How much can you gift your child per year

Gift Tax Limit 2022: How Much Can You Gift?

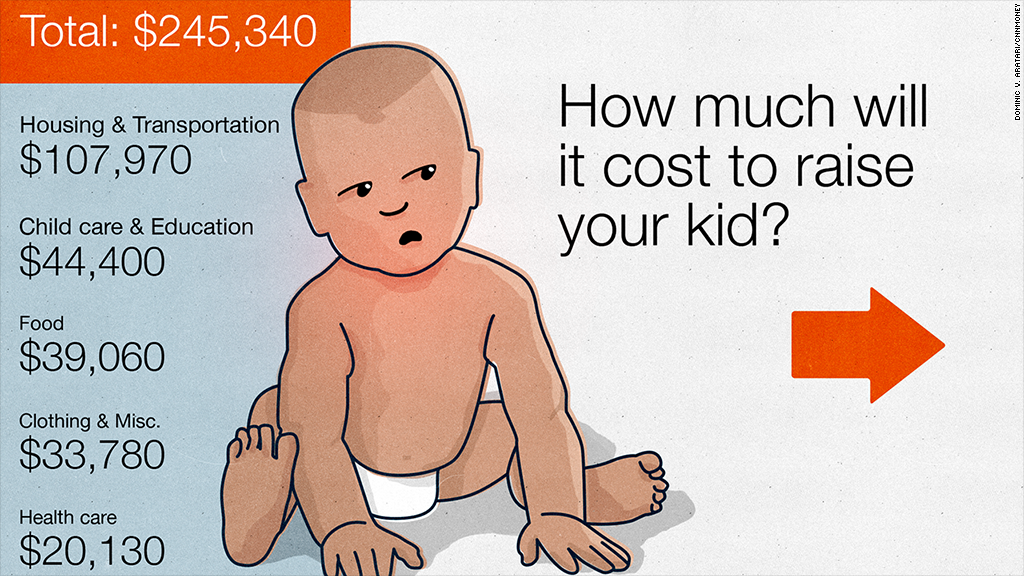

For 2022, the annual gift tax exemption is $16,000, up from $15,000 in 2021. This means you can give up to $16,000 to as many people as you want in 2022 without any of it being subject to the federal gift tax. The gift tax is imposed by the IRS if you transfer money or property – worth more than an exempted amount – to another person without receiving at least equal value in return. This could apply to parents giving money to their children, the gifting of property such as a house or a car, or any other transfer. There is also a lifetime exclusion of $12.06 million in 2022. For help with the gift tax or any other personal finance issues you may have, consider working with a financial advisor.

The annual gift tax exclusion of $16,000 for 2022 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit. So you don’t need to worry about paying the gift tax on, say, a sweater you bought your nephew for Christmas.

The annual gift exclusion limit applies on a per-recipient basis. This gift tax limit isn’t a cap on the total sum of all your gifts for the year. You can make individual $16,000 gifts to as many people as you want. You just cannot gift any one recipient more than $16,000 within one year. If you’re married, you and your spouse can each gift up to $16,000 to any one recipient.

If you gift more than the exclusion to a recipient, you will need to file tax forms to disclose those gifts to the IRS. You may also have to pay taxes on it. If that’s the case, the tax rates range from 18% up to 40%. However, you won’t have to pay any taxes as long as you haven’t hit the lifetime gift tax exemption.

Lifetime Gift Tax LimitsMost taxpayers won’t ever pay gift tax because the IRS allows you to gift up to $12.06 million (as of 2022) over your lifetime without having to pay gift tax. This is the lifetime gift tax exemption, and it’s up from $11.7 million in 2021.

This is the lifetime gift tax exemption, and it’s up from $11.7 million in 2021.

So let’s say that in 2022 you gift $216,000 to a family member. This gift is $200,000 over the annual gift exclusion, meaning you’ll need to report it to the IRS. However, you won’t immediately have to pay tax on that gift. Instead, the IRS deducts that $200,000 from your lifetime gift tax exemption. So assuming you never made any other gifts over the annual exemption, your remaining lifetime exemption is now $11.86 million ($12.06 million minus $200,000). The table below breaks down this example:

| Example of Lifetime Exemption Limits | |||||

| Gift Value | $216,000 | ||||

| 2022 Gift Tax Exemption Limit | $16,000 | ||||

| Taxable Amount | $200,000 | ||||

| Lifetime Gift Tax Exemption Limit | $12,060,000 | ||||

| Remaining Lifetime Exemption Limit | $11,860,000 | ||||

Most taxpayers will not reach the gift tax limit of $12. 06 million over their lifetimes. However, the lifetime gift tax exemption becomes important again when you die and pass on an estate.

06 million over their lifetimes. However, the lifetime gift tax exemption becomes important again when you die and pass on an estate.

The IRS defines a gift as “any transfer to an individual, either directly or indirectly, where full consideration is not received in return.” In other words, if you write a big check, gift some investments or give a car to someone other than your spouse or dependent, you have made a gift. The IRS has a gift tax limit, both for the amount you can give each year and for what you can give over the course of your life. If you go over those limits, you will have to pay a tax on the amount of gifts that are over the limit. This tax is the gift tax.

In almost every case, the donor is responsible for paying gift tax, not the recipient. A recipient will only pay gift tax in special circumstances where he or she has elected to pay it through an agreement with the donor. Even though recipients don’t face any immediate tax consequences, they can face capital gains tax if they sell gifted property down the line.

There are two numbers to keep in mind as you think about gift tax: the annual gift tax exclusion and the lifetime gift tax exemption.

How to Calculate the Gift TaxJust like your federal income tax, the gift tax is based on marginal tax brackets. And rates range between 18% and 40%. If you want to calculate the taxable income for gifts exceeding the annual exclusion limit, the table below breaks down the rate that you will have to pay based on the value of the gift.

| 2022 Gift Tax Rates | |||||||||

| Gift Value Above the Annual Exclusion Limit | Rate | ||||||||

| Up to $10,000 | 18% | ||||||||

| $10,001 to $20,000 | 20% | ||||||||

| $20,001 to $40,000 | 22% | ||||||||

| $40,001 to $60,000 | 24% | ||||||||

| $60,001 to $80,000 | 26% | ||||||||

| $80,001 to $100,000 | 28% | ||||||||

| $100,001 to $150,000 | 30% | ||||||||

| $150,001 to $250,000 | 32% | ||||||||

| $250,001 to $500,000 | 34% | ||||||||

| $500,001 to $750,000 | 37% | ||||||||

| $750,001 to $1,000,000 | 39% | ||||||||

| More than $1,000,000 | 40% | ||||||||

The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption. The exemption for 2022 is $12.06 million. At the same time, the exemption for your estate may not be the full $12.06 million. You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

The exemption for 2022 is $12.06 million. At the same time, the exemption for your estate may not be the full $12.06 million. You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

So let’s say that you have lowered your lifetime exemption down to $10 million by making $2.06 million in taxable gifts over your life. The federal government would then tax any estate that you pass on to someone for all value over $10 million. In other words, the gift tax and estate tax have a single combined exclusion. Regardless of whether the gift is passed to the recipient before or after your death, it applies toward that same $12.06 million limit.

All of this means that one way to prevent taxation of any assets you pass on is to gift those assets in increments of $16,000 or less. This could take some planning on your part but it is completely legal. There are also some gifts that you never have to pay tax on.

What Gifts Are Safe From Taxes?Taxable gifts can include cash, checks, property and even interest-free loans. It also applies to anything you sell below fair market value. For instance, if you sell your home to your non-dependent child for $175,000 when it’s worth $250,000, the $75,000 difference could be considered a gift. That surpasses the annual gift tax limit and thus is deducted from your lifetime gift tax limit.

It also applies to anything you sell below fair market value. For instance, if you sell your home to your non-dependent child for $175,000 when it’s worth $250,000, the $75,000 difference could be considered a gift. That surpasses the annual gift tax limit and thus is deducted from your lifetime gift tax limit.

What constitutes a gift that counts toward your gift tax limit is generally easy to understand. There are several things that the IRS doesn’t consider a gift, however. You can give unlimited gifts in these categories without facing a gift tax or having to file gift tax paperwork:

- Anything given to a spouse who is a U.S. citizen

- Anything given to a dependent

- Charitable donations

- Political donations

- Funds paid directly to educational institutions on behalf of someone else

- Funds paid directly to medical service or health insurance providers on behalf of someone else

There are, of course, a few exceptions to keep in mind. If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year. Anything above that is subject to gift tax and counts against your lifetime limit.

If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year. Anything above that is subject to gift tax and counts against your lifetime limit.

Funds that cover educational expenses refer only to tuition. That does not include books, dorms or meal plans. You can skirt the gift tax by contributing to someone’s 529 college savings plan with a lump sum and then spreading it over five years for tax purposes. The IRS allows taxpayers to donate $75,000 into a 529 plan without paying tax or reducing the lifetime limit. The only caveat is that any additional gifts for the same recipient will count toward your lifetime limit.

Lastly, it’s important to note that charitable donations are not only exempt from gift tax, they may also be eligible as an itemized deduction on your individual income tax return.

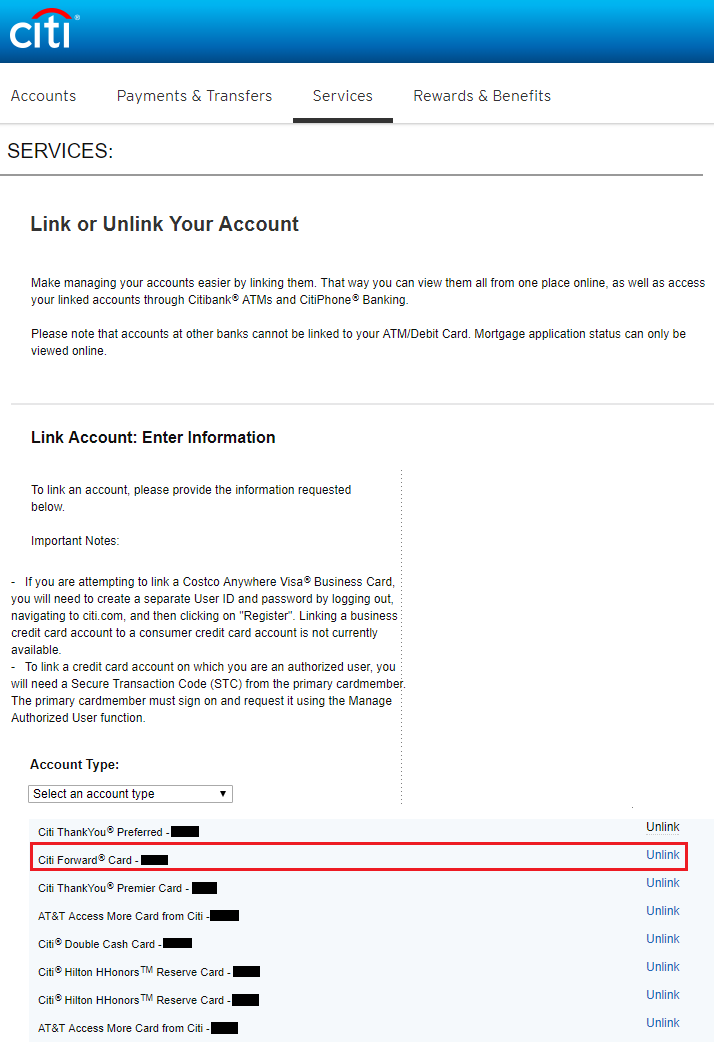

How to File Your Gift Tax ReturnThe first step to paying gift tax is reporting your gift. Complete IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, on or before your tax filing deadline. Download the document, complete each relevant line and sign and date along the bottom. You then send the form in with the rest of your tax return.

Download the document, complete each relevant line and sign and date along the bottom. You then send the form in with the rest of your tax return.

You should complete Form 709 anytime you gift in excess of $16,000 – even if you’re within the $12.06 million lifetime limit. You’ll have to file a Form 709 each year you give a reportable gift, and each form should list all reportable gifts made during the calendar year.

If you live in Connecticut or Minnesota, you may also have to file a state gift tax return. These are the only states that have their own gift tax. In most cases, you can file a gift tax return on your own. If your transfers are large or complex, though, consider finding a financial professional.

Bottom LineThe IRS allows every taxpayer is gift up to $16,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $12.06 million. Even if you gift someone more than $16,000 in one year, you will not have to pay any gift taxes unless you go over that lifetime gift tax limit.

You will still need to report gifts over the annual exclusion to the IRS via Form 709. The IRS will lower your remaining lifetime exclusion over time and then use that amount to determine how much of your estate you need to pay estate tax on.

Tips for Getting Through Tax Season- Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Any charitable donations that you make are tax deductible. As you plan for your taxes, it’s important to keep track of your potential deductions throughout the year. They could save you money if you make deductions worth more than the standard deduction.

- One way to maximize your deductions is to use the right tax filing service.

Two of the best filing services, H&R Block and TurboTax, both offer tools to help you maximize your deductions. And while both services are easy-to-use, certain taxpayers may prefer one over the other. Here’s a breakdown of H&R Block vs. TurboTax to help you decide which is best for you.

Two of the best filing services, H&R Block and TurboTax, both offer tools to help you maximize your deductions. And while both services are easy-to-use, certain taxpayers may prefer one over the other. Here’s a breakdown of H&R Block vs. TurboTax to help you decide which is best for you.

Photo credit: ©iStock.com/donald_gruener, ©iStock.com/Goran13, ©iStock.com/YinYang

Liz Smith Liz Smith is a graduate of New York University and has been passionate about helping people make better financial decisions since her college days. Liz has been writing for SmartAsset for more than four years. Her areas of expertise include retirement, credit cards and savings. She also focuses on all money issues for millennials. Liz's articles have been featured across the web, including on AOL Finance, Business Insider and WNBC. The biggest personal finance mistake she sees people making: not contributing to retirement early in their careers.

Gift Tax Rate: What Is It & Who Pays in 2022-2023

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Two things keep the IRS out of most people's hair: the annual gift tax exclusion and the lifetime exclusion.

Written by Tina Orem, Sabrina Parys

Reviewed by

Lei Han

At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

There are a lot of things to worry about in life, but the gift tax probably isn’t one of them.

What is the gift tax?

Gift tax is a federal tax on transfers of money or property to other people while getting nothing (or less than full value) in return. Few people owe gift tax; the IRS generally isn’t involved unless a gift exceeds $16,000 in 2022 and $17,000 in 2023. Even then, it might only trigger extra paperwork.

Do you pay taxes when you receive a gift?

In most cases, no. Assets you receive as a gift or inheritance typically aren’t taxable income at the federal level.

Internal Revenue Service

. Publication 525: Taxable and Nontaxable Income..

Accessed Oct 21, 2022.

View all sources

However, if the assets later produce income (perhaps they earn interest or dividends, or you collect rent), that income is likely taxable. IRS Publication 525 has the details. Also, some states have an inheritance tax.

How do I avoid gift tax?

Two things keep the IRS’s hands out of most people's candy dish: the annual exclusion ($16,000 in 2022 and $17,000 in 2023), and the lifetime exclusion ($12.06 million in 2022 and $12.92 million in 2023).

Stay below those and you can be generous under the radar. Go above, and you'll have to fill out a gift tax form when filing returns — but you still might avoid having to pay any gift tax.

How the annual gift tax exclusion works

In 2022, you can give up to $16,000 to someone in a year and generally not have to deal with the IRS about it. In 2023, this threshold is $17,000. A bit more about how that works:

In 2023, this threshold is $17,000. A bit more about how that works:

If, for example, you give more than $16,000 in cash or assets (for example, stocks, land, a new car) to any one person in 2022, you need to file a gift tax return. That doesn’t mean you have to pay a gift tax. It just means you need to file IRS Form 709 to disclose the gift.

The annual exclusion is per recipient; it isn’t the sum total of all your gifts. That means, for example, that you can give $16,000 to your cousin, another $16,000 to a friend, another $16,000 to a neighbor, and so on all in 2022 without having to file a gift tax return.

If you’re married, you and your spouse may give away up to $16,000 each without needing to file a gift tax return in 2022. If you want to combine your annual exclusions in order to together gift a donee up to $32,000, you can elect to take advantage of "gift splitting"

Internal Revenue Service

.

.

.Accessed Aug 23, 2022.

View all sources

. The IRS has more details here.

Gifts between spouses are unlimited and generally don’t trigger a gift tax return. Though, if the spouse isn't a U.S. citizen, special rules may apply.

Internal Revenue Service

. Instructions for Form 709 : Gifts to Your Spouse.

Accessed Oct 21, 2022.

View all sources

Gifts to nonprofits are charitable donations, not gifts.

The person receiving the gift usually doesn't need to report the gift.

How the lifetime gift tax exclusion works

On top of the $16,000 annual exclusion in 2022, you get a $12.09 million lifetime exclusion in 2022. This rises to $12.92 million in 2023. And because it’s per person, married couples can exclude double that in lifetime gifts. That comes in handy when you’re giving away more than $16,000.

That comes in handy when you’re giving away more than $16,000.

“Think about buckets or cups,” says Christopher Picciurro, a certified public accountant and co-founder of accounting and advisory firm Integrated Financial Group in Michigan. Any excess “spills over” into the lifetime exclusion bucket.

For example, if you give your brother $50,000 this year, you’ll use up your $16,000 annual exclusion. The bad news is that you’ll need to file a gift tax return, but the good news is that you probably won’t pay a gift tax. Why? Because the extra $34,000 ($50,000 - $16,000) simply counts against your lifetime exclusion. Next year, if you give your brother another $50,000, the same thing happens: you use up your annual exclusion and whittle away another portion of your lifetime exclusion.

The gift tax return keeps track of that lifetime exclusion. So if you don't gift anything during your life, then you have your whole lifetime exclusion to use against your estate when you die. Learn more about how estate tax works.

Learn more about how estate tax works.

Another trick that can help you avoid an unwanted surprise is simply keeping an eye on the calendar. In 2026, the lifetime exclusion amount will revert back to its pre-2018 level of around $5 million (as adjusted for inflation) per individual.

Internal Revenue Service

. Estate and Gift Tax FAQs.

Accessed Aug 23, 2022.

View all sources

You can find more details here.

What is the gift tax rate?

If you’re lucky enough and generous enough to use up your exclusions, you may indeed have to pay the gift tax. The rates range from 18% to 40%, and the giver generally pays the tax. There are, of course, exceptions and special rules for calculating the tax, so see the instructions to IRS Form 709 for all the details.

What can trigger a gift tax return

Caring is sharing, but some situations often inadvertently trigger the need to file a gift tax return, pros say.

Spoiling the grandkids with college money

If Grandma or Grandpa put, say, $60,000 in a 529 plan for a grandchild, Picciurro gives as an example, that may trigger the gift tax exclusion because it's over the limit.

A special rule allows gift givers to spread one-time gifts across five years’ worth of gift tax returns to preserve their lifetime gift exclusion.

Internal Revenue Service

. 2021 Instructions for Form 709: Qualified Tuition Programs (529 Plans or Programs).

Accessed Aug 23, 2022.

View all sources

Springing for vacations, cars or other stuff

If you fork out $40,000 for Junior’s wedding, or just pay for the crazy-expensive honeymoon, get ready to do some paperwork.

If you’re paying tuition or medical bills, paying the school or hospital directly can help avoid the gift tax return requirement (see the instructions to IRS Form 709 for details).

Laid-back loans

Lending money to friends and family can be tricky, and the IRS can make it even worse. It considers interest-free loans as gifts. Or if you lend them money and later decide they don't need to repay you, that's also a gift.

Elbowing in on a non-spouse bank account

“Let’s say you live by Grandma, so for convenience, we're going to put you on Grandma's bank account. Guess what just happened?” Picciurro says. “If you're put as a joint [owner] on a bank account with somebody and you have the right to take the money out at any time, essentially Grandma is giving you a gift.”

Advertisement

Member FDIC | Member FDIC | Member FDIC |

|---|---|---|

NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. | NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. | NerdWallet rating NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. |

Learn More | Learn More | Learn More |

APY3.60% With $0 min. balance for APY | APY3.25% With $0 min. balance for APY | APY3.00% With $0 min. balance for APY |

BonusN/A | Bonus$250 Earn up to $250 with direct deposit. Terms apply. | Bonus$200 Requirements to qualify |

About the authors: Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

Sabrina Parys is a content management specialist at NerdWallet. Read more

On a similar note...

Find a financial advisor

View NerdWallet's picks for the best financial advisors of 2022.

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

What to give a child for a year?

What to give a child ...

17 answers Remove

#1

#2

#3

Opinion

The most optimal is a certificate in the Children's world / boat and so on. The amount, see for yourself - 1000-1500-2000 as finances allow. Well, or ask the approvers what they haven't bought yet. Or any educational toy, but there may be a repetition.

The amount, see for yourself - 1000-1500-2000 as finances allow. Well, or ask the approvers what they haven't bought yet. Or any educational toy, but there may be a repetition.

#4

Guest

Dengi I Karobku Kanfet

#5

Do you think this is a normal amount? I have no idea how much they give it now)

#6

#7

Opinion

Yes, they were given just these amount, I even thought it was too much. But it's more useful than a similar toy, because, for example, I bought food for my child :) it's very nice to buy jars for a week and not pay your 1000, but pay with a certificate :)

#8

#9

You can give a certificate for a photo session Guest

Keep calm in 2000. Depending on what city of course. Talk to photographers, they will offer you the best option. I also wanted to give a certificate for a children's photo session, just a familiar truth, the budget was 1000))) I was just looking for a photographer, photo studios in VK. Wrote one, she said 1500-2000. Then she herself offered me an option a few days later: a 15-minute photo shoot for 1000. For a child, this is enough, but 30 minutes is certainly better)

Depending on what city of course. Talk to photographers, they will offer you the best option. I also wanted to give a certificate for a children's photo session, just a familiar truth, the budget was 1000))) I was just looking for a photographer, photo studios in VK. Wrote one, she said 1500-2000. Then she herself offered me an option a few days later: a 15-minute photo shoot for 1000. For a child, this is enough, but 30 minutes is certainly better)

#10

#11

Duplo. It is cheaper than giving money and definitely a memory gift from you.

#12

#13,0003

#14

Anna

Good age designer.

#15

Ulia

I bought my sister a bunch of stuff in Next for her son's anniversary. There was so much happiness there.

#16

#17,0003

New topics for a week:

-

Mom with children from one to two to two, how do you manage to live?

16 answers

-

Child gains little weight

1 answer

-

What to do at home with a child in 1.5?

25 answers

-

Clothing for the newborn

2 answers

-

Cettle Cotle

1 Answer

-

AACRESLOLACE ATELULAK?

2 answers

-

Stroller

3 answers

-

My husband and I started to choose a stroller and got stuck.

..

.. 4 answers

-

A question for older women who have not given birth?

34 answers

-

Why are sons more important?

8 answers

Popular topics of the week:

-

Question for older women who have not given birth?

34 answers

-

What to do at home with a child at 1.5?

25 answers

-

Mothers with children from one to two, how do you manage to live?

16 answers

-

Why are sons more important?

8 answers

-

children ...

7 answers

-

began to choose a stroller with her husband and got into a rostor .

..

.. 4 answers

Previous Topic

-

Inexplicably infuriates his daughter ((

97 answers

What to give the child for a year?

The first year of the child’s life is very excitement a family member, trying to give him everything he needs and the best. A child is unlikely to remember his first birthday, but the gifts received on this day will delight him for more than one year. Parents and relatives of a baby are often puzzled by the question of what to give a child for a year, because you want the present to be not only beautiful, but also useful.0003

Sometimes, trying to please the baby, adults make mistakes, presenting gifts that cause more fear and apprehension than joy and delight. These include:

- radio-controlled devices;

- construction sets with small parts;

- soft and too loud toys.

Radio controlled devices are a good gift for a godson or goddaughter, but not for a year. A child will become interested in them in a year or two, and at the age of one, they can scare. Constructors with small details are also not the best option, because now the child tries everything “by the tooth” and can swallow the small elements of the set.

A child will become interested in them in a year or two, and at the age of one, they can scare. Constructors with small details are also not the best option, because now the child tries everything “by the tooth” and can swallow the small elements of the set.

Soft toys do not quite meet the age needs of the baby, you cannot perform many different actions with them, so interest in such a gift will quickly fade. Loud toys can be scary, moreover, their frequent use negatively affects the nerves of parents.

What toy to give a child for 1 year?

At this age, everything that a child touches must develop a certain skill in him, so ordinary rattles are no longer suitable. The list of the best gifts in this category is as follows:

- large car/tolocar;

- rockers;

- doll carriages;

- bicycles with a handle;

- sled;

- ball pool;

- swing.

One-year-old children enthusiastically react to everything that rides, so the tolocar can be a great gift for a grandson or granddaughter. Preference should be given to models that have moving parts, because they can be twisted and moved, which the baby will really like. Most children respond positively to cars with music and a flashing function. If the gift budget is small, then you can choose a handmade toy. Such a wheelchair is usually smaller and can be on a stick or rope.

Preference should be given to models that have moving parts, because they can be twisted and moved, which the baby will really like. Most children respond positively to cars with music and a flashing function. If the gift budget is small, then you can choose a handmade toy. Such a wheelchair is usually smaller and can be on a stick or rope.

Rocking chairs improve coordination, train muscles and agility. They can be made in the form of different animals and often have sound effects that correspond to the characteristics of a particular animal.

A good present for a girl is a stroller for dolls. At this age, the baby is already beginning to actively walk, loves rolling objects and repeats after adults. Despite the fact that many products of this type indicate an age limit of 3 years, parents say that girls who are one and a half years old love to roll their dolls in a stroller. The only thing is, when choosing such a gift, give preference to models with a metal case, which can serve as a reliable support for the baby.

A bicycle with a handle can be a good alternative to a stroller. The handle here also functions as a steering wheel, allowing parents to change the direction of movement, but the child will have the feeling that he controls the equipment on his own. Such a gift for a child for 1 year can be used for several years, because as the baby grows, the handle, sides and footboards can be removed, allowing your child to learn how to ride a bicycle on their own.

For the cold season, children can be presented with a sled, it is also a “growth” transport that can be used for more than one season. Particularly convenient for parents will be models with additional wheels, thanks to which there is no need to carry the sled on your hands every time you cross the road, you can simply roll it.

Inflatable pool with balls can serve as a real play area for the baby, where he will spend a lot of time. Pediatricians believe that such toys have a positive effect on the physical development of children. But parents need to prepare for the fact that colorful balls may well migrate from the pool to different parts of the house.

But parents need to prepare for the fact that colorful balls may well migrate from the pool to different parts of the house.

Children of all ages love swings, so this swing would make a great gift for a one year old. There is a huge selection of swings on the market for both outdoors and indoors. This is a good option if the child lives in a private house or there is a horizontal bar in the room. As a rule, such a device does not take up much space.

Developing and useful gifts for a baby for a year

Parents make every effort to ensure that their son or daughter develops in accordance with age norms, therefore, they will positively perceive gifts that expand the horizons of the baby and help him learn. These include:

- training center;

- development mat;

- bodyboard;

- musical instruments;

- logic toys;

- constructors.

The learning center usually has the form of a table on which everything is organized so that the child learns to distinguish objects by color, size and shape. Sets are different, but their main task is to develop logic, coordination and concentration.

Sets are different, but their main task is to develop logic, coordination and concentration.

Active and inquisitive little ones will love the developmental mats, they attract with their bright colors and sound effects. This children's flooring improves coordination, develops a sense of rhythm and stimulates physical activity.

Busyboard is a board with a huge number of different locks and tools that can captivate a child for a long time. There are a lot of options for such educational devices, but they all have common features: bright and rich drawings, numbers, animal figures. The business board improves fine motor skills, develops logical thinking and attentiveness. Hypoallergenic paints are used here, so this toy is absolutely harmless to kids.

For the creative development of a child, you can donate a set of musical instruments. After he examines them all, the baby will begin to extract his first sounds. This will cause him delight and desire to continue to explore the limitless musical world. Such instruments contribute to the development of dexterity and coordination, as well as improve musical ear.

Such instruments contribute to the development of dexterity and coordination, as well as improve musical ear.

Logic toys include nesting dolls, puzzles, sorters, pyramids. They develop an important skill according to psychologists - folding small objects into large ones. With the help of such a gift, the baby will be able to learn to distinguish between numbers and colors, as well as navigate in the figures and surrounding objects.

The construction set is a good tool for the comprehensive development of the child, it trains spatial thinking, hand-eye coordination, and imagination. In children's stores today you can find a huge number of such sets, the main thing is to choose them according to the age of the baby and avoid constructors with too small details.

Practical and useful gifts include bedding, clothes and shoes, as well as personal care products. Such gifts will surely find their application in everyday life and will never be superfluous. True, here you should take into account the tastes and characteristics of the baby, so that the pants or shoes that you give him will not only be liked, but also fit in size.

True, here you should take into account the tastes and characteristics of the baby, so that the pants or shoes that you give him will not only be liked, but also fit in size.

Original and memorable gifts for a year old girl and boy

Relatives and friends of a baby always want to give a gift that will long remind of a happy and important day in a child's life. They approach the choice of such a presentation with special responsibility. In this case, gifts such as engraved silver spoons or cups, jewelry, personal scrapbooking photo albums, and a cast kit would be appropriate. Such gifts do not lose their relevance for a long time and retain pleasant memories.

It doesn't matter if you choose a birthday present for a boy or a girl, it must be of high quality and beautifully packaged. To be sure of the quality and safety of children's products, it is better to buy them in reliable and specialized stores, such as avtokrisla.com. In this online store you can buy a gift that your baby will definitely like and benefit him.