How is child support calculated in new york state

How to Calculate Child Support in New York | SnapDivorce

Calculating child support in New York is very circumstantial and requires a detailed process based on New York guidelines that can be modified to fit your specific needs.

Divorced parents are required to pay child support in New York until their children reach the age of 21In New York, divorcing parents are obligated to continue to support their children until the children reach age 21. If you are considering a divorce or separation and have children under the age of 21, you are likely aware that you or your spouse will have to pay child support but probably have a lot more questions. How much is child support? What does child support include? Do I still have to pay child support if we have equal custody? In this article, we will answer these questions and give you a basic overview of how child support works in New York.

If you are still confused after reading this article, consider talking to to a New York Divorce Mediator.

In New York, there are two categories of child support – basic child support and add-ons. Basic child support consists of the costs the children’s basic living expenses such as food, clothing, and shelter. Practically speaking, basic child support is for covering expenses such as mortgage payments, real estate taxes, utilities, and groceries. Add-ons are additional expenses the children may require such as health insurance, unreimbursed medical expenses, childcare if the custodial parent is working, and certain educational expenses if deemed appropriate by the court. In some cases, add-ons can also include other kinds of expenses like extracurricular activities, camp or therapy.

Child support in New York is calculated based on a set of guidelinesNew York law provides a set of guidelines for calculating child support. Basic child support is calculated as a percentage of the parents’ combined incomes based on the number of children in the household. This is paid from the non-custodial parent to the custodial parent. The custodial parent is generally the parent that cares for the children more than 50% of the time. If the parents share custody of the children on an equal 50/50 basis, the higher-earning parent is the non-custodial parent for child support purposes and pays child support to the lower-earning parent. Add-ons are divided between the parents in proportion to their pro-rated percentage share of their combined incomes. This can either be paid directly from one parent to the other or to a third-party such as a doctor or childcare provider.

This is paid from the non-custodial parent to the custodial parent. The custodial parent is generally the parent that cares for the children more than 50% of the time. If the parents share custody of the children on an equal 50/50 basis, the higher-earning parent is the non-custodial parent for child support purposes and pays child support to the lower-earning parent. Add-ons are divided between the parents in proportion to their pro-rated percentage share of their combined incomes. This can either be paid directly from one parent to the other or to a third-party such as a doctor or childcare provider.

The law provides a formula for calculating basic child support based on the parents’ combined incomes up to $148,000. For combined parental incomes above the $148,000 cap, the courts have discretion in applying the child support guidelines, which they often do.

Step one in calculating child support in New York is determining the parent’s gross income

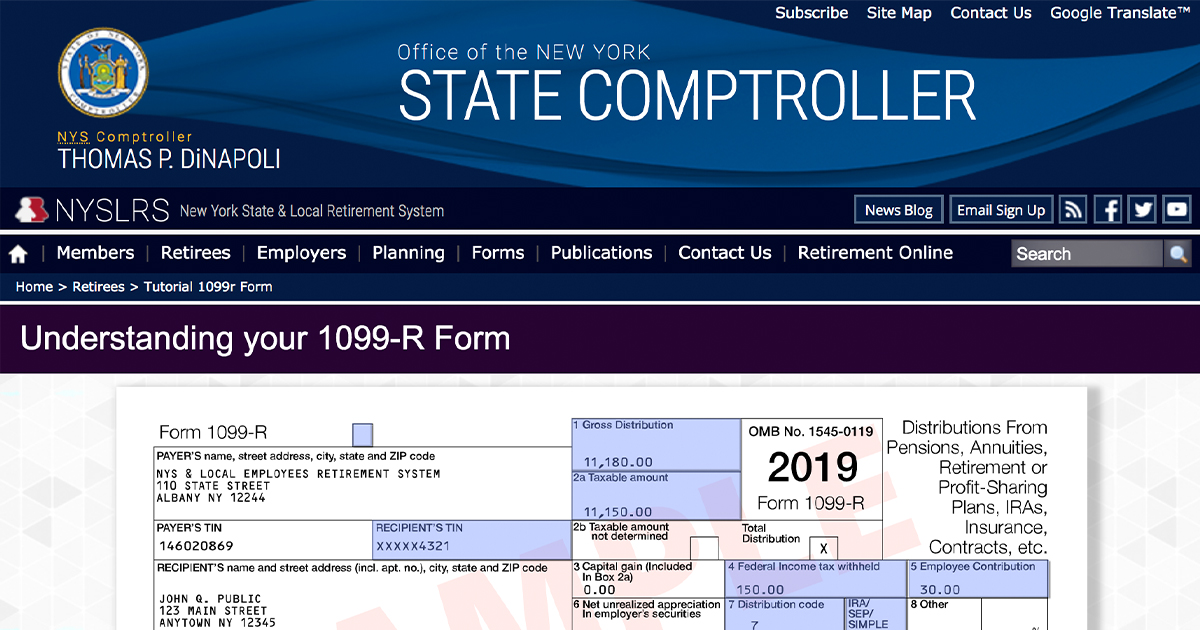

The first step in calculating child support is determining the parents’ combined gross income. Gross income is defined in the same way for both alimony and child support calculations and can be complicated. In the simplest cases, your income is what you report on your most recent federal tax return (such as on your W-2 and 1099 forms) and includes income from employment, business income and self-employment (before taxes and contributions to retirement or other tax-deferred accounts). However, not every case is this simple and tax returns do not necessarily provide the most accurate financial picture of a family’s actual available income. Courts may also “impute” or include the income for one or both parents based on a certain number of variables. An example would be if one of the parents receives non-taxable benefits through his or her employment, or receives financial assistance from another family member. Determining what an income really is for child support purposes is often a hotly litigated issue in court but we will get back to that issue later in the article when we discuss how divorce mediation in New York can help you come to a fair and mutually beneficial agreement on child support.

Gross income is defined in the same way for both alimony and child support calculations and can be complicated. In the simplest cases, your income is what you report on your most recent federal tax return (such as on your W-2 and 1099 forms) and includes income from employment, business income and self-employment (before taxes and contributions to retirement or other tax-deferred accounts). However, not every case is this simple and tax returns do not necessarily provide the most accurate financial picture of a family’s actual available income. Courts may also “impute” or include the income for one or both parents based on a certain number of variables. An example would be if one of the parents receives non-taxable benefits through his or her employment, or receives financial assistance from another family member. Determining what an income really is for child support purposes is often a hotly litigated issue in court but we will get back to that issue later in the article when we discuss how divorce mediation in New York can help you come to a fair and mutually beneficial agreement on child support.

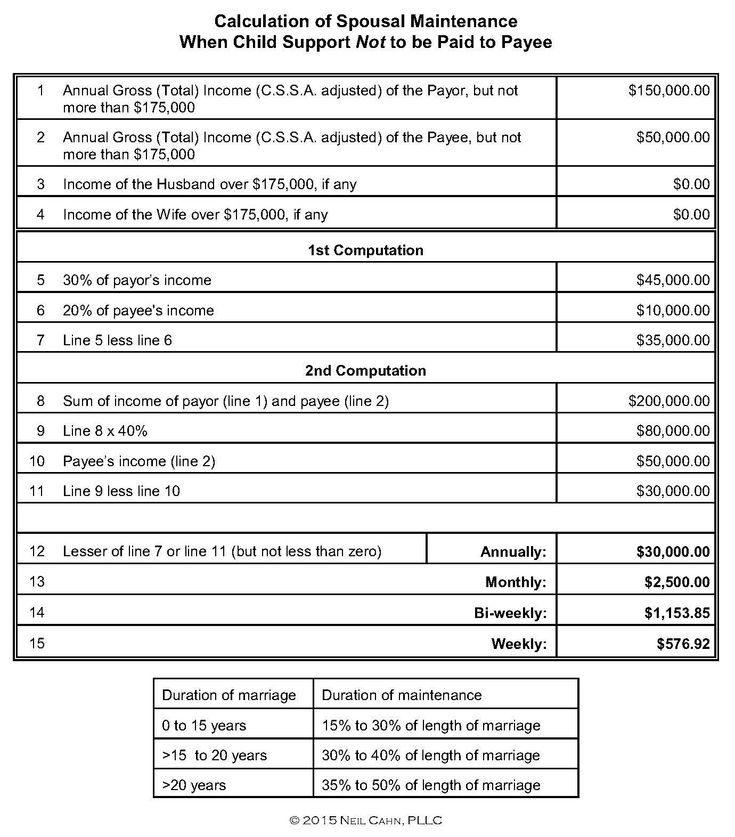

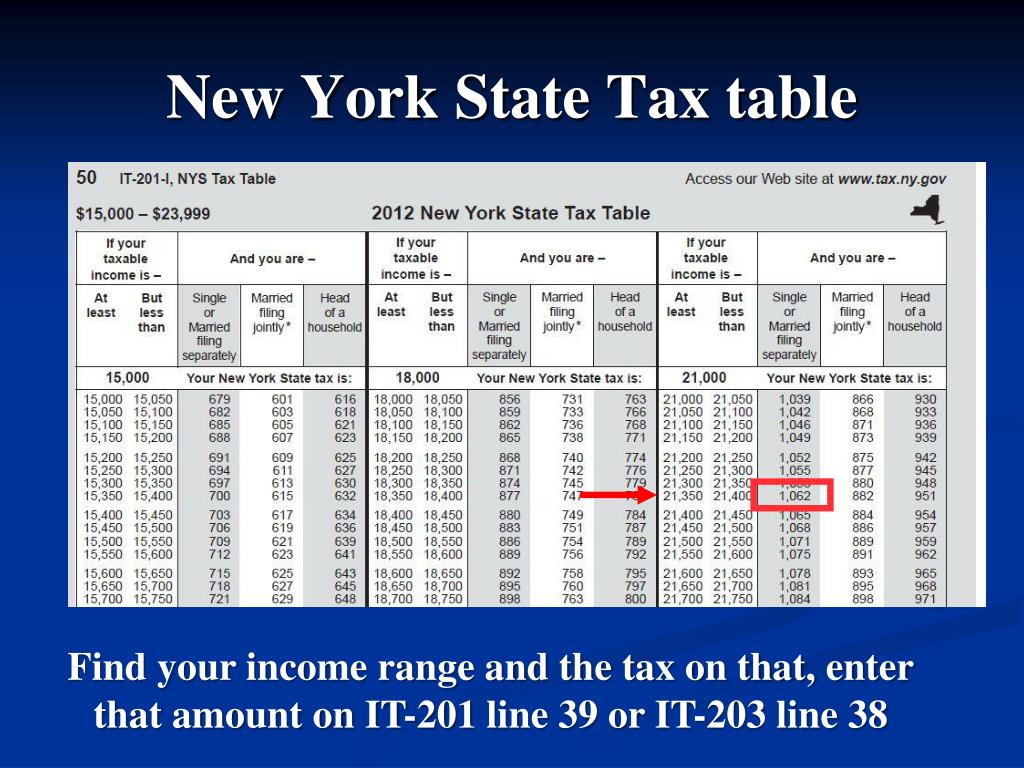

Once you determine each parent’s income, you deduct FICA (social security and Medicare taxes) and some local taxes (for example, in New York City or Yonkers) in order to arrive at a net income for child support calculation purposes. If one of the parents is paying alimony (maintenance) to the other parent, the amount of maintenance will be deducted from the payor parent’s income and added to the receiving parent’s income.

The number of children in your family determines the percentage that is applied to child support in New York

Next, the parents’ incomes are added together and a percentage is applied based on the number of children in the family. For one child, you take 17% of the parents’ combined income, for two children you take 25%, for three children you take 29%, for four children you take 31% and for five children you take no less than 35% of the parents’ combined income and this percentage amount represents the basic child support obligation.

Then we calculate each parent’s proportional share of the basic child support obligation by dividing each parent’s individual income by the total combined parental income to arrive at a percentage. That percentage is then applied to the total basic child support obligation to determine each parent’s pro-rata percentage share. The non-custodial parent then pays his or her pro-rated amount of the total basic child support obligation to the custodial parent.

That percentage is then applied to the total basic child support obligation to determine each parent’s pro-rata percentage share. The non-custodial parent then pays his or her pro-rated amount of the total basic child support obligation to the custodial parent.

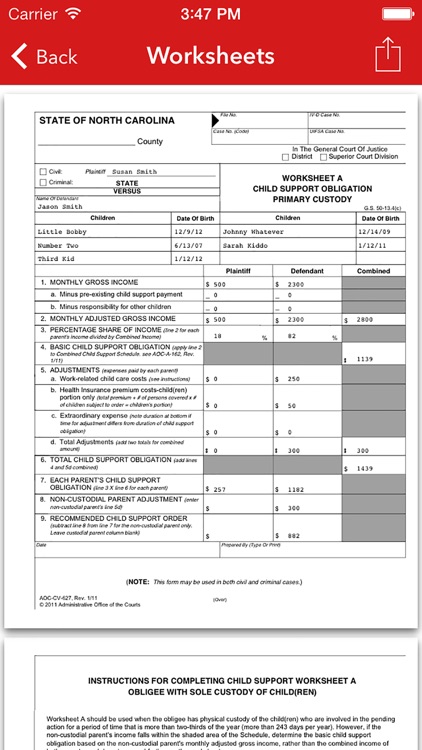

A sample New York child support calculation

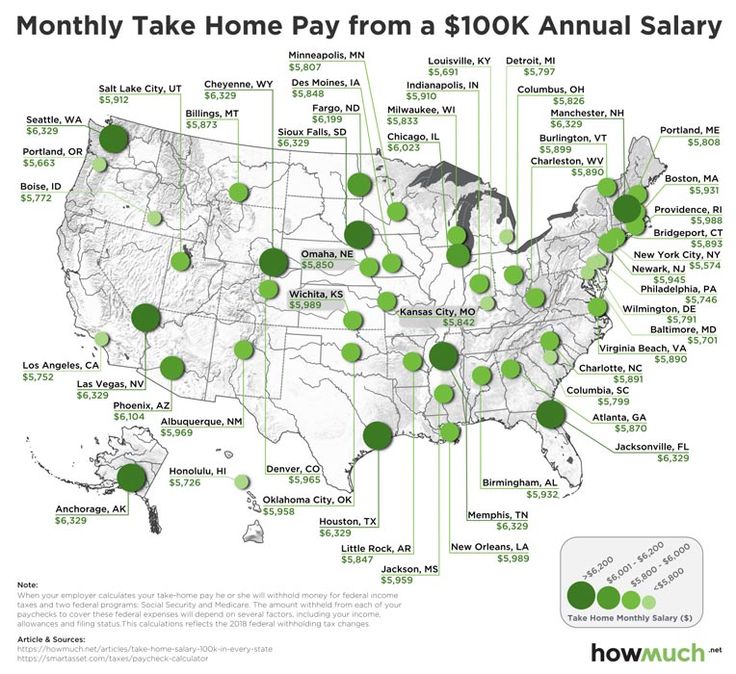

So, let’s calculate child support for two children using the same couple from our maintenance example where Husband earns $100,000 net per year and the Wife earns $50,000 net per year. In that example, to make things simple, we are assuming that we already deducted FICA and local taxes but now have to account for maintenance.

So, for child support calculations, Husband’s income would be $92,500 ($100,000 – $7,500 per year in maintenance) and Wife’s income would be $57,500 ($50,000 + $7,500 per year in maintenance). Since there are two children we would then take 25% of the total combined parental income of $150,000, which is $37,500. Next, we determine each parent’s pro-rata share by dividing each of their individual incomes by their combined income. Wife’s pro-rata share would be 38% ($57,500/$150,000) and Husband’s pro-rata share would be 62%. Let’s assume that Husband is the non-custodial parent. Husband would pay Wife $23,250 (62% of $37,500) per year in basic child support or $1,938 per month.

Wife’s pro-rata share would be 38% ($57,500/$150,000) and Husband’s pro-rata share would be 62%. Let’s assume that Husband is the non-custodial parent. Husband would pay Wife $23,250 (62% of $37,500) per year in basic child support or $1,938 per month.

With respect to add-on expenses, we would divide those according to the same pro-rata share. For example, if the children’s health insurance premiums cost $2,500 per year, Husband would be responsible for 62% of this amount or $1,550.

While we are discussing add-ons, at SnapDivorce we are often asked by couples exactly what expenses are included in “add-ons”? Do add-ons include summer camp? Tutoring? Horseback riding lessons? The answer is, it depends. At the minimum end of the spectrum, the law provides for certain mandatory add-ons, which are: health insurance premiums, unreimbursed medical expenses, and childcare to allow the custodial parent to work. Often families with children have significant additional expenses for extracurricular activities, summer camp and educational expenses among others. Under the law, neither party is obligated to contribute to these expenses but parties who chose to settle child support out of court often provide for such expenses in an agreement, which is one of the many benefits to agreeing to child support in an out-of-court agreement.

Under the law, neither party is obligated to contribute to these expenses but parties who chose to settle child support out of court often provide for such expenses in an agreement, which is one of the many benefits to agreeing to child support in an out-of-court agreement.

Speaking of agreements, this brings us to one of the key points of this article. In mediation, most couples do not follow the child support guidelines calculations and instead reach their own agreements based on their individual financial needs and circumstances. We are often asked by couples in mediation whether it is mandatory to follow the child support guidelines. The short answer is no – with one caveat. When parties reach their own child support agreement out of court, the language of the agreement itself must comply with specific requirements including a breakdown of the calculations of the presumptive child support guidelines in order to be enforceable by a court in the future. That is why it is important for couples to understand how the guidelines work and to have an experienced family law attorney draft your child support agreement.

Mediation gives couples the freedom to come up with their own child support agreements that work best for their unique family situations. In litigation, parents often spend unnecessary time and money litigating issues involving child support when they could instead be maintaining these resources for their children’s current and future needs. As mediators, we know that while the legal guidelines are often a good starting point, realistically speaking, for many families, taking such a formulaic approach does not always result in an amount of child support that is appropriate or feasible. This is true for a variety of reasons including having a child with special needs or certain tax implications. So, while the parent’s incomes for child support purposes may come out one way, in reality, their actual take-home income is far more or far less and parents want to account for this discrepancy. By the same token, especially with parents who are self-employed or have their own businesses, actual income available for support may be tricky to figure out.

By the same token, especially with parents who are self-employed or have their own businesses, actual income available for support may be tricky to figure out.

In mediation, we explain the guidelines to parents and let them make their own decisions as to whether or not to apply them to their cases. Often parents choose to take a different approach and focus less on what the calculations say and look more at the parents’ actual take-home income and budgets. We look at how much the custodial parent actually needs to cover his or her own basic monthly obligations (some of these expenses would technically be a part of basic child support such as food and housing costs) and then determine how to apportion the children’s expenses. This approach is based less on income and more on the family’s reasonable needs and values.

Divorce Mediation allows child custody to be personalized to each family

In mediation, we can be creative in ways that you cannot be in litigation. In court, judges will most often take a far more rigid approach and apply the child support guidelines without regard to the parties’ individual circumstances. In mediation, when both parents are committed to working together for the best interests of the children, they combine their mental and financial resources and to come up with a practical solution rather than waste time and money on arguing and attorney’s fees. For example, for some families, it might make sense for the custodial parent to take less support in exchange for a greater share of the marital assets, especially if those assets include the marital residence that may have minimal carrying costs or no mortgage. For other families, it might make more sense for one of the parties to pay for a larger share of the children’s day-to-day expenses, while the other party agrees to pay for the higher cost items such as camp, private school or the children’s college tuition and costs.

In mediation, when both parents are committed to working together for the best interests of the children, they combine their mental and financial resources and to come up with a practical solution rather than waste time and money on arguing and attorney’s fees. For example, for some families, it might make sense for the custodial parent to take less support in exchange for a greater share of the marital assets, especially if those assets include the marital residence that may have minimal carrying costs or no mortgage. For other families, it might make more sense for one of the parties to pay for a larger share of the children’s day-to-day expenses, while the other party agrees to pay for the higher cost items such as camp, private school or the children’s college tuition and costs.

In mediation, we will review your needs and priorities and go through options with you. We will then encourage meaningful and productive discussion and help you brainstorm to come up with creative solutions that work based on your individual family circumstances.

Child Support Calculator NY | Calculating Child Support in NY

By Sari M. Friedman, Legal Counsel

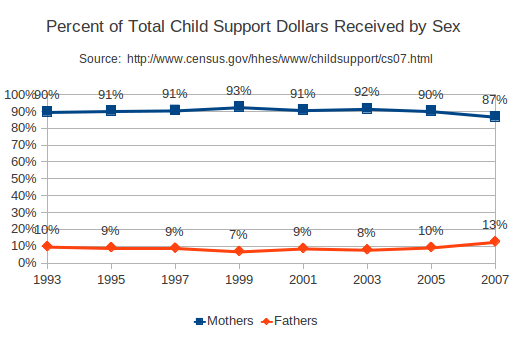

Fathers' Rights Association – NYS & Long Island

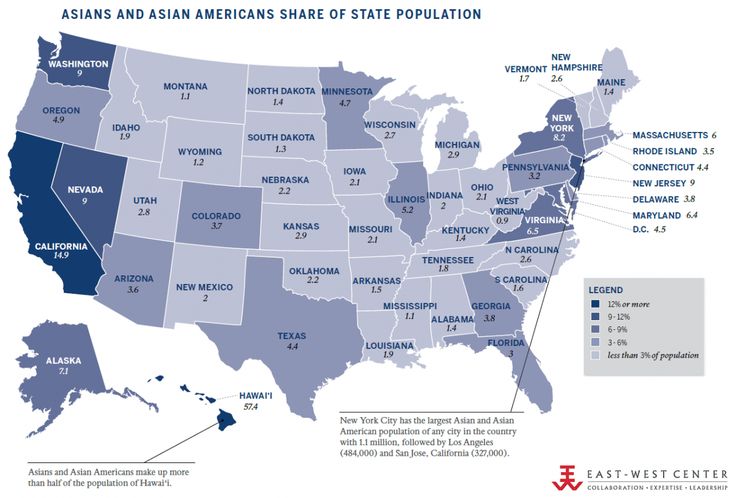

In New York State, who pays child support in a 50/50 joint custody arrangement since there there is no one "custodial parent"? Generally, the lower-earning parent will be treated as the “custodial parent” and the higher-earning parent will end up paying child support. Continue reading for more details about child support in NYC, Long Island, and all of New York.

In an earlier article we wrote about the Court of Appeals decision in Bast v. Rossoff 91 N.Y.2d.723. In this case, the Court held that shared custody arrangements do not alter the scope and methodology of the Child Support Standards Act (CSSA).

The act, passed in 1989, states that the three-step statutory formula for calculating NY child support must be applied in all shared custody cases.

Related Reading:

- Child Support & Extra Curricular Activities

- Child Support & College Expenses

- Interstate Child Support Laws

- New Child Support Law

- When Is My Child Emancipated?

Contact a Child Support Lawyer Today! Serving Long Island, NYC & All of NYS.

How Much Is Child Support in NY?

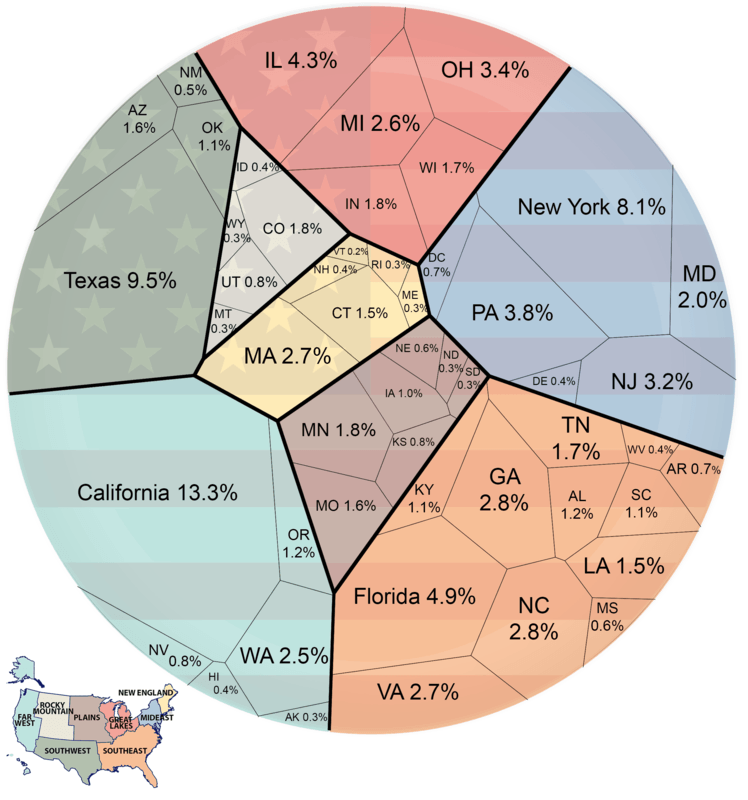

New York State child support is calculated using the NY child support calculator formula. NYC.gov also has an online NY child support calculator. You can use their child support calculator to help you get an idea of how much child support may be required for your case in NY.

The three-step formula for calculating NY child support is:

- Calculate the combined income and each parent's pro-rata share of the same

- Use the correct percentage of total income CSSA says should be devoted to child support:

- 17% for one child

- 25% for two children

- 29% for three children

- 31% for four children

- 35% for five or more children

- Calculate each parent's share thereof.

The non-custodial parent is directed to pay a pro-rater share of the child support obligation unless the court finds the amount to be unjust or inappropriate based on consideration of specified factors in Section F of CSSA.

The problem is that Bast (in Bast v. Rossoff) does not specifically address how to apply the CSSA in cases of equal shared custody. Indeed, the Bast case did not recognize cases of equal shared custody.

In Equal Shared Custody, Who Is the Custodial Parent?

The Appellate Division, 3rd Department did address the shared custody issue in Baraby v. Baraby 250 A.D 2d 2201, and the Appellate Division, 4th Department addressed it again in Carlino v. Carlino 277 A.D. 22d 897.

In Baraby, the third department stated the parent with the larger income would be deemed the non-custodial parent for purposes of calculating support under CSSA. The parent with the non-custodial designation must be directed to pay his or her pro rata share of the child support obligation to the other parent unless the statutory formula yields a result that is unjust or improper. In that situation, the trial court can resort to the "Paragraph F" factor in CSSA and order an amount that is just and appropriate under the circumstances.

The parent with the non-custodial designation must be directed to pay his or her pro rata share of the child support obligation to the other parent unless the statutory formula yields a result that is unjust or improper. In that situation, the trial court can resort to the "Paragraph F" factor in CSSA and order an amount that is just and appropriate under the circumstances.

The 4th department in Carlino, citing the Baraby case, which said in a 50/50 shared custody arrangement, if the parent with the larger income demonstrates that expenses incurred in having equal time substantially reduces the cost the parent with the lesser income has to bear as non-custodial parent, then the court should find that it would be unjust or inappropriate to award the statutory amount. Instead, the court should determine a proper support amount based on the specific expenses and the degree such expenses have been substantially reduced as a result of the time spent with the non-custodial parent. That court, as in Baraby, also remanded the case to the Trial Court for a hearing to calculate support in accordance with its decision. It found the Trial Court record lacked sufficient requisite information necessary to make the calculation.

That court, as in Baraby, also remanded the case to the Trial Court for a hearing to calculate support in accordance with its decision. It found the Trial Court record lacked sufficient requisite information necessary to make the calculation.

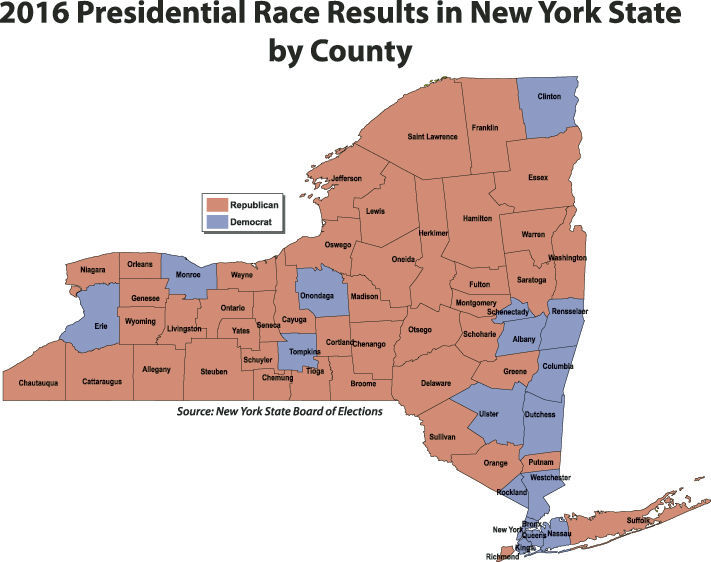

What Does This Mean To You?

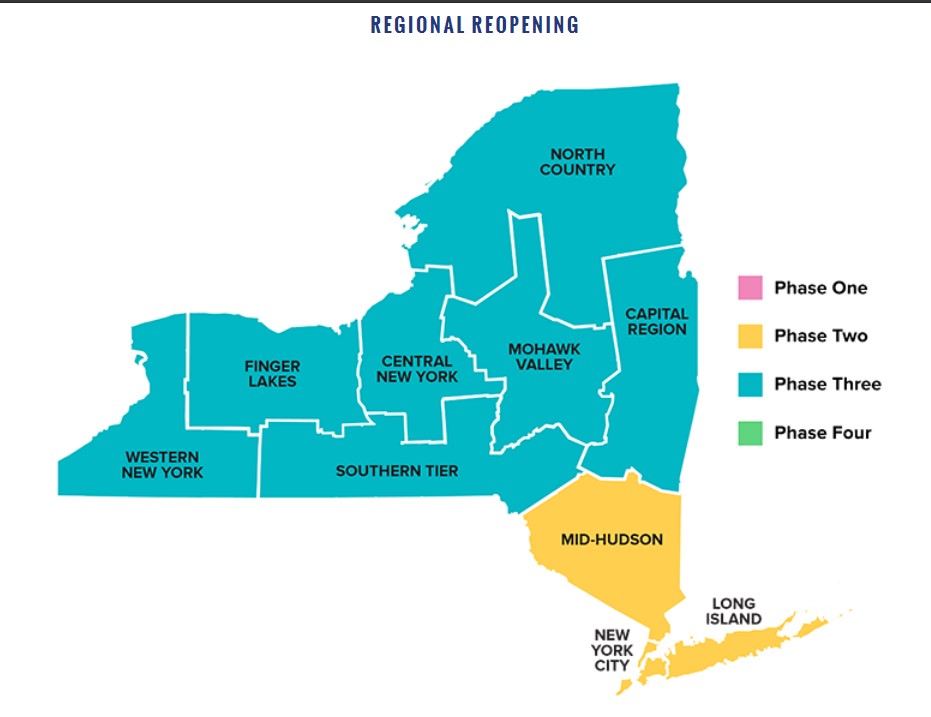

If you live in New York State in the first or second Judicial Department, chances are the principles laid out in Baraby as well as in Carlino will be adhered to. This further means that if you are the larger wage earner and thus the non-custodial parent for purposes of CSSA in a case of equal time, then you should be prepared to demonstrate how your time with the child reduces the custodial parent's expenses for things such as, but not limited to, food, electricity, telephone, transportation, entertainment, etc.

Prior to these decisions, Bast made clear the statutory formula should be applied and courts were quite reluctant to deviate from the Act on the principle of "unjust or inappropriate". These two cases may well have provided a platform for arguing that people with close to 50/50 time should obtain the same treatment of analyzing to what extent the custodial parent's expenses are reduced by the substantial time the non-custodial parent spends with the child.

These two cases may well have provided a platform for arguing that people with close to 50/50 time should obtain the same treatment of analyzing to what extent the custodial parent's expenses are reduced by the substantial time the non-custodial parent spends with the child.

What If You Do Not Have 50/50 Time, but More Than Standard Visitation Time?

The unknown question at this point is how far the New York courts, as a parochial matter, will extend their willingness to deviate from CSSA based upon the time each parent spends with the child. An environment has been created where individual treatment of each case, based on its unique set of acts, has been discouraged in favor of applying a uniform standard.

| Request a Case Evaluation |

Up to this point, courts have been reluctant to find that the statutory formula produced a result that is unjust or improper, and therefore, to permit deviation. The Baraby and Carlino cases would re-encourage a case by case analysis by the trial courts based upon the sensitivity of its own individual facts. This possibly results in a wide variance of case decisions because of un-uniform discretion applied by different judges. Elimination of this discretion was what was originally sought when CSSA was enacted. It was felt that there should not be similar cases decided differently because two different judges chose to exercise discretion differently

The Baraby and Carlino cases would re-encourage a case by case analysis by the trial courts based upon the sensitivity of its own individual facts. This possibly results in a wide variance of case decisions because of un-uniform discretion applied by different judges. Elimination of this discretion was what was originally sought when CSSA was enacted. It was felt that there should not be similar cases decided differently because two different judges chose to exercise discretion differently

Conclusion

Hopefully, we are coming full circle with Baraby and Carlino in recognizing that justice cannot be dispensed without consideration of the individual facts of each case. The CSSA Act was passed when most men were the sole or primary wage earners. It does not recognize the two wage earner household where wives may indeed earn as much as - or more - than their husbands. New arguments and decisions on this issue will help to change the current standard rules to conform to current societal practices. Until then, you and your attorney will have to work to establish these changes. The good news is that you can.

Call Friedman & Friedman at (516) 688-0088 for further information about New York State child support or divorce.

Alimony lawyer in New York. Alimony for the maintenance of a child

Today, in all states, the procedure for assigning amounts for the maintenance of a child (alimony) is established by law.

How child support is determinedTo avoid prejudice and to protect the equal rights of children, the federal government has established child support guidelines that are mandatory for all states. States, in turn, have the right to make more specific recommendations to established principles.

Income

One of the main guidelines for determining child support is income. This takes into account the gross or net income of both parents, and from the percentage is calculated the amount that each parent must pay as alimony.

Deductions

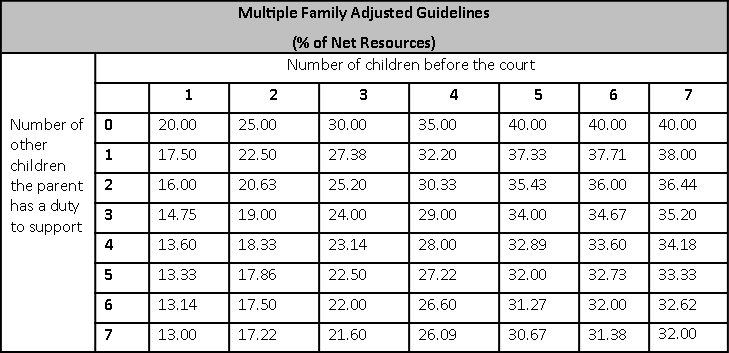

If one of the parents has already been ordered by the court to pay child support and he pays it regularly, then the amount of this child support is subject to deduction when determining his income for the purposes of determining the amount of new support. However, this rule is valid only for the establishment of new alimony, it is not possible to revise the previous established amount of alimony taking into account new alimony.

Childcare expense

The government also determines the amount that parents must spend on childcare. Usually, this amount is calculated taking into account the mandatory taxes that the parent pays. However, some states provide benefits to parents who pay child support and exempt them from taxes on their income.

Health care expense

Among other things, when determining the amount of child support, great attention is paid to the coverage of the child's health insurance. When support is approved, the amount needed to pay off health insurance is included in the main amount of support. Some states also account for emergency medical expenses as well as incidental medical expenses.

When support is approved, the amount needed to pay off health insurance is included in the main amount of support. Some states also account for emergency medical expenses as well as incidental medical expenses.

Other expenses

The amount of support can also be increased taking into account other expenses. Other expenses usually include specific expenses that are specific to each individual case. Such expenses include the cost of educating children with disabilities or gifted children. Usually such expenses are divided between the parents proportionally and are included in the amount of alimony.

Shared Custody and Visitation

The judge tries to take into account the time the child spends with either parent when setting the amount of child support. The more a parent is allowed to spend with a child, the more child support is assigned. For example, if a child is assigned joint custody, the amount of child support will be significantly less than if the child has a single guardian for short visits.

The use of guidelines in determining the amount of alimony is not only aimed at protecting the rights and interests of children, but also calculated on the fair distribution of material responsibilities between parents. However, there are situations in which the amount of child support established is greater than or less than the amount determined by the guidelines. In this case, litigation is required to establish mitigating factors.

Our law office will provide you with quality legal assistance in all matters of family law.

Please note important information in the Family Law section

Family Law – Sharifov & Associates – Attorneys at Law

division of joint property in New York

Family law is the branch of law that deals with matters relating to the family and family relations. Our family law practice includes representing clients both at the negotiation stage and in court in cases involving domestic violence (usually followed by an order of protection), divorces, separation, residence of children after divorce, and visitation of children. , child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

, child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

divorce by consent in New York

Frequently Asked Questions:

1. What is the difference between a contested divorce and a non-contested divorce?

When both husband and wife voluntarily agree on all aspects of divorce, including division of joint property, residence and visitation of children, child support and for former spouses, or are able to sign a separation agreement, their divorce is considered a divorce by consent. Arrest for Domestic Violence in New York On the other hand, when spouses cannot agree among themselves on all aspects of divorce and separation, and require the court to make appropriate decisions on the above aspects of divorce, they are forced to deal with a judicial divorce. On the practical side, a legal divorce requires a lot more work, usually takes longer, and tends to cost more.

order of protection in new york

2. How can I get an order of protection in case family violence?

If something threatens your physical or emotional safety or the safety of your children, you should immediately seek the advice of a lawyer or seek the assistance of the Court. You need to take immediate steps to keep you and your children safe. Family courts in all counties in the State of New York are able to make a quick decision on an application for an order of protection; usually, if needed, it can be done within one day. The Summons, Petition and Order of Protection must be delivered to the defendant. This can be arranged through the local police station, privately, or through a professional document delivery agent. The Family Court may order the Sheriff's Department to serve the documents. The case will be rescheduled and the defendant will be subpoenaed to respond to the domestic violence petition. Either by agreement of the parties or after a hearing, the judge may issue a permanent order of protection, limited or complete, for up to 2 years.

Sometimes the police refuse to make an arrest during an investigation into domestic violence; however, the police may advise the victim to go to Family Court and ask the Judge to issue an Order of Protection. Both the New York State Criminal and Family Courts have concurrent jurisdiction over certain domestic violence offenses. The difference between the procedure in these two courts is that in Family Court, you, as the plaintiff, are a party to the process, and you have control of the lawsuit against the defendant (the person you accuse committed acts of domestic violence against you). violence). at any time you can reach an agreement with the defendant as closed; case, or you can just pick up your petition. If the police refuse to arrest the person you complained about, you can file a petition with Family Court. The Family Court Judge has jurisdiction to issue an Order of Protection (full or limited), which will have the same effect as an Order issued by a Criminal Court Judge. For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

The Domestic Violence Petition, unless both parties agree, is decided by the Family Court Judge at the conclusion of the hearing on the merits. The New York State Family Court has jurisdiction over other types of petitions, such as Child Visit and Residence, Child Support, Neglect of a Child, Establishment of Paternity, etc.

Occasionally, after an arrest and first appearance in criminal court, a Domestic Violence Petition is also filed in Family Court, requiring the client to attend both courts for the duration of both relevant cases. If there are minor children in the family, the Criminal Court will often include such children in the Protective Order, however, making an exception for Family Court modifications of the order. In such a case, the defendant who wishes to maintain a relationship with his children must go to Family Court and register a child visitation petition, asking the Judge to schedule visits to the children. Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

legal guardianship

3. I can't find my spouse, can I file for divorce?

Personal delivery of original divorce papers (Summon Notice or Summons of Complaint) is required by law. However, in the event that the plaintiff (the person initiating the divorce case) cannot find his/her spouse, the plaintiff must obtain court permission for alternative delivery of documents by filing a written petition with the court.

4. When am I officially divorced?

The parties to a divorce proceeding are considered divorced from the moment the judge signs the divorce decree. In the case of a divorce by consent, if a postcard has been filed in advance, the court will notify the final divorce by mail. In the event of a judicial divorce, although the judge may verbally announce during the trial that the parties are divorced, the divorce is officially finalized after the parties' lawyers have submitted the documents to the court and the judge has signed the divorce decree.

5. What is custody (custody) and how is the issue of children's residence after a divorce resolved?

There are two types of custody – legal custody and physical custody. Legal custody essentially means the right to make decisions. During marriage, both parents have rights to raise the child. This includes the right to make decisions about all aspects of a child's upbringing, including religion and education, as long as the parent's decisions do not pose a threat to the child. After a divorce, one of the spouses who has received legal custody of the child makes all decisions independently. You can consult with the other parent, and this is even recommended, however, if you are unable to agree with the other parent or do not wish to consult, you can make your own parenting decisions. Note that the court can always review a parent's decision to raise a child to ensure that the decision is in the best interests of the child. Joint legal custody essentially means that both parents have equal rights to make significant decisions that affect their children's lives. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

Post-divorce custody means the right of a parent to have a child permanently reside with that parent in the same family and be responsible for their child as long as they live with that parent. If one of the parents received the right to live with the child after the divorce, then the other parent is likely to receive the right to visit the child (visitation). If the parents cannot agree on a visitation schedule for the child, the court will provide such a schedule. Sometimes it is possible to have a joint right of residence of a child with parents in turn in equal shares (joint physical custody). In this case, the child will live half the time in the family of one parent, and half the time in the family of the other.

6.

Will I have less time to visit my child if the other parent has sole legal custody?

Will I have less time to visit my child if the other parent has sole legal custody? Optional. Legal custody means the right to make decisions, not the right to spend time with the child. The parent with exclusive legal custody has the right to make most parenting decisions if both parents cannot agree on that decision. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. Each parent in this case has equal rights to make decisions regarding the child. Regardless of whether your spouse has exclusive legal custody or both of you, you still have the opportunity to see your child as much as his schedule allows. Visitation of a child is usually independent of legal custody.

7. How is child support calculated?

New York State offers a formula for calculating the amount of child support payable by a parent as specified in Family Code section 240(1-b). This is a rather complicated article of law that must be read and interpreted carefully in order to accurately calculate the amount of child support. Usually, after the allowed deductions from the parent's total earnings, a certain percentage is applied to the balance of earnings to calculate basic child support. The percentage depends on the number of dependent children under 21:

Usually, after the allowed deductions from the parent's total earnings, a certain percentage is applied to the balance of earnings to calculate basic child support. The percentage depends on the number of dependent children under 21:

17% per child, 25% for two children, 29% for three children, 31% for four children, and 35% for five or more children;

It is necessary to carefully and carefully interpret the article of the law in order to accurately calculate child support, as there are many factors and conditions prescribed in the law that affect these calculations.

8. Who pays child support?

Generally, the parent with whom the child does not live most of the time will pay child support to the other parent.

child support in New York

9. Will I be able to pay less child support than is legally allowed?

The best chance to achieve this is to negotiate a reduction in child support as part of a common agreement between the parties. Do not forget, however, that the other party is not obliged to agree to this. Only in rare cases does the court find reasons not to apply the formula provided by law.

Do not forget, however, that the other party is not obliged to agree to this. Only in rare cases does the court find reasons not to apply the formula provided by law.

10. What if the children spend a significant part of their time with me, or even 50% of the time?

Once again, if you are unable to negotiate a reduction in child support with the other party, it will be extremely difficult for you to persuade the court not to apply the statutory formula. To illustrate this, note that even if the parents spend the same amount of time with the children, there is case law stating that the parent with the higher income counts as the parent not living with the child for purposes of calculating child support, and such parent would have to pay formula support! ! This shows how much more beneficial it is for clients to take good faith negotiations seriously as the best way to resolve a dispute.

11. Until what age should a parent support a child?

In New York State, a child is entitled to parental support until the age of 21, unless he/she begins independent living earlier. If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

12. Will a child be eligible for support if she stays in college after her 21st birthday to complete her studies and earn a bachelor's or graduate degree?

No. If child support continues after his 21st birthday, it will only be as a result of the agreement of both parents. The law does not require parents to continue supporting children after they turn 21, regardless of whether higher education is completed.

OK with this parent?

The Court takes the issue of changing the residence of children very seriously. The main criterion for the court is the issue of the welfare of the children. In attempting to make such a decision, the court will ask the question: "If such a change in the place of residence of the child is allowed, will it significantly change the nature of the relationship between the child and the parent who does not move to a new place with him?" The court will try to find out as much as possible about the nature of the relationship with the parent. (For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

(For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

14. Will my spouse be required to pay me alimony or maintenance after the divorce, and if so, for how long?

A recent change to the law that went into effect in 2016 provides for a formula on how to calculate temporary alimony, as well as a recommended formula for calculating permanent alimony after divorce and how long it lasts. There are also additional factors that the court must consider when determining the amount and duration of child support.

There are also additional factors that the court must consider when determining the amount and duration of child support.

Here are a few factors that are considered the most significant:

- the length of the marriage; the age and state of health of each spouse;

- present and future earning potential for each spouse;

- your opportunity to become financially independent;

- reduced or lost earnings opportunity due to denial or delay in education, training, employment, or career development during marriage;

- having children in your home;

This is a complex decision and will be influenced by many factors.

15. Can my spouse evict me from our home?

Unless you have physically, verbally, or mentally abused your spouse, or have already found another place to live, it will be extremely difficult for your spouse to evict you from their home. Unless you agree to move out voluntarily, your spouse will have to file a petition with the court for you to be evicted, and the court will give you an opportunity to respond to it.

16. Can I and my children continue to live in our house after the divorce?

Assuming that the children will be living with you, and if you have a child under 18, the court will generally try to keep the child in the home, neighborhood, and school to which the child is already accustomed, assuming that the child is fine in that environment, and also implying that financial circumstances allow it.

17. Am I entitled to a share in the value of the house, even if the title is not in my name?

If the house was purchased during the marriage with money earned during the marriage (regardless of which spouse earned the money), then it is likely that you will be entitled to a share in the price of the house, even if the house is not registered on you. There are many factors to calculate the size, value and percentage of this share.

18. I bought our house before our marriage with funds I bought before our marriage. Will I have to share the cost of my home with my ex/ex-spouse?

Usually not. However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

19. Will the court force me to sell my house?

If there are no children, and assuming the house is jointly owned, the court will allow each spouse to buy out the other spouse's share. If neither spouse has the ability to buy out the other's share, or is not interested in doing so, the court may order the sale of the house and divide the proceeds from the sale at the discretion of the court.

20. Credit cards: Should they be cancelled?

If you think your spouse will use credit cards beyond justified living expenses, consider closing the account. Most accounts can be closed by either paying off the debt or transferring to another credit card. If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

21. Do I have to withdraw money from all joint accounts to protect myself from my spouse taking or hiding the money?

The courts do not approve of either spouse withdrawing all the money from a joint account or withdrawing money without good reason. The husband should think seriously before withdrawing money. Do not forget that the court has the right to demand liability from the spouse if it is proved that he squandered or hid the joint funds.

22. If I have a business or share in a business, will my spouse get a share of the business?

If your business was created during your marriage, or you acquired an interest in a business during your marriage, then your spouse will most likely be able to claim a portion of that business or a portion of your interest in the business. If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

23. Can my spouse claim the estimated value of my professional license or higher education diploma?

For divorces initiated before 2016, by law, if all or part of the acquisition of a professional license or higher education occurred during marriage and was paid for by joint family funds, then it is likely that the spouse will be able to claim a portion of the assessed value of such a license or diploma. Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

24. Which courts can hear divorce, custody and alimony cases?

The Supreme Court has exclusive jurisdiction over divorce cases; however, Family Court has concurrent jurisdiction over custody, visitation, and child support matters. If a person wants to get a divorce, he needs to fill out the original documents in the Supreme Court. If the child's parents are not seeking a divorce, or are not married at all, and want to sue for domestic violence, custody, visitation, or child support, they should file an application in Family Court.

25. What is a juvenile delinquency trial?

This is a New York State Family Court lawsuit involving a delinquent case involving a juvenile between the ages of 7 and 16. When such a minor is arrested in New York State, he/she may obtain a subpoena from the police in Family Court in the county where the alleged offense was committed. On the other hand, when the allegations are serious enough and/or the minor child has had previous police referrals, the child may be detained overnight in a special detention center for children and brought to Family Court the next day when the court is open.

When a child comes to court with a parent or guardian, he/she and the parent will be interviewed by a probation officer and, depending on the charges, previous criminal convictions, the wishes of the victim and their parents, if the victim is a minor, the case may be referred to probation department. In this case, the petition against the juvenile delinquent is not filed and the child agrees to follow the rules of the probation department for an initial period of up to 60 days. The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

If a juvenile is charged with a felony, or if the victim wants the case to continue, the New York City Law Department, which in such cases acts as a prosecutor, will file a petition against the juvenile offender, and the child will be required to appear before judge. A case on juvenile delinquency is similar to a criminal case of an adult in a criminal court, however, there are significant differences: there is no bail for the release of the defendant to freedom for a minor - either he is left in custody or released without bail on bail to the parent / guardian; no right to a jury trial, instead a court hearing before a judge; no criminal conviction - instead, recognition as a juvenile delinquent; punishment options also vary, including case closure, conditional closure, suspended sentences of up to 2 years, or detention with varying degrees of security for an initial period of up to 18 months. For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

26. What is marriage annulment and how is it different from divorce?

A man and a woman must be legally capable of entering into a legal marriage. If the parties are not authorized to enter into a marriage, such a marriage can be annulled, that is, declared invalid. Grounds for marriage annulment are untraceable disability, minority, lack of consent, or consent obtained through fraud or intimidation, and incurable mental illness for five years.

- If one of the spouses is terminally incapable of sexual activity, the marriage may be annulled.

- Both parties must be over 18 years of age to marry without parental consent. A marriage between persons under the age of 18 may be annulled, at the discretion of the court, if the spouse under 18 wishes to annul the marriage.

- If, after marriage, either partner becomes terminally ill for 5 years or more, the marriage may be annulled.

However, a healthy spouse may be required to maintain a mentally ill spouse for life.

However, a healthy spouse may be required to maintain a mentally ill spouse for life. - The parties must knowingly consent to the marriage. A marriage can be declared invalid if either party consented to the marriage as a result of violence or threats from the other party, or if either party did not understand the meaning and consequences of marriage.

- A marriage may be annulled if the consent was obtained by fraud, provided that the fraud was such as to deceive an ordinary reasonable person and was essential to obtain the consent of the other party. Fraud must be at the heart of the marriage contract. Only the injured party can annul the marriage on the grounds of lack of consent.

27. What is a declaration of invalidity of a marriage and how does it differ from annulment?

Unlike an annulment, where a marriage can be declared invalid, some marriages are invalid from the moment they are contracted. Such marriages include incest and bigamy.