How child care credit works

Child and Dependent Care Credit – Get It Back

Child and Dependent Care Credit

The Child and Dependent Care Credit is a federal tax benefit that helps families pay expenses for child care needed to work or to look for work. The credit also is available to families that must pay for the care of an incapacitated spouse or an adult dependent.

NEW: The Child and Dependent Care Credit is fully refundable for tax year 2021 only (which you file taxes for in 2022). This means the credit can provide money back even if you don’t owe taxes.

Your family can claim this credit if you:

- Paid for care in 2021 for a qualifying child under age 13 claimed as a dependent*, or a spouse or dependent not able to care for themselves, who lived with your family for more than half of the year. AND

- Needed the child or dependent care to work or look for work. (In a two-parent family, both spouses must have needed the child or dependent care to work or to look for work unless one spouse was a full-time student or unable to care for themselves.

) AND

- Spent less for dependent care during 2021 than your total income for the year. If taxpayers are married and filing a joint tax return, they must have paid less for care than the income of the spouse with the lowest earnings. There are special rules for calculating the income of a spouse who was a full-time student or disabled.

Types of care that qualify for this credit:

- Any kind of child or dependent care can qualify, including care at a center, a family day care home or a church, vacation day camps, or care provided by a neighbor or a relative (except if provided by a spouse, a dependent, or a child of the tax filer under 19).

- If a family receives free child care, such as from a state-subsidized program, that care cannot be used to qualify for the credit. Copayments by families for subsidized care, however, are an eligible expense.

The EITC and CTC do not affect a family’s eligibility for this credit. Claiming all three credits, when possible, may mean even more money back from the IRS.

Claiming all three credits, when possible, may mean even more money back from the IRS.

* In general, the credit can only be claimed if a child is claimed as a tax dependent, but there are special rules for children of divorced or separated parents. See the IRS Publication 503, Child and Dependent Care Expenses, “Child of divorced or separated parents or parents living apart” section.

The size of the Child and Dependent Care Credit depends on the number of children or dependents in care, your family’s income, and the amount your family paid for care during the year.

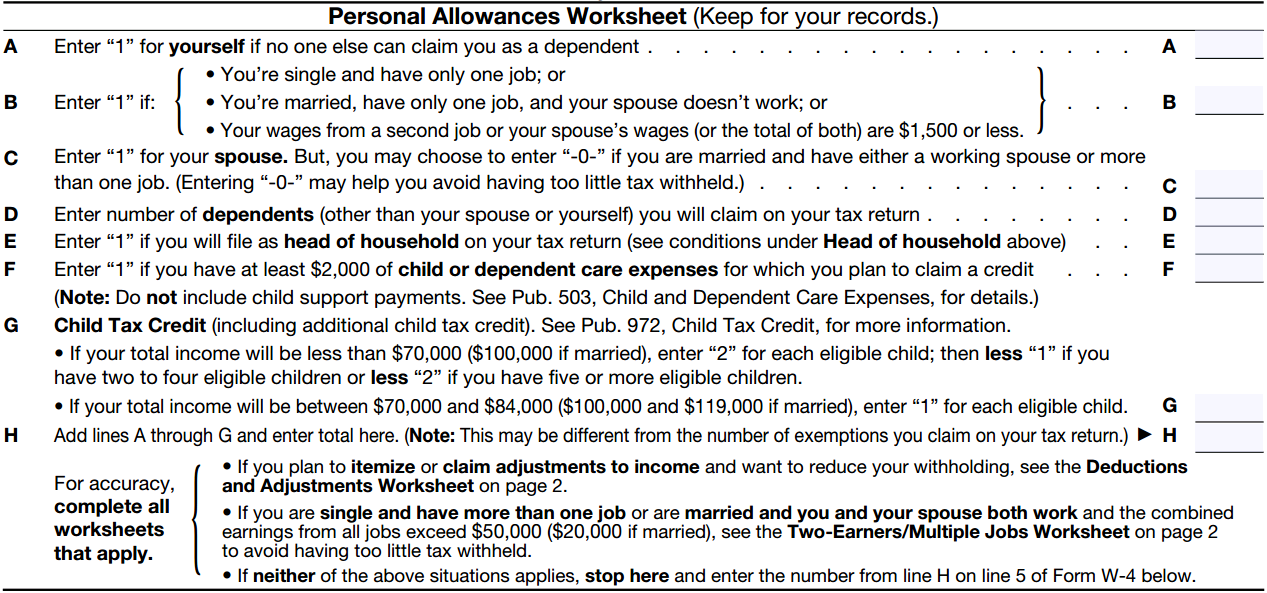

| Number of Children | Amount of Qualified Expenses | Adjusted Gross Income (AGI) | Maximum Percentage of Expenses | Maximum Credit |

| 1 | Up to $8,000 | $0-$125,000 | 50% | $4,000 |

| $183,000-$400,000 | 20% | $1,600 | ||

| 2 | Up to $16,000 | $0-$125,000 | 50% | $8,000 |

| $183,000–$400,000 | 20% | $3,200 |

The CDCTC is unavailable to families with AGI greater than $438,000. For families earning between $125,000-$183,000 or between $400,000-$438,000, the credit rate decreases by one percent for each additional $2,000 in income and the maximum credit varies.

For families earning between $125,000-$183,000 or between $400,000-$438,000, the credit rate decreases by one percent for each additional $2,000 in income and the maximum credit varies.

Example: Ms. Lewis has one child and earned $30,000 in 2021. Ms. Lewis spent $8,000 during the year on child care and she is eligible for a Child and Dependent Care Credit up to 50 percent of what she spent on care, or up to $4,000. Her Child and Dependent Care Credit eliminates her tax liability. (She also qualifies for other tax benefits: she is eligible for a CTC refund worth $3,600 and her EITC is worth $2,099.)

Use the Bipartisan Policy Center’s calculator to help determine how much your credit is worth.

Families must file a federal income tax return and submit Form 2441, “Child and Dependent Care Expenses.” You will need to submit the provider’s name, address, and Taxpayer Identification number (TIN). To complete the tax form, you will also need to know how much you spent on care in 2021. You can refer to receipts or bank account statements depending on how you paid for the care.

You can refer to receipts or bank account statements depending on how you paid for the care.

Twenty-four states have state child and dependent care credits. Of these 24 states, 11 states provide a refundable credit: Arkansas (only for children under 6 in an approved child care facility), Colorado, Hawaii, Iowa, Louisiana, Maine, Minnesota, Nebraska, New Mexico, New York, and Vermont. In these states, low-wage earners that don’t owe income tax can still receive a refund. For more information, contact your state department of revenue.

Find out the 13 states with state child and dependent care credits that have adapted their credits based on the federal expansion.

- IRS Publication 503 “Child and Dependent Care Expenses”

- National Women Law Center’s 5 Things You Should Know About the Child and Dependent Care Tax Credit This Year

- National Women Law Center’s 2021 Child and Dependent Care Credit Fact Sheet (available in English & Spanish)

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

How to get a loan on maternity leave

It should be noted right away that obtaining a loan on maternity leave will be a difficult task. Indeed, when considering a loan application, the bank pays special attention to the level of income of the borrower, and payments for a child do not fall into this category. But if you need a small amount, then the likelihood of approval exists.

Loan on maternity leave: to take or not to take

If you are thinking about taking a loan on maternity leave, it is important to soberly assess your financial capabilities. A breach of debt obligations can ruin your credit history. Errors in financial discipline can become an obstacle to the approval of loans, even with a high level of your ability to pay in the future.

If you decide to take out a loan while on maternity leave, think about how to reduce the risk of debt default in the event of unfavorable developments. To do this, we recommend paying attention to the following factors:

- whether you plan to receive money in the future, possibly from the sale of any property, material assistance from the employer or cash gifts from relatives and friends;

- whether you have savings, for example, in foreign currency or in the form of other assets, which, in case of emergency, can be used to repay the loan;

- whether relatives or friends are ready to help financially if you cannot cope with loan payments on your own.

It is desirable that the evaluation of the maximum number of factors be positive. Then the need for payments will not cause anxiety and anxiety, the availability of a loan will not become a cause of stress for you, which is especially important when a baby is growing in the family.

Available loans on maternity leave

It is most likely impossible to get a mortgage or a car loan while on maternity leave. Most banks, when considering applications for large amounts, require documents confirming income, even if you are ready to pledge property or bring guarantors.

However, among consumer lending programs, there are those that require registration with one or two documents and without income statements. This is usually the case for small loans. Thus, you can apply for a consumer loan while on maternity leave if you are talking about minor unplanned expenses, rather than large, expensive purchases.

We also recommend that you consider the option with a credit card. This method of taking a loan on maternity leave has advantages over classic consumer lending. Firstly, interest on the card is not charged from the moment the loan is issued, but after you actually start spending money. Secondly, many cards have an interest-free period, that is, you will have to pay for using the bank's money only if you were unable to repay all the debt during the grace period.

The most convenient way to apply for a loan on maternity leave is through the website. Fill out a short form on the loan page and our specialists will contact you.

Share with friends:

What is a deferred payment on a loan and how to take a loan holiday in a bank

severe illness. In this case, you should never shy away from communicating with the bank. If the reason for non-payment is valid, the bank will offer options for resolving the situation. One of them is deferred payment, or credit holidays.

However, it is not always possible to get credit holidays. Not every bank is ready to give a deferment, and it does not work for all customers. You will learn how credit holidays work, who can get them and how to apply for them in this article.

Summary of the article

How to postpone a loan:

- Make sure that there are no delays on the loan, more than 3-6 months are left until its repayment, and the contract provides for loan holidays

- Report the situation to the bank and wait for a preliminary decision

- Fill out an application and submit documents confirming the reason for receiving vacation

- Wait for a response from the bank

- If the decision is positive, sign an additional agreement to the contract and receive a new payment schedule

- If required, pay a fee for the service

Conditions for obtaining a loan holiday

A deferment of the monthly payment provided by the bank when it is impossible to repay the debt is called a loan holiday. Such a delay is usually granted for a period of up to 1-3 months, less often - up to six months. During this period, the repayment of the loan body and the accrual of interest are stopped. During the loan holidays, the borrower will be able to solve the problem that does not allow repaying the debt on time. Credit history does not deteriorate from this.

Such a delay is usually granted for a period of up to 1-3 months, less often - up to six months. During this period, the repayment of the loan body and the accrual of interest are stopped. During the loan holidays, the borrower will be able to solve the problem that does not allow repaying the debt on time. Credit history does not deteriorate from this.

Credit holidays can only apply to the body of the loan, to interest or to the entire amount of the payment. It depends on the period for which they are provided, and the total amount of overpayments.

The main condition for granting a deferment for a consumer loan is the presence of a sufficiently serious reason that does not allow repaying the loan. These reasons typically include:

- Job loss due to reasons beyond the employee's control, such as a layoff or the closure of the employing company

- Maternity leave for pregnancy or care of a child under the age of one and a half years

- Need for long-term treatment of severe illness

- Survivor

- Call to the army for military service

- Loss of property or health due to an accident - fire, robbery, natural disaster or other

Another important condition is a sufficient level of borrower's reliability. The bank is more likely to approve a deferment if you have previously made all payments on time and have a good credit history. Active use of other bank services, such as credit cards, will be an advantage.

The bank is more likely to approve a deferment if you have previously made all payments on time and have a good credit history. Active use of other bank services, such as credit cards, will be an advantage.

At the same time, the bank will most likely refuse to grant you a deferment if:

- You were dismissed of your own free will or due to disciplinary violations

- You make large delays, including in other credit institutions, and have a bad credit history

- You were employed unofficially - it becomes more difficult to prove the fact of employment and dismissal

- Less than three months remain after the loan is issued or before its full repayment

- You are suspected of intentionally evading payments - such actions are considered fraud

Loan deferment without good reason is not available in all banks and is usually paid.

How to apply for a loan deferral?

First of all, in case of problems, contact the bank as soon as possible - report your problem and find out if it is possible to take a deferment in such a situation. You need to do this before the due date of the mandatory payment, otherwise the bank may fix the delay. It is best to contact the bank in person, but you can also ask for a delay by phone.

You need to do this before the due date of the mandatory payment, otherwise the bank may fix the delay. It is best to contact the bank in person, but you can also ask for a delay by phone.

Next, study the loan agreement. It may set out the conditions and procedure for granting a deferment. If there are no such conditions, then check them with the support service. Most likely, your organization provides this service on a case-by-case basis or, more rarely, does not provide it at all.

Then prepare documents that will support the reason why the vacation is required. Depending on the situation, this may be a work book with a mark of dismissal, medical certificates, sick leave and others. You will also need a passport and a loan agreement with a payment schedule. The bank may also request other documents - for example, a plan for solving a problem with a loan.

If the reason for the inability to repay the debt was the loss of a job, then you will also need a certificate from the employment center - it will confirm your status as unemployed.

After you collect the package of documents, contact the bank and fill out an application for a loan holiday. You can check the application form with the organization. The bank will consider your application within a few days and study the situation that does not allow you to repay the loan. If the reason is serious enough, he will make a positive decision. In this case, you will conclude an additional agreement with the bank to the loan agreement and, if required, pay a commission.

After signing the agreement, you will receive a new payment schedule, drawn up in accordance with the deferment. Credit holidays will finally come into force.

Pros and cons of a loan holiday

In a difficult situation, a loan holiday is a good solution if you are unable to pay off your loan. This service has several advantages:

- During the grace period, you will have enough time to resolve the situation and start paying off the debt again according to the previous schedule

- Credit holidays do not harm the credit history, for the duration of their validity, the accrual of fines and penalties is terminated

- If the vacation is incomplete, then you can slightly reduce the overpayment by repaying part of the body of the loan or interest on it

However, the disadvantages of such a solution must also be taken into account:

What other ways are there to ease the burden of credit?

Sometimes, instead of a credit holiday, the bank may offer other options for solving a problem with loans. Such methods usually involve changing the payment schedule or transferring debt repayment obligations to a third party. Consider the ways to reduce the credit burden, which are used most often.

Such methods usually involve changing the payment schedule or transferring debt repayment obligations to a third party. Consider the ways to reduce the credit burden, which are used most often.

Refinancing . It applies if you have taken out several loans in different banks. In this case, a new loan is issued, which is used to pay off debts on previous ones. Payments are reduced as you only need to pay to one bank. If the loan is issued on security, then the encumbrance is removed from the property - it can be sold or donated.

Benefits of refinancing:

- Refinancing is available for many types of loans - consumer loans, car loans, mortgages and credit cards

- When refinancing, the interest rate is reduced and the maturity of the debt is increased

- You can also receive an additional amount that can be spent for any purpose

Disadvantages of refinancing:

- The number, amount and types of loans that can be refinanced are limited

- It is usually not possible to refinance debts that are in arrears

- Some banks issue refinancing only for third-party loans

- If the refinancing is for a mortgage, you will not be able to receive the property tax deduction

Restructuring . It implies a complete revision of the loan repayment schedule. During the restructuring process, a new schedule is drawn up, in which the size of the regular payment will be reduced. Sometimes the bank may change the debt repayment scheme from annuity to differentiated or reduce the interest rate.

It implies a complete revision of the loan repayment schedule. During the restructuring process, a new schedule is drawn up, in which the size of the regular payment will be reduced. Sometimes the bank may change the debt repayment scheme from annuity to differentiated or reduce the interest rate.

Advantages of restructuring:

- It will be easier for you to repay the debt if the amount of the mandatory payment decreases

- Restructuring does not worsen the borrower's credit history

Cons of restructuring:

- Restructuring will not help if you have lost your job or ability to work for a long time

- It is difficult to issue restructuring in the presence of open delays

Assignment agreement (assignment of debt) . In this case, the obligation to repay the loan is transferred to a third party - the assignee. With him, the bank concludes a separate agreement, which specifies the terms of the new loan. The person to whom the obligations are transferred must meet the requirements of the bank.

The person to whom the obligations are transferred must meet the requirements of the bank.

Advantages of the assignment agreement

- You will have no obligations to the bank - they will all be transferred to the new borrower

- Both individuals and (less often) legal entities can act as an assignee

Disadvantages of the assignment agreement

- It is necessary to find a person who will agree to take over the debt and will meet the requirements

- If the assignment is for a car loan or mortgage, then the right to acquired property also passes to the assignee

- Banks very rarely offer this solution to the problem due to the complexity of its execution

Redemption by collateral, surety or insurance . It is available only when applying for a loan secured or surety, as well as when applying for insurance of the borrower. If the loan is secured by collateral, then the mortgaged property is sold, and the proceeds will be used to pay off the debt. If a guarantee is issued, then the obligation to repay passes to the guarantor. If there is insurance, then the insurance company will pay off the loan.

If a guarantee is issued, then the obligation to repay passes to the guarantor. If there is insurance, then the insurance company will pay off the loan.

Advantages of such repayment:

- The loan amount, including interest on it, will be repaid in full or transferred to another person

- If insurance is issued, then not only you, but also your relatives can receive compensation (for example, after the death of the borrower)

Disadvantages of such repayment:

- When registering a pledge, your rights to use the pledged property are limited. Loss of valuable property (car or home) can be serious

- The guarantor may waive his obligations if he can confirm the reason for the refusal

- Getting insurance can be very expensive (need to pay insurance premiums regularly). In addition, it will be necessary to confirm the fact of the insured event

Conclusion

Banks are interested in borrowers repaying loans without significant problems. In litigation with debtors, they will lose more than in granting a deferral or restructuring. Therefore, do not be afraid to apply for credit holidays if necessary - if you can confirm your reliability, you can easily get an installment plan.

In litigation with debtors, they will lose more than in granting a deferral or restructuring. Therefore, do not be afraid to apply for credit holidays if necessary - if you can confirm your reliability, you can easily get an installment plan.

Try to apply for credit holidays only if there are no other options for repaying the debt. If you try to get a vacation without a good reason, the bank will begin to trust you less. Don't forget about other ways to ease the load, such as restructuring and refinancing. Perhaps in your situation they will be more convenient than deferred payment.

So, if you have problems with paying off your debt, you can take advantage of a deferred payment for several months - credit holidays. For this you need:

- Check if your loan agreement allows deferrals

- Make sure you have a good reason (layout due to redundancy, maternity leave or disability)

- Submit an application and documents confirming the reason to the bank

- Conclude an additional agreement to the loan agreement

Credit holidays will give you time to eliminate the problem that interferes with repayment, but you can get out of it only under certain conditions.