How much are child support payments in canada

Step 6: Find the table amount

- Previous Page

- Table of Contents

- Next Page

The amount in the table is the starting point. As will be explained in Step 7 and in Step 8, there may be an additional amount if there are special or extraordinary expenses or the amount may change if there is undue hardship.

You have now determined how many children are being supported (Step 2), what table or tables you need to use (Step 4), and what income the amount of child support will be based on (Step 5).

Step 6 explains how to find the table amount that matches your income and the number of children being supported.

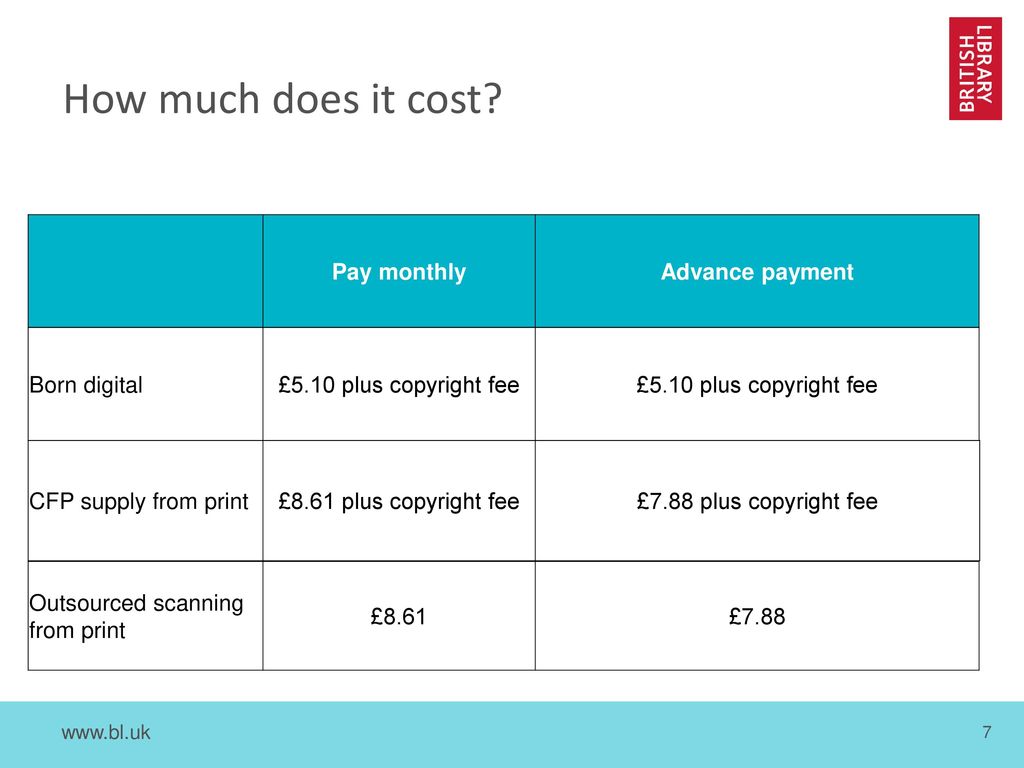

You can use the tables in the Federal Guidelines or you may find it easier to use the Simplified Tables or the Online Lookup. The Department of Justice Canada created the simplified tables and the Online Lookup to make it easier to estimate a child support amount. The tools can be found on the family law webpages. However, the tables in the Federal Guidelines are the only official tables.

The basic child support amount generally depends on your parenting time arrangements.

Majority of parenting time

Use the federal table for the province or territory where the paying parent lives. On that table, find the amount of support that matches the paying parent’s income and the number of children being supported.

Charles and Brigitte

When Charles moved to Manitoba for a new job, his wife, Brigitte, decided to stay in Ontario with their three children. Their marriage had been in trouble for a while, and after a year of living apart, they decided to divorce. They agreed that the children should continue living in Ontario with Brigitte and that Charles would pay child support based on the federal tables. Since Charles and Brigitte live in different provinces, they use the federal table for Manitoba, where Charles lives, to determine the basic amount of child support.

Charles earns $45,000 per year. The table shows that the basic amount of child support for three children based on that income is $848 per month.

Split parenting time

You will each need to check the table for the province or territory where you live to find out how much support you would pay for the children that are with the other parent for the majority of parenting time.

Once you have found the table amount that you would each pay, subtract the lower amount from the higher amount.

Raj and Isha

Raj and Isha have three children: a 14-year-old daughter named Dhara, a 12-year-old son named Ajay, and a 10-year-old son named Amir. The entire family was living in Prince Edward Island. But when Raj and Isha decided to divorce, Isha accepted a job in Nova Scotia.

Dhara is a very talented musician and wants to make that her career. Raj and Isha decide that she would have better access to the training she needs in Halifax. So they agree that Dhara will move to Nova Scotia and live with Isha. They also agree that Ajay and Amir will stay in Prince Edward Island with Raj. In other words, Isha will have the majority of parenting time with one child, Dhara, while Raj will have the majority of parenting time with two children, Ajay and Amir, for child support purposes.

They also agree that Ajay and Amir will stay in Prince Edward Island with Raj. In other words, Isha will have the majority of parenting time with one child, Dhara, while Raj will have the majority of parenting time with two children, Ajay and Amir, for child support purposes.

They use the table for Nova Scotia to find out how much support Isha would have to pay for the two children living with Raj. It shows that, based on her income of $27,000 per year, Isha would pay $400 per month.

They use the table for Prince Edward Island to find out how much support Raj would have to pay for the one child living with Isha. It shows that, based on his income of $23,000 per year, he would have to pay $160 per month.

Then they subtract the lower amount from the higher amount.

| Isha’s monthly payment: | $400 |

|---|---|

| Raj’s monthly payment: | -$160 |

| Difference: | $240 |

Isha will pay Raj $240 per month.

Shared parenting time

If you share parenting time, it does not mean that no child support is needed.

If you share parenting time, the rules for calculating child support are a bit different. You need to consider the amount in the tables that each of you would pay for those children if the other parent had the majority of parenting time. But you also need to consider:

- the increased cost of shared parenting time; and

- the condition, means, needs and other circumstances of each parent and child.

The Federal Guidelines allow some discretion about how to weigh all these factors to determine an appropriate child support amount. Below is just one example of how you may determine a child support amount if you share parenting time.

Kaya and Peter

Kaya and Peter both live in Nunavut. Their relationship is not working and they have decided to divorce. They have agreed to share parenting time for their two young daughters, eight-year-old Paj and nine-year-old Anik. Kaya earns $25,000 while Peter earns $35,000 per year.

Kaya earns $25,000 while Peter earns $35,000 per year.

To determine a support amount, they look at the table for Nunavut to find out the amount each of them would pay to the other parent if the other parent had the majority of parenting time of both children. Based on their incomes, the table shows that Kaya would pay $407 per month and Peter would pay $564 per month for two children.

Next, they decide to subtract the lower amount from the higher amount.

| Peter’s monthly payments: | $564 |

|---|---|

| Kaya’s monthly payments: | -$407 |

| Difference: | $157 |

Kaya and Peter then look at the expenses they each expect to have to pay while the girls are spending time with them. They find that Kaya will have to pay for more expenses than Peter. They agree that it is reasonable and fair for Peter to pay an extra $20 per month to help cover those expenses because he earns more and can take on a greater part.

They agree that the amount of child support that Peter will pay each month to support Paj and Anik will be $157 + $20 = $177.

Income over $150,000

The child support tables only show an amount for the first $150,000 of income. As explained in Step 5, you have two choices for determining how much child support should be paid on the portion of income over $150,000:

- you can multiply the amount of income over $150,000 by the percentage shown in the table for the province or territory where the paying parent lives

or - you can agree on an additional amount of support based on the condition, means, needs and other circumstances of your children and your financial ability to contribute

Add the table amount for the first $150,000 of annual income to the amount determined for the portion of income over $150,000 to get the basic child support amount.

Alex and Marie

Alex and Marie live in Alberta. They have a seven-year-old daughter named Zoe. When Alex and Marie decided to live apart and divorce, they agreed that Zoe would live with Alex and that Marie would pay child support.

They have a seven-year-old daughter named Zoe. When Alex and Marie decided to live apart and divorce, they agreed that Zoe would live with Alex and that Marie would pay child support.

Marie earns $175,000 per year. In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

Alex and Marie decide to use the percentage shown in the table for Alberta to determine how much additional support Marie should pay on the portion of income over $150,000. The percentage for one child in Alberta is 0.84%:

- $175,000 - $150,000 = $25,000 (portion of income over $150,000)

- $25,000 x 0.0084 = $210 (support payable on income over $150,000)

- $1318 + $210 = $1528 (combined total)

Assuming there are no other expenses, Marie will pay $1528 per month to Alex to support Zoe.

Recap

You have now determined the basic table amount for the support of your children. You may want to include the relevant information in section 7 of your Child Support Tool.

You may want to include the relevant information in section 7 of your Child Support Tool.

- Previous Page

- Table of Contents

- Next Page

2017 Child Support Table Look-up

Note

This version of the Child Support Table Look-up (online look-up) is based on updated Federal Child Support Tables that came into effect on November 22, 2017. You may use it to calculate a child support amount for a period from that date onward. Use the 2011 Child Support Table Look-up to calculate a child support amount for a period before that date.

Important Tips for Using the Table Look-up

This child support table look-up will help you find the base amount of child support. Read the Step-by-Step Guide and the Table Look-up Disclaimer for more details. The Guide offers instructions and worksheets that will help explain how to calculate child support amounts. It also has information on special or extraordinary expenses that may need to be added to the basic child support amount.

You may wish to ask a lawyer for advice about your situation. The base amount is often not the final child support amount to be paid. For example, if there are special expenses such as child care or if you have a shared parenting time arrangement, the amount will likely be different.

Under the Federal Child Support Guidelines, the table amount is determined by:

- the number of children;

- the province or territory where the paying parent lives; and

- the paying parent's before tax annual income.

Enter the following information:

Validation Errors

Please review the following:

Annual gross income of paying parent: (required)

Number of children: (required)123456+

Province of residence of paying parent: (required) AlbertaBritish ColumbiaManitobaNew BrunswickNewfoundland and LabradorNorthwest TerritoriesNova ScotiaNunavutOntarioPrince Edward IslandQuebecSaskatchewanYukon

Table Look-up Disclaimer

The Child Support Table Look-up has general information only. It is not a legal document. Provincial or territorial guidelines may apply in some cases.

It is not a legal document. Provincial or territorial guidelines may apply in some cases.

Note: Several companies sell software for calculating child support. Be aware that the Department of Justice was not involved in the development of that software.

Report a problem on this page Please select all that apply:

Something is broken

The page has spelling or grammar mistakes

The information is wrong

The information is outdated

I can't find what I'm looking for

Other

Thank you for your help!

You will not receive a reply. For enquiries, please contact us.

For enquiries, please contact us.

- Date modified:

Divorce in Canadian. How many years will you have to support the former? – Immigrant today

How a three-year marriage leads to 15 years of benefits

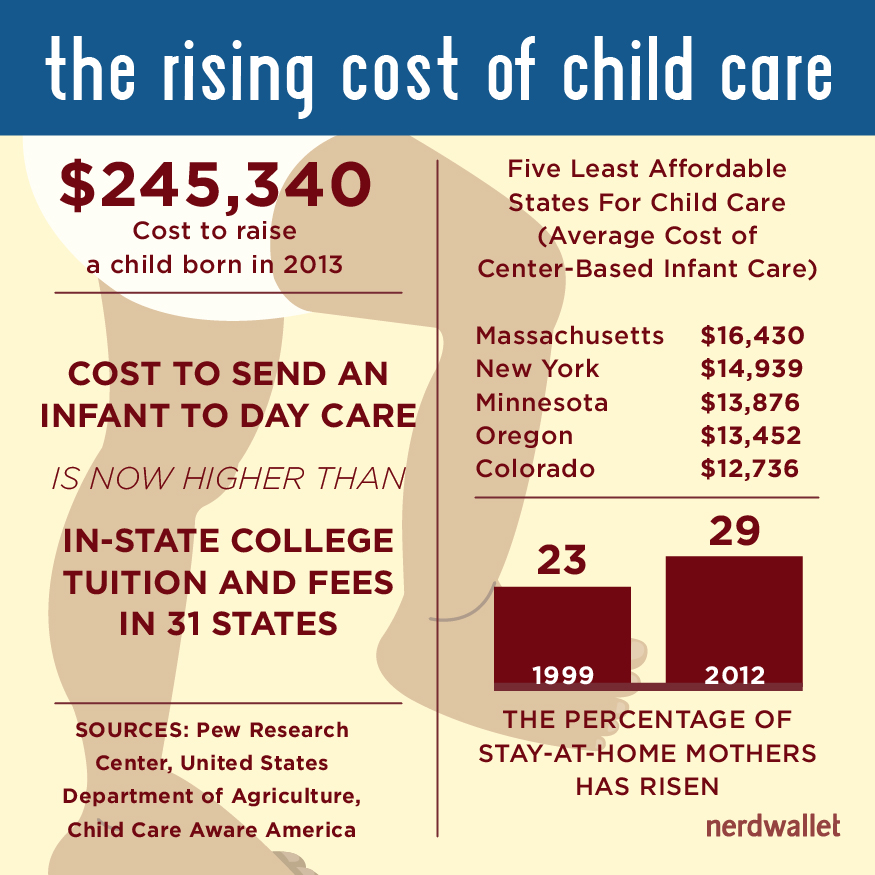

During a divorce, alimony is paid not only for the child, but also for the spouse, this payment is called spousal support. According to the Spouse Support Advisory Guide (SSAG), the amount and timing of payments can vary greatly depending on many factors. What matters is how many years the spouses have lived together, how many children they have and how old they are, what salary both partners receive, and much more.

Spousal support usually lasts half to the entire duration of the relationship. That is, if the spouses decide to divorce after three years of marriage, one of them will pay the other from one and a half to three years.

But if a couple has a small child after a divorce, the age of the child matters a lot. So, if a couple who has been married for three years has a two-year-old child, then spousal support can be paid from three to 15 years after the divorce: up to five times longer than the relationship itself! Most often this happens if the care of the child falls on the shoulders of one of the parents.

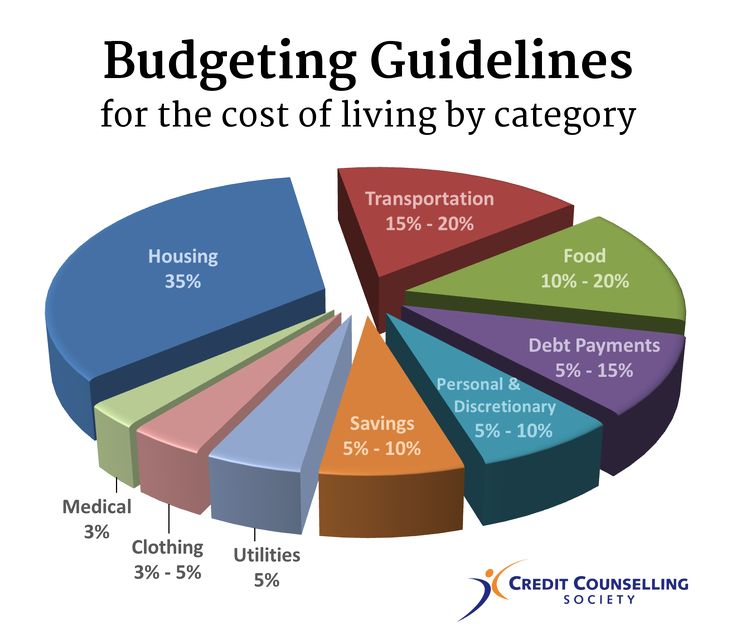

Let's imagine that the husband earns $60,000 a year, and the wife has not yet had time to go to work. In this case, the spouse would pay $1,090 on average to the ex-spouse and $556 per child per month, for a total of 33% of their earnings. If the spouse works and earns $30,000 a year, half as much as her ex-husband, and the child remains on her shoulders, she will receive from her husband only $556 per month per child. That is, the spouse will give only 11% of his monthly salary.

If the parents take responsibility for taking care of the child together, then the parent who earns more will pay spousal support and child support. You may not have to pay for spousal support at all. Let's say that the husband receives $60,000 a year, and the wife $35,000, the spouses are divorced, but both take care of the child. In this case, the husband will pay the children's money - $ 252 per month, which is 5% of the salary. It is also possible that the husband will pay another $395 spouse, or 8% of salary. That is only 13%.

You may not have to pay for spousal support at all. Let's say that the husband receives $60,000 a year, and the wife $35,000, the spouses are divorced, but both take care of the child. In this case, the husband will pay the children's money - $ 252 per month, which is 5% of the salary. It is also possible that the husband will pay another $395 spouse, or 8% of salary. That is only 13%.

If both spouses earn the same, then no one owes anything to anyone. If the wife in this example earns $70,000 a year, then she will pay about $100 in child support and give a little more than $100 to an ex-husband who earns less.

If the father is on welfare and does not work (while receiving $20,000), and his ex-wife takes care of the child, goes to work and receives $50,000, then the father by law must pay the child $161 every month (approximately 10%) . But at the same time, he will receive monthly support from his ex-wife in the amount of $ 255, that is, he will still be in the black and at the same time will not fall under the article for non-payment of alimony.

And what would happen in Russia in such a situation? Child with mother, husband receives unemployment benefits and must give a quarter in the form of alimony. What happens next? He pays nothing, he is fined or assigned community service. If he does not pay further, then he goes to prison, where he receives less than the amount of unemployment benefits, and then he leaves prison and again falls into the alimony pit. Which system do you think is fairer?

Pension will also have to be shared

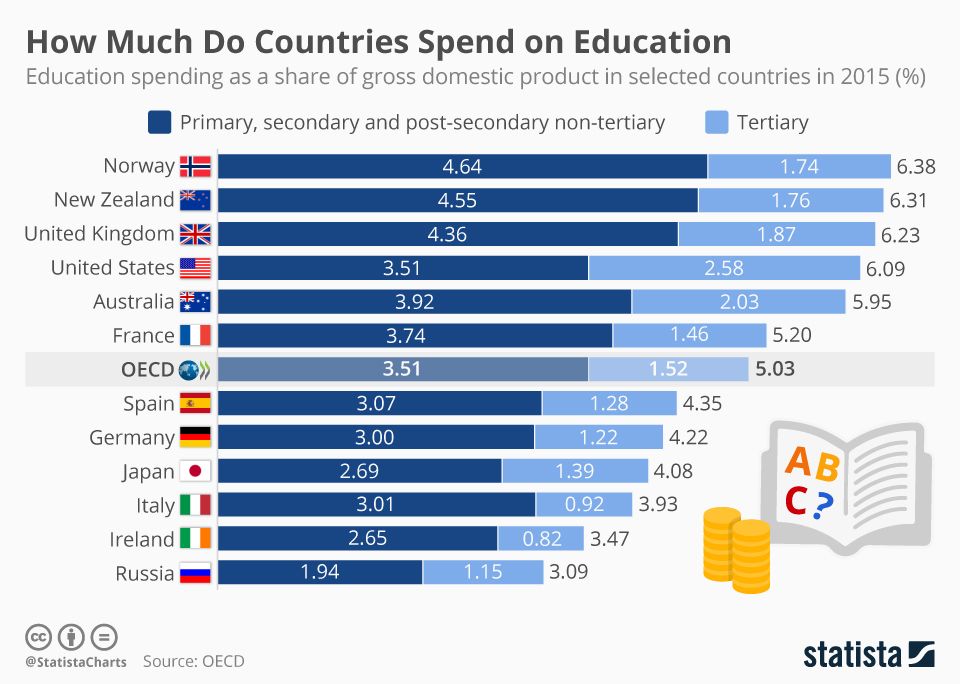

The divorce rate in North America among people aged 50 and over has doubled in the last 25 years, and tripled among people aged 65. In this category, there are 6 divorces per 1,000 marriages. Some of these statistics can be explained by demographics: people are living longer. In Canada, for example, the average life expectancy is 82.3 years. Also, society now condemns less those who do not want to save their marriage at all costs, but want to take a second chance.

What will happen in case of divorce of spouses at the age? Recall that the retirement age in Canada is 65 years. The kids are grown up and you don't have to pay child support. And what about each other's support? The pension savings of the spouses will be divided. Usually they are divided in half, but can be divided unevenly: factors such as the duration of the marriage, the time since the divorce, the age of children or dependents, the financial situation and needs of both parties, and others are taken into account.

The pension assets accumulated over the years of living together are most often shared. But there are cases when a spouse is entitled to a part of the pension, which was formed after the divorce. It also happens that the former partner receives the spouse's pension decades after they separated. Of course, other options for dividing joint assets by agreement of the parties are also possible: for example, a pension for a husband and a house for a wife.:format(webp):no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19705678/Artboard_1_80.jpg)

The calculation of spousal support is considered to be one of the most complex in Canadian family law. For more information about how the divorce process works in Canada, you can read here .

Want to immigrate to Canada but don't know where to start?

👉Take a free artificial intelligence odds assessment that will analyze all available options and tell you if it's worth your time.

LIFE IN IMMIGRATION AND ... IN DIVORCE - Vancouver & Us

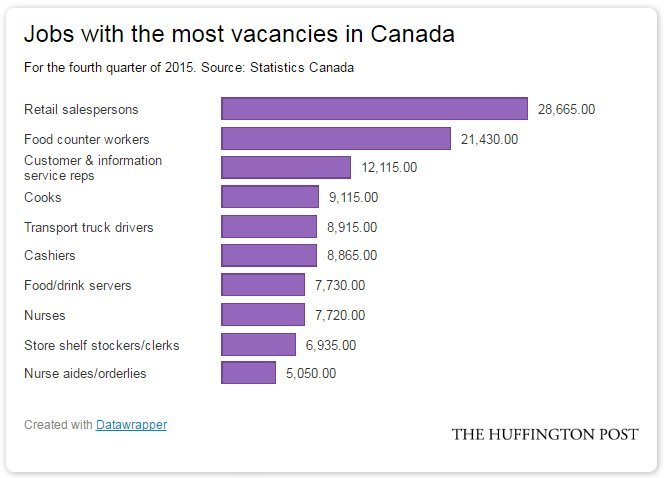

About 10 years ago, in a private conversation with one of the immigration consultants, I received information that horrified me: about 50% of immigrant families break up after several years of living in Canada.

These 10 years later, on a similar topic, we talk with Vancouver family law attorney Maria Cook .

- Maria, as a lawyer, you advise on all matters of family law, so perhaps you are aware of some statistics on immigrant divorces in British Columbia or Canada?

- Of course, I don't keep statistics, but as far as my personal impressions are concerned, in general, the divorce statistics in the country are high, I don't know how it is expressed in percentage terms, but definitely more than 50%. And, again, according to my impressions, it is even higher among immigrants. People come to another country, a whole host of difficulties arise, they face circumstances that they may never have had to deal with, some problems are aggravated.

And, again, according to my impressions, it is even higher among immigrants. People come to another country, a whole host of difficulties arise, they face circumstances that they may never have had to deal with, some problems are aggravated.

– Well, yes, immigration is a kind of extreme situation, and it, this situation, shows how strong a family is.

- Absolutely. Although, of course, a lot also depends on where the immigrants come from, from which country, what was the relationship between husband and wife in that country ... But in Canada, they look at many things differently.

- According to your observation, how long after arrival in Canada do most immigrants file for divorce? One, two, five?..

- It seems to me that 4-5 years is the period when people, having arrived in Canada, understand whether they can save their families in immigration. I had cases when it was after 5 years of Canadian life that couples came to me who had lived together for 30 years before that.

- Who files for divorce more often - men or women?

– When it comes to sole divorces, in my practice I deal with women more often. But men also often apply - especially if there are no problems, just a “clean” divorce. And if there are any claims, unresolved issues, then, probably, more women come first. And this is understandable. A woman is most often in a dependent situation from a man, and if she does nothing, does not file for divorce, then she may be left without a livelihood - and they are often concentrated in male hands.

– And the child, as a rule, still stays with the woman…

– Lately, by the way, men are increasingly fighting for their paternal rights in order to spend as much time as possible with the child. True, in some cases this happens partially, perhaps because in these cases the amount of child support decreases - depending on the time that the father spends with him. Generally, child support can be reduced if the father spends 40 percent or more of the time with the child.

– How easy (I don't mean the moral side of the question, of course) is getting a divorce in Canada?

- All divorce proceedings in Canada go through the courts. You can file for divorce at any time - from the moment people realized that the marriage had already broken up, but you need to be prepared for the fact that this is a two-stage process. That is, you can apply for a divorce, but you cannot get it until the period of separation, which takes a year, has passed. That is, people are given time to weigh everything again, to think. And if people this year, even if for some reason they do not leave, do not position themselves as a family, do not conduct a joint household, then the court considers their application for divorce.

- Is there any difference between divorce proceedings in different provinces of Canada?

- Divorce Law - Federal. The rules for filing divorce papers are the same. For example, spouses must have lived in any province for at least 12 months in order to file for divorce. This rule applies to all provinces. But the procedural rules, some requirements for documents - may be different.

- In your ad, you quote for divorce services with and without children. With children it's more expensive. Are divorces more difficult? Require significant effort, time? This is not two stages, but more?

- No, the number of stages does not change. The process, in principle, is the same, but more information is required, more documents. And the most important difference is that when there are children, the law requires that the judge, before making a decision, be convinced that the children will not suffer in this case - this applies, for example, to alimony for each child, the amount of which is determined by a special table . Until the appropriate child custody order or separation agreement is signed, divorce may not be allowed, because the same alimony is paid exactly according to these papers.

- And if the divorce is obtained, all the papers for alimony are signed, and the ex-spouse does not pay money for the child? I read recently that the percentage of child support defaulters in Canada is quite high. So what can a woman do in this case?

So what can a woman do in this case?

- First, there is such a program - Family Maintenance Enforcement Program. The phone can be found in the White Pages. This is a free program. Ask them for an application form, fill it out, give them a copy of the court order or separation agreement, and this organization will work to get those who do not pay child support to fulfill their obligations. They, for example, can contact the company where the defaulter works, and the alimony will be withdrawn from his salary. Or they can make it so that they don't renew their driver's license or issue a new passport. Or whatever the man was supposed to receive in the tax refund would be paid to his ex-wife. There are many ways. True, I cannot say that the efforts of the Family Maintenance Enforcement Program always end successfully - it all depends on the specific situation. But, in any case, this is one of the ways to achieve payment of alimony.

- I'll clarify - child support is paid until the age of 19?

- Yes, child support is paid until the age of 19. But it happens that the child finishes school earlier, starts working earlier, then the alimony is no longer paid. Or, conversely, the child continues to study full time at a college / university, then there is a chance that child support will be paid until the end of his studies.

But it happens that the child finishes school earlier, starts working earlier, then the alimony is no longer paid. Or, conversely, the child continues to study full time at a college / university, then there is a chance that child support will be paid until the end of his studies.

- And for this you need to additionally apply to the court?

- Most of the issues people still try to resolve among themselves, a relatively small percentage goes to court - those who cannot resolve financial issues peacefully. But even in this case, most contentious issues are still resolved before the court, at an intermediate stage.

– It’s clear with children, providing them with a future is a holy cause, it doesn’t matter whether the spouse is divorced or not… life after divorce? Or is it only possible if you have children?

- Spousal support does not depend on the presence of children, although children are one of the factors. Everything always depends on the specific situation. It happens that the husband, suppose, worked, but the wife did not. Or the husband did not want his wife to work at all. But at the same time, she ran a household, raised children who had already grown up at the time of the divorce. Or even if there were no children at all, but she still had care for her husband, for the house. The chance that the wife can receive alimony after the divorce is very good. And the amount already depends on the income of the spouse. And for these payments, there are also special tables. They are not as mandatory as in the case of child support, but in particular in British Columbia they are followed very strictly.

It happens that the husband, suppose, worked, but the wife did not. Or the husband did not want his wife to work at all. But at the same time, she ran a household, raised children who had already grown up at the time of the divorce. Or even if there were no children at all, but she still had care for her husband, for the house. The chance that the wife can receive alimony after the divorce is very good. And the amount already depends on the income of the spouse. And for these payments, there are also special tables. They are not as mandatory as in the case of child support, but in particular in British Columbia they are followed very strictly.

Depending on the duration of the marriage, on the income of the spouse according to the tables, these are assigned payments. If, suppose, the marriage is 5 years old, then the period of maintenance of the former spouse is assigned from 2.5 to 5 years. If people have lived together for a long time, let's say 20 years, then - from 10 to 20 years.