How much does a child add to tax return

Claiming Dependents As New Parents

First of all: if you recently had a baby, congratulations! You’re in for a lot of changes, and those include changes to the way you file your taxes. Let’s talk about the primary differences you’ll need to be aware of when you file your taxes as a parent for the first time.

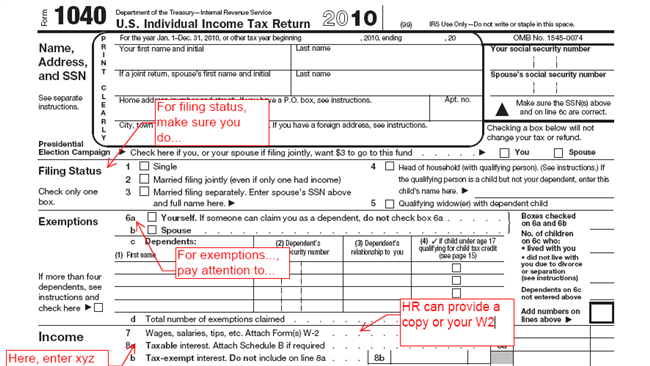

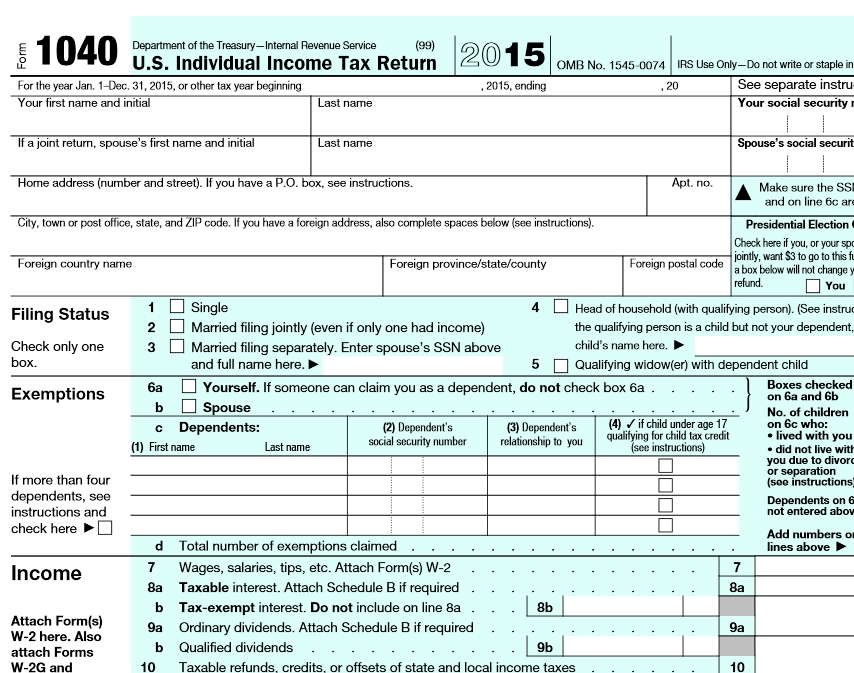

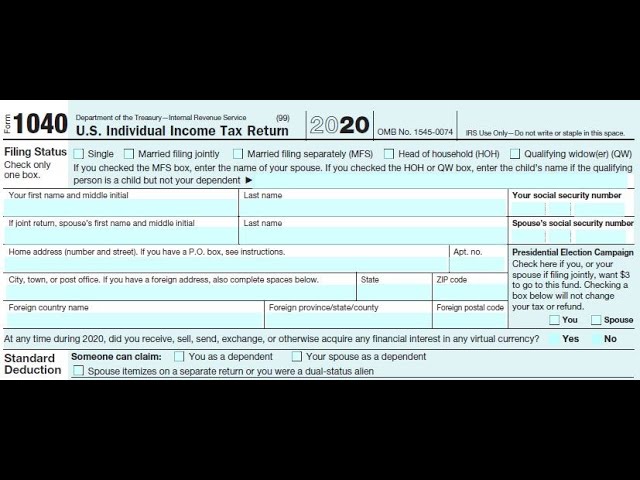

First time filing taxes with a child: Dependency requirements

In order to claim a new child as a dependent, your child will have to meet dependency requirements.

Your first step needs to be applying for your baby’s Social Security Number. You will need this number before doing anything else.

To get the number, visit or contact the Social Security Administration to fill out Form SS5, the Application for a Social Security Card. Once you have applied, it will typically take about two weeks for the number to arrive.

Another requirement is your child must have lived with you for more than half of the year. A dependent child born during the year is treated as having lived with you for more than half of the year if your home was the child’s residence for more than half of the time he or she was alive during the year.

Time the child spent in a hospital after birth won’t count against you.

If you are single, had a baby, and now support that child, your filing status could change to Head of Household (HH).

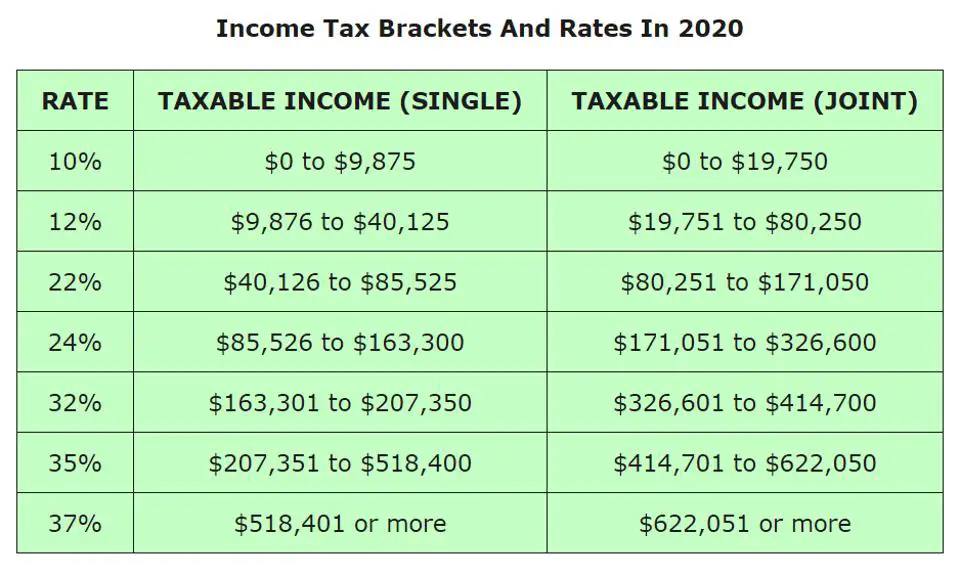

The HH filing status gives you a larger standard deduction and more favorable tax brackets. That means – thanks to your new bundle of joy – you could be paying less federal tax as HH than you would as single for the same dollar amount of income.

If you are married, having a child will not generally affect your filing status.

Claiming the Child Tax Credit

Sometimes parents with newborn will ask, “how much can you get back on taxes per child?”

One of the best-known tax breaks for parents is the Child Tax Credit. A taxpayer with a new baby may claim the child tax credit, which lowers their tax bill by up to $2,000 per qualifying child if the taxpayer’s income is not too high. In some cases, the credit may even exceed your taxes, allowing you to get extra money back as a refund. Everyone knows children can be expensive and paying less in taxes means better diapers or nicer toys for your little one.

Everyone knows children can be expensive and paying less in taxes means better diapers or nicer toys for your little one.

Claiming tax breaks for child care and medical expenses

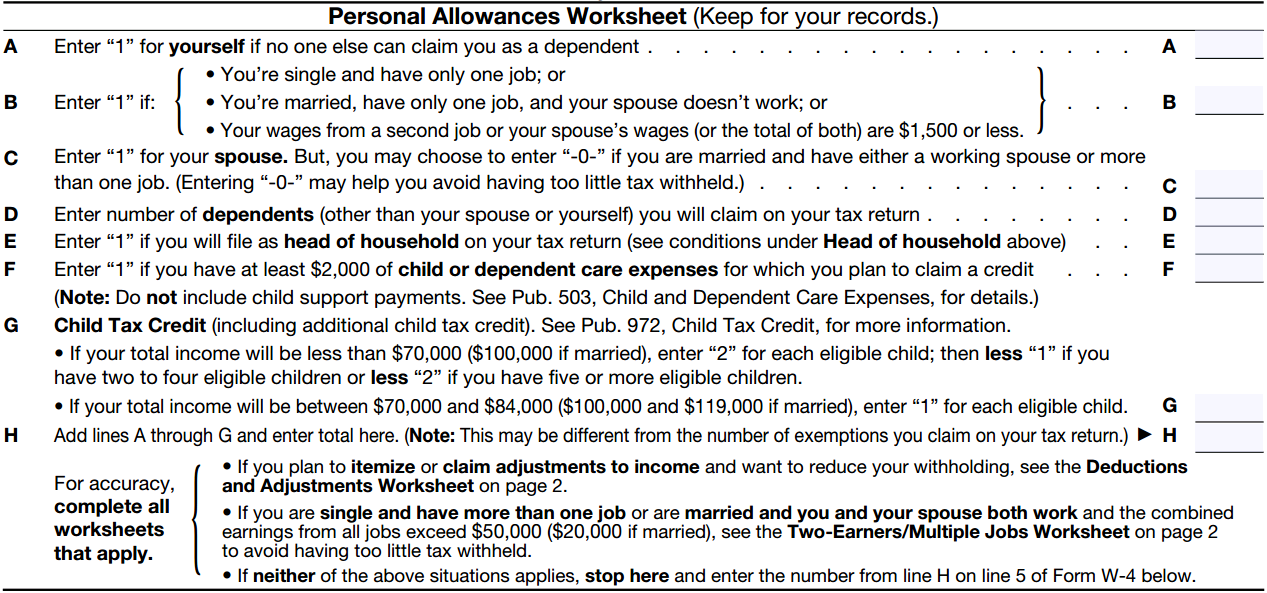

If you paid someone to care for your child while you worked – like a daycare center – you may be able to claim the Child and Dependent Care Credit on your federal income tax return. It’s based on your amount of earned income and can be up to 35% of your qualifying child care expenses, up to a max expense of $3,000 for one child, and up to a max expense of $6,000 for two or more children.

The Child and Dependent Care Credit may be reduced if you receive tax-free dependent care benefits from your employer.

Medical expenses can be deductible if they exceed 7.5% of your adjusted gross income. The out-of-pocket cost of the hospital stay to birth your baby and related care counts as medical expenses, but mothers are surprised to find out that the cost of breast pumps and lactation supplies are medical expenses as well. These expenses may help you get over that 7.5% hump. To qualify for this deduction, you will need to itemize deductions instead of claiming the standard deduction.

These expenses may help you get over that 7.5% hump. To qualify for this deduction, you will need to itemize deductions instead of claiming the standard deduction.

Working taxpayers with a child can claim a credit for qualified child care expenses.

Other tax breaks for parents

Additional tax breaks can be claimed if the following apply:

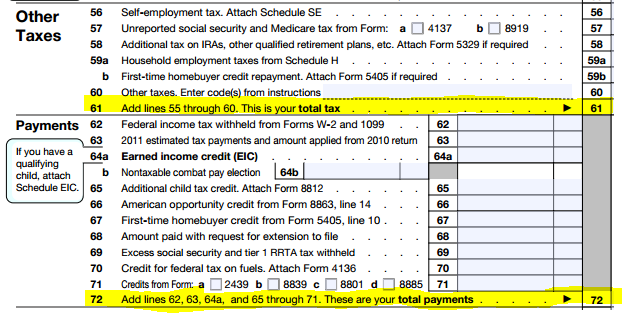

- You qualify for the Earned Income Tax Credit.

- Gifts (in money or property) from friends, grandparents and other relatives are income tax free to you and your child.

- You participate in a qualified tuition program (QTP, also called “a 529 plan”) offered by your state. QTPs allow you to set aside money for your child’s future secondary and higher education expenses. While there is no immediate federal tax break, earnings in the account grow tax free, distributions used for education costs are tax-free, and you may get a state deduction or credit for your contributions.

Are you filing as a first-time parent?

The experts at H&R Block can look at your personal situation and help make sure you don’t miss any tax breaks you qualify for as a new parent. And if you’d rather file your taxes yourself, know you are still backed by our 100% accuracy and maximum refund guarantees. In an office or online, don’t just get your taxes done. Get your taxes won with H&R Block.

And if you’d rather file your taxes yourself, know you are still backed by our 100% accuracy and maximum refund guarantees. In an office or online, don’t just get your taxes done. Get your taxes won with H&R Block.

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

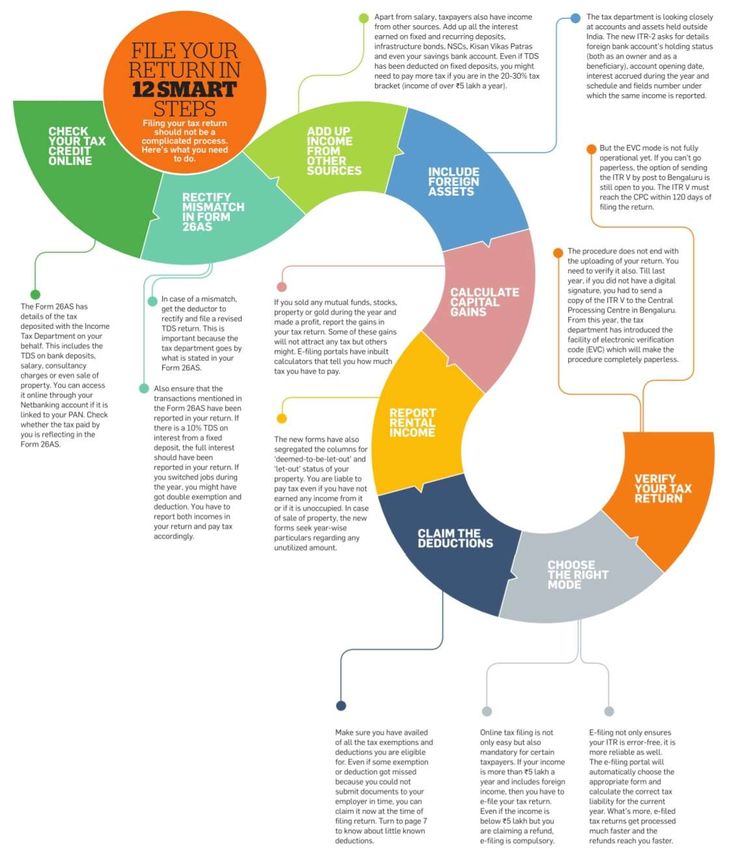

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

Why do some give up US citizenship?

- Tom Gagin

- BBC

Sign up for our 'Context' newsletter to help you understand what's going on.:strip_icc()/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif)

In the second quarter of 2013, 1,131 people renounced US citizenship

This year, the number of Americans renouncing US citizenship broke all records. This is partly due to the new tax law, which forced many expatriates to break away from their homeland forever.

Goodbye, US passport.

Of course, it cannot be said that this is a popular idea among Americans. But many began to think about it and act in this direction.

The number of expatriate Americans who renounced their citizenship in the second quarter of 2013 is many times higher than in the same period last year - 1131 cases compared to 189.

Against the backdrop of six million Americans living and working abroad, this is a small percentage , but the growth dynamics is very serious.

FATCA is a nightmare

The above data is published in the US Federal Register. The specific reasons for this phenomenon are not named, but, according to many, the matter is in the tax system.

On July 1 next year, a law known as FATCA will come into force in the United States, which is aimed at combating tax evasion by Americans using foreign accounts.

Skip the Podcast and continue reading.

Podcast

What was that?

We quickly, simply and clearly explain what happened, why it's important and what's next.

episodes

End of Story Podcast

According to it, all international financial institutions (banks, investment funds, trusts, etc.) will be required to submit reports to the US Internal Revenue Service on the accounts and assets of US clients in amounts greater than $50,000.

According to the US authorities, citizens who hold accounts abroad annually underpay the treasury in taxes in the amount of 100 billion dollars. The new law, they expect in Washington, will help rectify the situation.

Unlike many other countries, Americans are taxed not only because they live in the United States, but also because they have American citizenship - in whatever country they live, they must pay taxes.

And then some expats started waking up in a cold sweat. They used to have to provide all income data and indicate foreign accounts on special FBAR forms, but not all of them did this.

Now, with the introduction of FATCA, those working abroad will have to thoroughly remember everything they own, because from now on the US authorities will be able to learn about them that they did not know before.

Discount card panic

Image caption, Not all foreign banks have yet agreed to comply with the new US Customer Information Act. However, critics of the new measure object, saying that in an effort to pin down the tax-evading rich, the authorities doomed ordinary citizens to a lengthy and expensive paperwork process. For some it was too much.

For some it was too much.

Bridget (name changed at the request of a BBC interviewee) renounced her US citizenship in 2011. She has been living in Scandinavia for the last 32 years.

"This has nothing to do with tax evasion. I've never had to pay taxes in the US because I pay more here. It's just getting harder and harder to keep up with changes in the tax code and comply This procedure was not easy anyway, and after the adoption of FATCA, I thought: “why do I need all this?”, says Bridget.0011

According to her, she felt some kind of threat, even when she seemed to fulfill all her obligations to the state. For example, she panicked when she realized that a regular grocery store discount card was linked to a bank account she didn't know about.

Bridget owns a translation and proofreading company in Scandinavia.

At some point, filing tax returns became so complicated that she decided to turn to professionals. However, their services cost her two thousand dollars a year, and with the introduction of the FATCA law, this amount threatens to increase to $5,000.

However, their services cost her two thousand dollars a year, and with the introduction of the FATCA law, this amount threatens to increase to $5,000.

In addition, fewer tax lawyers are willing to deal with US clients, and some banks are even refusing to open accounts.

"In general, I sleep much better now knowing that I don't have to worry about meeting US requirements. I will never be able to live in the US or own real estate, but I can visit this country and that's enough for me" - says a former US citizen.

Americans under the cap

According to her, even her emotional attachment to the US dissipated over time.

"I've always liked being an American, even though I haven't lived there since I was young. I've always associated myself with America and therefore felt especially angry when I realized that my American citizenship had become more of a burden" - says Bridget.

"When you're an American and you live in America, it's one thing. But when you live abroad, in a sense, the connection with your country is even stronger. You realize that your way of thinking, your personality traits are products of your national identity" .

But when you live abroad, in a sense, the connection with your country is even stronger. You realize that your way of thinking, your personality traits are products of your national identity" .

"Until recently, I always presented myself as an American. Although I will always remain one in my heart, even without a passport. I will always celebrate Thanksgiving and Independence Day on July 4th."

According to Bridget, the tax system is the most talked about topic among US expats she knows. Tax lawyers in the US who deal with Americans living outside the country say this is the hottest and most pressing issue right now.

"I'm all for getting people to pay taxes, but it's getting very expensive to comply with the law," says David Kuenzi, founder of a company that specializes in helping expatriate Americans. fill out their tax returns, just to make sure they don't owe the US anything."

According to Kuenzi, under FATCA, people will have to fill out additional paperwork, but even this did not cause such a flurry of discontent. Basically, people are afraid that now the tax service will have full access to private information.

Basically, people are afraid that now the tax service will have full access to private information.

"There are many very rich people who hide their income and do not pay enough taxes, and this, of course, is a disgrace, something needs to be done about it. But such a measure has taken under the hood every American living abroad, and this is too " adds the lawyer.

"Let the guilty be afraid"

Photo caption,The US Treasury says that only those who have something to hide from the tax inspectorate should be afraid of FATCA

Foreign banks do not seem to be too happy with the new American law either. Republican Senator Rand Paul proposed to remove from it the items relating to the exchange of information between banks and US authorities.

However, the US Treasury strongly supports the new law. In a statement on the agency's website, Deputy Secretary for International Tax Affairs Robert Stack brings some clarity to the situation.

"The passage of the new FATCA does not impose any additional obligations on US citizens living abroad. US taxpayers, including those living outside the country, must comply with US tax laws," he said.

"Those who use offshore accounts to evade taxes do have reason to fear that FATCA will reveal their illegal activities. However, the decision to renounce US citizenship will not relieve these citizens from having to fulfill their tax obligations to the United States for the period, preceded the renunciation of citizenship," the US Treasury Department said in a statement.

Being an American is more important!

But those joining the ranks of former US citizens say it's not about taxes at all.

47-year-old Victoria Feroge is married to a Frenchman and has been living abroad for almost 20 years, mostly in France. She wonders what awaits her if France agrees to comply with the terms of FATCA.

"Will my bank accounts be closed? Or will my husband be forced to remove my name from our joint accounts?"

The thing is that Victoria doesn't work. She is recovering from breast cancer and has no income. This year she paid almost a thousand dollars to complete all the paperwork, and next year she will have to pay even more.

Victoria Feroge was born in Seattle, where her parents still live. She would not want to give up her American citizenship.

"I do not know a single American abroad who would not think about renouncing citizenship, but I will still fight for my rights. And only when I realize that I have used all the methods, I will arrange an audience at the US Embassy," - Feroj says.

However, there are those who are not ready to give up their American citizenship, no matter what the difficulties. In their opinion, being an American is much more important than anything else.

Evelin Liivamägi, Head of the Taxation Department of the Tax and Customs Board, notes that this year the deadline for submission is extended by one month, until April 30 (previously it was possible to submit until March 31).

The NTD will start returning the money, as usual, on February 26th. And this year, 147 million euros of overpaid income tax have already been prepared for a refund. This is an estimate for now, as it may correlate as tax returns come in.

Get or pay extra?

Before filing tax returns, the question often arises: is everything right? And will it not be necessary, by chance, to pay extra to the state?

“Recently I discovered that due to the fact that the accountant at work did not complete everything correctly, I will have to pay an additional 67 euros,” says Anatoly. - And last year you had to pay 125 in general! I really don't understand how this system works.

The NTD specialist notes that last year 530,000 people, or 53%, did not use all the benefits provided to them by the state. And they, after filing income declarations, can get ready to get their money back. Between them, presumably, these 147 million euros will be divided - on average, 277. 35 euros will be obtained for each.

35 euros will be obtained for each.

“Already now, every person can go to the STD self-service department at www.emta.ee and find out in the “My income” section how much of their tax benefit for 2019 they have already used,” advises the specialist.

This section indicates or lists all the income of a person known to the tax authorities. Of course, if you rented real estate last year, sold an apartment or house, were engaged in entrepreneurship, then after filing an income tax return, this amount may change.

Usually it is calculated as follows: if your income is less than 1200 euros per month gross, and you have only one job, then you write an application to the accountant so that every month your benefit of 500 euros (not subject to income tax), which you laid down by law.

If more, then you need to calculate together with the accountant how much you can apply for. And the closer your gross income is to the limit of 2,100 euros per month, the more the tax-free minimum tends to zero.

Tax credits

“I read in your newspaper that the tax credit for the third child has increased significantly since January 1st,” says Kristina. - What for the second - 1848 euros, and for the third - already 3048 euros. Will parents of three children receive such a benefit already now?”

“No,” says Evelin Liivamägi. “The exemption really took effect on January 1, 2020, but you will only be able to use it in 2021 when you file your 2020 tax returns.”

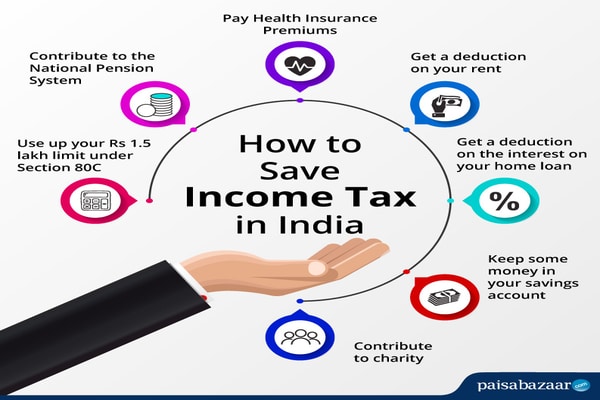

In addition, there are a number of other benefits that are already in effect when filing an income tax return. For example, you can deduct from income: payments to the mandatory funded pension and unemployment insurance payments (if you are not an FIE), insurance premiums paid under the supplementary funded pension insurance contract (the so-called third pillar, you can deduct 15% of income, but not more than 6,000 euros per year), compulsory social insurance payments paid in a foreign country.

Also, if you or your spouse did not work a full year, did not work at all, or had a small salary, they can transfer part of their unused tax credit to you. For example, if the spouse's income for the past year does not exceed 2,160 euros, while the total income of the spouses does not exceed 50,400 euros per year, then you can receive an additional tax benefit. The benefit is calculated for each case individually: the difference between 2160 euros and the income of the spouse for the previous year is calculated.

For example, if the spouse's income for the past year does not exceed 2,160 euros, while the total income of the spouses does not exceed 50,400 euros per year, then you can receive an additional tax benefit. The benefit is calculated for each case individually: the difference between 2160 euros and the income of the spouse for the previous year is calculated.

Another benefit has been added this year: the child's additional tax-free income will not be reduced if the child receives a survivor's pension or a survivor's national pension.

Interest on a home loan taken out to purchase a home for oneself can be debited up to 300 euros per year.

Tax benefits also include tuition fees, gifts and donations. But the total amount of benefits cannot exceed 1200 euros and at the same time should not exceed 50% of the taxable income of the taxpayer in Estonia for the previous year. That is, in order to write off expenses and receive a benefit of 1200 euros, your income for the last year must be at least 2400 euros.

Working pensioners

Among the pensioners there are those who have to work to somehow make ends meet. And for them, the state provides additional opportunities so that they do not overpay income tax.

For example, if both the pension and the pensioner's salary are less than 500 euros, he can apply the benefit in both places: the Social Insurance Board and the employer. To do this, he needs to write an application there and there, indicating the required amount. That is, the benefit in the amount of 500 euros not subject to income tax can be divided in the necessary proportions - based on how it will be more profitable. And before, for example, this was not the case - you could only submit one application, and pensioners lost a lot of money every month.

But when submitting applications to two places, it is important not to miscalculate - so that you do not have to pay extra later.

“For example, the pension is 425 euros per month,” says Evelin Liivamägi, “and the salary is 1,000 euros gross. That is, it turns out that a person’s total income of 1425 euros per month gross (and we remember that after the bar of 1200 the tax benefit begins to decrease. - Ed.) allows you to use only a minimum of 375 euros per month that is not subject to income tax. If a working pensioner writes an application for a tax benefit of 500 euros per month to both the Social Insurance Board and the employer, then he will have to pay extra.”

That is, it turns out that a person’s total income of 1425 euros per month gross (and we remember that after the bar of 1200 the tax benefit begins to decrease. - Ed.) allows you to use only a minimum of 375 euros per month that is not subject to income tax. If a working pensioner writes an application for a tax benefit of 500 euros per month to both the Social Insurance Board and the employer, then he will have to pay extra.”

According to the NTD specialist, if a person asks for a tax benefit of 1,000 euros per month (500 + 500), although he is entitled to a benefit of only 375 euros, then sooner or later the state will require him to return the money.

“It turns out that a person will then have to pay 1,500 euros to the state,” says Evelin Liivamägi.

In order not to bring it to this point, do not write to both places - the Department of Social Insurance and the employer - an application for the application of the tax relief "to the maximum". And it is better to calculate where you get more? If, for example, your pension is the same 425 euros per month, plus you still earn 250 euros, then write to the Social Insurance Board, which pays you a pension, an application for 425 euros per month so that taxes are not withheld from the pension at all, and then apply to the employer for 75 euros per month (500–425=75). And then you don't have to pay anything.

And then you don't have to pay anything.

It's also important to remember that when you file your tax return, you can deduct, for example, a fee for your grandson's daycare or playing football as a tax credit. Based on an average of 50 euros per month, a benefit of 600 euros per year is obtained. And the law allows you to write off the cost of education of any resident of Estonia under the age of 26, you only need to provide the tax authorities with a certificate that you really paid (and the school must have a license). Then this amount will be deducted from your income, and you will have to pay less taxes.

If you have two jobs

If you work in two (or more) places, then there are also some nuances. Unlike working pensioners, you can only apply for the €500 exemption to one employer.

“For example, a person in 2019 worked in two places,” says Evelin Liivamägi, “and received 1,000 euros gross both there and there. He wrote an application to one employer for 500 euros, and the second calculated income tax from the first euro. But the total income was 24,000 euros per year, or 2,000 euros per month, and the benefit could be applied not at 500 euros, but 10 times less, that is, 55.56 euros per month. And the person will have to pay 1,066.66 euros to the state.”

But the total income was 24,000 euros per year, or 2,000 euros per month, and the benefit could be applied not at 500 euros, but 10 times less, that is, 55.56 euros per month. And the person will have to pay 1,066.66 euros to the state.”

But if you have children, a home loan with interest on it, you pay for mugs, donate money to someone or save for the third pension pillar, then you can write it all down as tax benefits, and then you will have to pay less extra. Or not at all.

Real estate for rent

At the beginning of this year, about 5,000 people who rent out real estate received a letter of happiness from the tax authorities.

“If the person who received the letter rented out real estate and received income from it, then he must correct the declarations for previous years by February 7,” says Evelin Liivamägi. - If a person received a letter, while not handing over anything and receiving no income, you need to inform the NTD about this and, if necessary, provide evidence. You can report by e-mail: [email protected] or by phone 880 0811.”

You can report by e-mail: [email protected] or by phone 880 0811.”

If, she adds, you rented out a property but didn't get a letter this time, you don't have to wait for the roasted rooster to peck. Tax officials urge to honestly indicate everything in the declaration and pay income tax.

“I'm renting out an apartment,” says Vladimir, “but since I started doing it only last year, I still don't know all the nuances. At work, they say that I can write off 20% of the income supposedly for repair costs, and pay income tax on only 80%. There is no need to submit proof of repair costs. Is it so?"

The tax authorities confirm that such a benefit does exist. And indeed, they do not need to provide any documentary evidence of the costs of repairs and maintenance.

“NTD itself calculates 20% of the income indicated as “received from the lease of real estate under a lease agreement,” she says. – This happens automatically from the amount (gross) entered by the person. But this applies only to real estate leased as residential premises. If we are talking about business premises, then 20% of the owner’s rental income cannot be deducted.”

But this applies only to real estate leased as residential premises. If we are talking about business premises, then 20% of the owner’s rental income cannot be deducted.”

Donations and gifts

“My children transfer 100 euros to my account every month as assistance. The pension is small, not enough to live on. Will the tax authorities demand to pay taxes on this money? - Valentin Fedorovich, a resident of Kohtla-Jarve, is worried.

However, the NTD specialist assures that if one private person provided any assistance to another private person, with money or things, that is, an ordinary person helped another ordinary person, then this money is not taxed. True, they cannot be used as benefits as gifts or donations either.

“What if I donated to an animal shelter last year and transferred money to little Annabelle, who needed 2 million euros for medicine? asks Andrei, a resident of Tallinn. “Can I put this money on my tax return to be written off as a benefit as a donation?”

“If donations were from a private person to the account of another private person, then they cannot be written off,” the tax authorities explain.

:max_bytes(150000):strip_icc()/recognizing-and-treating-a-yeast-diaper-rash-284385_V3-aecf9328ee0b491992c051f490e5a4bf.png)