How much child support does a father pay

How much is child support?

If you’re preparing for divorce, you’re probably wondering – “How much is child support?”

If you’re preparing for divorce or merely curious, you want to understand how child support is calculated. You might be surprised by the amount deducted from your paycheck. You may also wonder what a reasonable cost is for monthly payments, and which parent spends the most.

We have answers to those questions here.

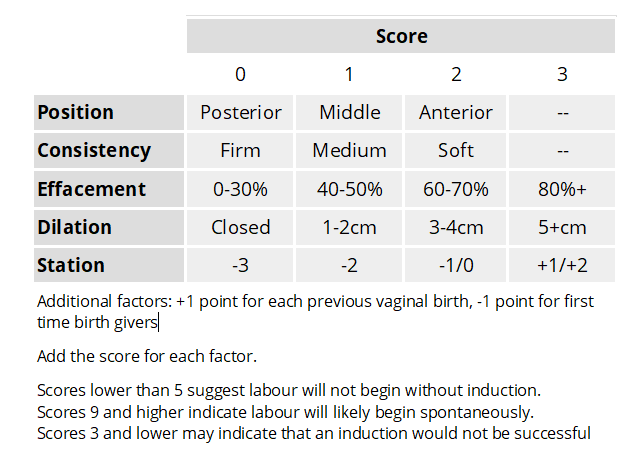

The court will consult the child support guidelines for their state to determine your child support obligation before making an official support order. Like any average, there are quite a few variables. Parents who are in a lower income bracket might not have enough gross income for paying child support, while others who are more well-off end up paying a higher monthly amount. Every state calculation takes into account your total monthly net resources.

Parent’s Pro-Rata Share

How much child support you pay also takes into account whether you are the non-custodial parent, how much income the other parent makes compared to you, and other factors such as whether you or the other parent will provide health insurance coverage for the children, and who will pay for educational expenses and other child care expenses.

The general rule is that the child support obligation is shared by both parents in proportion to their incomes, but there are a lot of other factors that go into how much each parent will actually pay.

Custodial Parent’s Income

In some cases, the custodial parent’s income can be imputed (or assumed) for child support purposes. This usually happens when the custodial parent is not working or is not working to their full potential. The court will look at factors like education and work history to determine how much gross income the custodial parent could be earning, and base child support on that amount.

Other Factors Affecting Child Support

There are other factors that might affect how much child support you pay, such as whether you have other children to support, whether you are paying spousal support (alimony), and your personal expenses. Some states also factor in the cost of living in each parent’s household when determining how much child support to award in a court order.

Example Child Support Calculation

In our example, the court starts by determining your “adjusted” gross income – this is your total income minus deductions for state taxes and business expenses – and multiplies it by the guideline percentage for the number of children involved.

For example: if your yearly salary is $15,000 and you have one child, you would be paying 17% of your income per year in child support–this comes out monthly to $212.50 or annually as $2,550.

Average Child Support Order

We have seen according to the 2010 Census Bureau Reports, the average monthly child support payment is $430. Again, this is just an average of the monthly amount of child support payments across the United States and should only be used as an estimate. Your situation is unique, and the amount the court determines will depend on your circumstances and financial resources.

To get a more accurate estimate of how much you might owe in child support, speak with an experienced family law attorney in your state. They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

They will be familiar with how child support is calculated where you live and can help ensure you are paying (or receiving) the appropriate amount of support for your children.

If you’re interested in an estimate of what your support payments should be, use our child support calculator.

And for more information on how you can better understand the child support laws and regulations in your state, visit our state resources section.

How Much Should A Father Pay In Child Support?

While fathers may be ordered to pay children, mothers may question just how much they are supposed to be settling in child support. If you have been through the Texas family law courts fighting for help for your children, you will be familiar with how the process works.

If you have not, it is essential to know that without an order that mandates child support payment, either pay is not obligated to make child support payments. If you have no charges in place but are in need, your beginning starts in a Texas family law court.

Once a judge has ordered a parent to provide child support, there is not much that can be done to deviate from this order. Some parents may question the amount of child support they have been ordered to pay, but you should know that amount was not picked up randomly.

To begin, you will need to understand why child support is ordered, what it covers, and who will be awarded the child support in your Texas family law case.

Who Pays Child Support & What Is It For?The noncustodial parent, or the parent who does not have custody of the child the majority of the time, is the parent who is responsible for paying child support. They are known as “obligors,” meaning they are legally bound to the custodial parent to pay for child support. The custodial parent is the parent who has custody of the child the majority of the time.

If you have been ordered to pay child support, you should know it was collected for the child’s best interest. In Texas, we use the “Best Interest of the Child” standard to determine what conservatorship, possession and access, and child support should be ordered.

Your child support payments are paid to support the necessities of your child’s life. These include shelter, clothing, and food. Although all your child support will cover other nonessential, necessary expenses can include uninsured medical costs, educational fees, or extracurricular expenses. As custodial parents receiving child support, they will likely work to make all of these expenses work within what they are receiving in child support and their equal contributions to the child’s resources.

Texas Child Support GuidelinesAs it is with every state, Texas has its rigid statutory guidelines to calculate how much child support a parent should be paying. There are only guidelines, and every case has different circumstances and factors to consider when ordering child support. That being said, a judge can always order below or above guideline child support depending on the situation. The parties themselves can also agree upon an amount deviating from the guidelines.

Payments are calculated as a percentage of the obligor’s monthly net income up to the first $9,200 per month of that income. This maximum net income was changed in September 2019 and will be altered every six years as the economy changes. The monthly net income is calculated by taking the obligor’s monthly gross income and subtracting all deductions. These deductions can include federal income taxes, union dues, medicare and social security taxes, and insurance premiums.

After you have calculated your net monthly income depending on how many children you have, how much of your net monthly payment will go as child support. A breakdown of the rates per child are as follows:

Number of Children | Support Percentage |

1 | 20% |

2 | 25% |

3 | 30% |

4 | 35% |

If you have over four children, it will be calculated at %40 of your net monthly income.

Most parents believe that if they don’t have a job, they will have no obligation to pay child support, but this could not be false. The Texas Family Code Section 154.068 states that a parent with no net resources can represent income equal to the minimum wage for a standard 40-hour workweek.

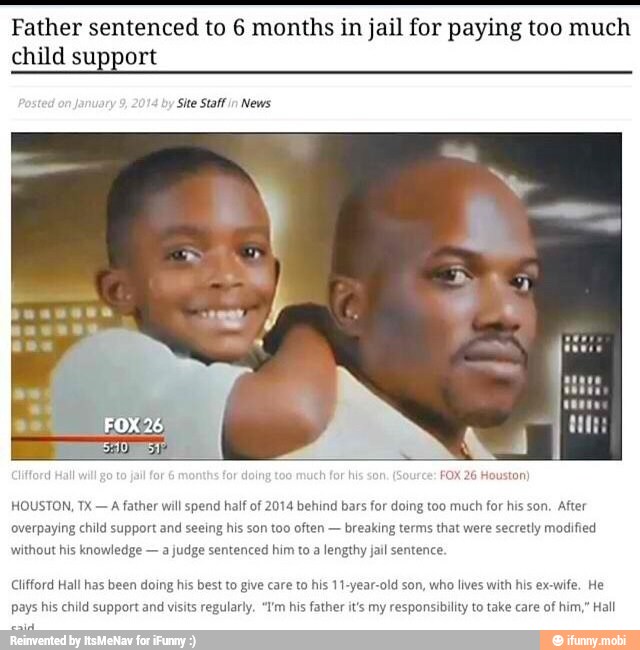

What If I Decide Not to Pay My Child Support?If you violate your child support order, the custodial parent can proceed through any child support enforcement options. These enforcements can include fines, jail time, or garnishment of wages. However, to avoid the occurring of child support payments not being paid, there are options to help ensure that the court orders are followed, and they include:

- Withholding Wages- the parent’s employer is noticed to automatically withhold the parent’s child support amounts from their wages. That money is then sent to the child support office, which will then disburse that money to the custodial parent.

- Contempt- A violating parent can be held in contempt, which means being placed in jail and on community supervision for up to 5 years. The parent can also be ordered to pay the attorney fees incurred from the enforcement action.

- Money Judgements- The amount of unpaid child support can be reduced to many judgments that accumulate interest.

- License Suspension- If you fail to pay child support for more than 90 days, the courts can order the suspension of any license you have.

If there are significant changes in circumstance that have hindered your ability to pay your child support, such as a loss of a job, you may be eligible for a child support modification. In this modification, a family law judge will evaluate and consider these circumstances that may warrant a reduction in your child support. Any changes in child support payments that a judge has not ordered could land you in a bit of trouble. Therefore, all legalities surrounding your children should be handled in a court of law.

Therefore, all legalities surrounding your children should be handled in a court of law.

In summary, child support is ordered because it is in the best interest of your child. Your payments will help give your child a stable childhood. Now that you understand how your child support will be calculated, you will not second guess that your prices are for the benefit of your child.

If you still have questions about your child support or need help clarifying what your child support order means, please do not hesitate to contact our office to set up your FREE 30-minute consultation. Our expert attorneys will be glad to serve you and help you with all your family law matters. Thank you for reading into today’s blog.

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under the age of 18 and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0010

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances.

marriage or within five years thereafter, and the spouses have been married for a long time.0010

marriage or within five years thereafter, and the spouses have been married for a long time.0010

Also, child support can be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- a single housing document and income statements for all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, if the child does not marry earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated. Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Alimony may be denied: or spouse, including an ex, if he or she has become disabled and needs help due to alcohol, drug abuse, or intentional crime, or has behaved unworthily in marriage, such as gambling;

Who is obliged to pay child support?

home

Free legal assistance and legal information for the population

Legal information and legal education of citizens

Alimony obligations

Who is required to pay child support?

1. Parents

In accordance with Article 80 of the Family Code of the Russian Federation, parents are required to support their minor children.

Parents must pay child support

- minor children;

- children left without their care;

- Disabled adult children who need help.

Parents have the right to conclude an agreement on the maintenance of their minor children ( agreement on the payment of alimony ), which must be notarized. The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court.

In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from parents in a judicial proceeding.

In the absence of an agreement on the payment of alimony, alimony for minor children are collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents.

In accordance with article 83 of the Family Code of the Russian Federation p in the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in a share of earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

The amount of a fixed amount of money based on is determined by the court from the maximum possible preservation of the child's previous level of his security, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Article 84 of the Family Code of the Russian Federation fixes that alimony for children left without parental care are recovered only through the court . The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or custodian of the child, his adoptive parents or transferred to the account of the organization in which the child is (educational, medical organizations, social service organizations, etc.).

In accordance with article 85 of the Family Code of the Russian Federation, alimony in favor of disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In the absence of an agreement, alimony can be collected through the court. In this case, their size in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

In the absence of an agreement, alimony can be collected through the court. In this case, their size in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

2. Able-bodied adult children

In accordance with article 87 of the Family Code of the Russian Federation, able-bodied adult children are required to support their disabled parents who need help. An exception is made by parents deprived of parental rights, to whom children are not obliged to pay alimony.

Alimony can be paid either on the basis of a notarized agreement between parents and children, or on the basis of a court decision. The court sets the amount of alimony in a fixed amount of money , payable monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children.

3. Spouses, including former spouses

This issue is regulated by chapter 14 of the Family Code of the Russian Federation.

Spouses or ex-spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties.

If such support is refused and there is no agreement between the spouses on the payment of alimony, the right to demand the provision of alimony in court from the other spouse who has the necessary means for this, have:

- disabled needy spouse;

- wife during pregnancy and within three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I.

In accordance with Article 90 of the Family Code of the Russian Federation, the right to demand the provision of alimony in court from a former spouse who has the necessary funds for this has:

- ex-wife during pregnancy and within three years from the date of birth of a common child;

- a needy ex-spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I;

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of the dissolution of the marriage;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

In the absence of an agreement between the spouses (former spouses) on the payment of alimony, the amount of alimony collected on the spouse (former spouse) in a judicial proceeding is determined by the court based on the financial and marital status of spouses (former spouses) and other noteworthy interests of the parties in a fixed amount of money payable monthly.

4. Other family members who may be required to pay child support

- able-bodied adult brothers and sisters

In accordance with Article 93 of the Family Code of the Russian Federation, able-bodied adult brothers and sisters may be payers of alimony to the following persons:

- minor brothers and sisters, provided that they do not have the opportunity to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

- grandparents

In accordance with Article 94 of the Family Code of the Russian Federation, the following have the right to receive alimony in court:

- minor grandchildren in need of assistance in case of impossibility to receive maintenance from their parents;

- adult disabled grandchildren in need of assistance, if they cannot receive maintenance from their spouses (former spouses) or from their parents.

- tons able-bodied adult grandchildren

In accordance with Article 95 of the Family Code of the Russian Federation, able-bodied adult grandchildren may be payers of alimony disabled grandparents in need of assistance , provided that the latter are unable to receive maintenance from their adult able-bodied children or spouses.

- t able-bodied adult pupils

In accordance with Article 96 of the Family Code of the Russian Federation, able-bodied adult pupils (except for those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to disabled persons who carried out the actual upbringing and maintenance of pupils until they reach 18 years of age with provided that they do not have the opportunity to receive maintenance from their adult able-bodied children or from spouses (former spouses).