How long can you claim dependant child on taxes

How Long Do Kids Stay Dependents?

Once you are a parent, you never stop being a parent. You stayed up with your kids when they had the flu, helped them study for the ACT, cheered them on at their graduation. You have been there for their highs, lows, and everything in between. You will continue to care, love, and support your children for the rest of your life.

But will there ever be a time they can fly away from the nest?

According to the federal government, the answer is yes!

From the time your children were born, you claimed them as dependents on your federal and state taxes, which has saved you money on your taxes over the years. The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

In the Nest – How Long You Can Claim

The federal government allows you to claim dependent children until they are 19. This age limit is extended to 24 if they attend college. If your child is over 24 but not earning much income, they can be claimed as a qualifying relative if they meet the income limits and/or if they are permanently disabled. It is important to know that there is no age limit if your child is permanently disabled.

Other factors that contribute to your ability to claim your children as dependents are:

- Amount of time your children live with you

- Your child must live with you for at least 6 months before you can claim them as a dependent.

- Financial support

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- Marital Status

- If you are not married and the child lived with you and the other parent half of the time, the person with the highest adjusted gross income will often take the deduction. This, however, can be negotiated.

- If you pay child support but the child lives with you for less than half of the year, you cannot claim the child as a dependent unless you have a signed Form 8332.

Still unclear if you can claim your child as a dependent? The IRS has a questionnaire here you can use to find out. Simply answer a few questions and the IRS will tell you whether or not you are eligible to claim a person as your dependent on your taxes.

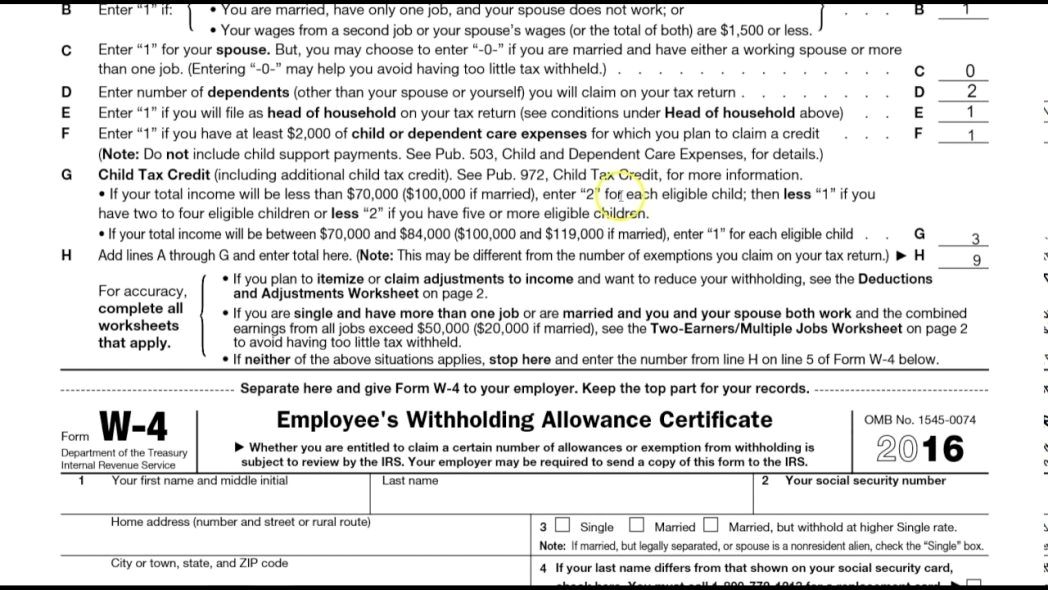

For many families, the longer they are able to claim their children as dependents the better it will be. But the new Tax Cuts and Job Act has changed the way parents claim dependents. Prior to 2018, parents were able to receive a personal exemption that reduced taxable income. For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

Out of the Nest

Since the exemption for dependents is suspended until 2025, parents have to look for other tax credits and deductions that can help them on their tax bill. Here are a couple of credits to keep an eye on.

Here are a couple of credits to keep an eye on.

This is just one of the many examples of how our comprehensive tax planning creates value for our clients. See other important tax planning topics on our website, here.

- Earned Income Credit

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have. $6,935 is the maximum earned income credit available for the 2022 tax year for three children and parents earning no more than $59,187. For two children the maximum credit is $6,164 with an income threshold of $55,529. $3,733 is the maximum credit for one child with the parents’ income being less than $49,622. Remember, for any credit, your child must pass the qualifying child test.

- Child Tax Credit

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased. Households qualify for the full amount of the Child Tax Credit for tax year 2022 for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000, or $400,000 if filing as a married couple.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased. Households qualify for the full amount of the Child Tax Credit for tax year 2022 for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000, or $400,000 if filing as a married couple. - If your child does not qualify for the tax credit, the new tax code does offer a $500 benefit per child. This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

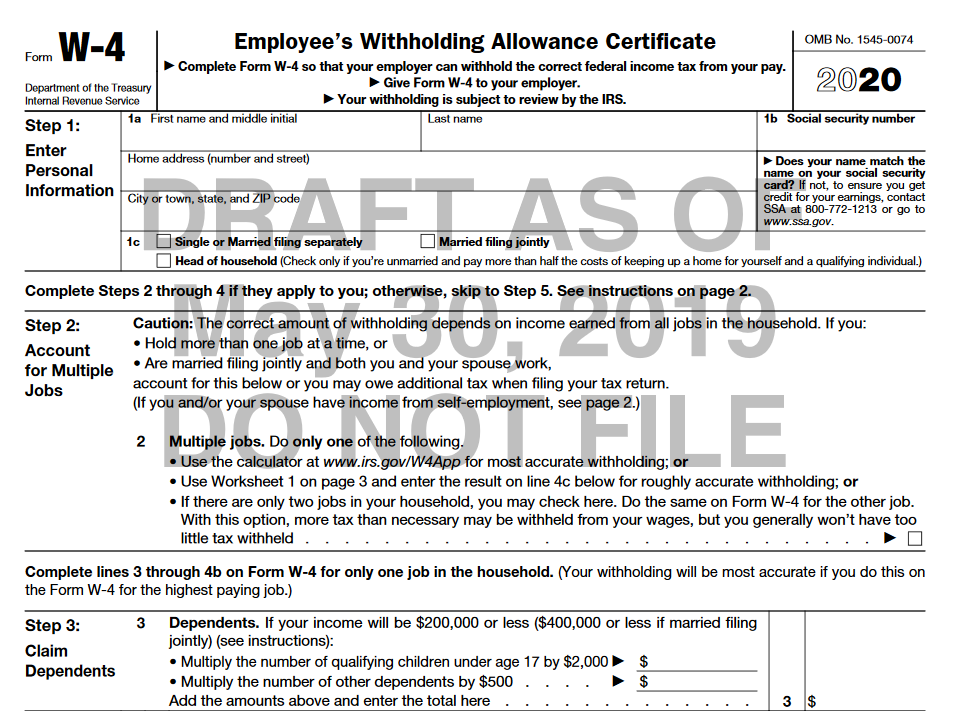

The new Tax Cuts and Jobs Act has changed the way parents will claim dependents in 2018 through 2025. Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Related Video – Claiming College Students as Dependents

If you want personal advice on how to claim your dependents, contact us!

Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Ready to Get Started?

Rules for Claiming Dependents on Taxes

Editor’s Note: Relationship changes and job loss can all affect who is living in your house and, therefore, claiming dependents on your tax return. Here are the most important rules that you need to know about claiming dependents before preparing your taxes this year.

Few things are more important than family. These are the people we share special memories with…the people we rely on when we hit tough spots.

However, sometimes you are the family member who helps others out. Maybe your grandmother couldn’t live safely on her own anymore, so she moved in with you this year. Maybe your uncle lost his job so he’s been staying with you.

This is what family is about – helping each other, regardless of the burden. But the extra expense of additional family members can put a financial strain on you. The rising costs of food, electricity, gas, and water can all add up quickly.

Special Rules for Claiming Dependents on Tax Returns

There are a few rules to help you navigate claiming dependents on tax returns – and decide who you should and shouldn’t claim as tax dependents:

The DOs: Who Can I Claim as a Dependent?

You can only claim dependents who are either a qualifying child or a qualifying relative.

DO claim all qualifying children that were born or adopted within the tax year. Even if your child was born on December 31, your child may be able to be claimed as a dependent on your taxes. To qualify as a dependent, the child must:

To qualify as a dependent, the child must:

- Be under age 19, a full-time student under age 24 or permanently and totally disabled;

- Not provide more than one-half of the child’s own total support; and

- Live with you for more than half of the year.

DO claim certain family members (such as parents, grandparents, aunts or uncles, nieces or nephews) as qualifying relatives. You should claim certain family members only if:

- You provided more than half of the person’s total support for the year;

- They aren’t yours or another taxpayer’s qualifying child; and

- The relative’s gross income is less than the personal exemption amount (which is $4,200 for 2019).

All dependents must be a United States citizen, resident alien of the United States, or resident of Mexico or Canada (with certain adopted children as an exception) and can’t file a joint return (unless it’s to receive a claim of refund of taxes withheld or estimated taxes paid). You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

The DON’Ts: Rules for Claiming a Dependent

DON’T claim a child that has lived with you for less than six months of the year. Unless the child was born within the tax year, the child must have lived with you at least six months of the tax year to fall under the qualifying child rules. If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

DON’T attempt to claim a child for whom you have paid child support, but lives with you for less than half the year unless you have a Form 8332 signed by the custodial parent.

Help is at Your Fingertips

For additional assistance with the tax rules for claiming a dependent, H&R Block has your back.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you navigate the rules for claiming a dependent family member on your taxes.

Child and Dependent Care Tax Credit (CDCC)

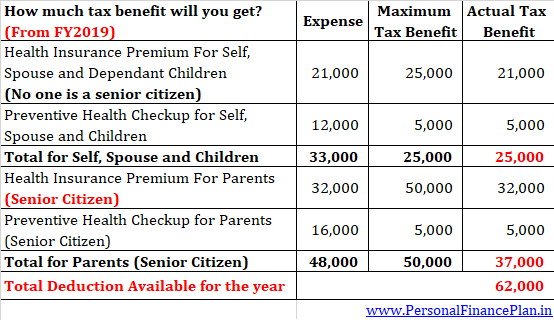

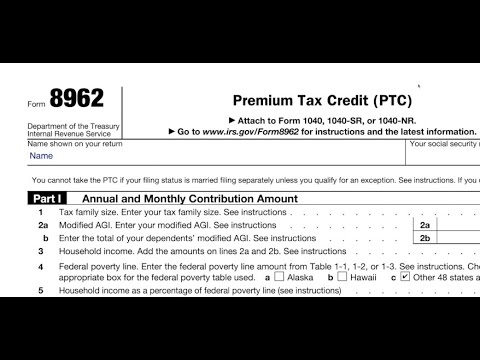

You are eligible for the Child and Dependent Care Tax Credit if you had expenses to care for children or adult dependents. In tax year 2022, taxpayers may qualify for a refund (tax deduction) of up to $3,000 for care expenses for one eligible person and up to $6,000 for care expenses for two or more eligible persons. You can be reimbursed for up to 50% of child or dependent care costs.

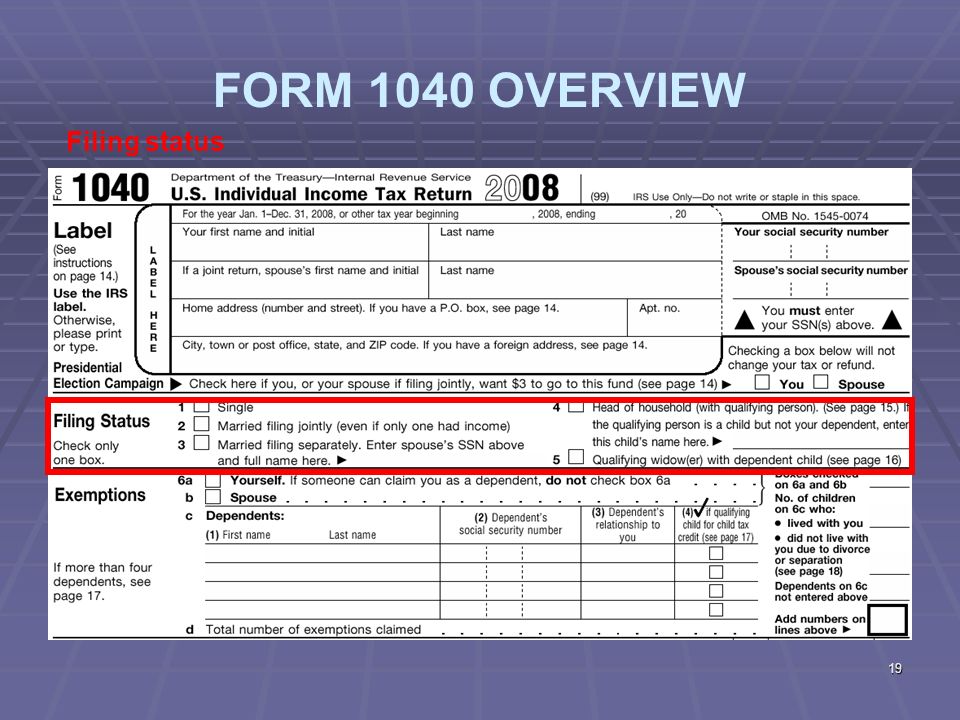

- File your 2022 federal and New York State tax returns by April 18, 2023 to claim a tax credit.

- Enclose Form 2441 with the package of documents, as well as the income tax return of an individual living in the United States (Form 1040) or the income tax return of a non-resident living in the United States (Form 1040NR).

- Eligible expenses for the tax credit program include non-reimbursable out-of-pocket expenses for caring for an eligible child or children that you incur while you were working or looking for work.

- This includes the cost of child care outside the home, such as at a day care center, or at your home, such as with a nanny.

- If you claim this tax credit when you file your tax return, you can reduce the taxes you pay and potentially increase your refund.

Who is eligible

You are eligible for the child and dependent care tax credit if you can answer yes to all of the following questions .

- Have you paid any person or organization to care for a dependent so that you (and your spouse if you are filing jointly) can work or look for work? Eligible Dependents:

- child under the age of 13 at the time of receiving care;

- spouse or dependent who is unable to care for themselves due to a physical or mental condition.

- Did the dependent live with you for more than six months in the tax year?

- Did you (and your spouse, if filing jointly) have earned income in the tax year? This may be income in the form of wages, salaries, tips or other taxable funds, or income from self-employment.

- Do you have one of the following tax statuses: single, married family member (joint filing), head of household, or eligible widow/qualified widower with dependent child?

- If you are married, do you and your spouse work outside the home?

- Or does one of you work outside the home while the other is a full-time student, has a disability or is looking for a job?

What you need to apply

To claim benefits, for all people listed on your tax return, you must show the following: passport or certificate of naturalization.

How to apply

When you file your return, you will need the following forms:

- Dependent Maintenance Expenses Form (Form 2441);

- income tax return of an individual residing in the United States (Form 1040); or Non-U.S. Resident Income Tax Return (Form 1040NR).

You must provide details of any person or organization that provided care for your eligible child or children, including:

- the provider's name and address;

- Taxpayer Identification Number (TIN) or Social Security Number (SSN).

Applicants must use the IRS Form W-10 to request this required information.

Applicants must use the IRS Form W-10 to request this required information.

If your household income was $80,000 or less in 2022 OR if you are filing an individual return and your income was $56,000 or less in 2022, you can file your tax return free of charge using the Center for Free NYC Free Tax Prep . IRS-certified VITA/TCE Volunteer Counselors can help you apply online or on your behalf.

How to get help

- Detailed information on the 2022 Child and Dependent Care Tax Credit can be found on the IRS website in the FAQ section.

- Learn more about the tax credits you can claim.

- Call 800-906-9887 for the nearest Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) location.

Other Money and expenses Programs

Money and expenses

New York City Free Tax Prep Center

NYC Department of Consumer and Worker Protection (DCWP)

Free Tax Prep Services

If your household income was $80,000 or less in 2022 OR if you are filing an individual return and your income was $56,000 or less in 2022, you can file your tax return free of charge using the Free Prep Assistance Center New York City Free Tax Prep.

Money and expenses Teenager young adult age Guardian

See all programs

updated February 9, 2023

Tuition tax deduction: how to get, documents, how much

Trends

TV channel

Pro

Investments

Events

RBC+

New economy

Trends

Real estate

Sport

Style

National projects

City

Crypto

Debating club

Research

Credit ratings

Franchises

Newspaper

Special projects St. Petersburg

Petersburg

Conferences St. Petersburg

Special projects

Checking counterparties

RBC Library

Podcasts

ESG index

Policy

Economy

Business

Technology and media

Finance

RBC CompanyRBC Life

RBC Trends

Photo: Helloquence / Unsplash

We explain how much, how and who can legally get back money for education from the state budget

1

How much is the tax deduction for tuition?

Tuition tax deduction is a refund of part of the education fee, which is reimbursed by the state in the amount of 13% of the cost, but not more than ₽50 thousand if the parents pay for the child's education and not more than ₽120 thousand if they pay themselves or for the education of a member families. In 2023, the State Duma adopted a law to increase the limits on the amount of tax deductions, if the Federation Council and the president pass the law, then it will be possible to reimburse up to ₽110 thousand for the education / treatment of a child and up to ₽150 thousand for yourself or a family member. This is one of the types of social tax deductions. They can also be obtained for treatment, the purchase of medicines, sports and charity. According to Russian law, only residents of the Russian Federation who pay personal income tax can apply for it. The statute of limitations for issuing a refund is three years.

In 2023, the State Duma adopted a law to increase the limits on the amount of tax deductions, if the Federation Council and the president pass the law, then it will be possible to reimburse up to ₽110 thousand for the education / treatment of a child and up to ₽150 thousand for yourself or a family member. This is one of the types of social tax deductions. They can also be obtained for treatment, the purchase of medicines, sports and charity. According to Russian law, only residents of the Russian Federation who pay personal income tax can apply for it. The statute of limitations for issuing a refund is three years.

2

How many times can I claim a tuition tax deduction?

You can receive it more than once, the number of applications is not limited.

3

For how many years can I get a tuition tax credit?

The limitation period for issuing a refund is three years, regardless of whether the training is ongoing or has already been completed. That is, in the current year you can get a deduction for 2020-2022.

That is, in the current year you can get a deduction for 2020-2022.

4

When do I apply for the tuition tax deduction?

It is the date of payment for the semester that is important to receive it. Important: you can file a declaration only in the year following the year of payment (in 2023 you can apply for 2022, etc.)

5

My grandmother paid for my studies. Can she get a deduction?

Social tax deduction can be issued by the person who paid:

- own education,

- study of your child (children),

- study of the ward,

- brother or sister training.

According to the law, grandparents, aunts and uncles, even officially working and paying for the education of their grandchildren and nephews, will not receive the deduction (if they are not the official guardians of the child). The same applies to non-working pensioners and unemployed students, since they do not have a salary and tax deductions from it. They can claim compensation only if they receive other income taxed at 13%, for example, from renting out housing.

They can claim compensation only if they receive other income taxed at 13%, for example, from renting out housing.

Individual entrepreneurs who pay taxes under the simplified scheme cannot claim compensation either. The same applies to those who paid for their studies at the expense of the employer or maternity capital.

6

Are there any particularities of getting a tuition deduction?

When calculating the amount of this social benefit, there is an upper limit on annual spending on paying for your own education - now it is ₽120 thousand per year, therefore, the maximum amount that the state can return to you is ₽15.6 thousand. But in 2023, the limit may raise up to ₽150 thousand, then the maximum they can return to you is ₽195 thousand. The form can be any: evening, day, correspondence. It can be higher, secondary, additional education, driving school, short-term courses, etc. You can get a deduction even while studying abroad. The main thing is that the institution has a license. If you are studying with a legal entity or individual entrepreneur whose educational services are only one of the areas of activity, you also have the right to count on a deduction.

If you are studying with a legal entity or individual entrepreneur whose educational services are only one of the areas of activity, you also have the right to count on a deduction.

7

Can I get a tax deduction for studying at a driving school?

Yes. It can be higher, secondary, additional education, driving school, short-term courses, etc. You can get a deduction even while studying abroad. The main thing is that the institution has a license. If you are studying with a legal entity or individual entrepreneur whose educational services are only one of the areas of activity, you also have the right to count on a deduction.

8

What do you need to know to get a tax deduction for the education of children, brothers and sisters?

The amount of expenses for the education of one's or a foster child is also limited and amounts to ₽50 thousand per year. Thus, the amount of the refund will not exceed ₽6.5 thousand. According to the Tax Code, even if both parents pay for a school or university, the threshold remains unchanged. The upper limit of spending on the study of a brother and sister is higher and amounts to ₽120 thousand per year, as is the case with their own education. In 2023, the limits may increase. But a refund is possible only if it was a full-time form and before reaching the age of 24.

The upper limit of spending on the study of a brother and sister is higher and amounts to ₽120 thousand per year, as is the case with their own education. In 2023, the limits may increase. But a refund is possible only if it was a full-time form and before reaching the age of 24.

You can get a 13% refund for both school and university, training courses, kindergarten, etc. (and not necessarily government). Also, for two years, there is a norm according to which you can get a tax deduction for a child’s classes with a tutor (if he works officially).

Important: the payment agreement and the payment documents themselves are best drawn up for one of the parents (it doesn’t matter for whom specifically), then there will be no problems with compensation of funds.

9

What should I do if not all documents were issued to the parent?

There are several common scenarios and options:

-

The contract for educational services is issued for the child, and one of the parents is the payer.

In this case, in order to receive a deduction, you must have with you confirming payment receipts, checks issued in the name of the parent.

In this case, in order to receive a deduction, you must have with you confirming payment receipts, checks issued in the name of the parent. -

The contract is in the name of the parent, and the name of the child is indicated in the "payment". This is the more problematic option. The Ministry of Finance in this case opposes receiving a deduction. But sometimes a power of attorney to deposit funds by a child on behalf of a parent can help.

-

All documents are issued for the child. In this case, only he can receive the deduction.

-

Tuition is paid by both the parent and the child. Then both have the right to receive the deduction, but only one of them can receive it.

- The contract is registered for one of the parents, and the second one plans to receive the deduction. This is possible, since the funds acquired by them during the marriage are joint property.

For registration, you will need to attach a marriage certificate to the rest of the documents.

For registration, you will need to attach a marriage certificate to the rest of the documents.

10

Can I get a tax deduction for the education of my wife or husband?

Not formally, but you can still get it. Let's say a wife started learning English, and her husband paid for the courses. Spouses are not mentioned in the Tax Code, which means they cannot theoretically claim a refund. But the wife can issue a deduction for her education, despite the fact that the husband is indicated in the payment documents, because their money is jointly acquired property.

11

How do I get a tuition tax deduction?

This can be done through the tax office (for the next year after payment or for the previous 3 years, that is, in 2023 you can receive a deduction for 2020-2022) or through the employer (for the current year).

12

How to get a tax deduction for education through the Federal Tax Service?

To apply to the tax office, you need:

- Prepare the necessary documents (see paragraph 14) and fill out a declaration

- Attribute everything to the tax office at the place of residence.

You can also submit a declaration online - through the taxpayer's personal account on the website of the Federal Tax Service. In this case, you will not need to visit the tax office in person and take a 2-NDFL certificate from the employer, because all the information is already contained in your personal account. The maximum period for verification of documents is three months. If the answer is yes, the funds will be transferred within a month to the specified current account.

Errors may be found in the documents, then the tax deduction will be denied. But they can be re-submitted - indicating when filling out that you are submitting a corrective declaration.

13

How do I get a tuition tax deduction through an employer?

It is easier to do this through the employer: then you will only need to receive a notification from the tax office about the right to deduct, the accounting department will take care of everything else.

To do this, you need to collect a package of documents and submit them to the Federal Tax Service. It will take about a month to check the papers. Further, the notification is referred to the accounting department at work, after which, for a certain period, personal income tax will not be withheld from the salary.

It will take about a month to check the papers. Further, the notification is referred to the accounting department at work, after which, for a certain period, personal income tax will not be withheld from the salary.

An application can be submitted through the website of the Federal Tax Service if you have a personal account. To get access to it, contact the tax office. The username and password from the State Services website are also suitable.

14

Documents for the tuition tax deduction

Usually the package of documents includes:

-

Declaration 3-NDFL for each year of study. All information about it is on the website of the FTS.

-

Certificate 2-NDFL. You can request at work (or several places of work, if you managed to change it during your studies) or also get it on the website of the Federal Tax Service.

-

Proof of relationship (birth certificates, custody papers, sibling's birth certificates) or proof of identity (passport).