How much can i give my child tax free

Gift Tax Limit 2022: How Much Can You Gift?

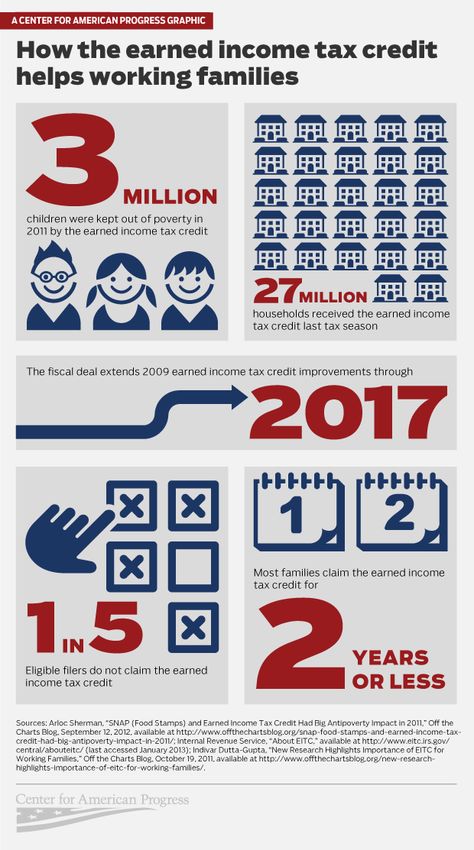

For 2022, the annual gift tax exemption is $16,000, up from $15,000 in 2021. This means you can give up to $16,000 to as many people as you want in 2022 without any of it being subject to the federal gift tax. The gift tax is imposed by the IRS if you transfer money or property – worth more than an exempted amount – to another person without receiving at least equal value in return. This could apply to parents giving money to their children, the gifting of property such as a house or a car, or any other transfer. There is also a lifetime exclusion of $12.06 million in 2022. For help with the gift tax or any other personal finance issues you may have, consider working with a financial advisor.

The annual gift tax exclusion of $16,000 for 2022 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit. So you don’t need to worry about paying the gift tax on, say, a sweater you bought your nephew for Christmas.

The annual gift exclusion limit applies on a per-recipient basis. This gift tax limit isn’t a cap on the total sum of all your gifts for the year. You can make individual $16,000 gifts to as many people as you want. You just cannot gift any one recipient more than $16,000 within one year. If you’re married, you and your spouse can each gift up to $16,000 to any one recipient.

If you gift more than the exclusion to a recipient, you will need to file tax forms to disclose those gifts to the IRS. You may also have to pay taxes on it. If that’s the case, the tax rates range from 18% up to 40%. However, you won’t have to pay any taxes as long as you haven’t hit the lifetime gift tax exemption.

Lifetime Gift Tax LimitsMost taxpayers won’t ever pay gift tax because the IRS allows you to gift up to $12.06 million (as of 2022) over your lifetime without having to pay gift tax. This is the lifetime gift tax exemption, and it’s up from $11.7 million in 2021.

This is the lifetime gift tax exemption, and it’s up from $11.7 million in 2021.

So let’s say that in 2022 you gift $216,000 to a family member. This gift is $200,000 over the annual gift exclusion, meaning you’ll need to report it to the IRS. However, you won’t immediately have to pay tax on that gift. Instead, the IRS deducts that $200,000 from your lifetime gift tax exemption. So assuming you never made any other gifts over the annual exemption, your remaining lifetime exemption is now $11.86 million ($12.06 million minus $200,000). The table below breaks down this example:

| Example of Lifetime Exemption Limits | |||||

| Gift Value | $216,000 | ||||

| 2022 Gift Tax Exemption Limit | $16,000 | ||||

| Taxable Amount | $200,000 | ||||

| Lifetime Gift Tax Exemption Limit | $12,060,000 | ||||

| Remaining Lifetime Exemption Limit | $11,860,000 | ||||

Most taxpayers will not reach the gift tax limit of $12. 06 million over their lifetimes. However, the lifetime gift tax exemption becomes important again when you die and pass on an estate.

06 million over their lifetimes. However, the lifetime gift tax exemption becomes important again when you die and pass on an estate.

The IRS defines a gift as “any transfer to an individual, either directly or indirectly, where full consideration is not received in return.” In other words, if you write a big check, gift some investments or give a car to someone other than your spouse or dependent, you have made a gift. The IRS has a gift tax limit, both for the amount you can give each year and for what you can give over the course of your life. If you go over those limits, you will have to pay a tax on the amount of gifts that are over the limit. This tax is the gift tax.

In almost every case, the donor is responsible for paying gift tax, not the recipient. A recipient will only pay gift tax in special circumstances where he or she has elected to pay it through an agreement with the donor. Even though recipients don’t face any immediate tax consequences, they can face capital gains tax if they sell gifted property down the line.

There are two numbers to keep in mind as you think about gift tax: the annual gift tax exclusion and the lifetime gift tax exemption.

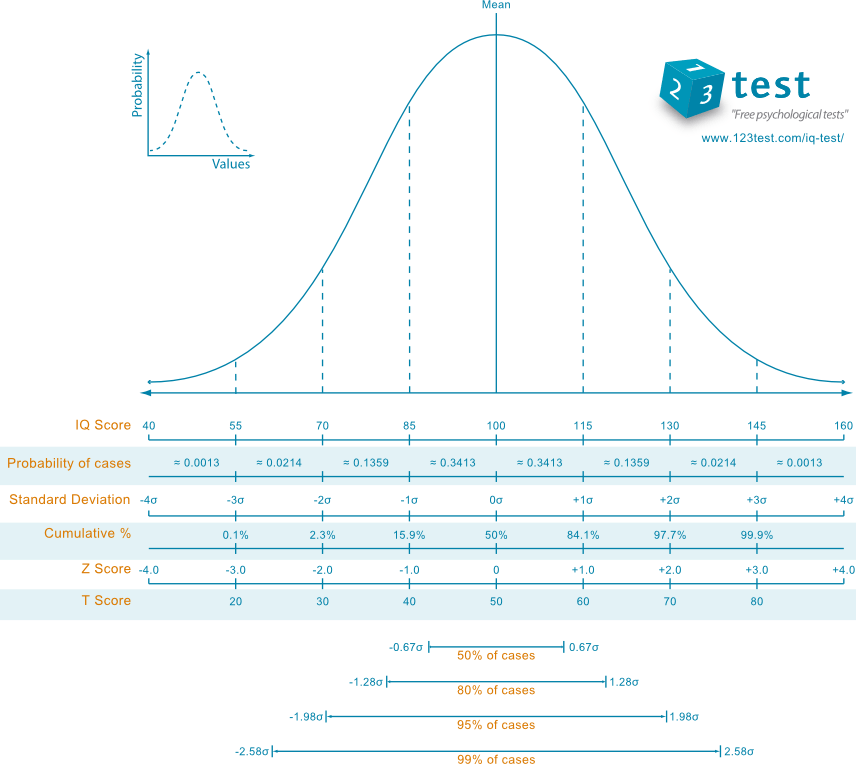

How to Calculate the Gift TaxJust like your federal income tax, the gift tax is based on marginal tax brackets. And rates range between 18% and 40%. If you want to calculate the taxable income for gifts exceeding the annual exclusion limit, the table below breaks down the rate that you will have to pay based on the value of the gift.

| 2022 Gift Tax Rates | |||||||||

| Gift Value Above the Annual Exclusion Limit | Rate | ||||||||

| Up to $10,000 | 18% | ||||||||

| $10,001 to $20,000 | 20% | ||||||||

| $20,001 to $40,000 | 22% | ||||||||

| $40,001 to $60,000 | 24% | ||||||||

| $60,001 to $80,000 | 26% | ||||||||

| $80,001 to $100,000 | 28% | ||||||||

| $100,001 to $150,000 | 30% | ||||||||

| $150,001 to $250,000 | 32% | ||||||||

| $250,001 to $500,000 | 34% | ||||||||

| $500,001 to $750,000 | 37% | ||||||||

| $750,001 to $1,000,000 | 39% | ||||||||

| More than $1,000,000 | 40% | ||||||||

The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption. The exemption for 2022 is $12.06 million. At the same time, the exemption for your estate may not be the full $12.06 million. You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

The exemption for 2022 is $12.06 million. At the same time, the exemption for your estate may not be the full $12.06 million. You can only exempt your estate up to the amount of your remaining lifetime gift tax exemption.

So let’s say that you have lowered your lifetime exemption down to $10 million by making $2.06 million in taxable gifts over your life. The federal government would then tax any estate that you pass on to someone for all value over $10 million. In other words, the gift tax and estate tax have a single combined exclusion. Regardless of whether the gift is passed to the recipient before or after your death, it applies toward that same $12.06 million limit.

All of this means that one way to prevent taxation of any assets you pass on is to gift those assets in increments of $16,000 or less. This could take some planning on your part but it is completely legal. There are also some gifts that you never have to pay tax on.

What Gifts Are Safe From Taxes?Taxable gifts can include cash, checks, property and even interest-free loans. It also applies to anything you sell below fair market value. For instance, if you sell your home to your non-dependent child for $175,000 when it’s worth $250,000, the $75,000 difference could be considered a gift. That surpasses the annual gift tax limit and thus is deducted from your lifetime gift tax limit.

It also applies to anything you sell below fair market value. For instance, if you sell your home to your non-dependent child for $175,000 when it’s worth $250,000, the $75,000 difference could be considered a gift. That surpasses the annual gift tax limit and thus is deducted from your lifetime gift tax limit.

What constitutes a gift that counts toward your gift tax limit is generally easy to understand. There are several things that the IRS doesn’t consider a gift, however. You can give unlimited gifts in these categories without facing a gift tax or having to file gift tax paperwork:

- Anything given to a spouse who is a U.S. citizen

- Anything given to a dependent

- Charitable donations

- Political donations

- Funds paid directly to educational institutions on behalf of someone else

- Funds paid directly to medical service or health insurance providers on behalf of someone else

There are, of course, a few exceptions to keep in mind. If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year. Anything above that is subject to gift tax and counts against your lifetime limit.

If your spouse is not a U.S. citizen, you can only give him or her $157,000 each year. Anything above that is subject to gift tax and counts against your lifetime limit.

Funds that cover educational expenses refer only to tuition. That does not include books, dorms or meal plans. You can skirt the gift tax by contributing to someone’s 529 college savings plan with a lump sum and then spreading it over five years for tax purposes. The IRS allows taxpayers to donate $75,000 into a 529 plan without paying tax or reducing the lifetime limit. The only caveat is that any additional gifts for the same recipient will count toward your lifetime limit.

Lastly, it’s important to note that charitable donations are not only exempt from gift tax, they may also be eligible as an itemized deduction on your individual income tax return.

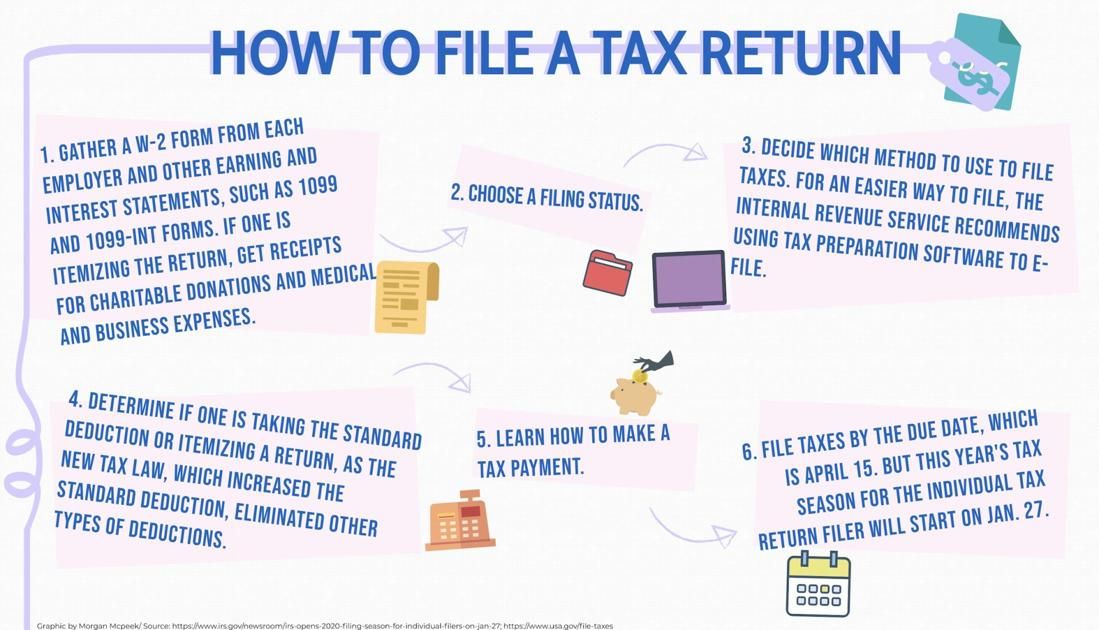

How to File Your Gift Tax ReturnThe first step to paying gift tax is reporting your gift. Complete IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, on or before your tax filing deadline. Download the document, complete each relevant line and sign and date along the bottom. You then send the form in with the rest of your tax return.

Download the document, complete each relevant line and sign and date along the bottom. You then send the form in with the rest of your tax return.

You should complete Form 709 anytime you gift in excess of $16,000 – even if you’re within the $12.06 million lifetime limit. You’ll have to file a Form 709 each year you give a reportable gift, and each form should list all reportable gifts made during the calendar year.

If you live in Connecticut or Minnesota, you may also have to file a state gift tax return. These are the only states that have their own gift tax. In most cases, you can file a gift tax return on your own. If your transfers are large or complex, though, consider finding a financial professional.

Bottom LineThe IRS allows every taxpayer is gift up to $16,000 to an individual recipient in one year. There is no limit to the number of recipients you can give a gift to. There is also a lifetime exemption of $12.06 million. Even if you gift someone more than $16,000 in one year, you will not have to pay any gift taxes unless you go over that lifetime gift tax limit.

You will still need to report gifts over the annual exclusion to the IRS via Form 709. The IRS will lower your remaining lifetime exclusion over time and then use that amount to determine how much of your estate you need to pay estate tax on.

Tips for Getting Through Tax Season- Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Any charitable donations that you make are tax deductible. As you plan for your taxes, it’s important to keep track of your potential deductions throughout the year. They could save you money if you make deductions worth more than the standard deduction.

- One way to maximize your deductions is to use the right tax filing service.

Two of the best filing services, H&R Block and TurboTax, both offer tools to help you maximize your deductions. And while both services are easy-to-use, certain taxpayers may prefer one over the other. Here’s a breakdown of H&R Block vs. TurboTax to help you decide which is best for you.

Two of the best filing services, H&R Block and TurboTax, both offer tools to help you maximize your deductions. And while both services are easy-to-use, certain taxpayers may prefer one over the other. Here’s a breakdown of H&R Block vs. TurboTax to help you decide which is best for you.

Photo credit: ©iStock.com/donald_gruener, ©iStock.com/Goran13, ©iStock.com/YinYang

Liz Smith Liz Smith is a graduate of New York University and has been passionate about helping people make better financial decisions since her college days. Liz has been writing for SmartAsset for more than four years. Her areas of expertise include retirement, credit cards and savings. She also focuses on all money issues for millennials. Liz's articles have been featured across the web, including on AOL Finance, Business Insider and WNBC. The biggest personal finance mistake she sees people making: not contributing to retirement early in their careers.

How Much Can I Gift My Child Tax-Free?

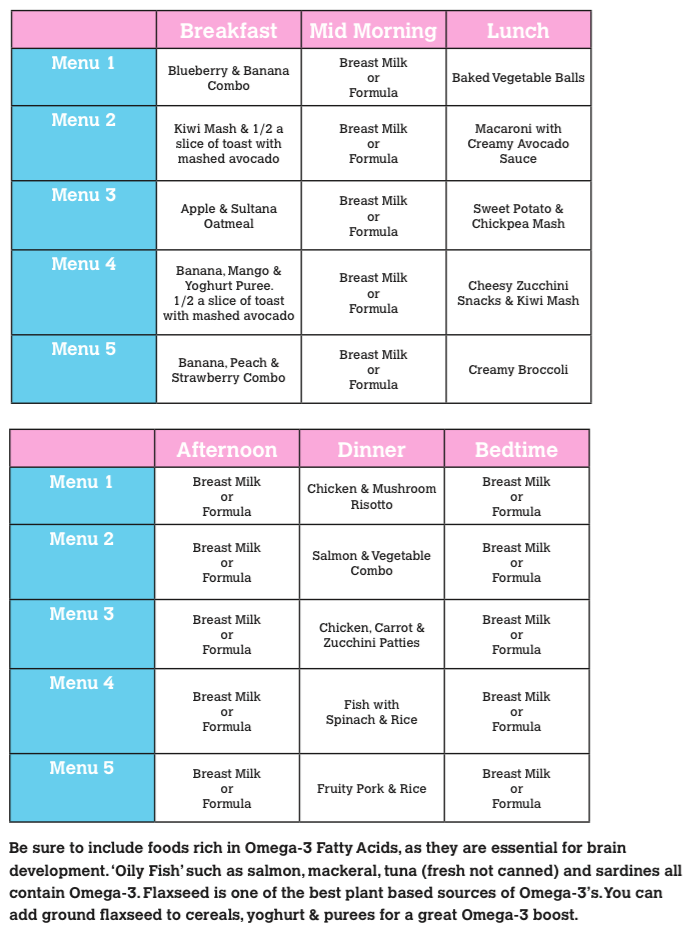

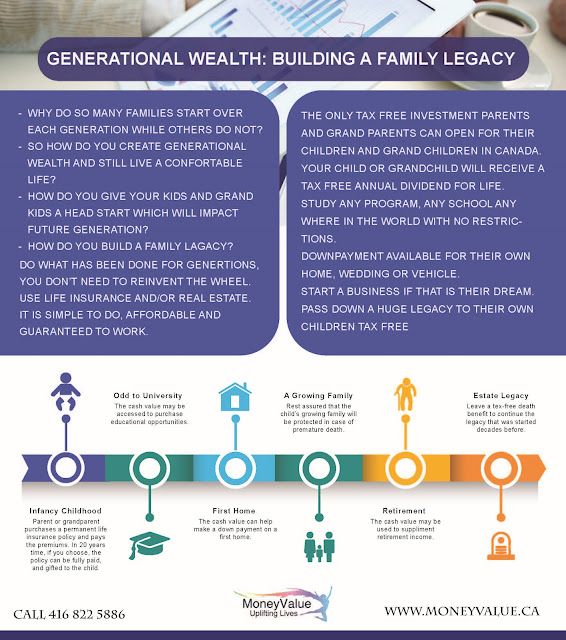

How to Go About Gifting Money for Your Child’s FutureParents might be shocked to learn that they can’t gift their children limitless money in any given year without potentially paying taxes or filing a lifetime gift tax exclusion form. Filing this tax form will eliminate the tax consequences of gifting above the annual threshold. If you’re gifting your child money to put towards their future, there may be another way to go about it. But first, how much can you gift your child without needing to file for a lifetime gift tax exclusion?

Filing this tax form will eliminate the tax consequences of gifting above the annual threshold. If you’re gifting your child money to put towards their future, there may be another way to go about it. But first, how much can you gift your child without needing to file for a lifetime gift tax exclusion?

Each year, each person is allowed to gift another person up to $16,000 (2022), which could be $32,000 a year per child from both parents, without having to pay taxes or file a lifetime gift tax exclusion form. Any additional monetary gifts on an annual basis will either require taxes be paid on the amount above $16,000 or a lifetime gift tax exclusion filing is used. The lifetime giving threshold for each person is $12,060,000 (2022). Unless your estate is or expected to be above this number in the near future, the lifetime gift tax exclusion filing is what most parents will use to eliminate a tax consequence for that year. On the other hand, if your estate is above this threshold, depending on the tax consequences, it may be worth paying taxes today to keep a higher exemption when you pass. Note, the lifetime gift tax exclusion level is expected to drop in 2026 to about half the current level unless extended by congress.

Note, the lifetime gift tax exclusion level is expected to drop in 2026 to about half the current level unless extended by congress.

Another great benefit of using 529 college savings plans is the potential tax deduction you can receive. While not applicable on the federal level, some states offer a tax deduction for some or all of the contribution amount that you put into the plan. So, not only are you helping your child, but you could also be helping yourself lower your state tax bill.

Of course, simply gifting your child money isn’t always wise. Unless it’s placed in an investment account, like a 529 college savings plan, your gifted money won’t have much of a chance to grow. However, placing monetary gifts into an account that may allow it to increase over time can help pay for your child’s future.

At Sootchy, we’re dedicated to helping parents afford college tuition by offering a 529 college savings plan. To start saving and investing in your child’s future, download Sootchy’s app from the iOS App Store or Google Play Store today.

Gifting your child a substantial amount of money isn’t always necessary unless you are adding to their college fund. Using the threshold of $16,000 from above, and adding that each year to a 529 college savings plan for a child can quickly increase the value of the account over time, especially if taking into consideration potential growth. But, if that is not affordable, anything given can be used to benefit your child’s future.

Gifting your child $16,000 to sit in a bank account won’t necessarily contribute as much to their future. Many parents decide to add to their children’s college funds from the moment they’re born. The method that you use is important, though. Simply gifting funds to your child over the years means little unless that money grows alongside them. Seeking help from a trusted source like Sootchy for 529 college savings plans, can help parents provide for their children. These plans allow parents to save and invest their money over the years. Opening a 529 college savings plan can allow you to spend less while contributing more to your child’s future.

These plans allow parents to save and invest their money over the years. Opening a 529 college savings plan can allow you to spend less while contributing more to your child’s future.

Simply gifting your children money without investing it in any way can cause you to spend too much without potentially gaining any earnings. Alternatively, you can start a 529 college savings plan. This method allows parents to start saving when their children are young and contribute money over time. As the years go on, you can accumulate more earnings in a 529 college savings plan, especially through compounding growth, allowing your child to pursue higher education while focusing on eliminating financial difficulty.

529 College Savings Plan DetailsA 529 college savings plan is a great way for parents to start saving for their children’s education without having to spend too much upfront. Parents can open a 529 college savings plan in virtually any state. These plans are state-sponsored savings and investment opportunities for parents who want to contribute to their children’s secondary education goals. Because of the nature of 529 college savings plans, there’s more leeway for parents who want to give their children tax-free monetary gifts more focused on education and have the opportunity to grow.

Because of the nature of 529 college savings plans, there’s more leeway for parents who want to give their children tax-free monetary gifts more focused on education and have the opportunity to grow.

Although contributions to 529 college savings plans are subject to the same rules as any other monetary gift, there’s an important bonus: the gifts can grow. You can find the right plan for your family by working with experienced professionals, like those at Sootchy. Once you do, you can start contributing money that will benefit your child’s future.

When you invest money in a 529 plan, whether $5 or $5,000, it has the potential to grow over time. By the time your child is ready to attend college, you may have saved and accrued enough funds to fully cover the cost of tuition. The money earned from these plans is tax-free, provided it’s used to fund your child’s higher educational pursuits. Not only can the funds be used for college, but also for K-12 tuition, and some other education programs.

As mentioned before, 529 college savings plans allow parents to invest in their children’s futures from day one. But, not all parents are financially capable of gifting their children $16,000 each year, especially for families with more than one child. That’s why working with the professionals at Sootchy for 529 college savings plans is beneficial. Young parents and long-time parents alike can begin saving and investing now.

Gifting your child money doesn’t necessarily benefit them when it comes time to pay for education expenses. FASFA, the application to receive Federal Financial Aid, takes into consideration the finances of both the parents and the children. If your child has $16,000, or more, in a bank account from monetary gifts, it could prevent them from receiving adequate financial aid. Whereas, using some or all of a child’s monetary gifts in a 529 college savings plan significantly reduces the money’s effect on receiving aid via the FAFSA application. As such, there can be two sources to cover education expenses. More potential aid can be received by the child in addition to having a 529 college savings plan.

As such, there can be two sources to cover education expenses. More potential aid can be received by the child in addition to having a 529 college savings plan.

Unlike other investment plans, there are few eligibility requirements to open a 529 college savings plan. No matter your financial circumstances, you can start a 529 college savings plan to support your child in their efforts to attend a higher education institution. Not only that, the funds earned and saved in a 529 college savings plan are both tax-deferred (meaning gains compound each year instead of taxes being paid on them) and tax-free when taken out of the plan so long as the funds accrued in your plan are used to pay for higher education costs. So, not only can you contribute a substantial amount of money annually to your child’s future, but that money will not be taxed upon use or during its growth.

Giving your child the gift of tax-deferred and tax-free education funds is something every parent wants. By downloading the Sootchy app you can start investing and accruing funds in a 529 college savings plan today.

iOS App Store & Google Play Store

how to pay, how to find out the TIN of a child, make him a personal account in the tax office and link him to your own apartment. Until the tax office sued her daughter.

In 2012, my husband and I bought an apartment in St. Petersburg and, in order to use maternity capital, we registered shares for our daughters. They are twins, and then they were 3.5 years old. nine0003

For the next 8 years, I paid property tax through my personal account on the website of the Federal Tax Service. I thought that I was paying not only for my share, but also for children. I didn’t know that children, it turns out, have their own TIN from birth, and the tax on their shares is calculated separately. I didn't receive any letters from the tax office either.

As a result, in 2021, I myself accidentally reminded the Federal Tax Service of the shares of my daughters. After that, the tax office sued one of them and demanded to pay property tax for the previous three years. I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

I'll tell you how it all happened and how not to turn a child into a debtor. nine0003

How the tax office remembered her daughter

In 2021, one of the daughters received a disability. By law, children with disabilities may not pay property tax for one apartment, room, house, garage of any size or for shares in them. I decided to apply for this benefit: I thought that the tax for my daughter's share was included in my amount, and I wanted to reduce it.

sub. 3 p. 1 art. 407 of the Tax Code of the Russian Federation

On August 10, 2021, I wrote an application in the personal account of the Federal Tax Service Inspectorate for a property tax exemption. She attached her daughter's birth certificate and a certificate that she received a disability. nine0003

A few days later I was asked to send a scan of the back of the certificate. And a week later I received an answer: the IFTS refused the benefit, because it is due to children with disabilities, and not to their parents.

/zabral-dengi-za-imuschestvo/

How to save money on property taxes

The response of the IFTS was very brief, and at first I did not understand why my daughter was denied a legal benefitI was indignant - I wrote to the tax appeal and demanded to explain why the daughter cannot receive the benefit. A few days later, they answered me that she was still entitled to the benefit. But since disability appeared in 2021, it means that the benefit will be taken into account when they calculate the tax for 2021, that is, in 2022. nine0003

I decided that the first time the tax office had just made a mistake, and calmed down. And the tax office, apparently, began to check her daughter's taxes.

This is an appeal where I asked to explain why my daughter was denied benefits. I wrote it through the usual form for appeals in the taxpayer's personal account. The answer of the tax inspectorate, which reassured me and lulled my vigilanceHow the Federal Tax Service filed a lawsuit against my daughter

On October 11, 2021, I received a registered letter from the Federal Tax Service. It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

It contained a copy of the application that the tax office had already sent to the justice of the peace. The inspectorate asked for a court order in the name of my daughter to collect tax for 2017, 2018 and 2019years.

Taxes for minor children are paid by parents - Federal Tax Service

Meetings are not held in such cases. The tax office submits documents on the debt to the court, the judge considers them without calling the parties and, if he considers them convincing, issues a court order. The taxpayer must fulfill it or demand to cancel it. To do this, it is enough to submit objections to the court within 20 days from the date of receipt of a copy of the order. The judge will cancel it without a trial.

paragraph 1 of Art. 46 Tax Code of the Russian Federation

ch. 11.1, part 3 of Art. 123.5 CAS RF

When the taxpayer is a child, the parents or other legal representatives execute the order or send objections to him. If this is not done, money may be deducted from the accounts.

I still haven't received the order. But initially I planned to object to him: I never received notifications that my daughter should pay tax. Later, I learned that if a taxpayer or his representative - for example, a parent of a child - did not receive a tax notice before December 1, then on December 31 of the same year he is obliged to notify the IFTS about this. I didn't. nine0003

Section 2.1 Art. 23, paragraph 4 of Art. 397 NK RF

I also decided that in 2021 the debt should be considered only for 2018-2020. And according to the law, the tax office is not entitled to claim debts for more than three previous tax periods. Then I realized that three years are counted from the date of non-payment of tax.

Art. 113 NK RF

Let me explain with an example. Until December 1, 2021, I am obliged to pay property tax for 2020. If I do not do this, then from December 1, the countdown on non-payment for 2018, 2019 will beginand 2020 years. Until December 1, 2021 comes, the countdown starts from December 1, 2020. That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

That is, non-payment is considered for the three years before 2020: for 2017, 2018 and 2019. It turns out that the tax office did not violate the law.

In addition, I was embarrassed that the tax inspector dated the application to the justice of the peace on April 29, 2020, and sent the letter with the notification only on October 1, 2021. I decided that he also filed an application for a court order retroactively. But then I found out from lawyers I knew that, most likely, the application was filed in April 2020, and they simply forgot to send me a notice. nine0003

/wrong-tax/

The tax office decided that I owe money for someone else's land

The IFTS sent me an application for a court order on October 1, 2021. But the statement itself was dated April 29, 2020. It confused me. At first, I generally decided that the tax office was trying to deceive us and demand tax not for three, but for the previous four years. It would be illegal. Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the terms

Later, I found out that the IFTS did not violate anything - it was I who incorrectly calculated the terms The letter from the inspection did not contain any calculations or full details for payment. Therefore, I wrote a new appeal: I requested details and receipts, and at the same time clarified why in October 2021 the IFTS filed an application dated April 2020 with the court.

Two weeks later, I received an answer: I was asked to come to the IFTS branch for receipts and promised to give me access to my daughter's personal account. There was no mention of the application to the court at all.

What to do? 12/18/19

My accounts were frozen, but I don’t know why

As a result, I paid property tax for children for four years: debt for 2017-2019 and accrued tax for 2020. And I figured out how to do it from the very beginning - I share my instructions. nine0003 In a letter to my new appeal, the Federal Tax Service did not answer the question why the application to the court from 2020 was sent in the fall of 2021. But the inspector told me how to get access to the child’s personal account

But the inspector told me how to get access to the child’s personal account

How I paid tax for children’s shares

It turned out that that as soon as I registered the children's shares in Rosreestr and registered my daughters in the apartment, the departments sent information about them to the tax office. And she assigned them a TIN and created personal taxpayer accounts.

p. 3 and 4 art. 85 Tax Code of the Russian Federation

I found out the TIN of my daughters on the website of the Federal Tax Service and then decided to order paper certificates of tax registration from the inspection. How to do this, Tinkoff Magazine has already written.

TIN became the login for entering the taxpayer's personal account. And in order to get the password, I came to the IFTS with a passport and birth certificates of children. The inspectorate immediately generated and printed passwords.

On the same day, I went to my daughters' personal accounts. There was no evidence that they owned any property - for some reason, the information appeared later. But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

But there were five unread tax notices for 2016-2020. I paid the receipts for 2017-2020. nine0003

So what? 03.03.17

Tax debts can be collected even from those who owe nothing

To find out the TIN of a child, in the request form on the website of the Federal Tax Service, you must specify his data and the number of the birth certificate. The TIN will appear instantly. Such a sheet with a password was given to me by the tax office. When I came home, I immediately changed it. Here are the taxes that are in my daughter's personal account. I did not receive any email notificationsHow to link personal accounts of children to my

While I was writing this article, functionality has expanded in the taxpayer's personal account. Now children's accounts can be linked to the parent's, and the parent will be able to pay their taxes from their account.

You can now pay taxes for minor children in the personal account of the parent's tax office - the Federal Tax Service

Here's what you need to do:

- Go to your personal taxpayer account.

- Click on your last name, first name and patronymic at the top. The Profile section will open. nine0100

- Find the "Family Sharing" tab there and click on it. A request form to add a child will appear.

- Enter the child's TIN on the form.

- Go to the child's personal account and open "Family Sharing" as well.

- Find a message with a request for access and click the "Confirm" button there.

After that, the child's personal account will be linked to yours, and you can easily and conveniently pay child taxes. To do this, click on the "Taxes" tab and select a child in the drop-down list. nine0003

When the child turns 18, his personal account will be automatically unlinked from the parent account.

Finding the Family Sharing tab is not easy. In the "Profile" section, it is on the far right and is not visible at first - you need to scroll through. And the access request form is quite simple - you only need to enter the child's TIN. A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red cross

A request for access will appear in the child's personal account. It needs to be approved. After that, you will appear on the list of legal representatives of the child. To untie your personal account, just click on the red cross What I understand about the tax on children's shares

- The IFTS assigns a TIN to a child from birth and creates a taxpayer's personal account.

- As soon as the child becomes the owner of a share in the apartment, he is charged property tax.

- Parents or other legal representatives must pay property tax for the child. If they do not know about the debt, this does not relieve them of responsibility.

- The tax office may collect the debt at any time, but not more than for three previous tax periods. nine0100

How much money can be transferred to relatives and friends?

Do I need to report money transfers sent to friends, family and colleagues on my income tax return? And in what cases is it necessary to pay income tax from the population?

When filing an income tax return, questions often arise as to whether remittances received from relatives, friends and acquaintances need to be declared. In what cases should you not worry about this, and in which incomes should you not only declare, but also pay personal income tax for them? We propose to consider different situations and sort them out together with the head of the Swedbank Institute of Finance Reinis Jansons and tax consultants from the State Revenue Service. nine0003

In what cases should you not worry about this, and in which incomes should you not only declare, but also pay personal income tax for them? We propose to consider different situations and sort them out together with the head of the Swedbank Institute of Finance Reinis Jansons and tax consultants from the State Revenue Service. nine0003

Situation: My friends and I are raising money for a joint trip, using my account for this, since it is much more profitable to buy tickets for a group at once than separately. Do I have to declare this amount and pay personal income tax on it?

As the head of the Swedbank Institute of Finance Reinis Jansons explains, the basis for the application of personal income tax is a transaction that brings a certain income. If friends chip in for something and one of them buys the thing, there is no income, unless the payer decides to keep the interest on the deal. “I can also advise you to make all transactions electronically and not throw away receipts for purchases, so that in case of questions you can confirm that the money was really collected and spent on the trip,” says Reinis Jansons. At the same time, the expert emphasizes that one private person, without any explanation, can transfer up to 1,425 euros per year to another person, unless this money is transferred as a reward for services rendered or economic activity. nine0003

At the same time, the expert emphasizes that one private person, without any explanation, can transfer up to 1,425 euros per year to another person, unless this money is transferred as a reward for services rendered or economic activity. nine0003

Situation: My account collects money for the class fund, from which we buy drinking water for children, purchase stationery necessary for children and pay for extracurricular activities. Do I need to declare this amount?

State Revenue Service consultants explain that a private person only has to declare his income. In turn, if money intended for certain purposes is transferred to his account, and the account holder cannot use it for his personal needs, then this is not considered a way to generate income. nine0003

Situation: I borrowed 1,000 euros from a friend. Do I have to declare this amount?

A loan received from another person must be declared only if the loan amount exceeds 15,000 euros and the borrower is not related to this person by marriage or kinship up to the third generation. However, you do not have to pay tax on the declared loan. In this particular case, a loan in the amount of 1,000 euros does not need to be declared, and no tax needs to be paid on it either.

However, you do not have to pay tax on the declared loan. In this particular case, a loan in the amount of 1,000 euros does not need to be declared, and no tax needs to be paid on it either.

Situation: My life partner and I are not officially scheduled, but we regularly transfer large sums of money to each other, the total amount of which exceeds 1425 euros per year. Do we need to declare this money? nine0137

If the sender and the recipient of money are not connected by marriage or kinship up to the third generation * and this money is not used to pay for treatment or education, then they must be declared and personal income tax in the amount of 23% (from amounts exceeding 1425 euros).

True, the law provides for exceptions in which cases this amount does not need to be declared. In particular, if the sender and recipient of money are not connected by marriage or kinship (for example, neighbors, friends, etc.) and the money is transferred to pay for treatment and / or education. However, in this case, the recipient of the money must have documents proving that the money was spent specifically for these purposes. nine0003

However, in this case, the recipient of the money must have documents proving that the money was spent specifically for these purposes. nine0003

Situation: A husband works abroad and transfers part of his income to his wife every month. Should the wife declare these incomes?

As experts of the State Revenue Service explained, there is no need to pay tax if the sender and recipient of money are married or related to the third generation and the money is intended for household maintenance (for example, to pay utility bills, buy food and other goods, support children and etc.).

Money must be declared, but no tax must be paid if the amount of money transfers from one person exceeds 10,000 euros and the sender and recipient of money are related to the third generation in the understanding of the Civil Law, but they do not have a common household. Shared household means that all family members live together and jointly cover the costs associated with maintaining the respective housing.