How to buy savings bonds for child

Giving savings bonds as gifts — TreasuryDirect

Gifting electronic EE or I savings bonds

For electronic savings bonds as gifts, both you and the recipient must have a TreasuryDirect account. TreasuryDirect is the official United States government application in which you can buy and keep savings bonds.

Learn about TreasuryDirect Open a TreasuryDirect account

You can gift a savings bond to adults or children. A child under 18 can have a TreasuryDirect account if the child's parent or other adult custodian has a TreasuryDirect account and sets up a linked account for the child.

About linked accounts

In TreasuryDirect, you can give anyone either EE or I savings bonds.

EE savings bonds I savings bonds

Comparing EE and I savings bonds

What you need to know about the recipient

To give an electronic savings bond to someone else, you must know that person's

- Full name

- Social Security Number (or Taxpayer Identification Number)

- TreasuryDirect account number

You can also save that information in your account so it will be there for you to give the person other gift savings bonds in the future.

How far in advance to buy the savings bond

You must hold the savings bonds in your account for at least 5 business days before you deliver them to the gift recipient.

That 5-day hold lets us be sure that the money for the gift has successfully gone through the banking system.

How to buy and deliver a gift bond in TreasuryDirect

Use either these videos or the PDF step-by-step instructions sheet:

Buying a Gift Savings Bond

Delivering a Gift Bond

Step-by-Step Instructions

How the person knows there's now a gift bond in their account

When you deliver the savings bond to the recipient's TreasuryDirect account, we send them an email announcing the gift.

You can also let them know yourself with one of our gift announcements.

Gifting paper I savings bonds

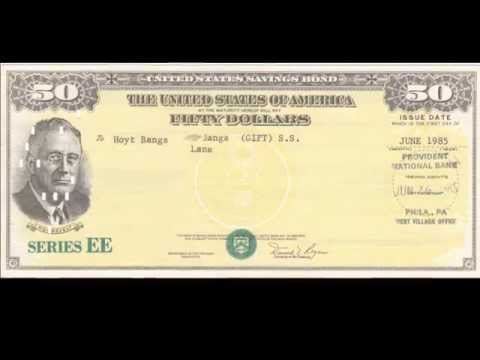

Only Series I savings bonds are available in paper.

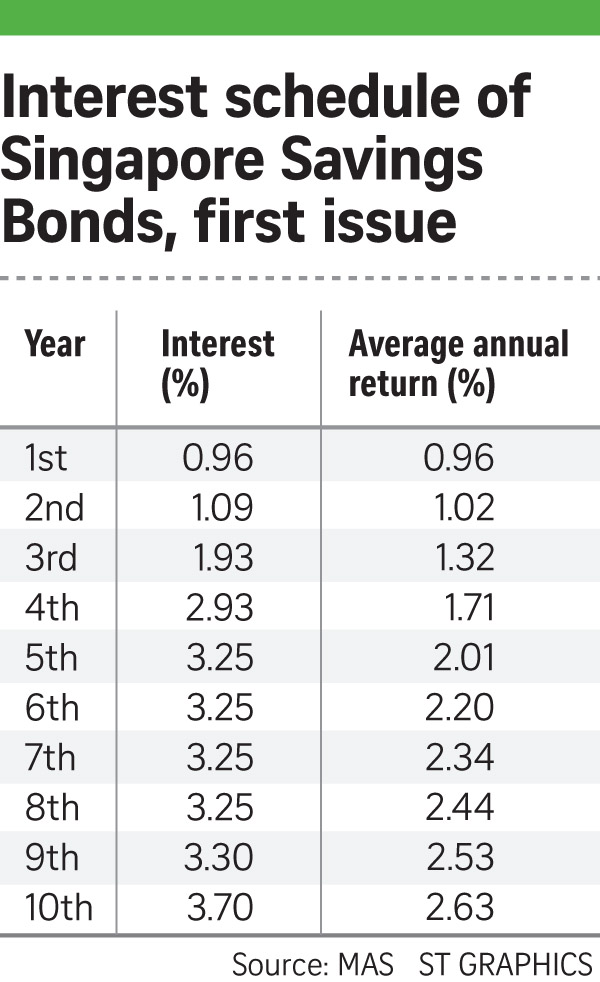

Paper Series I savings bonds come in 5 denominations: $50, $100, $200, $500, and $1,000.

The only way to get a paper savings bond is to use your IRS tax refund. With your tax refund, you can buy savings bonds for anyone (yourself, your child, or as a gift to anyone).

With your tax refund, you can buy savings bonds for anyone (yourself, your child, or as a gift to anyone).

If you buy paper savings bonds, we mail the savings bonds to you. You can then give the gift bonds yourself to the gift recipient.

You can also send or include one of our pretty gift announcements.

For more about buying paper savings bonds, see Using your income tax refund to buy paper savings bonds

Sending an announcement to tell about your gift

We have more than 25 announcements in 9 different categories for you to choose from.

Choose the design you want. Personalize it online. Print it at home. Give or send it to let someone know they are getting a savings bond from you.

See all the available gift announcements

User Guide Sections 121 Through 130 — TreasuryDirect

User Guide 121

Page Title: ManageDirect

® > De-Link Minor Account RequestWhat you can do on this page:

After reviewing the information you provided, submit your request to de-link the Minor account you selected. When a minor reaches age 18 and establishes a Primary account, you may de-link the securities and Zero-Percent C of I from the Minor account to move to the new Primary account. You may not perform transactions in a de-linked account, however, all records of previous transactions are still available in History.

When a minor reaches age 18 and establishes a Primary account, you may de-link the securities and Zero-Percent C of I from the Minor account to move to the new Primary account. You may not perform transactions in a de-linked account, however, all records of previous transactions are still available in History.

Primary Actions

- Click "Submit" to go to ManageDirect > De-Link Minor Account Review.

- Click "Cancel" to return to ManageDirect > De-Link an Account.

Help Home

User Guide 122

Page Title: ManageDirect

® > De-Link Minor Account ReviewWhat you can do on this page:

Review your request to de-link a Minor account from your Primary account.

By clicking "Submit" you agree to the following:

- You are certifying that you have the authority to perform the de-link transaction on behalf of the Linked account number noted in the transaction.

- You understand the securities in the Linked account will be de-linked from your account and moved to the former minor's Primary account number you provided.

- You understand that it is your responsibility to provide the former minor any tax forms generated by this account. De-linking is neither a taxable event for the Primary account holder nor for the former minor.

The purchase amount of the securities you transfer, deliver as gifts, or de-link to another TreasuryDirect account holder is applied to their annual purchase limitation in the year the transaction occurs. You may purchase up to $10,000 of each security type - EE or I Bonds - per person each calendar year.

HELPFUL HINT

The minor is responsible for any taxable amount that we report on an IRS Form 1099.

Primary Actions

- Click "Submit" to go to ManageDirect > De-Link Minor Account Confirmation

- Click "Cancel" to return to ManageDirect > De-Link Minor Account Request

Help Home

User Guide 123

Page Title: ManageDirect

® > De-Link Minor Account ConfirmationWhat you can do on this page:

This confirmation page verifies the Minor account has successfully de-linked and is now inactive. You will no longer be able to perform any transactions in this account. All of your previous records of transactions will be available in History.

You will no longer be able to perform any transactions in this account. All of your previous records of transactions will be available in History.

You may want to print this page or record this information.

HELPFUL HINT

You will be given a confirmation number for each security and the Zero-Percent C of I that is de-linked. The first character will be "X" for Security De-Linked and "V" for Zero-Percent C of I De-Linked. Each confirmation number will be sequentially designated and never repeated for each account number. Increments build from letters AAAA to numbers 9999 for each confirmation number.

Help Home

User Guide 125

Page Title: ManageDirect

® > Linked Account(s) SummaryWhat you can do on this page:

You may view a summary of your Linked accounts and select one you wish to access.

TreasuryDirect Linked accounts let you open a Minor account (in an individual account only) or Custom account linked to your Primary account. Use the Conversion account to convert your paper securities into electronic form through SmartExchange®. Holdings for each Linked account are kept separately from your Primary account and can be accessed only through your Primary account. An online IRS Form 1099 is available for your Primary account and each Linked account.

Use the Conversion account to convert your paper securities into electronic form through SmartExchange®. Holdings for each Linked account are kept separately from your Primary account and can be accessed only through your Primary account. An online IRS Form 1099 is available for your Primary account and each Linked account.

A Minor account (in an individual account only) is a custodial account you may establish for a child under the age of 18 if you are a parent, natural guardian, or person providing chief support. You may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. When the minor reaches age 18 and establishes a Primary account, you may de-link the securities from the Minor account to move them to the new Primary account.

A Custom account is a flexible account you establish to meet specific financial goals. You can even create a customized name, such as "Vacation Fund," for the account. The account offers the same capabilities you enjoy in your Primary account.

A Conversion account is an account created so that you may convert your paper Series EE and I Bonds to electronic securities. You may convert your bonds through SmartExchange when the link “Establish a Conversion Linked Account” appears in the “Manage My Linked Accounts” section on the ManageDirect page in your primary account

Primary Actions

- Choose a radio button and click "Select" to go to the Account Summary for the appropriate Linked Account.

- Click "Cancel" to return to ManageDirect

Help Home

User Guide 126

Learn More About Linked Accounts

TreasuryDirect linked accounts allow individual account owners, and Account Managers on behalf of entity accounts, the flexibility of managing a securities portfolio customized to your needs in an account that is "linked" to your TreasuryDirect account. Open a Minor account (individuals only) or Custom account, or use the Conversion account to convert your paper securities into electronic form. TreasuryDirect linked accounts make it easy to keep track of all your savings securities in a single account. Linked accounts may only be accessed through your Primary TreasuryDirect account. For your added convenience, holdings for each Linked account are kept separately from your Primary TreasuryDirect account.

TreasuryDirect linked accounts make it easy to keep track of all your savings securities in a single account. Linked accounts may only be accessed through your Primary TreasuryDirect account. For your added convenience, holdings for each Linked account are kept separately from your Primary TreasuryDirect account.

Minor Account

This is a custodial account that a parent, natural guardian, or person providing chief support establishes for a child under the age of 18. The Minor account is linked to your primary TreasuryDirect account and only you, as the custodian, can access the account. You may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. When your child reaches age 18 and establishes his/her own TreasuryDirect account, you may de-link the securities into their new account. De-linking refers to moving the Linked account's securities to a Primary TreasuryDirect account. Instructions for De-linking can be found on the How Do I. ..? link within the account. Once the minor account is de-linked it is deactivated and all new transactions within the minor account are prevented.

..? link within the account. Once the minor account is de-linked it is deactivated and all new transactions within the minor account are prevented.

If you choose to maintain the Minor account once the minor reaches age 18, you are restricted from performing nearly all transactions, however, you can still purchase securities on the child's behalf. Minor linked accounts are not available in entity accounts.

After establishing a minor account, if you wish to add any of the bank accounts listed in your Primary account or add a new bank, go to ManageDirect within the minor account and click the “Update my Bank Information” link for further information. If you need to designate a different existing bank account as the primary bank, call us at (844) 284-2676.

Custom Account

This is a flexible account you can establish to meet specific financial goals. You can even create a customized name, such as "Vacation Fund," for the account. We offer the same convenient capabilities as in your Primary TreasuryDirect account.

After establishing a custom account, if you wish to add any of the bank accounts listed in your Primary account or add a new bank, go to ManageDirect within the custom account and click the “Update my Bank Information” link for further information., If you need to designate a different existing bank account as the primary bank, call us at (844) 284-2676.

Conversion Account

This is an account you can create to convert your paper Series EE or I Savings Bonds into electronic securities in your TreasuryDirect account. When a bond that has reached final maturity is converted, TreasuryDirect will automatically redeem it and purchase a Zero-Percent Certificate of Indebtedness (C of I) in the primary account.

NOTE: An online IRS Form 1099-Substitute is available for your Primary account and each Linked account.

Help Home

User Guide 128

Page Title: ManageDirect

® > Establish an Account for a Minor > ReviewWhat you can do on this page:

All the information you submitted in the account establishment process is displayed for your review. You may select "Edit" to change what you entered.

A Minor account is a custodial account you may establish for a child under the age of 18 if you are a parent, natural guardian, or person providing chief support. You may purchase, redeem, receive gift deliveries, and perform other transactions within the account on behalf of the minor. When the minor reaches age 18 and establishes his or her own Primary account, you may de-link the securities from the Minor account to move them to the newly established account.

By clicking "Submit" you agree to the following:

- I certify that I am establishing this account on behalf of a child who is under the age of 18 years.

- I understand that the terms and conditions of the governing regulations contained in 31 CFR part 363 apply to this account.

- I understand that I have agreed to accept Form 1099-Substitute electronically instead of on paper for every year a statement is furnished for this account.

- I certify that I am the child's parent, or if I am not the child's parent, that I provide the child's chief financial support. I further certify that no legal representative for the child's estate has been appointed.

- I understand that a security purchased for this account is the property of the child. After the child attains the age of 18 years, I understand that I have the option to deliver the security to the account of the child, or the child may request the delivery of the security from the Bureau of the Fiscal Service (formerly Bureau of the Public Debt). I understand that after the child attains the age of 18 that I am restricted to performing certain transactions on the minor's behalf.

- I certify that all information provided for this account establishment application, including the financial institution account information, is true, correct and complete.

Primary Actions

- Click "Submit" to go to Account Info.

- Click "Edit" to return to ManageDirect > Establish an Account for a Minor.

- Click "Cancel" to return to ManageDirect > Establish an Account for a Minor.

Help Home

Further Reading

Currently Viewing: User Guide Sections 121 Through 130 (Subpage of: User Guide)

Other Pages:

- TreasuryDirect Help

- TreasuryDirect FAQ

- TreasuryDirect Glossary

- User Guide

- How Do I...?

- Learn More

- Technical Help

how to invest in savings bonds for kids

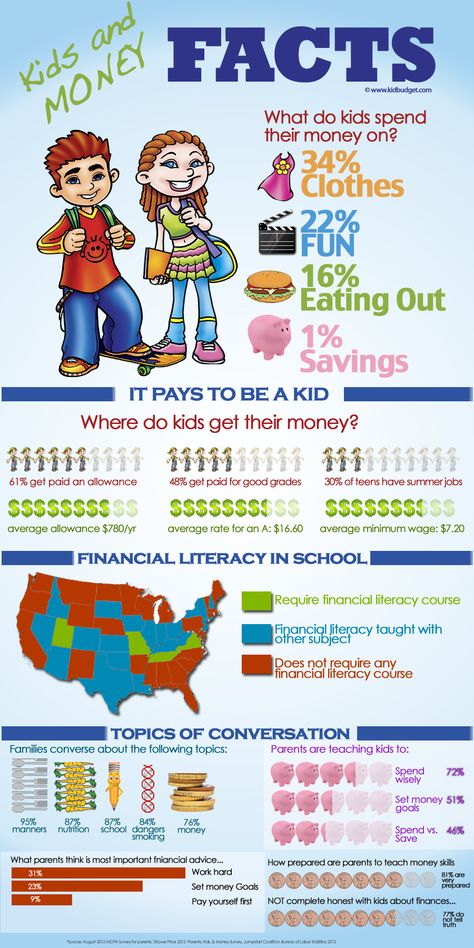

A cash gift is always a great choice for the special young man in your life who has everything. You can show them how much you care about them and do something good for their future. Making a financial contribution is often as easy as putting a few dollars in an envelope. This does not mean that these gifts have no value. Luckily, there are additional gift options that convey the same emotions but have the added benefit of making money over time. You can buy or give money to the children or grandchildren in your life today, and invest in their future well-being and aspirations by purchasing US Treasury savings bonds for them.

You can show them how much you care about them and do something good for their future. Making a financial contribution is often as easy as putting a few dollars in an envelope. This does not mean that these gifts have no value. Luckily, there are additional gift options that convey the same emotions but have the added benefit of making money over time. You can buy or give money to the children or grandchildren in your life today, and invest in their future well-being and aspirations by purchasing US Treasury savings bonds for them.

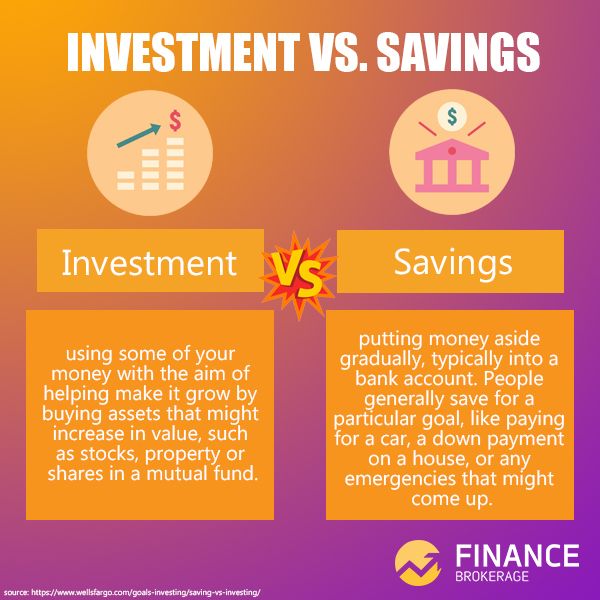

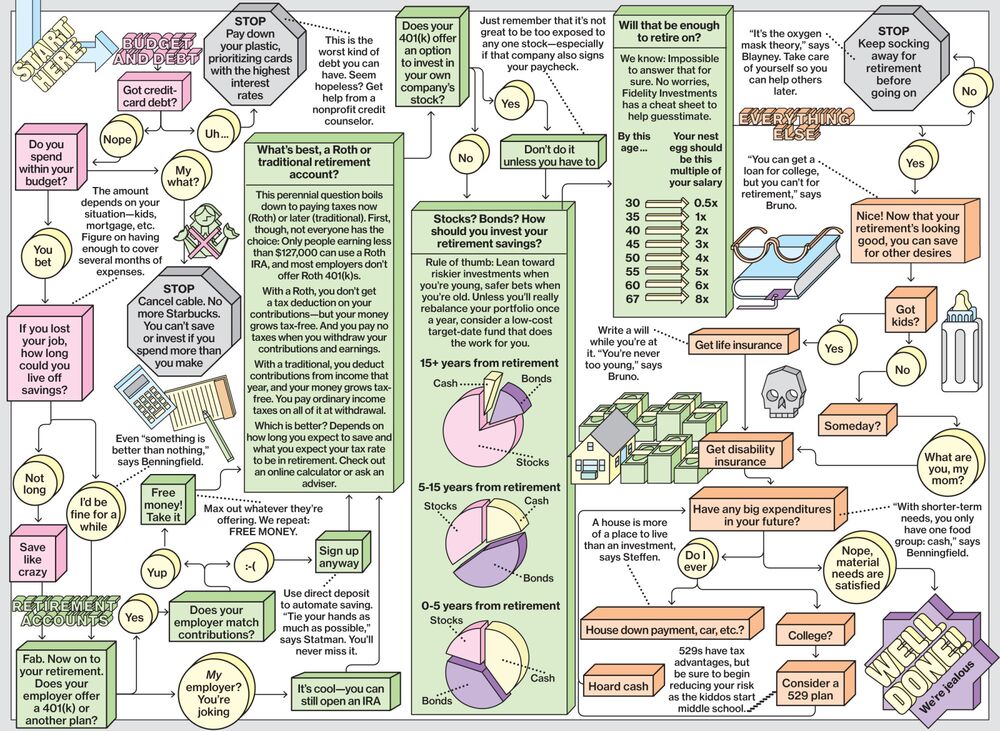

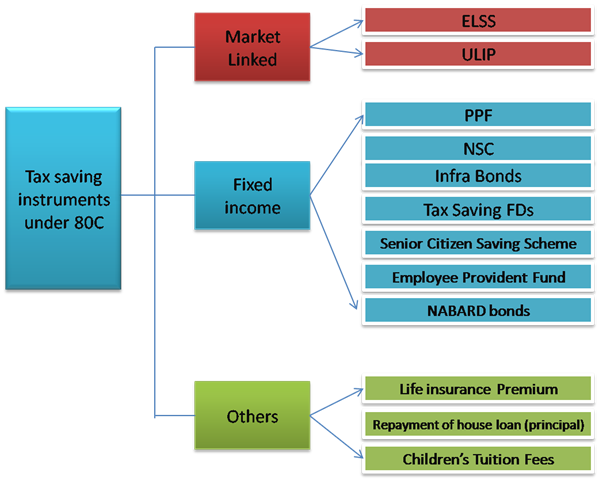

Unlike other assets such as stocks or real estate, savings bonds have limited upside potential. Savings bonds are a type of investment that has been around for a long time. Stock market index funds are often more profitable than legacy assets such as mutual funds.

Do you have doubts about giving a savings bond to a young person in your life? Learn more about savings bonds, the pros and cons of buying them for kids, and some other options to consider if a savings bond isn't right for you by continuing to read this article!

What are savings bonds?

The United States Department of the Treasury issues savings bonds as an investment. It is an investment with low risk and high return.

It is an investment with low risk and high return.

As if lending money to the government, buying a savings bond is like investing. The government must return the money to you after a set period of time. At the same time, you will also be able to receive interest on the loan.

TreasuryDirect, the US government's official Treasury bond website, offers online purchasing of savings bonds. Whether for yourself or as a gift, they are available.

Giving savings bonds to children is becoming more and more common. Their prices do not fluctuate with the stock market, making them a low-risk investment that provides a stable rate of return.

Compared to some of the best investments for kids, savings bonds offer a negligible return on investment (usually less than 1%). (like shares).

How do savings bonds work?

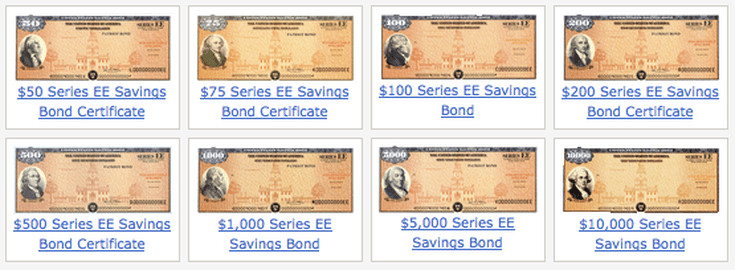

The federal government supports savings bonds issued by the US Treasury. They are available for as little as $25 or up to $10,000, depending on your budget.

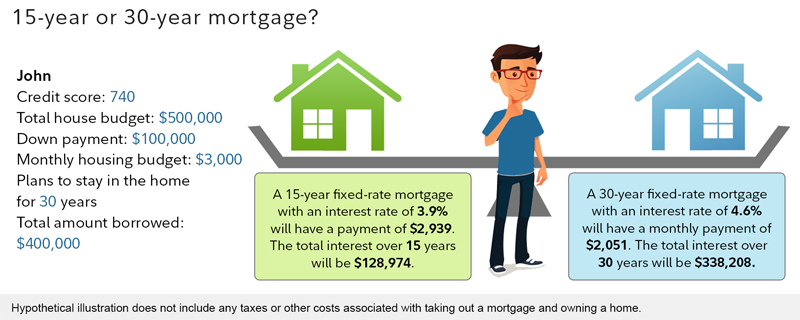

Buying a savings bond is simply a loan to the government and you will get your money back at a later date. While you wait, interest can accumulate up to 30 years.

However, you must wait at least five years before cashing out your savings bond to receive all accrued interest.

The best time to give a savings bond is when the recipient is willing to redeem it in full.

According to the US Department of the Treasury, as of April 1980, about 29million savings bonds maturing in 2021 billion dollars remained outstanding.

There are two different types of savings bonds:

Series EE bonds:

As monthly interest payments, these bonds are available in electronic form.

In the next 20 years they will double in value. EE series bonds purchased before April 0.10 will pay an interest rate of 2022 percent.

Series I bonds:

With an IRS tax refund, you can buy a Series I bond on paper, but you can also get these bonds online.

Unlike EE bonds, they have a fixed interest rate and a variable interest rate that fluctuates with inflation. This distinguishes them from EE series bonds.

Series I Notes purchased before April 2022 carry a composite interest rate of 7.12%. Every six months, a portion of this rate is linked to inflation.

Purchase restrictions have been set. You can buy up to $10,000 in Series I Electronic Bonds, $10,000 in Series I Physical Bonds, and $5,000 in Series EE Bonds during a calendar year.

Also, these figures do not include savings bonds received as gifts.

How do EE bonds work?

Minimum purchase: $25

Maximum purchase amount: $10,000 per year.

Interest rate: Constant rate (currently 0.1%). In addition, the return on investment in EE bonds is guaranteed to double in 20 years (which is about 3.5 percent if held for 20 years).

Minimum holding period: 1 year

Interest period: 30 years or until maturity, whichever comes first

Early repayment penalty: Cancel interest for the previous 3 months up to 5 years; after 5 years no penalty

Tax considerations: Interest is taxed as income at the federal level, but is exempt from most state and local taxes. However, if they are used to pay for qualified education expenses, the interest may be exempt from federal taxation.

However, if they are used to pay for qualified education expenses, the interest may be exempt from federal taxation.

There is no other savings bond like the EE bond that will increase in value by 100% if held for the full 20 years.

EE Series Savings Bond;

The interest rate paid on EE bonds is relatively modest (currently 0.1 percent). On the other hand, if a bond is held for 20 years, a one-time adjustment will be made to ensure that the value of the bond has increased by an amount equal to its face value.

Series EE bonds can yield 2% per annum for 20 years. This is the same as an interest rate of around 3.5 percent.

On the other hand, if you don't keep it for 20 years, you'll just benefit from the reduced interest rate that applied when you bought it.

In sharp contrast to this:

- In 20 years, a $1,000 EE bond will be worth $2,000 in cash.

- A total of $1,019.17 could be earned on $1,000 worth of EE bonds held for 19 years (based on current interest rates).

- EE bonds often make the most sense if held for at least 20 years due to the specific interest structure of the bond. Series I bonds, on the other hand, are more likely to deliver higher returns over time.

How to pay off savings bonds?

The TreasuryDirect online account is the preferred redemption method for savings bond holders. The connected bank account can receive the initial money for the purchase, as well as any interest earned once the transaction is completed.

EE and Series I Notes must be held for at least one year before they can be redeemed. They cannot be used for the first year.

To pay off your savings bond early, you will have to pay a small fee. The past three months have been quite exciting for me.

I-bonds are redeemable after 20 months but will only pay interest for 17 months due to a prepayment penalty.

Pros and cons of savings bonds for children

There are good and bad things you should know about savings bonds. Remember these important points.

Remember these important points.

Pros

Low risk investment:

The United States government supports savings bonds. Their value will not fall until the government pays off its debts (which is highly unlikely). Savings bonds are safe investments, unlike more volatile investments such as stocks, which can cause you to lose money.

Long-term gift to a child:

You can increase the effectiveness of your financial giving by investing in savings bonds, which increase in value over time. Financial gifts can help a child get on the right financial path.

No fees or charges:

Savings bonds are purchased through TreasuryDirect instead of a stockbroker. Purchases and redemptions are free of any fees or commissions.

Tax benefits:

Most state and local taxes on interest on savings bonds are excluded. On the other hand, federal income tax is still required for interest payments..png)

Cons

Low returns:

Savings bonds have lower returns than more aggressive investments such as stocks. To reduce risk, investors must make this trade-off.

Separate account required:

TreasuryDirect is the only place you can buy savings bonds. You cannot buy them with a regular brokerage account or a minor's depository account.

Minimum holding period:

The holder of Series I and Series EE bonds must wait at least one year after purchase before redeeming them.

Percentage sanctions:

In both types of savings bonds, if you redeem them before the five-year milestone, you will be fined. In case of early repayment, you will lose the interest accrued for the last three months. I-Bonds can be redeemed after 25 months, but interest will only be paid for 22 months.

Adjustable rate:

Every six months, the interest rate on I-bonds changes. No matter what inflation rate was specified at the time of purchase, it is only valid for 6 months.

No matter what inflation rate was specified at the time of purchase, it is only valid for 6 months.

Inflation will be the determining factor in future interest rates. On the other hand, the interest rate on EE bonds is fixed and cannot be changed.

Buying Savings Bonds for Kids

Savings Bonds on Treasurydirect

When it comes to buying savings bonds for kids, TreasuryDirect.gov is the only place to buy savings bonds. This is the only way to buy electronic savings bonds.

You can also use the tax refund to buy Series I physical savings bonds, but only if you are due a refund. Paper bonds can only be purchased electronically.

You or someone else can purchase a savings bond. The recipient may be included in the pledge as the "owner" or "co-owner". You can give savings bonds to anyone, even children.

The recipient must already have a TreasuryDirect account for this to work. If they don't, open an account before buying the bond. A parent or guardian must set up an account associated with the minor in order for the child to use this service.

A TreasuryDirect account is also required by the purchaser when purchasing savings bonds for children. Because of this, you and your child must each create an account.

Information required to purchase Child Savings Bonds:

- Child's Full Name

- Child's Social Security Number (SSN)

- Minor's TreasuryDirect Account Number

- The child's Social Security Number (or Taxpayer Identification Number) must be obtained from the parent.

- If you want to buy savings bonds on behalf of another person, you will need that person's tax identification number.

Treasury bonds purchased as gifts must remain in the purchaser's account for five days before being released to the intended recipient.

Print a certificate describing the opportunity to donate a savings bond. However, you must still follow the online procedures above.

You should already know that you cannot buy or sell savings bonds on the open market or through brokerage accounts. After a one-year waiting period, TreasuryDirect is the only place to buy and redeem savings bonds.

After a one-year waiting period, TreasuryDirect is the only place to buy and redeem savings bonds.

Buy Savings Bonds for your grandchildren

To purchase digital savings bonds as a gift for your grandchildren, you can use the TreasuryDirect website, which is a secure web-based system operated by the US Department of the Treasury. For those unfamiliar with the process of buying digital savings bonds, here are the main steps to follow to purchase them:

- Go to www.treasurydirect.gov.

- Sign in to your TreasuryDirect account (or open it in your name).

- Purchase the desired type of savings bond (Series EE or Series I) of desired denomination ($25 to $10,000).

- Deliver a savings bond gift to the recipient's TreasuryDirect account.

- Print out a gift certificate to give to the recipient.

Recipient's full legal name, social security number, and TreasuryDirect account number are required. Once a parent or legal guardian of a minor has created their own TreasuryDirect account, they may gift savings bonds to the minor if they have the appropriate permissions to do so.

To keep buying savings bonds for your grandchildren, you will store them in your account's Gift Box.

You can then transfer them to the child's account later if the parent or guardian does not want to create an account.

As a parent, you must provide your child's social security number because the bond will count towards the annual bond purchase limit, not yours.

Series EE Electronic Bonds, Series I Electronic Bonds and Series I Paper Bonds have an aggregate annual purchase limit of US$10,000. This includes all three types of bonds: electronic and paper.

All I'm saying is:

In the 2020 and 2021 tax years, you can give tax-free gifts to any number of people up to $15,000 per year ($529 if you and your spouse live together). This includes gifts for XNUMX college savings plans.

Due to the complexity of tax law, it is recommended that you work with qualified tax professionals. In order for your family to be able to buy or give cash gifts, such as buying savings bonds for your children and grandchildren, and reducing tax penalties, you must act proactively.

Savings bonds for children

Are savings bonds a good gift?

Yes, investing in savings bonds that pay interest over time is considered a safe and simple financial strategy. Also, minors can keep them in their own name, making them the perfect gift for kids.

How can I buy savings bonds for children?

When it comes to buying savings bonds for kids, TreasuryDirect.gov is the only place to buy savings bonds because it's the only way to buy electronic savings bonds.

How can I buy savings bonds for my grandchildren?

To purchase savings bonds for your grandchildren, you can use the US Department of the Treasury's TreasuryDirect website, which is a secure web-based system.

- What is INCOME BOND: definition and benefits

- Best ways to invest money: 7 best + options in 2022 and best practices

- WORK FOR CHILDREN UNDER 13

- BEST SAVINGS ACCOUNT FOR A CHILD: why and how to open a savings account for your child

- KID JOBS: Employment opportunities for children of all ages

month Ukrainians bought them for 94 million dollars.

And all is well if these two-year bonds were not denominated in foreign currency, writes Forbes.ua.

And all is well if these two-year bonds were not denominated in foreign currency, writes Forbes.ua. For centuries, there have been ways in the world to raise funds from the population without taking on currency risks. As early as the 1630s, France was issuing rentes, government bonds to private investors to raise money to finance the Thirty Years' War. In the 1860s in the United States, Philadelphia banker Jay Cook sold Treasury bonds to local residents, thereby helping Lincoln finance the Civil War.

Today, governments of at least 16 countries issue various debt instruments to the public. Ukraine has chosen one of the riskiest options for itself.

Italy

Inflation-Indexed Bonds

Now any loan to the debt-ridden southern European countries is already a victory, but on October 18, 2012, Italy was able to place Eurobonds for 18 billion euros in just a week.

One of the secrets of success: Italian housewives took part in the placement.

Back in the late 1970s. The Italian government decided to reduce its dependence on the banking system and increase the average maturity of government bonds. To do this, it made a bet on the population. The government offered ordinary Italians to buy long-term government bonds. And to make them more interesting, tied to a floating interest rate or exchange rate and agreed to a high yield on these securities. As a result, rates on medium-term bonds for households were higher than on long-term bonds that banks could buy.

This step turned out to be quite effective, helping to increase the investor base and the average maturity of government bonds.

According to the Bank of Italy, the total wealth of Italian families is 9.5 trillion euros (data for 2010). It was through the savings of the population that the state was able to attract the required amount at the October auction.

Italian government bonds (Buono del Tesoro Poliennale - BTP) are regular, inflation-linked, mid- and long-term coupon government bonds. They are not adapted specifically for retail investors, but they are popular with them.

In Italy, as in many other countries, the population can purchase government bonds not only at the secondary market, but also at the primary auction of the Ministry of Finance. Any Italian can buy them through a system similar to the eBay Internet platform.

Belgium

Lottery bonds

The essence of the instrument is a mixture of a bond and a lottery. On the outside, a lottery bond is very similar to a regular, fixed-income bond. But by buying such a paper, a lucky investor can win much more than in the case of buying an ordinary bond - the government buys some of the bonds at a higher cost than they sold them.

For example, the Belgian government can issue 10,000 lottery bonds with a face value of 1,000 euros each. And at the same time, announce that half of them will be redeemed earlier than the official maturity date, and another, say, 120 - not only earlier, but also at a cost a quarter higher than the face value.

These papers are very popular not only in Belgium. They are in use in Sweden, France, Britain and many other countries. In September, Spain also announced plans to finance the needs of local budgets with the help of lottery bonds.

USA

Cumulative bonds

On January 1, 2012, a small era ended in the United States financial market. From that day on, Americans can no longer buy for a friend's birthday or as a gift to a child government paper savings bonds (Paper Savings Bonds) - papers that have been popular in the country for three-quarters of a century.

The Bureau of Public Debt, a division of the US Treasury, decided to abandon the 1935 of the paper form of these instruments, leaving them only in the electronic version.

The news made a lot of noise - Paper Savings Bonds turned out to be an extremely successful tool for retail investors. It was convenient to put them in a congratulatory envelope, and millions of Americans often did this. According to the Bureau, 22 million people hold almost 700 million bonds worth more than $190 billion, although demand has been slowly declining. In 2001, the Americans bought them for $6 billion, in 2010 - only $2 billion.

However, in return, the Treasury provided the public with the ability to directly buy savings bonds from the government through the TreasuryDirect platform. Anyone who has a bank account can use this system, and there is no commission. This makes the process itself more convenient and less costly both for investors and for the state (in Ukraine, bonds for the population are issued not only in foreign currency, but also in paper form to bearer).

Any resident can choose to invest in the USA from two instruments: accumulation bonds and bonds indexed to inflation. Both have maturities of up to 30 years and a put option, but the investor pays a penalty if he submits the bonds to maturity before five years. During the year, one person cannot buy bonds for more than $10,000.

South Africa

bonds with a fixed rate and bonds with an indexed interest rate of

Reserve Bank South Africa

The Government of the South Africa South -Eud was offered in 2004 for the choice of two instruments - for the choice with fixed and indexed interest rates. Both those and others - with maturities of 3, 5 and 10 years.

To become a state creditor, an ordinary resident of South Africa needs to take only three steps: register on the special website of the Reserve Bank of South Africa, select the type of bond and its maturity, and pay.

Although there is an alternative method - to buy a bond, say, in any supermarket.

The bond cannot be transferred to a third party or used as collateral. The minimum investment in fixed rate bonds is 1,000 rand ($112.8), the maximum is 5 million rand ($564,000). Only individuals-citizens or residents of South Africa who have an account with a local bank can buy securities. A put option allows you to sell securities to the government before their maturity date (although not earlier than a year later).

The South African government introduced these instruments not only and not so much in order to find a source of additional funding. The main task is to teach the population to save.

Great Britain

Consoles, lottery bonds

Back in 1751, the legendary consoles (from the "consolidated annuity", Consolidated Annuities) were issued in the UK - obligations of the British government that do not have a maturity.

Funds raised through the release of consoles were used, among other things, to finance the war against Napoleon (which in turn was financed by rentes). Many of the issued papers are still in circulation.

In addition to them, today in Britain there is a whole arsenal of debt instruments for the population. Including lottery bonds proposed by the government back in 1956 (the official name is Premium Bonds).