How to due

Pregnancy Due Date Calculator | BabyCenter

Calculation method

When did your last period start?

When did your last period start?mm-dd-yyyy

Cycle length

BabyCenter's Due Date Calculator

Use our pregnancy due date calculator by plugging in either the date of your last menstrual cycle or the date you know you conceived. The calculator will do the rest.

How is my due date calculated?

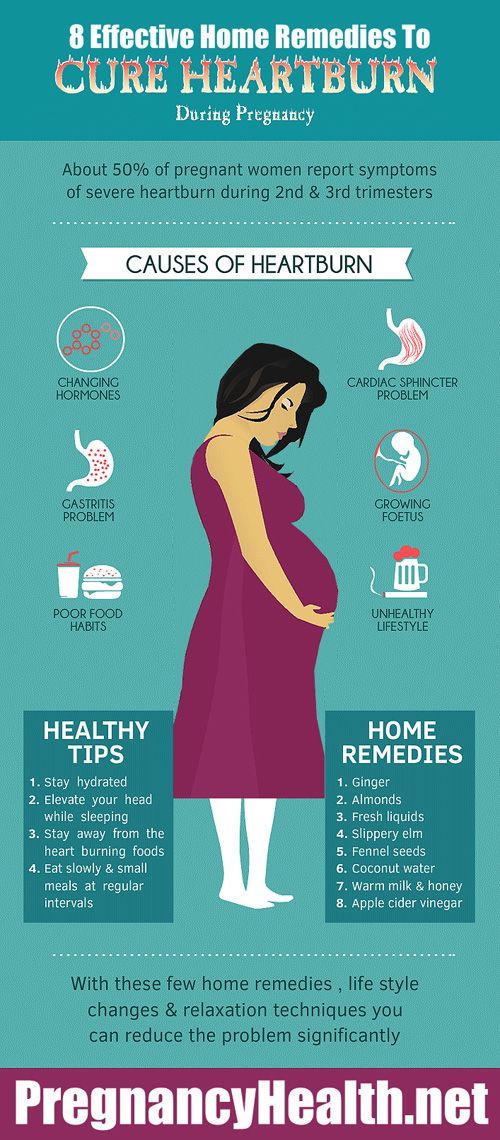

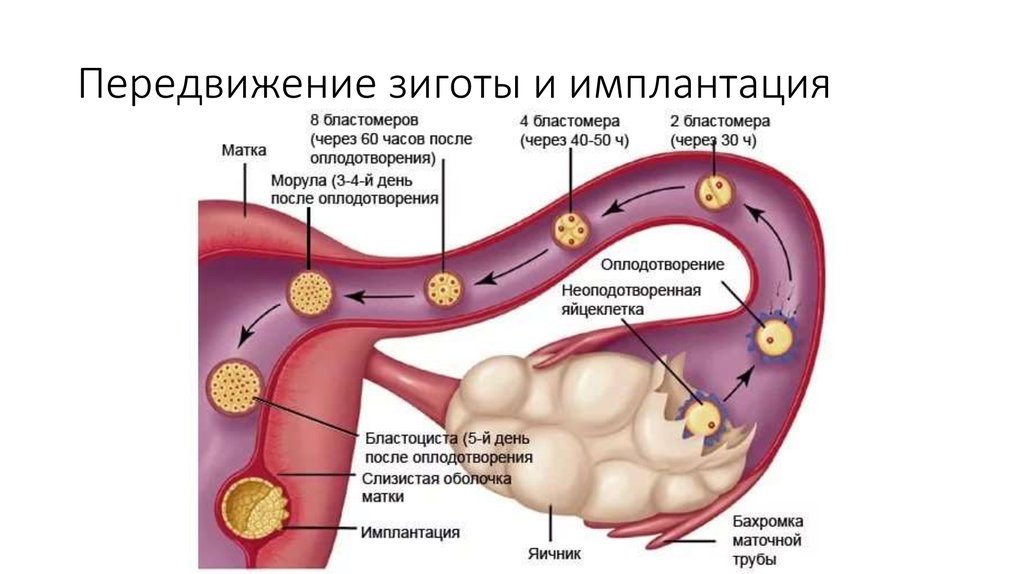

There are several ways your due date is determined. If you happen to know the day you conceived, you can count 38 weeks from that day to find your due date. (Human gestation takes about 38 weeks.)

But very few expectant moms know exactly when they conceived. Even if you only had sex once during your fertile period, you wouldn't conceive on that day unless you happen to be ovulating. Sperm can live for up to five days inside your fallopian tubes. So, it could be up to five days after you have sex that you release an egg (ovulate) and it gets fertilized by a waiting sperm. That's the day you conceive.

So, without knowing the day of conception, how does anyone determine a due date?

First day of your last period

The most common way to calculate your pregnancy due date is by counting 40 weeks from the first day of your last menstrual period (LMP). And that's how most healthcare providers do it.

If your menstrual cycle length is the average length (28-day cycle), your menstrual cycle probably started about two weeks before you conceived. This explains why pregnancies are said to last 40 weeks instead of 38 weeks.

This method doesn't take into account how long your menstrual cycle actually is or when you think you might have conceived. But generally speaking, women typically ovulate about two weeks after their menstrual cycle starts. And women are more likely to know when their last period started than the day they ovulated.

Conception date

If you do happen to know precisely when you conceived – say, if you were using an ovulation predictor kit or tracking your ovulation symptoms – you can calculate your pregnancy due date based on your conception date. Just choose that calculation method from the pulldown above and put in your date.

Just choose that calculation method from the pulldown above and put in your date.

Note: Again, you don't necessarily conceive on the day you have sex.

IVF transfer date

If you conceived through IVF, you can calculate your due date using your IVF transfer date. If you had a Day 5 embryo transfer, count 261 days from your transfer date. If you had a Day 3 embryo transfer, count 263 days.

Can my due date change?

Your healthcare provider might revise your due date if your baby is measured during a first trimester ultrasound scan and found to be much bigger or smaller than expected for gestational age. This is more likely to happen if you have an irregular menstrual cycle length that makes it hard to pinpoint the date of conception.

Your healthcare provider will measure your baby during that ultrasound exam to figure out how far along your baby is and then provide you with a new due date.

What if I already know my due date?

If you already know your due date, you can use this calculator to see your pregnancy timeline. It will tell you when you'll hit various milestones, and when you may be due for prenatal tests and prenatal visits. You'll also find what your baby's sign and birthstone will probably be and which famous people were born on your due date.

It will tell you when you'll hit various milestones, and when you may be due for prenatal tests and prenatal visits. You'll also find what your baby's sign and birthstone will probably be and which famous people were born on your due date.

How likely am I to give birth on my due date?

Of course, a due date calculation is always approximate, whether it's from our tool or from your doctor or midwife. Only 1 in 20 women delivers on her due date. You're just as likely to go into labor any day during the two weeks before or after.

Want more information about how the weeks, months, and trimesters of pregnancy are counted? See our pregnancy timing chart.

How soon can I take a pregnancy test?

With all this talk about pregnancy due dates, you may be wondering when you can take a pregnancy test. To ensure you get the most accurate reading, it's best to wait a few days after your missed period to take a pregnancy test.

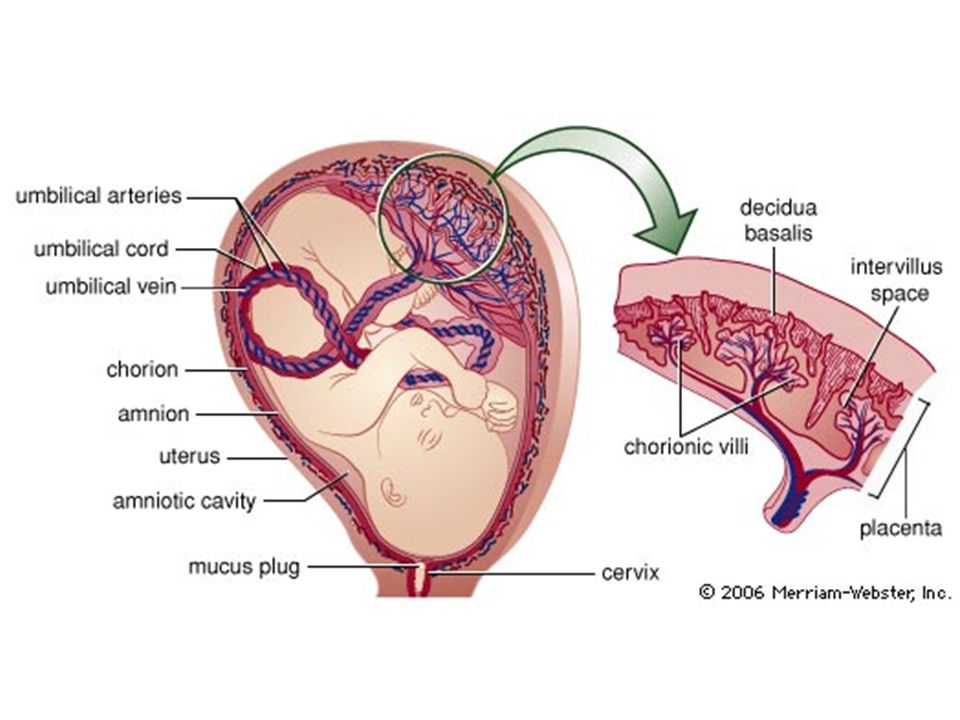

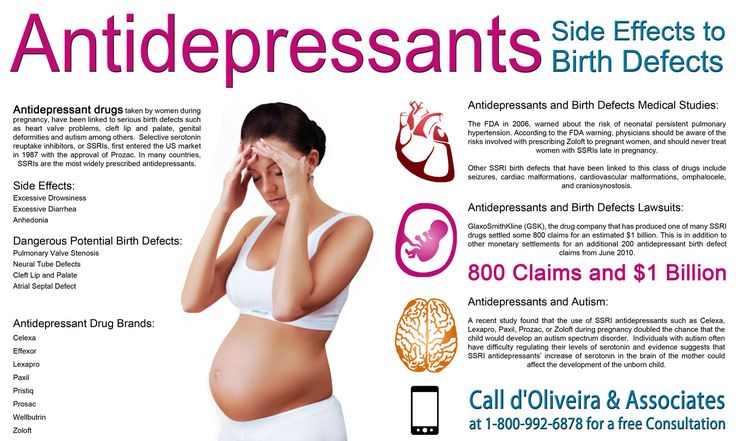

At-home urine tests measure the amount of hCG (human chorionic gonadotropin) present in your body. If you take a pregnancy test before you miss your period, you may not get an accurate result, despite what some tests advertise.

If you take a pregnancy test before you miss your period, you may not get an accurate result, despite what some tests advertise.

If you're getting a blood test in your provider's office, you may get results sooner. These tests also measure the amount of hCG in your bloodstream, but they're more sensitive than at-home urine tests. Blood tests may be able to detect pregnancy six to eight days after ovulation.

Read more:

- Your pregnancy, week by week

- Your first trimester pregnancy checklist

- Pregnancy Weight Gain Calculator

- Ovulation Calculator

- See all tools

BabyCenter Staff

Content that appears under this byline was created by members of the BabyCenter Editorial team.

Advertisement | page continues below

Due vs Do Rules to Remember

DESCRIPTION

example due vs do

SOURCE

jamtoons / DigitalVision Vectors / Getty Images, tatianazaets / iStock / Getty Images Plus

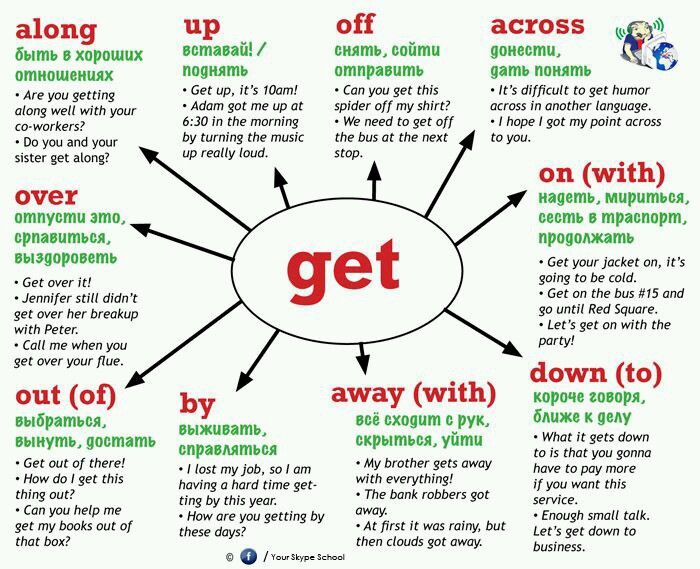

When it comes to the English language, nothing is quite as frustrating as homophones. These are fun little words like “do” and “due” that have different spellings and meanings but are pronounced the same way. To eliminate any confusion, get simple rules for when you use "do" vs. "due."

These are fun little words like “do” and “due” that have different spellings and meanings but are pronounced the same way. To eliminate any confusion, get simple rules for when you use "do" vs. "due."

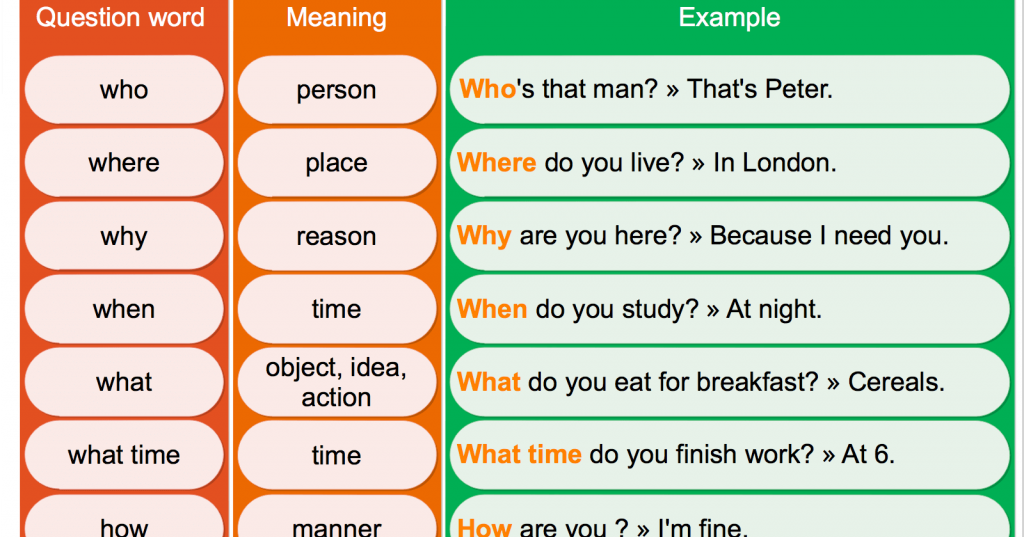

When to Use “Do”

How can you know when to use “do”? By looking at its definition, of course. The verb “to do” means you are performing some kind of action. In a sentence, this looks like:

- I like to do my homework at home.

- We do our shopping at the corner store.

- I do my running at the track.

- I do like that band.

You will also find “do” used as an auxiliary verb to clarify action in a question like:

- Do you need help?

- Do you like those peas?

- Do you want sweet potatoes?

- Do you know that guy?

"Do" can also function as an auxiliary verb in negative statements. For clarity's sake, the examples will avoid the contraction don’t, but just remember it could be in there too. For instance, the first example sentence could be rewritten as, "I don't believe aliens exist."

For clarity's sake, the examples will avoid the contraction don’t, but just remember it could be in there too. For instance, the first example sentence could be rewritten as, "I don't believe aliens exist."

- I do not believe aliens exist.

- We do not like the flavor of black licorice.

- I do not go there. It is dangerous.

- They do not want that smelly dog.

Another way to remember the difference between “do” and “due” is to look at the tense and conjugation of "do."

Advertisement

Different Forms of “Do”

Since “do” is a verb, it can have different forms that it will take depending on the tense. Since it is an irregular verb, it only has one change in present tense conjugation. The third-person plural uses “does.”

She does her chores every Saturday.

In the past tense, “do” becomes “did.”

She did her chores last Saturday.

You have now mastered the rules of “do.” Great work! It’s time to move on to “due.”

Deciding on “Due”

When it comes to using “due,” the term is going to work as an adjective (to show something planned/expected or needs to be paid) or as a noun (in the plural form: dues). You can see how these are used in example sentences to drive this point home.

- My paper for English class is due on Monday.

- It is important to get the book back to the library before the due date.

- Karen told me that our physics paper was due yesterday.

- We are due for a home run.

- Did you pay my dues for the gym?

- Your dues are going to be due on Friday. (Notice the noun and adjective used here.)

Those are the main differences between "do" and "due." Since you've mastered them, have some fun with "do" and "due" idioms too.

Advertisement

Idioms Using “Do” and “Due”

English has a lot of expressions. It is one of the fun things about the language. But, it can be difficult when it comes to trying to figure out whether to use “do” or “due” in these idioms.

Is It “Make Due” or “Make Do”?

When you are going to “make do” with something, it means that you are going to improvise or manage with what you have. In this case, “do” will be your go-to word.

- I’ll have to make do with a pen.

- We will have to make do with a one-bedroom condo.

- I don’t have a flathead screwdriver. Can you make do with a butter knife?

- They don’t have sunglasses. You’ll have to make do with a visor.

Is It “Due To” or “Do To”?

Another fun idiom in the English language is "due to the fact (of)," which is generally shortened to “due to.” This usually signifies that one thing is attributed to or caused by something else. "Due to" is usually followed immediately by a noun.

"Due to" is usually followed immediately by a noun.

For example:

- Due to the traffic, I was late.

- We missed the show due to a power outage.

- School was canceled today due to snow.

- The truck went into the ditch due to the ice.

“Do to” can also be used in a sentence, but the meaning and context are difference. This is typically found in "what" questions with a verb coming immediately after "do to."

- What can we do to improve your experience?

- What did you do to get the rash?

- What would Abby have to do to earn your trust again?

One quick trick to know if you should use “due to” or “do to” is to see if it can be replaced with "because." If it can, then "due to" is correct.

- The show was canceled due to low ratings.

The show was canceled because of low ratings. (Correct)

(Correct) - What did Kylo do to deserve such punishment?

What did Kylo because deserve such punishment? (Incorrect)

Advertisement

Not a Problem for the Brits

Pronunciation in American and British English is different. That’s why the accents are so amazing. Due to the difference in pronunciation, “due” and “do” aren’t typically homophones in British English.

- In American English, they are both [doo].

- In British English, “due” is pronounced [dewe] and “do” is pronounced [doo].

Difference Between “Due” and “Do”

Knowing when to choose “do” over “due” is just a matter of following the rules of grammar. Are you interested in learning more about idioms? View a lot of fun idiom examples. They are a dime a dozen!

How to transfer money to Russia: all relevant methods

Transferring money from abroad to Russia has become more difficult amid sanctions against the country's financial system and the withdrawal of international companies from the Russian market. RBC Investments has collected valid options

RBC Investments has collected valid options

Photo: Shutterstock

Russians can still transfer funds to the country from abroad: the Central Bank clarified that there are no restrictions on accepting payments. However, difficulties may be associated with the sanctions and counter-sanctions of Russia, as well as the measures of the Central Bank to stabilize the exchange rate. RBC Investments » figured out how to transfer money to Russia.

1. With the help of money transfer systems

Due to sanctions, American and European services WesternUnion, MoneyGram, Wise, OFX, PayPal, TransferGo have suspended their activities in Russia. However, three domestic translation services are available:

www.adv.rbc.ru

- Golden Crown;

- "Unistream";

- Contact.

Golden Crown

The service allows you to transfer money to Russia from a wide range of countries, including EU states, but you can receive funds only in rubles. The system sets the conversion rate independently. “You can send a transfer from Mir, Visa, Mastercard, Maestro cards issued by Russian banks. In Uzbekistan, money can be sent from cards of Uzcard or HUMO payment systems issued by any bank in the country,” the service’s website states. The card must support 3D Secure payment technology, that is, transaction confirmation via SMS.

The system sets the conversion rate independently. “You can send a transfer from Mir, Visa, Mastercard, Maestro cards issued by Russian banks. In Uzbekistan, money can be sent from cards of Uzcard or HUMO payment systems issued by any bank in the country,” the service’s website states. The card must support 3D Secure payment technology, that is, transaction confirmation via SMS.

RNKO "Payment Center", the operator and settlement center of the Zolotaya Korona payment system, indicates in the text of the agreement that if the country of receipt of the transfer is the Russian Federation, the client can send no more than five transfers in 30 consecutive calendar days, and the total amount of the transfer from card issued by a Russian bank during this period cannot exceed ₽300 thousand. The service sets the maximum amount of transfers from a card issued by an EU bank based on the volume of confirmed information about the client. At the same time, the Zolotaya Korona service for cash transfers can be used at the offices of partner banks, as well as in the shops of the Beeline, Svyaznoy, MegaFon, MTS, kari and other networks - in this case, the transfer limit is ₽ 600 thousand or $10 thousand / €10 thousand

Unistream

Through Unistream, you can transfer to Russia no more than ₽295. 5 thousand or the equivalent in foreign currency at a time, including commission, and no more than ₽595.5 thousand per month. The rules state, that when receiving a money transfer in a currency in excess of ₽100 thousand, $1 thousand or €500 at customer service points, you must pre-order the amount in the required currency to receive: “The time for issuing a money transfer under these circumstances may take from one to ten days ".

5 thousand or the equivalent in foreign currency at a time, including commission, and no more than ₽595.5 thousand per month. The rules state, that when receiving a money transfer in a currency in excess of ₽100 thousand, $1 thousand or €500 at customer service points, you must pre-order the amount in the required currency to receive: “The time for issuing a money transfer under these circumstances may take from one to ten days ".

"Unistream" makes only transfers "not related to business activities, investments, transactions with securities." Also, the service does not perform transfers between individuals - residents of Russia in foreign currency throughout the country. At the same time, an individual who is not a Russian resident can transfer funds in rubles and foreign currency across the territory of Russia without restrictions.

Contact

On its website, the service indicates that there are no restrictions on accepting transfers from other countries to Russia: “We recommend that you check the details at the place of sending in partner systems that operate on the territory of other countries. ” It will not be possible to send a transfer through the online service from a card of a foreign bank, only cards of Visa, Mastercard and Mir payment systems of Russian banks are supported for debiting, transfers through the online service to a card of another country are also not available.

” It will not be possible to send a transfer through the online service from a card of a foreign bank, only cards of Visa, Mastercard and Mir payment systems of Russian banks are supported for debiting, transfers through the online service to a card of another country are also not available.

The service in Russia issues cross-border transfers in foreign currency from any country exclusively in rubles: “Currently, not all banks have set up a system for issuing currency transfers converted into rubles, so we recommend calling the bank’s contact phone number before contacting the point in person for consultations".

The Central Bank clarified the requirements for transferring funds without opening a bank account: “Funds received as a transfer from a bank outside the Russian Federation, as well as from electronic wallets, are issued exclusively in rubles. The conversion is made at the rate of the bank, and the amount paid cannot be less than the amount calculated on the day of payment at the official rates of the Central Bank.

2. With the Mir card

Transfers from abroad to Russia are possible through the Mir card: it also allows you to pay abroad and withdraw cash in local currency. Mir cards are now accepted by some partner banks in nine countries, including Armenia, Belarus, Vietnam, Kazakhstan, Kyrgyzstan, South Korea and others, RIA Novosti reported.

3. Cross-border bank transfers

You can also transfer money from abroad to Russia using SWIFT transfers using account details through banks that are still not under blocking sanctions, including Tinkoff, Rosbank, Gazprombank , Raiffeisenbank.

The operation will not work if the accounts are opened in Russian banks under blocking sanctions: VTB, Sovcombank, Novikombank, Promsvyazbank, Otkritie, Rossiya, as well as Alfa-Bank and Sberbank. The sanctions include the freezing of bank assets and the imposition of a ban on US citizens and companies from doing business with them.

4. Through stablecoins

A stablecoin is a digital currency whose value is pegged to the exchange rate of another asset. One of these cryptocurrencies is USDT from Tether, which is pegged to the value of the US dollar at a ratio of 1:1. There are other stablecoins, such as USDC from Circle or BUSD issued by the Binance crypto exchange. Issuers stablecoins keep on their balance sheet the necessary amount of assets to ensure binding to their digital coin. You can buy stablecoins using crypto exchanges, p2p platforms and exchangers:

One of these cryptocurrencies is USDT from Tether, which is pegged to the value of the US dollar at a ratio of 1:1. There are other stablecoins, such as USDC from Circle or BUSD issued by the Binance crypto exchange. Issuers stablecoins keep on their balance sheet the necessary amount of assets to ensure binding to their digital coin. You can buy stablecoins using crypto exchanges, p2p platforms and exchangers:

How to buy stablecoins safely. Simple instructions

“This cross-border transfer option has no jurisdiction and is a so-called gray investment scheme. In this case, all the risks lie on the shoulders of the investor or the individual making the transfer,” warned financial consultant Igor Fainman.

It will not be possible to transfer money from abroad through UnionPay

UnionPay cards do not provide cross-border p2p transfers (person-to-person), writes Frank Media. At the same time, transferring funds across the border between system cardholders is possible through the UnionPay MoneyExpress service, but money can only be transferred to UnionPay cards issued by Chinese banks.

UnionPay cards from Russian banks. Will they replace Visa and Mastercard

At the same time, only individuals can make transfers in the Russian Federation, according to UnionPay rules. The daily limit for the transfer of funds in the order of p2p transactions is ₽600 thousand or the equivalent in foreign currency. At the same time, the maximum amount of one transaction is ₽150 thousand. You can transfer funds to a UnionPay card within Russia in the following ways:

- from another UnionPay card;

- by topping up your UnionPay card;

- by debiting funds from the bank account or reducing the balance of the payer's electronic money and crediting funds to the recipient's account or increasing the balance of the recipient's electronic money account.

In Russia, transactions with UnionPay cards are carried out in rubles, except in cases where the law allows settlements in foreign currency, for example, in duty-free shops, as indicated in the rules of the system. Currency conversion takes place at the exchange rate of the Bank of Russia at the time of the transaction.

Currency conversion takes place at the exchange rate of the Bank of Russia at the time of the transaction.

More interesting stories and news about finance in our telegram channel "You yourself are an investor!"

A person who issues securities. The issuer can be both an individual and a legal entity (companies, executive authorities or local governments). Investment is the investment of money to generate income or to preserve capital. There are financial investments (purchase of securities) and real ones (investments in industry, construction, and so on). In a broad sense, investments are divided into many subspecies: private or public, speculative or venture, and others. Read more

How to transfer money from abroad to Russia

Due to the events in the world and the subsequent sanctions restrictions, it has become more difficult to transfer money to Russia from abroad, but this possibility still remains. We understand how important it is to be able to help family, relatives and friends, or solve an urgent financial issue. We understand that many specialists and ordinary people from Europe are closely connected with Russia and, while continuing to work in European countries, have the need to transfer funds abroad. With the help of our service, it is possible to transfer money from Europe to Russia, which can be done easily and quickly.

We understand how important it is to be able to help family, relatives and friends, or solve an urgent financial issue. We understand that many specialists and ordinary people from Europe are closely connected with Russia and, while continuing to work in European countries, have the need to transfer funds abroad. With the help of our service, it is possible to transfer money from Europe to Russia, which can be done easily and quickly.

It is necessary to note the situation with sanctions, because they made it impossible to transfer money for a number of companies and banks. But you can still send money to Russia to the cards of banks that are not banned. Especially for this, we have created a separate article, which indicates which banking organizations foreign transfers are possible and which are not.

An international transfer made to Russia using Profee will be automatically converted to RUB. For a better understanding, we will tell you about all types of international transfers that are widespread among people making them:

- SWIFT transfer, or simply bank transfer, is the most classic way to send money abroad.

It is possible only if you have a bank account in the bank with which you want to make a transfer;

It is possible only if you have a bank account in the bank with which you want to make a transfer; - Sending cash using international money transfer companies. The same is done in the branches of the company providing the service, but without the need to open a bank account;

- Crypto-transfer is a fast, modern, but not the most reliable way to send money due to the imperfection of existing security systems and the complicated execution process. Such transfers are subject to the EMF system, which makes transfers almost instantaneous and require a minimum commission.

- Money transfer system (P2P), or direct transfer from card to card. A much more convenient money transfer method that allows you to send money to Russia using a computer or mobile phone in any place convenient for the sender. At the moment, this is the most convenient and reliable way of all available. It is in this way that money is transferred to Russia using Profee;

As a result, all types of transfers still work when transferring money to Russia, adjusted for whether the recipient's bank falls under sanctions or not.

How much will an international transfer to Russia cost?

Fortunately, when working with our service, money transfers to any country do not affect the size of the commission. This service will not exceed 1 euro (or 1 pound for the UK), while for small international or local transfers, the fee may be less.

This is achievable thanks to the algorithm of the service, which is different from banking, when working with which you pay a certain percentage of the transfer amount and a hidden commission included in the process of converting funds, withdrawing money by the recipient, and so on. This can be seen personally when working with money transfers abroad with most European banks. It is possible, but not necessary.

First, let's look at the nuances when using bank transfers and money transfers using other operators:

- The amount of commission for bank transfers from Visa and MasterCard payment systems averages 2% of the transfer amount, and the term for crediting such transfers starts from 3 working days;

- When using payment systems for money transfers, the average level of commissions is kept at around 3%, and the speed ranges from a couple of minutes to several days.

When sending large amounts, an additional commission may be charged for each specific money interval, which makes large foreign transfers through such operators especially unprofitable;

When sending large amounts, an additional commission may be charged for each specific money interval, which makes large foreign transfers through such operators especially unprofitable; - In most cases, when receiving such a transfer, you need to come to one of the bank branches or operators' branches with an identity document and stand in line to receive the transfer. This usually takes up your precious time, and time is money.

Our service carries out the issue of electronic funds and is subject to the institution of electronic money, and not to the international banking system. That is why Profee is an affordable and convenient way to transfer money to Russia to customers of any European bank that works with Visa and MasterCard.

If you want to know how to save even more of your money when making purchases and other financial transactions on the Internet, we recommend reading our article about cashback.

How much money will the recipient receive in the transfer?

Knowing how relevant this issue is, we made sure that when sending money abroad, our clients immediately see the final amount of the transfer. To do this, we have created a convenient interface in which you can see the currency conversion rate, the final amount in the recipient's currency and information about the profitability of the exchange rate at the moment compared to the previous day, and this speeds up the process of comparing the currency conversion rate. The system automatically calculates this in a fraction of a second, saving you time as well. You can see how it looks on the example of one of the most popular destinations for fast money transfers to Russia, namely from Germany: just click here to go.

To do this, we have created a convenient interface in which you can see the currency conversion rate, the final amount in the recipient's currency and information about the profitability of the exchange rate at the moment compared to the previous day, and this speeds up the process of comparing the currency conversion rate. The system automatically calculates this in a fraction of a second, saving you time as well. You can see how it looks on the example of one of the most popular destinations for fast money transfers to Russia, namely from Germany: just click here to go.

Due to the favorable exchange rate, the recipient always receives more money than in cases of using other methods of sending money to Russia. In this case, the funds go directly to the specified card, they do not need to be withdrawn or received at branches. This is one of the main advantages of electronic money transfers.

The one-time amount of funds received when transferring money from Europe to Russia is also different. It depends on the sender's account type. For example, the Basic account allows you to transfer only 100 euros per month and is more suitable for instant, irregular money transfers from Europe to Russia. Upon obtaining the Plus or Premium status, the transfer limit increases to 15,000 and 100,000 euros per year, respectively, giving the recipient the opportunity to receive large amounts of money with a commission of only 1 €.

It depends on the sender's account type. For example, the Basic account allows you to transfer only 100 euros per month and is more suitable for instant, irregular money transfers from Europe to Russia. Upon obtaining the Plus or Premium status, the transfer limit increases to 15,000 and 100,000 euros per year, respectively, giving the recipient the opportunity to receive large amounts of money with a commission of only 1 €.

How long does it take to transfer money to Russia on card

With Profee, this process will take you no more than a few minutes on average. In order to make a money transfer to a recipient from Russia and any other country supported by the Profee service, you need to log into an existing Profee account or go through a simple registration procedure. To do this, you need to perform the following steps:

- Select the desired direction for money transfer, for example, from Spain to Russia, and indicate the desired transfer amount. The currency converter will indicate the total amount in the recipient's currency, then click the "Submit" button;

- Enter your phone number, provide basic information about yourself, and download an additional documentation package if you wish to upgrade your account.