How do i get the 500 stimulus for my child

$500 in missing stimulus money for your kids: To get it, you'll have to do your taxes first

If you weren't able to make the November deadline to claim $500 for each qualified child dependent that was left out of your first stimulus check in error, your second chance is coming up. The same general process applies for people who didn't get the $600 owed for each child dependent in the second stimulus check. You'll be able to claim the additional amount as a Recovery Rebate Credit when you file your 2020 tax return this year.

CNET's first stimulus check calculator and your adjusted gross income will help you determine the payment amount you were supposed to get in the initial check. Parents who pay or receive child support could each qualify for $500 per dependent with the first check, but they must share custody of a child dependent and may need to file a claim this year to get the payment. And in some cases, the IRS might also garnish a stimulus check to settle child support debts (that rule doesn't apply to the second check).

We'll provide more details about how to know if you're owed a stimulus payment and how you'll have to claim it now that tax time is almost here (hint: don't call the IRS). Meanwhile, read up on the second stimulus check, including who qualifies for more stimulus money -- and who doesn't. Here's what's going on with a third stimulus check and the current timeline for the new payment. This story was recently updated.

How do I know if I'm eligible for a stimulus check with child dependents?

To be eligible for a payment, you must be a US citizen, a permanent resident or a qualifying resident alien. You must also have a Social Security number and can't be claimed as a dependent of another taxpayer.

Here's where things get tricky. On the surface, the rules to claim a first stimulus check -- with or without a child dependent -- including having an adjusted gross income under $99,000 (single people), $146,500 (heads of household) or $198,000 (married couples filing jointly). But, and here's the big catch, because of the way the IRS calculates your stimulus check, you may actually be entitled to some money if you claim a child on your taxes, even if you exceed the income limit.

But, and here's the big catch, because of the way the IRS calculates your stimulus check, you may actually be entitled to some money if you claim a child on your taxes, even if you exceed the income limit.

The CARES Act from March 2020 stipulates a $500 allowance per child dependent in addition to the $1,200 cap for single filers and up to $2,400 for couples filing jointly. (We've also calculated how much money you might be able to get for dependents in the second stimulus check.)

There may be specific details you'll want to explore if your child dependent is adopted, disabled (of any age) or a citizen of another country.

Now playing: Watch this: Second stimulus checks: Everything you need to know

3:22

How can I claim my missing $500 per child?

When you file your taxes this year, you can claim the additional amount on behalf of eligible dependents. According to the IRS:

For individuals who did not receive an Economic Impact Payment or the full amount that they believe they are entitled to, they will be able to claim the additional amount when they file a 2020 tax return in 2021.

This will be called the Recovery Rebate Credit.

You can use the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR to claim a catch-up payment. The IRS will provide a Recovery Rebate Credit Worksheet to help you determine if you are missing a payment.

You'll be able to track the status of your IRS payment by visiting the IRS Get My Payment webpage. From there, you'll need to provide your Social Security number, date of birth, home address and ZIP code.

For more information, here's everything to know about stimulus payments. Here's what we know so far about a third stimulus check, including how much money it could be for, the IRS's potential timeline and every way it might be able to bring you more money.

How can I Claim My Remaining Child Tax Credit (CTC) or Missing Dependent Stimulus Payment in 2022? IRS Refund Payment Delays |

This article provides updates, income qualification thresholds and FAQs on current and past child tax credit (CTC) and dependent stimulus (economic impact) payments.

Each one has slightly different rules (and payment constraints) so please ensure you review each one separately and the associated FAQs/videos. Click the links below to jump to the relevant stimulus payment.

Covered in this Article:

2022-2023 CTC

Without further extensions the Child Tax Credit (CTC) will return to normal levels and can only be claimed when filing your tax return, versus advance payments provided during the pandemic years.

The child tax credit (CTC) will reset to at $2,000 per child in 2022 and 2023. Families must have at least $3,000 in earned income to claim any portion of the credit and can receive a refund worth 15% of earnings above $3,000, up to $1,500 per child (Additional CTC).

See this article for the latest income thresholds and eligibility rules for getting the full CTC payment

Get the latest money, tax and stimulus news directly in your inbox

Claiming Remaining CTC Payment in your Tax Return (Reconcile Amounts)

Millions of households can now claim the remaining portion or any missing amounts of the expanded child tax credit in their 2021 tax return, which are now being processed by the IRS. This also includes any missing dependent stimulus payments.

This also includes any missing dependent stimulus payments.

Get your biggest tax refund, guaranteed. Get started today.

Non-filers or those who didn’t register last year can use the IRS CTC portal to provide information or unenroll from receiving monthly CTC payments. See more FAQs on the CTC payment in this detailed article.

Note that as in previous years, the CTC refund payment is subject to the PATH act delay. Further the IRS has noted issues with some of the reconciliation 6419 letters they sent out earlier this year outlining payments made in 2021.

In particular married spouses are getting separate letters but need to ensure they combine amounts if filing jointly. Another error was with a small group of taxpayers who moved or changed bank accounts in December. The IRS 6419 notice didn’t always account for this payment and so could be under reporting what you got.

The best option is to ensure your 6419 letter and online IRS CTC account reconcile. In fact the IRS guidance is that if they amounts don’t reconcile, go with the total amount reflected on the online IRS account because it has the most up-to-date information regarding the CTC.

In fact the IRS guidance is that if they amounts don’t reconcile, go with the total amount reflected on the online IRS account because it has the most up-to-date information regarding the CTC.

You want to ensure the CTC portion claimed in your 2021-22 Tax return is consistent with that the IRS has. Otherwise your tax return and refund could be held up further for manual IRS verification.

IRS Payment Confirmation for Monthly Advance CTC Direct DepositsCalifornia $500 Golden Stimulus Dependent Check

CA Governor Newsom recently announced, thanks to large state budget surplus’ and federal funding via the Biden ARPA stimulus package, another $12 billion in direct cash payments to Californians. This expansion, called the “Comeback Plan” is in addition to the recent Golden State Stimulus, provides $1100 in additional direct payments to middle-class families that make up to $75,000. It will provide $600 direct payments to adults. Qualified families with dependents, including undocumented families, will also be eligible for an additional $500 dependent payment. This will include dependents in undocumented families.

Qualified families with dependents, including undocumented families, will also be eligible for an additional $500 dependent payment. This will include dependents in undocumented families.

To get this payment you would have needed to file your 2020 tax return (state and federal). Income data (AGI) in your tax return will be the main source for determining eligibility for these payments. I will provide more updates as details and payment dates are released. You can follow along via the options below

Update on Third $1400 Dependent Stimulus Check

Under the now approved $1.9 Trillion Biden Stimulus Package, or American Rescue Plan (ARP), there are provisions included for another round of stimulus checks. The amount being paid for this third round of stimulus “checks” is $1400 for each dependent – the same as the third adult stimulus check.

Unlike earlier dependent stimulus payments which were restricted to those under the age of 17, the third stimulus check would go to a broader set of dependents that were claimed in an adult tax return. This includes college age children and elderly dependent parents. It will also allow people to use the later of 2019 or 2020 tax data (file your tax return via TurboTax to update dependent information) to ensure the latest dependent and payment information is leveraged by the IRS.

This includes college age children and elderly dependent parents. It will also allow people to use the later of 2019 or 2020 tax data (file your tax return via TurboTax to update dependent information) to ensure the latest dependent and payment information is leveraged by the IRS.

Note that even though adult dependents will qualify, the stimulus payment will still go to the parent or head of household who claims the dependent on their latest tax return. The adult claimant will also need to qualify for the stimulus payment which is based on the following income thresholds where the lower limit indicates the maximum amount of income (MAGI) to get the full stimulus payment, which is reduced until the maximum threshold (or phase-out) limit is reached. Almost 80% of households will qualify for a stimulus payment based on these thresholds.

| 2019 or 2020 Tax Filing Status | Income Below Which FULL Stimulus is Paid | Maximum Income To Qualify for Partial Stimulus |

|---|---|---|

| Single or Married filing separate | $75,000 | $80,000 |

| Head of household | $112,500 | $120,000 |

| Married filing jointly | $150,000 | $160,000 |

When Will I Get The $1400 Payment from the IRS?

Most eligible Americans and their dependents have received their stimulus payments (see the estimated IRS stimulus processing schedule). Payments will occur in several batches to most eligible recipients and are expected to be complete by mid-April for normally processed payments. Catch-up or “plus-up” payments are also being made to those who filed their return later and had a change on circumstance that allowed them to qualify for these payments.

Payments will occur in several batches to most eligible recipients and are expected to be complete by mid-April for normally processed payments. Catch-up or “plus-up” payments are also being made to those who filed their return later and had a change on circumstance that allowed them to qualify for these payments.

Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates, which I do expect to occur again with this round of payments given the changed income qualification criteria and expansion to a broader set of dependents.

Note: Like the first and second dependent stimulus checks, I expect there to be ongoing issues with paying this round of stimulus payments. You can see a discussion of issues (and solutions) in this video.

Stimulus Payments for Non-Filer Dependents

For non-filers who haven’t filed a recent tax return, the IRS worked with relevant agencies (e.g. SSA for Social Security recipients) to get the latest payment and dependent data. There is also talk of a new non-filer tool the IRS would roll out to allow payment and dependent detail updates for this payment. This would also allow updates to flow through for other expanded Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) stimulus payments in the ARP package. Or else the IRS will use payment and dependent details based on previous stimulus payments (which created issues for many).

There is also talk of a new non-filer tool the IRS would roll out to allow payment and dependent detail updates for this payment. This would also allow updates to flow through for other expanded Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) stimulus payments in the ARP package. Or else the IRS will use payment and dependent details based on previous stimulus payments (which created issues for many).

Do College Age kids or Adult dependents get the payment directly?

No. While college students and relatives who are claimed as dependents in 2019 or 2020 tax returns will be eligible to get this stimulus check payment (unlike the past two economic impact payments) they will NOT be getting a direct payment from the IRS. The dependent payment would instead go to the parent or qualified taxpayer – which may be a surprise to many college aged kids hoping for some bonus/free money!

Also note, you cannot claim the stimulus check as an adult and as a dependent. If you were claimed as a dependent in a 2019 or 2020 tax return, you cannot now file a claim for the larger stimulus check.

If you were claimed as a dependent in a 2019 or 2020 tax return, you cannot now file a claim for the larger stimulus check.

Get the latest money, tax and stimulus news directly in your inbox

Second Child Dependent Stimulus Check ($600)

[Update following initial IRS payments] In addition to adult stimulus checks (a.k.a 2020 Recovery Rebates) the recently passed $900 billion COVID relief bill includes another round of stimulus payments for adults and ALL qualifying dependent children under the age of 17 at the end of 2020. While the adult stimulus check amount was only $600, half of the original $1200 stimulus payment, in order to keep the overall stimulus package price tag reasonable for Republican Senators to approve, the new dependent stimulus payment will be $100 more at $600 per qualified dependent.

Eligibility for the $600 child dependent recovery rebate stimulus is still subject to (AGI) income limits, which were adjusted from original levels, as shown in the table below. The benefit will phase out or reduce by $5 (or 5%) for every $100 of income above the lower level threshold to get the full stimulus. For every additional dependent the maximum income threshold rises by $12,000 ($600 / 5%).

The benefit will phase out or reduce by $5 (or 5%) for every $100 of income above the lower level threshold to get the full stimulus. For every additional dependent the maximum income threshold rises by $12,000 ($600 / 5%).

| Status | Income Below Which FULL Dependent Stimulus is Paid (Lower Threshold) | Max Income To Qualify for Stimulus (no kids) | Max Income to Qualify with 1 Child | Max Income to Qualify with 2 Children |

|---|---|---|---|---|

| Single or married filing separate | $75,000 | $87,000 | $99,000 | $111,000 |

| Head of household | $112,500 | $124,500 | $136,500 | $148,500 |

| Married filing jointly | $150,000 | $174,000 | $186,000 | $198,000 |

Are Adult High School or College Age Dependents Covered?

Unfortunately the approved stimulus bill has not addressed this same criticism around the original $500 dependent stimulus (see updates and comments below) which excluded adult dependents from getting this payment. This includes thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, who will continue to be ineligible for the additional $600 payment. The one exception to this is that if you are a college student AND filed a single 2019 tax return AND were not claimed as a dependent on another adult’s tax return (file for free at Turbo tax), you may qualify for the $1200 adult stimulus check per standard rules.

This includes thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, who will continue to be ineligible for the additional $600 payment. The one exception to this is that if you are a college student AND filed a single 2019 tax return AND were not claimed as a dependent on another adult’s tax return (file for free at Turbo tax), you may qualify for the $1200 adult stimulus check per standard rules.

When will I get the second $600 dependent stimulus payment?

Like the original dependent stimulus this payment will be made by the IRS to qualifying guardians who filed a 2019 recent tax return and claimed the child as dependent. Stimulus check 2 payments started on December 30th, 2020 per IRS guidance and dependent payments will be issued with the adult stimulus payment. Payments will occur in several batches to most eligible recipients within 1 to 2 weeks of the initial round and are expected to be complete by mid-January 2021 for normal processing. Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates.

Exception processing will start after that. You can see the comments section below for Q&A on payment issues and updates.

Also I have posted two recent videos on this topic – one is a detailed review of the $600 Dependent Stimulus and a subsequent one is a Q&A for Issues People are Seeing with this Payment.

Dependents not in 2019 returns or born in 2020

Households that added dependents in 2020, who might not qualify for the dependent stimulus based on 2019 tax returns, would be able to claim this payment in their 2020 tax returns. The stimulus checks work like a refundable tax credit so are no additional taxes are due on them when filing your tax return.

While there is no limit to the number of qualifying dependents a tax payer can claim, the same dependent cannot be claimed twice for this payment and the IRS will this payment based on dependent information from 2019 tax returns.

For parents who had babies this year, and who won’t be listed in 2019 tax returns, they will need to file a return (start for free at Turbo Tax) to claim their dependent payments. The good news is that all babies born this year will be eligible for both the original $500 dependent stimulus (details in earlier updates below) and the second $600 one being paid in 2021. This makes a total of $1,100 that parents could get for their newborns born in 2020. You will still need to meet income qualification thresholds for both dependent stimulus payment and will need to file a tax return; or for non-filers wait till the IRS opens it’s GMP tool to allow you to add dependents born this year.

The good news is that all babies born this year will be eligible for both the original $500 dependent stimulus (details in earlier updates below) and the second $600 one being paid in 2021. This makes a total of $1,100 that parents could get for their newborns born in 2020. You will still need to meet income qualification thresholds for both dependent stimulus payment and will need to file a tax return; or for non-filers wait till the IRS opens it’s GMP tool to allow you to add dependents born this year.

The inclusion of the one-time stimulus payment however has also meant a cut in extra unemployment benefits that are also part of the overall package. You can also see more on this topic in the $600 Dependent Stimulus Check Video.

Issues with my Second Dependent Stimulus Check (Recovery Rebate) Payments

Like the first round of dependent payments (see updates below), many readers are reporting similar issues with the IRS payments for the second child dependent stimulus payment, despite having received their adult stimulus checks. At this point it is best to wait for the IRS to finish processing, especially if you had issues with the first round of payments. It is highly likely you will also get your dependent stimulus check later after the first round of “standard” payments is done in early to mid-January 2021. If you don’t have your payment you will need to check state on the IRS website, call their call center (later in January is better) or just file for this when you submit your 2020 tax return.

At this point it is best to wait for the IRS to finish processing, especially if you had issues with the first round of payments. It is highly likely you will also get your dependent stimulus check later after the first round of “standard” payments is done in early to mid-January 2021. If you don’t have your payment you will need to check state on the IRS website, call their call center (later in January is better) or just file for this when you submit your 2020 tax return.

First Dependent Economic Stimulus Payment ($500)

[August 2020 update] This IRS has fixed certain stimulus payment issues (which were due to a programming errors) for non-filer groups, many of whom are yet to receive their first $500 dependent stimulus credit. The resolved $500 dependent stimulus (economic impact) payments were being seen by several eligible recipients from early August for each qualifying child.

Further the IRS has announced it will reopen the registration period – starting Aug. 15 through Sept. 30 – for eligible non-filing federal beneficiaries (e.g. SSDI, Retirees and SSI recipients) who were eligible for the $500 per child payments but had not filed or needed to update payment details to get their payment. Those who file (via the IRS Non-filer tool) and are deemed eligible should start seeing their payments by Mid-October.

15 through Sept. 30 – for eligible non-filing federal beneficiaries (e.g. SSDI, Retirees and SSI recipients) who were eligible for the $500 per child payments but had not filed or needed to update payment details to get their payment. Those who file (via the IRS Non-filer tool) and are deemed eligible should start seeing their payments by Mid-October.

For those Social Security, SSI, Department of Veterans Affairs and Railroad Retirement Board beneficiaries who have already used the Non-Filers tool to provide information on children, no further action is needed. The IRS will automatically make a payment in October.

The above is great news for those who were in limbo about their payment and hopefully addresses many of the comments below.

$500 Dependent Stimulus Credit Qualification Thresholds and FAQs

Updated in May 2020 with answers at the end of this article. Several readers have asked questions around the additional $500 child dependent stimulus payment approved under the CARES stimulus bill. This is in addition to the $1200 individual and $2400 couple stimulus checks being paid to qualifying Americans. To get the supplementary child stimulus check payment you must have filed a recent (2018 or 2019) tax return, claimed the child as dependent AND the child must be younger than 17-years-old. They must also be related to you by blood, marriage, or adoption. There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This is in addition to the $1200 individual and $2400 couple stimulus checks being paid to qualifying Americans. To get the supplementary child stimulus check payment you must have filed a recent (2018 or 2019) tax return, claimed the child as dependent AND the child must be younger than 17-years-old. They must also be related to you by blood, marriage, or adoption. There is no limit to the number of dependents who can qualify for the additional $500 in one household.

[Updated answer to the 700+ comments] By far the most common comment I am seeing on this article is where parent(s) have received their $1200/$2400 stimulus check but did not get their $500 kid stimulus credit for one or more of their eligible dependent children. This reader comment is a good example of this, “My husband and I filed married filing jointly and claimed our two boys 10 , and 6. We have filed it this way for years! And we only received the stimulus for us and nothing for them! And we have no idea who to call or how to fix this.

It was obviously an error. Which is understandable considering all the people they have to do this for. But I just wish there was a way we could get the extra $1,000. Before filing next year.”

You can scroll down to see further examples (and some underlying reasons) like this but at this point there is little recourse for most people to resolve this in the near future as the IRS is not taking calls on this.

This age limit to get the dependent stimulus check is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a “student” younger than 24 years old as of the end of the calendar year. Hence the confusion being caused for many trying to claim this stimulus payment. So just remember if your child or eligible dependent is 17 or over at the end of 2020 you cannot claim the stimulus dependent payment for them. The full qualifying criteria for this payment is shown below.

College and High School Seniors Dependents

Thousands of college students and high school kids who are older than 17, but are still being claimed as a dependent by their parents or relative on their federal tax return, are unfortunately ineligible for the additional $500 payment based on current rules.

However if you are a college student AND filed a 2018 or 2019 tax return (file for free at Turbo tax), you may qualify for the $1200 stimulus check per standard rules. Note that you can still file a tax return (and must, if you want to get a refund of federal or state tax withholding) AND be a dependent on your parents return. So many 17 to 26 year old’s who filed federal returns will still not get a stimulus payment because they are considered dependents on their parents return (and their parents likely received a $500 tax credit for their dependency on the original return).

A parent could technically file a revised tax return in which they no longer claim their college student (giving up $500) that would allow their child to claim the $1200 normal stimulus. This however may take a while to get paid out.

This however may take a while to get paid out.

Grandparent, Step Parents and Relatives

It’s not uncommon for a grandparent, close relative or a step parent to claim a child living with them as a dependent. In these cases, the payment goes to the person who claimed that child as a dependent on the most recent tax return. They will still also have to meet the standard rules to qualify for the overall stimulus check payment. Just ensure multiple people don’t claim the same person as a dependent or like your tax refund, the stimulus payment could be delayed a long time as the IRS figures out the right person to pay.

$500 Payment

Most people who qualify for this payment will get it along with their stimulus check payment (direct deposit or check). The IRS has already started making these payments. In special circumstances or where the IRS needs to investigate further, the payment will come separately at a later date. This payment is not taxable and does not have to be paid back. You also won’t be required to repay any of the stimulus check even if your qualifying dependent turns 17 in 2020.

You also won’t be required to repay any of the stimulus check even if your qualifying dependent turns 17 in 2020.

The one exception to this are for veterans or those who receive Social Security retirement or disability benefits (SSDI), Railroad Retirement benefits or SSI and have a qualifying child. The IRS does not have their qualifying dependent information so they will have to explicitly register via the IRS’ Non Filers payment update tool by April 22nd to receive the $500 per dependent child payment in addition to their $1,200 individual payment. If beneficiaries in these groups do not provide their information they will have to wait until later in the year to receive their $500 per qualifying child payment.

Frequently Asked Questions (FAQ)

I am getting several hundred questions on this topic! Based on the IRS website and what I am seeing across several other reputable sites, I have tried to group and answer some of more common questions. Please consider this informational as everyone has a unique tax and life situation.

If parents or the primary filer does not qualify for $1200/$2400 stimulus check can they still get the $500 dependent stimulus?

It depends and the IRS guidelines are not very clear on for this. The ruling is that eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples AND up to $500 for each qualifying child. So it appears that both parents have to be eligible under standard rules to get the dependent stimulus.

Note that the entire stimulus payment is subject to the income phase out – $5 for every $100 between the lower and higher Adjusted Gross Income (AGI) range – shown in the table below.

But where it gets a little complicated is that if you have kids, the maximum AGI threshold limits to get some of the $500 stimulus rise since your phase out limit is tied to your credit ($5 of credit for every $100 AGI). This allows you add $10,000 to your AGI limit for every child you claim as a dependent.

For example if your income was exactly $99,000 as a single (or $198,000 joint) and you had no kids it would completely disqualify you for the standard $1,200 (or $2,400). But if you had two kids and were married filing jointly in 2019 you would still get some type of the $500 dependent stimulus until your AGI reaches $218,000.

| Status | Income Below Which FULL Dependent Stimulus is Paid | Max Income To Qualify for Stimulus (no kids) | Max Income to Qualify with 1 Child | Max Income to Qualify with 2 Children |

|---|---|---|---|---|

| Single or married filing separate | $75,000 | $99,000 | $109,000 | $119,000 |

| Head of household | $112,500 | $136,500 | $146,500 | $156,000 |

| Married filing jointly | $150,000 | $198,000 | $208,000 | $218,000 |

This is by far the most common theme I see questions around. While everyone has a unique situation when it comes to a qualifying dependent here are some answers I found from my research on why you didn’t get a payment or where it was much lower than expected. I have also addressed questions in the many comments below so please review those before adding a new one.

While everyone has a unique situation when it comes to a qualifying dependent here are some answers I found from my research on why you didn’t get a payment or where it was much lower than expected. I have also addressed questions in the many comments below so please review those before adding a new one.

Your child was claimed by someone else according to IRS records. In this case you won’t get the $500 payment and will need to lodge a claim with the IRS (process still to be confirmed).

While you may have qualified for the stimulus payment based on income thresholds (shown above) your dependent child wasn’t qualified per IRS records and CARES stimulus rules summarized below. This is even more strict than the Child Tax Credit (CTC) criteria.

- They must be related to you (blood, marriage, or adoption)

- They must either be under the age of 17 by the end of 2020

- You must claim them as a dependent on your tax return

- They cannot provide more than half of their financial support during the tax year and must have lived with you for at least half of the year

- They must be a U.

S. citizen, a U.S. national or a U.S. resident alien

S. citizen, a U.S. national or a U.S. resident alien

Note if you didn’t qualify for the CTC in your 2018 or 2019 tax return, you will not qualify for this stimulus payment either!

You get Social Security retirement, disability benefits (SSDI), Railroad Retirement benefits or SSI. Per the section above you need to take an extra step and explicitly register via the IRS’ Non Filers payment update tool to receive the $500 per dependent child payment

Children born or adopted in 2020 or Change in Dependent statusIf you had or adopted a child in 2020 or there was a change in dependent status since your 2019 tax filing the parent or qualifying relative could still be eligible for the $500 payment. But it will not be paid in via the current batch of stimulus check payments and will instead need to be claimed in your 2020 tax return as an additional credit. This is because the IRS is basing stimulus check payments on information from your 2019 or 2018 tax return, which won’t reflect children born or adopted this year, or any change in dependent status.

The $500 child stimulus, like the regular adult stimulus payment, can be offset only by past-due child support or can be garnished by creditors once it hits your bank account. Both these reasons could mean a lowered stimulus payment that may look like you didn’t get the $500 additional kid stimulus. You will need to wait for a letter from the Bureau of the Fiscal Service to confirm the offset. For garnishments you will need to check with your bank to see which creditors have taken this payment.

IRS payment errors and missing dependent paymentsThe most common error I am seeing across the comments on this article is around the following examples:

“I claimed my [son or daughter] for [2018 or 2019] taxes and didn’t receive $500! What’s going on?????

My husband and I received 1200 each but nothing for our 13 year old son. We are under the income guidelines, no child support involved, and he has always been claimed on our taxes. I sure hope there is a solution to this soon. It’s so strange that this has happened to so many people.

I sure hope there is a solution to this soon. It’s so strange that this has happened to so many people.

“We received our $2400.00 stimulus check on April 15, but didn’t get the additional $500 for our son/daughter. Is there something additional I need to fill out?”

So today I finally received my 1200 stimulus payment, which was suppose to be 1700 with the 500 for my son who is 8. I filed my taxes with him as a dependent and don’t understand why I did not receive the 500!! This is pretty heartbreaking that our country is falling apart and the only money I had coming in to support us during this time I didn’t even receive the full amount.

I used the IRS non filers tool to get my stimulus check. I received the $1200 stimulus payment, but did not receive the dependent portion for my 8 year old son. Upon review of the 1040 form I downloaded after submitting my personal information for my son and I, using the IRS Non-Filers Tool. I noticed that the box for the child tax credit was not [✔]checked off. Even though my son does qualify for the dependent stimulus payment. This is definitely an error on the IRS side. Checking the box was not an option when filling out the form online. It was something that had to be done when the form was generated using the tool. Anyway, my theory is that the “box” not being checked is the reason myself and many others did not receive their dependent portions of the stimulus payments.

Even though my son does qualify for the dependent stimulus payment. This is definitely an error on the IRS side. Checking the box was not an option when filling out the form online. It was something that had to be done when the form was generated using the tool. Anyway, my theory is that the “box” not being checked is the reason myself and many others did not receive their dependent portions of the stimulus payments.

Readers have left several comments along these lines and at a high level it looks the IRS is either not paying the $500 correctly for qualifying dependents or missing payments for families with multiple dependents, despite the adults getting the standard $1200 or $2400 stimulus.

But even if you do see a clear error or miss in your payments it might be difficult to get a hold of someone in the IRS to correct the issue in the near future. This is because the IRS teams are focused on getting the remaining stimulus payments out and have staffing constraints due to Coronavirus/COVID-19 related absences.

Also note if the IRS is still processing your 2019 tax return or refund it will likely use your 2018 tax return data to process this stimulus payment, so if your dependent information changed between your 2018 and 2019 return (e.g you had a kid) you may have a missed payment that would have been accounted if your 2019 tax return had actually been processed.

Get the latest money, tax and stimulus news directly in your inbox

Can I contact the IRS for Stimulus Check Payment Issues or Errors?The IRS has been mailing Economic Impact Payment (EIP) letters to each eligible recipient’s last known address 15 days after the stimulus check payment is made. It was supposed to provide details on how the payment was made and how to report any failure or underpayments (e.g a way to report the missing $500 payment). Unfortunately the letter has been of little help as discussed in this article. It provides a number to call which gets you an automated line that directs you to the IRS website for details. But if you stay on the line you can get connected to an IRS representative (after a long wait) to discuss general questions about the payment and your situation. See details and numbers to call in this article.

But if you stay on the line you can get connected to an IRS representative (after a long wait) to discuss general questions about the payment and your situation. See details and numbers to call in this article.

Update – The IRS has confirmed that those who did not receive the full amount of stimulus payment they believe they were entitled to – including the $500 child dependent payment – will need to claim the additional amount when they file their 2020 tax return. This is tough news for many families who needed/expected the $500 payment as soon as possible and were hoping to get a supplementary or corrective payment in the mail sometime in the near future. You’ll now need to wait till 2021 when you file your tax return to fix this.

For VA and SSI recipients who don’t have a filing requirement and have a child, they need to use the Non-Filers tool (see above) to have the $500 added automatically to their standard stimulus check payment.

It has also been nearly impossible to contact the IRS via numbers provided in the EIP for your issues with the $500 child stimulus per this article. But also note that the IRS will not contact you about your stimulus check payment details either. Watch out for scams and people trying to steal this information from you in the name of expediting your Economic Impact Payments.

Finally you will also likely be able to claim any missing payments in your 2020 tax return. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Now everyone has different tax and dependent situations so I first suggest you review the above FAQs in this article to ensure you meet income and qualifying dependent criteria per your most recently filed tax return. You can also search for many articles on this website for commonly reported stimulus check errors. Before leaving a comment see what others have written and lessons learned. And most of all, be nice to each other.

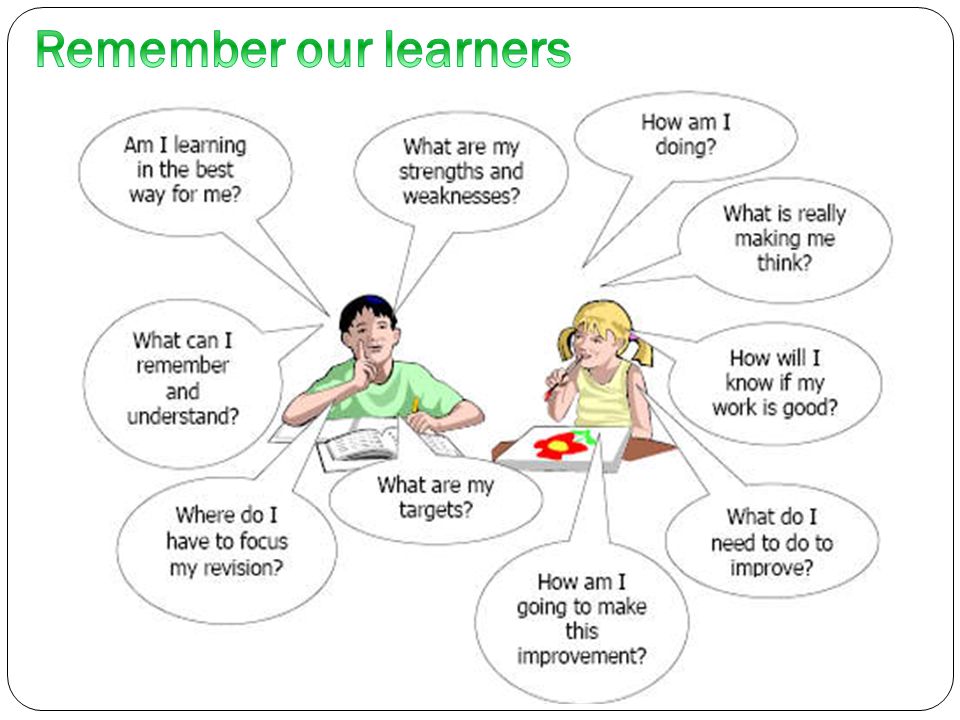

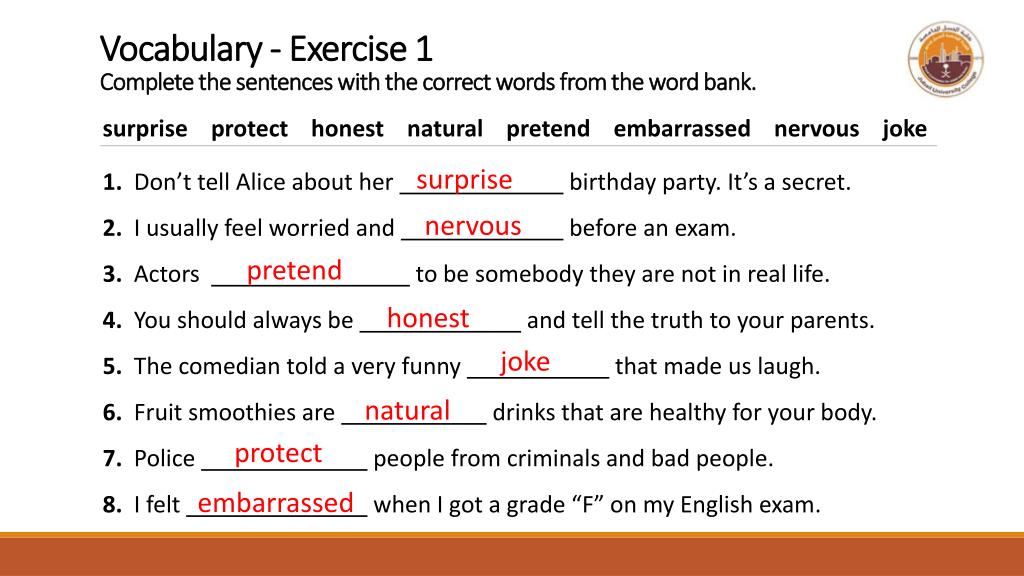

formation of school motivation for learning in a child

Educational motivation can be external and internal. If the child is interested, he himself is drawn to knowledge, if not, you need to come up with rewards and punishments.

External motivation usually works until adolescence. Therefore, it is better to abandon the "carrot and stick" method before the child hates learning.

The following five factors will help to form internal learning motivation.

Source: freepik.comInterest as a basis for learning motivation in a child

To increase the motivation for learning in children and adolescents, the studied material should be:

- New, but “recognizable”. It makes no sense to explain the degrees, if you have not yet passed the multiplication table. Lessons should surprise and at the same time have references to previous topics.

- Each time is a little more difficult than the previous one.

If the child is easy, he starts to get bored. Based on his experience and gradually complicate the tasks.

- Diverse. Tutorials, webinars, excursions, experiments - the more formats, the more exciting the learning.

Autonomy for Motivation

In 1965, an American elementary school teacher, Barbara Shiel, conducted an interesting experiment. She had a difficult class - 36 people, most of whom did not want to study.

One day the teacher announced that every student can do whatever they want during the day. Some children studied, others drew, others stood on their ears. At the end of the day, the teacher summed up the results: almost everyone liked the experiment, the children wanted to continue it.

At the next stage, the guys also had freedom of action, but Barbara helped them plan for the day and gave a teacher's book where the guys could evaluate the results of their work. Later, she also explained that there is a program and a week you need to go through certain material.

As a result of the experiment, almost everyone started to have internal learning motivation. Children liked autonomy and they achieved results.

Let your child decide for himself what he will do today or during the week. Gradually introduce the rules of study work to increase the motivation to study.

<

Feeling Competent

In the 1960s, American psychologist Martin Seligman conducted a series of experiments with dogs and discovered the phenomenon of learned helplessness. Animals were shocked, harmless to health, but painful. One group of dogs could avoid this by pushing a lever. The other is not. Then both groups got into a situation where the current could be turned off. The first group of dogs did this successfully, the second did not. After that, the experiments were repeated many times on humans, and the results were the same.

Learned helplessness occurs when children often find themselves in circumstances where they cannot do anything. The experience of being out of control of the situation is imprinted in the memory, and then, when it is already possible to do something, the child does not try to cope with the task.

If a person is told that he can't do anything, his motivation tends to zero. When a student is constantly faced with a task that he cannot solve, and then receives a feasible task, he will not even try to complete it.

Praise your children for even minor learning progress and help them with “unsolvable” tasks. By doing this, you will contribute to the proper formation of school motivation.

Positive relationships with others

Communication with like-minded people and teamwork has a very positive effect on learning motivation.

A child in homeschooling may experience a lack of communication, and this may affect his interest in learning.

At Foxford Home School, students connect through live online classes and extracurricular activities to increase each other's learning motivation.

You can also invite your child to do a science project with a friend, sibling, grandparent.

The meaning of learning to increase motivation

Goal-setting is an important aspect of educational strategy and the formation of motivation for learning activities. Parents and the child should clearly understand why attend classes and do homework.

Ask your child what he sees as the meaning of his education, and then formulate your goal together. Not necessarily global, it is better if the goal is commensurate with the age of the student. Entering Moscow State University or becoming a programmer sounds too abstract for a fifth or even seventh grader.

<