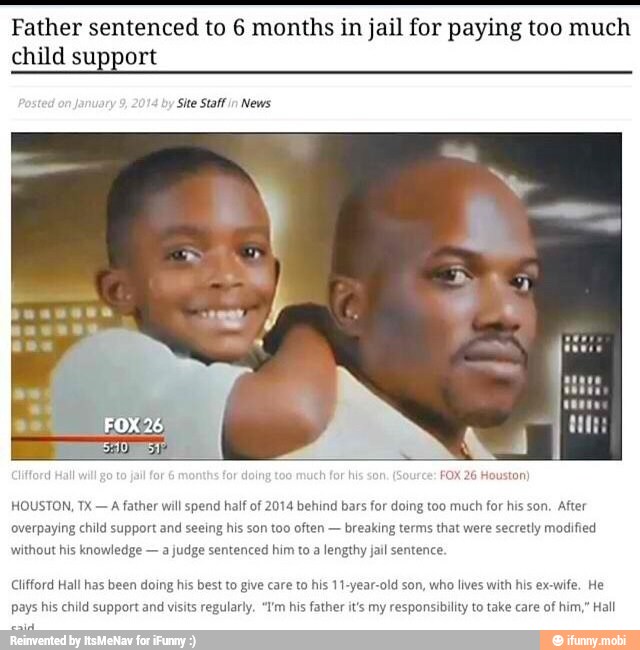

How much do you pay for child support in massachusetts

|

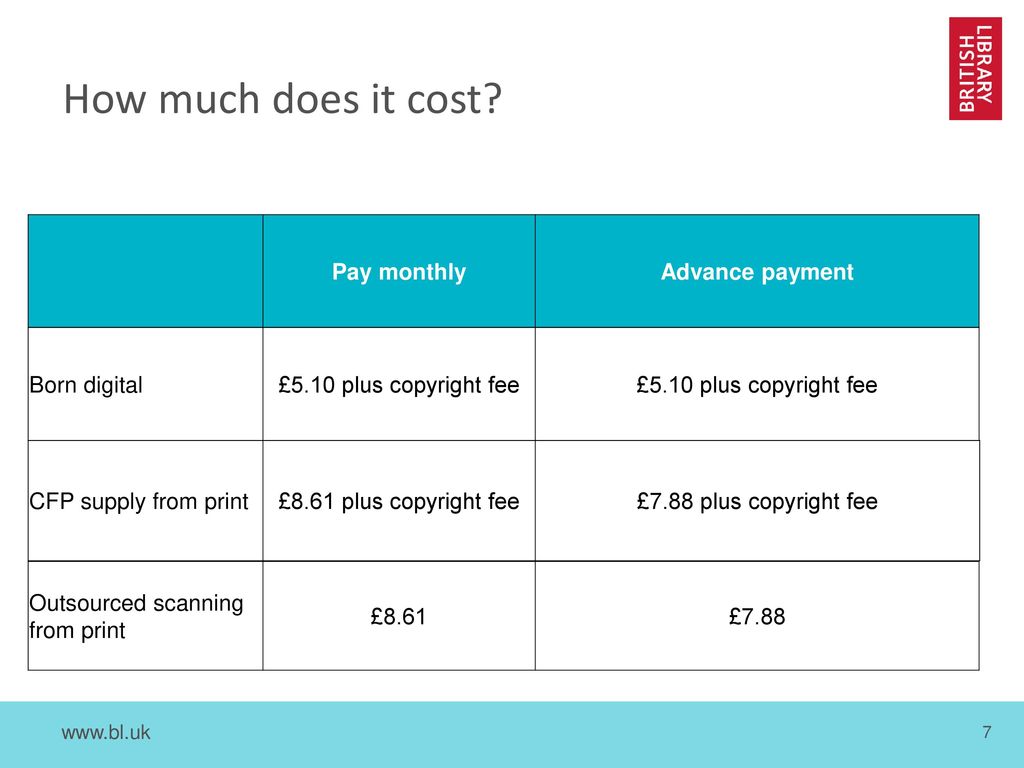

Establishing and Calculating Child Support in Massachusetts

Massachusetts Child

Support Calculator by AllLaw.com In

Massachusetts, child support is based on the non-custodial parent's gross

weekly income and the number of children to be supported. The breakdowns

are based on the following categories of gross weekly income: $0-100; $100-280;

$281-750 and $751-max. At the maximum income, support is as follows based

on 1, 2 or 3 children: $167+25%; $199+30% and $222+33%. If there are more

than 3 children in the custodial home, the support shall be for no less than 3

children. Based on considerations of the non-custodial parent, the support

may be ordered to increase or decrease by 2%. Determining the Amount of Child Support Generally, child support payments are for the ordinary expenses of food, shelter, clothing, education and medication needs for the children only. In determining child support, a court will look at all the following issues: The Needs of the Children - For example, an ill or developmentally disabled child will often require a higher level of support than a healthy child. The Age of

the Children - Infants and younger children often cost less to support than

older children. However, daycare costs, which can be significant, will also be

taken into account. The Ability of the Non-custodial Parent to Pay - The court will look at income from all sources when it decides on the amount of child support. Generally your ability to pay does not include calculations of bills and debts such as car payments, credit cards, etc. If the non-custodial parent marries again, the court will usually not look at the new spouse's income. However, there are some exceptions. The court will consider a new spouse's income if one of the following occurs: (1) The parent paying the child support claims that s/he is unable to pay because of debts. (2) "Voluntary Impoverishment" - The court may look at a new spouse's income if the custodial parent claims that the parent who owes the support has left a job voluntarily in order to avoid paying child support. (3) There is a claim that the parent paying child support is hiding assets. The

Earning Capacity of the Custodial Parent - Both parents have the duty to support

their children, not just the paying parent. The Other Responsibilities of the Parents - The court will also look at the other lawful responsibilities of both parents. For example, if the non-custodial parent is paying child support from a previous marriage, the court will consider that obligation also. Necessities of life, such as rent and food will also be considered by the court. However, the court will not reduce child support payments to make it easier for you to pay discretionary obligations. For example, a parent cannot buy an expensive car instead of providing for his or her own children. Child Support Guidelines New Jersey

has passed a law requiring the courts to use Child Support Guidelines in all

child support cases. Parents cannot agree to not support their children. The state legislature decided that "the law and policy of this State is that the child's best interest is of paramount importance and cannot be altered by the parties. A parent has a legal obligation to provide support for the child [in proportion to their gross earnings]." The math to determine the Guideline amount is fairly simple. The Legislature provided a form which must be followed. The Child Support Calculator follows the Guidelines and is an easy way to avoid doing the math yourself. However, here is an overview for those who are interested. 1.

Determine the gross monthly income of each parent.

2. Determine the percentage: (Divide the mother's Adjusted Income by the Combined Total Adjusted Income,. Divide the father's Adjusted Income by the Combined Total Adjusted Income.) 3. Obtain the basic child support amount from the table 4. Add to the table amount (if relevant):

5. Equals the total support obligation 6.

Multiply the total support obligation by each parent's percentage share of

income (line 2). This is the presumed correct amount of child support. There is a separate form for situations where the parents share physical custody of the children. (back to top) |

The Easiest Massachusetts Child Support Calculator

How many children? i

Your time with children as % i

Your weekly pay i

Other parent's pay i

Child support = $0 weekly i

Not in Massachusetts? Use your location's child support calculator.

Massachusetts child support payments

Child support is designed to ensure both parents contribute financially to their children's care after they separate.

Like all U.S. states, Massachusetts uses a formula to determine how much each parent should contribute, and the result serves as a guideline for the judge who issues the child support order. Use the calculator above to estimate what the formula will produce in your case.

For a typical family, the Massachusetts formula produces the highest payment in the country, according to a 2019 study by Custody X Change. When a parent in the Bay State would pay $1,200 a month in child support, a parent in the same situation elsewhere may pay a third of that.

When a parent in the Bay State would pay $1,200 a month in child support, a parent in the same situation elsewhere may pay a third of that.

A judge can deviate from the formula under certain circumstances, such as when a child has special needs or parents agree to an alternate amount.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Parenting Time Now

How child support is calculated

In Massachusetts, the parent with less parenting time typically pays child support monthly, though a judge can order weekly payments. If parents have nearly equal time with the children and both contribute financially, the parent with the higher income pays.

To estimate your payment, use the calculator above. To calculate your guideline support amount exactly, fill out the Child Support Guidelines Worksheet.

You'll need to enter the number of eligible children you have together, each parent's approximate portion of parenting time and their gross weekly income.

Eligible children are typically under 18 or still in high school. However, support may continue to age 23 if the child still lives with a parent and is financially dependent on them, or until 23 if the same circumstances apply and the child is pursuing an undergraduate degree.

Indicate whether the children live with each parent for nearly equal time (shared physical custody) or with one parent for at least two-thirds of the time (sole physical custody). A third option, for parents who each provide the primary home for a different child (split physical custody), is rare.

Gross weekly income is the amount earned from work, tips and other sources before taxes. Costs for child care, health insurance and other support payments then get subtracted from each parent's total.

Low-income and high-income families

If a parent has a weekly gross income of less than $250, the support guidelines recommend they pay between $12 and $20 a month in child support. A judge can order a lower or higher payment if they think it would better fit the circumstances.

The guidelines cap out at a yearly income of $400,000 for both parents combined. When parents earn more, their support payment is based solely on $400,000 (though the judge can increase the payment if it would benefit the children).

Paying child support

The Massachusetts Department of Revenue has details on how to pay support. The paying parent shouldn't pay the other parent directly, because then the court couldn't track it. In some cases, support is withheld from the paying parent's paycheck.

Modifying child support

You can request a child support modification every three years. You'll need to show the court that your payment differs from the current guideline amount, you've lost or can no longer afford health insurance for the children, or a major change in circumstances has occurred, such as a job loss or a change in parenting time.

If you request a modification before three years have passed, you'll need to prove that a major change in circumstances is impacting your ability to pay.

Enforcing a child support order

If a parent misses child support payments, the Department of Revenue can automatically take actions like suspending their driver's license or placing a lien on their bank account.

When a parent routinely fails to pay support, you may need to bring a contempt of court case against the other parent to have a judge enforce child support orders.

Keeping track of payments and expenses

Remember that a child support order is legally binding and must be taken seriously.

Whether you're paying or receiving support, the Custody X Change app can help you keep track of payments. Log details of every one into your expense tracker to ensure you're sticking to the court order.

You can also track other child-related expenses and print an invoice if the other parent needs to reimburse you.

Custody X Change keeps you on top of all aspects of child custody, including payments and expenses.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Let Custody X Change calculate your time.

Calculate My Parenting Time Now

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My TimeDo I need a lawyer? - MassLegalHelp

Developed by an AmeriCorps Project of Western Massachusetts Legal Services updated and revised Massachusetts Law Reform Institute

Retrieved February 2010

To apply for divorce, or separation support, or child custody, or You don't need a lawyer to get child support. You can open a case yourself. In Massachusetts, you have the right to represent yourself in all court cases, including divorce or separation with support.

Matters such as divorce or custody can be very complex. The stakes are very high. Therefore, in such important cases, it is good to have a lawyer, especially in the case of abuse, violence and tight control by the spouse.

It will be easier for you to handle a case with a lawyer than to deal with it on your own. A lawyer can help you decide what kind of claim to file in your case and can help you file one. A lawyer can draw up an agreement with the other parent. If there is no agreement between you, the lawyer will help in the consideration of the case at the court session. If there is violence, abuse from the spouse or he does not agree to a divorce or separation, as well as if difficult issues arise during a divorce or separation, it is best if a lawyer represents you.

A lawyer can help you decide what kind of claim to file in your case and can help you file one. A lawyer can draw up an agreement with the other parent. If there is no agreement between you, the lawyer will help in the consideration of the case at the court session. If there is violence, abuse from the spouse or he does not agree to a divorce or separation, as well as if difficult issues arise during a divorce or separation, it is best if a lawyer represents you.

If you receive government benefits or have a low income, contact your local legal aid office, where you can get a lawyer free of charge. Legal Aid will try to help you or refer you to a private attorney who will take on your case for free ("pro bono").

If legal aid cannot provide free services to you, try to find a private lawyer who will charge you a "sliding scale fee". Under a sliding tariff, prices are higher for people with more income and lower for those with less money. You should immediately tell the lawyer about your financial capabilities.

Lawyers often charge a retainer. This means that you pay a certain amount of money in advance, in advance. As the case progresses, the attorney receives money for the work from this retainer. When the money runs out, the attorney will present you with an invoice that shows how and on what the retainer was spent. Then he asks to pay the fee again. Try to find a lawyer who will take on your case with no or very little upfront fee.

Private lawyers charge per hour. Your lawyer's services will cost less if he does not have to spend a lot of time collecting information. The more information or documents that a lawyer needs that you can get yourself, the less you will have to pay for the services of a lawyer. Get your own file. Be prepared to meet with a lawyer or have a telephone conversation with him. If the lawyer says that he needs some information, be ready to provide it. All these measures will help you save money.

In some cases, the court may order your spouse to pay for a lawyer. Read Requesting an Order for Your Spouse to Help Pay for Your Attorney.

Read Requesting an Order for Your Spouse to Help Pay for Your Attorney.

If you can't find a lawyer or want to represent yourself in court, you may still need help. Some Women's Centers or Legal Services offer do-it-yourself programs to guide you through the entire divorce process on your own. You can also read the Divorce chapter in Family Law Advocacy for Low and Moderate Income Litigants, which explains in detail how to get a divorce. Your local library or county law library has books on family law that you can use to guide you.

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 years old and has not yet become fully capable by decision of the guardianship or court.

Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains; - if he is over 18 years old but has been declared incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0033

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and takes care of a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, state of health and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.

0033

0033

Alimony can also be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at your place of residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The statement of claim for the payment of alimony must be accompanied by:

- copies of it - one for the judge, the defendant and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and income statements of all family members;

- calculation of the amount you expect to receive as alimony. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-off of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

Under exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are obliged to support their children after birth and until the age of 18, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.

The court will also look at the

earnings of the custodial parent. In particular the court will look at the

resources which are available to support the children. The court may also look

at your capacity to earn more money. The court may also consider the income of a

new spouse when determining child support levels.

The court will also look at the

earnings of the custodial parent. In particular the court will look at the

resources which are available to support the children. The court may also look

at your capacity to earn more money. The court may also consider the income of a

new spouse when determining child support levels. The Guideline's amount is the correct amount.

However, you can argue that the Guidelines amounts are wrong. First you must

complete the Guidelines and show the amount. Then you can then explain your

concerns in the comments section of the Guidelines.

The Guideline's amount is the correct amount.

However, you can argue that the Guidelines amounts are wrong. First you must

complete the Guidelines and show the amount. Then you can then explain your

concerns in the comments section of the Guidelines.