the parent’s full retirement benefit.

There is a limit to the total amount that a family can receive from Social Security based on one worker's earnings record, though. The maximum family benefit typically ranges from 150% to 180% of the parent's full benefit amount. The formula for maximum family benefits is based on a retired parent's work record. If the parent is disabled, a different formula applies.

The maximum family benefit typically ranges from 150% to 180% of the parent's full benefit amount. The formula for maximum family benefits is based on a retired parent's work record. If the parent is disabled, a different formula applies.

$2.92 billion

The total average amount of monthly Social Security benefits paid to children as of 2022. Approximately 4.97 million children received benefits each month.

If the amount due to the entire family surpasses the maximum, some individual payments will be proportionately reduced. As an example, consider a retiree named June, who has a dependent child, Ruth, who is also eligible for benefits. June's full retirement amount is $1,500 per month, and her family maximum is $2,300 per month. June would receive her full $1,500, while her spouse, John, and daughter Ruth would split the remaining $800 payment, each receiving $400.

SSI benefits are determined by a different calculation, and the maximum benefit changes each year. Some states also supplement SSI. In addition, a disabled child who collects SSI may also be eligible for Medicaid to help pay for medical bills.

Some states also supplement SSI. In addition, a disabled child who collects SSI may also be eligible for Medicaid to help pay for medical bills.

How to Receive Benefits

You can apply for benefits by calling 800-772-1213 or by visiting your local Social Security office. Applications for children's benefits are not accepted online. However, you may apply online for SSI for children.

The family must present the child's birth certificate, the parents' Social Security numbers (SSNs), and the child's Social Security number. Additional documents may also be required. In relevant cases, the applicant must provide a parent's death certificate and/or evidence of disability from a doctor.

If you are taking care of a child and are receiving Social Security benefits for that reason, the child's benefits may stop at a different time from your own. For example, if your child is not disabled, your benefits will end when the child turns 16 years old. If the child is disabled and you are responsible for them, your benefits may continue. For these types of specific circumstances, it’s best to contact the Social Security Administration for guidance.

For these types of specific circumstances, it’s best to contact the Social Security Administration for guidance.

If your child is disabled, the Social Security Administration offers a Disability Starter Kit that can help you navigate the process of applying for benefits.

How Soon Can Survivor Benefits for Children Be Started?

To initiate survivor benefits for children, an application and supporting documentation must be supplied to the Social Security Administration. How quickly benefits begin depends on how long it takes the agency to determine eligibility and for the applicant to submit the required documentation. However, benefits cannot be paid for the month in which the recipient died.

How Do You Use Social Security Benefits for Children of Disabled Parents?

Social security benefits for children can be used to care for their basic needs and to cover their share of living expenses. For example, it can be used for food, school supplies, rent or mortgage, and utilities.

When Do Survivor Benefits End for the Parent With Children?

Survivor benefits for the surviving child's parent end when the child turns 16. However, if the child is disabled and remains in their care, the benefits may continue indefinitely.

Monthly allowance in connection with the birth and upbringing of a child (Unified allowance)

Living wages and family income

How to apply for a payment

To receive a payment, you need to apply through the State Services portal or contact the client service of the Social Fund of Russia at the place of residence or at the MFC. The Social Fund of Russia will independently request the necessary documents within the framework of interagency cooperation from the relevant authorities and organizations. It will be necessary to provide additional information only in certain life situations, when information about the life situation is not reflected in state information systems.

Pregnant women who have been sentenced to imprisonment can apply for a monthly allowance for a pregnant woman through the administration of a correctional institution or pre-trial detention center.

Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days.

Processing time

The decision to assign benefits is made within 10 working days from the date of registration of the application and receipt by the Social Fund of Russia of the necessary information from the organizations and documents of the applicant. If the payment is denied, a notification of this is sent within 1 business day.

The first transfer of funds occurs within 5 working days after the decision on the purpose of the payment is made. In the future, funds are transferred from the 1st to the 25th day of the month following the month for which the allowance is paid. At the same time, in the established law enforcement practice, funds are transferred on a single settlement day on the 3rd day of the month following the month for which the allowance was paid.

The deadline for making a decision on the application is extended by 20 working days if the Social Fund of Russia has not received information from organizations or documents confirming the right to payment.

How family needs are assessed

Transitional period

Questions and answers

What is the procedure for granting a single benefit? What documents and where do I need to send in order to receive payment?

To receive benefits, you need to submit an electronic application through the public services portal or contact the customer service of the Social Fund of Russia at the place of residence, you can also apply through the MFC.

The Fund will independently request the documents necessary for the assignment of benefits from the relevant authorities and organizations. You will need to provide additional information only in certain cases prescribed by law.

Do I need to apply for a single allowance for every child in the family?

All children in a family under the age of 17, who are planned to receive a single allowance, can be specified in one application.

Will the amount of maternity benefit be recalculated if it was granted before January 1, 2023?

There will be no recalculation of the previously assigned allowance for a pregnant woman in connection with the introduction of a single allowance from 01/01/2023.

Pregnant women who receive benefits under the old rules can apply and switch to a single benefit. If, after calculating the average per capita income of the family, the new payment turns out to be more profitable in terms of amount, they will be assigned a new allowance in an increased amount, that is, 75 or 100% of the regional subsistence minimum, taking into account the paid amounts of the previous allowance. In this case, the payment of the previous benefit will automatically stop.

Do I need to submit documents for pregnancy registration?

No, the Social Fund of Russia requests this information independently as part of the program of interagency cooperation. Confirmation may be needed if the required documents are not received by the Fund. In this case, a message with further instructions will be sent to your personal account at public services.

If a family is already receiving one of the child benefits and has applied for a single benefit, will the old benefits continue if denied?

Yes, if the unified allowance is not assigned, then previously assigned payments will be paid until the end of their assignment period.

Is it possible to receive a single allowance and a payment from maternity capital for children under 3 years old at the same time?

Yes. If a family with a child under 3 years old receives a single allowance, and at the same time the average per capita income of the family remains below 2 living wages, then such a family can apply for a payment from maternity capital.

If a child was born in 2023 and the family was denied a single allowance, will the payment from the maternity capital also not be paid?

If a family applies for the first time and does not fall under the criteria for paying a single allowance, then you can apply for a payment from maternity capital, which is assigned without a comprehensive means assessment to families with an average per capita income of no more than two living wages.

Can non-working parents receive child care allowance up to 1.5 years?

Non-working and non-full-time parents can receive child care allowance up to 1. 5 years under the old rules if the child was born before the end of 2022. For children born after January 1, 2023, benefits can only be provided according to the new rules, i.e. taking into account a comprehensive means assessment.

5 years under the old rules if the child was born before the end of 2022. For children born after January 1, 2023, benefits can only be provided according to the new rules, i.e. taking into account a comprehensive means assessment.

For what period is the family income calculated when assigning a single allowance?

For the single benefit, the billing period is the 12 months preceding the 1 month prior to the month of application. This means that if you apply for payment in January 2023, then income from December 2021 to November 2022 will be taken into account, and if in March 2023 - from February 2022 to January 2023.

Is a single allowance paid to those who do not receive maternity benefits?

Yes. A single allowance is assigned regardless of maternity payments.

Am I required to report changes in family composition and income to the Social Fund if they have occurred since the application was submitted?

No. Recipients of the unified allowance are not required to report to the Social Fund of Russia about changes in family composition or income levels during the period for which the unified allowance is assigned.

Our family lives in a house that was provided as social support to a large family. Do I have to provide documents that state this?

Yes. Supporting documents on the premises provided to the family as social support are submitted by the applicant. This is necessary for the correct determination of the property security of the family.

Before the decree, I worked. Will I continue to receive child care allowance until the age of 1.5?

Yes. The rules won't change. Such allowance will continue to be granted until the child reaches 1.5 years of age in the amount of 40% of the average earnings for the previous 2 years.

Before the decree, I did not work, can I get help for a child under 1.5 years old?

Yes, you can if your child was born before 1 January 2023. For children born from January 1, 2023, the allowance will be assigned taking into account a comprehensive needs assessment, i.e. taking into account income or objective reasons for their absence, as well as property.

Can working parents who already receive child care allowance up to 1.5 years old receive a single allowance?

Yes. If the monthly income per person in the family does not exceed the regional subsistence level per capita and the family passes the criteria for a comprehensive means assessment, a single allowance will be assigned.

Will the one-time allowance for the birth of a child continue in 2023?

Yes, the one-time allowance for the birth of a child remains. All families will continue to receive a one-time allowance at the birth of a child, regardless of their income and property.

I receive allowance for the first child up to 3 years old, in May 2023 the child will turn 2 years old. Will it be possible to apply for benefits under the old rules again?

Yes. If the family has already been assigned an allowance for the first child under 3 years old, then after January 1, 2023 you can choose whether to receive payment according to the previous rules or switch to a single allowance.

How will the "zero income rule" work if earnings were not all months of the billing period?

If the period during which there was no income due to objective reasons totals 10 or more months of the billing period, the decision to refuse to assign a single allowance is not taken.

What should I do if I make a mistake while filling out the application?

If you made a mistake when filling out the application, the Social Fund of Russia, without making a refusal, will return it to you for revision, which takes 5 working days.

How long does it take to receive payment after applying?

Consideration of the application takes 10 business days from the date of registration of the application. In some cases, the maximum period can be up to 30 working days.

Funds are paid out within 5 working days after the decision on granting benefits. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

If a payment is denied, a notice stating the reasons will be sent within 1 business day.

What should I do if I receive a refusal to assign a single allowance because of property that does not actually exist?

To assign a single allowance, information about the real estate of the applicant and his family members is provided by Rosreestr, about vehicles - by the Ministry of Internal Affairs of Russia, about small boats - by the Russian Emergencies Ministry. In the event of a refusal to assign a single allowance due to the fact that the family owns the above property, which in fact is not available, it is necessary to contact the appropriate authority to correct the information. After confirming that the family does not own the property that caused the refusal, the decision will be reviewed.

What to do if the payment is refused due to the lack of documents that were submitted to the Social Fund?

In this case, you need to contact the branch of the Social Fund of Russia at the place of residence so that the specialists check the information again.:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/6521033/working-family-tax-credits-1.png) To do this, you can contact the Fund in person or by calling the reference phones of the departments.

To do this, you can contact the Fund in person or by calling the reference phones of the departments.

How can I find out if I have been granted benefits or not?

When submitting an application through the public services portal, a notification about the status of its consideration will appear there.

If the application was submitted in person at the client service of the Social Fund of Russia or at the MFC, in case of a positive decision, the funds will be transferred without additional notice to the applicant no later than 5 working days after the day the monthly allowance was assigned.

If a payment is denied, a notice stating the reasons will be sent within 1 business day from the date of the decision to deny.

When can I submit a new application if I am denied?

A new application may be submitted at any time after the reason for the denial has been resolved. There is no point in submitting a new application earlier.

Can I receive a single allowance only on the Mir card?

The single allowance can be credited to any bank cards, including the Mir card. It is important to remember that when filling out an application for benefits, it is the applicant's account details that are indicated, and not the card number.

It is important to remember that when filling out an application for benefits, it is the applicant's account details that are indicated, and not the card number.

What payment details do I need to provide when applying?

The application must indicate the details of the applicant's bank account: the name of the credit institution, the BIC of the credit institution, the applicant's account number.

Can I receive a single allowance through the Russian Post?

Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for the Unified Benefit, as well as indicate the address of the recipient.

I receive care allowance for people over 80 years of age. Will this allowance be taken into account when calculating my income?

Yes.

I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Yes, they will.

I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Can I receive benefits if the parents of the child have been deprived of parental rights?

Yes, you can. Parents (adoptive parents, guardians (custodians) of a child under the age of 17 are entitled to the Unified Benefit.

Is it possible to receive a single allowance without citizenship of the Russian Federation?

No. The Unified Benefit is provided to citizens of the Russian Federation who permanently reside in Russia.0003

How can I verify my actual place of residence if I do not have a residence registration?

In the absence of a confirmed place of residence (stay), the place of actual stay is determined by the place of application for the grant.

At what subsistence level will my income be calculated if I have two registrations - at the place of residence and at the place of temporary residence?

In this situation, the subsistence minimum will be taken into account at the place of application for the appointment of a single allowance.

My family owns an apartment and a residential building, in total their area exceeds the standard of 24 sq. m. m. per person, will I be denied benefits?

You will not be refused. Restrictions on square meters do not apply if the family owns housing of various types, as in your case. Moreover, each of the types of housing should not exceed the established standard.

Where can I turn if I have questions about the grant?

If you have any questions about the allowance, you can call the Unified Contact Center at 8-800-600-00-00, in addition, you can ask your question on the official social networks of the Social Fund of Russia or contact any client service of the Fund .

how to get a disability pension, care allowances and benefits

Yulia Semenyuk

mother of a child with a disability

Author profile

In the summer of 2020, my daughter got sick. She periodically had a fever and her legs hurt.

The pediatrician prescribed antibiotics and sent us to a rheumatologist. The rheumatologist ordered a bunch of tests and, in turn, sent me to an infectious disease specialist, but neither one nor the other could make a diagnosis. Two months later, my daughter and I ended up in a children's hospital for an examination. And two months later and after two biopsies, my daughter was diagnosed with lymphoma.

Now she has a disability and I am the mother of a child with a disability. In this article I will tell you what benefits and compensations are due to our family and how to apply for them. In addition to payments to parents of children with disabilities, there are tax and labor benefits: I haven’t applied for them yet, so I can’t share my experience.

What payments are due to a family with a child with a disability? I will tell you about the main benefits that families with a child with a disability can count on.

Disability pension is called social because the child did not work, but receives a pension due to health problems. As of September 2021, the pension of a child with a disability was RUR 13,912.10. From April 1, 2022, it increased to RUR 14,983.32, and from July 1, 2022, to RUR 16,619.39. to them, the amount of the social pension is additionally multiplied by the regional coefficient.

As of September 2021, the pension of a child with a disability was RUR 13,912.10. From April 1, 2022, it increased to RUR 14,983.32, and from July 1, 2022, to RUR 16,619.39. to them, the amount of the social pension is additionally multiplied by the regional coefficient.

Art. 11, 18 of the Federal Law "On state pension provision in the Russian Federation"

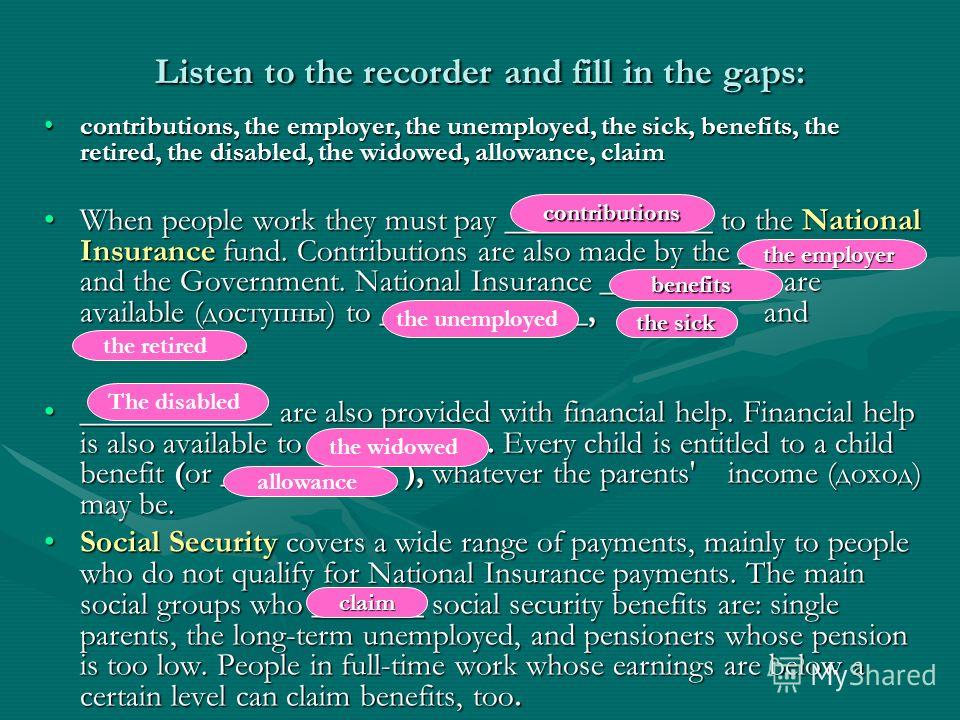

Monthly cash payment, or CST, consists of two parts - the actual cash payment and the set of social services, or NSO. There are only three services: free travel on commuter trains, as well as on intercity transport to and from the place of treatment, medicines and annual rest of the child in a sanatorium. You can refuse all this and receive monthly compensation.

Art. 28.1 of the Federal Law on the social protection of people with disabilities in the Russian Federation

art. 6.2, part 3 of Art. 6.3 Federal Law "On State Social Assistance"

Every year the payment is indexed: from February 2022, it is equal to 1850. 78 R. Compensation for the NSO is another 1313.44 R monthly.

78 R. Compensation for the NSO is another 1313.44 R monthly.

Table of amounts of UDV with and without VAT

Both pension and UDV are paid by the pension fund. You do not need to apply separately for a monthly cash payment: it is assigned automatically and the pension fund transfers it using the same details as the social pension.

Childcare allowance for a child with a disability. If a child with a disability needs constant care and mom or dad cannot work because of this, the pension fund pays an allowance.

Decree of the President on monthly payments to persons caring for children with disabilities and people with disabilities from childhood of group I

As of July 2022, non-working parents can receive 10,000 R monthly. If a child with a disability is cared for not by a parent, but, for example, by an aunt, the payment will be less - 1200 R.

Benefit for paying utility bills. Families with children with disabilities are entitled to compensation for housing and communal services.

Art. 17 Federal Law on the social protection of people with disabilities in the Russian Federation

Housing and communal services, in particular, include payment for the maintenance of residential premises and current repairs, payment for major repairs, for garbage collection, for electricity, water, gas, heating. This is a federal benefit, but each region calculates it differently.

We live in St. Petersburg: in our region, the benefit is calculated according to a complex formula that takes into account the number of people in the family and the regional payment standard per square meter. To be rough, it will turn out like this - the larger the apartment and the fewer people registered in it, the less the benefit will be.

Cash payments for paying for housing and utilities to certain categories of citizens - St. Petersburg public services portal

The regional standard changes several times a year, so in winter the payment will be more due to the heating season, and less in summer. From July to August, we paid an average of 5912 R for a communal apartment, and received compensation of 2908 R for each month - a little less than 50%.

From July to August, we paid an average of 5912 R for a communal apartment, and received compensation of 2908 R for each month - a little less than 50%.

Payment relief is not a discount, but compensation: you still have to pay the full amount on the receipt, but then some of the money is returned. The most important thing is to avoid debts: if there is a payment arrears for at least two months, then the money is no longer transferred.

Cash payments to disabled people from the budget of St. Petersburg

Regional payments. For families with children with disabilities, regional payments are provided: their size and terms of appointment differ in different cities. In St. Petersburg, we receive 17,257 R monthly for a child with a disability and a little more than a thousand for our second child. To receive these payments, you need to contact social security: directly or through the MFC.

Art. 18 of the Social Code of St. PetersburgPDF, 950 KB

All payments are assigned for the period of disability, they do not need to be reissued every year. Next, I will give step-by-step instructions that will help you apply for benefits and not get confused in the documents.

Next, I will give step-by-step instructions that will help you apply for benefits and not get confused in the documents.

Step 1

Obtain disability documentsTo receive benefits for a child with a disability, you need a certificate of disability. It indicates the date of birth, the address of the child's registration and the period of disability.

To obtain a certificate, you must pass a commission of medical and social expertise. In our case, it took place in absentia: Alina and I were in the hospital, so the ex-husband took the birth certificate, medical statements to the clinic at the place of residence and filled out applications.

These documents were enough for us, but other polyclinics may require other papers: for example, records of a child’s examination by narrow specialists of this particular polyclinic and a reference from the school. In our case, the polyclinic specialists independently contacted the school administration and clarified all the points of interest to them.

In our case, the polyclinic specialists independently contacted the school administration and clarified all the points of interest to them.

/list/disabled-child/

Benefits for parents of a child with a disability

I received my certificate of disability by registered mail addressed to the child. Together with him came an individual program of rehabilitation and habilitation - IPRA. It indicates the degree of restriction of the child - this is something like disability groups in adults. But unlike adults, in children, the higher the number, the worse their health.

A rehabilitation program will be needed if the child needs extra help, medication or special mobility aids. I wore a rehabilitation program at the MFC when I applied for a benefit for housing and communal services, I didn’t use it anymore. From 2021, the IPRA should be only in electronic form, and it is sent on paper upon request: but in our case, the program was attached to the letter.

paragraph 10 of the order, approved. By order of the Ministry of Labor No. 486n

dated June 13, 2017, I usually carry a photo of a certificate with me: according to it, a child can, for example, enter the park for free on weekends and holidays. An individual rehabilitation or habilitation program consists of more than 10 sheets. It lists the child's health problems, as well as the need for social and psychological assistance or special equipment such as crutches, strollersStep 2

Apply to the pension fund for a pension and a single paymentA social pension and a single social allowance are due to a child from the moment the disability is received until it ends - these dates are indicated in the certificate of disability. If you apply for a pension later, the state will repay the debts, but for a maximum of six months.

My daughter's pension and cash payment arrive in my account around the middle of the month. The payment schedule can be clarified on the website of the pension fund - for this, you need to select your region.

What documents are needed. Birth certificate and certificate of disability of the child, parent's passport, details for crediting money. If this data is available in your personal account on the website of the pension fund or public services, they will be pulled up to the application automatically.

/invalidnost/

Personal experience: how to apply for disability

Where to apply. A pension for a child with a disability can be issued remotely through the personal account of the pension fund. Another option is to submit documents in person: at the MFC or the territorial department of the pension fund at the place of residence of the child.

We applied through the personal account of the pension fund. Here is what was needed for this:

- Scan or photograph all the necessary documents, save the details for crediting the pension.

- Send an application through your personal account on the website of the pension fund.

On the main page, you need to select "pension provision" - "assign a pension", on the next screen, log in through public services and then select "apply for a pension". The application must be submitted "through a representative", because this is the personal account of the parent, not the child. After filling in and confirming all the fields, click "generate an application".

On the main page, you need to select "pension provision" - "assign a pension", on the next screen, log in through public services and then select "apply for a pension". The application must be submitted "through a representative", because this is the personal account of the parent, not the child. After filling in and confirming all the fields, click "generate an application". - Wait for a decision on granting a pension: in our case, the application was considered for a week. You can follow the progress of the case in your personal account.

- Submit an application about where the pension will go. By default, the pension is sent to the mail. In order for money to be credited to a bank card, one more application must be submitted on the website of the pension fund or public services - “on the delivery of a pension”. To do this, you will need a Mir card: this payment will not be credited to cards of other systems. I didn't have a Mir card, and I couldn't go to the bank because we were in the hospital.

Therefore, I added a Mir virtual card to my existing bank account: it took a few minutes. The details of the virtual bank card were accepted by the pension fund without question.

Therefore, I added a Mir virtual card to my existing bank account: it took a few minutes. The details of the virtual bank card were accepted by the pension fund without question.

To increase the payment, you can refuse a set of social services through the website of public services, the personal account of the pension fund, at the pension fund department or the MFC. This application must be submitted before October 1 of the current year: then the money for the NSO will begin to accrue from January of the next.

The Pension Fund has received an application. After processing and verifying the data, the PF assigned a pension. If the data is not enough, specialists call and clarify the information. I was asked about registration. Source: State ServicesStep 3

Apply for disability child care allowance This allowance is also paid by the pension fund. He is assigned to a person who cares for a child, and only on the condition that he is not working at this time. Retired grandparents cannot claim the allowance: it is paid only to able-bodied persons.

Retired grandparents cannot claim the allowance: it is paid only to able-bodied persons.

Decree of the President on monthly payments to persons caring for children with disabilities and people with disabilities from childhood, group I

What documents are needed. To assign this payment, only an application is needed: the pension fund requests and receives other documents on its own.

Application form for child care allowance

Where to go. You can apply remotely through the personal account of the pension fund or by phone. And you can come to the client service of the pension fund or the MFC.

The pension fund will make a decision within 10 days. For the months preceding registration, the allowance is not paid.

If the person caring for the child goes to work or retires, the allowance will stop. Changed circumstances must be notified to the pension fund within five days.

Community 09/08/21

How to combine pension and disability care payment?

To apply by phone, you will need to set a secret code or a secret question in the personal account of the pension fund, with the help of which the operator will verify the identity of the applicantStep 4

Issue compensation for expenses for paying for housing and utilities Compensation can be received retroactively: after registration, it will be accrued no more than six months from the moment the child received a disability.

My daughter was diagnosed with a disability in January, I submitted the documents for payment at the end of April, and a positive decision was made in mid-May. I received my first compensation at the end of June - 2817.26 R, at the same time I received a payment for the previous four months.

What documents are needed. Certificate of disability, child's birth certificate, parent's passport, payment details, and Form 8 or 9 certificate: this document confirms that a child with a disability is registered in an apartment for which they receive a benefit.

/subsidia-zhku/

How to get a subsidy for utility bills

These forms differ in different regions and are issued by different organizations: you can find out what kind of certificate you need at the MFC or on the regional public services website.

This is form 8, which is issued in St. Petersburg, it has been at my house since 2013. It was issued when the child was registered in apartment In St. Petersburg, form 8 for children is given during the registration of the child, and it is kept at home. But I forgot that I have it, so I went for form 9: you can get it at the department of moving in and registration or at the passport office. It looks different - it lists everyone registered in the apartment.

Petersburg, form 8 for children is given during the registration of the child, and it is kept at home. But I forgot that I have it, so I went for form 9: you can get it at the department of moving in and registration or at the passport office. It looks different - it lists everyone registered in the apartment.

You still need to bring receipts for housing and communal services, electricity and major repairs to the MFC for the last month. If there are no required receipts, the documents will still be accepted, but the receipts will be asked to be delivered later.

At the same time, in some regions - for example, in St. Petersburg - the payment is in no way tied to receipts. Nevertheless, at the MFC they asked me to convey them. In the end, I did it after I made a positive decision, although I didn’t see the point in it.

/guide/zhkh/

How to pay utility bills

Where to go. The benefit can be issued remotely through the regional website of public services. But I didn’t succeed, because I had to attach a certificate that I do not receive such a benefit: and I did not have such a certificate.

But I didn’t succeed, because I had to attach a certificate that I do not receive such a benefit: and I did not have such a certificate.

Another way is to contact the MFC. The operators will fill in all the documents themselves, they will only need to be signed. Then you will receive an SMS about what decision was made - positive or negative.

The process of obtaining benefits through the MFC was very simple: I brought only the original documents, the operators on the spot made copies of them. I forgot to print out the payment details and simply copied them by hand from the banking application directly to the MFC.

Step 5

Apply for a monthly allowanceThe monthly allowance for a child with a disability is paid by the regions, so the amount of the payment is different everywhere.

In St. Petersburg, the Committee on Social Policy of St. Petersburg is responsible for benefits and allowances for children with disabilities, and the City Information and Settlement Center pays benefits: there you can ask questions about the timing and amount of payments and change your account details.

In St. Petersburg, 7659 R per month is paid for a child with a disability. Money comes first.

7965 Р

monthly allowance for a child with a disability in St. Petersburg

What documents are needed. Certificate of disability and IPRA, child's birth certificate, parent's passport, form 8 or 9, payment details.

I also brought with me to the MFC a certificate of divorce and a birth certificate for my second child - they were copied and saved in the database. These data did not affect current payments. I think that the MFC was collecting documents for the future - for example, if I wanted to apply for benefits for single-parent families.

Where to contact. The allowance can be issued through the personal account of the regional website of public services or in person through the MFC. My child and I were in the hospital, so I applied for the allowance remotely through the St. Petersburg public services portal.

Petersburg public services portal.

Here's how to do it:

- Collect the necessary documents. Prepare scans or photographs of the main documents for the electronic application. Bank account details must also be in electronic form.

- Log in to the site through the ESIA - as well as for public services.

- Select the service "Monthly allowance for a disabled child from birth to 18 years of age" in the catalog.

- Fill out an application, attach all required documents and wait for a positive decision.

The application is considered within a month, but if a positive decision is made, then all debts are returned - a maximum of the previous six months from the date of disability. For example, my daughters were put on disability in January, but I applied for benefits only in May: when he was assigned, I received money for four months - from January to May.

/benefits/

Payments and child benefits in 2022

Favorable benefit decision: here I am advised to apply for second child benefit. The contact phone number is the district department of social protection of the population: it is easy to get through, they answer all questions about benefits

The contact phone number is the district department of social protection of the population: it is easy to get through, they answer all questions about benefits When I received a positive decision, it turned out that my child is considered a child with a disability with special needs and we have the right to receive an increased payment.

Monthly allowance for a disabled child with special needs

Monthly allowance for a child with a disability with special needs is paid for a child whose individual rehabilitation program indicates the third degree of restriction. This payment is more than the regular allowance: 17,947 R instead of 7,965 R.

17,947 R

monthly allowance for a child with a disability with special needs in St. Petersburg

You can apply for this benefit only through the MFC. You need to bring a standard set of documents with you: passport, birth certificate, certificate of disability and IPRA, form 8 or form 9, payment details.

I applied at the end of April, the city administration made a positive decision at the end of May. In June, all my debts were paid off, because less than six months had passed since the disability was registered. If more time had passed, then they would have given the money only for six months.

Step 6

Apply for a monthly allowance for a child from 7 to 16 years oldIn St. Petersburg, there is an allowance for school-age children from special families, including those in which a child with a disability is brought up. In 2022, they pay 1085 R per child.

What documents are needed. Certificate of disability, birth certificates of children, parent's passport, form 8 or 9, payment details.

So what? 04/27/21

Zero income rule for payments for children aged 3 to 7: what it is and how to comply with it

Where to go. This allowance is quite simple to issue remotely through the St. Petersburg public services portal: you need to fill out an electronic application, attach scans of documents and wait for a positive decision. Another way is to contact the MFC with a package of documents, but I have not tried this method: the application was easily accepted and approved remotely.

Petersburg public services portal: you need to fill out an electronic application, attach scans of documents and wait for a positive decision. Another way is to contact the MFC with a package of documents, but I have not tried this method: the application was easily accepted and approved remotely.

Step 7

Get free medicinesThe medicines necessary for the life of a child with a disability are listed in the individual rehabilitation and habilitation program of the IPRA. All of their children can receive for free - regardless of whether they are on the federal or regional lists of essential drugs or not.

If parents have renounced NSI in kind and receive money, then they do not have benefits for receiving free medicines from the federal budget. But the rights to a regional benefit still remain, so , children with disabilities can receive both the federal co-payment for NSI and free medicines at the expense of the budget of the constituent entity of the Russian Federation.

Program of state guarantees for free medical care in St. PetersburgPDF, 7.1 MB

item 1 of the review of the Supreme Court on disputes related to social support for citizensPDF, 807 KB

List of population groups that are entitled to free medicines and medical products for outpatient treatment

Clarification of the Ministry of Health on the right to receive free medicines from the regional budget

What documents are needed. Certificate of disability, IPRA. In our clinic, these documents are already in the database - you do not need to bring them every time.

Where to go. Preferential prescriptions are written by a pediatrician or an attending physician, so you need to contact the clinic at the place of residence of the child. Since parents of children with disabilities often visit pediatricians on various issues, sometimes it is possible to agree on convenient conditions: for example, we take blood tests at home for free, and the pediatrician leaves all the necessary referrals at the registry so that I do not sit in line at cabinet.

We don't get free medicines, but I suppose we can arrange to get prescriptions for medicines also in a special regime.

If the pediatrician refuses free medicines, I advise you to write to the head of the clinic with a request to provide the child with medicines at a discount. A written request must be answered within 30 days, but usually issues are resolved faster: after I complained to the manager about the long paperwork for the medical and social examination, they apologized to me the next day, and disability was established after five days.

The 10 most purchased drugs in Russia

After filling out a prescription, you can get medicines at the pharmacy. Not everyone is suitable: in the clinic you need to find out which pharmacy you can get free prescription medicine. If the medicine is not available, you will need to leave a request and wait for delivery.

After my email to the clinic, the documents were sent to the ITU instantlyStep 8

Get a ticket to the sanatorium Once a year, children with disabilities can go to the sanatorium for 21 days free of charge. Together with a child, one accompanying person can also travel for free. This is a federal benefit provided by the Social Security Fund, so if the parents refused the NSI in kind, they will not give a free ticket.

Together with a child, one accompanying person can also travel for free. This is a federal benefit provided by the Social Security Fund, so if the parents refused the NSI in kind, they will not give a free ticket.

Art. 6.2 Federal Law "On State Social Assistance"

What documents are needed. Certificate on form 070/y from a pediatrician, child's birth certificate, parent's passport and application.

Where to go. A ticket to a sanatorium is given to a child with a disability only if indicated and in the absence of contraindications, so you first need to contact a pediatrician at the clinic. The pediatrician will issue a certificate on form 070/y: this certificate is valid for 12 months.

After that, the documents must be submitted to the FSS: personally, through the MFC or using the public services portal.

On the website of public services, select "provision of spa treatment" and then "provision of a voucher for spa treatment in the territorial bodies of the Fund. " After authorization, an electronic application form will appear, where you will need to enter data on a medical certificate, place of residence, passport and birth certificate. You can’t choose a sanatorium, places are given in turn and according to the diagnosis.

" After authorization, an electronic application form will appear, where you will need to enter data on a medical certificate, place of residence, passport and birth certificate. You can’t choose a sanatorium, places are given in turn and according to the diagnosis.

/socstrah/

What benefits from the state are due to people with disabilities

To get tickets, you need to fill out a separate application and select the item "providing free travel by intercity transport to the place of treatment and back in the territorial bodies of the Fund."

When the applications are approved, the FSS will issue a ticket and paper or electronic coupons for free travel. Paper coupons can be exchanged for tickets at Russian Railways ticket offices, and an electronic ticket will allow you to issue tickets through the Russian Railways website. You can select only certain tickets - they are visible in the "FSS benefits" filter.

Remember

- Children with disabilities throughout the country can apply for a monthly social pension and a single cash payment - in 2022, only 18,470.