How much child support and alimony will i have to pay

Alimony Calculator | Sterling Lawyers, LLC

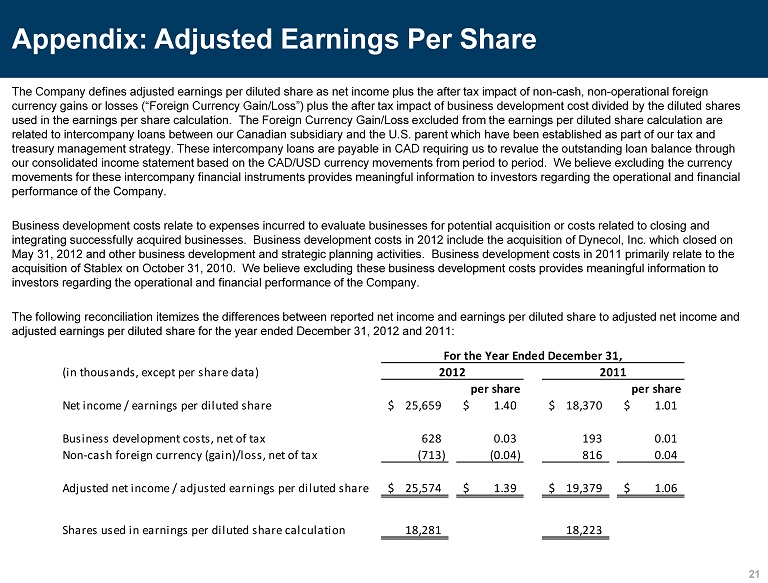

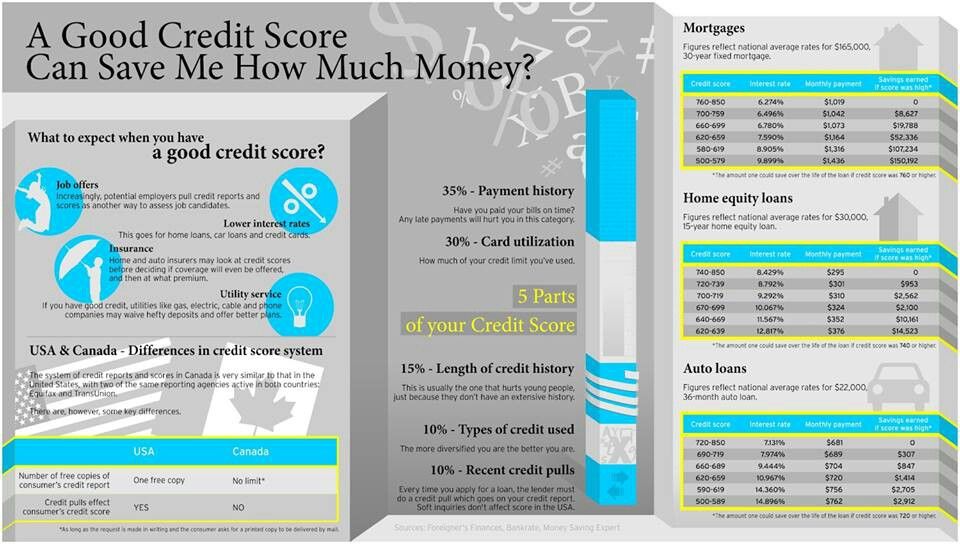

Common methods for calculating spousal support typically take up to 40% of the paying spouse's net income, which is calculated after child support. 50% of the recipient spouse's net income is then subtracted from the total if they are working. Spousal support amounts should be agreed to by both parties and can be waived by the recipient spouse.

Spousal Support (Alimony) in Divorce

When we talk about spousal maintenance, support, and alimony we are talking about the same thing. Although spousal support is not mandatory in most states, it can be mandated by a judge depending on certain conditions, in particular:

- If one spouse will face hardships without financial support

Court-ordered spousal support is enforced if there is sufficient need to maintain his or the party's standard of living. The courts recognize both parties are entitled to live at the financial level they enjoyed during marriage. It's important to keep track of alimony as there are implications to be aware of when filing taxes after divorce.

Alimony Calculators

Start Here

Start Here

Considerations

When Is Spousal Support Not Considered?

The presiding judge is unlikely to order alimony under the following conditions:

- The marriage was less than two or three years.

- Both spouses are employed and self-sufficient.

How long does Spousal Maintenance last?

The spousal support duration varies depending on the agreements in place.

Timeframes include the following:

- Unlimited or indefinite (until the death of either party).

- Until the remarriage of the recipient.

- Until a fixed end date.

Frequently Asked Questions

How is alimony calculated?

Alimony is calculated differently in different states. In general, the court looks at how much each party needs to achieve their standard of living, how much each party can/should reasonably earn, and how long a party needs to be supported.

How often is alimony awarded?

Alimony is ordered in around 10% of cases. So, alimony happens regularly but isn't a part of most cases.

How can I avoid alimony?

If alimony is on the table in your case, one way to avoid alimony is by paying lump-sum alimony. Lump-sum alimony allows you to pay in one big chunk rather than paying continuously over time. But, once alimony is ordered, there isn’t much you can do to avoid it.

How much is alimony usually?

Alimony is usually around 40% of the paying party’s income. This number is different in different states and different situations. The court also looks at how much the other party makes or could make and how much they need to maintain their standard of living.

Book My Consult

X

Call for Immediate Assistance

(888) 240-8146

or fill out the form below

Type of Matter

AnnulmentDe NovoDivorceLegal SeparationPaternityRestraining OrderPrenuptial AgreementAlimonyChild SupportCustody / PlacementProperty DivisionCollege ContributionGuardianship--ChipsCivilCriminalEmancipationEmploymentEstate Planning ImmigrationLiensOtherPersonal Injury Postnuptial AgreementReal EstateTax LawTPR/AdoptionTribal Law Tell Us More - Optional

How Judges Determine the Amount of Alimony

Find out what judges consider when deciding how much support one spouse has to pay to the other during or after divorce.

Nobody likes paying alimony. At least when you're paying child support, you can remind yourself that it's for your kids, not your ex. Long-term alimony (or spousal support, maintenance, or whatever term your state uses) is less common that it used to be. But some spouses—particularly those who've stalled their own careers while taking care of the home and children—still need the financial help, at least for a transitional period during and after divorce.

As with all issues in a divorce, you and your spouse can agree between yourselves that one of you will pay alimony or spousal support—and if so, how much and for how long. But if you can't agree, a judge will decide for you. Even when you hope to reach an agreement, it helps to know how alimony or spousal support works, so that you can negotiate wisely.

- Who Gets Alimony?

- When Do Judges Use a Formula to Calculate Spousal Support?

- What Judges Consider When Setting Alimony

- How Do Judges Determine Spouses' Needs?

- Are Savings Included in a Couple's Standard of Living?

- What Is a Spouse's Earning Capacity?

- Upper Limits on Alimony and One Judge's Informal "40% Rule"

- How Long Does Alimony Last?

- Getting Help With Alimony

Who Gets Alimony?

Before judges get to the point of figuring out how much the alimony checks will be, they need to determine who is eligible to get the payments, and what type of support is appropriate.

Although some people still believe that only wives get alimony, the right to this financial support doesn't depend on gender. It also doesn't depend on who filed for divorce. Either spouse may request alimony in the divorce petition (or complaint) or the response (answer) to the initial divorce papers. Then, unless the couple reaches an agreement on the issue, the judge has to decide whether to grant that request.

In the vast majority of U.S. states, eligibility for alimony is based on:

- need—whether one spouse needs financial support, and

- ability to pay—whether the other spouse can afford pay that support.

But some states have very specific—and strict—requirements that must be met before a judge may award any alimony. Also, the qualification requirements are often different for the various types of spousal support, such as:

- temporary alimony (or alimony "pendente lite") after a divorce case has started but before the judge issues the final divorce judgment or decree

- rehabilitative spousal support (sometimes called transitional support, short-term maintenance, or similar terms), which is meant to help a spouse make the transition toward becoming self-supporting, and

- "permanent" alimony or maintenance in the rare cases when a spouse can't be expected ever to become self-supporting and so needs long-term periodic payments.

(Learn more about how alimony works in general, as well as the specific types and requirements for spousal support in your state.)

When Do Judges Use a Formula to Calculate Spousal Support?

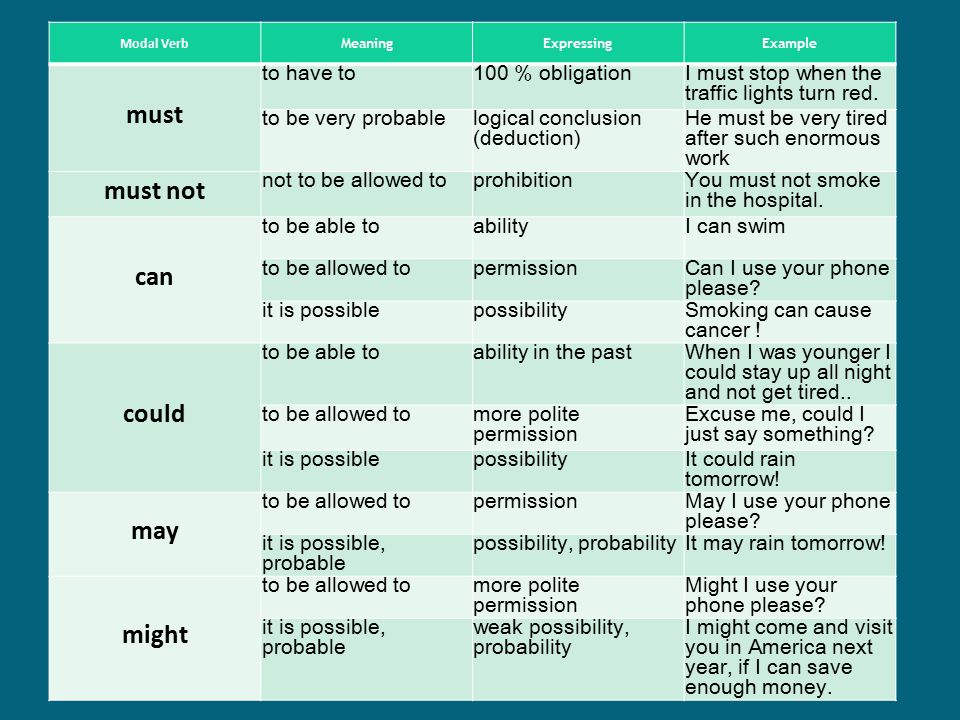

Unlike with child support orders—which are based on detailed guidelines for calculating the amount of support—the amount of alimony is usually based on what the judge believes is fair under the circumstances (known in legalese as the judge's "discretion"). So while you might find websites touting alimony calculators, very few states actually use these formulas.

New York, Illinois, and Colorado are the notable exceptions to this norm. In those states, spousal maintenance is typically calculated by subtracting a percentage of the paying spouse's income from a percentage of the recipient's income. But even in those states, judges may still choose to depart from the guidelines when they believe the calculated amount would be unjust or inappropriate.

The use of formulas is somewhat more common for calculating temporary alimony, either as a matter of state law (like in Pennsylvania) or as a matter of court policies in certain counties. But when a state's law doesn't provide a guideline, judges will use these formulas only as a starting point. They'll still need to follow the legal requirements for considering the particular circumstances in a couple's marriage (discussed below).

But when a state's law doesn't provide a guideline, judges will use these formulas only as a starting point. They'll still need to follow the legal requirements for considering the particular circumstances in a couple's marriage (discussed below).

What Judges Consider When Setting Alimony

In the vast majority of states, the laws require judges to consider certain factors when deciding how much alimony to award in a divorce. They usually must explain their reasons in their orders. Beyond that, however, judges are mostly free to decide what's appropriate in any particular case.

The specific factors that judges must consider vary from state to state, but they typically include:

- both spouses' needs

- each spouse's ability to earn and support themselves, based on their education, employment history, age, health, and other factors

- both spouses' other financial resources, including separate property, assets they did or will receive as part of the property division in their divorce, expected future assets, and debts

- whether the supported spouse can't work outside the home because of the needs of a child or children living with that spouse

- each spouse's contributions to the marriage, including through childcare, homemaking, and efforts to further the other spouse's education, career, and future earning capacity

- whether the supported spouse was out of the workforce or passed up career opportunities in order to care for the couple's children, their home, or both

- the tax consequences of alimony payments, under both federal law (which eliminated the alimony deduction for divorces finalized or alimony orders modified after 2018) and state law (which might not follow the federal rules)

- the length of the marriage (although that's more of a factor when deciding how long alimony will last), and

- any history of domestic violence.

In a few states, judges will also consider a spouse's adultery or other misconduct when making alimony decisions.

How Do Judges Determine Spouses' Needs?

When judges are considering both spouses' needs, state laws usually explain that those needs are based the standard of living a couple enjoyed during the marriage (before they separated). As a practical matter, of course, many divorced spouses find it difficult to maintain that living standard in the immediate aftermath of divorce, given the added expenses of maintaining two separate households—especially when children are in the picture.

That's why most judges focus on spouses' reasonable needs. And a few state laws define "need" narrowly, as the reasonable minimum amount required to meet basic living expenses. Of course, it's up to the individual judge to sort out what's reasonable under the circumstances. And in cases when there simply isn't enough money to go around, judges usually look for a way to make the divorced spouses share the financial pain equally.

Example: Roderic Duncan, a now-deceased former family law judge (and Nolo author) shared an example of how a judge might determine a supported spouse's reasonable need for alimony: "Imagine that a husband who files for divorce earns $5,000 a month. His wife stays at home with three young children and earns no income. Under their state's formula, she's entitled to $1,650 in monthly child support. But say she demonstrates that her total rock-bottom needs (including rent or house payments) are $2,300 a month. If convinced that her budget is solid, the judge would conclude that she needs $650 in spousal support ($2,300 minus $1,650) to make up the difference." And if all the other considerations support that amount (including the husband's ability to pay it), the judge might very well award that much in alimony—at least until the children get older and the wife can reenter the workforce and begin to support herself. (But see more below on potential limits to the amount of alimony, even when the recipient has demonstrated a need for more support. )

)

Are Savings Included in a Couple's Standard of Living?

The goal of maintaining the marital standard of living after divorce might not be a problem when the high-earning spouse has enough money to cover both spouses' expenses, even at their former lifestyle. But what about couples who agreed it was important to put away a generous slice of their income into savings, retirement accounts, or other investments? Should judges consider that habit to be a part of their standard of living—and therefore include a savings component in the amount of alimony?

If you're fortunate (or frugal) enough to be facing this issue, the answer to that question will depend on where you live. Courts in different states have taken opposite views on the question. For instance:

- California courts have long held that when a couple's marital standard of living included savings and investments, judges may consider that as part of their ongoing expenses. As one court put it, the wife shouldn't "be deprived of her accustomed lifestyle just because it involved the purchase of stocks and bonds rather than fur coats.

" (In re Marriage of Winter, 7 Cal. App. 4th 1926 (1992).)

" (In re Marriage of Winter, 7 Cal. App. 4th 1926 (1992).) - In contrast, the Florida Supreme Court has held that alimony may not include a savings component. Even when a couple had a history of frugality and savings, the court explained that the supported spouse would receive a share of those savings as part of the property division in the divorce, so the judge shouldn't include "speculative post-dissolution savings" in alimony. (Mallard v. Mallard, 771 So.2d 1138 (Fla. Sup. Ct. 2000).)

The bottom line: The courts in your state may or may not have taken a stand on this and many similar questions. There's plenty of room for disagreement. If you're dealing with a dispute over alimony, you should speak with an experienced, local family law attorney who will understand the rules in your state—and how local judges are likely to deal with these issues.

What Is a Spouse's Earning Capacity?

As we've seen, states typically require judges to consider both spouses' ability to earn. That means a judge won't just look at current income, but what spouses could reasonably earn, given their education, training, experience, job skills, and the local demand for those skills.

That means a judge won't just look at current income, but what spouses could reasonably earn, given their education, training, experience, job skills, and the local demand for those skills.

When either spouse is voluntarily earning below their potential, the judge may "impute" income to that spouse. For example, say you were the high-earning spouse in your marriage, making $200,000 a year as a lawyer. But after you and your spouse separated, you quit your job to become a sculptor earning less than $30,000 a year. The judge might order you to pay an amount of alimony consistent with your ability to earn rather than your actual earnings.

However, if you had a valid reason to switch to a lower-paying job—for instance, because work-related stress was causing medical and psychological harm—you might be able to provide evidence to convince a judge not to base the alimony amount on your old salary. But you can expect a fight from your spouse or ex.

The supported spouse's current and future earning potential also comes into play when judges are setting the amount of alimony. As part of rehabilitative alimony, judges often order a vocational evaluation with an expert who will analyze how much that spouse can currently earn and what steps need to be taken in order to become self-supporting.

As part of rehabilitative alimony, judges often order a vocational evaluation with an expert who will analyze how much that spouse can currently earn and what steps need to be taken in order to become self-supporting.

Upper Limits on Alimony and One Judge's Informal "40% Rule"

A few state laws set caps on the amount of alimony. In Illinois, for instance, when maintenance is calculated under the state's guideline formula, the result may not be more than 40% of both spouses' combined net incomes. Also, when the guideline calculation would result in combined spousal maintenance and child support that is more than 50% of the paying spouse's income, the law says that judges may dispense with the state's formula and decide on a fair amount of support after considering the relevant circumstances in the case. (750 Ill. Comp. Stat. § 5/504(b-1) (2022).)

Even when there isn't a statutory limit on the amount of alimony, some judges might follow their own unwritten standards. For instance, Judge Duncan told us: "When I was on the bench, I had a personal and informal rule that I would usually not leave people who were paying support with less than 40% of their income after they had made their child support and alimony payments, no matter how great the other spouse's need. Without at least that amount, it seemed to me that a wage earner would have little incentive to go to work every day. However, if the couple had more than four children and the supported spouse had no job skills, I might well go lower than 40%. I have never discussed this ‘rule' with other judges, but I would expect that many—although not all—would agree with the reasoning."

Without at least that amount, it seemed to me that a wage earner would have little incentive to go to work every day. However, if the couple had more than four children and the supported spouse had no job skills, I might well go lower than 40%. I have never discussed this ‘rule' with other judges, but I would expect that many—although not all—would agree with the reasoning."

How Long Does Alimony Last?

By its very nature, temporary alimony lasts only until the divorce is final. Some states also have absolute limits on particular types of spousal support, such as a two-year limit on "bridge-the-gap" alimony in Florida. And all alimony ends when the supported spouse remarries (or, in some states, begins living with a nonmarital partner).

Otherwise, states have different rules for determining how long support payments will last. Often, judges will base that decision on the same considerations as when they set the amount of maintenance. Other times, state laws will provide separate rules for the duration of alimony. For example:

For example:

- In California, spouses are expected to become self-supporting in a "reasonable" amount of time. When the marriage has lasted for less than 10 years, that generally means half the length of the marriage.

- In Kansas, alimony may not last for more than 121 months, with rare exceptions.

Getting Help With Alimony

If you want to avoid the expense, stress, and time of a divorce trial, but you and your spouse are having trouble resolving your disagreements about alimony, mediation could be a good solution. When you're able to reach a comprehensive settlement agreement before starting the divorce process, you'll be able to file for an uncontested divorce—which means that you can probably get a DIY divorce without a lawyer.

But if one of you wants maintenance and the other hasn't agreed, you should at least speak with a lawyer about your rights and options going forward. Particularly in states that don't use a formula to calculate spousal support—most of the country—the judge will decide on how much alimony to award based on the evidence you and your spouse provide about your expenses and assets, earning capacity, the standard of living you had during the marriage, and all the other factors that go into alimony decisions. An experienced family law attorney will know how to gather the right kind of evidence to convince the judge of your position—or even to convince your spouse's lawyer to agree to a settlement.

An experienced family law attorney will know how to gather the right kind of evidence to convince the judge of your position—or even to convince your spouse's lawyer to agree to a settlement.

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under the age of 18 and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.

0010

0010 - wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.0010

Also, child support can be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents.

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones; - incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones. This rule does not apply to guardians, trustees and adoptive parents;

- social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

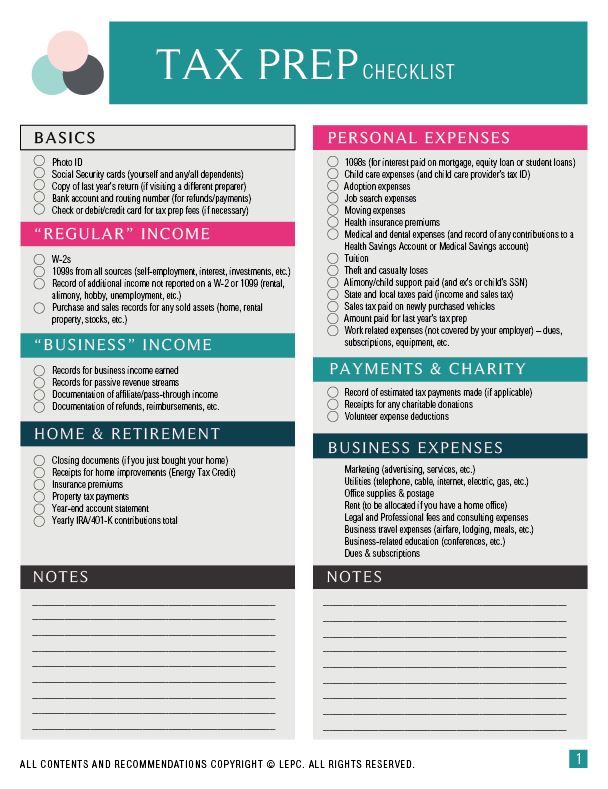

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- a single housing document and income statements for all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

In exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which their recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and up to 18 years of age, if the child does not marry earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated. Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Parents must support the child, even if he does not need material assistance. The incapacity of the parents, the recognition of their incapacity in court or the deprivation of parental rights also does not release from this obligation.

Alimony may be denied: or spouse, including an ex, if he or she has become disabled and needs help due to alcohol, drug abuse, or intentional crime, or has behaved unworthily in marriage, such as gambling;

Criminal liability for non-payment of child support

If you do not pay child support, you can go to jail - that's the law. And we'll see how it is in life: what punishment is prescribed by the courts for alimony debts and why it cannot be avoided, even if the parent gave the child as gifts or could not support him until he worked

Failure to pay child support is a crime

Responsibility for non-payment of alimony for minor children is provided for by Art. 157 of the Criminal Code of the Russian Federation (hereinafter - the Criminal Code of the Russian Federation). The same article applies to cases of non-payment by children of funds for the maintenance of their disabled parents. But we will focus only on alimony.

So, if a parent who is obliged to pay alimony does not regularly pay them without a good reason, then he is threatened with punishment: corrective or forced labor for up to 1 year, or arrest for up to 3 months, or imprisonment for up to 1 year.

To bring the alimony payer to criminal liability under Art. 157 of the Criminal Code of the Russian Federation, the court must establish the following (Resolution of the Plenum of the Supreme Court of the Russian Federation of December 22, 2022 No. 39):

- the debtor does not pay maintenance on purpose. That is, the court needs to establish intent and check whether the debtor could support the child;

- there is no good reason for non-payment. The court must examine all the reasons why the debtor does not pay alimony. However, the problem lies in the fact that criteria for assessing the validity of the cause are not defined. In judicial practice, there are examples when the alimony payer referred to illness, but such an argument was not taken into account;

- repeated non-payment. Repeatedly takes place if during the period of non-payment of alimony the payer was subjected to administrative punishment for a similar act under Art. 5.35.1 of the Code of Administrative Offenses of the Russian Federation.

Subjected to such punishment, he will be considered within the period specified in Art. 4.6 of the Code of Administrative Offenses of the Russian Federation. In this case, non-payment of alimony must continue for at least two months in a row.

Subjected to such punishment, he will be considered within the period specified in Art. 4.6 of the Code of Administrative Offenses of the Russian Federation. In this case, non-payment of alimony must continue for at least two months in a row.

Calls about approaching criminal liability

There are two situations that lead the alimony debtor to the plane of criminal punishment:

- “explanatory conversations” with a bailiff. He reminds the debtor of the need to pay alimony, finds out the reasons for their non-payment, talks about the possible prosecution;

- bringing the alimony payer to administrative responsibility under Art. 5.35.1 of the Code of Administrative Offenses of the Russian Federation.

If, after these events, the parent deliberately, without good reason, does not pay child support, he cannot escape criminal punishment.

Practice of bringing to criminal responsibility for non-payment of alimony

According to recent examples from judicial practice, it is clear that there is no such trend - if a parent does not pay child support for two months, then he is immediately sent to prison. But there are circumstances that alimony payers mistakenly consider exonerating. Let's consider them.

But there are circumstances that alimony payers mistakenly consider exonerating. Let's consider them.

1. No job and no permanent source of income. Only the absence of a permanent place of work will not save you from criminal liability for non-payment of alimony. Usually in such situations, the courts say: the person is able-bodied and does not take measures for employment, which cannot be considered a good reason for non-payment of alimony.

Before sentencing, the courts check whether the unemployed debtor was registered with the employment center and whether he tried to get a job. If the debtor did not get registered and did not look for work, then it will not be possible to convince the court that he was not able to pay alimony due to lack of income. The court will not consider this a valid reason. On the contrary, it will decide that the payer did not do everything possible to receive income and pay alimony.

For example, the Shelekhovsky City Court of the Irkutsk Region, in its guilty verdict of 22 February 2022 in case No. 1-370/2021, noted:

1-370/2021, noted:

“... The defendant, knowing for certain about the administrative punishment, having no valid reasons for non-payment of alimony, in the absence of a permanent source of income, being an able-bodied person, for a long time did not take measures to find employment in a permanent place of work, receiving income from temporary employment, alimony from he did not pay them, spent them at his own discretion, did not inform the bailiff about the place of work, did not provide documents confirming the payment of alimony. Having the opportunity to receive unemployment benefits, find a permanent job and pay alimony, I did not apply to the State Public Institution “Center for Employment of the Population” for assistance in finding a job, I did not register as unemployed.”

2. I bought gifts for my child and took them on vacation. Buying food, things and gifts for a child or taking a vacation together cannot replace the payment of alimony. Therefore, references to such circumstances will not help the alimony payer to avoid liability.

Therefore, references to such circumstances will not help the alimony payer to avoid liability.

For example, the Moscow City Court in its appeal ruling dated May 17, 2022 No. 10-8640/2022 noted:

“The arguments of the convict and his defenders that the purchase of a mobile phone, a joint vacation, the purchase of clothes for the daughter should be taken into account as the execution of a court decision on the payment of alimony, are not based on the norms of the current legislation, which provides for the payment of alimony in cash, in the amount of determined by the parties in the relevant agreement or in a court decision.

Punishment for non-payment of alimony

Article 157 of the Criminal Code of the Russian Federation provides for the most severe punishment of imprisonment for up to 1 year. However, correctional labor is more often prescribed with the deduction of part of the earnings to the state revenue.

Corrective labor is appointed for a period of 4 to 10 months. And from 5 to 10% of wages are deducted to the state income (verdicts of the Chusovsky City Court of the Perm Territory of November 17, 2021 in case No. 1-337 / 2021; Shakhunsky District Court of the Nizhny Novgorod Region of February 18, 2022 in case No. 1- 197/2021; Chesmensky District Court of the Chelyabinsk Region dated February 18, 2022 in case No. 1-150/2021).

And from 5 to 10% of wages are deducted to the state income (verdicts of the Chusovsky City Court of the Perm Territory of November 17, 2021 in case No. 1-337 / 2021; Shakhunsky District Court of the Nizhny Novgorod Region of February 18, 2022 in case No. 1- 197/2021; Chesmensky District Court of the Chelyabinsk Region dated February 18, 2022 in case No. 1-150/2021).

Guidelines for Support Payers

Parents often ask: what to do so that they are not prosecuted for alimony debts? For this you need:

- accept the fact that the payment of alimony is an obligation and is not relieved by unwillingness to work or conflict with a spouse;

- carefully read the text of the maintenance agreement, if it was concluded, and strictly follow it;

- collect evidence that will confirm that maintenance was not paid for a certain period for a good reason;

- appeal against the judicial act on the recovery of alimony in case of disagreement with it.