How much child support should i pay in illinois

Illinois Child Support Calculator & Worksheets 2022

Use the child support calculator below to estimate your child support and medical support payments. Illinois child support is based on a variety of factors including the number of children, the number of overnights with each parent, and each parent’s net income.

How to Calculate Child Support in Illinois

Illinois child support takes many factors into account. The exact calculation is a lengthy process, but our calculator does all the work for you. All you have to do is plug in the numbers, and the calculator estimates your child support payments.

For any questions on what a section of the calculator means, refer to the guide below the calculator. Your actual child support payments may be different than what the calculator estimates because judges have discretion to adjust as necessary.

For Immediate help with your family law case or answering any questions please call (312) 757-8082 now!

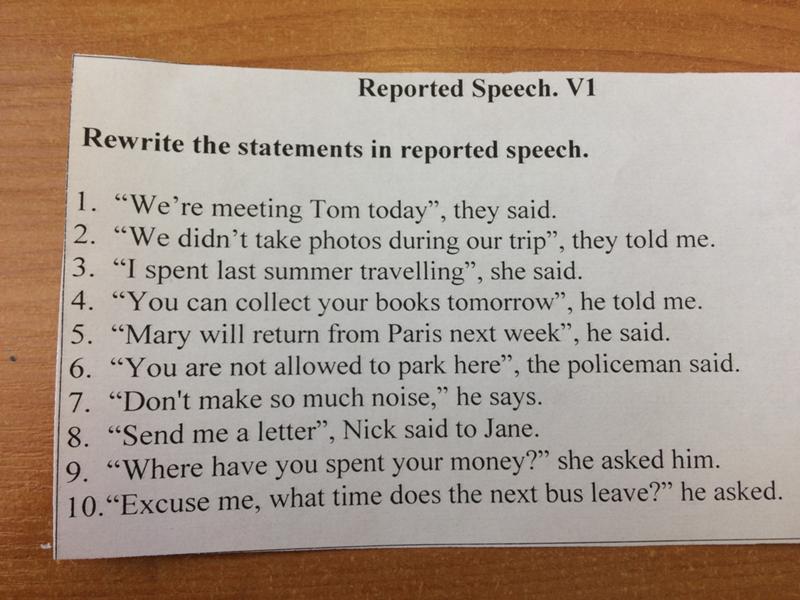

Guide to the Child Support Calculator

- Number of Children = The number of children you have with the opposing party in this case.

- Number of Overnights with the Custodial Parent = Of the 365 days in the year, how many nights are spent with the custodial parent.

- Determine Net Using = Chose standardized or individualized for the custodial parent (CP) and non-custodial parent (NCP). Standardized means the person’s gross monthly income (separate spousal maintenance). Individualized is income after taxes are taken out found by using Illinois’s income conversion chart.[1]

- Maintenance Received/Paid = If either parent receives or pays spousal maintenance (alimony), include that here.

- Social Security Benefit Allotment = If either parent receives social security checks, record that here.

- Multi-Family Adjustment with Order = If a parent pays child support through the state for a child with a different mother, the amount paid goes in this section.

- Children on Multi-family Adjustment with Order = If the above box is filled out, list the number of children they are paying for in this box.

- Multi-family Adjustment Without Order = Fill out this section if a parent pays child support for a different child, and the child support is not paid through Child Support Services.

- Children on Multi-family Adjustment Without Order = If the above box is filled out because someone is paying informal child support, list the number of children they are paying for here.

- Child’s Monthly Health Insurance = Provided means there is currently active insurance. Available means there is the option of having insurance. State whether the insurance is from the custodial parent (CP) or non-custodial parent (NCP), how much it costs, and how many people are covered on the plan.

- Child Care Expenses = This includes any daycare, after-school care, camps, etc.

- Extraordinary School and Extracurricular Activity Expenses = Any extra costs for a child’s participation in sports, clubs, field trips, etc.

Potential Deviations

A judge deciding child support can order more or less child support than the state guidelines require. This is called a deviation. They can do this if the support would otherwise be “inequitable, unjust, or inappropriate.”[2] With any deviation, the judge has to provide a written explanation telling why they think the deviation is necessary. One example of this is if the child has a disability that leads to extra expenses.

The best way to ensure fair child support is to have an attorney support you through the process. For any questions, call Sterling Hughes or fill out the linked form and we can set you up for a meeting to talk with an attorney who specializes in family law.

Are you ready to move forward? Call (312) 757-8082 to schedule a strategy session with one of our attorneys.

How to Calculate Child Support

Here is a simplified explanation of how the child support calculator estimates child support payments. The actual calculator takes even more factors into account, but this calculation lays out the core of the calculation.

The actual calculator takes even more factors into account, but this calculation lays out the core of the calculation.

Below each step, there is an example following along. For this example, there are two kids, the custodial parent (CP) has an income of $4,000 per month, and the non-custodial parent (NCP) has an income of $5,000 per month.

Adjusted Net Income

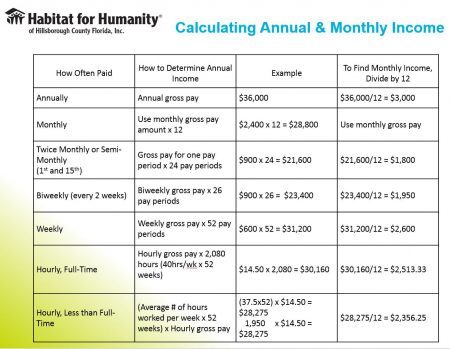

1.) Find each party's gross monthly income and convert it into net income using the IL standardized income conversion chart (found in the first reference link below).

Example:

Based on the standardized income chart, CP has a net income of $3,164. NCP’s net income is $3,771.

2.) Then, add the net incomes together to get the parents’ combined adjusted net income.

Example:

$3,164 + $3,771 = $6,935.

Total Support Obligation

3.) The state of Illinois says the basic child support for one child is $1,215 per month. Multiply this number by the number of children to get the basic support obligation.

Example:

$1,215 x 2 = $2,430

4.) Then, to get the total support obligation, add any extra expenses such as child care, extracurricular activities' expenses, and insurance premiums.

Example:

We’ll say it’s $90 for after-school care and $100 for the child’s insurance per month.

$2,430 + $90 + $100 = $2,620

Share of the Obligation

5.) Take each parent’s adjusted net income and divide it by the combined net income to get the percent of their contribution.

Example:

CP: $3,164 ÷ $6,935 = 45.6%.

NCP: $3,771 ÷ $6,935 = 54.4%

6.) Multiply that percentage by the total support obligation, and you get the amount each parent must pay towards the child’s support.

Example:

CP: 45.6% of $2,430 = $1108.08

NCP: 54.4% of $2,430 = $1321.92

7.) Since in this case, the child lives with CP, NCP has to pay the full amount of their child support.

Example:

$1,321. 92

92

Now that you know how our calculator works, feel free to click here to head to the calculator of you haven't already.

Calculate Child Support for Shared Parenting (Joint Custody)

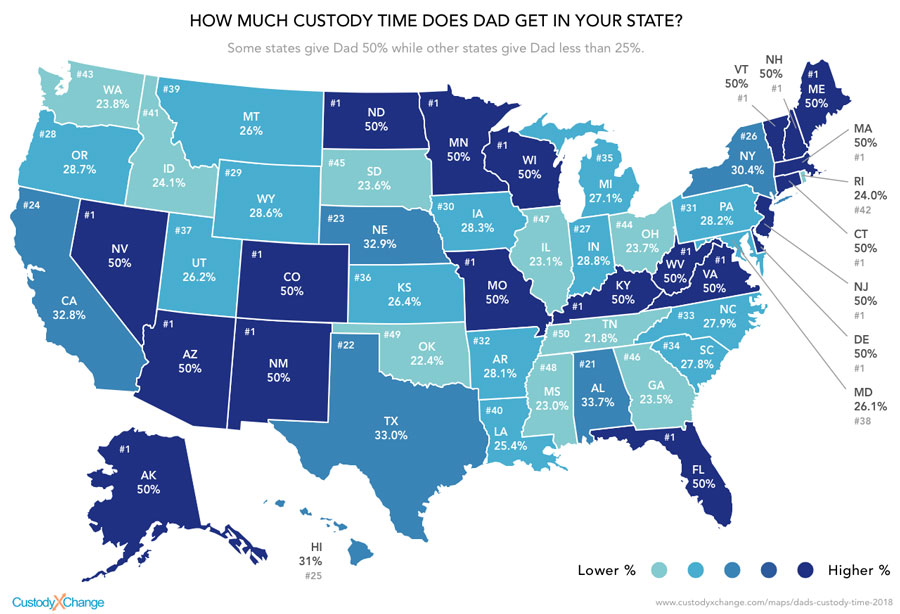

Shared parenting is when each parent has at least 146 days with the child. In this case, the courts calculate child support a little differently. For the below example, we use the same numbers as the previous examples. However, CP has the child for 219 days of the year (60%), and NCP has the child for 146 days of the year (40%).

1.) / 2.) First, steps 1 and 2 are the same to get each parent’s net income.

3.) / 4.) Then, for steps 3 and 4, to get the total support obligation, the cost per month of a child is multiplied by 150%. It goes from $1,215 to $1,822.50.

Example:

Using the above calculation, their total support is $3,644. ($1,822.5 x 2)

5.) / 6.) Steps 5 and 6 are done the same to get each parent’s share of the obligation.

Example:

CP’s portion of the support obligation is $1,661.66. (45.6% x $3,644)

NCPs portion of the support obligation is $1,982.34. (54.4% x $3,644)

7.) Now, rather than finding the difference between their support obligations right away, you first multiply their individual obligations by the percentage of time the other parent has with the child. This finds each parent's new support obligation.

Example:

CP’s placement percent multiplied by NCP’s share of the support obligation to get NCP’s new support obligation. (60% x $1,982.34 = $1,189.40)

NCP’s placement percent multiplied by CP’s share of the support obligation to get CP’s new support obligation. (40% x $1,661.66 = $664.66)

8.) Finally, with the two resulting numbers, you take the non-custodial parent’s obligation and subtract the custodial parent’s to get the final child support payment amount. If the number is positive, the non-custodial parent pays that amount. If the number is negative, the custodial parent may have to pay that amount.[3]

If the number is negative, the custodial parent may have to pay that amount.[3]

Example:

In this situation, NCP will have to pay CP $524.74 in child support. ($1,189.40 – $664.66)

Our calculator can estimate child support for joint or sole custody. Click here to head back up to the calculator.

For Immediate help with your family law case or answering any questions please call (312) 757-8082 now!

Calculating child support | Illinois Legal Aid Online

Worried about doing this on your own? You may be able to get free legal help.

Apply Online

Note: Covid-19 is changing many areas of the law. Visit our Covid-19 articles for the latest information.

To calculate the amount of child support, consider both parents’ income. You can use this Child Support Estimator. The information below will give you a better sense of:

The information below will give you a better sense of:

- How the calculation works

- Factors that are important to it

- What information you will need to figure out support

Want something more visual?

Learn about calculating child support through our infographics:

- Calculating child support infographic - both parents have at least 146 overnights

- Calculating child support infographic - one parent has less than 146 overnights

Combined adjusted net income

The gross income of each parent includes income from all sources, including:

- Court-ordered support (maintenance) from a current or former spouse

- Second jobs

- Overtime pay

- Holiday pay

Gross income does not include benefits received by the parent:

- From public assistance programs (e.

g., TANF, SSI, or SNAP)

g., TANF, SSI, or SNAP) - For other children in the household (e.g., child support, survivor benefits, or foster care payments)

First, the gross income of each parent is converted to net income using this standardized income conversion chart.

Second, the two net incomes are added together to find the parents’ combined adjusted net income.

Example

Parent 1 (P1) and Parent 2 (P2) each have a gross monthly income of $5,000. The child lives with P1.

Based on the standardized income conversion chart, P1 has a net income of $3,850. P2 has a net income of $3,759.

Their combined adjusted net income is $7,609.

Basic support obligation

Basic support obligation is a term used to show how much money parents normally spend on their children. The amount of money takes into consideration the income of the parents. The income shares schedule sets out this amount. Look for the parents’ combined adjusted net income on the schedule to find the basic support obligation.

Example

P1 and P2 have a combined adjusted net income of $7,609.

Based on the schedule, their basic support obligation for one child is $1,215. (Schedule value for combined adjusted net income + number of children= basic support obligation)

Additional expenses

Other actual expenses are added to the general basic support obligation to adjust to the specific needs of a child. This includes the costs of:

- Child care expenses (e.g., after-school care, work-related child care expenses, or camps)

- Extracurricular activity and other school-related expenses

- Insurance premiums (not basic out-of-pocket medical expenses and health care needs not covered by insurance)

The sum of these creates the total support obligation.

Example

P1 and P2 have a basic support obligation for one child of $1,215.

P1 spends $84 per month on the child’s after-school care.

P2 pays $100 per month to keep the child on his medical insurance coverage.

Their total support obligation is $1,399.

(basic support obligation + child care expenses+ insurance premium = total support obligation)

Each parent’s share of the total support obligation

The total costs for support are assigned to each parent according to their contribution to the combined income.

Example

P1 and P2 have a combined adjusted net income of $7,609.

P1 has a net income of $3,850. This is 50.6% of the total combined adjusted net income.

P2 has a net income of $3,759. This is 49.4% of the total combined adjusted net income.

P1 and P2 total support obligation of $1,399.

P1’s obligation would be 50.6% of this, or $707.89.

P2’s obligation would be 49.4% of this, or $691.11.

Since the child lives with P1, then P2 owes P1 child support. In the example above, P2 owes P1 $691.11 per month.

Shared parenting

Shared parenting is a term used when both parents spend a significant amount of time with the child. In shared parenting, both parents exercise overnight parenting time with the child at least 146 times per year. Sometimes, the parent with more parenting time must pay the parent with less parenting time.

In shared parenting, both parents exercise overnight parenting time with the child at least 146 times per year. Sometimes, the parent with more parenting time must pay the parent with less parenting time.

To calculate child support for shared parents, start by finding the basic support obligation on the income shares schedule. Next, increase the basic support obligation by 150% (multiplied by 1.5) to estimate the shared expenses between the parents’ households.

Example

P1 and P2 have a basic support obligation for one child of $1,215.

Their shared parenting obligation is $1,215 X 1.5 = $1,822.50.

As before, the total costs for providing for the child are assigned to each parent according to their contribution to the combined income. That amount is then multiplied by the percentage of time the child spends with the other parent. The parent owing more child support pays the difference between the 2 amounts.

Example

P1 and P2 have a combined adjusted net income of $7,609.

P1 has a net income of $3,850. This is 50.6% of the total combined adjusted net income.

P2 has a net income of $3,759. This is 49.4% of the total combined adjusted net income.

P1 and P2 have a Shared Parenting Obligation of $1,822.50.

P1's share is $1,822.50 X .506 = $922.19

P2's share is $1,822.50 X .494 = $900.31

Now, we multiply each number by the percentage of the year the other parent spends with the child.

P1 spends 219 nights with the child per year. This is 219/365 = 60% of the year.

We multiply this percentage by P2's share, so $900.31 X .60 = $540.19 is P2's new obligation.

P2 spends 146 nights with the child per year. This is 146/365 = 40% of the year.

We multiply this percentage by P1's share, so $922.19 X .40 = $368.88 is P1's new obligation

Finally, we subtract P1's obligation from P2's to get the amount P2 will have to pay:

$540.19 - $368.88 = $171. 31

31

Special circumstances

Deviation

Sometimes the judge will order more or less child support than required. This is called a “deviation” from the guidelines. A judge must explain in writing their reasons for deviating from the guidelines. For example, a judge may choose not to follow the guidelines when a child with special needs requires extra financial support.

Split care

Split care is when you have more than one child but do not have physical care of all of them. The guidelines for determining support are the same. You will have to do 2 calculations instead of one. First, find out how much you are owed for all the children living with you. Second, find out how much you owe for all the children with the other parent. These two amounts are offset. The parent owing more pays the difference.

Certain income thresholds

If the paying parent’s income is at or below 75% of the Federal Poverty Guidelines (for a one-person family), the court will order a $40/month child support obligation per child. The total monthly obligation for such a paying parent is capped at $120. So, even if that parent is paying for the support of 4 children, the paying parent will only have to pay $120 every month—not $160.

The total monthly obligation for such a paying parent is capped at $120. So, even if that parent is paying for the support of 4 children, the paying parent will only have to pay $120 every month—not $160.

If the paying parent has no income for reasons that are beyond their control, then the court will not require them to pay any support. For example, they cannot work because of disability or incarceration. In that case, the judge will order them to pay $0.

Last full review by a subject matter expert

August 20, 2018

Last revised by staff

May 24, 2020

Only logged-in users can post comments. Please log in or register if you want to leave a comment. We do our best to reply to each comment. We can't give legal advice in the comments, so if you have a question or need legal help, please go to Get Legal Help.

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1.

Who can apply for child support?

Who can apply for child support? Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under the age of 18 and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0010

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances.

marriage or within five years thereafter, and the spouses have been married for a long time.0010

marriage or within five years thereafter, and the spouses have been married for a long time.0010

Also, child support can be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- a single housing document and income statements for all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, if the child does not marry earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated. Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Alimony may be denied: or spouse, including an ex, if he or she has become disabled and needs help due to alcohol, drug abuse, or intentional crime, or has behaved unworthily in marriage, such as gambling;

Republicans did not change the balance of power - the crime rate in US cities will continue to grow - InoTV

The Republicans failed at the national level to actualize the problems that seemed to them advantageous, and therefore succumbed to the Democrats. However, they will still have the opportunity to show themselves, as the challenges from crime, drug trafficking and illegal migration are likely to remain for a long time, Fox News columnists said on air of the channel. Many should learn how to formulate a simple and clear message to voters, as Donald Trump did in a discussion on border security in 2016, the interlocutors noted.

Welcome again! On The Big Sunday Show. The midterm elections have not changed the balance of power at the top, and crime rates are likely to continue to rise out of control, especially in liberal-led cities. Here's one example of what's left as it is: a drug dealer accused was arrested with 20,000 fentanyl pills just a couple of days ago, but has reportedly already been released "thanks" to bail laws in place in the state.

LEE ZELDIN, New York gubernatorial candidate: Support men and women in law enforcement. Many of the issues that we discuss during the election race will not disappear after the voting is over. We are not going anywhere and we only plan to work harder.

. This county has a very high crime rate, more than 97 percent of other districts of the country. We have the text of a Facebook post* written by the Sheriff himself. In it he makes accusations, let's read: “ We have been talking to the county government for several years, warning that we have too few staff. Instead of taking quick, decisive action, they delayed judgment and allowed too many good employees to leave Job .” I want to contact you, Tommy. During this year, their staff was reduced by 20 people. I don't know how many employees there are in the local police department, but 20 is a lot for tens of thousands of departments across the country. They are paid from 50 to 62 thousand a year, while in the neighboring district the base rate is 82 thousand. This is not about the measures and the policies that take them, but rather that the police departments do not have enough funds.

This is not about the measures and the policies that take them, but rather that the police departments do not have enough funds.

TOMIE LAREN, political observer: Funding is really lacking. But talking about this case, I remember that here in New York, many police officers say: “I'm going to Florida! When the governor and local leaders support me, this is very important.” What matters is the action taken. The abolition of the practice of cashless collateral in the states where it is used will only lead to the fact that now it will only be used more actively. Illinois, for example, will be ready to accept many new police officers, but we also need to inspire them to work. We need to abandon the idea of recruiting activist district attorneys, we need to improve the field work and resist sponsoring this initiative from George Soros funds. We need to take a life-affirming view of our police officers and let them know how necessary and irreplaceable they are. They don't work for money, you and I know that - they do it out of duty. But when you don't feel supported, you can't effectively keep order on the streets - this is a big obstacle for those who are ready to work in response to the call of duty.

They don't work for money, you and I know that - they do it out of duty. But when you don't feel supported, you can't effectively keep order on the streets - this is a big obstacle for those who are ready to work in response to the call of duty.

You know, Charlie, it occurred to me that the Republicans did a "good" job, like Glenn Yankin, in tying school district councils to the national agenda. Did we miss the point where it was necessary to combine municipal-level issues—under the authority of county police departments, county commissioners, and county sheriffs—with national-level stories?

CHARLIE HURT, political commentator: That's the "magic of politics": to get involved in a topic, as Glenn Jankin did in strengthening parental control in the process of educating children. Then raise it to the status of a goal and determine the tasks necessary to achieve it. Republicans in the broadest sense, at the national level, failed to do so this time. Let's look at the positives of last week's events: Lee Zeldin didn't win, but was very close to winning in a highly pro-democracy state - he talked about the problem of crime and completely focused on it, and people felt it. JD Vance talked about fentanyl coming into the country from abroad, talked about illegal immigration - specific, local and very dramatic. Ron DeSantis spoke about the problem of border control. These questions, if you can pitch them to a local audience and justify them well, as Ron DeSantis, Lee Zeldin, and J.D. Vance did, will help you win! The Republicans will still have a chance to try it out. Problems like this don't go away on their own, they only get worse. All the accumulated annoyance will apparently not be released this time, but it will happen next time!

Let's look at the positives of last week's events: Lee Zeldin didn't win, but was very close to winning in a highly pro-democracy state - he talked about the problem of crime and completely focused on it, and people felt it. JD Vance talked about fentanyl coming into the country from abroad, talked about illegal immigration - specific, local and very dramatic. Ron DeSantis spoke about the problem of border control. These questions, if you can pitch them to a local audience and justify them well, as Ron DeSantis, Lee Zeldin, and J.D. Vance did, will help you win! The Republicans will still have a chance to try it out. Problems like this don't go away on their own, they only get worse. All the accumulated annoyance will apparently not be released this time, but it will happen next time!

Jackie, this news about the sheriff's office having to lay off or lay off 20 employees may be the result of the idea of defunding the police, or it may be the result of problems in the economy. If these men and women cannot be paid there, then perhaps they can simply transfer to serve in a neighboring district. Back to the 20,000 fentanyl news, here's what The New York Post wrote about it:year ". So this guy is out on bail, thanks to the changes proposed by the New York Democrats this year. We see the results of the midterm elections. On the eve of the Republicans actively pedaled the problem of crime, but did they manage to justify its importance?

If these men and women cannot be paid there, then perhaps they can simply transfer to serve in a neighboring district. Back to the 20,000 fentanyl news, here's what The New York Post wrote about it:year ". So this guy is out on bail, thanks to the changes proposed by the New York Democrats this year. We see the results of the midterm elections. On the eve of the Republicans actively pedaled the problem of crime, but did they manage to justify its importance?

JACKIE DEANGELIS, Correspondent Fox Business : I think that Lee Zeldin did a great job with this task. Here in New York, the problem was that for many of the women I interacted with, abortion was an important topic. They told me, “I don't care about crime, I care about inflation. I'm worried that women's rights will be taken away at the national level, because that's what the Republicans want to do!” It was the instigation of fear that influenced the decision of local voters. But Zeldin's results are nevertheless very good, and he certainly managed to shed light on what is happening here. The problem is that as long as the cashless bail system is practiced and Kathy Hokul is in charge, everything will remain the same: she, for example, wants to install more cameras in the subway, she wants to send policemen to patrol the subway, but until her policy changes, as long as the cashless bail is maintained everything will be as it is. Everyone has iPhones, the subway is full of cameras - you can see the footage from one of them - but nobody cares, they go down the subway and commit crimes. This is part of the problem. As for the police officers, I think it's about morale. Their hands are tied, they feel powerless. So, as you pointed out, people are moving to other states, retiring en masse, because they just don't want to be a part of it anymore. Therefore, we must now suffer.

But Zeldin's results are nevertheless very good, and he certainly managed to shed light on what is happening here. The problem is that as long as the cashless bail system is practiced and Kathy Hokul is in charge, everything will remain the same: she, for example, wants to install more cameras in the subway, she wants to send policemen to patrol the subway, but until her policy changes, as long as the cashless bail is maintained everything will be as it is. Everyone has iPhones, the subway is full of cameras - you can see the footage from one of them - but nobody cares, they go down the subway and commit crimes. This is part of the problem. As for the police officers, I think it's about morale. Their hands are tied, they feel powerless. So, as you pointed out, people are moving to other states, retiring en masse, because they just don't want to be a part of it anymore. Therefore, we must now suffer.

The topic to which everything that has been said directly relates and which we have not yet discussed is the problem of border security. Charlie, I come back to you with this question: how is it that all the problems that affect people at the local level are still directly related to the challenges of the national level, but the political agenda does not tie them together?

Charlie, I come back to you with this question: how is it that all the problems that affect people at the local level are still directly related to the challenges of the national level, but the political agenda does not tie them together?

CHARLIE HURT : I think the point is that the Republicans failed to deliver a strong message on this issue. The issue of border protection has been raised for many decades. You can blame the Democrats, the Republicans handled it much better than the Democrats, but this is a failure for both parties! Both parties failed to deal with this problem properly. In 2016, when Trump showed up and said, “This is the biggest problem,” both parties got scared and decided that he was wrong. And he was right! That is why he successfully lured voters away from the Democrats.

TOMI LAREN: Speaking of shaping the message to the voter: who was the only Republican with a good stance on border security? Donald Trump! Because the message was simple: "Build a wall!" We need more of these "battle cries" that are easy enough to understand.