How much is child support for two children

Monthly Child Support Calculator | Office of the Attorney General

- About

- News

- Opinions

- Jobs

- Contact Us

This calculator provides an estimate for a single source of income. The actual amount set or approved by the court may differ.

Income

The person paying support is:

an employeeself-employed

Income Frequency:

YearlyMonthlySemi-MonthlyBi-WeeklyWeeklyHourly

Amount:

Deductions

Medical Support

If you are providing (or can provide) health insurance for your children, enter the monthly premium amount.

Dental Support

If you are providing (or can provide) dental insurance for your children, enter the monthly premium amount.

Union Dues

If you are a member of a union and make regular payments to be a member of the union, enter the monthly dues amount.

State Income Tax

If you work or reside in a state where a state income tax is assessed against your income, enter the monthly amount.

Support Order Determination

Children in this Action

Enter the number of children under age 18 in the child support order.

Children outside this Action

Enter the number of other children for whom you have a legal duty to support.

Support Order Calculations

Monthly Gross Income

Monthly OASDI, Medicare, and Federal Taxes

Monthly OASDI Taxes

Monthly Medicare Taxes

Monthly Federal Income Taxes

Monthly Income

Other Deductions

Medical Support Deduction

Dental Support Deduction

Union Dues Deduction

State Income Tax Deduction

Net Resources

Low-Income Child Support Guidelines Percentage:

Texas Family Code Sec. 154.125 Low-Income Child Support Guidelines are used in actions filed on or after 9/1/2021

154.125 Low-Income Child Support Guidelines are used in actions filed on or after 9/1/2021

Projected Monthly Child Support Obligation for net resources up to $9,200

**The Guidelines for the support of a child are specifically designed to apply to monthly net resources not greater than $9,200. This calculator does not calculate support in excess of the $9,200 net resource amount per Texas Family Code Sec. 154.125(a).

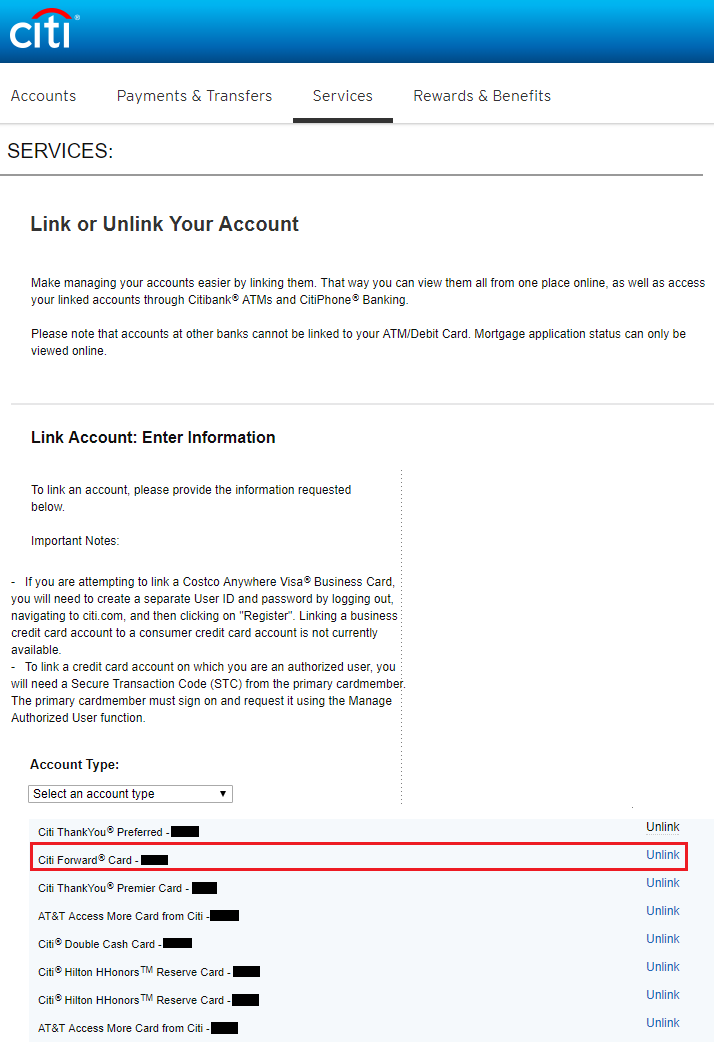

Child Support Percentage by State 2022

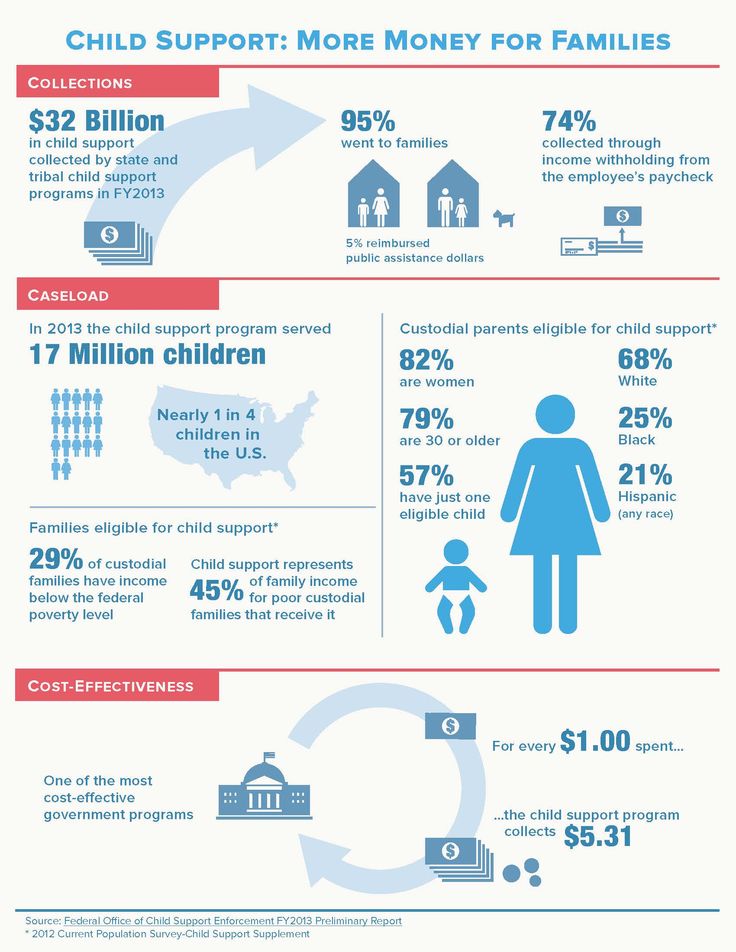

In family law, child support is an ongoing, periodic payment made by a parent for the financial benefit of a child following the end of a marriage or other relationship. Payment is made by an obligor, often the non-custodial parent, to an obligee, typically the custodial parent, a caregiver, a guardian, or the state.

Child support is often arranged as a result of a divorce, material separation, annulment, determination of parentage, or a dissolution of a civil union.

Child support laws vary between jurisdictions. Typically, one has the same obligation to pay the support irrespective of sex, so a mother is required to pay the father just as a father must pay the mother. In some jurisdictions where there is joint custody, the child is considered to have two custodial parents and no non-custodial parent. This might result in the parent with a higher income being required to pay the other custodial parent.

The 1992 United Nations Convention on the Rights of the Child is a being connection that was signed by every UN member state and formally ratified by all members except for the U.S. This convention declares that the upbringing and development of children and providing them a standard of living that is adequate for their development is a human the responsibility of both parents.

In the United States, the Office of Child Support Enforcement is responsible for the federal child support enforcement program. Federal regulations, in accordance with Title IV-D of the Social Security Act, require the uniform application of child support guidelines throughout a state, but each state may determine its own method of calculating support. Code of Federal Regulations Title 45 302.56 requires each state to establish and publish a guideline and review the guideline every four years. Most states have adopted their own “Child Support Guidelines Worksheet” that determines the standard calculation of child support in that state.

Code of Federal Regulations Title 45 302.56 requires each state to establish and publish a guideline and review the guideline every four years. Most states have adopted their own “Child Support Guidelines Worksheet” that determines the standard calculation of child support in that state.

How Child Support is Calculated

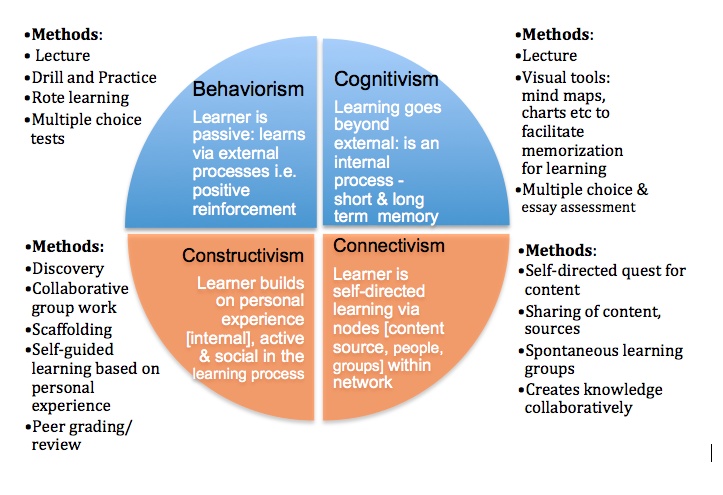

According to the National Conference of State Legislatures, child support guidelines in each state follow one of three models: the income share model, the percentage of income model, and the Melson Formula.

The income shares model combines both parents’ income, determines the basic child support, \ adds expenses, and then an obligation is prorated between the parents based on their percentage of the combined income. Forty states use the income share model

The percentage of income model determines the non-custodial parent’s income, determines the percentage of the non-custodial parent’s income that will be applied, applies the percentage to the income, and finalizes the obligation by making adjustments for add-ons and deductions. Seven states use the percentage income model, four of which use the flat percentage model.

Seven states use the percentage income model, four of which use the flat percentage model.

The Melson Formula is a more complicated version of the Income Shares model, which incorporates public policy judgments to unsure each parent’s basic needs are met in addition to the children. Only Delaware, Hawaii, and Montana use the Melson Formula.

The District of Columbia uses a hybrid model that starts as a varying percentage of income model and is then reduced by a formula based on the custodial parent’s income.

- Income shares model

- Basic Child Support Obligation Schedule

- Child Support Calculator

- Percentage of obligor's income

- Multiply the non-custodial parent’s (obligor’s) annual net income by 20% for one child, 27% for two children, and 33% for three children. For each additional child, add 3%.

- Child Support Calculator

- Income shares model

- Basic Child Support Obligation Schedule

- Child Support Calculator

- Percentage of obligor’s income - percentage varies based on income

- Arkansas Administrative Order of the Supreme Court, Rule 10

- Child Support Estimator

- Income shares model

- California Courts Self-Help - Child Support

- Guidelines Calculator

- Income shares model

- Child Support Commission Final Report

- Child Support Calculator

Delaware

- Melson Formula

- After determining each parent’s share of total available income, the primary support allowance for the number of children in each parent’s household can be found in the Forms 509 and 509-I

- Delaware Child Support Calculator

District of Columbia

- Because D.

C. has a hybrid model, child support can be very complex and confusing. The best way to determine the child support obligation is to use the Child Support Guideline Calculator or contact an attorney.

C. has a hybrid model, child support can be very complex and confusing. The best way to determine the child support obligation is to use the Child Support Guideline Calculator or contact an attorney.

- Income shares model

- If monthly income exceeds $10,000, child support is calculated by multiplying the amount of income over $10,000 by a percentage based on the number of children. For this, one child is 5%, two is 7.5%, three is 9.5%, four is 11%, five is 12%, and six is 12.5%.

- Florida Child Support Guidelines

- Child Support Calculator

- Incomes shares model

- Georgia Child Support Commission

- Child Support Calculator Georgia Courts

Hawaii

- Melson Formula

- Hawaii Child Support Guidelines

- Hawaii Child Support Calculator

- Income shares model

- Idaho Child Support Guidelines

- Idaho Child Support Calculator

- Income shares model

- Illinois Child Support Guidelines - Income Shares

- Child Support Estimator

- Income shares model

- Indiana Child Support Guidelines

- Child Support Calculator

- Income shares model

- Child Support Guidelines

- Child Support Estimator

- Income shares model

- Kansas Child Support Guidelines

- Kansas Child Support Worksheet

- Income share model

- Kentucky Child Support Guideline

- Kentucky Child Support Estimate

- Income shares model

- Louisiana Child Support Guideline Schedule

- Child Support Payment Calculator

- Income shares model

- Child Support Guidelines

- Child Support Calculator

- Income shares model

- Child Support Guidelines

- Maryland Child Support Calculator

- Percentage of obligor’s income

- Massachusetts Child Support Guidelines

- Massachusetts Child Support Calculator

- Incomes shares model

- Michigan Child Support Formula

- Income shares model

- Minnesota Guideline Used in Child Support Determinations

- Child Support Guidelines Calculator

- Percentage of obligor’s income

- The guideline formula for determining the amount of child support is 14% of noncustodial parent's income for one child, 20% for two children, 22% for three children, 24% for four children and 26% for five or more children

- Mississippi Child Support Calculator

- Income shares model

- Missouri Child Support Guidelines and Forms

Montana

- Melson Formula

- Montana Child Support Guidelines Information

- Income shares model

- Nebraska Child Support Guidelines and Worksheets

- Child Support Calculator

- Percentage of obligor’s income

- Child Support Guidelines

- Nevada Child Support Guidelines Calculator

- Income shares model

- New Hampshire Statute Chapter 485-C: Child Support Guidelines

- NH Child Support Calculator

- Income shares model

- NJ Child Support Guidelines and Worksheets

- Child Support Calculator

- Income shares model

- Child Support Statutes, Rules, and Regulations

- Child Support Calculator

- Income shares model

- Child Support Standards

- Child Support Calculator

- Income shares model

- Child Support Guidelines

- Child Support Calculator of North Carolina

- Percentage of obligor’s income

- Child Support Guidelines and Calculator

- Income shares model

- Child Support Guideline Manual

- Child Support Calculator

- Income shares model

- Child Support Guidelines

- Child Support Estimator

- Income shares model

- Child Support Guidelines

- Child Support Payment Calculator

- Income shares model

- Child Support Guidelines

- Child Support Calculator

- Income shares model

- Child Support Obligations

- Child Support Obligation Calculator

- Income shares model

- Child Support Guidelines

- Child Support Calculators and Worksheets

- Percentage of obligor’s income

- One child= 20% of Net Monthly Income, two children = 25%, three children = 30%, four children = 35%, five children = 40%, and six children = no less than 40%

- Monthly Child Support Calculator

- Income shares model

- Child Support Guidelines

- Child Support Calculator

- Income shares model

- Child Support

- Child Support Calculator

- Income shares model

- Child Support Guidelines

- Child Support Payments Calculator

- Income shares model

- Washington State Child Support Schedule

- Child Support Estimator

- Income shares model

- Child Supporter Guidelines

- Child Support Payments Calculator

- Percentage of obligor’s income

- One child = 17%, two children = 25%, 3 children = 29%, 4 children = 31%, 5 or more children = 34%.

- Child Support Calculator and Worksheets

- Income shares model

- Child Support Guidelines

- Child Support Calculator

Child Support Percentage by State 2022

Child Support Percentage by State 2022

- Child Support Guideline Models by State

Sources

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 years old and has not yet become fully capable by decision of the guardianship authority or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0010

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.0010

Alimony can also be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient means for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at your place of residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- a single housing document and income statements for all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-off of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, if the child does not marry earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated. Parents must support the child, even if he does not need financial assistance. Disability of parents, recognition of their incapacity in court or deprivation of parental rights also does not release from this obligation.

Parents must support the child, even if he does not need financial assistance. Disability of parents, recognition of their incapacity in court or deprivation of parental rights also does not release from this obligation.

Alimony may be denied: or a spouse, including an ex, if he or she has become disabled and needs help due to alcohol abuse, drug abuse, or as a result of an intentional crime, or behaved in an unworthy marriage, such as gambling;

Alimony for two children in 2022 - what percentage is due for 2 children

By the way: We can collect maximum child support MoreWhen a divorce is associated with disputes about children, this is a double test, not only because of the breakup of the family, but also because of the bureaucratic difficulties of documenting the settlement of these issues. In such cases, it is advisable to consult with a specialist in family law. In this article, we will describe all possible cases of recovery of alimony for two minor children.

Procedure for collecting maintenance for two children

First of all, you need to try to negotiate with a potential alimony payer, discuss an agreement on alimony, the amount, the procedure for payments and other conditions that are important for the parties. Some do not want the alimony to be collected by the court and the writ of execution to go to work for them. But if a peaceful agreement does not work out, then you should go to court.

If the debtor has a regular official income and does not have other maintenance obligations, you should apply to the court for a court order for the recovery of alimony, which will be considered by the court as soon as possible, but the debtor, having disagreed with it, has the right to cancel it.

If there is no reliable information about the debtor's income and whether he has other maintenance obligations, if the court order was previously canceled by him, we file a claim with the court, which will be considered with the parties summoned to court hearings and, at the end, with the issuance of a court decision and the issuance of an executive order. sheet.

The next stage is the execution of a court decision (court order), the recoverer has an alternative action, apply with a writ of execution at the place of work of the debtor or to the bailiff service, who will initiate enforcement proceedings and begin enforcement. Depending on the specific case, choose the appropriate version of the solution.

In which court should I file for child support for two children?

If at least one common minor child is registered with the alimony collector, he has an alternative: to file an application with the Magistrate's Court at his place of registration or at the place of registration of the defendant. If the children are registered with a potential alimony payer, you should apply to the Magistrate's Court at its place of registration. Disputes about the recovery of alimony are within the jurisdiction of justices of the peace in cases where they do not involve other requirements that the district court must consider, for example, establishing paternity.

Alimony agreement

An alimony agreement is a voluntarily concluded agreement between the claimant and the alimony payer. If the parties have agreed on all the essential conditions of maintenance obligations: the amount of payments, the procedure, terms, etc., they should contact a notary to draw up an agreement. The document is drawn up, as a rule, on a special form and certified by a notary. One of the main conditions of the agreement is that the amount of alimony should not be less than those that could be collected by the court according to the law, for two children at least ⅓ of the debtor's income. The alimony agreement has the force of an executive document and can be presented to the bailiff service for enforcement. Termination of such an agreement in the future can only be by mutual agreement or in court.

The document is drawn up, as a rule, on a special form and certified by a notary. One of the main conditions of the agreement is that the amount of alimony should not be less than those that could be collected by the court according to the law, for two children at least ⅓ of the debtor's income. The alimony agreement has the force of an executive document and can be presented to the bailiff service for enforcement. Termination of such an agreement in the future can only be by mutual agreement or in court.

Recovery as a percentage of earnings

Alimony can be collected as a percentage of income or as a fixed amount of money. The first case is the most frequent, the Family Code establishes the amount of alimony for two children - 1/3 of the income of the alimony payer, 1/6 for each child. As for those cases where the debtor already has maintenance obligations for other children, the ratio of shares for each child will be equal to, but not more than ½ of the debtor's income.

Alimony for two children is 33% of the payer's total income

Child support order

If the debtor has no other maintenance obligations, is officially employed, has a regular income, you should apply to the court for a court order, which will be considered in summary proceedings within 5 days and without calling the parties.

If in this case you apply immediately with a statement of claim for the recovery of alimony in a share ratio to earnings, it will be returned by the court, since nothing prevents the case from being considered in a simplified procedure. From June 01, 2016, all claims for the recovery of alimony for minor children that are not related to the establishment of paternity, contestation of paternity (maternity) or the need to involve other interested parties are executed only in the form of an application for the issuance of a court order for the recovery of alimony (Federal Law of 02.03. 2016 N 45-FZ). But the debtor in this case has the right to cancel it within 10 days from the date of receipt of the court order, then the next stage will be the filing of a statement of claim.

But the debtor in this case has the right to cancel it within 10 days from the date of receipt of the court order, then the next stage will be the filing of a statement of claim.

Download sample application for issuance of a court order

Application for a court order

Statement of claim for the recovery of maintenance for two children

A claim for the recovery of alimony can be filed in two cases:

- if the debtor is already paying alimony to other children, recovery can be made only by filing a claim for the recovery of alimony. Those to whom the debtor is already paying alimony will be involved in court proceedings as third parties;

- if the debtor canceled the court order for the recovery of alimony.

Download a sample statement of claim for the recovery of alimony for two children

Here are some examples:

Example #1:

Alena needs to collect alimony for two common minor children from her marriage with Ivan, but he also has a child from his first marriage and pays him alimony.In this case, in total, for three children, the amount of alimony collected from Ivan will be ½ of income, ⅙ for each child, or rather ⅙ for a child from his first marriage and ⅓ for two children from marriage with Alena.

Example no. 2:

Polina also needs to collect alimony for two children, but her ex-husband Mikhail has maintenance obligations to three more minor children from previous marriages, in such a situation, the share of each child of Mikhail is 1/10 of his income, that is, Polina has the right to claim only ⅕ from Mikhail's income for the maintenance of two common minor children.

Alimony for the second child from another marriage

A similar case will be in the recovery of alimony for two children from different marriages, each child has equal rights to receive alimony. Accordingly, ⅓ of the income will be divided among the children in equal shares. The older child will be charged ⅙ until he reaches the age of majority, and the younger child will be charged ⅙ until the elder reaches the age of majority, and then ¼ until he reaches the age of majority. Also, alimony in such cases can be set in a fixed amount with subsequent indexation for each child.

Also, alimony in such cases can be set in a fixed amount with subsequent indexation for each child.

Recovery of alimony for two children in a fixed amount of money

If a person obliged to pay alimony has irregular, changing earnings, income in foreign currency, a fixed, fixed amount of alimony can be established with subsequent indexation. The amount of alimony is determined by the court based on the financial situation of the parties and the maximum preservation of the child's previous level of support and maintenance.

See also: Who benefits and when is alimony prescribed in a fixed amount of money?

Based on our judicial practice, we can say that, as a rule, the minimum amount of a fixed amount per child is equal to half of the subsistence minimum established in the corresponding subject of the Russian Federation. In such alimony disputes, the process of proving the debtor's real income and expenses for children is important. To do this, it is necessary to file a petition for the elicitation of evidence, in which to indicate the institutions and organizations, official information and data from which can confirm, for example, the property owned by the defendant, his income from other types of activities, as a rule, these are the Federal Tax Service, the Pension Fund of the Russian Federation, Rosreestr , traffic police of the Main Directorate of the Ministry of Internal Affairs, etc. The court should assist in the collection of evidence, namely, hand over or send judicial requests on its own to the relevant organizations to provide information. It is also necessary to attach to the statement of claim a calculation of alimony, in which all items of expenses for children are stated, indicating the quantity and prices of goods and services purchased for the maintenance of minors. If possible, this calculation should be confirmed by cash receipts for the declared goods and services.

The court should assist in the collection of evidence, namely, hand over or send judicial requests on its own to the relevant organizations to provide information. It is also necessary to attach to the statement of claim a calculation of alimony, in which all items of expenses for children are stated, indicating the quantity and prices of goods and services purchased for the maintenance of minors. If possible, this calculation should be confirmed by cash receipts for the declared goods and services.

Download a sample statement of claim for the recovery of alimony for two children in a fixed amount of money

Please note that if the minor for whom alimony is being collected acquires legal capacity before he reaches the age of eighteen, the payment of funds for his maintenance is terminated.

Alimony for the past period

Interestingly, the legislation provides for the right of the recipient of alimony to collect payments for the past period within three years. A person gets this opportunity if he has previously repeatedly applied to the alimony debtor with a request for financial assistance, but all attempts were unsuccessful. The complexity of such cases lies in the fact that it is extremely difficult to prove to the court that such attempts were actually made, and the person evaded payments.

A person gets this opportunity if he has previously repeatedly applied to the alimony debtor with a request for financial assistance, but all attempts were unsuccessful. The complexity of such cases lies in the fact that it is extremely difficult to prove to the court that such attempts were actually made, and the person evaded payments.

Alimony is collected by the court from the date of application to the court.

If the person initially filed an application for a court order, the debtor canceled the court order, and then the claimant files a claim for the recovery of alimony, he has every right to demand alimony from the date of the initial application to the court for the issuance of a court order.

Changing the amount of alimony

A change in the amount of alimony may be required for various reasons, one of them is the emergence of new maintenance obligations. So, if a person already pays alimony and is approached with demands for the recovery of alimony for other children, the court will establish alimony for their maintenance, taking into account existing maintenance obligations, and for changing the amount of alimony that were collected earlier, the person will need to apply to the court on their own , In most cases.

Here is an example:

Vasily pays alimony to two minor children from marriage with his ex-wife Svetlana in the amount of ⅓ of income, Vasily's current wife, Natalya, files a lawsuit in court to recover alimony also for two common children with Vasily. The court will set the amount of alimony for Natalya for the maintenance of two minor children in the amount of ¼, each child ⅛. In such a situation, Vasily has the right to file a lawsuit against Svetlana to change the amount of alimony from ⅓ to ¼. Thus, each of the four children of Vasily will receive ⅛. Further, the situation will change when Svetlana's eldest child reaches the age of majority, Svetalana will receive ⅙, and Natalya - ⅓, after the age of Svetlana's next child, the amount of alimony for Natalya will not change, since two children are legally entitled to ⅓, after the age of one of Natalya's children, the amount of alimony for an only minor child will be ¼ until he reaches the age of majority.