How to get your license back from child support

Driver’s License Reinstatement | Division of Child Support Services

DCSS Customer Service

The Georgia Division of Child Support Services (DCSS) has made revisions to the driver’s license process as a result of an amendment to GA Law, O.C.G.A. §19-11.9.3(o). The law states that DCSS will inform delinquent noncustodial parents (NCPs) of resources that are available to them as potential alternatives to driver’s license suspension.

These License suspension options are available to any NCP who notifies DCSS about significant changes in their employment and income. They must provide verification of a new job, the loss of a job or any change in income. It is very important for the NCP to contact DCSS as soon as possible so that they will have an opportunity to explain their circumstances. They will also be encouraged to sign an Enforcement Deferral which will help them to avoid license suspension if they pay as agreed.

What is our Goal?

To reduce the number of payers whose cases are certified for license suspension and to provide the parent with Outreach services as an alternative to license suspension.

One change that DCSS made to achieve this goal and to help reduce the number of cases certified for license suspension was extending the time frame for parents who are out of compliance with a child support order from 60 to 90 calendar days. This will allow NCPs on newly established cases more time to remain compliant and to avoid license suspension.

To achieve this goal, it is critical for the NCP to notify DCSS if they become unemployed or have a reduction in income. If they do, alternate payment arrangements can be made to prevent license suspension, if they pay as agreed.

GA Driver’s License Suspension Criteria and Process

Account balances on all NCP active cases must be equal to or greater than the total monthly child support due for the previous three (3) months (90 calendar days). Additionally, the total payments for the last 105 days must be less than three (3) times the total of all monthly, weekly, bi-weekly or semi-monthly support amounts due on all active NCP cases.

The time-frame for parents who are out of compliance with a child support order has been extended from 60 to 90 calendar days. That will give a parent more time to come back into compliance when they become unemployed or underemployed. Some parents may be eligible to enroll in the Fatherhood Program as an alternative to administrative license suspension. When that happens, DCSS will also review the case to determine if the case qualifies for a review and modification of the support order.

License Suspension Release Options:

If your license is suspended or you received a Notice of Intent to Deny or Suspend, you may contact DCSS to select the most appropriate option and sign and Enforcement Deferral to have your license suspension released or avoid suspension. Other options include:

- Payment of the full Past Due balance on all cases that meet the criteria for suspension

- Payment of 20% of the total past due balance on all cases that meet the criteria for license suspension

- Payment of three (3) times the current support and past due payments on all active cases that meet the criteria for suspension

- Payment of a judicial or administrative court ordered purge payment or arrears payment

- Verification of noncustodial parent's newly employed status

- Enrollment in and successful completion of the Fatherhood Program

- Social Security Benefits approval letter

- Medical verification of an inability to work

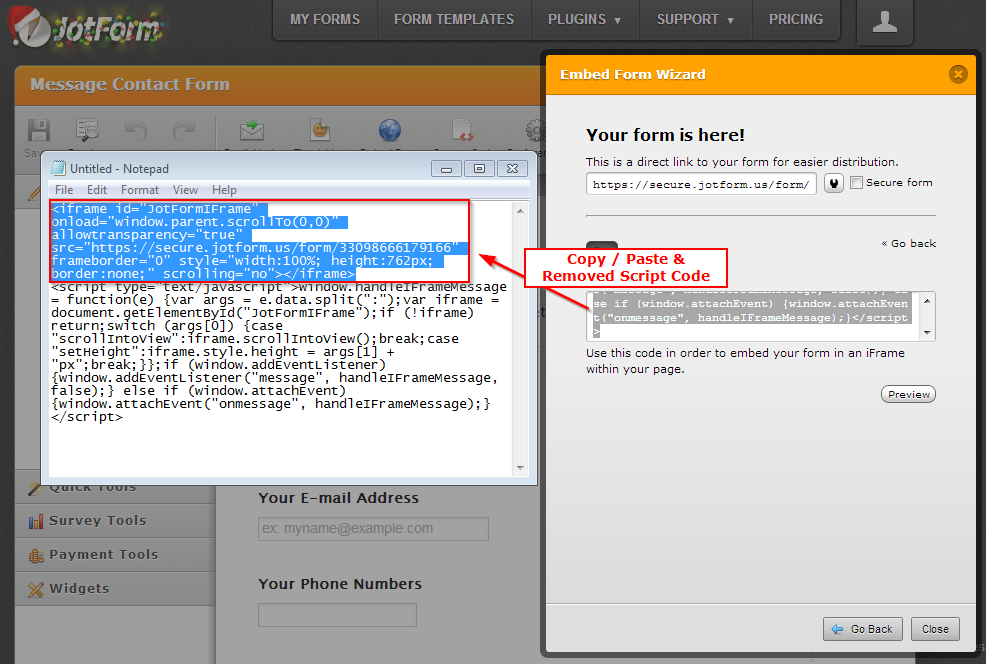

DCSS Mobile App QR Code

The GA DCSS On the Go app provides easy and secure access to your child support account on the go. Driver’s license release options are available on the app.

Driver’s license release options are available on the app.

Download on the App Store

Download on Google Play

Driver's License Reinstatement - Georgia Department of Driver Services

Driver's License Reinstatement- DDS

NYS DCSS | Support Enforcement

Enable JavaScript to access your account

To access your account information, please enable JavaScript in your browser. Follow these instructions to enable JavaScript.

You can receive your payment information by phone at 1-888-208-4485 (TTY: 1-866-875-9975), Monday–Friday, 8:00 AM–7:00 PM.

The child support program can legally collect overdue child support (arrears) and obtain health insurance

coverage through a variety of "administrative procedures" or enforcement actions. These administrative

enforcement

actions (PDF) may take effect without any party having

to go to court.

These administrative

enforcement

actions (PDF) may take effect without any party having

to go to court.

For many of these actions, you can submit a form to challenge the action. Translations of these forms in several languages are available for REFERENCE ONLY. Complete and submit forms in English.

Check your eligibility

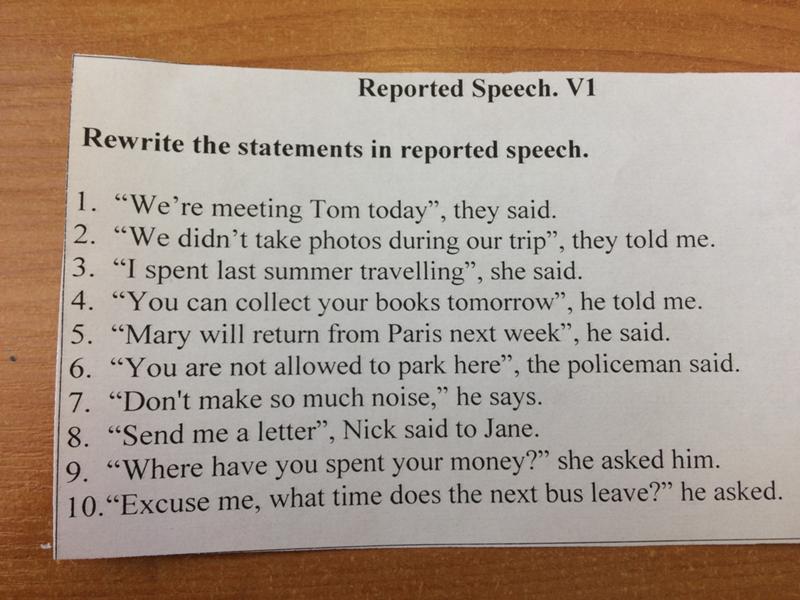

Your driver license may be suspended when your account is more than four months past due. You will receive a notice in the mail about the suspension: Important Notice Regarding Your Driving Privileges and Your Failure to Pay Child Support.

To avoid suspension of your driver license, within 45 days you must either make full payment,

enter into a Satisfactory Payment arrangement, or have a challenge upheld. You can challenge the

suspension by completing a Driver License Suspension Request…or Challenge

(PDF) and an Affidavit of

Net Worth (PDF). Return these forms to the

Support Collection Unit (SCU) where your child support account is located.

Get the address of your

local child support office.

You can challenge the

suspension by completing a Driver License Suspension Request…or Challenge

(PDF) and an Affidavit of

Net Worth (PDF). Return these forms to the

Support Collection Unit (SCU) where your child support account is located.

Get the address of your

local child support office.

If your license has been suspended due to nonpayment of child support, you may qualify for a restricted use license. You must apply for a restricted use license in person at a New York State Department of Motor Vehicles (DMV) office. You can do this at most, but not all, Motor Vehicles offices. Contact your nearest DMV office to find out where you can apply.

A restricted use license may only be used only under certain conditions, which may include

driving to and from your place of employment

or education, when required. A restricted use license issued as a result of nonpayment of child

support may not be used to operate a

commercial motor vehicle as defined in Vehicle and Traffic Law § 501-a(4).

A restricted use license issued as a result of nonpayment of child

support may not be used to operate a

commercial motor vehicle as defined in Vehicle and Traffic Law § 501-a(4).

- Important Notice Regarding Your Driving Privileges and Your Failure to Pay Child Support

- Satisfactory Payment Arrangements to Avoid or Terminate Suspension of Driving Privileges

- Notice of First Failure to Comply with Payment Plan

- Notice of Second Failure to Comply with Payment Plan

- Review of Challenge to Notice to Suspend Driver License—(Upheld or Denied)

- Driver License Suspension Request…or Challenge (PDF)

- Affidavit of Net Worth (PDF)

Your federal and/or State income tax refund may be intercepted to pay overdue child support.

New York State tax refunds may be intercepted when your account is more than $50 past due. Federal tax refunds may be intercepted when your account is more than $150 past due. You will be notified in early September if your tax refund can be intercepted.

To avoid having your tax refund intercepted, you must either pay the full amount past due or file a challenge by the date in the notice. Use the Request for Administrative Review… (PDF) form to challenge a tax refund intercept.

- Federal: Tax Refund Pre-Offset Notice with "Important Information"

- New York State: Notice of Claim Against Your Income Tax Refund

- Request for Administrative Review… (PDF)

Your application or renewal for a passport may be denied if you owe more than $2500 in past due

support (arrears). If a passport applicant is identified as having child support arrearages

meeting the threshold, federal law requires that the individual's passport be denied, revoked,

restricted, or limited. [42 USC §652 (k)(1)].

If a passport applicant is identified as having child support arrearages

meeting the threshold, federal law requires that the individual's passport be denied, revoked,

restricted, or limited. [42 USC §652 (k)(1)].

You must pay the arrears in full. Once the arrears are paid in full, the passport will be released.

If you qualify, you may request an emergency release of your passport. Call 1-888-208-4485 TTY: 1-866-875-9975) for more information about an emergency release.

Information about passport denial is included with federal notices about tax refund offsets.

- Tax offset letter includes statement regarding passport denial

- Denial of Passport for Certification of Arrearage in Child Support

- Challenge with Request for Administrative Review… (PDF)

Your bank account(s) may be frozen when your account is more than two months past due and you owe

more than $300.

If your bank account(s) have been frozen, you must either pay the amount shown in the notice or file a claim (PDF) within 15 days.

- Restraining Notice

- Notice to Judgment Debtor/Obligor of Restraining Notice

- Notice to Vacate Restraining Notice or Execution

- Mistake of Fact or Exempt Money Claim (PDF)

- Child Support Enforcement Execution and Notice

- Notice of Determination of Your Mistake of Fact and/or Exempt Money Claim

Your New York State lottery winnings may be intercepted when the past-due support is more than $50 and the amount won is more than $600.

You must request a review of your case within 30 days. You can call or write to request the

review.

You can call or write to request the

review.

- Important Information Regarding Your Lottery Prize and Past Due Support

You may be subject to liens against your real or personal property (e.g., personal injury claim or award) when your account is more than four months past due.

You must make full payment or claim mistake of fact within 35 days.

- Notice of Intent to File a Lien

- Notice of Lien

You may be referred to the New York State Department of Taxation and Finance (DTF) when your account is more than four months past due and the amount owed is more than $500. DTF can then apply specific tax collection remedies to collect the overdue child support. These collection methods may include:

- Filing a lien against any real or personal property

- Seizure and sale of your real and personal property

- Any other action the NYS Department of Taxation and Finance deems necessary to collect the debt

You must make full payment within 45 days or submit a written challenge

(PDF) within 45 days.

- Important Notice Regarding Referral of Your Case to the NYS Dept. of Taxation and Finance for Your Failure to Pay Child Support

- Results of Review of Your Challenge to the Referral of Your Case to the NYS Dept. of Taxation and Finance for Your Failure to Pay Child Support (Upheld or Denied)

- Department of Taxation and Finance Challenge (PDF)

Your name may be submitted to the major consumer credit reporting agencies (credit bureaus) when

your account is more than two months past due or when the amount past due is

more than $1000. You may have difficulty obtaining a loan or other forms of credit until the

overdue child support is paid.

You must reduce the past-due amount to less than $1000 or less than the amount to be paid for two months or claim mistake of fact within 10 days.

- Report to Consumer Reporting Agencies

After a court hearing, your state-issued professional, occupational, business, or recreational licenses, permits, or registrations may be suspended when your account is more than four months past due.

You must immediately make full payment or file a claim form within 15 days.

- Warning Notice (includes claim form, PDF)

- Violation Petition

Procedure for deprivation of rights for debts on alimony

Contents

- Arguments in favor of the new law

- Vehicles that are prohibited from driving

- Conditions that allow depriving the debtor of the right to drive

- Persons not subject to deprivation of a driver's license 9005 Procedure 9005 carrying out the procedure for deprivation of rights

- If there is an agreement

- If there is a writ of execution

- Decision on deprivation of rights

- Transfer of a driver's license

- Administrative liability for failure to comply with the instructions

- Restoration of a driver's license

2016. Its essence is to restrict the right to drive of persons who have debts for:

Its essence is to restrict the right to drive of persons who have debts for:

- maintenance payments;

- penalties for the crime committed; nine0006

- compensation for the harm caused.

Bank loan and utility bills were not included in the list. The restriction consists in the temporary withdrawal of a driver's license by bailiffs, traffic police officers and other officials. This measure is intended to induce the debtor to repay debts. The law applies not only to individuals, but also to individual entrepreneurs. The changes affected by it concern:

- st. 64, 67.1 Federal Law No. 229 "On Enforcement Proceedings" dated October 2, 2007 ;

- Art. 12.7 , 17.14 Administrative Code .

Arguments in favor of the new law

Did you know

Alimony can be filed not only after a divorce, but also while in an officially registered marriage. To do this, certain conditions must be met - the presence of a common minor child (children), the inability of one of the parents to independently financially provide for themselves or children, and more. Read more in this article

Read more in this article

In Russia, before the introduction of Federal Law No. 340 , drivers could lose their license only for non-compliance with traffic rules. However, the restriction of a driver's license for non-payment of alimony is widely used in some developed countries: the USA, Canada, Great Britain, Finland, Poland, Israel and others. Its effectiveness has been proven by a significant reduction in maintenance debts. This was the reason for the adoption of such a law in the Russian Federation, the discussion of which began quite a long time ago. nine0003

The expected effectiveness of the new law is all the more high because about a third of the debtors, which is 450,000 people, have a driver's license. (according to Rosstat). An indirect confirmation of its effectiveness is the practical application of Article . 67 of the Federal Law "On Enforcement Proceedings" , also adopted recently. Its content is to prohibit the debtor from traveling outside the Russian Federation. The consequence of this measure was the repayment of maintenance debts in the amount of approximately 1.5 billion rubles. in 2014 nine0003

The consequence of this measure was the repayment of maintenance debts in the amount of approximately 1.5 billion rubles. in 2014 nine0003

Vehicles prohibited from driving

If there is a debt, the right to drive is withdrawn:

- cars;

- motorcycles;

- mopeds;

- tricycles and quads;

- self-propelled machines;

- river and sea vessels;

- by air.

Conditions that allow depriving the debtor of the right to drive

The possibility of depriving the driver of a driver's license appears in the presence of the following circumstances:

- The court issued an order to collect the debt from the defendant.

- The amount of debt in the aggregate is at least 10,000 rubles. When determining it, other unpaid obligations are also taken into account - imposed for violation of traffic rules or other legislative norms. That is, if they are available, an administrative measure can be applied even if the debt for alimony does not reach the required limit.

The term of non-payment is not taken into account.

The term of non-payment is not taken into account. - This situation does not belong to the mentioned legislation, in which the application of these measures would be unacceptable. nine0006

Persons not subject to deprivation of driving license

Para. 5 p. 9 art. 67.1 of Federal Law No. 229 provides for cases in which deprivation of rights for debts is impossible:

- The cost of outstanding obligations is below 10,000 rubles.

- Transport is used by the defendant as the main source of income. For example, when transporting passengers or goods. This fact must have documentary evidence - the existence of an agreement, a work book or a certificate of creation of an individual entrepreneur. nine0006

- The place of residence of the debtor and his family members is located far from public transport route lines. In this connection, driving a car is the only way to reach a place of work or study and a condition for a normal existence.

- The defendant has a disability.

- Debtor provides maintenance for:

- a child with a disability, regardless of its group;

- adult invalids of group I or II.

- The payer was granted a deferral of debt repayment, as he missed the payment deadlines for good reasons:

- was ill for a long time;

- was fired due to redundancy;

- other causes

These circumstances must be confirmed by relevant documents. For example, an extract from the work book, a certificate from the place of residence, about disability, about the presence of a delay. Copies of the documents along with the application are transferred to the bailiff. nine0003

The application should preferably be made in two copies to avoid misunderstandings. After considering the application, the bailiff draws up an act on the ban on the withdrawal of a driver's license. It is better to always have a copy of the act, as well as supporting documents, in the car for presentation to the traffic police.

The procedure for deprivation of rights

A document obliging the defendant to pay alimony and determining the amount of monthly payments can be drawn up in the form: nine0003

- Mutual agreement (rare in practice).

- Court order on the basis of which the enforcement decision is issued.

If there is an agreement

If the payer does not comply with the terms of the agreement, the child support recipient has the right to apply to the court for revocation of a driver's license for debts. The application must indicate the amount of the debt and the period of non-payment. A bailiff can also file a lawsuit, which is allowed to do so by the expanded powers granted by the new law. nine0003

If there is a writ of execution

The bailiff has the right, without going to court (on his own initiative or at the request of the plaintiff), to issue an order depriving the defendant of the right to drive. The possibility of performing these actions also appeared as a result of the adopted law. This requires the presence of a writ of execution, the instructions of which were not fulfilled within the specified period. The voluntary term for payment of debts, as a rule, is 2 months. If we are talking about maintenance payments, the court may set other terms. The statute of limitations for child support arrears is 3 years. This means that in the case of a debt for several years, the defendant will be obliged to pay only the debt for the last three years. Read more on our website https://divorceinfo.ru/3057-sroki-davnosti-po-uplate-alimentov

This requires the presence of a writ of execution, the instructions of which were not fulfilled within the specified period. The voluntary term for payment of debts, as a rule, is 2 months. If we are talking about maintenance payments, the court may set other terms. The statute of limitations for child support arrears is 3 years. This means that in the case of a debt for several years, the defendant will be obliged to pay only the debt for the last three years. Read more on our website https://divorceinfo.ru/3057-sroki-davnosti-po-uplate-alimentov

Deprivation of rights

The contents of the order include:

- driver's license information;

- instructions on the fulfillment of obligations to the debtor;

- notice that the debtor may be deprived of rights for non-payment of alimony within 5 days.

The document is subject to approval by the senior bailiff. Its copies must be sent within one day:

- to the alimony recipient; nine0006

- to the payer;

- to the bodies of the Ministry of Internal Affairs, traffic police and other services (according to the type of transport), which record information about the collection in the database.

Transfer of a driver's license

Having received a decision on deprivation of rights, the defendant must pay off debts or hand over the driver's license to the Federal Bailiff Service (FSSP) within 5 days. At the same time, an act of transferring the document is drawn up, which is stored in the Bailiff Service until it is returned to the owner. nine0003

Administrative liability for failure to comply with the instructions

A debtor who has ignored the requirements of the bailiff may be subject to a fine in the amount of ( Art. 17.14 part 1 of the Code of Administrative Offenses ): defendant. One quarter - for one child, one third - for two, exactly half - for three or more children. Read more about the minimum amount of alimony in the article here

- RUB 1000–2500 for individuals.

- 10000–20000 rubles for individual entrepreneurs.

If even after that the violator does not give up the right and continues to drive vehicles, any of the following measures are applied to him:

- Imposition of a fine up to 30,000 rubles.

- Imprisonment for up to 15 days.

- Correctional labor for 100-200 hours

The person who transferred the right to drive to the debtor is subject to a penalty in the amount of 30,000 rubles. nine0003

After fines have been imposed, the child support debtor's driver's license may be forcibly revoked and transferred to the Bailiff Service. The imposition of an administrative penalty does not exclude the need to repay the debt.

Restoration of driver's license

The driver's license is returned to the debtor after full payment of existing debts and penalties accrued for late payments. As confirmation, he must provide the bailiff with documentary evidence. For example:

- bank statement on transferring money to the recipient's card;

- a receipt for cash, written by the plaintiff in the presence of a bailiff or notarized;

-

copies of receipts for payment to the treasury, if the debts on maintenance payments were reimbursed to the recipient by the state.

If the case was initiated by the FSSP, an additional execution fee of 7% of the amount owed is paid. After that, the bailiff within two days (including the day of the debtor's application) issues a decision on the issuance of a driver's license. This information is entered into the database, and a copy of the document is sent to the traffic police. nine0003

For more information - ask questions in the comments to the article

How to return excessively transferred alimony \ Acts, samples, forms, contracts \ ConsultantPlus

- Home

- Legal resources

- Collections

- How to return overpaid alimony

A selection of the most important documents upon request How to return overpaid alimony (regulations, forms, articles, expert advice and much more). nine0003

- Alimony:

- Alimony obligations of children for the maintenance of parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of an individual entrepreneur

- still .

..

..

Articles, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments, comments. answers to questions : How to return overpaid alimony

Register and get trial access to the ConsultantPlus system for free to 2 days

Open the document in your system ConsultantPlus:

Article: Disputes over child support ) With the actual withholding of alimony by the employer organization, issues related to personal income tax often arise. Alimony is collected after deductions from wages and other income from personal income tax. If the employer provides the employee with a property deduction, that is, pays him wages without personal income tax withholding, then alimony must be calculated from the entire amount of the employee's wages (income) (Letter of the Federal Labor Service of the Russian Federation dated December 28, 2006 N 2261-6-1). If an employee applies to the Federal Tax Service for a property deduction, the Federal Tax Service checks this declaration, provides a property deduction and returns the overdeducted personal income tax amounts to the employee’s current account. The alimony payer must pay alimony from the amounts returned by the tax authorities, because the tax authority does not have the right to do so. The tax returned in connection with the receipt of the deduction is not listed in the list of income subject to alimony in the Decree of the Government of the Russian Federation of 07/18/1996 N 841. Judicial practice on this issue is also developing not in favor of alimony recipients (Appeal ruling in the case of 11/17/2015 N 11a-14277 / 2015).

The alimony payer must pay alimony from the amounts returned by the tax authorities, because the tax authority does not have the right to do so. The tax returned in connection with the receipt of the deduction is not listed in the list of income subject to alimony in the Decree of the Government of the Russian Federation of 07/18/1996 N 841. Judicial practice on this issue is also developing not in favor of alimony recipients (Appeal ruling in the case of 11/17/2015 N 11a-14277 / 2015).

Register and get test access to the consultantPlus system free on 2 days

Open the document in your consultantPlus system:

Article: disputes on alimony

(Baldynova A.)

("Labor Law", 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021, 2021 N 4) With the actual withholding of alimony by the employer organization, issues related to personal income tax often arise. Alimony is collected after deductions from wages and other income from personal income tax.