How much can child make and still be claimed dependent

When Does Your Child Have to File a Tax Return?

How much can a dependent child earn? Learn the rules about when a child must file a tax return because of earned and unearned income.

Say your dependent child is earning money from working, investments, or both. Great, but beware—your child might have to file a tax return. It might seem odd, but the IRS says dependent children who earn more than a threshold amount must file returns.

If a child fails to file, you (the parent) might be liable for the tax. Moreover, if your child can't file a return for any reason, such as age, you're legally responsible for filing one on your child's behalf.

For all these reasons it's vitally important to know how much your dependent child can earn before a tax return has to be filed. But how much can a dependent child earn? Read on to find out.

Types of Income for Dependents

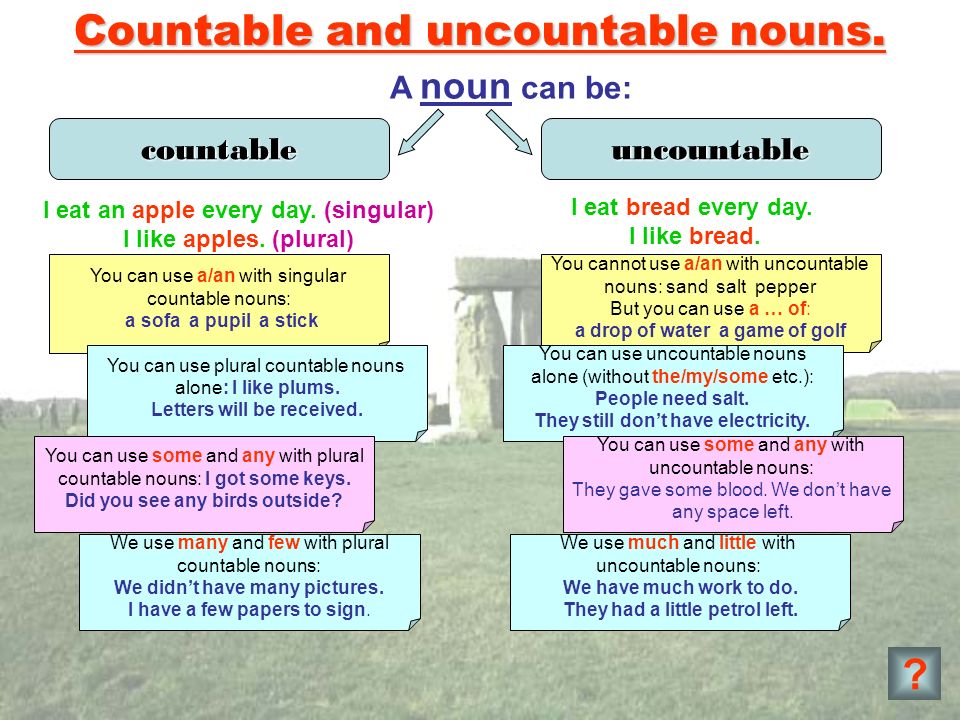

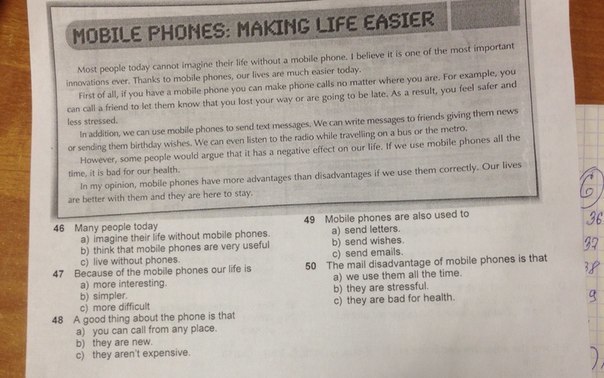

Whether your child is required to file a tax return depends on the applicable standard deduction and how much earned and unearned income the child had during the year.

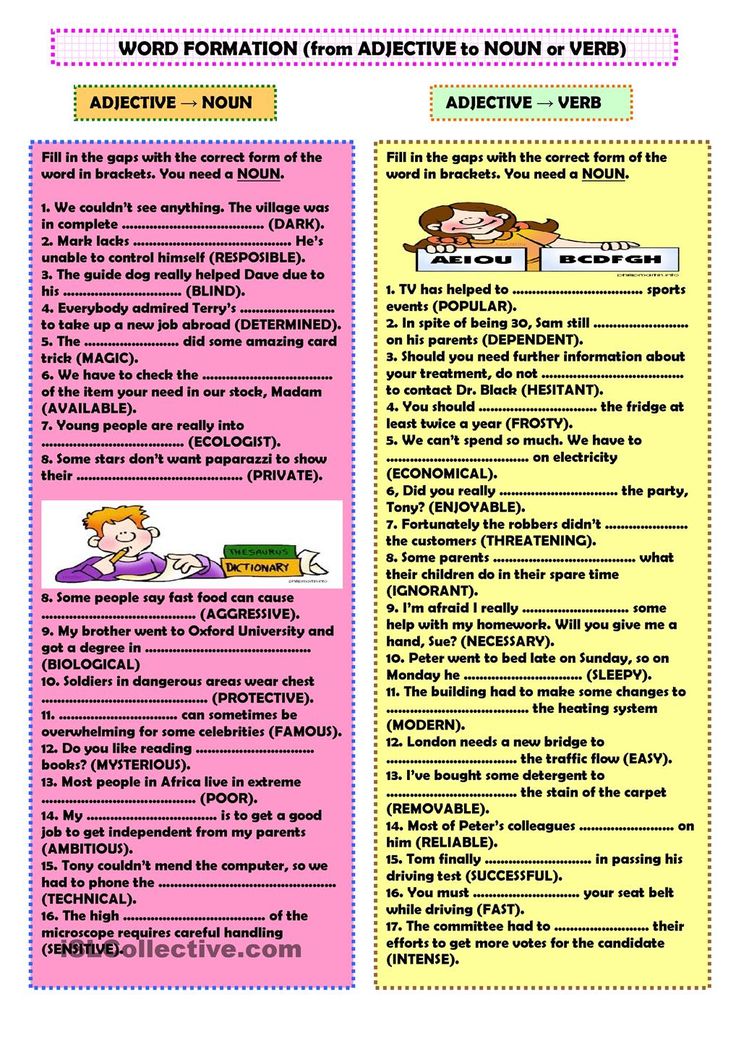

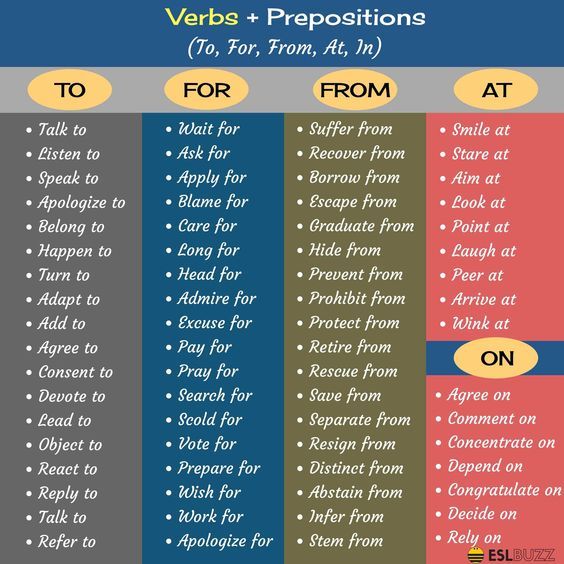

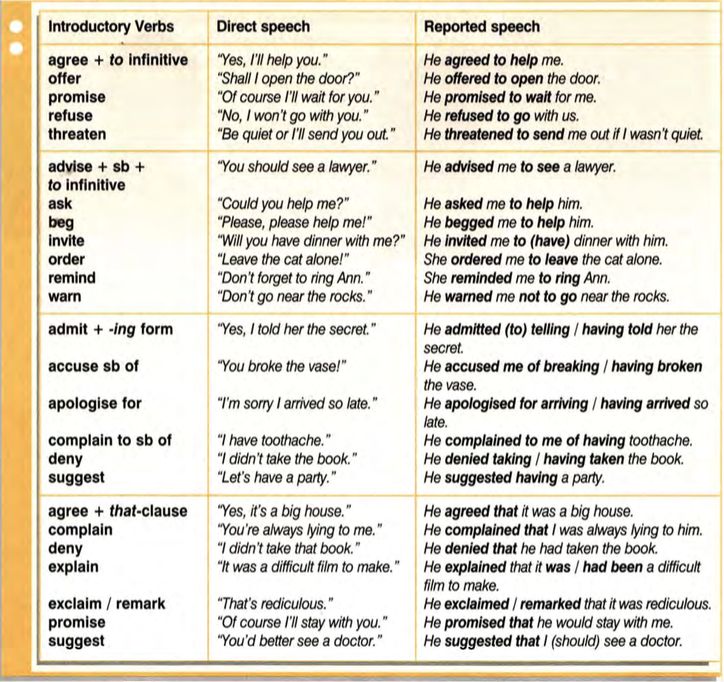

What is earned income? "Earned income" is income a child earns from working. It includes salary or wages, tips, professional fees, and taxable scholarship and fellowship grants.

What is unearned income? "Unearned income" is investment-type income. It includes taxable interest, dividends, capital gains, unemployment compensation, Social Security benefits, annuities, and distributions of unearned income from a trust.

If Your Child Has Earned Income OnlyA child who has only earned income must file a return only if the total is more than the standard deduction for the year. For 2022, the standard deduction for a dependent child is total earned income plus $400, up to a maximum of $12,950. So, a child can earn up to $12,950 without paying income tax.

If Your Child Has Unearned Income OnlyExample: William, a 16-year-old dependent child, worked part-time on weekends during the school year and full-time during the summer.

He earned $14,000 in wages during 2022. He didn't have any unearned income. He must file a tax return because he has earned income only, and his total income is more than the standard deduction amount for 2022.

A child who has only unearned income must file a return if the total is more than $1,150 for 2022.

Example: Sadie, an 18-year-old dependent child, received $1,900 of taxable interest and dividend income during 2022. She didn't work during the year. She must file a tax return because she has unearned income only, and her total income is more than the unearned income threshold for 2022.

However, if your child's interest and dividend income (including capital gain distributions) total less than $11,500, you can elect to include that income on your (the parents') return rather than file a return for the child. In this event, all income over $2,300 is taxed at your tax rates—you could end up paying more with this method.

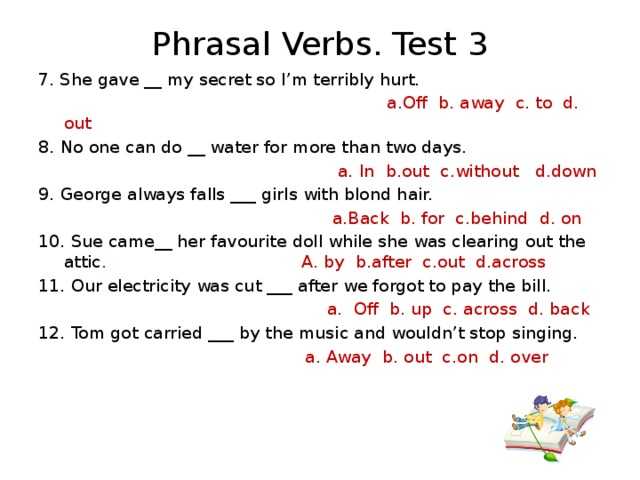

If a child has both earned and unearned income, that child must file a return for 2022 if:

- unearned income is over $1,150

- earned income is over $12,950, or

- earned and unearned income together totals more than the larger of (1) $1,150, or (2) total earned income (up to $12,500) plus $400.

Should Your Child File a Return Even If Not Required?Example: Mike, a 19-year-old college student claimed as a dependent by his parents, received $200 taxable interest income (unearned income) and earned $2,800 from a part-time job during 2022 (earned income). He doesn't have to file a tax return. Both his earned and unearned income are below the thresholds, and his total income of $3,000 is less than his total earned income plus $400 ($3,200).

Even if your child doesn't meet any of the filing requirements discussed, that child should file a tax return if:

(1) income tax was withheld from that child's income, or

(2) that child qualifies for the earned income credit, additional child tax credit, health coverage tax credit, refundable credit for prior year minimum tax, first-time home buyer credit, adoption credit, or refundable American opportunity education credit.

See the tax return instructions to find out who qualifies for these credits. By filing a return, your child can get a refund.

What Is Your Child's Income Tax Rate?The first $1,150 of unearned income is covered by the kiddie tax standard deduction, so it isn't taxed. The next $1,150 in unearned income is taxed at the child's tax rate, which is ordinarily lower than the parent's. Income over $2,300 is taxed at the parent's maximum income tax rate.

Figuring the kiddie tax can be complex. For example, if a parent has more than one child subject to the kiddie tax, the net unearned income of all the children has to be combined, and a single kiddie tax calculated.

For federal income tax purposes, the income a child receives for personal services (labor) is the child's, even if, under state law, the parent is entitled to and receives that income. So, dependent children pay income tax on their earned income at their own individual tax rates.

For more on tax rules for children, see IRS Publication 929, Tax Rules for Children and Dependents.

Dependent Tax Return Filing Requirements For 2021 Taxes

Generally, if you are going to be claimed as a dependent by someone else but have earned income, it may be beneficial to file a tax return. This applies even if you only make less than $10,000 from a wage part-time job, but had taxes withheld. See if you need to file a tax return here for more details and a personalized answer.

by @omidarmin

Your qualifying dependent may need to file a tax return if their income is within the IRS filing requirements. To determine if your dependent is required to file a return, use our FILEucator Tax Tool. Once you answer a few simple questions about your dependent's situation, you will find out if your dependent needs to file a tax return. It's that easy! If your dependent is required to file a tax return, you or your dependent can prepare and e-file the return on eFile.com.

For 2021 Returns, if a person was born during the year or before 2002 and has low taxable income - below the standard deduction amount - it might be advantageous to prepare and e-File a tax return to possibly benefit from the Earned Income Tax Credit or EITC in form of a tax refund. The EITC age limit for 2021 Returns was changed from age 25 to 19. Note: when you claim your dependent, you do not report their earned income on your tax return.

The EITC age limit for 2021 Returns was changed from age 25 to 19. Note: when you claim your dependent, you do not report their earned income on your tax return.

Your dependent may be required to file a return if they have one or more of the following types of income:

- Earned Income: This includes wages, salaries, tips, and other amounts you received as pay for work you actually perform. Taxable scholarship and fellowship grants are also included as earned income. See a list of possible forms that taxable income could be reported on.

- Unearned income: Taxable interest, capital gains, and ordinary dividends, are examples of unearned income. Also considered unearned income is unemployment compensation, taxable social security benefits, pensions, annuities of unearned income from a trust, and capital gain distributions. Unearned income is not always nontaxable income.

- At any age, if you are a dependent on another person's tax return and you are filing your own tax return, your standard deduction can not exceed the greater of $1,100 or the sum of $350 and your individual earned income.

Example 1: If your earned income was $700, your standard deduction would be: $1,100 as the sum of $700 plus $350 is $1,050, thus less than $1,100. Example 2: If your income was $3,200, your standard deduction would be: $3,550 as the sum of $3,200 plus $350 is $3,550 thus greater than $1,100. Learn more about who qualifies as a dependent.

Example 1: If your earned income was $700, your standard deduction would be: $1,100 as the sum of $700 plus $350 is $1,050, thus less than $1,100. Example 2: If your income was $3,200, your standard deduction would be: $3,550 as the sum of $3,200 plus $350 is $3,550 thus greater than $1,100. Learn more about who qualifies as a dependent.

- In 2022, this amount will be the greater of $1,150 or the sum of $400 and your earned income.

- Be aware that if you are under age 16 and have never filed a tax return, you cannot yet e-file your first year. You can prepare your return on efile.com, print it, and mail it to the IRS to file it. However, you will be able to e-file your return the following year. As a dependent, your return is most likely free on eFile.com - should it not be free for any reason, Contact us for promo code.

- Use the FILEucator tool to quickly find out if you have to file a return.

- Do IT Less Taxing!

See more information via IRS Publication 929, Tax Rules for Children and Dependents.

Tax Year 2021

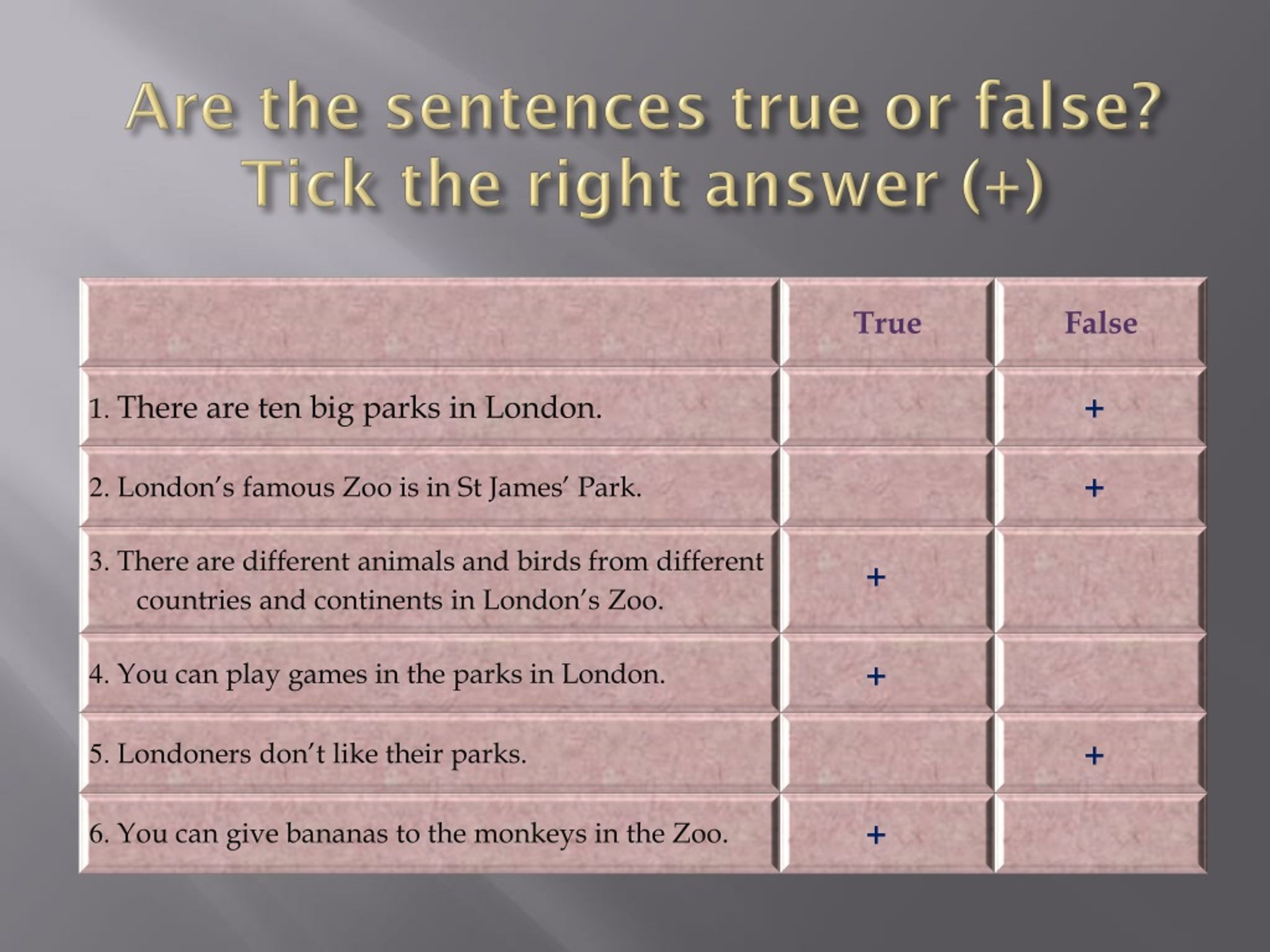

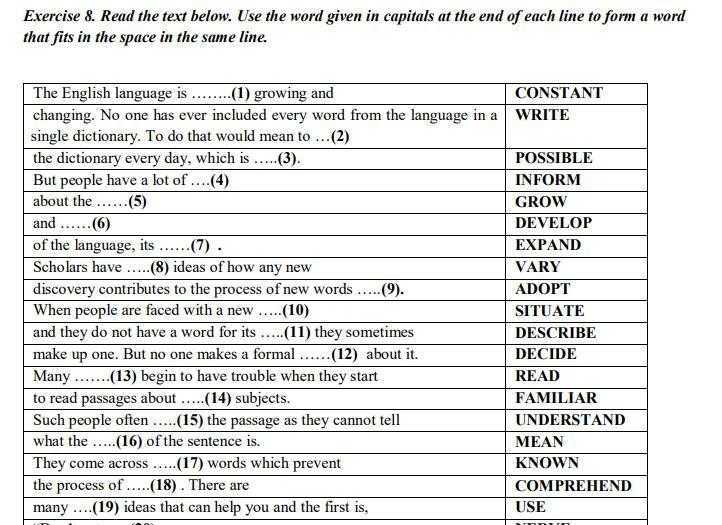

If you claim a dependent on your tax return, they may still be required to file an income tax return of their own. The 2021 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

W-2 Income Earned

Self-Employ. Income

Single

>65

Over $12,550

and Blind: $14,250

Over $1,100 unearned*

$400

Single

65+

Over $14,250

and Blind: $15,950

Over $2,750 unearned*

$400

Married**

>65

Over $12,400 earned

or Blind: $14,250

Over $1,100 unearned*

At least $5 if spouse files separate return and itemizes deductions, or more than $3,700 unearned*

$400

Married**

65+

Over $14,250

and Blind: $15,950

Over $2,400 unearned*

At least $5 if spouse files separate return and itemizes deductions, or more than $3,700 unearned*

$400

*Income that you did not earn by working, such as investment income or gifts.

** You must file a return if your spouse files a separate return and itemizes deductions and your total income is $5 or more.

Dependent Standard Deduction

The dependent standard deduction for 2021 Returns is $1,100 or the sum of $350 plus the dependent's earned income. See examples on the standard deduction page, under the table item, Dependent.

Tax Year 2022

If your dependent is claimed on your tax return, they may still be required to file an income tax return of their own. The requirements vary by filing status and age. The 2022 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

Minimum Income Requirement

Minimum Self-Employment Income Requirement

Single

Under 65 (and not blind)

More than $12,950 earned (or more than $1,100 unearned*)

$400

Single

65 or older OR blind

More than $14,300 earned (or more than $2,750 unearned)

$400

Single

65 or older AND blind

More than $15,650 earned (or more than $4,400 unearned)

$400

Married**

Under 65 (and not blind)

More than $12,950 earned (or more than $1,100 unearned)

$400

Married**

65 or older OR blind

More than $14,300 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $2,400 unearned)

$400

Married**

65 or older AND blind

More than $15,650 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $3,700 unearned)

$400

Dependent Standard Deduction

A dependent in 2022 may be qualified for a standard deduction of $1,150 or the sum of $400 plus their earned income. See the table item Dependent on the standard deduction page for details and examples.

See the table item Dependent on the standard deduction page for details and examples.

Tax Year 2020

The 2020 Tax Year minimum income requirements for dependents are listed in the table below.

Marriage Status

Age

Minimum Income Requirement

Minimum Self-Employment Income Requirement

Single

Under 65 (and not blind)

More than $12,400 earned (or more than $1,100 unearned*)

$400

Single

65 or older OR blind

More than $14,050 earned (or more than $2,750 unearned)

$400

Single

65 or older AND blind

More than $15,700 earned (or more than $4,400 unearned)

$400

Married**

Under 65 (and not blind)

More than $12,400 earned (or more than $1,100 unearned)

$400

Married**

65 or older OR blind

More than $14,050 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $2,400 unearned)

$400

Married**

65 or older AND blind

More than $15,700 earned (at least $5 if spouse files separate return and itemizes deductions) (or more than $3,700 unearned)

$400

*Income that you did not earn by working, such as investment income or gifts.

**You must file a return if your spouse files a separate return and itemizes deductions and your total income is $5 or more.

If you have a dependent child who earned income by performing services, this income is included in your dependent's gross income and must be reported on his or her individual tax return. This is true even if a local law states that a child's parent has the right the claim the earnings and even received the earnings because of this ruling.

Be aware that you should NOT include your dependent's income as income on your own tax return. Your dependent has to report their income on their own tax return. In addition, your dependent needs to check a box on his or her own tax return to report that he or she can be claimed as a dependent on somebody else's tax return. If your dependent fails to do this, it might cause the IRS to reject your return when you attempt to e-file it.

Dependent Has No Income

Your dependent might need to file a return if one of the special reasons to file a tax return applies to them. For example, if they bought health insurance from the Marketplace, they need to file a return in order to claim the refundable Premium Tax Credit.

For example, if they bought health insurance from the Marketplace, they need to file a return in order to claim the refundable Premium Tax Credit.

Your dependent can file a return if they want to, even if they do not have to. If it is possible that they will receive a tax refund, they should file a return in order to claim the refund. If your dependent wants to find out if they will be getting a refund or will owe taxes, they can use our Free Tax Calculator. Once they enter their tax information (income, tax withheld, tax credits/deductions, etc.), the calculator will provide an accurate estimate. However, the best way to determine whether or not they will receive a refund is to start preparing a tax return on eFile.com, where the calculations will be 100% correct.

Start Your Tax Return Now!

Your student may need to file a return if they meet the IRS filing requirements. Even if they are not required to file, they may want to file a return in order to claim a refundable tax credit (i. e. American Opportunity Credit).

e. American Opportunity Credit).

Be aware that if your dependent is under 16 years old and this is their first time filing a tax return, they cannot e-file their return. They can still prepare their return on eFile.com, print it, and mail it to the IRS to file it. They will be able to e-file their tax return the following year.

Dependent Cannot File Due to Age

If your dependent child must file a tax return, but cannot because of their age or other reason, then you, a guardian, or other person who is legally responsible for the child must file the return on the child's behalf. The person must also sign the child's name on the return if the child cannot sign it, followed by "By [your signature], parent for minor child." In addition, if your child owes tax on their income, you (or the child's guardian) are responsible for paying the owed tax.

Dividend and Interest Income From Dependent

You may be able to include your dependent child's dividend and interest income on your tax return. If you report this income on your return, your child will not have to file their own tax return. All of the following conditions must be met before you can claim your child's interest and dividend income on your return:

If you report this income on your return, your child will not have to file their own tax return. All of the following conditions must be met before you can claim your child's interest and dividend income on your return:

- Your child is under age 19 (or under age 24 if a he or she is a student) at the end of the Tax Year.

- Your child's gross income is only from dividends and interest (including capital gain distributions and Alaska Permanent Fund dividends).

- The dividend and interest income was less than $10,500.

- Your child is required to file a tax return unless you meet the requirements to file your own return with your child's income.

- Your child does not file a joint tax return.

- No estimated tax payments were submitted for the current tax year and no overpayment for the previous tax year were applied for the current tax year under your child's name and Social Security number.

- You must be the parent whose tax return is used when reporting your child's income.

- No federal backup withholding tax was withheld from your child's income.

Backup Withholding

Usually, backup withholding applies to most types of payments reported on Form 1099. These payments include:

- Interest payments (reported on Form 1099-INT)

- Dividends (reported on Form 1099-DIV)

- Patronage dividends (reported on Form 1099-PATR, but only if at least half the payment is in money)

- Rents, profits, or other gains (reported on Form 1099-MISC)

- Commissions, fees, or other payment for independent contractor work (reported on 1099-MISC)

- Payments by brokers (reported on Form 1099-B)

- Payments by fishing boat operators (reported on Form 1099-MISC, but only the money part and it should represent a share of the proceeds of the catch)

- Royalty payments (reported on Form 1099-MISC)

- Gambling winnings (reported on Form W-2G).

Backup withholding generally does not apply to other payments reported on Form 1099-MISC (other than royalty payments and payments by fishing boat operators) unless at least one of the following three situations applies:

- The amount received from any payer is $600 or more.

- The payer had to give you a Form 1099 for the previous tax year.

- The payer made payments to you last year that were subject to backup withholding.

- The amount is less than $10 (neither a Form 1099 nor backup withholding is required).

Filing a Return for A Young Child/Relative

In order to decide if your dependent should file a return on their own or with you, we recommend that you use our FILEucator tool to find out. Then, you can use our DEPENDucator tax tool to see if you can claim your child or relative as as dependent. Finally, use the results from both tools (as well as review the IRS tax return filing requirements) to decide the best way to file based on your situation.

Your dependent can prepare and e-file their tax return on eFile.com. We will determine the correct forms based on their answers to simple tax questions. We will then prepare their return and double-check for accuracy and missing information.

Start Your Tax Return Now!

Before they start preparing their return your dependent will need copies of their W-2, 1099-MISC, or other tax forms from their employer.

Related Information on Dependents and Tax Returns

- Tax Return Filing Requirements

- Claiming Dependents on Tax Returns

- Filing a Tax Return as a Student.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

how to recover, sample statement of claim, amount of payments

Alisa Markina

lawyer

Author profile

Usually, child support is collected as a share of the parents' income: for one child - a quarter, for two - a third, for three - half of the income .

With this approach, if one parent has a regular income, then the second one receives the same amount for children every month and can plan spending: on clothes, sections and tutors.

But if a parent is a piece-rate freelancer and gets 200,000 R one month and zero the next, it becomes difficult to predict how much money a child will receive in a given month. Therefore, the family code provides for alimony, the amount of which will not change from month to month. This is alimony in a fixed amount of money.

In the article I will tell you what it is, in what situations alimony is prescribed in a fixed amount of money, how to calculate and collect it.

What is hard money alimony

Hard money is a fixed, constant amount of alimony that does not change from month to month depending on the income of the alimony payer.

Child support can be collected as a share of official income, a fixed amount of money, or a combination of both. By law, children have the right to receive a fixed amount from their parents for maintenance so that their quality of life does not change from month to month. Therefore, alimony in a fixed amount of money is more profitable if the parent does not have a permanent income or he hides it.

Therefore, alimony in a fixed amount of money is more profitable if the parent does not have a permanent income or he hides it.

/alimony/

How to calculate and pay child support

Also, if there are several children in the family and the child stays with each parent, child support can only be collected from a more affluent parent in a fixed amount of money.

Parents can agree on a fixed amount of child support and fix it in a notarial deed without going to court. The main thing is that the child receives no less than what is required by law. The agreement cannot be terminated unilaterally, it has the force of a writ of execution: if the debtor stops paying, the money under such a document can be forcibly recovered. I will tell you more about how to draw up an alimony agreement in a fixed amount of money below.

ch. 16 SK RF

You can also ask for a fixed amount of alimony in court, if there are grounds. For example:

For example:

- the second parent has a variable income;

- the other parent receives income in foreign currency or in kind;

- the second parent has no official sources of income;

- it is impossible, difficult, or it significantly violates the rights of children to collect alimony in a share. For example, if the official salary of the second parent is equal to the regional minimum wage, and he receives the rest in an envelope.

st. 83 SK RF

In addition to children, other needy family members can claim child support in their favor. And only in hard cash. Disabled brothers and sisters, grandparents, and grandchildren have this right. Even with stepchildren, stepfathers and stepmothers - if there are no closer wealthy relatives.

/guide/to-file-for-support/

How to apply for child support

Legal framework. All maintenance issues are regulated by the family code - section 5 of the RF IC is devoted to this.

All maintenance issues are regulated by the family code - section 5 of the RF IC is devoted to this.

Chapter 13 of the RF IC defines the conditions for the collection of alimony from parents to children - both in shares and in a fixed amount - and from children to parents.

Chapter 14 of the RF IC establishes the conditions for collecting alimony in favor of spouses and former spouses. As a general rule, spouses should help each other. And the former spouse can count on help if he is raising a common child or if he has become disabled.

Chapter 15 of the RF IC is devoted to the issues of alimony to grandparents, brothers, sisters and other relatives.

When the court determines the amount of alimony, it is guided by Chapter 17 of the RF IC. And if relatives agree on alimony without a court - in a notarial agreement, then they should be guided by Chapter 16 of the RF IC: it is devoted to the conclusion, amendment and termination of alimony agreements.

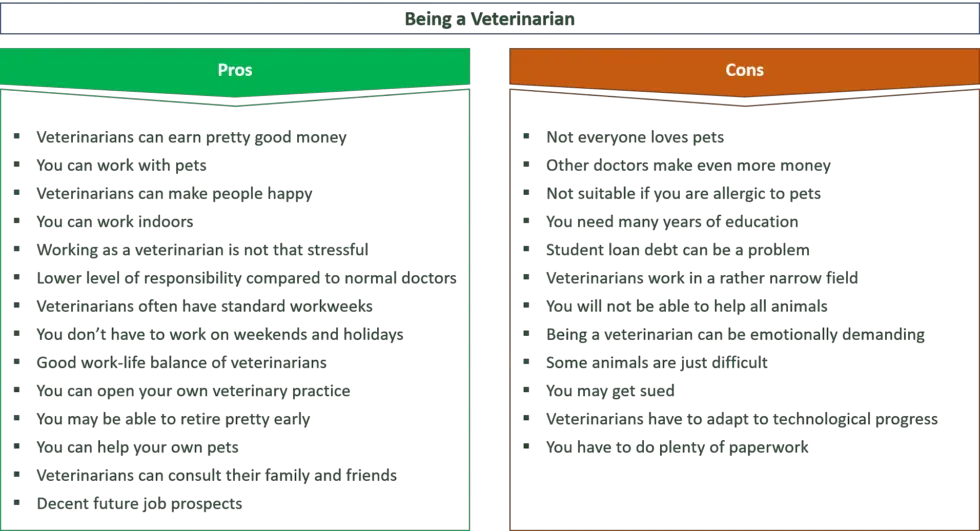

Pros and cons of alimony in a fixed amount of money

There are no pluses or minuses in a fixed amount of alimony for relatives other than children: this is the only possible option.

But child support in a fixed amount of money can sometimes be more profitable, because it guarantees stability: if the parent who pays them earns less than usual in some month, the child will not suffer. This ensures that the child will maintain a normal standard of living in any case.

We told the story of a pilot who wanted to reduce child support for his eldest son. It was about the share of alimony, but it was not possible to reduce them: the mother and her lawyer argued that this would change the child's habitual lifestyle.

It is also more convenient to calculate alimony in a fixed amount of money. For example, when a child stays with each of the parents, but one of the parents is better off.

There is only one minus: if the parent who pays alimony starts earning more, and the other parent does not find out about this and does not demand an increase in the amount of alimony in court, then the child will receive less than he could. However, a loving parent, if he has more opportunities, will offer to pay for the child, for example, additional classes or a trip abroad.

However, a loving parent, if he has more opportunities, will offer to pay for the child, for example, additional classes or a trip abroad.

/dolgi-roditelya/

What the other parent of the child owes you

Grounds for assigning alimony in a fixed amount of money

Fixed child support the court appoints to ensure a stable quality of life for the child. As I wrote above, this is relevant when a parent has an irregular, changing income, or he receives it in kind or in foreign currency, or he does not have it at all. For example, such alimony is often collected from entrepreneurs.

para. 6 paragraph 3 of section 3 of the review of judicial practice in cases of recovery of child supportPDF, 409 KB

Alimony payments to a child with a disability after 18 years are provided if he is unable to work. The Plenum of the Armed Forces of the Russian Federation considers disabled children with any group of disabilities. If children simply cannot find work without education or are busy studying, then they are not considered disabled.

If children simply cannot find work without education or are busy studying, then they are not considered disabled.

item 7, para. 2 p. 38 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 451 KB

Mother and father have equal obligations to support a child with a disability. If the parents and the disabled child do not agree among themselves on the amount of alimony, they will be determined by the court, taking into account the financial and marital status of the child, each of the parents and other noteworthy circumstances. At the same time, the court always assigns 90,021 alimony for adult disabled children in a fixed amount of money.

st. 85 SK RF

If an adult with a disability is not recognized as incompetent, then he independently applies to the court. If recognized, the guardian applies to the court.

The court takes into account how much the applicant with a disability needs to meet his needs and deducts the state pension from this amount. The court also finds out what other relatives can support him: for example, whether he has a spouse.

The court also finds out what other relatives can support him: for example, whether he has a spouse.

/divorce-deti/

“The child must not be separated from the mother”: 10 questions to the lawyer about the rights of parents in a divorce benefit of other relatives, loans, penalties under executive documents. All of these factors will affect the amount that the court will charge. Maybe the court will generally decide that the pension from the state is enough.

For the maintenance of the spouse , maintenance is always assigned in a fixed amount of money.

Art. 90 SK RF

The following can claim maintenance for themselves:

- wife during pregnancy and up to the third anniversary of a common child;

- the father of a child under three years of age, if he sits with him, and the mother has retired from education;

- a needy spouse who cares for a common child with a disability up to 18 years of age or a child with a disability from childhood of the first group, regardless of age;

- disabled needy ex-spouse.

paragraph 44 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 No. 56PDF, 351 KB

According to the Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 No. 56, spouses and former spouses are considered disabled if they have any disability group. Or if they have reached retirement or pre-retirement age - 55 years for women and 60 years for men.

So what? 03/22/19

Alimony for pre-pensioners: who will pay and how to get

A disabled spouse is entitled to apply for maintenance after a divorce if he/she:

- received a disability before the divorce or within a year after it;

- reached retirement age within 5 years of divorce if the marriage was long-term. How long - the family code does not say. So, in each case, it will be up to the court to decide.

At the same time, according to the Supreme Court of the Russian Federation, the former spouse will be entitled to alimony not only if he registered a disability during the marriage, but also if he received a disability earlier. This means that marriage to a person with a disability or a pensioner is a potential risk that in the event of a divorce, you will have to pay alimony. Although if the marriage was short, then the court may refuse to collect alimony.

This means that marriage to a person with a disability or a pensioner is a potential risk that in the event of a divorce, you will have to pay alimony. Although if the marriage was short, then the court may refuse to collect alimony.

paragraph 45 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

Payment of alimony to parents from children is possible if the parents:

- are not deprived of parental rights.

- Fulfilled their parental duties, including financial support for their children.

- They need extra money, which they have nowhere else to get, and children can help them financially.

st. 87 SK RF

If the children can prove that the parents once evaded parental responsibilities, the court may refuse to recover child support. But he may not refuse - in such disputes, the question of the amount is more important. For example, if the father demands 20,000 R per month, and the son asks to dismiss the claim because the father disappeared immediately after his birth, then the court may not refuse the claim completely, but collect only 500 or 1000 R per month.

What to do? 12.04.19

Can biological parents get maintenance from their children?

The court also takes into account the material needs and capabilities of the parent: whether he receives a state pension and other payments, whether he needs housing and expensive treatment or care, whether he has a spouse and other children who are obliged to help, how much money he needs and how much he already receives from other sources.

In the same way, the court takes into account the financial and family situation of children: how much money an adult child has after paying off loans, enforcement orders, paying alimony, is this amount enough for all members of his family.

/list/platite-detishki/

What to do if the children do not help: 5 court cases of child support

If the child being sued has brothers or sisters, the court may not consider their financial situation, but divide the amount needed by the parent, taking into account all the children.

For example, Nikolai Stepanovich has four children, and he only demands money from Masha's daughter. If he lacks 5,000 R per month for treatment, then the court has the right to recover only 1,250 R per month from Masha. At the same time, he does not have the obligation to divide the amount of alimony for all children.

How to calculate maintenance in a fixed amount

The relative who applies for maintenance must justify its amount, and the court must assess whether the plaintiff really needs such an amount and whether the defendant can pay that much. That is, the court always starts from the requested amount - it does not come up with it itself. If the plaintiff does not indicate the amount of alimony in his claims, the claim will not even be considered.

The main task in calculating child support in a fixed amount of money is to maintain the child's previous standard of living to the maximum. Here are the circumstances the court draws attention to:

- How the child was provided for while the parents were married or while the other parent paid child support voluntarily.

- Does the child go to a music or art school, in sports and dance sections, in other additional development institutions - and how much does it all cost.

- How much does a parent living separately earn and what kind of property does he have, through which he can provide for children: real estate, vehicles, bank deposits.

- Whether the second parent provides for other relatives.

Review of judicial practice in cases of recovery of child support PDF, 409 KB

At the same time, child support can be collected simultaneously in shares and in a fixed amount if the parent’s salary is small and he has additional sources of income.

For example, Ivan's salary is 40,000 R, but he earns another 60,000 R as a freelancer. His only child, Pasha, has asthma and needs money for treatment. The court may assign alimony in the amount of 25% of the salary and another 10,000 R on top - for treatment-related expenses.

In this way, two principles are observed: a son will always have money for treatment, regardless of his father’s income, but, like children from a complete family, he can receive a different amount for education, food and clothing, depending on whether his father will work.

Alimony for adults is collected only as assistance, and not as full maintenance. Therefore, when the court calculates their amount, it takes into account whether the alimony recipient has housing and other property. As well as money from other sources - scholarships, pensions, benefits. The court also takes into account whether the alimony payer has other relatives whom he supports, obligations under loans and court decisions.

/prava/soderzhite-detei/

Support rights

An adult who applies for support will have to prove the amount of necessary expenses not covered by the state. That is, that he really needs additional treatment, nutrition and care. At the same time, the court may not recover the entire requested amount - it depends on the capabilities of the alimony payer.

For example, a parent is seriously ill. He needs 60,000 R per month for a nurse and medicines, while his pension is only 20,000 R. All expenses are supported by medical documents. But if a child earns only 30,000 R and keeps his children and wife on maternity leave, then he will definitely not be charged the entire amount the parent needs.

But if a child earns only 30,000 R and keeps his children and wife on maternity leave, then he will definitely not be charged the entire amount the parent needs.

How to draw up an agreement on alimony in a fixed amount of money

An agreement on the payment of alimony in a fixed amount can be concluded by any relative. But if it is about alimony for children, then in their interests it is signed by a parent, guardian or other legal representative. In the same way, if an incompetent person receives alimony, then the guardian signs the agreement instead.

Any agreement on the payment of alimony is concluded in writing and certified by a notary - no matter how the parties agreed to pay them: in shares or a fixed sum of money.

Art. 100 SK RF

As a rule, an agreement is concluded if there is no dispute between relatives about the amount of alimony. This is faster than going to court, but more expensive: you will have to pay a state fee and pay for notary services. State duty for certifying an agreement on the payment of alimony - 250 R.

State duty for certifying an agreement on the payment of alimony - 250 R.

paragraphs. 9 p. 1 art. 333.24 Tax Code of the Russian Federation

All documents that are subject to certification are drawn up in the notary's office for a fee - this is called legal and technical services. Most likely, it will not work to come with a ready document and not pay for the services of a notary - we wrote about this in another article.

The cost of legal and technical services varies by region. For example, in 2022 in Moscow, the service for drawing up an agreement on the payment of alimony costs 8000 RUR, and in the Orenburg region - 6400 RUR. This means that if a relative stops paying under an agreement, then it is enough to take the agreement to the bailiffs so that they begin to collect money forcibly.

A notarial agreement can be challenged in court if it violates someone's rights.

/prava/poluchite-alimenty/

Rights when receiving alimony

For example, parents from the Nizhny Novgorod region entered into an agreement that a father would pay alimony for two sons. Later, the sons moved in with their dad: one turned 18, and the place of residence of the second with dad was officially determined by the court.

Later, the sons moved in with their dad: one turned 18, and the place of residence of the second with dad was officially determined by the court.

The mother went with an agreement to the bailiffs to collect money in her favor, as if her sons were still living with her. The father asked the court to invalidate the agreement, and the court agreed with him.

How to collect alimony in a fixed amount of money through the court

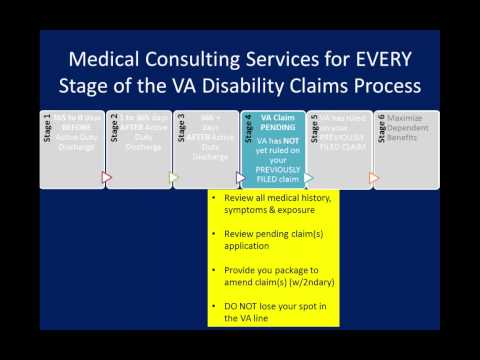

Until October 1, 2019, justices of the peace dealt with disputes about the recovery of alimony. Now they only issue court orders for the recovery of child support for minor children as a share of income. Therefore, , for a decision on the recovery of alimony in a fixed amount of money, you must apply to the district or city court at the place of residence of the plaintiff or defendant. Which court to go to is chosen by the one who applies for alimony.

Art. 23, Art. 29 Code of Civil Procedure of the Russian Federation

Contents of the statement of claim. In the lawsuit, you need to explain how much and why you want to receive from your relative and how you can prove that the relative can pay such an amount, that is, justify your position in detail. But, judging by practice, this can not be done if we are talking about alimony for a minor child in the amount of the subsistence minimum.

In the lawsuit, you need to explain how much and why you want to receive from your relative and how you can prove that the relative can pay such an amount, that is, justify your position in detail. But, judging by practice, this can not be done if we are talking about alimony for a minor child in the amount of the subsistence minimum.

Art. 131 Code of Civil Procedure of the Russian Federation

Sample claim for the recovery of alimony

When applying to the court, you need to provide detailed information about who you are making demands on so that money is not debited by mistake from the debtor's namesake. In addition to the defendant's address, it is worth indicating:

- his date and place of birth;

- place of work;

- details of any document - passport, TIN, SNILS, driver's license, vehicle registration certificate.

If you don’t know any of this, don’t worry: the court will independently request information about the relative.

Documents. A document is attached to the copy of the statement of claim for the court, which confirms the sending of a copy of the claim to the defendant. Usually this is a notice of delivery of a registered letter signed by the defendant. Or the defendant can sign a copy of the claim. The court is obliged to send the defendant only subpoenas and judicial acts.

Art. 132 Code of Civil Procedure of the Russian Federation

It is also necessary to confirm the family relationship between the one who wants to receive alimony and the one from whom they are being collected, because alimony is an obligation of a family law nature. Suitable for this:

- birth certificate of the child, if maintenance is collected from a parent or, conversely, from an adult child for the maintenance of a needy parent;

- marriage certificate, if alimony is collected from the spouse;

- certificate of divorce, if alimony is collected from the former spouse.

The requested amount of alimony can be confirmed:

- checks for the purchase of clothes, shoes, food and other essential expenses;

- receipts or checks for payment for kindergarten, private school, sections;

- receipts or checks for payment for medicines and medical procedures prescribed by a doctor.

/alimony-stat/

Alimony through the eyes of statistics

An adult disabled person can confirm the need for alimony:

- with a certificate from the PFR stating that he does not have enough pension points for labor pension and/or age for social pension;

- a certificate of disability due to a serious illness that requires outside care and expensive medicines that the state does not provide;

- a certificate from the employment center stating that a person cannot be registered as unemployed.

Documents on expenses can be anything. But if a pensioner or a person with a disability already receives a pension from the state in the amount of more than the regional subsistence minimum for pensioners, then in order to assign alimony, the costs must be special. For example, paying for a nurse or rented housing if you don’t have your own, and you can’t live with relatives.

But if a pensioner or a person with a disability already receives a pension from the state in the amount of more than the regional subsistence minimum for pensioners, then in order to assign alimony, the costs must be special. For example, paying for a nurse or rented housing if you don’t have your own, and you can’t live with relatives.

Documents on the property of the defendant can also be attached to the claim, if the plaintiff has them. If not, the plaintiff may file a motion for the court to request documents from the defendant, his employer, Rosreestr or the traffic police.

Art. 57 Code of Civil Procedure of the Russian Federation

If it turns out that the defendant has several apartments and cars, then it can be assumed that he has a stable financial situation and can pay alimony. The defendant's high position can be confirmed, for example, by a printout from the company's website, where the management team is indicated. And if the defendant is the head or participant of the LLC, then with information from the Unified State Register of Legal Entities from the website of the Federal Tax Service.

If you need to receive alimony for the period before going to court, you will have to prove that you have already tried to receive alimony out of court before.

Art. 107 SK RF

section 6 of the review of judicial practice in cases of recovery of child supportPDF, 125 KB

Evidence can be registered letters with notifications, emails, canceled court orders for the recovery of child support, documents from law enforcement agencies on the search for the defendant. And the defendant himself can recognize the claim for the recovery of alimony for past periods.

The amount of state duty for filing a claim for the recovery of alimony is 0 R, that is, the plaintiff does not need to pay it. But if the court satisfies the demand for the recovery of alimony, then the state duty will be recovered from the defendant. Then its size is 150 R.

paras. 14 p. 1 art. 333.19

paras. 2 p. 1 art. 333.36 Tax Code of the Russian Federation

art. 154 Code of Civil Procedure of the Russian Federation

154 Code of Civil Procedure of the Russian Federation

Deadlines for consideration of the application. The judge must consider the dispute on the recovery of alimony within a month from the date the claim was received by the court.

These are official dates. They can be influenced by various circumstances. For example, bodies or organizations from which the court has requested information and documents may not provide them on time.

Or if the defendant is already paying alimony to someone, then these people will be involved in the lawsuit as third parties who do not make independent claims. So they are informed that the defendant, after the trial, will be obliged to pay alimony to someone else.

Art. 43 Code of Civil Procedure of the Russian Federation

It is not necessary for third parties to come to court, but if they decide to attend, this may delay the consideration of the case. For example, if the court asks them for some documents

Grounds for refusal of alimony in a fixed amount of money

If the child is already an adult and capable , the court will refuse to collect alimony from the parent.

For example, in 2018 in the Krasnodar Territory, a guardian grandmother demanded that her granddaughter's father reimburse the expenses of his daughter's paid higher education. The courts of first instance and appeals decided that the father deprived of parental rights and the guardian-grandmother, who replaces the mother, bear equal obligations to support the daughter. Therefore, 50% of the tuition fee was collected from the father for the first semester paid by the grandmother, and for the next 5 years of study.

The father complained to the Supreme Court of the Russian Federation, and he canceled the judicial acts for two reasons:

- At the time of filing the claim, the daughter was already 18 years old, that is, the right of the grandmother to act in the interests of her granddaughter as a guardian ceased.

- The Family Code does not require parents to pay for adult children's education, and the court can force parents to help adult children only in exceptional circumstances, such as if they are seriously ill.

Community 09.12.20

Is it possible to renounce paternity in order not to pay alimony?

Once I tried to collect alimony from my father in favor of the adult Elvira, who was a full-time student at a college on a commercial basis. We did not make the first mistake of the grandmother from the story above and filed a lawsuit from the daughter to the father. But the outcome of the case was the same: we went to the Supreme Court and received a decision to dismiss the claim due to the fact that the father is not obliged to help an adult daughter without a disability.

Until 2017, in such disputes, judges sometimes used the term from the law "On Labor Pensions in the Russian Federation" that full-time students up to 23 years of age are considered disabled, and collected alimony in their favor. Some of these decisions were even enforced, perhaps because of the unwillingness of parents to appeal against them and sue their own children.

For example, in Krasnodar in 2014, a father asked to be released from paying alimony in favor of his adult son, who is studying at the university. The father pointed out that his son did not have a disability and had a scholarship. But the justice of the peace, and then the district court, which considered the appeal, decided that the father should pay his son 1 minimum wage monthly until the age of 23 or until graduation. The judges considered that the father works and can find additional income, so he must help his son.

But in 2017, the Supreme Court explicitly clarified that full-time, able-bodied adults are not entitled to child support from their parents.

paragraph 38 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

If the amount of alimony is established by the current agreement , the court will not recover them. If the agreement is not fulfilled, first you need to send a claim to the one who promised to pay alimony. If you do not set a deadline for responding to a claim and it is not set by the agreement, you need to wait 30 days for a response.

If you do not set a deadline for responding to a claim and it is not set by the agreement, you need to wait 30 days for a response.

Art. 101 SK RF

art. 452 of the Civil Code of the Russian Federation

If this does not help, you can go to court at the same time for termination of the agreement and recovery of alimony. You can also ask that the agreement be declared invalid. For example, if it infringes on the rights of children and according to it, alimony is less than according to the law.

If the marriage was short, the other spouse behaved unworthily or became disabled due to his own fault - due to alcohol or chemical addiction or the commission of an intentional crime, the court will not collect alimony in favor of the spouse or former spouse. At the same time, even if the marriage was short, but the wife received a disability due to a difficult birth, this does not deprive her of the right to alimony.

Art. 92 RF IC

paragraph 10 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

56PDF, 351 KB

refuses alimony in a fixed sum of money. In this case, alimony will be collected in a share, and not in a fixed amount.

paragraph 3 of section 3 of the review of judicial practice in cases of recovery of child supportPDF, 351 KB

Changing the amount of alimony

You can change the amount of alimony determined by the court if the financial or family situation of the person who receives or pays alimony has changed. At the same time, the situation for the alimony payer should not only change, but also not allow paying alimony in the same amount. For example, if he received a disability or lost his job.

Art. 119 SK RF

If an adult capable recipient of alimony has committed a crime against the alimony payer, then the court has the right to refuse to collect alimony. The court has the same right if the alimony recipient abuses alcohol or drugs, psychotropic substances or gambling.

If the alimony payer wants to change their amount, he must apply to the court at the place of residence of the alimony recipient - in this case, he does not have the right to choose the court.

He must also pay a state duty from the amount that he saves in a year if the court satisfies his requirements. At the same time, even if you need to pay alimony for another 10 years, they consider the amount for only one year. But if you only need to pay child support for six months, then they calculate the amount for 6 months - for the remaining time.

p. 6, 7 Art. 91 Code of Civil Procedure of the Russian Federation

paragraphs. 1 p. 1 art. 333.19 TC RF

Let's imagine that by a previous court decision, alimony of 20,000 R per month was collected from a parent, and he wants to pay only 15,000 R. It turns out that the parent wants to sue the right not to pay 60,000 R per year: (20,000 R −15 000 R) × 12 months.

The state duty will be 2000 R: (60,000 R - 20,000 R) × 3% + 800 R.

Or another option. Alimony was collected from an adult child in favor of the parent - 10,000 R per month, but he does not want to pay at all. For the calculation of the state duty, it does not matter whether the child has reasons to refuse obligations.

He has to pay 120,000 R per year: 10,000 R x 12 months. And the state duty in this case will be 3600 R: (120,000 R - 100,000 R) × 2% + 3200 R.

The grounds for increasing the amount of alimony is a change in the financial situation of the payer and recipient of alimony.

A parent with whom children remain may ask for an increase in the amount of support if the payer is no longer required to support other children. For example, because they have become adults. Also, one parent can ask for an increase in alimony if the other has begun to earn more, and the common grown-up children have more material needs.

For example, a mother from the Oryol region asked to increase the amount of alimony for her son from half to one and a half living wages for children. She referred to the fact that the eldest son of her child's father had become of age and that he was no longer being charged alimony.

The court found the argument justified, but increased the amount of alimony to one living wage established in the region, with subsequent indexation.

In addition to income share support, the parent with whom the children live may ask the other parent to contribute to other expenses for the children. For example, if a child is seriously ill or seriously injured and now needs expensive medical care, the parent can be asked to cover some of the unexpected expenses. Or if the mother went on maternity leave with the second child of the same father and now cannot pay for rented housing, the court has the right to award the cost of renting housing in favor of the mother.

Art. 86 SK RF

An elderly relative has the right to ask the court to increase alimony if his health has deteriorated sharply.

Grounds for reducing the amount of alimony

For example, a maintenance payer has the right to ask the court to reduce their amount if he or a member of his family whom he is obliged to support has received a disability. Or if the alimony recipient started working or became an entrepreneur. These facts themselves are not an unconditional reason to reduce alimony, but if disability prevents you from maintaining your previous job and entails high treatment costs, and the alimony recipient's income is constant and substantial, then the court may reduce alimony.

The only reason I had to reduce child support through the courts was the birth of new children with my father. Usually reduce the share of income that is alimony. But if alimony is initially fixed, then new children worsen the financial situation of the father and his ability to help older children.

/alimony-debt/

How to find out child support arrears

At the same time, the Supreme Court, in section 8 of the review of judicial practice, indicates that due to the appearance of new children, child support is not always reduced. For example, if the younger child lives with both parents, the father began to earn more, and the mother of the older child still earns significantly less, then the amount of alimony can be kept.

Also the court will refuse to reduce the amount of child support if it is already less than the subsistence minimum for children in this region , even if the parent brings a certificate of a tiny salary. Courts usually justify such a refusal by the fact that the parent has no evidence that he cannot earn more due to disability or illness.

Courts usually justify such a refusal by the fact that the parent has no evidence that he cannot earn more due to disability or illness.

In a review of judicial practice on the recovery of child support, the Supreme Court noted that if the child support payer asks to reduce their amount, referring to obligations to other relatives, then it matters whether they have other sources of income. That is, for a fictitious reason, it is difficult to reduce alimony.

section 8 of the review of judicial practice in cases of recovery of child supportPDF, 409 KB

Registration of a change in the amount of alimony. If the alimony was collected by the court, their amount can also be changed only by the court in a new decision. Based on this new decision, the needy relative receives a writ of execution.

If the relatives agreed on the initial amount of alimony in an agreement with a notary, then the new amount of alimony can also be agreed there. Either terminate the notarial agreement through the court or declare it invalid, so that the court will establish the new amount of alimony.

I find it cheaper to determine and change child support through the courts than by agreement. When applying to the court for alimony, you do not need to pay a state duty - it will be paid by the defendant, and it is much less than the cost of notary services.

How to change the form of alimony

You can change the form of alimony only if they are collected from parents for minor children. The basis for changing the form of alimony is a change in the circumstances due to which such a form was chosen.

From interest to hard cash. If the alimony was collected by court order in shares of earnings, and it is not official, then in the interests of the children, you need to file a claim for the recovery of a fixed amount. The lawsuit will protect the rights of children if the parent provides documents with a greatly underestimated amount of income.

The procedure for substantiating claims is the same as in the case if alimony has not been collected before: you need to prove the needs of the child and the capabilities of the parents.

/less-alimony/

How to collect alimony through the court

With a fixed amount of money in interest. The court orders fixed child support if there is a reason for this, such as an unsustainable level of parental income. Therefore, you can change the form of alimony if the reason disappears. That is, if the alimony payer finds a permanent job and passes the probationary period, he or the alimony recipient will be able to ask for the replacement of a fixed amount of money with alimony in shares of the salary.

How maintenance is indexed in a fixed amount of money

If the parties to the maintenance obligation have entered into an agreement on the payment of maintenance, they themselves can agree in it how the amount of payments will change over time and what it will depend on.

Art. 105, art. 117 SK RF

If the alimony in a fixed amount of money is collected by the court, then the judge sets their amount as a multiple of the regional subsistence minimum for the category of the population to which the alimony recipient belongs.

Therefore, when the cost of living rises, the bailiff or the employer transferring alimony will also have to index the amount of alimony. Additionally, you do not need to go to court for indexing.

When the payment of alimony in a fixed amount of money stops

The payer no longer has to pay alimony from the moment when:

- the child becomes an adult or emancipated;

- a former spouse who receives alimony remarried;

- child support recipient died;

- a minor child was adopted or adopted;

- an adult maintenance recipient has ceased to need support or has restored his ability to work, and this has been recognized by the court.

st. 120 SK RF

If a child began to live with a parent whom the court ordered to pay alimony, then you can’t stop paying just like that. Although this would be logical, it is fraught with the formation of debt. You need to apply to the court with a claim for exemption from the payment of alimony and debt on them.

clause 36 of Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 26, 2017 No. 56PDF, 351 KB

responsibility.

Art. 5.35.1 Administrative Code of the Russian Federation

Art. 157 of the Criminal Code of the Russian Federation

What is the result

- Alimony in a fixed amount of money is collected in favor of adult relatives. And if the parents do not have a permanent income, then in favor of minor children.

- In order to receive child support, you must prove that the child support recipient's important expenses exceed their income. If these are alimony for minor children, then it is necessary to prove the amount of expenses only if they exceed the subsistence level and the share of the parents' income set by law.

- People from whom alimony is demanded must be able to pay this alimony. Therefore, when calculating the amount, their income, the presence of other dependents, their own needs for treatment and credit obligations are taken into account.

- The amount of alimony is indexed as the regional subsistence minimum increases and may change if the material and family circumstances of the alimony payer and recipient change.

- An agreement on the payment of alimony can be concluded at a notary - without a trial. It's faster, but more expensive.

Applications for Non EEA National Family Members of UK citizens

skip to contentLoading ...

Applications for family members of non-EEA UK citizensMi Whelan2022-08-03T15:06:04+00:00

An overview of the impact of Brexit on UK citizens wishing to come or work in Ireland?

Ireland has a special relationship with the UK because of the Common Travel Area (CTA) that has existed between us since 1922 and officially introduced in 1952. The CTA exists between Ireland, the UK, Guernsey, Jersey and the Isle of Man. This CTA is independent of Ireland and the UK's membership of the European Union. The CTA is based on legislation and bilateral agreements between Ireland and the UK. In connection with Brexit, the governments of Ireland and the United Kingdom have signed a memorandum of understanding, pledging to ensure that the rights arising from the CTA, in the interests of their citizens, continue to be protected.

The CTA is based on legislation and bilateral agreements between Ireland and the UK. In connection with Brexit, the governments of Ireland and the United Kingdom have signed a memorandum of understanding, pledging to ensure that the rights arising from the CTA, in the interests of their citizens, continue to be protected.

Ireland recently passed the UK Withdrawal (Supplementary Provisions) Act 2020. This law contains provisions to ensure the integrity and functioning of the CTA, thereby ensuring that the established rights associated with the functioning of the CTA continue. for their citizens. The UK-EU Brexit Trade Agreement expressly states that the agreement is without prejudice to any agreements reached between the two jurisdictions regarding the CTA. Therefore, after January 1, 2021, citizens of each jurisdiction will continue to have the same CTA-related rights, including the right to work, study, vote, and access health and social benefits. Citizens of both jurisdictions will continue to be able to move freely between both states without the need for border controls when traveling within a CTA post on January 1, 2021.

The rights of family members and dependents of non-EEA British citizens who came to Ireland after Brexit a non-EEA family reunification document that was published by the Irish Naturalization and Immigration Service, now called the Irish Immigration Delivery Service. 2016 Policy paper sets out the rights of certain categories of persons to apply for residence in Ireland based on their relationship with another person already entitled to reside in Ireland. As outlined in the new scheme for family members of non-EEA UK citizens who intend to reside in the State, and in accordance with the Policy Paper 2016, UK citizens do not have an automatic right to have a non-EEA family member reside with them . state.

Contact Sinnott Solicitors Dublin and Cork today with any questions regarding UK citizens wishing to visit or work in Ireland.

Schedule a callback

Application scheme for non-EEA UK family members to live in Ireland

live in the state. Under the scheme, UK citizens will be allowed to apply to sponsor a non-EEA family member or dependent to live with them in Ireland. The scheme's new policy document does not specify any automatic entitlement for British citizens to have their non-EEA relatives or dependents reside with them in Ireland. Under the scheme, UK citizens will be allowed to sponsor an application for permission to reside with them in Ireland for a designated non-EEA family member or dependent.

Under the scheme, UK citizens will be allowed to apply to sponsor a non-EEA family member or dependent to live with them in Ireland. The scheme's new policy document does not specify any automatic entitlement for British citizens to have their non-EEA relatives or dependents reside with them in Ireland. Under the scheme, UK citizens will be allowed to sponsor an application for permission to reside with them in Ireland for a designated non-EEA family member or dependent.

Position for family members of non-EEA British citizens who held a valid residence permit in Ireland on 31 December 2020

The position for these individuals is such that they will continue to retain the same rights of residence, work and study in Ireland in accordance with the withdrawal agreement. People in this category will be required to exchange their current Irish Residence Permit (IRP) card for a new Resident Card. The Card Exchange Program will be administered by the DOJ Immigration Delivery Unit and will be applicable from January 1, 2021.

New preclearance and visa scheme for family members and dependents of non-EEA British citizens

Family members and dependents of non-EEA British citizens who wish to join or accompany this UK citizen Ireland after 23:00 on December 31, 2020, they must first apply for a pre-clearance or visa depending on their nationality. The requirement does not apply to those who intend to live with a British citizen for less than three months.

Visa position for family members and dependents of non-EEA British citizens

Visa required Non-EEA family members must obtain the correct visa to travel to Ireland prior to travel. The Ministry of Justice has already confirmed that it will not accept any applications for the required visa. A non-EEA family member of a UK citizen arrived in Ireland on a 90-day tourist visa and is subsequently trying to stay.

Non-EEA Family Members and Dependents of UK Citizens without a Visa

Visa Free Non-EEA family members and dependents of British citizens must apply for Prior Authorization prior to travel.

All visa and non-visa applicants must normally reside out of state for 90 days and must remain out of state while the application is being processed.

If you need help with the application scheme for non-EEA UK family members to live in Ireland, contact Sinnott Solicitors Dublin and Cork today, call us on +353 1 406 2862 or email info @sinnott.ie and a member of our team will contact you.

New 4D Stamp - Permission to reside in Ireland for a family member of a British citizen who is not a member of the EEA.

Successful applicants will be granted initial approval for 12 months. The permit is temporary and renewable after the first year based on the Stamp 4D and then for another two years and then for another three years.

Who can apply for a Stamp 4D permit for a non-EEA family member or dependent British citizen to reside in Ireland?

Eligibility only applies to the following types of relationship with a UK National Sponsor or sponsor's spouse/partner:

- Spouse

- Civil Partner

- De facto partner

- Or partners dependent children

- Dependent parents of any partner

Contact Sinnott Solicitors Dublin and Cork today if you have any questions regarding the new 4D clearance stamp.

Schedule a callback

Overview of scheme conditions

Scheme conditions for sponsor

The following points will be taken into account:

- Sponsor's overall immigration history 38

- Sponsor financial capacity to support the applicant

- Behavior of the sponsors and in particular whether the sponsor has been subjected to negative scrutiny by Garda Siochana or immigration authorities.

- Authenticity of relationship between applicant and sponsor

Sponsor Financial Criteria

Sponsor's financial resources must not be wholly or predominantly dependent on State Social Security benefits or the Social Security equivalent in another State for at least two years prior to application.

The Immigration Service has established the following criteria for Sponsor Finances:

Sponsor must have a gross income for each of the previous three years that is greater than that used by the Department of Social Security (DSP) when evaluating Working Families Allowance (WFP) eligibility. WFP does not apply in the case of a married couple, civil partner / de facto partnership if there are no children and therefore the minimum taxable income for couples without children is €20,000 per year, on top of any entitlement to state benefits.

WFP does not apply in the case of a married couple, civil partner / de facto partnership if there are no children and therefore the minimum taxable income for couples without children is €20,000 per year, on top of any entitlement to state benefits.

A sponsor who wishes to reside with their dependent children in the state requires the net estimated income per week for their family size as determined by the Department of Social Security (DSP) when evaluating Working Families Benefit eligibility as posted on that Department's website. Web site. The sponsor must comply with these restrictions, including with respect to any changes to the WFP posted at (http://www.welfare.ie/en/Pages/Working-Family-Payment-Op.aspx.)

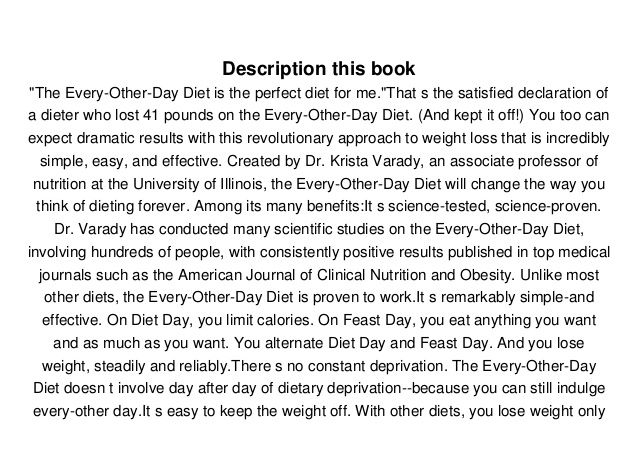

The Immigration Service has provided the following table for illustrative purposes and, given that they may change constantly, the limits are as follows:

| Family size | Weekly household income limit | Annual family income limit |

|---|---|---|

| 1 child | €521. 00 00 | €27,092.00 |

| 2 children | €622.00 | €32,344.00 |

| 3 children | €723.00 | €37,596.00 |

| 4 children | €834.00 | €43,368.00 |

| 5 children | €960.00 | €49,920.00 |

| 6 children | €1,076.00 | €55,952.00 |

| 7 children | €1,212.00 | €63,024.00 |

| 8 children | €1,308.00 | €68,016.00 |

It should be noted that evidence of having a family member in a relatively low per capita income country is not in itself an indication of the sponsor's ability to provide for the family member if that person is allowed to reside. in a State under circumstances where the cost of living is higher in that jurisdiction.

in a State under circumstances where the cost of living is higher in that jurisdiction.

It is expected that this minimum level of income will be maintained for the duration of any permit granted under this Scheme and that non-EEA family member(s) will not become an unreasonable burden on the State. If this level of income is not supported, the permit cannot be renewed under the scheme.

Therefore, on the application date, the sponsor must also demonstrate that he/she is capable of earning sufficient income to support his or her family members for the duration of their intended residence in the State. Under this scheme, the applicant and sponsor must provide proof of expected income from employment, self-employment, etc.

Sponsor and/or applicant's claimed and verified savings may be taken into account when evaluating cases that do not meet income thresholds. The Department may recalculate savings on an annualized basis as income spread over a period of 5-10 years. Alternatively, the nominal income can be determined based on the amounts involved.

Alternatively, the nominal income can be determined based on the amounts involved.

It is the applicant's duty to satisfy the Minister regarding the level of earnings and provide documentary evidence if required.

Overview of conditions for the applicant

Health insurance

- The applicant may have an appropriate health insurance policy for the duration of his residence in Ireland for private healthcare, including any period of hospitalization in a private hospital.

Police permit

- The applicant must provide a police clearance certificate valid for the last 6 months for each country in which he has resided for the last 5 years.

Applications for spouses, civil partners or de facto partners of British citizens to live in Ireland

Spouse, civil partner or de facto partner must be at least 18 years of age at the time of application for family reunification.

The general principle that applies to immigration decisions is that marriages or relationships involving civil partnerships must be monogamous, freely entered into by both parties, legally conducted and recognized under Irish law. The marriage/partnership must also be recognized under Irish law for other purposes outside of the immigration system.

Cases involving de facto relationships must be exceptional during the entire qualifying period. Prior to applying under this Scheme, de facto partners must have been in a relationship close to marriage for at least two years prior to applying for family reunification. .

No minimum duration of marriage/civil partnership required for marriage or civil partnership.

It should be noted that a commitment is required from both parties that they will permanently reside together in the State as spouses, civil partners or de facto partners immediately after successful processing of an application under this Scheme or as soon as circumstances permit. The declaration of this is part of the application process.

The declaration of this is part of the application process.

For the purposes of immigration, a person may be considered a de facto, opposite-sex, or same-sex partner of another person if:

- they have a mutual commitment to living together to the exclusion of all others, akin to marriage or civil partnership in practice but not in law,

- the relationship between them is real and ongoing,

- they live together or do not live separately and apart on a permanent basis for two years prior to application.

- they are not related

The applicant must be able to provide evidence of a genuine, long-term, and enduring relationship.

Contact Sinnott Solicitors Dublin and Cork today for more information about the terms of the scheme. Call us +353 1 406 2862 or email [email protected].

Granting permission as a spouse, civil partner or de facto partner

In the event of a successful application under this scheme, initial permission will be granted for a 12-month period under Stamp 4D conditions. Residence permits are considered temporary but can be renewed after the first year based on the Stamp 4D, for another 2 years and then for 3 years. This is provided that at each renewal the conditions under which the original authorization was granted continue to be met. Holders of this permit are allowed to seek employment without having to obtain a work permit from the Department of Business, Enterprise and Innovation.

Residence permits are considered temporary but can be renewed after the first year based on the Stamp 4D, for another 2 years and then for 3 years. This is provided that at each renewal the conditions under which the original authorization was granted continue to be met. Holders of this permit are allowed to seek employment without having to obtain a work permit from the Department of Business, Enterprise and Innovation.

Contact Sinnott Solicitors Dublin and Cork today if you have any questions or need advice regarding granting permission as a spouse, civil partner or de facto partner.

Schedule a callback

Applications for non-EEA dependents of UK citizens over 18

An application may be made by a person aged 18 or over who:

- is a direct descendant of the sponsor or his/her spouse, civil partner or actual partner,

- was adopted by a sponsor or his/her spouse, civil partner or de facto partner, or

- for whom a guardianship or other equivalent legal process has been established in accordance with the relevant jurisdiction in which such a procedure was established.

Adult dependent applicants claiming addiction are not independent and rely on a sponsor and/or spouse, civil partner or sponsor's de facto partner.

For the purposes of this scheme, "dependency" is demonstrated when an applicant receives financial support from a sponsor and/or a sponsor's spouse, civil partner or de facto partner on an ongoing basis. The dependency must pre-exist and persist until the application for family reunification is made. Appropriate financial, medical or other documentary evidence must be provided to support the addiction. For example, the sponsor and applicant must provide information and documentary evidence that:

- Applicant is pursuing full-time education in their country of origin or country of current residence and intends to continue full-time education in that state, he/she is under 23 years of age and requires financial support from a sponsor and/or spouse, civil partner or sponsor's de facto partner,

- if the applicant is not fully educated in the state, he/she is over 18 years of age and directly or indirectly dependent on a parental sponsor due to a serious medical condition making independent living impossible,

- due to health, financial or social conditions, the applicant could not meet his basic living needs (in whole or in part) without the financial or other material support of the sponsor and / or spouse, civil partner or sponsor's actual partner,

- such support is provided to the applicant by the sponsor and/or spouse, civil partner or actual partner of the sponsor, and

- the need for such support existed in the applicant's country of origin or in his/her country of residence immediately prior to arrival in the State

Adult Dependents in Exceptional Circumstances

Applications that include a Dependency Statement or Exceptional Circumstances will be assessed taking into account all relevant factors on a case-by-case basis. This will include the presence of other family members, especially in the applicant's country of origin or current residence, who could or should provide alternative support to the applicant.