How many dependents qualify for child tax credit

2022 Child Tax Credit: What Will You Receive?

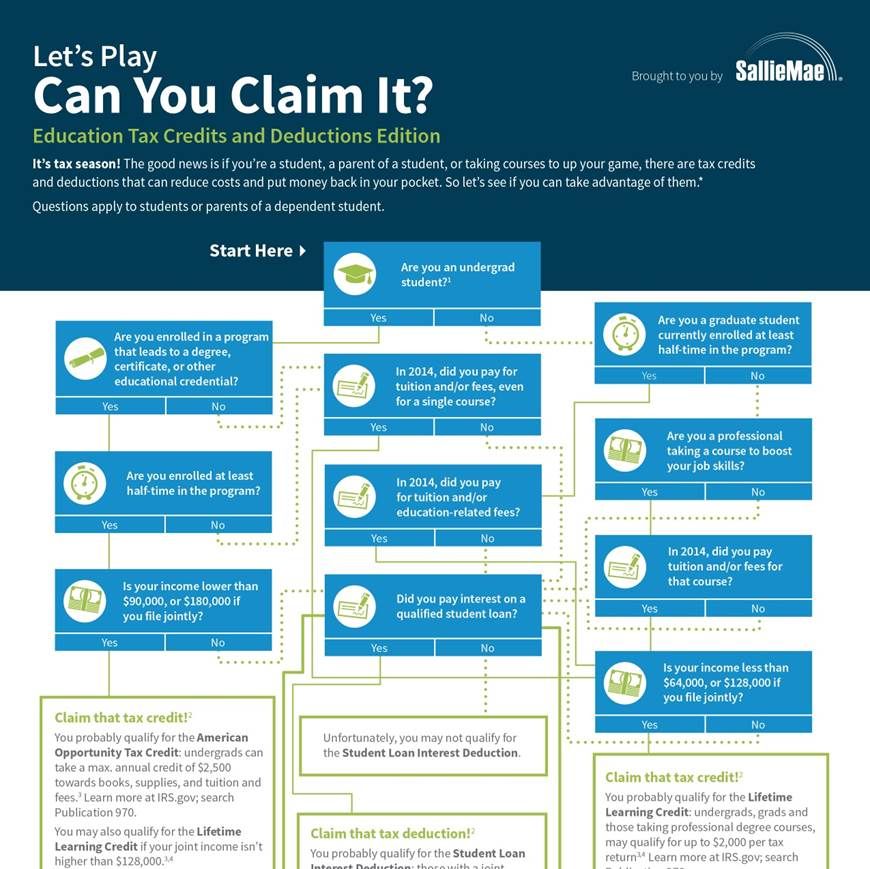

If you have children or other dependents under the age of 17, you likely qualify for the Child Tax Credit. In 2021, it was temporarily expanded as part of the American Rescue Plan, which was signed by President Biden in March of that year to help families deal with the financial hardships stemming from the COVID-19 pandemic. There are a number of income limits you should know about when planning how much you’ll receive.

Planning for your family’s finances goes beyond taxes. A financial advisor can help you create a financial plan for their needs and goals.

What Is the Child Tax Credit?The Child Tax Credit (CTC) is designed to give an income boost to the parents or guardians of children and other dependents. The American Rescue Plan temporarily increased the CTC for tax year to help filers cope financially with the pandemic. Half of those tax credit increases were delivered through automatic monthly payments and the remaining balance was available through 2021 tax returns filed by November 17, 2022.

The expanded child tax credit applies to dependents who are 17 or younger as of the last day of the tax year. For tax year 2021, the credit is worth up to $3,600 per dependent, but your income level determines exactly how much you can get.

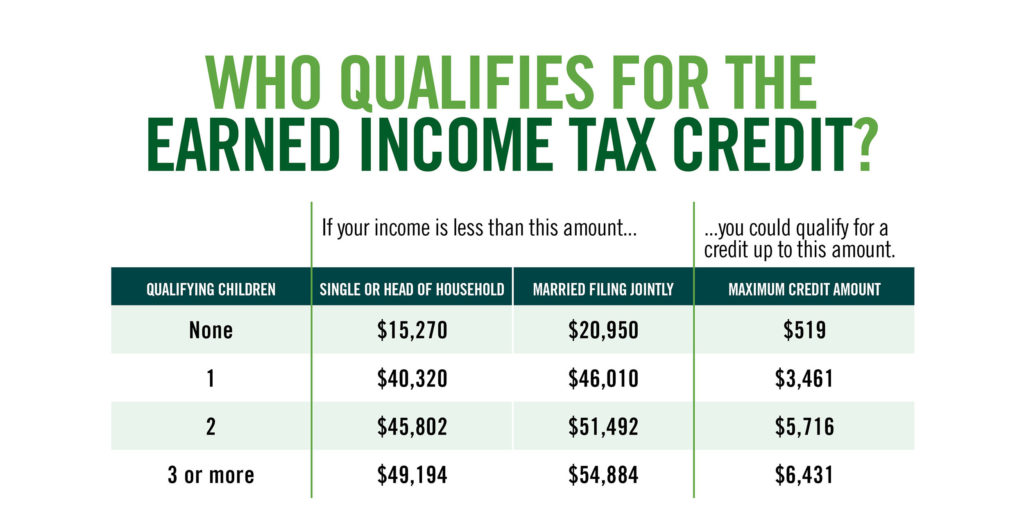

The child tax credit has now reverted in 2022 back to its original limit of $2,000 for every dependent under age 16. Income thresholds for single taxpayers and heads of household are set at $200,000 to qualify (and $400,000 for joint filers).

How Does the Child Tax Credit Work?For tax year 2022, the child tax credit starts phasing out for families with a modified adjusted gross income (MAGI) above $200,000 for single filers (and $400,000 for joint filers).

For a comparison, the expanded child tax credit (available for tax year 2021) began to phase out at a MAGI of $75,000 for single filers ($112,500 for heads of household and $150,000 for joint filers).

In 2022, qualifying families will no longer get advanced credit payments. This means that those taxpayers will get the credit when they file that return in 2023.

This means that those taxpayers will get the credit when they file that return in 2023.

For the expanded child tax credit, the Internal Revenue Service (IRS) began sending monthly payments on the 15th of every month (from July and through December). Half of the credit amount was paid in advance installments and the other half could be claimed by families on their 2022 tax returns.

As a reminder, tax credits directly reduce the amount you owe the IRS. So, if your tax bill is $3,000 but you’re eligible for $1,000 in tax credits, your bill is now $2,000. This differs from a tax deduction, which reduces how much of your income is subject to income tax.

Which Dependents Are Eligible for the Child Tax Credit?Eligibility for the CTC hinges on a few factors. The child you claim as your dependent has to meet seven pieces of criteria from the IRS:

- Age Test: The child was under age 18 at the end of the tax year. The CTC is increased for children under age 6.

- Relationship Test: The child is your daughter, son, stepchild, foster child, adopted child, brother, sister, stepbrother, stepsister, half-sister or half-brother. The child can also be the direct descendant of any of those just mentioned (your grandchild, niece or nephew).

- Support Test: The child did not provide more than half of their own support for the tax year. The child also cannot file a joint return that year.

- Dependent Test: The child must be claimed as your dependent on your federal tax return.

- Citizen and Resident Test: The child has to be a U.S. citizen, a U.S. national or a U.S. resident alien. The child must also have a Social Security number.

- Residency Test: The child must have lived with you for more than half of the tax year.

- Income Test: This is the same requirements as the ones listed earlier.

In short, the CTC begins phasing out for families with income above $200,000 (single filers) or $400,000 (joint filers).

In short, the CTC begins phasing out for families with income above $200,000 (single filers) or $400,000 (joint filers).

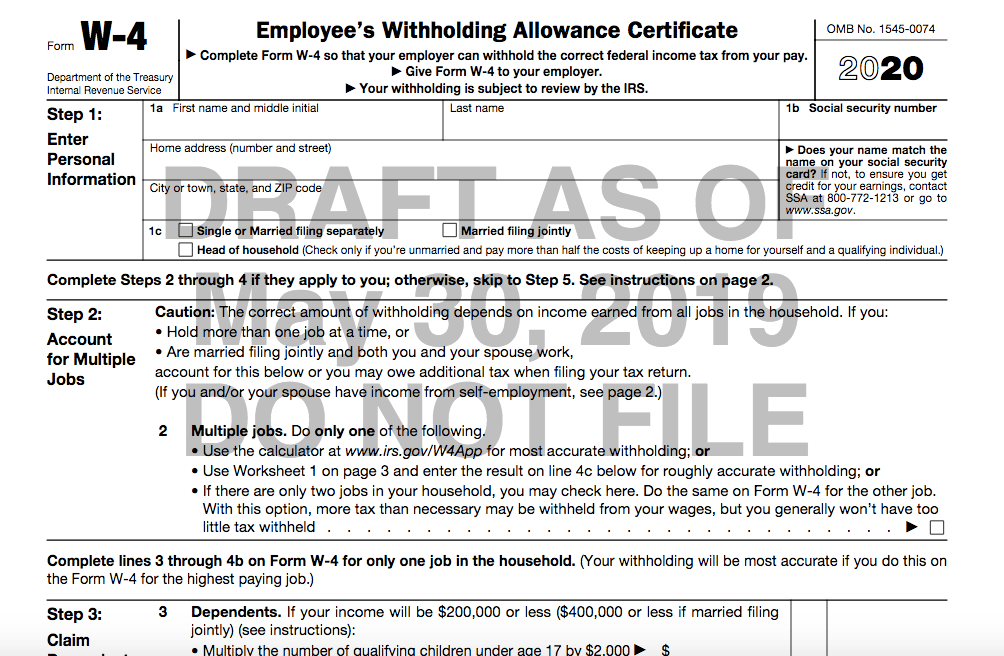

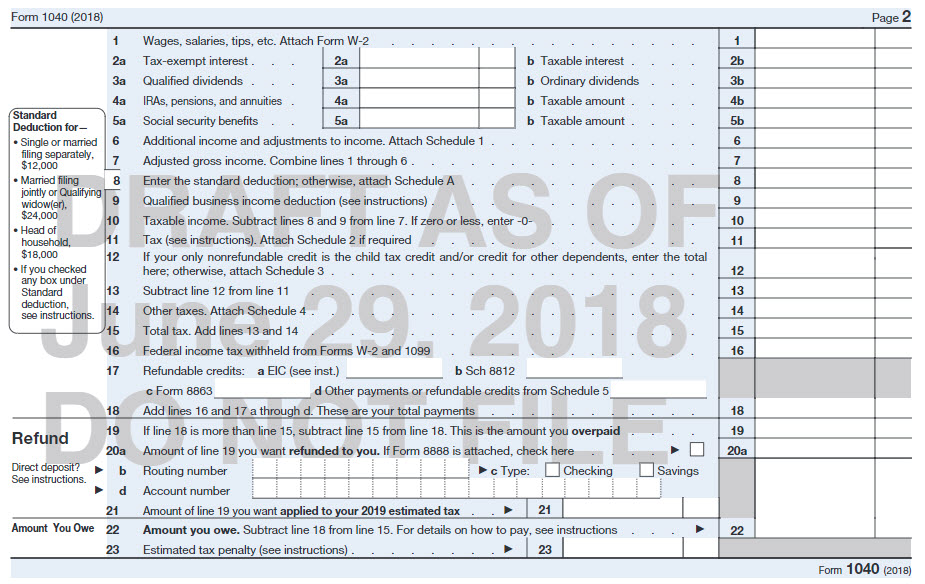

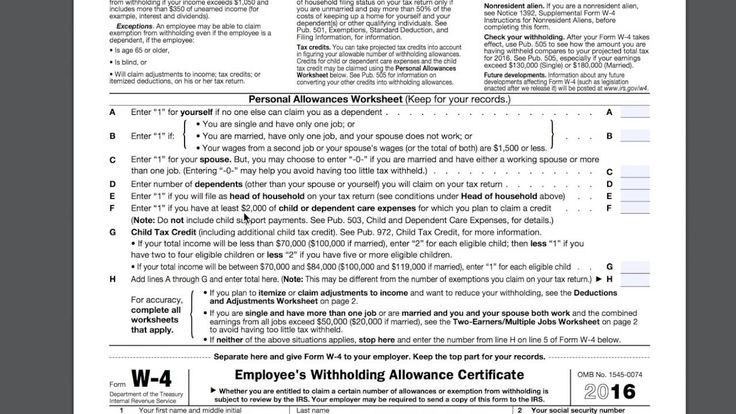

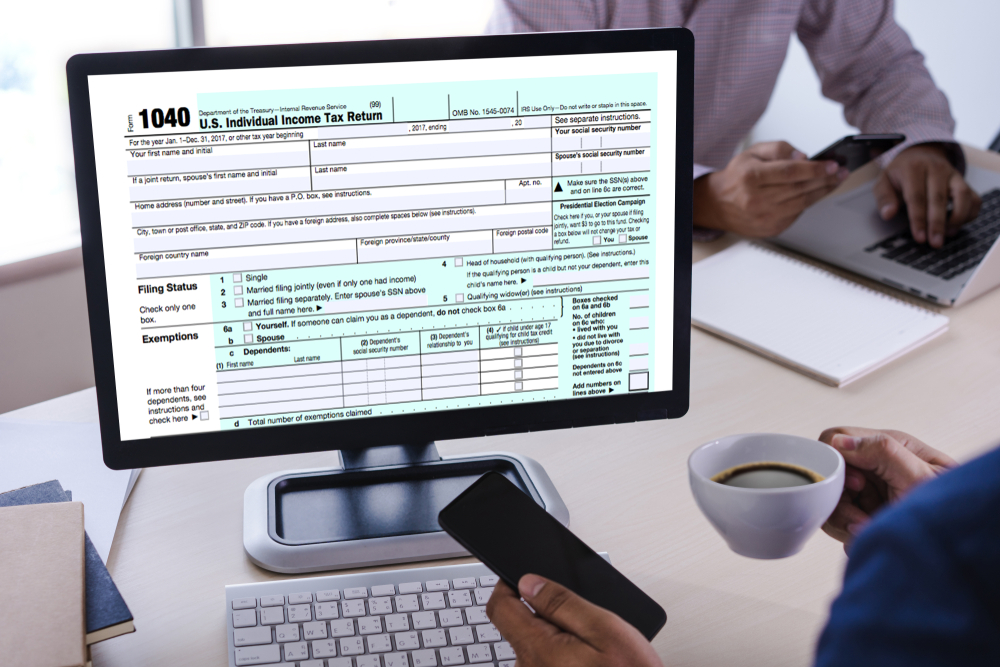

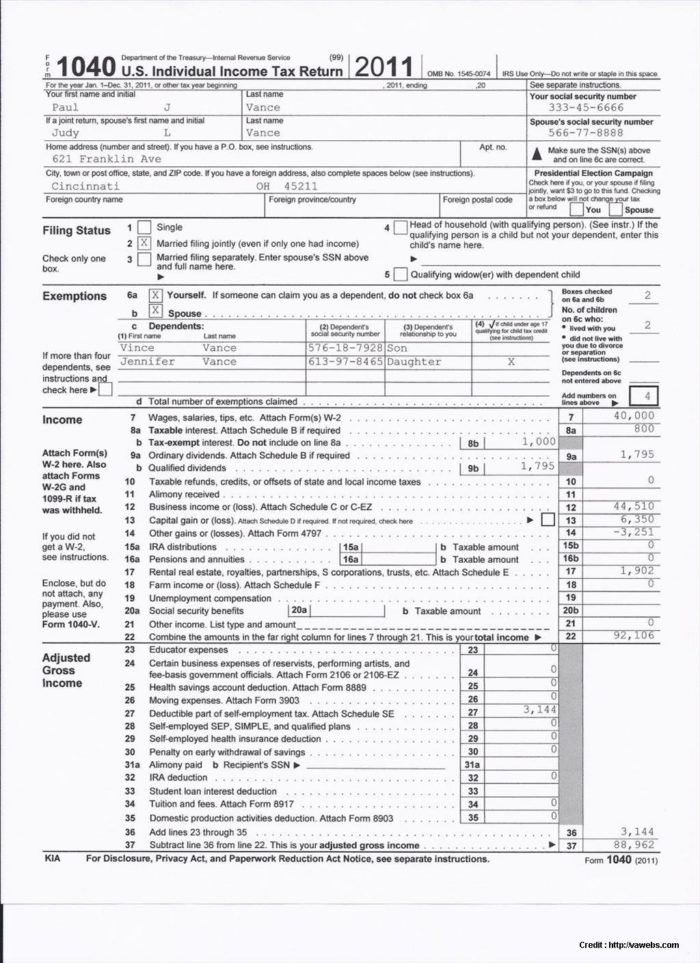

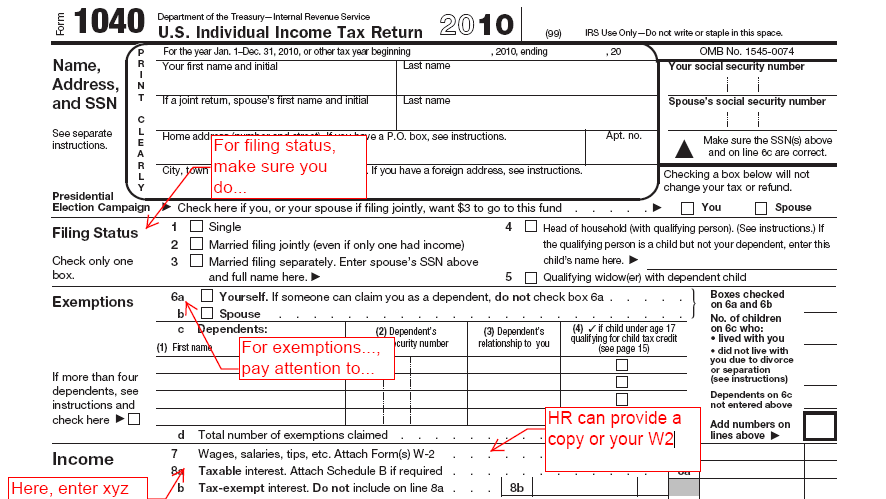

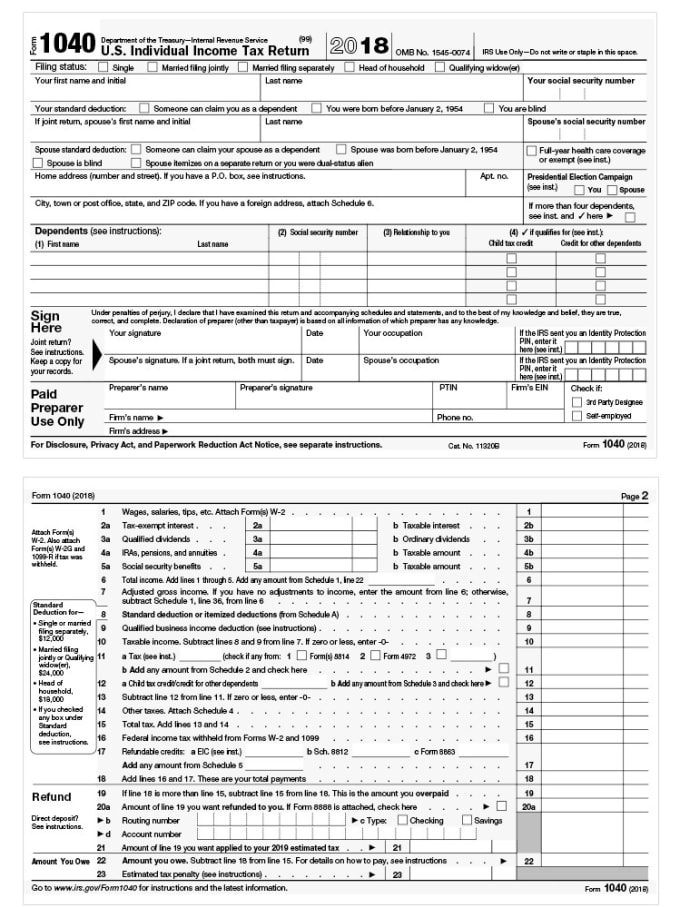

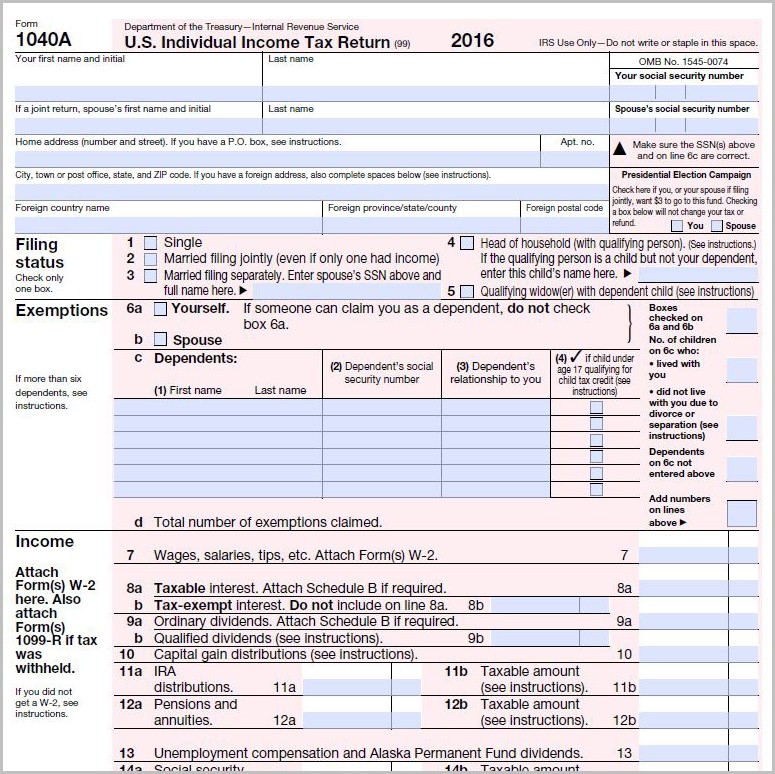

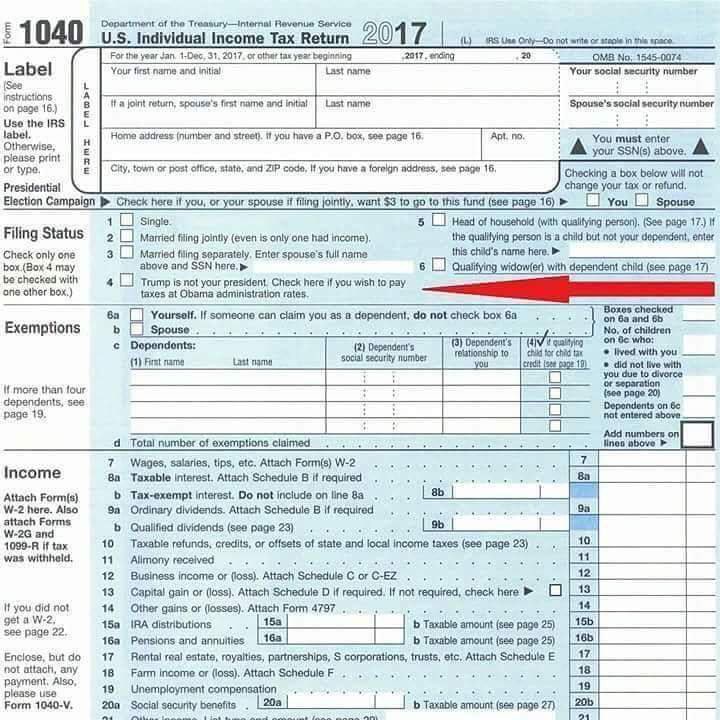

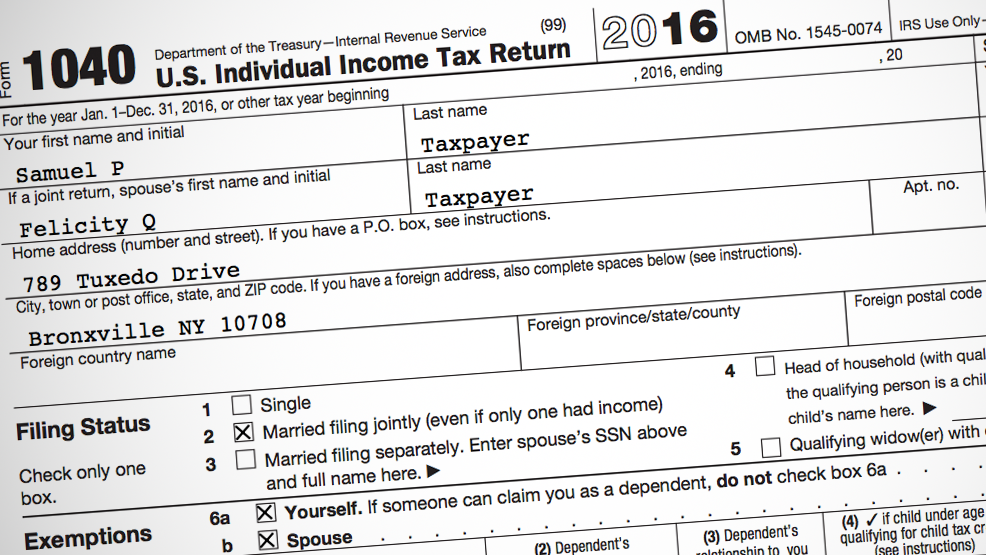

Here’s what you need to know about claiming your credit. Eligible filers can claim the CTC on Form 1040, line 12a, or on Form 1040NR, line 49. To help you determine exactly how much of the credit you qualify for, you can use the Child Tax Credit and Credit for Other Dependents Worksheet provided by the Internal Revenue Service. If you need to file a return for a year before 2018, you can only claim the credit on Forms 1040, 1040A or 1040NR.

Eligible recipients who did not receive the right amount or nothing at all should verify their information on the IRS Child Tax Credit Update Portal. For cases where the portal shows that payment has already been disbursed but not received, a trace or inquiry to locate funds can be filed by mailing or faxing Form 3911 to the agency.

There could be a payment delay depending on the disbursement method. The IRS says that it can trace payments:

The IRS says that it can trace payments:

- 5 days after the deposit date and the bank says it hasn’t received the payment

- 4 weeks after the payment is in the mail by check to a standard address

- 6 weeks after the payment is in the mail, and you have a forwarding address on file with the local post office

- 9 weeks after the payment is in the mail, and you have a foreign address

The agency updates its frequently asked questions page with information about Child Tax Credit payments and posts notifications about delays.

Other Credits for Children and DependentsThere are additional federal and state provisions that help families caring for children and other dependents.

Additional Child Tax Credit (ACTC)The additional child tax credit, which offered up to $2,000 for every qualifying child, was eliminated under the Tax Cuts and Jobs Act (TCJA) in 2018. This credit effectively gave you a refund if the CTC reduced your tax bill to less than zero. (Remember that the CTC was previously not refundable.) You should note that if you need to file a return for a tax year before 2018, you can find information for the ACTC on the Form 1040.

(Remember that the CTC was previously not refundable.) You should note that if you need to file a return for a tax year before 2018, you can find information for the ACTC on the Form 1040.

Starting with the 2018 tax year, there is an additional $500 Credit for Other Dependents (ODC). This allows you to claim non-child dependents, such as a parent, and dependents who are college students (under age 24). The eligibility requirements are very similar but you cannot claim the ODC for a dependent who qualifies for the CTC.

Child and Dependent Care Tax Credit (CDCTC)You can claim this credit if you have earned income and if you’re paying someone else to care for a dependent. Unlike the CTC, which you can only claim if you’re the parent or guardian of minor children, you can claim the CDCTC for aging parents and other disabled relatives. Qualifying dependents for the CDCTC include the following:

- Children who are 12 or younger at the end of the tax year

- Dependent adult family members or spouses who are not able to care for themselves due to mental or physical impairments, unless they had gross income of $4,300 or

more

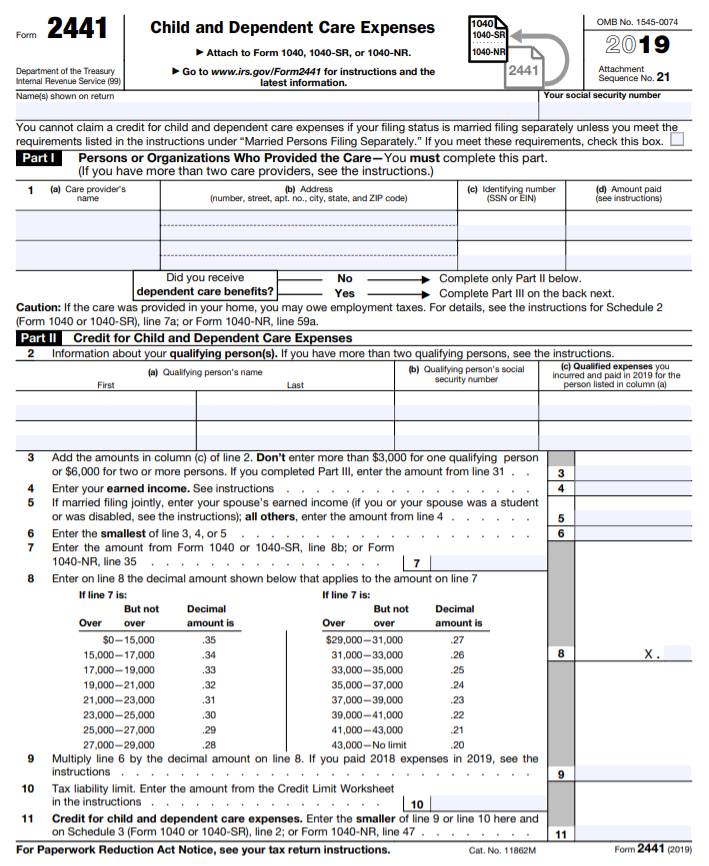

With the CDCTC, you can claim a credit from 35% to 50% of qualified care expenses for tax year 2021 (which you file in 2022). The exact percentage that you are eligible to deduct depends on your income level. The maximum amount of care expenses to which you can apply the credit is $8,000 in 2021 (up from $3,000 in 2020) if you have one dependent and $16,000 (up from $6,000) if you have more than one dependent. That means 35% of the credit is $2,800 ($1,050 in 2020) with one dependent and $5,600 ($2,100 in 2020) with multiple. The CDCTC is non-refundable. According to the IRS, expenses that qualify for the CDCTC include money that you paid “for household services and care of the qualifying person while you worked or looked for work.” Child support payments do not qualify. To claim the CDCTC, you need to fill out Form 2441.

The exact percentage that you are eligible to deduct depends on your income level. The maximum amount of care expenses to which you can apply the credit is $8,000 in 2021 (up from $3,000 in 2020) if you have one dependent and $16,000 (up from $6,000) if you have more than one dependent. That means 35% of the credit is $2,800 ($1,050 in 2020) with one dependent and $5,600 ($2,100 in 2020) with multiple. The CDCTC is non-refundable. According to the IRS, expenses that qualify for the CDCTC include money that you paid “for household services and care of the qualifying person while you worked or looked for work.” Child support payments do not qualify. To claim the CDCTC, you need to fill out Form 2441.

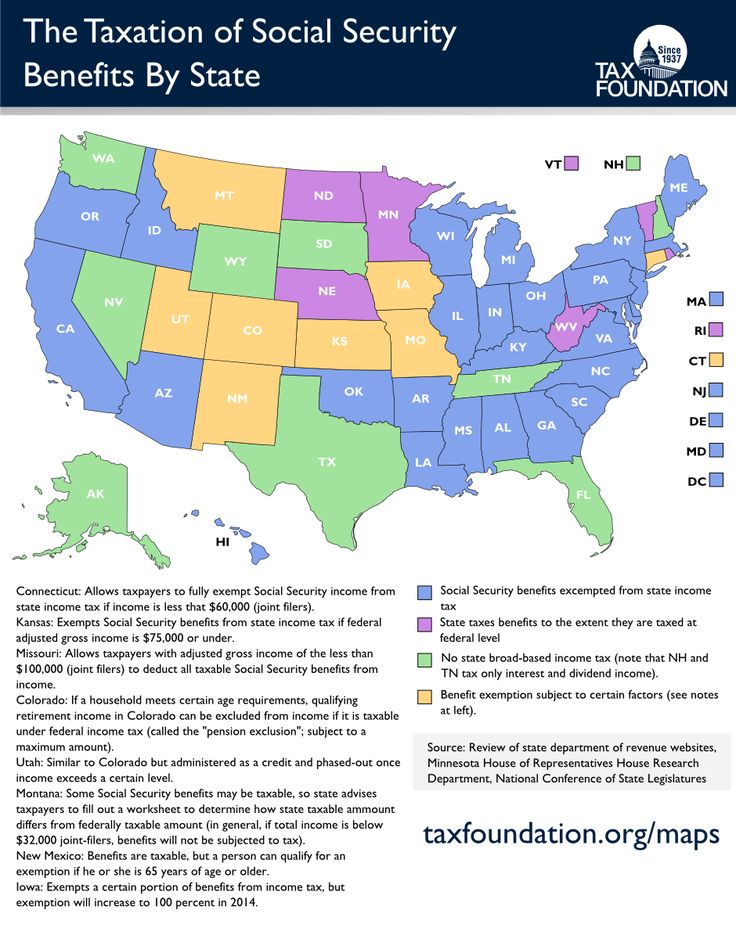

Some states offer a complementary state-level CTC and/or CDCTC that matches part or all of the federal credit. In some states, the credits are refundable and in other states they are not. This state-by-state guide breaks down which states offer their own Earned Income Tax Credit, CTC or CDCTC.

The IRS offers child tax credits to help parents and guardians offset some of the costs of raising a family. If you have a dependent who isn’t your direct child, you may also be eligible to claim a credit. And because some child tax credits are refundable, you might even make some money in the end.

Remember that the information surrounding child tax credits can change each year. In turn, it’s important to keep up on the current laws each tax year so you know what to expect.

Tips for Saving on Your Taxes- A financial advisor can help you optimize your tax strategy for your family’s needs. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- To make sure you don’t miss a credit or deduction that you qualify for, use a good tax software. SmartAsset evaluated common tax filing services to find the best online tax software for your specific situation.

Photo credit: ©iStock.com/Christopher Futcher, ©iStock.com/gruizza, ©iStock.com/DragonImages

Amelia Josephson Amelia Josephson is a writer passionate about covering financial literacy topics. Her areas of expertise include retirement and home buying. Amelia's work has appeared across the web, including on AOL, CBS News and The Simple Dollar. She holds degrees from Columbia and Oxford. Originally from Alaska, Amelia now calls Brooklyn home.

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6).

If they signed up by July:

If they signed up by July: - Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child and dependent care tax credits

You are eligible for child and dependent care tax credits if you had child or dependent care expenses. If you claim this tax credit when you file your tax return, you can reduce the taxes you pay and potentially increase your refund.

If you claim this tax credit when you file your tax return, you can reduce the taxes you pay and potentially increase your refund.

- File your 2021 federal and New York State tax returns by April 18, 2022 to apply for tax credits.

- In 2021, this tax deduction can reach:

- $4,000 per dependent; or

- $8,000 for two or more dependents.

- You can apply for tax credits if you have had work expenses. This is the cost of caring for a dependent that made it possible for you to work or look for work.

- For example, you paid a person or organization to look after your child.

Who is eligible

You are eligible for child and dependent care tax deductions if you can answer yes to all of the following questions:

- Do you pay any person or organization to care for a dependent so that you (and your spouse if you are filing jointly) can work or look for work? Eligible Dependents:

- child under the age of 13 at the time of receiving care; or

- spouse or dependent who is unable to care for themselves due to a physical or mental condition.

- Did the dependent live with you for more than six months in the tax year?

- Do you (and your spouse, if filing jointly) have earned income? This may be income in the form of wages, salaries, tips or other taxable funds, or income from self-employment.

- Do you have one of the following tax statuses: single, married family member (joint filing), head of household, or eligible widow/qualified widower with dependent child?

- If you are married, do you and your spouse work outside the home?

- Or does one of you work outside the home while the other is a full-time student, has a disability or is looking for a job?

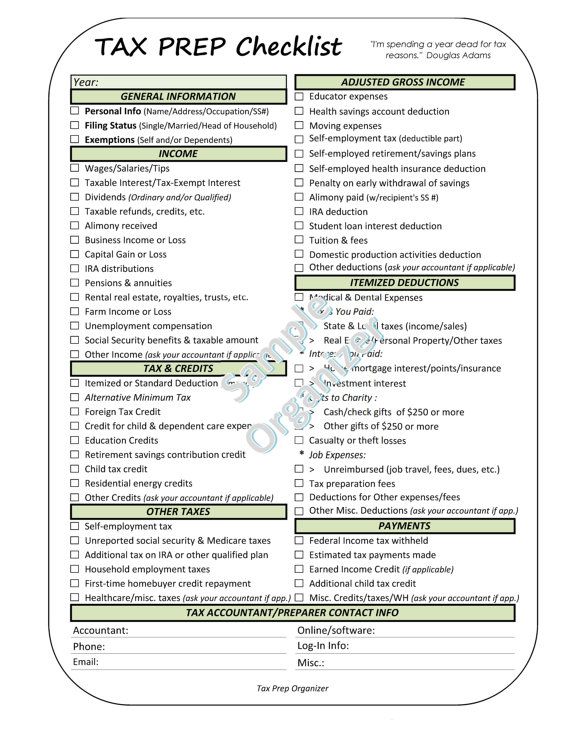

What you need to apply

To claim tax credits, you must prove the following for each person on your tax return: IDNYC, passport or certificate of naturalization.

How to apply

When you file your return, you will need the following forms:

- Dependency Expenses Form: Form No. 2441.

- US resident income tax return: Form 1040 or US resident income tax return: Form 1040NR.

If your 2021 income was less than $72,000, you can file your tax return for free with the New York City Free Tax Return Service. IRS Certified Volunteer Income Tax Assistance (VITA)/Tax Counseling for the Elderly (TCE) Volunteer Consultants will provide you with the assistance you need.

- Virtual declaration preparation. An advisor will help you file your tax return in a 60-90 minute virtual call.

- Self-preparation of the declaration. Complete your own tax return.

For help, you can contact the consultant by phone or e-mail.

For help, you can contact the consultant by phone or e-mail. - Service for receiving documents. Leave your tax documents and collect your completed tax return.

- In person. You can file your tax return in person at one of the nearest tax filing offices free of charge.

How to get help

Visit websites

Detailed information on the 2021 Child and Dependent Care Tax Credits can be found on the IRS website.

Learn more about other tax credits at the NYC Department of Consumer and Worker Protection.

Immigrants can make an appointment with ActionNYC Service Specialists for assistance.

Find VITA or TCE

Call 800-906-9887 for the nearest Income Tax Assistance Program (VITA) or Tax Advice for the Elderly (TCE) location.

Call 311

Ask for help filing your tax return.

Other Money and expenses Programs

Money and expenses

Affordable Connectivity Program (ACP)

Federal Communications Commission (FCC)

Monthly discount on internet services

Get up to $30 monthly off internet service and up to $100 off a laptop, tablet or computer.

Money and expenses All

See all programs

updated April 7, 2022

Tax deductions and discounts provided for by the tax legislation of Belgium

9 K. Demeer,

Lawyer, Nautadutilh, Belessel (Belgium)

The purpose of this article is the purpose of this article a brief overview of the tax deductions and reductions provided by Belgian law for individuals and legal entities. At the same time, only essential characteristics of the provisions of the legislation are given so that Russian readers can compare them with the relevant norms of Russian tax legislation

Personal income tax

As a general rule, the taxable income of a non-resident individual is subject to Belgian tax at a rate of 25 to 50% (for income over 32,860 euros [footnote 1] ) as well as local tax (at a rate of about 6%). With the exception of tax deductions granted on an individual basis (personal deductions), general deductions are made from the amount of the maximum possible income of a certain category of people, that is, the tax credit is calculated using the highest marginal rate applied to the income of the taxpayer. When calculating the tax, the taxpayer's expenses are taken into account.

With the exception of tax deductions granted on an individual basis (personal deductions), general deductions are made from the amount of the maximum possible income of a certain category of people, that is, the tax credit is calculated using the highest marginal rate applied to the income of the taxpayer. When calculating the tax, the taxpayer's expenses are taken into account.

In Belgian law, tax deductions can be divided into the following types.

Personal deductions. Under Belgian law, each taxpayer is entitled to a tax-free amount of €6,150, increased by €1,310, €3,370 or €7,540 depending on whether one, two, or three children are dependent on the taxpayer. This also applies to disabled persons.

Deductible for tax purposes is 80% of the amounts paid in favor of persons who must be taken care of by the taxpayer in accordance with the obligations stipulated by the Belgian Civil or Judicial Codes. But the same amount (80%) is taxed at their recipient.

The amounts paid by the taxpayer to the respective child care centers (not more than 11.20 euros per day) also reduce the taxable base.

Purchase and sale of real estate. Expenses for the acquisition of one's own dwelling (capital return, interest payments, life insurance premiums) are deductible for tax purposes, provided that the acquired dwelling is the taxpayer's only property and that the lending bank holds a mortgage on said property. The deduction is limited to 1 990 euros over the entire loan term, with an increase of 660 euros in the first ten years.

The proceeds from the sale of real estate objects are not taxable, provided they are owned for more than five years after its creation (construction) and eight years after their acquisition. Income received from the sale of one's own housing is not taxed, regardless of the time spent in the property.

Expenses related to the economic activities of the taxpayer. Expenses that a taxpayer incurs in connection with the acquisition or retention of taxable income (for example, expenses for restaurants and personal transportation) are tax deductible, subject to established regulatory limits. It is worth noting that if the tax authority recognized the professional nature of the expenses, it no longer has the right to make a decision on their necessity.

Expenses that a taxpayer incurs in connection with the acquisition or retention of taxable income (for example, expenses for restaurants and personal transportation) are tax deductible, subject to established regulatory limits. It is worth noting that if the tax authority recognized the professional nature of the expenses, it no longer has the right to make a decision on their necessity.

Capital gains from sale of shares and stock options. Income from the sale of shares is not taxable unless the capital gain is the result of speculation or the professional activities of the taxpayer.

An obligation to pay tax arises if a Belgian resident who owns (or has owned during the previous five years) alone or jointly with other persons (their list is provided by law - these are spouses, children) more than 25% of the company's share, sells him shares in a foreign ("non-Belgian") company. In accordance with the jurisprudence of the Court of Justice of the European Union, a “non-Belgian” company is considered to be a company formed outside the European Union.

In addition, capital gains are taxable in the hands of the original seller if the buyer subsequently sells the purchased shares to a "non-Belgian" company within twelve months of the first transaction.

Share options are primarily taxed on the lump sum grant. Capital gains resulting from the exercise of such options are not taxable.

Other deductions include interest on savings accounts, which are tax-free up to a maximum of €1,660 per annum, and donations, provided they are paid to beneficiaries directly designated by the monarch and in a certain amount (from 30 to 331,200 euros and not exceeding 10% of taxable income).

Other cases of tax reduction. Mandatory pension contributions are included in social security contributions (“Pillar Pension Benefits”). Most employers pay pension contributions to ancillary pension plans (“second pillar pensions”). Such payments from employees are not taxed. In addition, employees are entitled to a tax reduction (between 30 and 40%) regarding contributions to "third pillar pension plans", but not exceeding 830 euros per year.

Individual life insurance premiums also reduce the taxable base by an amount equal to 30-40% of the premium. The maximum possible amount is fixed at 1,990 euros per year.

The employer has the right to reimburse employees for the costs of public transport used to travel to work. At the same time, payments in the amount of 0.15 euros per kilometer are not taxed if the employee uses a bicycle to travel to the place of work. A tax reduction of 3 or even 15% of the purchase price of a car is granted if the carbon dioxide emissions from the use of this car are between 105 and 115 g/km or less than 105 g respectively (800 euros or 4,270 euros maximum).

The government has also established so-called "green" investments - tax deductions in the amount of investments in the residential sector. We are talking about the amounts spent by taxpayers on the purchase of new eco-friendly window frames and glass, insulation, solar panels, boilers, etc. The tax reduction in this case is 40% of the amount spent, but it should not exceed 6,525 euros per year .

In addition, in recent years Belgian tax legislation has been significantly influenced by the jurisprudence of the EU Court of Justice, which obliged to provide tax deductions and various kinds of tax reductions to citizens of other EU member states. Some of this jurisprudence has already entered Belgian law, but some amendments can be expected in the near future.

Corporate income tax

As a general rule, the taxable income of a resident or non-resident company is subject to income tax at the rate of 33.99%. A reduced tax rate (starting from 24.25%) applies to small and medium-sized companies (SMEs), i.e. enterprises whose taxable income does not exceed 322,500 euros. A special tax rate of 309% applies to all payments made to undisclosed recipients (the so-called "kickback tax").

The amount of the tax liability is calculated based on the amount of profit shown in the books and financial statements of the company. The amount of profit is adjusted in accordance with tax legislation. At the same time, the amount of the tax liability is determined at the company level - Belgian law does not allow the consolidation of the tax amount of companies included in the same group.

At the same time, the amount of the tax liability is determined at the company level - Belgian law does not allow the consolidation of the tax amount of companies included in the same group.

Resident parent companies enjoy the benefit. It provides for a 95% deduction on dividends received from subsidiaries in Belgium or abroad. But there are certain conditions for receiving benefits: at the time of payment or announcement of the payment of dividends, at least 10% of the shares of a subsidiary must be in the hands of the parent company. In this case, the value of the shares must be above 1,200,000 euros. If the value of the shares is less, then the holding must be continuous for one year. Another condition is that according to Belgian accounting standards, shares must be recognized as fixed financial assets.

Special rules apply to financial companies, banks and similar organizations.

Capital gains from the sale of shares in a subsidiary are not taxable.

In order to encourage equity financing, Belgian companies are entitled to a special deduction (following the abolition of the capital contribution tax in 2006). This deduction is calculated by applying the 10-year government bond rate (4.307%) to the adjusted capital of such companies. The use of this deduction provides a wide range of opportunities for tax planning and is therefore widely used by companies. At the same time, the tax authorities have already published an appropriate commentary (dated April 3, 2008), which contains rules aimed at preventing possible abuses.

Belgian law allows for a special tax regime for international companies headquartered in Belgium (“focal points”). The coordinating center carries out auxiliary or preparatory (mainly financial) activities of the group for the benefit of other members of the group. The taxable income of such a center is calculated on the basis of actual expenses incurred and operating costs.

However, the rules on focal points approved in 2003 by the Commission of the European Union were reviewed by the Court of Justice in 2006, and by 2010 the above regime will no longer apply. In this regard, Belgium has adopted new measures: the introduction of notional interest deductions, as well as favorable conditions for withholding tax. Such benefits apply not only to focal points, but to all companies.

In addition to those discussed, Belgian tax law also provides for the following separate deductions . Since tax year 2008, Belgian resident companies and Belgian permanent establishments of non-resident companies are entitled to a tax deduction of 80% of patent income. In addition to this deduction, the effective tax rate applicable to such income is 6.8% (ie 20% of the total rate of 33.99%).

Belgian companies can either produce proprietary products themselves or license them to a third party. Belgian resident companies and Belgian permanent establishments of non-resident companies can invest in audiovisual production up to a maximum of €500,000.