How long can a dependent child stay on health insurance

Dependent Health Coverage and Age for Healthcare Benefits

Table of Contents

- Table: State Laws Relating to Dependent Coverage

- Coverage Beyond the Federal ACA (7 states)

Contact

- Health Program

The Patient Protection and Affordable Care Act (ACA) mandates that all health insurance carriers in every state that offer coverage to both adults and their dependents must allow dependents to remain on their parents or guardians’ “family” plans until the dependents are 26 years old.

The issued regulations state that young adults are eligible for this coverage regardless of any, or a combination of any, of the following factors: financial dependency, residency of the young adult, student status, employment status, or marital status. This applies to all plans in the individual market and to almost all employer plans (small group, large group, including self-funded or so-called ERISA plans) created after March 23, 2010.

PPACA & HCERA; Public Laws 111-148 and 111-152: Consolidated Print

‘‘SEC. 2714. EXTENSION OF DEPENDENT COVERAGE.

‘‘(a) IN GENERAL.—A group health plan and a health insurance issuer offering group or individual health insurance coverage that provides dependent coverage of children shall continue to make such coverage available for an adult child until the child turns 26 years of age. Nothing in this section shall require a health plan or a health insurance issuer described in the preceding sentence to make coverage available for a child of a child receiving dependent coverage. [As revised by section 2301(b) of HCERA]

‘‘(b) REGULATIONS.—The Secretary shall promulgate regulations to define the dependents to which coverage shall be made available under subsection (a).

‘‘(c) RULE OF CONSTRUCTION.—Nothing in this section shall be construed to modify the definition of ‘dependent’ as used in the Internal Revenue Code of 1986 with respect to the tax treatment of the cost of coverage.”

- NCSL Fact Sheet

- White House Fact Sheet

- Commonwealth Fund: Rite of Passage: Young Adults and the Affordable Care Act of 2010

- Kaiser Family Foundation Summary

The States’ Role

The extension of coverage for young adults under their parents’ or guardians’ health insurance plans, like many of the ACA’s provisions, originated in state legislatures. Prior to the implementation of the ACA, at least 31 states required carriers to extend coverage to young adults. The age at which insurers were no longer required to provide coverage to young adults under their family plans varied by state. Additionally, some states required certain conditions to be met by young adults in order to be eligible for coverage under their guardians’ plans. For example, a number of states required that young adults be unmarried in order to qualify.

Prior to the implementation of the ACA, at least 31 states required carriers to extend coverage to young adults. The age at which insurers were no longer required to provide coverage to young adults under their family plans varied by state. Additionally, some states required certain conditions to be met by young adults in order to be eligible for coverage under their guardians’ plans. For example, a number of states required that young adults be unmarried in order to qualify.

States may continue with current state law requirements for extended dependent coverage unless they prevent the application of the ACA. As with other state health insurance statutes, the state mandate language enables the state insurance departments to educate the public, and to implement and enforce those laws directly, including use of state courts and state-specific penalties.

State and local governments, as employers and sponsors of coverage plans, are required to notify those under the age of 26 whose coverage has ended or who were denied coverage under their plans before turning 26, of enrollment opportunities.

State Actions

The federal ACA law applies to young adults in all states.

As of 2012, (before the ACA was fully in effect) the following 37 states had already extended the age that young adults can remain on their parents' health insurance plan: Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, Wisconsin and Wyoming.

There is considerable variation among state laws in terms of eligibility requirements. At least 30 states have extended dependent coverage, regardless of student status. Most states require that a young adult be unmarried and financially dependent on their parents in order to qualify for extended dependent coverage.

States may continue to apply current state law requirements for extended dependent coverage except to the extent that the requirements prevent the application of the Patient Protection and Affordable Care Act (ACA). [Reviewed/updated 2016]

The box allows you to conduct a full text search or type the state name.

| State | Laws |

|---|---|

| Colorado | Colo. Rev. Stat. § 10-16-104.3 states that a child is considered a dependent for insurance purposes up to age 25 (even if they are not enrolled in an educational institution) as long as they are unmarried and are financially dependent or share the same permanent address as the insurance provider. |

| Connecticut | C.G.S.A. § 38a-497 requires that group comprehensive and health insurance policies extend coverage to unwed children until the age of 26 provided they remain residents of Connecticut or are full-time students. |

| Delaware | Del. Code Ann. Tit. 18, § 3354 requires insurance providers to cover policyholder's dependent children until age 24. Dependents must be unmarried and a resident of Delaware or, if living outside the state, a full-time students. Insurance companies may charge more for dependent coverage past age 18, but it may not exceed 102 percent of the policyholder's cost before the child turned 18. |

| Florida | Florida 627.6562 allows for dependent children up to 25, who live with their parent or are a student, and up to 30 years old, who are also unmarried and have no dependent child of their own, to remain on their parents' insurance. |

| Georgia | Ga. Code § 33-30-4 allows dependent children up to age 25 who are enrolled as a full-time student at least five months during the year or are eligible to enroll but are prevented due to illness or injury to remain on their parents' insurance. Ga. Code § 33-24-28 requires that a health services plan or health insurer exempt dependent children incapable of self-sustaining employment due to disability from dependent age limits. |

| Idaho | Idaho Stat. § 41-2103 allows for any unmarried dependents to remain on their parents' health insurance until age 21; any full-time, unmarried student until age 25; or a dependent with a disability without regard to age. |

| Illinois | 215 ILCS 5/356z.12 provides parents with the option of keeping unmarried dependents on their health care insurance up to age 26. Parents with dependents who are veterans can keep them on their plans up to age 30. |

| Indiana | IC 27-8-5-2,28 and IC 27-13-7-3 require commercial health insurers and health maintenance organizations to cover children until age of 24 or without regard to age if they are incapable of self-sustaining employment due to disability. |

| Iowa | Iowa Code § 509.3 and Iowa Code § 514E.7 requires that health insurance providers continue to cover unmarried children under their parents' coverage provided that the child 1) is under the age of 25 and a current resident of Iowa, 2) is a full-time student, or 3) has a disability. |

| Kentucky | Ky. Rev. Stat. § 304.17A-256 allows parents to keep their unmarried children on their health plans until the age of 25. Parents may have to pay extra for their adult children. |

| Louisiana | La. Rev. Stat. Ann. § 22:1003 allows an unmarried, dependent child to remain on parent's insurance up to age 24 if they are a full-time student. |

| Maine | 24-A MRSA § 2742-B requires individual and group health insurance policies to continue coverage for a dependent child up to 25 years of age if the child is dependent upon the policyholder and the child has no dependents of the his/her own. |

| Maryland | MD Code, Insurance § 15-418 requires that health insurance be extended to, at the request of the policy holder, unmarried dependents under the age of 25. |

| Massachusetts | Mass. Gen. Laws Ann. Ch. 175 § 108 allows dependents to stay on their parent's coverage for two years past the age of dependency or until age 26, whichever occurs first, or without regard to age if they are incapable of self-sustaining employment due to disability. Young adults ages 19-26 are eligible for lower-cost insurance coverage, tailored to meet their needs, offered through the Commonwealth Health Insurance Connector. Reform summary and fact sheet, PowerPoint presentation. |

| Minnesota | Minnesota Chapter 62E.02 Defines "dependent" as a spouse or unmarried child under age 25, or a dependent child of any age who is disabled. |

| Missouri | Mo. Rev. Stat. § 354-536 defines dependent as an unmarried child up to age 26. If a health maintenance organization plan provides that coverage of a dependent child terminates upon attainment of the limiting age for dependent children, such coverage shall continue while the child is and continues to be both incapable of self-sustaining employment by reason of mental or physical handicap and chiefly dependent upon the enrollee for support and maintenance. |

| Montana | MCA 33-22-140 provides insurance coverage under a parent's policy for unmarried children up to age 25. |

| Nevada | NRS 689C.055 allows an unmarried, dependent child who is a full-time student to remain on his or her parent's insurance up to age 24 if parent is covered by small group policy. NRS 689B. |

| New Hampshire | N.H. Rev. Stat § 420-B:8-aa defines dependent as those who are unmarried up to age 26 and either a full-time student or resident of New Hampshire for purposes of health insurance coverage. 2009 SB 115 allows those up to age 26 to buy-in to coverage through the state's CHIP program, Healthy Kids. |

| New Jersey | N.J.S.A. 17B:27-30.5 states that, at the option of the insured person, a dependent may be covered up to the age of 31, as long as they are unmarried and have no dependents of their own. |

| New Mexico | NM Stat. Ann. § 13-7-8 states that health insurance for dependents may not be terminated based on age up to age 25. |

| New York | N.Y. Insurance Code, sec. 3216. (2009 AB 9038) allows an unmarried adult child to remain on parent's insurance through age 29 (up to age 30) if they are a resident of New York. [link updated 4/2015] |

| North Dakota | N.D. Cent. Code § 26.1-36-22 allows an unmarried, dependent child to remain on parent's insurance up to age 22 if they live with parents. If they are a full-time student, they can remain on parent's insurance from age 22 up to age 26. |

| Ohio | Ohio Rev. Code § 1751.14, as amended by 2009 OH H 1 allows an unmarried, dependent child that is an Ohio resident or a full-time student to remain on parent's insurance up to age 23, or without regard to age if they are incapable of self-sustaining employment due to disability. |

| Oregon | O.R.S. § 735.720 defines dependent as an unmarried child up to 23, elderly parents and disabled adult children for the purpose of insurance coverage. |

| Pennsylvania | 2009 SB 189 states that an unmarried child may remain on parent's insurance up to age 30 if they have no dependents and are residents of PA or are enrolled as full-time students. 51 Pa.C.S.A. § 7309 states that full-time students whose studies are interrupted by service in the reserves or the National Guard must be extended health care benefits as a dependent of their parent beyond the terminating age equal to the length of their deployment.. |

| Rhode Island | R.I. Gen. Laws § 27-20-45 and Gen. Laws § 27-41-61 requires insurance plans which cover dependent children to cover unmarried dependent children until age 19 or, if a student, until age 25. |

| South Carolina | S.C. Code Ann. § 38-71-1330 allows an unmarried, dependent child who is a full-time student to remain on parent's insurance up to age 22 if parent is covered by small group policy. S.C. Code Ann. § 38-71-350 requires that a dependent child who is not capable of self-sustaining employment be allowed to remain on his or her parent's insurance, without regard to age. |

| South Dakota | SD Codified Laws Ann. § 3-12A-1 states that any insurance provider offering benefits to a dependent may not terminate those benefits by reason of age before the dependent's 19th birthday. If the dependent is enrolled in an educational institution, they are not to be terminated until they reach age 24 and not terminated if unable to seek self-support due to disability. SD Codified Laws § 58-17-2.3 states that if the dependent remains a full-time student upon attaining age 24 but not exceeding age 29, the insurer shall provide for the continuation of coverage for that dependent at the insured's option. |

| Tennessee | Tennessee Code Ann. § 56-7-2302 allows for dependent coverage for children under their parents' health insurance plan up to age 24 provided the child is unmarried and financially dependent on the parents. |

| Texas | V.T.C.A. Insurance Code § 846.260 and V.T.C.A. Insurance Code § 1201.059 make dependent status available for an unmarried child up to age 25 for insurance purposes. |

| Utah | Utah Code Ann. tit. 31A § 22-610.5 requires that coverage for unmarried dependents continue up to age 26, regardless of whether or not the dependent is enrolled in higher education. |

| Virginia | Va. Code Ann. § 38.2-3525 makes dependent status available to any child up to age 19 or who is a dependent up to age 25 who resides with the parent or is a full-time student. |

| Washington | West's RCWA 48.44.215 states that, at the option of the insured person, an unmarried dependent may be covered up to age 25. |

| West Virginia | W. Va. Code § 33-16-1a defines dependent for health insurance coverage as a child or stepchild up to age 25. |

| Wisconsin | Wis. Stat. § 632.885 requires that coverage for unmarried dependents through a parent's insurance be offered up to age 27 if they are not offered insurance through an employer. Full-time students called to active duty in the armed forces can be covered beyond age 26 depending on various factors. |

| Wyoming | Wyo. Stat. § 26-19-302 states that if child is unmarried and a full-time student, they can remain on parent's insurance up to age 23 if parent is covered by small group policy. |

Coverage Beyond the Federal ACA | 2016 update

Six states, including Florida, Illinois, New Jersey, Pennsylvania, South Dakota and Wisconsin have enacted laws that require or authorize carriers to cover young adults beyond age 26. New York and Ohio previously enacted such laws, however those provisions are no longer in effect.

| State | Required Coverage Age Cut-off | Citation |

|---|---|---|

| Florida | 30 (must be unmarried and have no dependents of their own) | West's F. |

| Illinois | 30 (applies to Veterans only) | 215 ILCS 5/356z.12 |

| New Jersey | 31 | N.J.S.A. 17B:27-30.5 |

| New York | 29* (unmarried and not eligible for employer-based insurance) | McKinney's Insurance Law § 3216 |

| Pennsylvania | 30 | 40 P.S. § 752.1 |

| South Dakota | 29* | SDCL § 58-17-2.3 |

| Wisconsin | Full-time students, regardless of age | Wis. Stat. § 632.885 |

Who Pays?

The cost of notifying families about new enrollment opportunities is shared between insurance providers and employers. The cost of covering the young adults who take advantage of the extension is shared between employers and the families of newly covered young adults. For families with no employer health coverage, the cost may fall on the parents. Those families that qualify for States, as sponsors of coverage plans for state employees, also share the costs with families. A qualified young adult cannot be required to pay more for coverage than similarly situated individuals who did not lose coverage due to the loss of dependent status.

The cost of covering the young adults who take advantage of the extension is shared between employers and the families of newly covered young adults. For families with no employer health coverage, the cost may fall on the parents. Those families that qualify for States, as sponsors of coverage plans for state employees, also share the costs with families. A qualified young adult cannot be required to pay more for coverage than similarly situated individuals who did not lose coverage due to the loss of dependent status.

IRS Notice 2010-38 provides guidance to extend the general exclusion from gross income for the reimbursements for medical care under an employer provided accident or health plan to any employee's child who has not yet attained age 27 as of the end of the taxable year, making the benefit tax-free.

*The information on this page is intended for state policy makers. It is not intended as legal or medical advice or guidance to individual insurance enrollees. .

.

Source: NCSL legal research, 2016; State Health Facts by KFF. Legal review, 2011-2015: Richard Cauchi, NCSL Health Program.

Update 2016 research: Ashley Noble, J.D., NCSL Health Program

How Long Can You Stay on Your Parent's Insurance?

Under current laws, you can stay on your parent’s health insurance policy until you turn 26 years old.

In some states, it’s even longer.

When the time comes for you to get your own insurance, it’s important to know what your health insurance choices are and how to choose the right plan.

It can be a confusing topic, and sometimes it is difficult to know what your best options are.

This article breaks down what you need to know about your health insurance options, how to choose a plan that’s right for you, and if you even need insurance.

When You Lose Health Insurance Through Your Parents

Currently, the Affordable Care Act (ACA) requires your parent’s insurance plan to cover you until your 26th birthday.

You qualify for coverage under your parents even if you are:

- Married

- Attending school

- Not living with your parents

- Not financially dependent on your parents

- Eligible to enroll in your employer’s plan

If your parents have their insurance plan through an employer, you usually have coverage until the end of your birthday month.

Check with your individual plan to know for sure, as some states and plans have different rules.

If your parents have a Marketplace insurance plan, you have until December 31of the year you turn 26 to get your coverage.

States with an extended age limit

Some states have an extended age limit to remain on your parent’s policy if you meet specific criteria.

To be eligible for extended dependent coverage, you typically can’t be eligible for any other form of comprehensive health coverage.

For example, if you are eligible for your own employer’s health insurance, you may not be able to extend your parent’s coverage. (This does not apply to individuals who have a disability.)

(This does not apply to individuals who have a disability.)

Following are the states that offer exceptions; however, laws are always subject to change, so check with your own state’s laws.

| State | Dependent Age Limit Exceptions |

| Florida | Through age 29 for those who are unmarried, have no dependents, and are residents of the state or enrolled as a part-time or full-time student |

| Georgia | No age limit for persons with a disability incapable of self-support |

| Idaho | No age limit for unmarried persons with a disability |

| Illinois | Through age 29 for unmarried veterans No age limit for persons with a disability incapable of self-support |

| Indiana | No age limit for persons with a disability incapable of self-support |

| Massachusetts | No age limit for persons with a disability incapable of self-support |

| Minnesota | No age limit for persons with a disability |

| Missouri | No age limit for persons with a disability incapable of self-support |

| Nevada | No age limit for persons with a disability incapable of self-support |

| New Jersey | Through age 30 for those who are unmarried, have no dependents, and are residents of the state or full-time students |

| New York | Through age 29 for those who are unmarried and residents of or workers in the state No age limit for persons with a disability who are unmarried and incapable of self-support |

| Ohio | No age limit for persons with a disability incapable of self-support |

| Oregon | No age limit for persons with a disability |

| Pennsylvania | Through age 29 for those who are unmarried, have no dependents, and are residents of the state or enrolled as a full-time student |

| Rhode Island | No age limit for persons with a disability |

| South Carolina | No age limit for persons with a disability incapable of self-support |

| South Dakota | Through age 29 for full-time students No age limit for persons with a disability incapable of self-support |

| Wisconsin | No age limit for full-time students; for full-time students who are National Guard or reservists called into active duty; for those called for federal active duty; or for persons with a disability incapable of self-support |

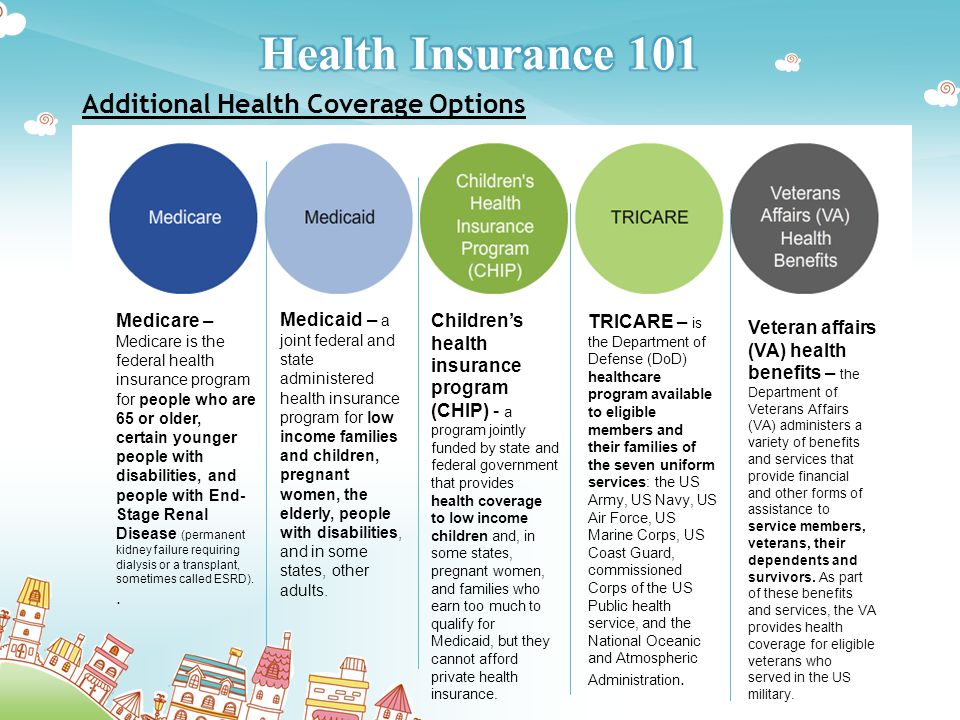

Health Insurance Options

If you are about to age out of your parent’s insurance policy, you have a few options to choose from.

If you or your spouse are currently employed full-time, you may be able to get health insurance coverage through an employer.

You must request special enrollment within 30 days of your loss of coverage.

Health insurance marketplace

For individual coverage, you may qualify for special enrollment through the Health Insurance Marketplace.

To purchase a Marketplace plan, you must special enroll within 60 days of aging out of your plan. You can find more information here.

You may even qualify for subsidies that can make your coverage more affordable.

COBRA

If your parent’s employer sponsors 20 or more employees on its plan, you may be eligible to purchase a temporary extension of health coverage for up to 36 months under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Be sure to notify your parent’s employer in writing within 60 days before you turn 26 if you want to elect COBRA coverage.

Medicaid

If you apply for insurance through your state health insurance marketplace, you will be asked to enter your income amount.

Depending on how much you make per year, you may qualify for your state’s Medicaid program.

If you are currently attending a university as a full-time student, you may be able to get health coverage through your school’s insurance policy.

This is a great option for graduate students who are getting older and aging out of their parent’s plan.

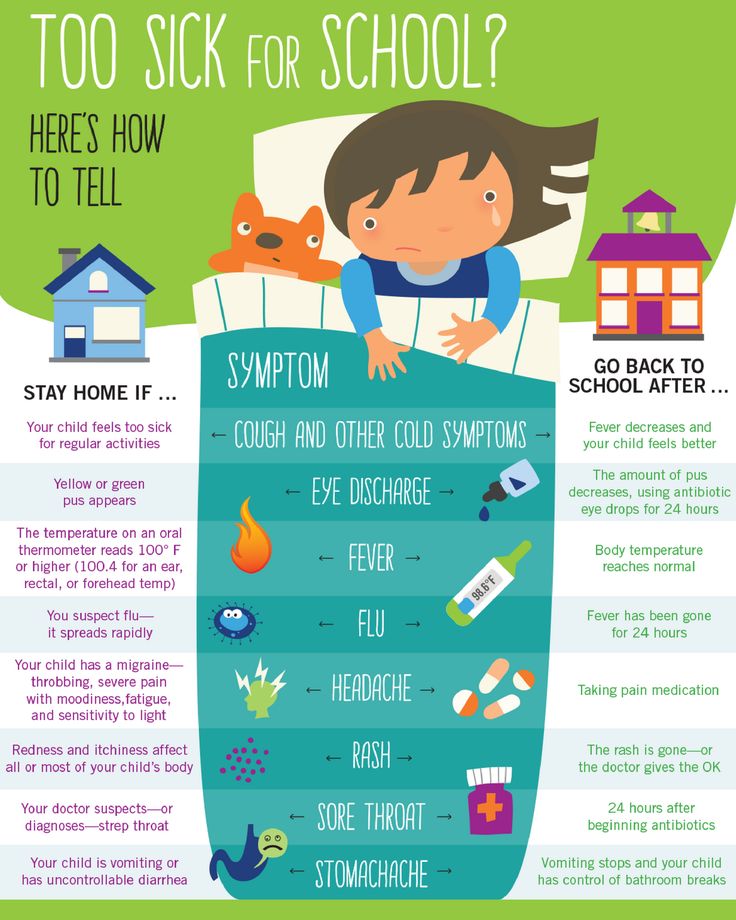

Check your symptoms using K Health and talk to a medical provider for a low cost.

Get StartedChoosing the Right Health Insurance

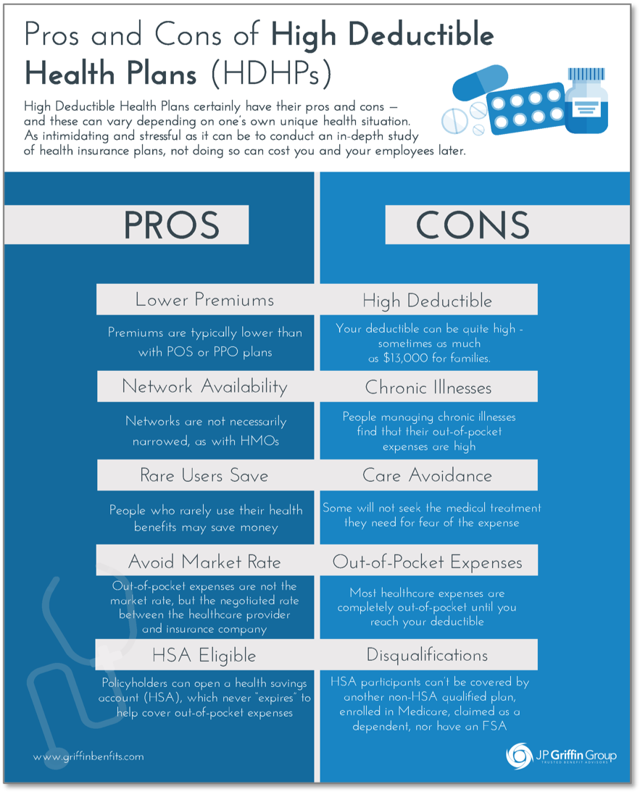

The health insurance plan you choose depends somewhat on your health status.

If you are in good health and don’t require monthly prescriptions or need to have a procedure done, you will want a different plan than someone who does.

Types of plans

Here are the most common types of health insurance plans.

Exclusive provider organizations (EPO): An EPO plan requires you to seek healthcare services from doctors and hospitals within their defined network if you want your costs to be covered, with exceptions for emergency care.

Health maintenance organizations (HMO): HMO plans typically contract with doctors within a specific area to provide services, including preventative measures. Except for an emergency, this type of plan only covers the cost of services provided by in-network healthcare providers.

Point of Service (POS): POS plans offer reduced-cost physician and hospital care when you seek care from their in-network providers. If you need an appointment with a specialist, you’ll need to get a referral from your primary care physician.

Preferred provider organization (PPO): With a PPO, you pay less for healthcare services when you only use in-network providers. This plan does not require a referral to see a specialist.

Marketplace: The health insurance Marketplace offers a few different levels of coverage plans. The plans are broken down by tier:

- Gold and Platinum: These plans have the most expensive premiums (monthly payments), but they also have the lowest deductibles (the amount you need to pay out of pocket).

This means you will have access to coinsurance benefits quickly. If you are in great health, this policy might end up costing more compared to the benefits you will receive. However, if you require monthly medications, this plan would be a great money-saving plan for you.

This means you will have access to coinsurance benefits quickly. If you are in great health, this policy might end up costing more compared to the benefits you will receive. However, if you require monthly medications, this plan would be a great money-saving plan for you. - Silver: These plans have average premiums, deductibles, and out-of-pocket maximums. It is more expensive than the cheapest plan, but it’s a great plan if you are preparing to start a family. In addition, Silver plans offers cost-sharing discounts if your income is below 250% of the federal poverty level.

- Bronze: These plans have low premiums and high deductibles but are only available for people under 30. If you are eligible for subsidies, you can apply them to get a Bronze plan for a low monthly rate. This type of plan is good if you don’t think you’ll have many medical expenses throughout the year.

- Catastrophic: These plans are also only available for people under 30.

They are the cheapest plans available on the Marketplace, but they have the highest deductibles and out-of-pocket maximums. This type of cheap plan is great if you are healthy and don’t expect to have substantial medical costs. You cannot apply subsidies to Catastrophic plans.

They are the cheapest plans available on the Marketplace, but they have the highest deductibles and out-of-pocket maximums. This type of cheap plan is great if you are healthy and don’t expect to have substantial medical costs. You cannot apply subsidies to Catastrophic plans.

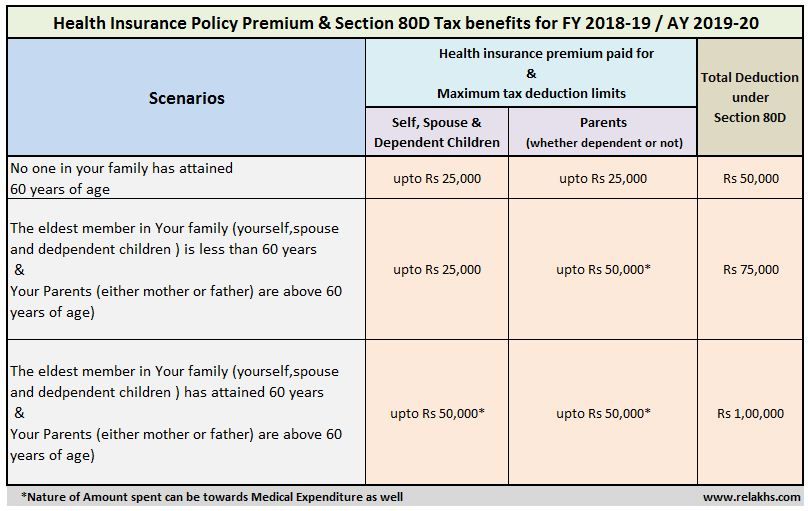

Costs

Whatever plan you choose, there is a required monthly premium (how much you pay for the plan each month).

If you don’t require any medical care, your premium is the only payment you can expect.

However, if you do require healthcare services, you will have to pay other costs as well.

- Deductible: This is the amount of money you pay out of pocket before the benefits of the policy start covering costs. For example, if you have a deductible of $2,000, you will need to pay the first $2,000 of any healthcare bills yourself before your insurance starts to pay.

- Copayment: Also called a copay, the copayment is typically a fixed cost for a service (e.

g., $25 to see your primary care physician). Once the deductible has been met, you will only be asked to pay your copay when you visit your doctor.

g., $25 to see your primary care physician). Once the deductible has been met, you will only be asked to pay your copay when you visit your doctor. - Out-of-pocket maximum: This is the maximum amount of money you will pay out of your own pocket for healthcare services in a single year. Until you reach this maximum, you are responsible for all of the out-of-pocket costs.

Check your symptoms using K Health and talk to a medical provider for a low cost.

Get StartedDo I Need Health Insurance?

If you are healthy, you might think that you don’t need health insurance coverage.

But consider that accidents happen all the time, and healthcare services can be expensive without the help of insurance.

According to the U.S. Centers for Medicare and Medicaid Services, the average hospital stay can cost $10,000 per day.

While that may be an extreme case, injury and illness can come as a surprise, and signing up for health insurance is one simple way to help avoid high medical bills if an issue does arise.

It’s always best to plan ahead—you’ll be happy you did.

How K Health Can Help

Need to go to urgent care but no insurance?

Check your symptoms, explore conditions and treatments, and if needed, text with a healthcare provider in minutes all through K Health.

K Health’s AI-powered app is HIPAA compliant and is based on 20 years of clinical data.

K Health articles are all written and reviewed by MDs, PhDs, NPs, or PharmDs and are for informational purposes only. This information does not constitute and should not be relied on for professional medical advice. Always talk to your doctor about the risks and benefits of any treatment.

K Health has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. We avoid using tertiary references.

-

Why Bother with Health Insurance? (n.

d.)

d.)

https://www.healthcare.gov/young-adults/ready-to-apply/ -

Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families. (2020.)

https://www.cms.gov/CCIIO/Resources/Files/adult_child_fact_sheet -

How to Get or Stay on a Parent’s Plan.

(n.d.)

(n.d.)

https://www.healthcare.gov/young-adults/children-under-26/ -

Health Insurance Marketplace. (n.d.)

https://www.healthcare.gov/glossary/health-insurance-marketplace-glossary/ -

The 2021 Florida Statutes.

(2021.)

(2021.)

http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0600-0699/0627/Sections/0627.6562.html -

Life Events – Child Turns 26. (n.d.)

https://team.georgia.gov/life-events-child-turns-26/ -

Idaho Statutes.

(2021.)

(2021.)

https://legislature.idaho.gov/statutesrules/idstat/title41/t41ch31/sect41-2103/ -

Dependent Coverage. (2017.)

https://www2.illinois.gov/cms/benefits/trail/state/Pages/AddingaDependent.aspx -

Eligibility requirements to enroll.

(n.d.)

(n.d.)

https://www.in.gov/spd/benefits/eligibility/eligibility-requirements-to-enroll/ -

Section 108. (n.d.)

https://malegislature.gov/Laws/GeneralLaws/PartI/TitleXXII/Chapter175/Section108 -

Family Eligibility.

(n.d.)

(n.d.)

https://mn.gov/mmb/segip/family-eligibility/ -

Title XXIII Corporations, Associations and Partnerships. (2008.)

https://revisor.mo.gov/main/OneSection.aspx?section=354.536 -

Chapter 689b - Group and Blanket Health Insurance.

(n.d.)

(n.d.)

https://www.leg.state.nv.us/NRS/NRS-689B.html#NRS689BSec035 -

Coverage of Young Adults in New Jersey Up to Age 31. (n.d.)

https://www.state.nj.us/dobi/division_consumers/du31.html#du31 -

Coverage Expansion Through Age 29.

(n.d.)

(n.d.)

https://www.dfs.ny.gov/consumers/health_insurance/faqs_age29_young_adult_option -

Disabled Dependent 26 Years of Age or Older. (2018.)

http://www.cs.ny.gov/employee-benefits/hba/shared/manuals/pa/pdfs/2.3_disabled_dependent_26_or_older.pdf -

Section 1751.

14. Termination of coverage of child. (2016.)

14. Termination of coverage of child. (2016.)

https://codes.ohio.gov/ohio-revised-code/section-1751.14 -

Eligibility and Dependent Eligibility. (2022.)

https://www.oregon.gov/oha/OEBB/Pages/Eligibility.aspx -

Senate Bill No.

189. (2009.)

189. (2009.)

https://www.legis.state.pa.us/CFDOCS/Legis/PN/Public/btCheck.cfm -

Chapter 41. Health Maintenance Organizations. (2012.)

http://webserver.rilin.state.ri.us/Statutes/TITLE27/27-41/27-41-61.HTM -

Title 38 - Insurance.

(2019.)

(2019.)

https://www.scstatehouse.gov/code/t38c071.php -

58-17-2.3. Dependent coverage termination--Age--Full-time students. (2011.)

https://sdlegislature.gov/Statutes/Codified_Laws/2074932 -

58-17-30.

1. Continuation of coverage for child with intellectual or physical disability--Proof of dependency. (2013.)

1. Continuation of coverage for child with intellectual or physical disability--Proof of dependency. (2013.)

https://sdlegislature.gov/Statutes/Codified_Laws/2074966 -

632.885. Coverage of dependents. (2011.)

https://docs.legis.wisconsin.gov/statutes/statutes/632/vi/885 -

Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families FAQs.

(n.d.)

(n.d.)

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/faqs/young-adult-and-aca -

Enroll in or change 2022 plans — only with a Special Enrollment Period. (n.d.)

https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/ -

Subsidized Coverage.

(n.d.)

(n.d.)

https://www.healthcare.gov/glossary/subsidized-coverage/ -

COBRA Continuation Coverage Questions and Answers. (n.d.)

https://www.cms.gov/CCIIO/Programs-and-Initiatives/Other-Insurance-Protections/cobra_qna

Dependent spouse | EHIF

. .. who brings up children ..., who has less than 5 years before retirement age

.. who brings up children ..., who has less than 5 years before retirement age

NB! 90,006 dependent spouses with a child under age 8 or a child under age 8 until the completion of first grade or three children under age 16 are eligible for health insurance.

-

Health insurance data

represents the Health Insurance Fund, the Social Insurance Board, to which the dependent spouse has previously submitted an application

-

Emergence of health insurance

within 7 days after providing data

-

Health insurance is valid

while raising a child

-

Termination of health insurance

After 1 month

- child reaches 8 years of age

- Grade 1 8-year-old child

- oldest child reaches 16 years old

-

Continuation of health insurance

- employer insured

- woman expecting a baby

- based on other types of health insurance

Additional information

- dependent spouse's health insurance

- ravikindlustuse kehtivuse kontroll

- terviseandmed

NB! 90,006 dependent spouses who are under five years of age before retirement are eligible for health insurance.

-

Health insurance data

the person submits to the Health Insurance Fund, together with application

-

Emergence of health insurance

within 5 days after submission of data

-

Health insurance is valid

during marriage before retirement age if dependent spouse has health insurance

-

Termination of health insurance

After 1 month

- dependent reaches retirement age

- marriage is dissolved

- survivor's insurance ends

-

Continuation of health insurance

- pensioner

- employer insured

- based on other types of health insurance

Additional information

- dependent spouse's health insurance

- types and conditions of pension

- health insurance validity check

- health data

Dependent spouse of the insured person who is raising children

Dependent spouses who are legally married and the dependent spouse of the insured person who is raising children are entitled to health insurance:

- at least one child under the age of 8 or

- age 8 before completing first grade, or

- at least three children under the age of 16

and whose spouse is insured as an

- employee or

- as a member of a supervisory or supervisory body of a legal entity, or

- as a person receiving payment for work or services on the basis of a contract under the law of obligations, or

- as a self-employed person.

NB! Please note that if your working spouse also receives parental benefit for a child, you will not be able to get health insurance for his or her work. You can find more information here

In order to receive health insurance, documents must be submitted to the Social Insurance Board, which will send the data required for insurance to the Health Insurance Fund. Additional information about documents can be obtained from the Social Insurance Board at 612 1360 or on the website www.sotsiaalindlustusamet.ee.

The dependent spouse of the insured person who has less than 5 years before the retirement age

The dependent spouse of the insured person who has less than 5 years before the retirement age years. In order to receive health insurance, an application must be submitted to the customer service office of the Health Insurance Fund.

Petition for health insurance

0006

- at least one child under the age of 8 or

- a child under the age of 8 before completing first grade, or

- at least three children under the age of 16

must apply to the Social Security Department.

The Social Insurance Board sends data to the Health Insurance Fund for obtaining health insurance.

2. Dependent spouse of the insured person who has less than 5 years before retirement age, must submit an application to the customer service office of the Health Insurance Fund.

Emergence of health insurance

Dependent spouse's insurance arises from the entry of the commencement of insurance into the health insurance database. The Health Insurance Fund has the right to make an entry within five calendar days after the Health Insurance Fund receives the documents drawn up in accordance with the requirements.

End of health insurance

1. Insurance of the dependent spouse who is raising:

- at least one child under the age of 8 or

- a child under the age of 8 until the end of the first grade, or

- not less than three children under the age of 16,

ends if the conditions that give the right to health insurance coverage are not met.

2. Insurance of the dependent spouse (s) of the insured person who has less than 5 years before retirement age, ends if

- the dependent reaches retirement age, or

- the marriage ends, or

- the survivor's insurance ends.

When the dependent reaches retirement age, insurance continues as an old-age pensioner. This data is submitted to the health insurance fund by the pension board.

The validity of the health insurance can be checked on the state portal eesti.ee in the service “Health insurance and information about the family doctor” or by calling the information line of the Health Insurance Fund + 372 6696630).

Additional contributions to the mandatory funded pension and health insurance

You are here

Raising children in the future will affect the amount of your pension, and although the retirement period may seem like a distant future when you have children, it is nevertheless important to think about your pension already at the time of having children.

C 2013 The increase in the child-bearing pension is carried out on two grounds:

- pension increase provided on the basis of the State Pension Insurance Law;

- Additional contributions made on the basis of the Funded Pension Act.

Which basis applies specifically to you – depends on whether you have joined the mandatory funded pension, i.e. the II pension pillar (and thus whether you have a mandatory funded pension account) or not.

You have a mandatory funded pension account if:

- you were born in 1983 or later;

- you were born before 1983, but entered into a compulsory funded pension agreement before October 31, 2010.

If by this time you have not entered into a mandatory funded pension agreement, it is no longer possible to conclude one. If you are not sure whether you have joined the mandatory funded pension system, you can check it on the state portal eesti. ee or on the website of the Pension Center https://www.pensionikeskus.ee/ii-sammas/kogumispension-ehk-ii -sammas/.

ee or on the website of the Pension Center https://www.pensionikeskus.ee/ii-sammas/kogumispension-ehk-ii -sammas/.

Please note that if you have joined the compulsory funded pension system, you are no longer entitled to receive an increase in the pension paid on the basis of the National Pension Insurance Law. Whether your pension will increase in the future due to raising children – in this case, it only depends on whether you used your right to receive additional contributions to the account for the mandatory funded pension while raising children!

The right to receive additional contributions is valid until the child reaches the age of 3 years.

We pay additional contributions only to one parent at a time . If both parents have an account for the mandatory funded pension and you want to share the additional contributions you receive for your children, you can change the beneficiary at the time you want.

If you have not joined the 2nd pillar of the mandatory funded pension and the other parent of the child has joined, make a joint decision on whether the funded pension contributions for raising the child will go to the child’s account or whether you will start receiving an increase in the raising pension at retirement age child on the basis of the State Pension Insurance Law. You can read more about the pension supplement paid on the basis of the State Pension Insurance Law HERE.

You can read more about the pension supplement paid on the basis of the State Pension Insurance Law HERE.

Supplementary contributions to the mandatory funded pension and applying for them

additional contributions to your account for the mandatory funded pension. We will monthly pay an additional 4% of the average Estonian income subject to social tax to the pension fund of your choice.

In 2021, we pay for each child under the age of 3 50.95 euros per month . When the average Estonian income changes, we will calculate a new amount for the next calendar year.

We pay additional contributions to the funded pension monthly for the period from the birth of a child until the child reaches the age of 3. In the month that the child is born and in the month that the child turns 3, we pay the additional contribution pro rata for the days for which you are entitled to receive it.

To receive additional contributions to the funded pension, you must submit an application to us, or if another child is born to the same parents and you used this opportunity in connection with the previous child, we will send an offer to receive compensation based on the previous application by e-mail.

Additional contributions to the funded pension can be applied for together with all other benefits and benefits related to the birth of a child. You will find in our self-service an offer for receiving additional contributions to the pension pillar. Read more about confirming family benefits

At the latest, you can apply for additional mandatory funded pension contributions up to 6 months after the child reaches the age of 3. Retroactively, we assign additional funded pension contributions for the days when your child is under 3 years old, and which are within six months from the date of application, for which they can be received retroactively.

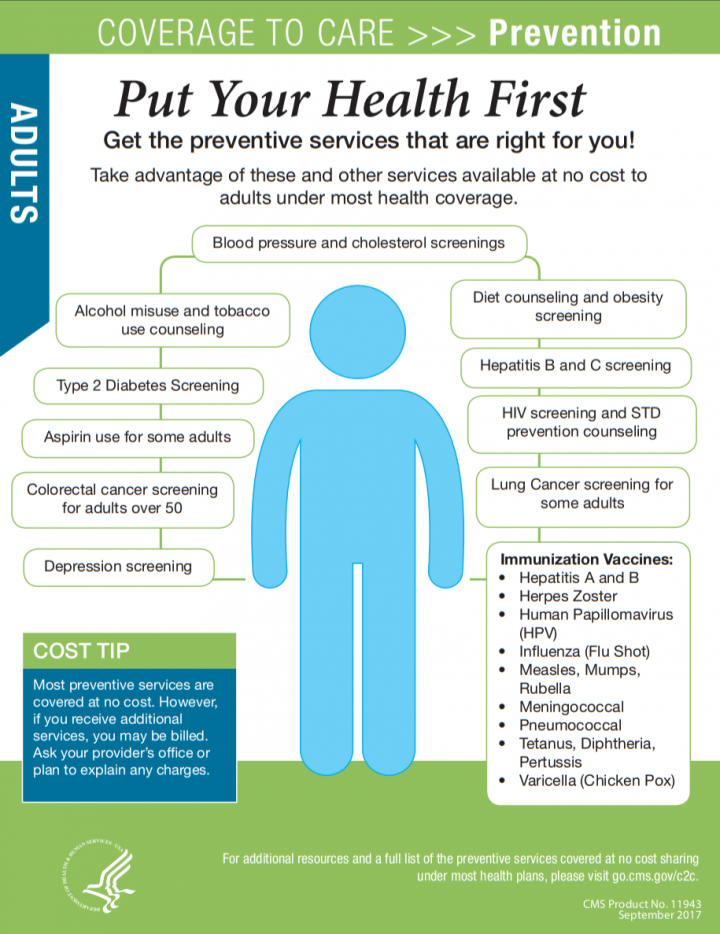

You must have health insurance in order to be covered by the Health Insurance Fund. Every person has health insurance automatically if social tax is paid for it.

If you are employed, your employer pays social tax for you. If you are not working or your employment contract is suspended, as when you are at home with a child, you can get health insurance through state family benefits.

If you are raising a child under the age of 3 in Estonia, you are covered by state health insurance . The state provides health insurance to one of the parents – as a rule, to the one who is paid parental benefit or, after the end of payment of parental benefit, child care allowance . In addition to the parent of the child, these conditions may also be met by a guardian or custodian with whom a written agreement on guardianship in the family has been concluded, or another person receiving childcare allowance who, instead of the parent, is on parental leave.

Please note that if you decide to change the beneficiary of benefits in the family, the person who receives benefits (adoption benefit, parental benefit, child care allowance or - in the family) will also be eligible for health insurance with seven or more children - allowance for a large family). It is important to pay attention to the fact that, for example, a mother who actually stays at home with a child does not remain without health insurance.

Example . The mother of the child stays at home with her 10-month-old child and receives parental benefit. The family decides to change the beneficiary of parental benefit and applies for parental benefit to the father of the child. At the same time, the mother of the child still wants to continue to stay at home with the child.

Since the mother no longer receives parental benefit for the child and does not return to work, she loses her health insurance, and if the mother needs medical care, the Health Insurance Fund will not cover her medical expenses.

You receive national health insurance automatically without applying, also if:

- you are raising seven or more children under the age of 19 in Estonia.

You must apply for health insurance if you:

- are not working and are raising three or more children under the age of 19 living in Estonia, of which at least one child is under the age of 8 ;

- you do not work, but your spouse works, and the employer pays social tax for him, if at least one child under the age of 8 or at least three children under the age of 16 grows up in your family;

Health insurance application form *.

035 requires that dependents retain coverage beyond age of policy termination if they are incapable of self-sustaining employment due to disability.

035 requires that dependents retain coverage beyond age of policy termination if they are incapable of self-sustaining employment due to disability.

If the dependent child is mentally or physically impaired, the plan must continue their coverage after the specified age.

If the dependent child is mentally or physically impaired, the plan must continue their coverage after the specified age.

S.A. § 627.6562

S.A. § 627.6562