How do i pay less child support

Lower Your Child Support Payments & Get More Parenting Time

Lower your child support payments

In most cases, you can lower your child support payments by figuring out the correct parenting timeshare percentage and increasing the amount of time you have your children.

Almost every state uses at least these two factors to calculate child support:

- How much time each parent has with the child

- How much income each parent has

Generally speaking, the parent with the least amount of time with the children pays child support to the parent who has more time. Due to this, some parents seek custody to avoid child support.

The amount of time you have with your children is calculated as the:

- Parenting timeshare percentage that shows the percentage of time each parent has the children

- Overnight timeshare percentage which shows the percentage of overnights each parent has the children

- Number of hours that each parent has the children

To get a correct child support calculation, you need to have the right timeshare percentage. Because this is difficult and time consuming to figure out, most lawyers and courts simply guess or estimate the timeshare percentage.

To lower your child support payments you need to figure out your timeshare percentage. Then you can know if your current child support calculation is correct.

Your payments may change just by having the right timeshare percentage. And, if they don't, you can take steps to increase your timeshare percentage so your payments are lower.

Calculate your timeshare percentage

First, you need to know your state's formula for calculating child support so you know what type of timeshare percentage to calculate. Your state may want the parenting timeshare (also called the visitation timeshare), the overnight timeshare, or the number of hours you have the children.

Custody X Change is software with a timeshare calculator.

Calculate My Parenting Time Now

Custody X Change calculates the:

- Parenting or visitation timeshare percentage

- Overnight timeshare percentage

- Number of hours you have your children

To get your timeshare percentage with Custody X Change you enter your parenting time schedule into the software and the program shows you the exact amount of time that each parent has the children.

See the timeshare percentage as you enter in your schedule.

Once your schedule is made, you can print a parenting time report to show the court or your lawyer. Then you will have the right timeshare percentage in your child support calculation.

Print a report that shows the timeshare percentage of each parent.

Increase your parenting time

Once you know your parenting timeshare percentage, you can work to increase your parenting time and lower your child support payments.

Custody X Change shows your timeshare percentage as you make your schedule. With the software you can experiment with your schedule to increase your parenting time. Often, you can make little changes to your schedule that will result in bigger changes to your child support.

Some little changes to make to your schedule are:

- Adding 30 minutes or so to your visits throughout the week

- Changing the start day of your schedule

- Looking at holiday time and increasing the number of holidays in your schedule

- Adding vacation time to your schedule

- Changing your holiday schedule

- Adding 3rd party time to your schedule

You should also check your state laws about how much parenting time you need in order to claim your child as a dependent on your tax forms. In some states, you need a certain timeshare percentage to claim your child. If you can increase your timeshare percentage to that amount, you can save a lot of money on your taxes.

In some states, you need a certain timeshare percentage to claim your child. If you can increase your timeshare percentage to that amount, you can save a lot of money on your taxes.

Track your actual parenting time

You may also want to track your actual parenting time because you may have the children more than you are scheduled. If you do, you can go to court and get your child support payments changed.

If you have your children more than you are scheduled and you aren't currently claiming your children as dependents on your taxes, you should also look into your state custody laws. You may have the children enough to claim them as dependents, and you can go to court and show your actual parenting time and save money on your taxes.

Custody X Change has an actual-time tracking and journaling feature that lets you:

- Track your actual timeshare percentage

- Keep notes about visitation in a journal

- Print a report that shows the difference between the scheduled timeshare percentage and the actual timeshare percentage

- Print a calendar that shows the actual parenting time schedule

Custody X Change is software with a timeshare calculator.

Calculate My Parenting Time Now

How to Lower Child Support Payments | Child Support Reduce

Where You Need a Lawyer:

Zip Code or City:

(This may not be the same place you live)

Choose a Legal Category:

Most Common Family Issues:

Please provide a valid Zip Code or City and choose a category

Please choose a category from the list

Please select a city from the list and choose a category

Please enter a valid zip code or city

Please select a city from the list

Connecting …

Are You a Lawyer? Grow Your Practice

What is a Child Support Order?

Child support is a recurring monetary payment meant to help support a child or children whose parents are no longer living together. Factors taken into consideration include:

Factors taken into consideration include:

- Custody Arrangement: Child support payments are almost always ordered to be paid to the parent that has been granted custody of the child. This is because the custodial parent will naturally incur more expenses related to the child (e.g. food, clothing, extracurricular activities).

- Lifestyle Prior to Separation: In situations where the child lived with both parents prior to the parents’ separation, the court will consider the lifestyle that the child was accustomed to when the parents were together in order to minimize disruption in the child’s life. For example, in the case of a child who has always attended an expensive private school, the court will likely order that the non-custodial parent provide enough financial support to allow the child to continue in the same type of school environment.

- Income of the Parties: The court will require both parents to submit proof of their total income so that each parent’s financial means can be used to determine how much support should be paid.

The overarching goal in entering custody or child support orders is to do what is in the best interest of the child.

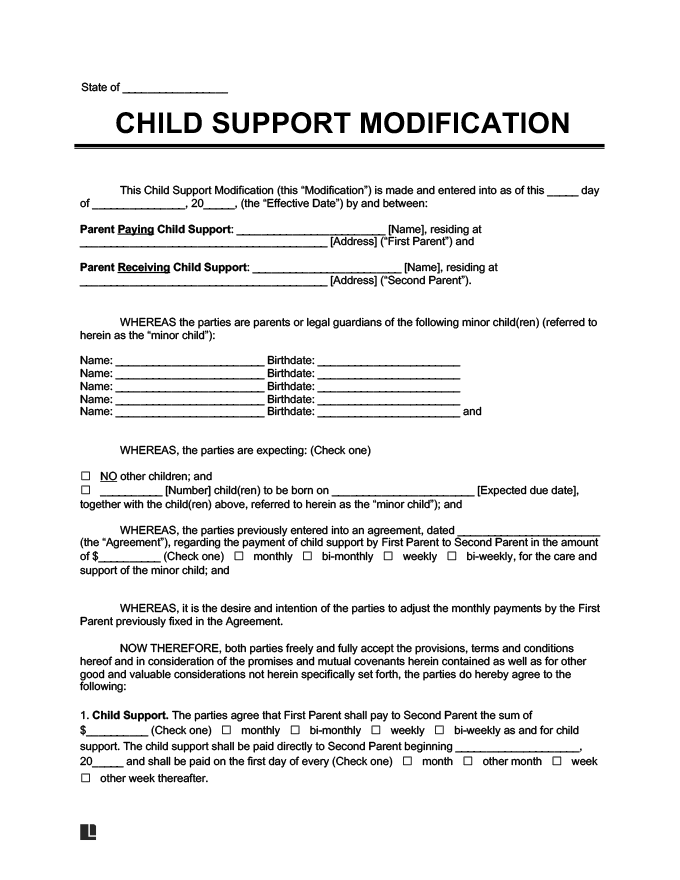

What Does a Child Support Order Usually Contain?

A child support order will declare which parent is ordered to pay support, the monthly amount due, obligations to help pay for daycare or provide health insurance, and a termination date for the payments. Child support orders involving multiple children will usually lay out the dates when the child support obligation will lessen based on one or more children reaching the age of majority.

The order will also almost always contain a brief summary of the consequences for non-payment and an overview of what must be done to alter the child support order.

Can Child Support Be Lowered or Changed Because of Financial Circumstances?

A child support order can change over time as a result of changing circumstances. If the paying parent thinks that the amount of child support should be reduced, they can request a child support reduction. A reduction is most often ordered due to changes in a parent’s financial situation (loss of job, etc.).

A reduction is most often ordered due to changes in a parent’s financial situation (loss of job, etc.).

How often a child support order can be altered is almost always limited, usually by requiring a certain period of time to pass before a change can be requested. This is because if there were no limits on how often an order can be updated, the courts would be completely overloaded with modification requests from parents not satisfied with the order entered.

How Can I Get My Child Support Payment Lowered?

In order to change child support payments, a parent must file a Motion to Modify. This is a formal request asking the courts to consider changing the child support order previously entered. The court is not required to grant the Motion to Modify, and usually requires proof that circumstances have changed substantially enough to warrant the change.

Requests to lower child support payments are most often granted as a result of:

- Changes in Income: Usually if the paying parent’s income is substantially less than when the child support obligation was calculated.

This could be after the parent loses a job, becomes incarcerated, or becomes disabled.

This could be after the parent loses a job, becomes incarcerated, or becomes disabled. - Changes in the Custody Arrangement: Modifications will also frequently be granted if the custody arrangement changes so that the paying parent naturally incurs more routine expenses to support the child.

- Change in Costs Taken into Consideration: A steep increase in health insurance costs could mean that a paying parent’s monthly child support payment will be lowered to reflect that.

What Else Should I Know About Lowering Child Support for Financial Reasons?

A parent may also be able to get the amount of child support lowered as a result of increased educational or extracurricular costs. If the parent can provide proof that they are now paying significantly more each month for such an expense, then the court may consider lowering the monthly child support payment.

The courts may also lower a parent’s child support obligation if additional children are born to the parent. Most states assess child support obligations based on the idea that a certain percentage of the parent’s income should go towards supporting their children. If the calculation was based on having a single child, and that parent later has children with a new spouse, then the amount of their income that the courts feel should go towards supporting children must now be spread out between all of the children.

Most states assess child support obligations based on the idea that a certain percentage of the parent’s income should go towards supporting their children. If the calculation was based on having a single child, and that parent later has children with a new spouse, then the amount of their income that the courts feel should go towards supporting children must now be spread out between all of the children.

What Happens if a Child Support Order is Violated?

A parent who is ordered to pay child support will face several consequences if they don’t pay, including:

- Fines, jail, or both

- Garnishment of wages, including unemployment and worker’s compensation

- Seizure of tax refunds

- Revocation of passport

- Suspension, revocation or denial of various licenses — professional, driver’s, hunting/fishing/boating

Should I Hire an Attorney if I Want to Lower My Child Support Payments?

While it is possible to get your child support payments lowered on your own, it is usually a good idea to at least consult an attorney before attempting so. Hiring a child support lawyer to seek the reduction in child support for you will almost always result in a quicker and more successful result.

Hiring a child support lawyer to seek the reduction in child support for you will almost always result in a quicker and more successful result.

Abigail Stark

LegalMatch Legal Writer

Original Author

Abby has a Bachelor's degree in Psychology and supported men and women with developmental disabilities for over a decade before earning her Juris Doctorate in 2017. She still serves on the local committee responsible for reviewing the necessity of any rights restrictions imposed on individuals with developmental disabilities. Her favorite part of law school and practicing law is the research and writing. When not working, Abby loves being outside, spending time with family, watching documentaries, and cooking. You can learn more about her from her Linkedin profile.

Jose Rivera

Managing Editor

Editor

Last Updated: Aug 10, 2020

Law Library Disclaimer

REDUCTION OF ALIMONY

home

Lawyer Blogs

REDUCTION OF ALIMONY

lawyer Pinkhasik Ilya Zelikovich,

June 10, 2022

Phone: +375296983211

Skype:Il Pinhasik

Minsk Regional Bar Association, Minsk Regional Legal Consultation No. 4

4

Alimony is

regular

monetary

payments

and

of one parent

to another for the maintenance of a minor child

9002.It doesn't matter if the marriage between the parents is registered or not.

The payment of alimony can be made voluntarily or collected by the court in a compulsory manner.

Amount of alimony

The amount of alimony due per month is determined by the document on the basis of which these payments are determined. This may be an agreement, a marriage contract, a writ of execution, a court order. That is, every month the parent must receive an amount not less than prescribed.

The most common option in the Republic of Belarus is the withholding of alimony

as a percentage of income. The amount of interest depends on the number of children for whom they are collected. For one child - 25%, for two children - 33%, for three or more children - 50% of income.

For one child - 25%, for two children - 33%, for three or more children - 50% of income.

However, there is a lower limit that the child support payer must pay. The minimum amount is defined as

as a percentage of the subsistence minimum budget per capita (hereinafter referred to as BPM).

Today it is:

50% - BMP for the maintenance of one child

100% BPM - for two children

150% BPM - for three or more children only in cases where the alimony payer does not work anywhere or has not provided documents confirming his income, or the income is less.

HOW TO LEGALLY REDUCED SALES

There are a number of special circumstances where you can reduce your child support and it's completely legal.

- the presence of other minor children who, if alimony is collected in the established amount, would be less financially secure than children receiving alimony

- disability of the parent from whom the alimony is collected, I or II group submission of the relevant

application to the court. The payer must submit an application with documents proving special circumstances.

The payer must submit an application with documents proving special circumstances.

There is no maximum support amount. However, the legislation defines

the maximum amount of deductions from the income of the alimony payer. So it is mandatory

that at least 30% of wages and income equivalent to it must be saved. That is, the maximum amount of deductions by court order is 70%.

Alimony reduction may be temporary and will change as the payer's situation improves.

CALCULATION EXAMPLE

For example: 25% for the first child and 16.5% for the second child

. It turns out that in total, not

33% is collected (as established by law), but 41.5%. You can apply to the court and reduce the amount of child support to 16.5% for each child.

. In addition, the punishment imposed by the court does not relieve the obligation to repay the arrears in the payment of alimony.

In addition, the punishment imposed by the court does not relieve the obligation to repay the arrears in the payment of alimony.

You cannot start paying less on your own without waiting for a court decision on the reduction that has entered into force.

After all, reducing the amount of alimony is a right, not an obligation of the court.

"VOLUNTARY" ALIMENTS

It is also necessary to pay attention to the following point.

Reduction of the amount of alimony to be collected may be claimed only if the alimony is collected on the basis of a court order. In the case of a voluntary procedure for paying alimony, as well as if the payment of alimony is regulated by the Marriage Agreement, the Agreement on Children or the Agreement on the Payment of Alimony, an application is filed with the court to challenge the conditions specified in the agreement or change the conditions.

Pinkhasik Ilya Zelikovich's blog

Return to the list

up to what age they pay, how much percentage of income they can withhold, and what documents are needed to apply for alimony

1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under 18 and has not yet become fully capable by decision of the guardianship authority or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years old, but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he is in need and recognized Disabled adults entitled to alimony are considered to be disabled people of I, II, III groups and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.

0158

0158 - wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, state of health and other circumstances. marriage or within five years thereafter, and the spouses have been married for a long time.0158

Also, child support can be received by:

- disabled parents who need help, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents.

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones; - incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive maintenance from their adult able-bodied children or spouses, including former ones. This rule does not apply to guardians, trustees and adoptive parents;

- social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at the place of your residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays child support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and certificates of income of all family members;

- calculation of the amount you expect to receive towards child support. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of alimony based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-off of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

Under exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which the recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and until the age of 18, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.