How much can your child earn and still be a dependent

When Does Your Child Have to File a Tax Return?

How much can a dependent child earn? Learn the rules about when a child must file a tax return because of earned and unearned income.

Say your dependent child is earning money from working, investments, or both. Great, but beware—your child might have to file a tax return. It might seem odd, but the IRS says dependent children who earn more than a threshold amount must file returns.

If a child fails to file, you (the parent) might be liable for the tax. Moreover, if your child can't file a return for any reason, such as age, you're legally responsible for filing one on your child's behalf.

For all these reasons it's vitally important to know how much your dependent child can earn before a tax return has to be filed. But how much can a dependent child earn? Read on to find out.

Types of Income for Dependents

Whether your child is required to file a tax return depends on the applicable standard deduction and how much earned and unearned income the child had during the year.

What is earned income? "Earned income" is income a child earns from working. It includes salary or wages, tips, professional fees, and taxable scholarship and fellowship grants.

What is unearned income? "Unearned income" is investment-type income. It includes taxable interest, dividends, capital gains, unemployment compensation, Social Security benefits, annuities, and distributions of unearned income from a trust.

If Your Child Has Earned Income OnlyA child who has only earned income must file a return only if the total is more than the standard deduction for the year. For 2022, the standard deduction for a dependent child is total earned income plus $400, up to a maximum of $12,950. So, a child can earn up to $12,950 without paying income tax.

If Your Child Has Unearned Income OnlyExample: William, a 16-year-old dependent child, worked part-time on weekends during the school year and full-time during the summer.

He earned $14,000 in wages during 2022. He didn't have any unearned income. He must file a tax return because he has earned income only, and his total income is more than the standard deduction amount for 2022.

A child who has only unearned income must file a return if the total is more than $1,150 for 2022.

Example: Sadie, an 18-year-old dependent child, received $1,900 of taxable interest and dividend income during 2022. She didn't work during the year. She must file a tax return because she has unearned income only, and her total income is more than the unearned income threshold for 2022.

However, if your child's interest and dividend income (including capital gain distributions) total less than $11,500, you can elect to include that income on your (the parents') return rather than file a return for the child. In this event, all income over $2,300 is taxed at your tax rates—you could end up paying more with this method.

If a child has both earned and unearned income, that child must file a return for 2022 if:

- unearned income is over $1,150

- earned income is over $12,950, or

- earned and unearned income together totals more than the larger of (1) $1,150, or (2) total earned income (up to $12,500) plus $400.

Should Your Child File a Return Even If Not Required?Example: Mike, a 19-year-old college student claimed as a dependent by his parents, received $200 taxable interest income (unearned income) and earned $2,800 from a part-time job during 2022 (earned income). He doesn't have to file a tax return. Both his earned and unearned income are below the thresholds, and his total income of $3,000 is less than his total earned income plus $400 ($3,200).

Even if your child doesn't meet any of the filing requirements discussed, that child should file a tax return if:

(1) income tax was withheld from that child's income, or

(2) that child qualifies for the earned income credit, additional child tax credit, health coverage tax credit, refundable credit for prior year minimum tax, first-time home buyer credit, adoption credit, or refundable American opportunity education credit.

See the tax return instructions to find out who qualifies for these credits. By filing a return, your child can get a refund.

What Is Your Child's Income Tax Rate?The first $1,150 of unearned income is covered by the kiddie tax standard deduction, so it isn't taxed. The next $1,150 in unearned income is taxed at the child's tax rate, which is ordinarily lower than the parent's. Income over $2,300 is taxed at the parent's maximum income tax rate.

Figuring the kiddie tax can be complex. For example, if a parent has more than one child subject to the kiddie tax, the net unearned income of all the children has to be combined, and a single kiddie tax calculated.

For federal income tax purposes, the income a child receives for personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. So, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

Dependent Tax Return Filing Requirements For 2021 Taxes

Generally, if you are going to be claimed as a dependent by someone else but have earned income, it may be beneficial to file a tax return. This applies even if you only make less than $10,000 from a wage part-time job, but had taxes withheld. See if you need to file a tax return here for more details and a personalized answer.

by @omidarmin

Your qualifying dependent may need to file a tax return if their income is within the IRS filing requirements. To determine if your dependent is required to file a return, use our FILEucator Tax Tool. Once you answer a few simple questions about your dependent's situation, you will find out if your dependent needs to file a tax return. It's that easy! If your dependent is required to file a tax return, you or your dependent can prepare and e-file the return on eFile.com.

For 2021 Returns, if a person was born during the year or before 2002 and has low taxable income - below the standard deduction amount - it might be advantageous to prepare and e-File a tax return to possibly benefit from the Earned Income Tax Credit or EITC in form of a tax refund. The EITC age limit for 2021 Returns was changed from age 25 to 19. Note: when you claim your dependent, you do not report their earned income on your tax return.

The EITC age limit for 2021 Returns was changed from age 25 to 19. Note: when you claim your dependent, you do not report their earned income on your tax return.

Your dependent may be required to file a return if they have one or more of the following types of income:

- Earned Income: This includes wages, salaries, tips, and other amounts you received as pay for work you actually perform. Taxable scholarship and fellowship grants are also included as earned income. See a list of possible forms that taxable income could be reported on.

- Unearned income: Taxable interest, capital gains, and ordinary dividends, are examples of unearned income. Also considered unearned income is unemployment compensation, taxable social security benefits, pensions, annuities of unearned income from a trust, and capital gain distributions. Unearned income is not always nontaxable income.

- At any age, if you are a dependent on another person's tax return and you are filing your own tax return, your standard deduction can not exceed the greater of $1,100 or the sum of $350 and your individual earned income.

Example 1: If your earned income was $700, your standard deduction would be: $1,100 as the sum of $700 plus $350 is $1,050, thus less than $1,100. Example 2: If your income was $3,200, your standard deduction would be: $3,550 as the sum of $3,200 plus $350 is $3,550 thus greater than $1,100. Learn more about who qualifies as a dependent.

Example 1: If your earned income was $700, your standard deduction would be: $1,100 as the sum of $700 plus $350 is $1,050, thus less than $1,100. Example 2: If your income was $3,200, your standard deduction would be: $3,550 as the sum of $3,200 plus $350 is $3,550 thus greater than $1,100. Learn more about who qualifies as a dependent.

- In 2022, this amount will be the greater of $1,150 or the sum of $400 and your earned income.

- Be aware that if you are under age 16 and have never filed a tax return, you cannot yet e-file your first year. You can prepare your return on efile.com, print it, and mail it to the IRS to file it. However, you will be able to e-file your return the following year. As a dependent, your return is most likely free on eFile.com - should it not be free for any reason, Contact us for promo code.

- Use the FILEucator tool to quickly find out if you have to file a return.

- Do IT Less Taxing!

See more information via IRS Publication 929, Tax Rules for Children and Dependents.

Tax Year 2021

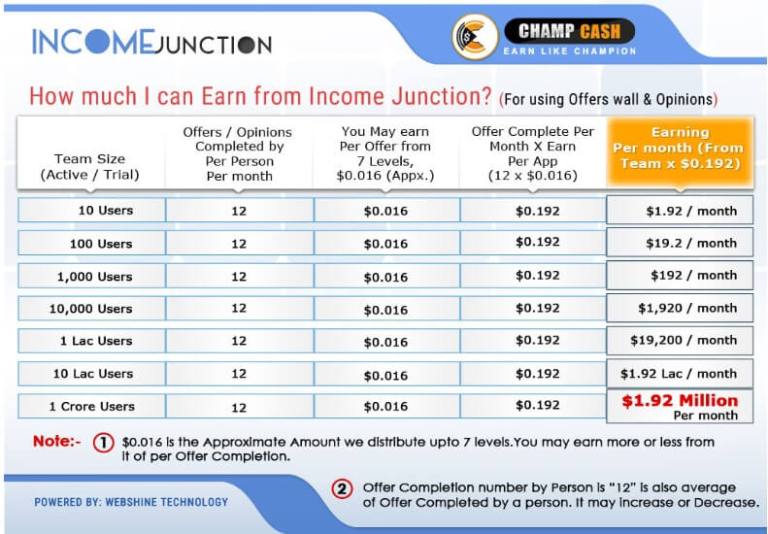

If you claim a dependent on your tax return, they may still be required to file an income tax return of their own. The 2021 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

W-2 Income Earned

Self-Employ. Income

Single

>65

Over $12,550

and Blind: $14,250

Over $1,100 unearned*

$400

Single

65+

Over $14,250

and Blind: $15,950

Over $2,750 unearned*

$400

Married**

>65

Over $12,400 earned

or Blind: $14,250

Over $1,100 unearned*

At least $5 if spouse files separate return and itemizes deductions, or more than $3,700 unearned*

$400

Married**

65+

Over $14,250

and Blind: $15,950

Over $2,400 unearned*

At least $5 if spouse files separate return and itemizes deductions, or more than $3,700 unearned*

$400

*Income that you did not earn by working, such as investment income or gifts.

** You must file a return if your spouse files a separate return and itemizes deductions and your total income is $5 or more.

Dependent Standard Deduction

The dependent standard deduction for 2021 Returns is $1,100 or the sum of $350 plus the dependent's earned income. See examples on the standard deduction page, under the table item, Dependent.

Tax Year 2022

If your dependent is claimed on your tax return, they may still be required to file an income tax return of their own. The requirements vary by filing status and age. The 2022 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

Minimum Income Requirement

Minimum Self-Employment Income Requirement

Single

Under 65 (and not blind)

More than $12,950 earned (or more than $1,100 unearned*)

$400

Single

65 or older OR blind

More than $14,300 earned (or more than $2,750 unearned)

$400

Single

65 or older AND blind

More than $15,650 earned (or more than $4,400 unearned)

$400

Married**

Under 65 (and not blind)

More than $12,950 earned (or more than $1,100 unearned)

$400

Married**

65 or older OR blind

More than $14,300 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $2,400 unearned)

$400

Married**

65 or older AND blind

More than $15,650 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $3,700 unearned)

$400

Dependent Standard Deduction

A dependent in 2022 may be qualified for a standard deduction of $1,150 or the sum of $400 plus their earned income. See the table item Dependent on the standard deduction page for details and examples.

See the table item Dependent on the standard deduction page for details and examples.

Tax Year 2020

The 2020 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

Minimum Income Requirement

Minimum Self-Employment Income Requirement

Single

Under 65 (and not blind)

More than $12,400 earned (or more than $1,100 unearned*)

$400

Single

65 or older OR blind

More than $14,050 earned (or more than $2,750 unearned)

$400

Single

65 or older AND blind

More than $15,700 earned (or more than $4,400 unearned)

$400

Married**

Under 65 (and not blind)

More than $12,400 earned (or more than $1,100 unearned)

$400

Married**

65 or older OR blind

More than $14,050 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $2,400 unearned)

$400

Married**

65 or older AND blind

More than $15,700 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $3,700 unearned)

$400

*Income that you did not earn by working, such as investment income or gifts.

**You must file a return if your spouse files a separate return and itemizes deductions and your total income is $5 or more.

If you have a dependent child who earned income by performing services, this income is included in your dependent's gross income and must be reported on his or her individual tax return. This is true even if a local law states that a child's parent has the right the claim the earnings and even received the earnings because of this ruling.

Be aware that you should NOT include your dependent's income as income on your own tax return. Your dependent has to report their income on their own tax return. In addition, your dependent needs to check a box on his or her own tax return to report that he or she can be claimed as a dependent on somebody else's tax return. If your dependent fails to do this, it might cause the IRS to reject your return when you attempt to e-file it.

Dependent Has No Income

Your dependent might need to file a return if one of the special reasons to file a tax return applies to them. For example, if they bought health insurance from the Marketplace, they need to file a return in order to claim the refundable Premium Tax Credit.

For example, if they bought health insurance from the Marketplace, they need to file a return in order to claim the refundable Premium Tax Credit.

Your dependent can file a return if they want to, even if they do not have to. If it is possible that they will receive a tax refund, they should file a return in order to claim the refund. If your dependent wants to find out if they will be getting a refund or will owe taxes, they can use our Free Tax Calculator. Once they enter their tax information (income, tax withheld, tax credits/deductions, etc.), the calculator will provide an accurate estimate. However, the best way to determine whether or not they will receive a refund is to start preparing a tax return on eFile.com, where the calculations will be 100% correct.

Start Your Tax Return Now!

Your student may need to file a return if they meet the IRS filing requirements. Even if they are not required to file, they may want to file a return in order to claim a refundable tax credit (i. e. American Opportunity Credit).

e. American Opportunity Credit).

Be aware that if your dependent is under 16 years old and this is their first time filing a tax return, they cannot e-file their return. They can still prepare their return on eFile.com, print it, and mail it to the IRS to file it. They will be able to e-file their tax return the following year.

Dependent Cannot File Due to Age

If your dependent child must file a tax return, but cannot because of their age or other reason, then you, a guardian, or other person who is legally responsible for the child must file the return on the child's behalf. The person must also sign the child's name on the return if the child cannot sign it, followed by "By [your signature], parent for minor child." In addition, if your child owes tax on their income, you (or the child's guardian) are responsible for paying the owed tax.

Dividend and Interest Income From Dependent

You may be able to include your dependent child's dividend and interest income on your tax return. If you report this income on your return, your child will not have to file their own tax return. All of the following conditions must be met before you can claim your child's interest and dividend income on your return:

If you report this income on your return, your child will not have to file their own tax return. All of the following conditions must be met before you can claim your child's interest and dividend income on your return:

- Your child is under age 19 (or under age 24 if a he or she is a student) at the end of the Tax Year.

- Your child's gross income is only from dividends and interest (including capital gain distributions and Alaska Permanent Fund dividends).

- The dividend and interest income was less than $10,500.

- Your child is required to file a tax return unless you meet the requirements to file your own return with your child's income.

- Your child does not file a joint tax return.

- No estimated tax payments were submitted for the current tax year and no overpayment for the previous tax year were applied for the current tax year under your child's name and Social Security number.

- You must be the parent whose tax return is used when reporting your child's income.

- No federal backup withholding tax was withheld from your child's income.

Backup Withholding

Usually, backup withholding applies to most types of payments reported on Form 1099. These payments include:

- Interest payments (reported on Form 1099-INT)

- Dividends (reported on Form 1099-DIV)

- Patronage dividends (reported on Form 1099-PATR, but only if at least half the payment is in money)

- Rents, profits, or other gains (reported on Form 1099-MISC)

- Commissions, fees, or other payment for independent contractor work (reported on 1099-MISC)

- Payments by brokers (reported on Form 1099-B)

- Payments by fishing boat operators (reported on Form 1099-MISC, but only the money part and it should represent a share of the proceeds of the catch)

- Royalty payments (reported on Form 1099-MISC)

- Gambling winnings (reported on Form W-2G).

Backup withholding generally does not apply to other payments reported on Form 1099-MISC (other than royalty payments and payments by fishing boat operators) unless at least one of the following three situations applies:

- The amount received from any payer is $600 or more.

- The payer had to give you a Form 1099 for the previous tax year.

- The payer made payments to you last year that were subject to backup withholding.

- The amount is less than $10 (neither a Form 1099 nor backup withholding is required).

Filing a Return for A Young Child/Relative

In order to decide if your dependent should file a return on their own or with you, we recommend that you use our FILEucator tool to find out. Then, you can use our DEPENDucator tax tool to see if you can claim your child or relative as as dependent. Finally, use the results from both tools (as well as review the IRS tax return filing requirements) to decide the best way to file based on your situation.

Your dependent can prepare and e-file their tax return on eFile.com. We will determine the correct forms based on their answers to simple tax questions. We will then prepare their return and double-check for accuracy and missing information.

Start Your Tax Return Now!

Before they start preparing their return your dependent will need copies of their W-2, 1099-MISC, or other tax forms from their employer.

Related Information on Dependents and Tax Returns

- Tax Return Filing Requirements

- Claiming Dependents on Tax Returns

- Filing a Tax Return as a Student.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Dependent children

Developments

Branch of the Pension Fund of Russia in the Chechen Republic informs that in accordance with Federal Law No. 400-FZ of 28.12. 2013 “On Insurance Pensions” an increase in the fixed payment to the insurance old-age (disability) pension is established.

2013 “On Insurance Pensions” an increase in the fixed payment to the insurance old-age (disability) pension is established.

In accordance with Article 10 of the above-mentioned Law, disabled family members are, in particular, children under the age of 18, as well as children studying full-time in basic educational programs in organizations engaged in educational activities, including in foreign organizations located outside the territory of the Russian Federation, until they complete such training, but not longer than until they reach the age of 23 or children older than this age, if they become disabled before the age of 18.

Based on the provisions of Article 10 of Federal Law No. 400-FZ dated December 28, 2013, family members can be recognized as dependents of the insured person if they are fully supported by him or receive assistance from him, which is a permanent and main source of funds for them to existence.

At the same time, the dependence of children under the age of 18 is assumed and does not require proof, with the exception of these children who are declared in accordance with the legislation of the Russian Federation as fully capable or who have reached the age of 18.

Thus, the establishment of an increase in the fixed payment to the insurance old-age (disability) pension, taking into account disabled family members who have reached the age of 18, is possible if there is documentary evidence of the fact that these family members are dependent on the insured person.

The requirement for persons over 18 years of age to prove the fact that they are dependent on their parents is based on the assumption that the person who has reached the age of majority is able to work. Adult citizens can work on full legal grounds, thereby earning their own income to ensure their livelihoods. Accordingly, the presumption of being dependent on parents can no longer be applied to such persons, even if they are studying full-time in basic educational programs in organizations that carry out educational activities.

At the same time, the fact that a disabled family member has income in connection with the implementation of work, the amount of which does not exceed the subsistence level in the Voronezh Region, cannot serve as an obstacle to recognizing him as a dependent, if the main and permanent source of livelihood is the assistance of a pensioner, and not the specified source of income (must be documented).

The issue of the fact that a disabled family member is dependent is decided by the territorial body of the PFR, including taking into account the current legal regulation, according to which the presence of disabled family members dependent is confirmed by documents issued by housing maintenance organizations or local authorities, documents on income of all family members and other documents stipulated by the legislation of the Russian Federation (other documents may include a court decision).

In addition, according to the Federal Law of December 28, 2013 400-FZ on the occurrence of circumstances (including those affecting the fact of dependence) that entail a change in the amount of the pension, the pensioner is obliged to notify the body providing pensions no later than the next working day after occurrence of the relevant circumstances.

Share news

How to move to Germany for permanent residence with children or spouse – DW – 06/03/2020

Sticked parents can move to children in Germany only in rare cases photos: Fotolia/Robert Kneschke

Nikita Zholkver

9000 9000

What are the requirements of German law for moving in Germany through family reunification, and how local officials recognize fictitious marriages - at DW.

https://p.dw.com/p/3d9Ob

Advertising

Hundreds of thousands of people every year move to Germany permanently through family reunification - parents to children, spouses to spouses. If we are talking about citizens of the countries of the European Union, then, as a rule, no problems arise: you order the transportation of furniture and go to your health.

Significantly more difficulties, and sometimes insurmountable ones, are in the way of relatives if the children live in Germany, and the parents in the so-called "third country", for example, in Russia. Or if one of the spouses lives there - a citizen or a citizen of the Russian Federation. At the same time, the citizenship of relatives living in Germany matters only in the second case - during the reunification of spouses.

Main condition - special life circumstances

The conditions under which children living in Germany can bring their parents from Russia or any other "third country" to them are set out in the extensive German residence law (Aufenthaltsgesetz), which regulates the rules for the entry, work and integration of foreigners in Germany.

Johannes Engelmann Photo: DW/N. JolkverThe main condition, explains the Berlin lawyer Johannes Engelmann, is, as stated in paragraph 36 of the law, the presence of special life circumstances, that is, when parents cannot take care of themselves. The need for care must be confirmed by appropriate medical certificates. Moreover, not every illness that requires care, the official of the German department for foreigners will necessarily consider "a special life circumstance."

"If, for example, parents are old, they have high blood pressure, their legs hurt, they walk with difficulty - this is not a special life circumstance," says the lawyer. "It's another matter if they have dementia, Parkinson's, memory lapses, mental disorders ". If an employee of the German embassy, for example, in Moscow, has doubts about the authenticity of the medical examination submitted by the applicant, then he can send him for a second examination to a doctor he trusts.

"It's another matter if they have dementia, Parkinson's, memory lapses, mental disorders ". If an employee of the German embassy, for example, in Moscow, has doubts about the authenticity of the medical examination submitted by the applicant, then he can send him for a second examination to a doctor he trusts.

The second indispensable condition for parents to move to their children in Germany is the absence of other children in their place of residence who could take care of them. And the third is the financial situation of children living in Germany, which should be such that parents are guaranteed a certain standard of living.

How much money is needed to accept parents

The calculation of this financial situation of children is a separate arithmetic. There is no specific figure - what the salary should be - does not exist. To illustrate the complexity of the calculation to the DW correspondent, Engelman took a pencil and a piece of paper.

The composition of a person's family, the presence of dependents, his personal fixed expenses, that is, payment for housing - whether it is his own or rented, medical and other insurance, are taken into account. To all such expenses, the minimum subsistence minimum is added, which currently stands at 431 euros per adult in Germany, slightly less for children, depending on age. An additional 20 percent is added to the subsistence minimum for the breadwinner and his dependents.

And all this taken together is deducted from his net salary (or net income), from which there must be enough left to support the parents or parent brought to Germany. At the same time, a living wage is also set at 431 euros per person - plus the cost of his health insurance. And this is the biggest unknown in this whole equation.

Main problem - health insurance for the elderly

Medical insurance, according to Engelman, can cost 600, 700 and 800 euros per person per month. The problem is that German insurance companies generally do not like to take on elderly people as clients, break up astronomical prices and, moreover, try to exclude from the contract payment for the treatment of typically "old people's" ailments, as well as those diseases that were recognized as "special life circumstances" . The official who decides on the reunification of such parents with children, studies the contracts of health insurance companies very carefully and, if there are such exceptions, has the right to refuse.

The problem is that German insurance companies generally do not like to take on elderly people as clients, break up astronomical prices and, moreover, try to exclude from the contract payment for the treatment of typically "old people's" ailments, as well as those diseases that were recognized as "special life circumstances" . The official who decides on the reunification of such parents with children, studies the contracts of health insurance companies very carefully and, if there are such exceptions, has the right to refuse.

It is the problem of medical insurance for elderly parents, the lawyer stated, that most often becomes an insurmountable obstacle to their moving to their children in Germany. His office - one of the leading in Berlin on family reunification - handles about 20-30 cases of this kind a year, and takes into production only those that meet all the requirements of the law and have a chance of success.

However, the lawyer noted, there is one option in which parents who came to visit their children in Germany can stay here: if their health condition has deteriorated sharply, that is, the same “special life circumstances” have arisen, confirmed by a medical certificate. If the official decides that the patient's condition may improve, then he - for humanitarian reasons, prescribed in paragraph 25 of the said law - may be granted a temporary permit to stay in Germany, which in this case is renewed every year.

How fake marriages are recognized

It is much easier for spouses to reunite in Germany. Unless, of course, we are talking about a fictitious marriage. German officials refuse fictitious spouses, even if all the prerequisites for moving to Germany are met. And a fictitious marriage can be recognized by a German official because, in his eyes, the spouses do not know each other well.

Love at first sight is not a decree for officials Photo: Fotolia/tramp51 If an official suspects such fictitious marriage, he can conduct a session of simultaneous questioning, said Johannes Engelman. Both spouses - one in Germany, the other in his homeland at the German embassy - are simultaneously invited for an interview, in which both German officials ask them the same questions online here and there, entering the answers into a common table.

Both spouses - one in Germany, the other in his homeland at the German embassy - are simultaneously invited for an interview, in which both German officials ask them the same questions online here and there, entering the answers into a common table.

Questions can be quite trivial, the lawyer says: when did you last talk to each other? What topics? How much does your spouse earn in Germany? Which of the relatives did you meet? Where did the groom propose to you? What did he give away? What are the spouses' hobbies? Is there a cat or dog in the house? If the answers do not match, then officials may decide that the marriage is fictitious, no matter what they are told by those being tested about love at first sight.

Marriages in Denmark no longer take place in Germany

Previously, it was possible to make a person a private invitation to Germany, go with him, for example, to Denmark, sign there and on this basis immediately - in the worst case, through the court - get a residence permit for him in Germany through family reunification.

A few years ago, such loopholes in the law were closed in Germany, and now, wherever a marriage is concluded - in Denmark, Russia or Germany itself - a foreign spouse must go home and apply to move to Germany with her husband or wife.

The requirements that apply depend, as already mentioned, on the nationality of the "receiving party". If a German resident is a German, then no one is interested in his financial situation at all. But before moving to him, a foreign spouse will have to pass an exam for the most primitive (A1 level) knowledge of the German language. An exception is the presence of children in a foreign spouse. If there is a child, then the German must have enough income to provide for him.

If a citizen of one of the EU countries lives in Germany, then the procedure is even simpler: he can sign anywhere, and his “second half” is automatically granted permanent residence in Germany.