How long can i claim my child as a dependant

How Long Do Kids Stay Dependents?

Once you are a parent, you never stop being a parent. You stayed up with your kids when they had the flu, helped them study for the ACT, cheered them on at their graduation. You have been there for their highs, lows, and everything in between. You will continue to care, love, and support your children for the rest of your life.

But will there ever be a time they can fly away from the nest?

According to the federal government, the answer is yes!

From the time your children were born, you claimed them as dependents on your federal and state taxes, which has saved you money on your taxes over the years. The decision to claim children as dependents rests on a myriad of factors, let’s see how those could affect you this year.

In the Nest – How Long You Can Claim

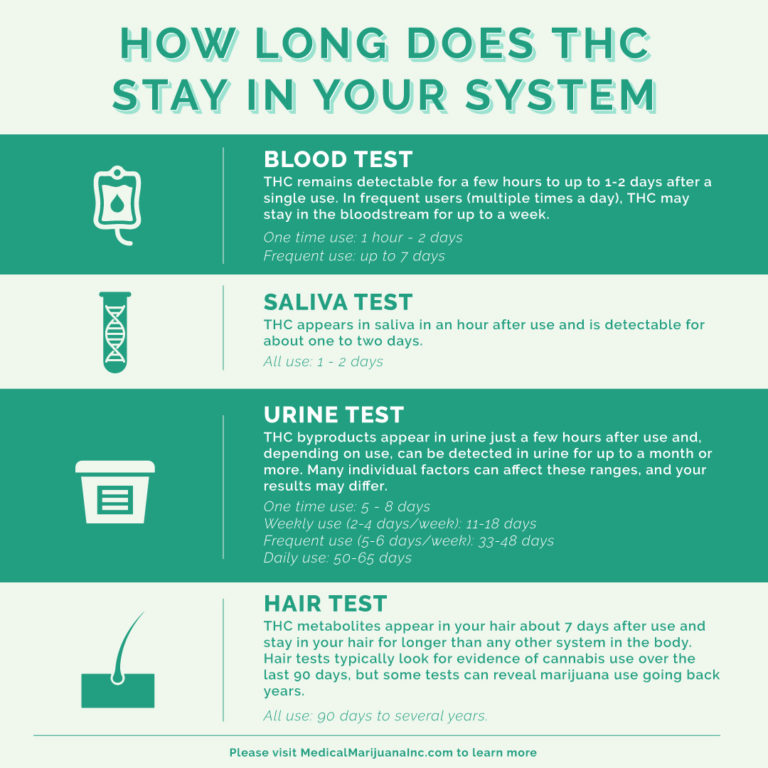

The federal government allows you to claim dependent children until they are 19. This age limit is extended to 24 if they attend college. If your child is over 24 but not earning much income, they can be claimed as a qualifying relative if they meet the income limits and/or if they are permanently disabled. It is important to know that there is no age limit if your child is permanently disabled.

Other factors that contribute to your ability to claim your children as dependents are:

- Amount of time your children live with you

- Your child must live with you for at least 6 months before you can claim them as a dependent.

- Financial support

- If your child makes more than half of their own support during the tax year, they cannot be claimed as a dependent. This support consists of housing, food, education, medical care, insurance, and recreational spending.

- Marital Status

- If you are not married and the child lived with you and the other parent half of the time, the person with the highest adjusted gross income will often take the deduction. This, however, can be negotiated.

- If you pay child support but the child lives with you for less than half of the year, you cannot claim the child as a dependent unless you have a signed Form 8332.

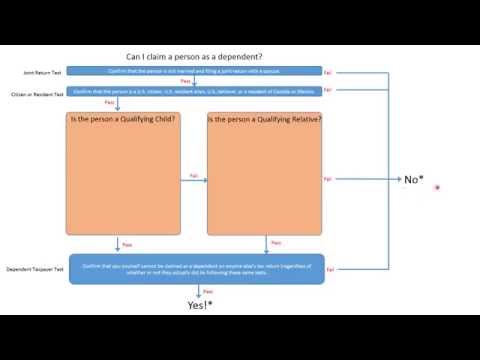

Still unclear if you can claim your child as a dependent? The IRS has a questionnaire here you can use to find out. Simply answer a few questions and the IRS will tell you whether or not you are eligible to claim a person as your dependent on your taxes.

For many families, the longer they are able to claim their children as dependents the better it will be. But the new Tax Cuts and Job Act has changed the way parents claim dependents. Prior to 2018, parents were able to receive a personal exemption that reduced taxable income. For example, in 2017, a married couple filing jointly could take a $4,050 exemption for themselves and each dependent. The new tax law has suspended that exemption benefit from 2018-2025. This means that parents will need to use other tax exemptions to help make up for the loss of the child exemptions.

Out of the Nest

Since the exemption for dependents is suspended until 2025, parents have to look for other tax credits and deductions that can help them on their tax bill. Here are a couple of credits to keep an eye on.

Here are a couple of credits to keep an eye on.

This is just one of the many examples of how our comprehensive tax planning creates value for our clients. See other important tax planning topics on our website, here.

- Earned Income Credit

- This credit is based on the amount of money you earn in a tax year. Designed to benefit low to medium income families with children, this credit will allow you access to a certain amount of money based on your income and the number of children you have. $6,431 is the maximum earned income credit available for 2018 for three children and parents earning no more than $54,884. For two children the maximum credit is $5,716 with an income threshold of $51,492. $3,461 is the maximum credit for one child with the parents’ income being less than $46,010. Remember, for any credit, your child must pass the qualifying child test.

- Child Tax Credit

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased.

A refundable credit will allow some or all of the credit to be refunded to the taxpayer after the tax liabilities are met. The reform allows for up to $1,400 of the credit to be refunded. The $2,000 credit is an increase from the $1,000 limit in 2017 and is set to stay until 2025. Additionally, under the new tax law, many more families will qualify for this particular tax credit as the income limit has increased. - If your child does not qualify for the tax credit, the new tax code does offer a $500 benefit per child. This is a non-refundable tax credit which means that the credit is limited to the tax liability and nothing is refunded.

- The Tax Cuts and Jobs Act stipulates that parents with qualifying children are eligible to receive a $2,000 refundable credit per child.

The new Tax Cuts and Jobs Act has changed the way parents will claim dependents in 2018. Therefore it is important to understand the nuances of the IRS qualifying system, exemptions that may or may not be applicable, and the other forms of tax credits available to you.

Related Video – Claiming College Students as Dependents

If you want personal advice on how to claim your dependents, contact us!

Let's Get Started

You'll get the most value from financial planning if your specific goals and needs match a firm's philosophy and services. Let's learn more about each other.

Let's learn more about each other.

Ready to Get Started?

Rules for Claiming Dependents on Taxes

Editor’s Note: Relationship changes and job loss can all affect who is living in your house and, therefore, claiming dependents on your tax return. Here are the most important rules that you need to know about claiming dependents before preparing your taxes this year.

Few things are more important than family. These are the people we share special memories with…the people we rely on when we hit tough spots.

However, sometimes you are the family member who helps others out. Maybe your grandmother couldn’t live safely on her own anymore, so she moved in with you this year. Maybe your uncle lost his job so he’s been staying with you.

This is what family is about – helping each other, regardless of the burden. But the extra expense of additional family members can put a financial strain on you. The rising costs of food, electricity, gas, and water can all add up quickly.

The rising costs of food, electricity, gas, and water can all add up quickly.

Special Rules for Claiming Dependents on Tax Returns

There are a few rules to help you navigate claiming dependents on tax returns – and decide who you should and shouldn’t claim as tax dependents:

The DOs: Who Can I Claim as a Dependent?

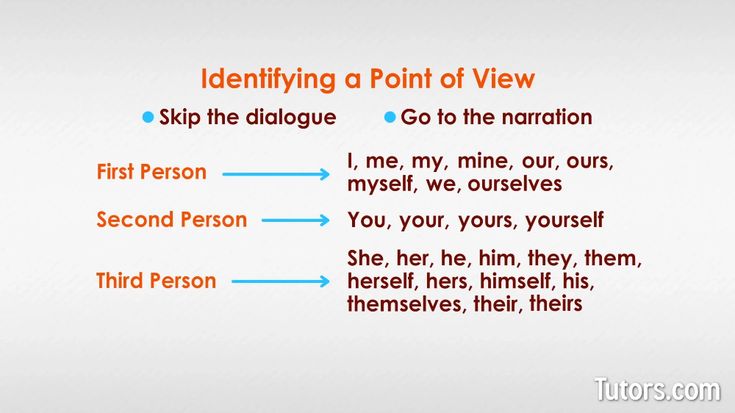

You can only claim dependents who are either a qualifying child or a qualifying relative.

DO claim all qualifying children that were born or adopted within the tax year. Even if your child was born on December 31, your child may be able to be claimed as a dependent on your taxes. To qualify as a dependent, the child must:

- Be under age 19, a full-time student under age 24 or permanently and totally disabled;

- Not provide more than one-half of the child’s own total support; and

- Live with you for more than half of the year.

DO claim certain family members (such as parents, grandparents, aunts or uncles, nieces or nephews) as qualifying relatives. You should claim certain family members only if:

You should claim certain family members only if:

- You provided more than half of the person’s total support for the year;

- They aren’t yours or another taxpayer’s qualifying child; and

- The relative’s gross income is less than the personal exemption amount (which is $4,200 for 2019).

All dependents must be a United States citizen, resident alien of the United States, or resident of Mexico or Canada (with certain adopted children as an exception) and can’t file a joint return (unless it’s to receive a claim of refund of taxes withheld or estimated taxes paid). You can’t claim a dependent if you or your spouse (if filing jointly) could be claimed as a dependent by another taxpayer.

The DON’Ts: Rules for Claiming a Dependent

DON’T claim a child that has lived with you for less than six months of the year. Unless the child was born within the tax year, the child must have lived with you at least six months of the tax year to fall under the qualifying child rules. If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

If you have a child that lives with each of the child’s parents separately for different portions of the year, the parent that cares for the child longer should claim the child as a dependent unless the custodial parent in the divorce has a signed Form 8332. There is an exception to the six-month rule for claiming a qualifying relative, but only if the child can’t be claimed as a qualifying child of any other taxpayer.

DON’T attempt to claim a child for whom you have paid child support, but lives with you for less than half the year unless you have a Form 8332 signed by the custodial parent.

Help is at Your Fingertips

For additional assistance with the tax rules for claiming a dependent, H&R Block has your back.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H&R Block to help you navigate the rules for claiming a dependent family member on your taxes.

Recognition of a person as a dependent of the testator does not depend on the receipt of his own income

According to one of the experts of the "AG", the definition of VS is very important for judicial practice, since it allows cohabitants to inherit the property of the deceased. Another said that the clarification of the concept of "dependency" was extremely important. The third concluded that the Court once again points out what to pay attention to when calling to inherit non-native heirs in the person of disabled dependents. nine0003

The Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation issued Ruling No. 5-KG20-66-K2 on an inheritance dispute between the deceased man's cohabitant and the Department of City Property of Moscow.

In 2018, Olga Yakovleva applied to the court to establish the fact that G., who died in 2017, was dependent on her. apartment. The woman motivated her claims by the fact that she had been in actual marital relations with G. for more than 35 years, lived together with him and ran a common household until the death of the man. nine0003

for more than 35 years, lived together with him and ran a common household until the death of the man. nine0003

The plaintiff also explained that, due to her disability and low income, she was fully supported by the deceased. At the same time, G. rented out his apartment for 10 years, and the payments received were transferred to the bank account of Olga Yakovleva by decision of the owner of the housing. After the death of the man, as the woman explained, she fully pays for housing and communal services for the disputed apartment.

In turn, the department filed a counterclaim against the woman for the recognition of Moscow's ownership of the disputed apartment and the eviction of the plaintiff from it. The agency pointed to the absence of heirs both by law and by will, as well as the fact that the disputed property is escheated property and becomes the property of the city. nine0003

The court of first instance satisfied the counterclaim of the department and dismissed the claim of Olga Yakovleva under the pretext that the latter had not proved the fact that she was on the full material support of the deceased, and that the assistance he provided was for her a constant and main source of livelihood. Subsequently, this decision of the court withstood the appeal and cassation.

Subsequently, this decision of the court withstood the appeal and cassation.

After studying the appeal of Olga Yakovleva, the Judicial Collegium for Civil Cases of the Supreme Court revealed significant violations of substantive and procedural law. nine0003

As the Court explained, Olga Yakovleva receives an old-age pension, has a disability of the second group and suffers from an oncological disease. It was she who organized and fully paid for the funeral of the deceased, and the inheritance case for the property of the deceased was opened at the notary at her request.

With reference to sub. “c” paragraph 31 of the Decree of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9, the highest court noted that a person who received from the deceased in the period of at least a year before his death (regardless of family relations) can be recognized as being dependent on the testator ) full maintenance or such systematic assistance, which was for him a constant and main source of livelihood, regardless of his own income. When examining the relevant evidence, the ratio of the assistance provided by the testator and other income of the disabled person should be assessed. nine0003

When examining the relevant evidence, the ratio of the assistance provided by the testator and other income of the disabled person should be assessed. nine0003

As the Court emphasized, the fact of G.'s cohabitation with the plaintiff was confirmed by certificates of registration at the place of residence, an act of the commission of the Mozhaisk department of social protection of the population, as well as the testimony of two witnesses. In addition, G. actually supported the woman, receiving money for the apartment he rented out, and after revealing that she had a serious illness, he bought her all the necessary medical care and expensive medicines. The allowance received by Yakovleva from her cohabitant was for her a constant and main source of livelihood. nine0003

The Supreme Court explained that in the case under consideration, one of the legally significant and subject to proof circumstances was the clarification of the question of whether the material assistance received by Olga Yakovleva from G. during their joint residence (including from the moment she was diagnosed with a serious illness) , her permanent and main source of livelihood. However, this circumstance concerning the applicant's sources of livelihood and their nature (permanent, main, additional) was not verified by the court, which did not determine it as relevant to the case, and it did not enter into the subject of proof. nine0003

during their joint residence (including from the moment she was diagnosed with a serious illness) , her permanent and main source of livelihood. However, this circumstance concerning the applicant's sources of livelihood and their nature (permanent, main, additional) was not verified by the court, which did not determine it as relevant to the case, and it did not enter into the subject of proof. nine0003

“Thus, the court committed a significant violation of the rules of procedural law that establish the rules of proof in civil proceedings, as well as the rules for examining and evaluating evidence. In addition, the concept of "dependency" implies both the full maintenance of a person by the deceased, and the receipt of maintenance from him, which was for this person the main, but not the only source of livelihood, that is, it does not exclude the person from having any own income (receiving a pension ). The fact of being dependent on or receiving significant assistance from the deceased can be established, including in court, by determining the ratio between the amount of assistance provided to the deceased and his own income, and such assistance can also be recognized as a permanent and main source of livelihood”, - concluded the Supreme Court, canceling the judicial acts of the lower courts and returning the case for a new trial in the first instance. nine0003

nine0003

Irina Zimina, the lawyer of Moscow Bank Infralex, called the Court's clarification of the concept of "dependency" extremely important. “The Supreme Court indicates that dependency involves both the full maintenance of a person by the deceased, and the receipt of maintenance from him, which was for this person the main, but not the only source of livelihood, that is, it does not exclude the person from having any own income (receiving a pension) . In the current judicial practice, unfortunately, there is a tendency for the courts to take a formal approach to clarifying the issue of the ratio of income of the testator and dependent. Having established that the dependent has a pension, earnings or other income, the courts refuse to satisfy claims for establishing the fact of being dependent (appeal ruling of the Lipetsk Regional Court dated July 11, 2018 in case No. 33-2453 / 2018, appeal ruling of the Moscow City Court dated July 8, 2016 in case No. 33-26755/2016),” she noted. nine0003

nine0003

According to the expert, the Supreme Court of the Russian Federation also reiterates the need to distinguish between the nature of the dependent’s source of livelihood, namely, the need to clarify the question of whether it is permanent, main or additional, which is not always taken into account by the courts when making decisions.

The director of the Presumption Agency, Philip Shishov, concluded that the Supreme Court once again points out that when calling to inherit non-native heirs in the person of disabled dependents, it is mandatory for the court to clarify whether the maintenance of the testator's dependent during the period of their joint residence during the last year before his death a permanent and main source of livelihood. nine0003

According to the lawyer, in such cases, what is of particular importance is the proportion of the personal income of the person claiming the inheritance and the income of the deceased. He added that a similar argument for cancellation is contained in the Ruling of the Supreme Court of the Russian Federation dated April 23, 2019 in case No. 73-KG19-3, when, due to the understatement by the court of first instance of the ratio of dependency and personal funds of a person called to inherit, a positive decision was canceled on the recognition of the right of a dependent to the inheritance of a deceased cohabitant who did not leave a will. nine0003

73-KG19-3, when, due to the understatement by the court of first instance of the ratio of dependency and personal funds of a person called to inherit, a positive decision was canceled on the recognition of the right of a dependent to the inheritance of a deceased cohabitant who did not leave a will. nine0003

“Also, based on the results of the analysis of this judicial practice, it should be noted that the Supreme Court may give a signal to the courts that the call to inherit disabled dependents in cases where there are no other heirs and the property is escheated is more realistic than when a dispute over the right to inheritance arises between non-native dependents and blood relatives,” suggested Philip Shishov.

Moscow City Administration lawyer Oleg Lisaev believes that the conclusions of the Supreme Court are very important for judicial practice, since they enable cohabitants to inherit the property of the deceased. “Very often, for various reasons, people do not register a marriage for a long time, although they live together and take care of each other. I believe that in order to protect the rights of citizens in such a situation, it is necessary to return to the concept of “actual marital relations” that existed in Soviet times and make appropriate changes to the legislation. This practice exists in the so-called civilized countries,” he said. nine0003

I believe that in order to protect the rights of citizens in such a situation, it is necessary to return to the concept of “actual marital relations” that existed in Soviet times and make appropriate changes to the legislation. This practice exists in the so-called civilized countries,” he said. nine0003

Questions by family categories

Please note that the information contained in the questions and answers is current at the time of publication.

Question

I am in the UK on a dependant visa. My partner is here on a work visa. We are both from Ukraine, not married. Now we are parting. Accordingly, we will soon have to file a notice with the Home Office and my visa will be terminated. Because of this, will my visa terminate within 60 days of filing the termination notice with the Home Office, or within 60 days of receiving the letter from the Home Office? nine0044

Reply

Your dependent partner visa will expire 60 days after the date of the letter from the Home Office that you must receive from the Home Office by post after the Home Office informs you that you and your partner have formally separated and your relationship is complete stopped. In practice, such a letter from the Home Office may arrive immediately, or it may arrive in a few months and, accordingly, the 60-day period may actually begin much later than originally expected. nine0003

In practice, such a letter from the Home Office may arrive immediately, or it may arrive in a few months and, accordingly, the 60-day period may actually begin much later than originally expected. nine0003

Question

I married an EU citizen (Spain) for religious reasons, and therefore our marriage was not recognized by the local government in the UK. He applied for a resident card on the basis of the spouse of an EU citizen, but was refused and later was expelled from the country for 10 years. At the moment, my wife is with me in Turkmenistan, and we officially registered our marriage in May 2021 at the local registry office. Can I apply for a resident card or EEA Pre-Settled Status as the spouse of an EU citizen? nine0044

Reply

If your marriage is valid and recognized in the country where you entered into it, it will be recognized in the UK. For example, if the marriage took place in Spain, then it must be legally valid in Spain. Or if you got married in Turkmenistan, then, accordingly, it is recognized in Turkmenistan. Otherwise, you need to re-register the marriage. And accordingly, you need to apply for a spouse visa if your spouse lives in the UK. nine0003

Or if you got married in Turkmenistan, then, accordingly, it is recognized in Turkmenistan. Otherwise, you need to re-register the marriage. And accordingly, you need to apply for a spouse visa if your spouse lives in the UK. nine0003

Question

I am a citizen of Russia. She recently married a British citizen, the marriage was concluded in Moscow. We are expecting a baby in two months. I am about to apply for a wife visa but I have had serious visa violations in the past: I was in the UK illegally for several years on an expired visitor visa. She left the country voluntarily, at her own expense. How will these circumstances affect my wife visa application?

Reply

You may be denied on the basis of a bad immigration history, but you will have a right to appeal and therefore a good chance of winning as long as that is the sole reason for the denial.

Question

I lived in the UK for 2 years on a wife visa, but my husband died and I just recently got Permanent Residency (ILR) as a widow. In total, I spent a little over two years in the UK. Can I apply for naturalization one year after receiving the ILR? nine0044

In total, I spent a little over two years in the UK. Can I apply for naturalization one year after receiving the ILR? nine0044

Reply

No, you need to have lived in the UK for at least five years. That is, you will be able to apply for naturalization 5 years after entering the country.

Question

I am about to apply for a Marriage Visitor to marry a British citizen. I do not want to apply for a fiancee visa, as the future husband works in another country, and we will come to the UK only to meet relatives and to formalize the marriage. I have my minor son with me. What kind of visa should I apply for him? Who can sponsor our trip? Or should it be just me as a mother? nine0044

Reply

You can apply for a Marriage Visitor visa for yourself and for your son a Child Visitor visa. At the same time, you must either show sufficient income and funds for the trip of you and your son to the UK, or the partner inviting you must do this if he pays for your trip and provides accommodation.

Question

If I am in the UK on a dependent unmarried partner visa, my partner has an Innovator visa, but we break up and our relationship ends and we have a young child who was born in Belarus and who also lives in Britain - Can I apply for a parent visa if my child is not a UK citizen? He also has a dependent visa. He is 3.5 years old, of which he lived in London for more than 2.5 years, goes to kindergarten at a public elementary school. nine0044

Answer

You can apply for a parental visa if the child is already a British citizen who was born in Britain. In your case, the child was born in Belarus and the dependent visa of the child was issued on the basis of the main visa of the father of the child. The visa of the child is not directly dependent on the visa of the mother. In view of this, when you and your partner notify the Home Office that your relationship has ended, then you, as the mother of the child, will not be able to obtain a parent visa or something like that, since the child himself does not permanently reside in Britain and plus the child’s visa depends from the dad's visa, not from the mom's visa. Also, you, as the mother of the child, will not be able to rely on sole responsibility for the child, since the visa for mother and child is dependent on the visa of the father of the child, that is, if you show that only you, as a mother, are responsible for the child, unfortunately this is not for you will not help, since you do not have a main visa. nine0003

Also, you, as the mother of the child, will not be able to rely on sole responsibility for the child, since the visa for mother and child is dependent on the visa of the father of the child, that is, if you show that only you, as a mother, are responsible for the child, unfortunately this is not for you will not help, since you do not have a main visa. nine0003

Question

I recently received permission to live in the UK under Article 8 of the European Convention on Human Rights. The visa was issued on the basis that I have lived here for over 15 years and have no family ties in my home country. Six months ago I met a girl, a student from Russia. We got married here, and now we are expecting a child. Her visa is expiring soon and she wants to leave the UK in time to avoid breaking the law. The child will be born in Russia. Will I be able to open dependants visas for my wife and child? nine0044

Answer

Yes, all this is possible and subject to all necessary immigration requirements.

Question

I am a citizen of Ukraine, unmarried, permanently residing in Ukraine. I have two young children from a previous marriage, both of whom have British passports. The children live with me. What are my chances of moving to the UK permanently?

Reply

If your children will be attending a private school in the UK as a full-time student, you can apply for a Parent of a Child at School visa for yourself until the youngest of them is 12 years old. The second option is to apply under Article 8 - Family Rights as they are British and you will be able to stay with them in the UK until they are 18 years old. But at the same time, children must live in the UK permanently, and it also matters where their father is. nine0003

Question

I married a UK citizen in March 2021 and we have a baby. Family life does not add up, and my husband and I are thinking about divorce. Unfortunately, we cannot agree with whom the child remains after the divorce. My husband is against the fact that the child returned with me to his homeland. I have a wife visa now. If we get divorced, will I have to leave the country, or can I stay until my visa expires? Is there any way for me not to be separated from my child? nine0044

My husband is against the fact that the child returned with me to his homeland. I have a wife visa now. If we get divorced, will I have to leave the country, or can I stay until my visa expires? Is there any way for me not to be separated from my child? nine0044

Reply

If it is not possible to keep the family together and your spouse does not want the child to leave the UK, then immediately after the divorce you will need to file an application outside the immigration rules in order to be able to stay with your child. With a positive result, you will receive a visa (Discretionary Leave) for 3 years, and you can extend it until the child is 18 years old. Currently, there is a rule according to which one can obtain permanent residence (ILR) based on 10 years of legal residence in the UK. Unfortunately, it is impossible to predict whether this rule will be valid in 10 years. nine0003

Question

I am a British citizen, currently in the process of adopting a grandson in Russia. After adoption, I would like to take him to the UK for permanent residence. Could you tell us what legalization procedures we need to go through in the UK?

After adoption, I would like to take him to the UK for permanent residence. Could you tell us what legalization procedures we need to go through in the UK?

Reply

Since Russia is not on the list of Designated Countries whose adoption procedure is automatically recognized in the UK, you must first go through this procedure in the UK. To do this, first of all, you need to contact special adoption agencies. In England and Wales, these are Voluntary Adoption Agencies (VAA) and local authorities. In Scotland and Northern Ireland there are other similar organizations. As for the immigration component, there are a lot of subtleties here. The reason for the adoption, what happened to the parents of the child, etc. is important. The Home Office decides on such applications in its sole discretion, and one of their conditions is that they must be sure that you have not adopted a child for the sole purpose of bringing him to the UK. nine0003

Question

I am married to a UK citizen but currently on a Skilled Worker Visa (formerly known as Tier 2). I'm going to apply for a spouse visa. Will time spent on a Skilled Worker Visa count toward the 5-year time limit required to qualify for an ILR?

I'm going to apply for a spouse visa. Will time spent on a Skilled Worker Visa count toward the 5-year time limit required to qualify for an ILR?

Reply

You need to live in the UK for 5 years on a spouse visa (two and a half years, then extend for another 2.5 years). Work visas do not count in your case, they only count for ten years of residence in the country. nine0003

Question

I am a Russian citizen and have been married to a British citizen for 3 years. Of these, I lived in the UK for 2.5 years on a wife's visa. It so happened that after 2.5 years of residence, I did not have the opportunity to apply for the next 2.5 years due to the illness of my mother, and I had to return to Russia, where I have been for 7 months. Now I would like to apply for a UK visa again. What to do?

Answer

Since your spouse visa has expired and you did not renew it, unfortunately you need to apply for a new spouse visa. In total, you will need to live in the UK with your spouse for 5 years, after which you can apply for ILR.

In total, you will need to live in the UK with your spouse for 5 years, after which you can apply for ILR.

Question

My sister is married to an Englishman, her three children are British, she has had a permanent residence for the last 22 years. Only because she was absent from the UK for over two years due to COVID-19at Heathrow she had her permanent residence revoked. What to do. My sister flew away.

Reply

Under UK immigration rules, permanent residence can be revoked at the UK border by immigration officials if a person is suspected of being outside the UK for two consecutive years. It is possible to appeal, but it may take years to reach a decision, and it is not certain whether the decision will be in favor of the sister or whether the decision of the UK Border Agency will be approved. More practical, your sister needs to apply for a returning resident visa as someone who has obtained early permanent residence and has been outside the UK for more than 2 years. nine0003

nine0003

Returning resident visa eligibility:

- planning to return to live in the UK permanently

- lived in the UK before last left

- demonstrate strong ties to the UK

- current circumstances with the epidemic and why she lived outside the UK

Question

My brother has been living in the UK on a sole representative of a foreign company visa for several years. He has a girlfriend with whom he is in a relationship, but without a registered marriage. He wants to join her on a dependent visa and is not sure whether he should register the marriage officially or file it as unmarried partners. nine0044

Answer

They can get married both in the UK and outside of it and then your brother's spouse will be able to apply for a visa dependent on the visa category of the sole representative of a foreign company. Or, if they do not register a marriage, they will need to show that for the last two years they have lived together at the same address in any other country. And further, your brother will be able to apply for permanent residence first, as he will quickly reach the 5-year mark of residence in the country on his visa, and his wife will need to extend her visa for a few more years until she herself lives five years on the dependent visa partner. nine0003

And further, your brother will be able to apply for permanent residence first, as he will quickly reach the 5-year mark of residence in the country on his visa, and his wife will need to extend her visa for a few more years until she herself lives five years on the dependent visa partner. nine0003

Question

My wife is an Italian citizen and lives in the UK based on her Pre-Settled status. I am a citizen of Georgia currently living outside the UK. How can I reunite with my spouse?

Reply

According to the current immigration rules, the important point is when the marriage was registered on or after December 31, 2020. If before the above date, then you can apply for a Family Permit visa under the EU Settlement Scheme according to the European rules under the simplified scheme. If the marriage was concluded after December 31, 2020, then in this case it is necessary to apply for a spouse visa according to the standard British rules, according to which, among other things, you need to meet certain financial requirements and you must demonstrate the required level of English proficiency.