How does an llc affect child support

Can My Child Support Affect My LLC License?

In this article...

This article will discuss what kind of impact child support can have on an individual's LLC license. We will answer the following questions:

- How does child support work?

- How does an LLC work?

- How is an LLC operated?

- Does child support put my LLC at risk?

This article will discuss child support's impact on an individual's LLC license. We will answer the following questions:

- How does child support work?

- How does an LLC work?

- How is an LLC operated?

- Does child support put my LLC at risk?

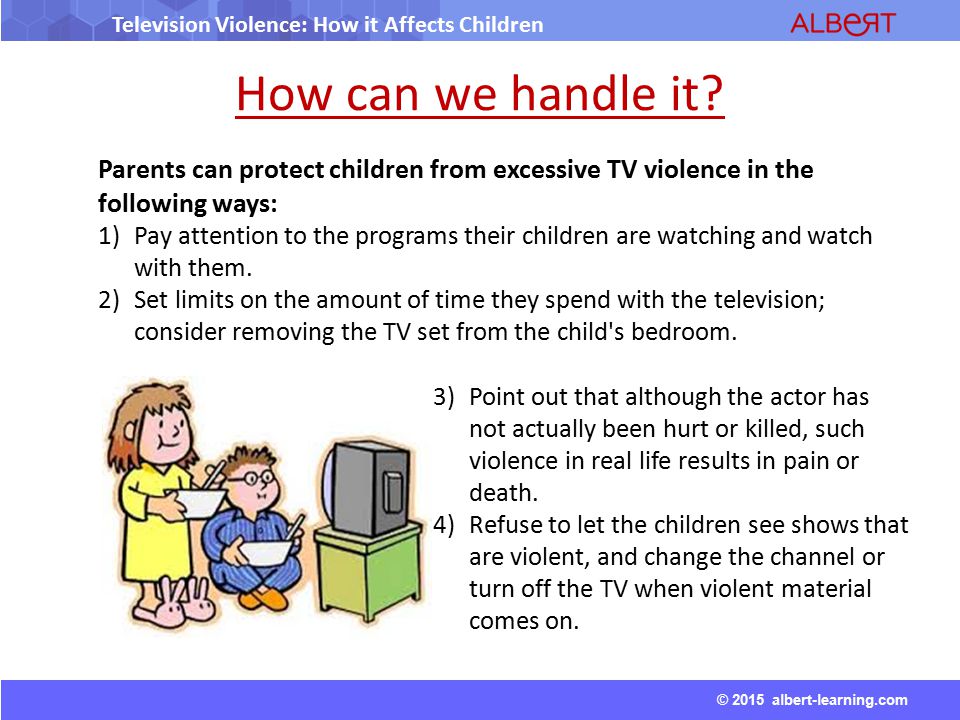

If you're a business owner or professional requiring a license, you may wonder if failing to pay child support can negatively impact your work. You've probably heard that past-due child support payments can be garnished from an individual's income, but can it extend to an LLC bank account? Does the LLC provide any protection from child support actions? Unfortunately, for the individual who owes child support, there is a good chance that failing to pay may jeopardize their professional life and business.

How Does Child Support Work?

The law requires biological parents to support their children regardless of the marriage status of the parents. Child support costs include health care, schooling, extra-curricular activities, and daycare expenses. As the child ages, the court can order child support to be paid for college, transportation expenses, and room and board. The parent making child support payments must do so until one of the following conditions is met:

- The child ages to an adult (parents may still have to pay non-minor child support)

- The child enlists in the military and goes on active duty

- The court emancipates the child

- The child is adopted, or you lose parental rights

The amount of child support owed is based mainly on each parent's income and how much time the child spends with each parent. When calculating child support, it's essential to include relevant costs and factors to determine an equitable number for both parties.

What Is An LLC?

A limited liability company, or LLC, acts like a "hybrid" business structure. It takes the best of corporations, such as pass-through taxes and limited liability for business debts, and marries them with the simplicity and accessibility of a sole-proprietorship. LLCs protect business owners and their families by placing a limited liability wall between their personal assets and business assets, meaning business creditors can't reach what is not part of the business. LLCs also offer a lot of flexibility for your company's organizational structure and are not subject to the restrictions and regulations adherent in S and C Corporations. For the owners of an LLC, profit and loss are reported on their individual tax returns.

Some states, including Illinois, allow business owners to form single-member LLCs, an excellent option for those who want more protection than what exists under a sole-proprietorship. However, LLCs don't protect any debts personally guaranteed by the owner. Any funds pulled from the business and placed into a personal account are fair game to creditors and collection actions.

Any funds pulled from the business and placed into a personal account are fair game to creditors and collection actions.

How Is An LLC Operated?

Forming an LLC requires a decent amount of work on the front end, but completing your due diligence decreases the risk of legal headaches later on.

Creating an LLC requires obtaining an employee identification number from the IRS. All business should be conducted using the EIN, and all contracts and invoices must be in the LLC's name. If you form a single-member LLC, you must sign all documentation as the president or managing member. Failing to follow the rules of an LLC, whether single-member or otherwise, can render the protection of the LLC void and access to child support services.

Mixing business assets with personal assets or failing to maintain LLC insurance can also jeopardize the LLC's protection and enable child support services to access your business's bank account.

Does Child Support Put My LLC At Risk?

Generally, no. Having a court order to pay child support as part of a divorce or for any other reason doesn't pose an immediate risk to your LLC. Furthermore, because an LLC separates your personal assets from your business assets, child support services can't legally garnish funds from the business bank account. However, plenty of scenarios could void the company's liability protection and put the LLC and its funds at risk. Some examples include:

Having a court order to pay child support as part of a divorce or for any other reason doesn't pose an immediate risk to your LLC. Furthermore, because an LLC separates your personal assets from your business assets, child support services can't legally garnish funds from the business bank account. However, plenty of scenarios could void the company's liability protection and put the LLC and its funds at risk. Some examples include:

- Failure to operate under the correct EIN

- Failure to correctly sign all documentation

- Failure to operate within the LLC guidelines established in your state

- Mixing business funds with personal assets

- Failure to maintain proper insurance and licensure

All of the above examples can jeopardize the LLC's liability protection and put the company's assets at risk.

It would seem that, as long as the business is run correctly, an LLC insulates any associated bank account or asset from child support actions; this assumption is false. While it's probably safe to assume that money in an LLC bank account is secure, as soon as that money is drawn, it is no longer protected, even if you're the owner. Part of the reason for this discrepancy is that the LLC is considered an employer. The money you pay yourself and the employees will be classified as a salary, bonus, commission, dividend, etc. According to most states' child support guidelines, gross income can be garnished. Examples of gross income include, but are not limited to:

While it's probably safe to assume that money in an LLC bank account is secure, as soon as that money is drawn, it is no longer protected, even if you're the owner. Part of the reason for this discrepancy is that the LLC is considered an employer. The money you pay yourself and the employees will be classified as a salary, bonus, commission, dividend, etc. According to most states' child support guidelines, gross income can be garnished. Examples of gross income include, but are not limited to:

- Wages

- Salaries

- Commissions

- Bonuses

- Pensions

- Interest

- Annuities

- Dividends

- Capital gains

- Unemployment insurance

- Prizes

Furthermore, a parent or child support agency could sue the owner of an LLC, alleging that the assets are owned by the defendant and should be available to pay for child support. While a claim such as this will probably fail due to the protections afforded by an LLC, specifics of the case may determine otherwise.

Another complication that could arise from failing to pay child support is the suspension or revoking of your professional license. If you run a business that requires an active license to secure and correctly operate the LLC, failing to meet your child support obligations could lead to termination of the LLC's liability protection.

Our team is ready to address your legal needs remotely OR at one of our many physical locations, including our Downers Grove Attorneys located at O'Flaherty Law of Downers Grove

5002 Main St., Ste 201,

Downers Grove, IL 60515

(630) 687-6993

Website: https://www.oflaherty-law.com/areas-of-law/downers-grove-attorneys

Google: https://g.page/oflaherty-law-downers-grove?share

Kevin O'Flaherty

View Author

About the author

Kevin O’Flaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. He has experience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation.

He has experience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation.

LLC & Child Support (What You Must Know) 2022 Update

Last updated: September 16, 2022

If you are a business owner responsible for paying child support, knowing how those two responsibilities intersect is crucial. In some cases, failing to fulfill your child support obligation can result in the loss of your limited liability company license.

This blog post will explain how child support works for business owners and what you need to do to make sure you comply with the child support law. We'll also provide tips on how to calculate child support expenses as an entrepreneur.

Child Support Explained

Regardless of whether or not the parents are married, the child support law compels biological parents to support their children.

Health care, education, extracurricular activities, and daycare fees are all included in child support payments. The court has the authority to require that child support be paid for college, transportation, and room and board as the kid grows older.

The court has the authority to require that child support be paid for college, transportation, and room and board as the kid grows older.

The parent who is responsible for settling child support must do so until one of the following conditions is met:

- The child becomes an adult

- The child becomes a soldier on active duty

- The court emancipates the child

- Parents lose parental rights/ child is adopted

The amount of child support owed is based on both parent's income and the child's length of time with each parent. When calculating a business owner's income for child support purposes, it's critical to evaluate all relevant expenses and factors to arrive at a fair figure for both parties.

Calculating Child Support as an Entrepreneur

If you are self-employed or run your own business, calculating child support can be more complicated. The first step is to calculate your gross income.

Gross income is the total amount of money you make in a year before taxes, and other deductions are taken out. To get an accurate number, you'll need to look at your profit and loss statement from the previous year. Excessive business expenses should be subtracted when calculating the business owner's income.

Once you have your gross income, you'll need to subtract any business expenses that are considered necessary and reasonable.

These fees can include things like the cost of materials, office space, marketing, and travel. What is considered necessary and reasonable will vary from state to state, so it's essential to check with your local child support guidelines.

In other cases, the entrepreneur's spouse will claim that the business-owning spouse is lying about income and that the entrepreneur should be paying more child support. It may trigger an investigation or, at the very least, cast the business owner in a negative light, forcing them to justify their earnings.

When business owners cannot demonstrate their income or successfully defend themselves against accusations, they may be forced to pay a higher child support amount.

Different Sources of Income

As an entrepreneur, your income is not necessarily limited to a salary. You may also have income from investments, side businesses, stock options, etc. When calculating business owners' income for child support purposes, it's essential to take all sources of income into account.

The more proof you have of all of these sources of income, the better. It's easier to figure out taxes and child support if you keep track of your income. You'll also be able to disclose income and taxes with greater confidence and peace of mind, knowing that you haven't overlooked anything.

Keep in mind that every type of business will be unique. It's better to figure out where your income comes from, how often you get paid, how much goes to expenses, etc.

Income might fluctuate substantially from month to month or year to year. Suppose you give a statement to the judges that shows you have consistent income throughout the year, but your income fluctuates significantly from month to month.

Suppose you give a statement to the judges that shows you have consistent income throughout the year, but your income fluctuates significantly from month to month.

In that case, you will be doing yourself a disservice and may end up paying more child support than necessary. Make sure that any claims you make correctly represent the bigger picture and that they don't imply regularity where none exists.

Effect Child Support Can Have on LLC License

If you're currently paying child support, you may be wondering how this will affect your LLC license. The good news is that as long as you're up to date on your payments, there should be no problem. However, if you fall behind on your payments, your LLC license could be at risk.

It's essential to stay on top of your child support payments, as falling behind can have serious consequences. Contact your lawyer or accountant if you're not sure how to make a payment or have any other questions.

They'll be able to help you stay in compliance and avoid any problems with your LLC license.

FAQs

If you work two jobs, the court is unlikely to split your earnings between them. Dividing the earnings would add to the state's administrative workload. Your child support obligation is determined by the court based on your income, and your payments should not be so high that your earnings from one job are insufficient to fulfill them unless you fall behind.

A court order to pay child support as part of a divorce or for any other reason does not put your LLC in jeopardy right now. Child support services cannot lawfully take funds from the business account because an LLC separates personal assets from business assets and your business bank account.

Different businesses in the same industry often have different procedures typical for the specific business but not for the industry. The use of a business car, free housing or housing allowance, or reimbursed meals are examples of the child support law that includes but does not limit to these things.

Establishing & Calculating Child Support for an LLC Owner.

..

..Determining child support amounts as a business owner can be difficult. You want to make sure you are calculating it correctly so that you don't end up paying too much or too little.

There are many different ways to make a mistake in this process, so it is essential to document all of your income and show it to the court. If you have any questions about handling child support, consult an attorney who can help you navigate the complex waters of child support fees. Thanks for reading!

Jon Morgan

From understanding users’ unique needs to consistent branding, Jon is eager to share his knowledge of SaaS and e-commerce with small business owners.

This passion for prioritizing customer success made the two e-commerce and SaaS businesses he founded so successful.

This practical and successful experience makes Jon’s knowledge an invaluable asset to small business owners looking to ensure every aspect of their business operates smoothly.

You May Also Like

from which investment income you need to pay child support

I pay child support for my minor child. I invest part of my income. Do I have to pay alimony from the following income:

- From the tax deduction from the use of IIS?

- From dividends on shares that I receive on IIS and reinvest?

- From income from trading in shares?

- Interest on bank deposits?

- From bond coupons?

Thank you.

Oleg M.

Oleg, the regulations do not give an unequivocal answer to most of your questions, and there are no clarifications binding on the courts either. I will tell you which positions are most reasonable, but you need to keep in mind that in each specific case, the court may decide otherwise.

Stanislav Egorkin

lawyer

The list of income from which child support is withheld is approved by the Government of the Russian Federation. The Constitutional Court of the Russian Federation and the courts of appeal of general jurisdiction will help interpret its provisions. The positions of the latter are not obligatory for courts when considering similar cases, although, as a rule, they are taken into account.

The positions of the latter are not obligatory for courts when considering similar cases, although, as a rule, they are taken into account.

Alimony from tax deductions for IIS must be paid

According to paragraph 4 of the list, alimony is collected from income after taxes are withheld from it in accordance with tax legislation.

Tax deduction reduces the tax base for personal income tax. As a result, the income from which alimony is withheld increases. Accordingly, alimony must be paid from the tax deduction received.

For example, your salary is 50,000 R per month, and you have one minor child, for whose maintenance you pay alimony. Every month, the employer deducts 13% of personal income tax from your salary. Every month you receive 43,500 R in your hands, of which 10,875 R - 1/4 of your income - you pay as alimony.

100,000 R you deposited on IIS in the same year - and next year the tax authority will return to you a part of the personal income tax withheld in the amount of 13,000 R. As a result, the salary for the previous year, which is calculated after the withholding of personal income tax, will increase by these 13,000 R. Therefore, 1/4 of this amount, that is, 3250 R, will have to be paid as alimony.

As a result, the salary for the previous year, which is calculated after the withholding of personal income tax, will increase by these 13,000 R. Therefore, 1/4 of this amount, that is, 3250 R, will have to be paid as alimony.

Art. 210, 220 NK RF

The Moscow City Court adheres to this position. Recently, it was supported by the Second Court of Cassation of General Jurisdiction, so in Moscow and a number of neighboring regions, the courts are likely to follow it.

Appeal ruling of the Moscow City Court dated December 2, 2019 in case No. 33а-8355/2019PDF, 182 KB

The situation is different in other regions. For example, the Chelyabinsk Regional Court and the Primorsky Regional Court independently came to the opposite conclusion four years ago: both courts pointed out that tax deductions, according to the list, do not constitute income, and therefore alimony is not withheld from them. Although these positions, in my opinion, are based on a misinterpretation of the law, they can be invoked if the case is heard outside of Moscow and the regions closest to it.

Appeal ruling of the Chelyabinsk Regional Court dated November 17, 2015 in case No. 11f-14277/2015PDF, 166 KB pay

Dividends are expressly indicated in the list of income from which alimony is withheld. At the same time, it does not matter where they are credited: to the IIS, to a regular brokerage account or immediately to a bank account. Even if dividends are credited to IIA and reinvested, this does not cancel the fact of receiving income from which alimony must be paid. The excuse that it is impossible to withdraw money from the IIA without closing it will not help here: the alimony calculated from the dividends can be paid at the expense of other available money.

sign. "k" Clause 2 of the list of types of wages and other income from which alimony for minor children is withheld

Tax deductions do not apply to dividends. They are subject to personal income tax in the general manner and are credited to the IIS or bank account after the tax has been deducted. Consequently, alimony is calculated from dividends immediately after they are received.

Consequently, alimony is calculated from dividends immediately after they are received.

Letter of the Russian Ministry of Finance No. 03-04-05/21361 dated April 3, 2018

Alimony from income from investments in shares is not required to be paid

The list of income from which alimony is withheld includes income received under agreements concluded in accordance with civil law.

This rather vague wording was interpreted back in 2012 by the Constitutional Court of the Russian Federation: alimony must be withheld only from income under civil law contracts that a person enters into in order to exercise the right to freely use one’s abilities and property for economic activities not prohibited by law, as well as the right to work.

Ruling of the Constitutional Court of the Russian Federation dated January 17, 2012 No. 122-О-О

This means that alimony must be paid only if you have made stock trading a permanent source of your income. For example, if you are a trader. If you make one-time transactions with shares, you do not need to pay alimony from the received profit.

If you make one-time transactions with shares, you do not need to pay alimony from the received profit.

Ruling of the Primorsky Regional Court dated June 25, 2015 in case No. 33-5265/2015PDF, 164 KB0003

This position found support in the decisions of the Primorsky Regional Court.

With alimony from interest on bank deposits, the situation is disputable

The position of the Constitutional Court of the Russian Federation mentioned above can also be applied to interest on bank deposits. The receipt of income in this case is not related to the realization of the investor's right to freely use his abilities or the right to work. Therefore, it is logical to come to the conclusion that it is not necessary to pay alimony from interest on a bank deposit.

However, in the few decisions on this issue, the courts come to the opposite conclusion. For example, the Supreme Court of the Republic of Tatarstan considered that, under the current legislation, it is possible to withhold alimony from the debtor's income from placing money in banks and other credit organizations. The Moscow City Court came to a similar conclusion.

The Moscow City Court came to a similar conclusion.

Appeal ruling of the Supreme Court of the Republic of Tatarstan dated 06/04/2015 in case No. 33-7929/15PDF, 163 KB24PDF, 169 KB

In general, the jurisprudence on this issue has not yet been formed. If you end up in court, then with reference to the ruling of the Constitutional Court of the Russian Federation, you can defend the position that alimony is not paid from interest on bank deposits.

No need to pay alimony on bond coupons

Bond coupons are not mentioned in the list of income from which alimony is withheld - and there is no reason to classify them in any of the categories that are mentioned in this list. Therefore, it is not necessary to pay alimony from coupons.

There are no court decisions on this issue yet.

What is the result

Alimony is paid from the following income: property tax deductions on IIA, dividends, including those reinvested in IIA, profits from trading, if this is your regular source of income.

No need to pay alimony on investment income from the sale of shares and on bond coupons. It is rather not necessary from interest on bank deposits, but the court may decide otherwise.

/alimony/

How to calculate and pay child support

If you have a question about personal finances, rights and laws, health or education, please write. The most interesting questions will be answered by the experts of the magazine.

Ask a question

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The question arises: how can a self-employed person pay alimony? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it.

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the current situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- by postal order.

It is better to keep the documents confirming the transfer of money. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child is left) can apply to bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of maintenance may be recalculated. The payout will be calculated in one of the following ways:

- as a percentage of the payer's income - 25% for one child, 33% - for two children, 50% - for three or more children;

- by the combined method - part of the payment will be calculated as a percentage of the payer's permanent income, and part will be accrued as a fixed amount.