How much can you pay into a child trust fund

Child trust funds | MoneyHelper

A Child Trust Fund is a savings account for children born between 1 September 2002 and 2 January 2011. They’ve since been replaced by Junior ISAs, but those with existing Child Trust Fund accounts or vouchers can still keep their accounts and pay in.

Find out more about how a Child Trust Fund works and what you could do with the funds in your account if you have one.

What’s in this guide

- What is a Child Trust Fund and who has one?

- Finding a Child Trust Fund account

- How a Child Trust Fund works

- Types of Child Trust Fund

- Adding money to the account and family member payments to a Child Trust Fund

- What about Child Trust Funds and young people with disabilities?

- If you want to change the Child Trust Fund account that HMRC set up for you

- What is a Junior ISA and should I switch my Child Trust Fund into one?

- I’m 18 or over and have a Child Trust Fund.

What should I do with the money in it?

What is a Child Trust Fund and who has one?

A Child Trust Fund (CTF) isa long-term tax-free saving account for children. They were designed to encourage children to become savers for their future adult life. You cannot apply for a new CTF because this government scheme is now closed but you can keep an existing CTF. CTF’s were available to all children born in the UK whose parents were awarded Child Benefit between 1 September 2002 and 2 January 2011.

All money earned on the CTF is tax-free, including capital gains, interest payments and any other money earned on the account. This means all the money in the fund belongs to the account holder and none of it will be lost in tax deductions.

The first CTFs matured in September 2020, when the oldest account holders turned 18. The last CTFs will mature in 2029. On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

On maturity, CTFs s can either be cashed in or transferred into an adult ISA.

If you’re 18 or over and have money in a Child Trust Fund, find out more about your options

Back to top

Finding a Child Trust Fund account

Child Trust Funds can be lost to the young person they were set up for. This can be because HMRC set up the account with a starter payment amount on their behalf (if the parents didn’t open one), or because it has been forgotten and the parents have not updated their address.

However, lost accounts can easily be located. You can find out where a lost Child Trust Fund, even if you don’t know the provider.

If you already have a Government Gateway user ID and password, you could fill in the HMRC online form at GOV.UK (Opens in a new window)

HMRC will send you details of the Child Trust Fund provider by post within three weeks of receiving your request.

Alternatively, you can use the Share Foundation to help you find your Child Trust Fund account for free (Opens in a new window). You might find this useful if your provider has changed or if you grew up in care.

Back to top

How a Child Trust Fund works

When CTF’s became available, HMRC sent the parents or guardians of qualifying children a starting payment voucher of £250 (or £500 if you were on a low income). This voucher could then be used to set up a Child Trust Fund account in the child’s name.

If you didn’t use the voucher within one year, HMRC would set up a Child Trust Fund account in your child’s name on your behalf.

Money in a Child Trust Fund account belongs to the child and is ‘locked in’ until they turn 18.

When a child or young person turns 16 years old, they can legally take over responsibility for their Child Trust Fund account and can make decisions about the fund (such as switching to another provider or transferring it to a Junior ISA). They can do this by contacting their Child Trust Fund provider.

They can do this by contacting their Child Trust Fund provider.

When the account-holder turns 18 years old, they can access and withdraw the money in their Child Trust Fund account.

Back to top

Types of Child Trust Fund

There were three types of account that could be opened with the voucher:

1. Cash Child Trust Fund

This is where you can make deposits just as you would for a bank or building society account, which can earn tax-free interest.

2. Stakeholder Child Trust Fund

This is where the savings in the account are put into a wide mix of stock market investments. There are a set of rules to reduce financial risk (including that the money would gradually be moved to lower-risk investments when the child reaches 13 and a cap on the annual charge).

Stakeholder Child Trust Funds are charged based on the value of the fund and capped at a maximum charge of 1.5% a year.

A child will have a stakeholder Child Trust Fund account, opened by HMRC on the child’s behalf, if their parent(s) failed to open a Child Trust Fund account within a year of receiving a payment voucher.

3. Shares-based Child Trust Fund

This is where most or all the money is invested in shares, but without the protections of a stakeholder account. The savings in the account could be put into the stock market via an investment fund of your choice or select your own investments.

Back to top

Adding money to the account and family member payments to a Child Trust Fund

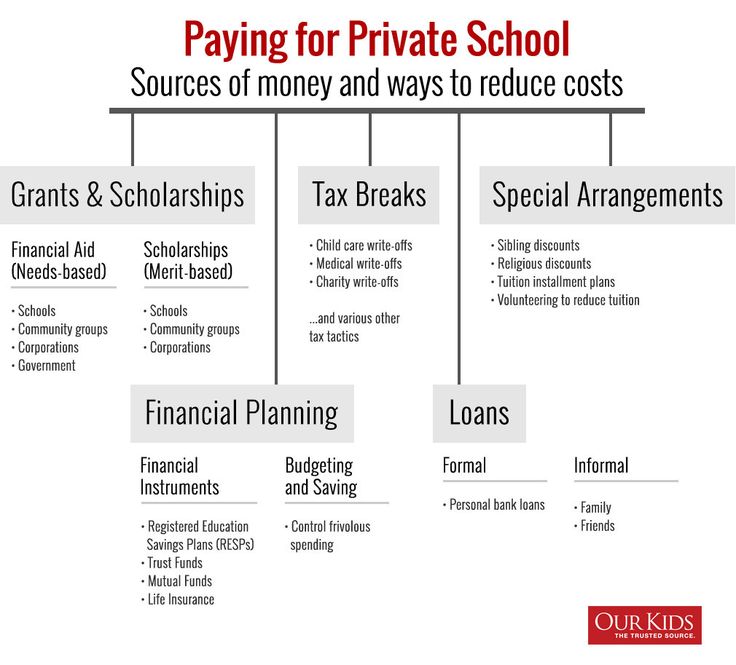

Anyone can pay money in to a CTF including parents, family members and friends. This is up to a total limit of £9,000 (2022/23) each year, with the child’s birthday considered the start of the year.

The amount of money in a child’s Child Trust Fund doesn’t affect any benefits or tax credits the child’s parent/guardian receives.

Child Trust Funds for Children in Care

Some children looked after by local authorities have a Child Trust Fund account set up on their behalf.

If a child has been in the care of a local authority and was born between 1 September 2002 and 2 January 2011, they could have a Child Trust Fund account.

The Share Foundation acts as the registered contact for Child Trust Fund accounts for children and young people who are care-experienced and manages them for the child or young person. The Share Foundation run both the Child Trust Fund and the Junior ISA schemes for children and young people in care.

The Share Foundation will write to the account holder about two months before they turn 16, telling them how to become the registered contact for their Child Trust Fund account.

Back to top

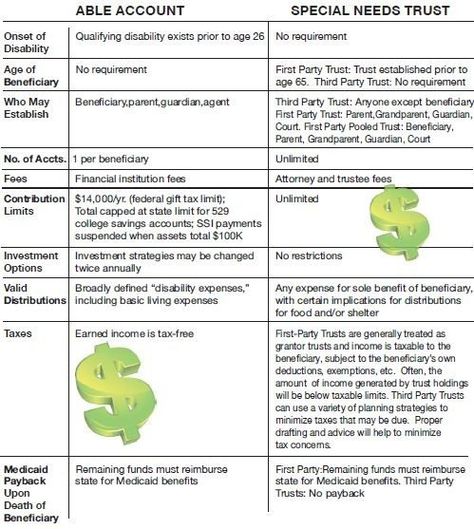

What about Child Trust Funds and young people with disabilities?

Some young people with a disability might not have the mental capacity to manage the money in their Child Trust Fund.

If your child doesn’t have mental capacity, then you as their parent(s)/carer(s) will need to apply to the Court of Protection to act as your child’s Deputy.

A Deputy is someone, usually a family member, who is appointed by the court to manage and make day-to-day decisions about someone’s finances. Without this, you won’t be able to manage the account when your child turns 18. This is because they legally become an adult and the money belongs to them.

At the moment, applying to the Court of Protection can be expensive. This is because there’s a court fee of £365 – and legal costs, if a solicitor is used. There might also be delays to the process due to the coronavirus pandemic.

It’s important to get legal advice if you want to apply to the Court of Protection so you understand all of the options. Solicitors might provide you with a free initial discussion.

However, the government announced on 1 December 2020 that all parents or guardians of children or young people who lack mental capacity can ask for court fees to be waived or refunded when seeking access to a Child Trust Fund.

Back to top

If you want to change the Child Trust Fund account that HMRC set up for you

If HMRC set up a Child Trust Fund account for your child, you can change to a Child Trust Fund provider or account of your choice. You can do this at any time.

Make sure you ask providers about any fees charged for running the account. Also ask about making further contributions. You can pay as little as £10 into a stakeholder account, but some providers might require larger payments for other accounts.

If you’re looking to change your Child Trust Fund provider, also be wary of scams, which are designed to get hold of your money and can come in many forms.

Back to top

What is a Junior ISA and should I switch my Child Trust Fund into one?

An alternative to switching Child Trust Fund providers is to switch your Child Trust Fund into a Junior ISA.

If you have a Child Trust Fund you can’t have a Junior ISA at the same time. But you can transfer your Child Trust Fund into a Junior ISA.

You don’t have to transfer a Child Trust Fund into a Junior ISA. However, a Junior ISA can work out better for your child’s savings in the long term.

Junior ISAs generally offer more choice and better value, whether it’s higher interest rates on their cash accounts or lower annual fund management charges.

You can’t transfer back to a Child Trust Fund when you’ve switched to a Junior ISA. So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

So it’s important to check that you’re getting the best possible deal in terms of investment returns and fees.

Back to top

I’m 18 or over and have a Child Trust Fund. What should I do with the money in it?

If you’re 18 years old or over, you can access the money in your Child Trust Fund account.

To access the money you will need to contact your Child Trust Fund provider. If you don't know who that is, read the section above on 'Finding a Child Trust Fund account'.

It’s your money, and it’s up to you what you do with it.

One option to consider is to continue saving your money. This could be by, for example, transferring your money into an adult savings account or an adult ISA. As your savings build up, they’ll grow faster – so your money makes money.

You might want to save regularly and build up your fund for a deposit towards a property purchase or a rental deposit.

The money in your Child Trust Fund could also provide an excellent foundation for building a ‘rainy day fund’ to make sure you have money available for emergencies or sudden expenses.

Putting money away now means you’re covered for an expense you didn’t see coming, reducing your need to borrow. For example, if you were to suddenly lose your job, need a new phone or need emergency dental treatment – that’s when a rainy day fund would be handy.

What happens when my Child Trust Fund matures?

If you have a Child Trust Fund but do not inform your provider what you would like to do with the money in it when it matures, the money will be held in a 'protected account' until you contact your provider.

Interest earned on funds in a 'protected account' will remain tax-free, and any terms and conditions that applied to your Child Trust Fund before it matured will still apply.

Back to top

Was this information useful?

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

Child Trust Funds | Use Our Calculator

The projections give an estimated fund value to help illustrate what could be available to the Planholder at age 18 with a Forester Life Child Trust Fund, Child Trust Fund - Stakeholder Options, Child Trust Fund - Shariah and Child Trust Fund - Options (invested in Aberdeen UK All Share Tracker Fund and Forester Stakeholder (Schroders) Managed 1 Fund only). At age 18 no contributions can be added to the Plan. Therefore the calculator will not be able to provide a projection.

Child's Date of Birth

Please enter a child’s DOB who has a CTF and is not 18 or over.

Value of CTF (£)

Please enter the current value of the CTF.

Monthly Contribution (£)

Please enter a regular monthly amount you wish to pay between £10 and £750, assuming that the maximum allowed monthly contribution is £750.

Single Contribution (£)

Please enter an amount between £10 and £9,000, assuming that the maximum allowed annual contribution is £9,000.

Estimated Value of Account at Age 18 (£)

When you select the Calculate button, the amount displayed on the screen will be showing the estimated value of the fund on your child’s 18th birthday.

Important Information- The amount shown by the calculator is only an estimate of what the savings could be worth on your child’s 18th birthday and assume an annual growth rate of 5% and an annual charge of 1.

5%. It is also assumed an annual increase in monthly payments of 2.5% per annum compound to keep pace with inflation, subject to allowable limits.

5%. It is also assumed an annual increase in monthly payments of 2.5% per annum compound to keep pace with inflation, subject to allowable limits. - These figures are only examples and are not guaranteed. The actual value could be more or less than shown, and could be less than has been paid in. What you will get back depends on how much your investment grows and on the tax treatment of the investment. Investments can go down as well as up.

- Inflation would reduce what you could buy in the future.

- There is an annual charge of 1.5% of the value of the funds you accumulate. If your fund is valued at £250 throughout the year, this means that we charge £3.75 that year. If your fund is valued at £500 throughout the year, this means that we charge £7.50 that year.

- These figures assume contributions and investment over 10 years. Top-ups to existing Plans may be invested for a shorter period depending on the age of the child at the time.

- These figures do not take into account any Government payments made into the Child Trust Fund.

- If the Plan has received any contribution in the birthday year, and the Plan value exceeds £300, we will send you a statement showing the payments received, the number of units held and the value of your child’s Plan. We will also issue statements on your child’s 11th and 16th birthdays.

- All payments are locked into the Plan until the child’s 18th birthday and cannot be reclaimed by the donor(s).

- For more information please read the Child Trust Fund Key Information Document and Brochure, if applicable.

- Potential investment annual growth rate of 5%.

- Potential annual increase in monthly payments of 2.5% per annum compound to keep pace with inflation, subject to allowable limits.

- Annual charge of 1.5%

What exciting milestones could you be saving towards a child’s future? Find out more >

Manage your Plan online

If you are the Registered Contact you can activate your online MyPlans account to view your child’s savings online. My Plans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

My Plans allows you to make payments online, view your Plan value, see the fund performance, investment information and contact your Financial Adviser.

Family and friends can also set up their own Gifters MyPlans account after making a contribution.

Activate your MyPlans account

Log in to MyPlans

Family trust - how to create a trust fund in Russia

This article will be of interest to wealthy Russians and residents of the CIS who need to create a trust fund. It describes a very simple way to quickly create a reliable family trust abroad.

This can be done in just a few days with the help of a special financial contract, detailed below. This decision will immediately protect the family's financial assets from claims by third parties, increasing the capital created year after year.

It is also important that this contract allows you to effectively pass on the inheritance to the next generations of the family. And at the same time, what is important - without paying inheritance taxes.

And at the same time, what is important - without paying inheritance taxes.

Finally, the contract allows you to make partial withdrawals of funds from the created fund at any time. These may be occasional withdrawals, or regular annuities to meet the family's running expenses. And even so, the capital in the trust is able to grow. Detailed calculations can be found in the article below.

Why you need a family trust

How to create a dynastic trust in Russia

Trust fund for children with Manulife Global Generation

Financial parameters of a family trust

How to deposit money into a trust

Sources of capital growth

How you can use the money of a trust

How does a trust fund work when investing an amount of 1.000.000 USD

How to start a family trust fund MGG

Wealthy people have long sought a solution to two important problems. And the first task is to secure your assets.

After all, creditors, business partners, former spouses and the state, for various reasons, can claim the assets that a person owns. And if you somehow refuse to own assets, while retaining control over them, then it will be impossible to foreclose on these assets.

And if you somehow refuse to own assets, while retaining control over them, then it will be impossible to foreclose on these assets.

The second important task is the transfer of assets to the next generations of the family. Children, and then grandchildren and great-grandchildren.

It is these two tasks that the classical trust fund solves. To do this, the founder transfers assets to the trust, and thereby ceases to own them. This is how the first task of protecting assets is solved. You cannot deprive a person of what does not belong to him.

The trustee will then manage the trust. And he will carry out this management in the interests of the beneficiaries, who were appointed by the founder of the trust.

And when the trust terminates, then all the property constituting it passes into the possession of the beneficiaries. Thus, solving the problem of transferring assets to the next generations of the family.

However, the classical implementation of this approach is not so simple. Because the legislation on trust funds is very complicated.

Because the legislation on trust funds is very complicated.

In addition, the work of family trust must be paid for. This can be quite a decent amount of fixed, annual expenses - which will have to be paid for decades. And in this regard, the question arises - is there an easier way to create your own trust fund in Russia?

Yes, there is a way. And it is suitable for those cases when it is necessary to transfer the capital of the family to the family trust. Let me emphasize that we are talking about financial resources. Different solutions will be needed to protect and transfer physical property to children.

An easy-to-implement trust fund to protect family wealth and pass it on to the next generation - described later in this article.

You can use a special insurance contract to create a family trust. Which was specifically designed to protect and increase the financial assets of the family. And also - to most effectively transfer the accumulated wealth to the next generations of the family.

This contract is offered by the renowned Canadian company Manulife. It is one of the largest financial companies both in Canada and worldwide. Which has high ratings from leading rating agencies. To isolate, protect and increase the family capital, Manulife has developed a special contract, which is called the Manulife Global Generation (MGG).

Play my video about how this contract allows you to create a family trust:

Let's look at the main features of this contract to understand how it allows you to create a family trust fund.

Manulife Global Generation is a life insurance contract. After the opening of the contract, its owner contributes to the plan those funds that he would like to place in the family trust fund.

Manulife pays annual dividends on the funds contributed to the contract. Since quite significant amounts usually come into the family trust, over time, the capital in the contract begins to grow noticeably.

This is due to the constant accrual of dividends on invested funds. Which over time begin to increase capital exponentially. This is how the problem of increasing the funds that make up the family fund is solved.

How is family wealth protected in a trust fund for children? Legally, the Manulife Global Generation contract is a life insurance policy. Therefore, funds in this policy cannot be foreclosed due to third party claims. This ensures the protection of financial assets belonging to the family.

And most importantly, if we are talking about generational planning. How can this tool be used to transfer assets to future generations of the family?

The Manulife Global Generation contract has a unique option for this. It allows you to change the insured person. And the number of such replacements is not limited. What does this mean for long-term financial planning purposes?

Let's say at 45 the head of the family opened the MGG plan. And he contributed a large amount there to create a trust fund for children and grandchildren. 30 years have passed - and during this time the invested capital has grown many times (below, the draft contract with real numbers is discussed in detail).

30 years have passed - and during this time the invested capital has grown many times (below, the draft contract with real numbers is discussed in detail).

And then, at the age of 75, the father decided to give his son the funds accumulated in the family trust. As well as the management of this capital.

To do this, the father only needs to give an order to change the insured person. And when the son becomes insured instead of the father, he will already become the full owner of all the funds accumulated in the contract. And he will appoint his son as the beneficiary of the family trust - who is the grandson of the original owner of the contract.

Having become the owner of the contract, the son will be able to manage the created capital and spend it if necessary. And when the son becomes mature, he will be able to transfer ownership of the policy and the accumulated capital to the grandson of the original owner of the contract. To do this, the son will replace the insured person in the contract with the grandson. Which in turn will change the beneficiary to a great-grandson.

Which in turn will change the beneficiary to a great-grandson.

So, placing family capital in a special Manulife Global Generation policy allows you to protect capital from third-party claims, increase capital through accrued dividends and interest on them - as well as effectively transfer the inheritance to the next generations of the family.

Such a contract can last 121 years. Please note that 121 is NOT the maximum age for the person who originally opened the contract. This is the maximum duration of the contract from the date of its opening.

Thus, the capital of the family can be reliably protected by this contract for more than a century, passing by inheritance from father to son. And increasing due to accrued dividends and interest on invested funds.

A policy can be passed down many times from generation to generation. And for the 121-year period of its existence, to meet the needs of three, four - and maybe five generations of the family.

Let's take a closer look at how this happens.

You can see the most important financial parameters of this contract on the slide below - and then I will comment on them:

basic parameters of the MGG family trust plan

The contract has a minimum contribution amount, as well as a maximum investment in the contract. The minimum contribution to this plan is 500,000 USD. This amount can be paid in a lump sum. Or - at the request of a person, it is divided into 5 or 10 annual payments into a contract.

The maximum plan contribution for a one-time payment is $7,500,000. If a person plans to make annual contributions to the contract, then the total contribution should not exceed 20,000,000 USD.

The policy can only be opened in US dollars. The age of a person at the time of issuing the policy with a lump-sum payment should be from six months to 75 years. For 5-year installments, the age of the applicant must be from 6 months to 70 years, and for 10-year installments, the age of the contract holder must be from six months to 65 years.

There are three ways to contribute to your Manulife Global Generation family trust. The first option is a one-time contribution of the entire amount of capital to the contract. Along with this, installment payments for 5 years, or for 10 years are possible.

For example, the contract owner would like to set up a trust fund for children and contribute $1,000,000 to it. If this amount is already available, then it can be contributed to the plan by a single transfer of a million dollars to your insurance contract.

If the entire amount is not available at the moment, then a person can open a contract with contributions in installments for 5 years. And each year contribute 200,000 USD to your contract.

Finally, you can choose a 10-year installment plan. And then in the next 10 years it will be necessary to contribute 100,000 USD annually to the plan.

Fee payment scheme must be selected before contract issuance. Once the policy is issued, it will no longer be possible to change the funding option of the policy.

Manulife Global Generation is a participating life insurance policy. The term "participating" means that Manulife distributes the profit received from the investment of contributions among clients in the form of insurance dividends.

Dividends are accrued in accordance with Canadian law on profit-sharing accounts under life insurance. According to the law, in the form of insurance dividends, the insurer is obliged to distribute among customers 97.5% return on investment. And only 2.5% of declared dividends can be used for administrative expenses of the insurer.

It should be noted that the contract does not guarantee the amount of insurance dividends. Therefore, the amount of dividends may vary from year to year due to the current level of interest rates, the situation in the financial markets and the results of Manulife's investments.

The current insurance dividend is around 4% in US dollars. Which is quite a lot compared to interest rates on deposit accounts, which actually tend to zero.

Dividends are declared annually. And after the accrual of dividends, the profit received becomes part of the savings of the insurance contract.

In addition to dividends, the owner of the contract also receives interest on the paid dividends, which also increases the amount of savings in the family trust fund. Interest is accrued on all dividends that are accumulated in the policy.

Finally, the policy provides for a terminal bonus. The amount of this payment is not guaranteed, and it is made at:

- expiration of the policy (121 years have passed since the issuance of the contract), or

- cancellation of the policy - the person decided to terminate his policy and take all the savings in the contract, or

- the death of the insured.

The terminal bonus also increases the final savings in the contract. And as an indicative value, because this parameter is not guaranteed, the terminal bonus is indicated in the draft contract. Which we will discuss below.

Which we will discuss below.

Easily implemented through a Manulife Global Generation contract, the Family Trust Fund provides several options for accessing the funds placed in it.

Over time, the MGG policy has the potential for very significant savings. And you can use these tools in the following ways.

- Withdrawals from accumulated dividends

Dividends accrued annually are the most important source of growth in the cash value of the policy. If desired, the owner of the contract can withdraw all or part of the accrued dividends. And use these tools to solve current problems.

- Loans against the cash value of the policy

The policyholder may at any time request a loan from the company against the cash value of the policy. And then a certain percentage will be charged on the loan taken.

The difference from the previous method is that when taking a loan, a person does not reduce the amount of accrued dividends in his policy. And therefore, interest will be charged by the insurer on all dividends accumulated in the policy. But at the same time, the owner of the contract will need to pay interest on the use of the loan taken from the insurance company.

And therefore, interest will be charged by the insurer on all dividends accumulated in the policy. But at the same time, the owner of the contract will need to pay interest on the use of the loan taken from the insurance company.

The interest rate on a loan varies over time and may change at any time. Loans and their interest rates are reflected in the cash value of the policy. However, this will in no way affect the payment of dividends and their accumulation.

- Partial Withdrawals

The policyholder may also make partial withdrawals from his contract. In this sense, a policy is a lot like a bank account. Part of the funds contributed to the insurance policy can be withdrawn without terminating the contract.

The minimum amount of a loan or partial withdrawal from the policy is 10,000 USD.

- Cancellation of the policy

Finally, the contract holder can cancel the policy at any time and receive all the money accumulated in the policy. However, it is worth remembering here that in the first few years after the policy is issued, its redemption amount may be less than the contributions made to the contract.

However, it is worth remembering here that in the first few years after the policy is issued, its redemption amount may be less than the contributions made to the contract.

Let's look at an example of how a family trust fund created with the help of Manulife Global Generation can work with a one-time investment of $1,000,000. I explain the numbers below in detail in my video - include my story:

Prior to the issuance of the contract, each client receives a draft policy, which reflects the guaranteed values and expected parameters of the policy.

The project below is for a 45 year old:

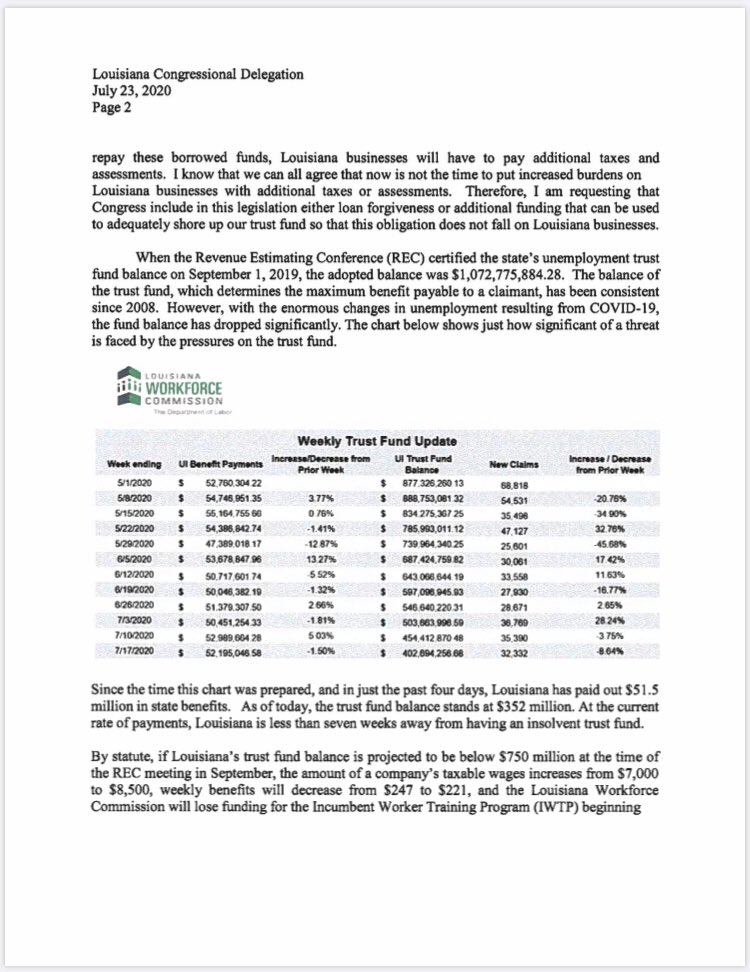

Let's briefly review the tenth year of the plan. This line is underlined in red.

The first two columns are guaranteed plan parameters. The company is required by law to provide them to the customer. The company guarantees that the contract will work no worse than these values. Which are calculated in the most negative scenario - financial markets are falling, interest rates are extremely low, investments bring minimal income.

Which are calculated in the most negative scenario - financial markets are falling, interest rates are extremely low, investments bring minimal income.

In this scenario, the guaranteed amount of savings in the tenth year of the policy is 1.046.805 USD. And the payment on the death of the owner of the contract this year will be exactly the same. Above, these numbers are highlighted in blue.

In fact, the probability of such a scenario is extremely small. It is most likely that the contract will work as described on the right side of the table. Manulife calculates the expected savings in the contract based on the results of previous years. Assuming that similar results will be obtained in the future. However, it must be remembered here that the results of the right-hand side of the calculation are only assumed. And they are not guaranteed by contract.

So, assuming that after 10 years of the contract, the amount accumulated in the contract will already be 1. 344.302 USD. And the payment at the death of the owner of the contract this year will be exactly the same amount. In the calculations above, these numbers are marked with a green rectangle.

344.302 USD. And the payment at the death of the owner of the contract this year will be exactly the same amount. In the calculations above, these numbers are marked with a green rectangle.

However, 10 years for such contracts is a very short time. After all, it is intended for several generations of the family. And so we would be interested to see how the plan works for longer periods:

We see that after 20 years the money put into the contract more than doubles. And now let's see what capital will be created in the policy by the 75th anniversary of the person who opened the contract:

We see that this capital will presumably amount to 3.772.868 dollars. Which, without paying inheritance taxes, a person can easily and quickly transfer to his child. Simply by changing the insured in your Manulife Global Generation contract.

This money will never leave the family. They are in a family trust fund. Which is managed by the person who is currently the insured person.

Let's not forget that the money accumulated in the policy can be used. For example, the contract owner can withdraw the necessary amount from the plan at a time. Or create an annuity to secure a retirement income. Which, if we wish, will not end with the death of the original owner of the contract. This will happen if he passes the policy to the next generation in advance.

A similar scenario is shown on the slide below:

A person opened a trust fund with Manulife Global Generation and invested a one million dollar lump sum into the plan at one time. After that, 21 years passed, and the owner of the contract ended his career.

And starting from the 22nd year of the contract, the person began to withdraw from the plan an amount of 118,048 dollars annually. To secure your retirement annuity. Later, at some point, the person passed this contract to his child. And from that moment on, the child is already the beneficiary of the family trust.

When the father passed away, the child continued to withdraw funds from the contract in the amount of $118,048 annually to pay for current needs. And so it went on for 70 years (!) in a row - from the 22nd to the 92nd year of the existence of the policy. Then the withdrawals from the contract ceased.

And so it went on for 70 years (!) in a row - from the 22nd to the 92nd year of the existence of the policy. Then the withdrawals from the contract ceased.

Thus, during these 70 years, 8,263,360 dollars were withdrawn from the policy by the family. As a result, by the end of the 92nd year of the policy in the contract, even with such significant withdrawals, it is expected that 10,824,073 dollars will be accumulated. Which in 20 years, by the end of the policy, will turn into 28.121.664 dollars of savings belonging to the family.

That's what an invincible cash flow can create for your family with proper financial planning, and the use of modern financial tools.

As already mentioned, Manulife Global Generation is legally a life insurance policy. This contract is opened in a standard way by submitting an insurance application to Manulife.

There is a very important and positive moment here. The Manulife Global Generation application does not include any questions about the health status of the prospective client. How is it that life insurance companies always ask their future clients about their health status?

How is it that life insurance companies always ask their future clients about their health status?

The fact is that life insurance in our usual sense is not actually in the contracts of Manulife Global Generation. This contract is designed to manage the wealth of the family for many generations. And it is clothed in the legal form of life insurance because this form of contract is most convenient for solving the tasks facing it.

After all, the payment on the death of the insured is actually equal to the capital that has already been created in the contract. Therefore, Manulife Insurance does not bear any financial risk in connection with the death of the owner of the contract. And in this regard, the future client does not need to answer questions of a medical nature, as well as undergo a medical examination before issuing a Manulife Global Generation contract.

In fact, when opening a contract, its owner opens a special account in an insurance shell for a period of 121 years. And puts on it funds that will pass from generation to generation of the family. Therefore, the age and health of the account holder does not play any role here.

And puts on it funds that will pass from generation to generation of the family. Therefore, the age and health of the account holder does not play any role here.

In this regard, the parameters of the contract will not depend on the age of the insured. The figures in the draft policy for both the baby and the mature person will be the same.

And since no medical examination is required before the policy is issued, the contract is issued very quickly. The processing of the submitted application takes 2-3 days, and then within a maximum of 5 working days the company will decide on the issuance of the policy. Thus, the creation of a family trust will take approximately 7 working days.

And a few words about the cost of setting up a family trust fund with Manulife Global Generation. To create a family trust, you only need to apply to Manulife. And then deposit the desired amount into the contract at a time or in installments.

Let me remind you that the contribution to the contract can range from 500. 000 USD to 20 million USD. At the same time, all the funds contributed to the plan constitute the savings of the family, on which dividends and interest are accrued year after year.

000 USD to 20 million USD. At the same time, all the funds contributed to the plan constitute the savings of the family, on which dividends and interest are accrued year after year.

There are no additional costs associated with this approach to establishing a family trust.

To sum it up

Manulife Global Generation is a handy tool for quickly and at virtually zero cost to create a family trust fund to protect and grow wealth - and to pass it on to the next generations of the family. I hope that by the end of the article you already understand how to create a trust fund in Russia for a child.

Manulife Global Generation gives you the opportunity to plan for the future of the family for several generations to come. And allows wealth to accumulate under the protection of the policy. The transfer of assets to the next generation is accomplished by simply replacing the insured. There are no inheritance taxes involved. There is no limit to the number of such replacements, so family wealth can be passed on to many subsequent generations.

The cash value of the policy increases significantly over the years. And the family has several ways to use these funds. This may be the withdrawal of accrued dividends, a loan secured by the cash value of the policy, partial withdrawals from the contract, or cancellation of the policy with the receipt of all funds accumulated in the contract.

This is a very convenient solution for wealthy people who are interested in generational planning and the transfer of created assets to children and grandchildren. With the help of the Manulife Global Generation contract, you can instantly create a family trust with a significant cash fund. And to ensure its protection, as well as reliable investment of funds - so that capital grows in the interests of future generations.

And if you need advice on the topic and a draft contract, just write to me in a convenient messenger to arrange our online meeting:

Vladimir Avdenin,

financial consultant

The article uses materials from Joseph Lazerson ( Joseph Lazerson)

Read more:

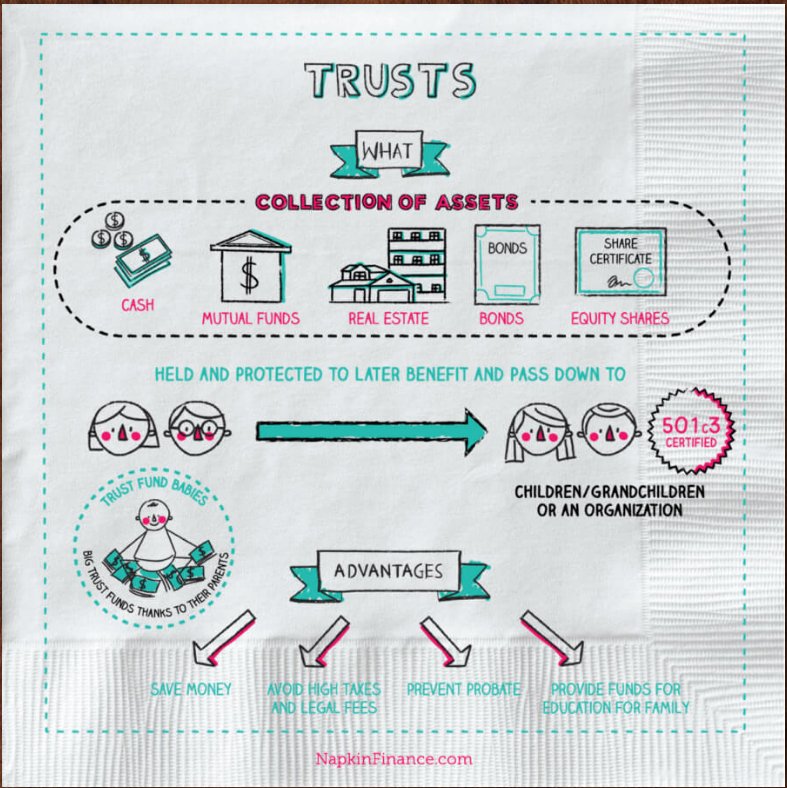

Trust is a mechanism that allows you to effectively solve many problems, one of which is the transfer of assets by inheritance.

With it, you can accumulate a fortune in the hands of one heir, divide the money between all family members or leave them penniless in your pocket. How exactly Russian clients use trusts, B.O. understood with the help of experts

With it, you can accumulate a fortune in the hands of one heir, divide the money between all family members or leave them penniless in your pocket. How exactly Russian clients use trusts, B.O. understood with the help of experts One day Alfred Nobel read in a newspaper: "Alfred Nobel, the 'merchant of death', has died." In fact, the obituary was for one of his brothers, but the reporters got the name mixed up. The realization that posterity will remember him as a villain, almost a serial killer, was a turning point not only for the 55-year-old inventor of dynamite and weapons manufacturer, but also for the history of world science. Nobel rewrote his will so that after his death all his money would be transferred to the Fund in the most conservative trust management. From 19Since 00, the management of the structure has been managing funds, holding Nobel symposiums, and awarding prizes to outstanding scientists, politicians, and writers.

True, as practice has shown, the Fund's managers did not always manage to adhere to the conservative management model traditional for trusts: the Fund acquired business structures, it happened that the managers actively played on the stock exchange, and in some years the results turned out to be completely negative. But at the same time, for more than a century in the payment of fees to Nobel Prize winners, as well as in holding other mandatory events

But at the same time, for more than a century in the payment of fees to Nobel Prize winners, as well as in holding other mandatory events

The Foundation focused on its own resources (in 2013 it needed financial assistance from philanthropists).

Heirs in flight / "Where's the money, dad?"

Trusts have a history of three centuries. Perhaps there are more "long-lived" trusts in the world than the Nobel Foundation, but they are clearly less public.

The brainchild of Nobel is a classic story that shows how large-scale tasks can be solved over a long period of time with the right structuring of assets and an approach to managing them. But it is also an illustration of how, bypassing the inheritance laws in force in the country of residence, anyone whom the testator deems fit can be excluded from the category of heirs, distributing assets among “desirable” family members or even outsiders.

In fairness, it must be said that Alfred Nobel had no direct descendants (but there were many nephews). But situations are not uncommon when the state does not go to their own children. Moreover, such cases are becoming more common, if not to say - are becoming fashionable. And before, children were deprived of their fortune, as a rule, for misconduct - real or imaginary, now the funds are given to charity. So, in 2019, the owner of the Hilton hotel chain, Barron Hilton, died in the United States. Billionaire passed 97% of the state to charity, bypassing the heirs.

But situations are not uncommon when the state does not go to their own children. Moreover, such cases are becoming more common, if not to say - are becoming fashionable. And before, children were deprived of their fortune, as a rule, for misconduct - real or imaginary, now the funds are given to charity. So, in 2019, the owner of the Hilton hotel chain, Barron Hilton, died in the United States. Billionaire passed 97% of the state to charity, bypassing the heirs.

Andrew Carnegie, who in 1889 published The Gospel of Wealth, is credited with pioneering the fashion for disinheriting offspring. His main postulate: "If you die rich, you die disgraced." He left enough for the family not to live in poverty, but no more.

The fact that this is fashion and it has many adherents is evidenced by statistics. It is known that the so-called giving oath was signed by the American billionaire, media mogul and politician Michael Bloomberg - as well as world-famous entrepreneurs Warren Buffitt, Bill Gates and Michael Zuckerberg, singers Elton John and Sting and hundreds of other wealthy people of the planet. Of the Russian representatives of the Forbes list, fathers with many children Vladimir Potanin (INTERROS) and Mikhail Fridman (Alfa Group) promise to follow this path.

Of the Russian representatives of the Forbes list, fathers with many children Vladimir Potanin (INTERROS) and Mikhail Fridman (Alfa Group) promise to follow this path.

But since “bypassed” heirs can challenge the will, such strategies often have to be launched in advance, with assets being transferred to various trusts and foundations. This is especially important when the will is drawn up in states where Anglo-Saxon law does not apply.

By mutual agreement

“Looking back at world history, wealthy people have been dealing with the issue of transferring inheritance through trusts since the 20s of the last century,” experts at Imperia Private Banking Russian Standard comment. “One of the first well-known users of this service is John Rockefeller. He created trust - in other words, chose a circle of trustees who dealt with the issues of his capital and transferring it to family members. It was not only about the immediate heirs, but also about the distribution of all assets among family members. "

"

This story is also interesting because the same John D. Rockefeller is one of those who contributed to the formation of a trend for charity. Together with his son, John D. Rockefeller, Jr., he also founded the Rockefeller Foundation in New York in 1913, to which he donated $35 million. Now the Fund's fortune is about 3.7 billion dollars. Thus, the heir to the patriarch of the family was not only aware that not all the wealth would go to him, but he himself helped in organizing a charitable organization.

It is curious that the size of the fortunes of Andrew Carnegie and John D. Rockefeller at that time were comparable, but the Rockefeller family is known all over the world today, and only a few remember Carnegie. History is silent about what his descendants thought about Andrew Carnegie's act.

However, according to Joseph Frangos, managing partner of the Cypriot company Bybloserve Management Ltd. in general, today's families are more conscious of charity than it was before. Heirs often support their fathers in their desire to transfer part of the capital to public needs. The heirs of Russian families do not stand aside either - in particular, Vladimir Potanin declares that his children agree with his decision.

Heirs often support their fathers in their desire to transfer part of the capital to public needs. The heirs of Russian families do not stand aside either - in particular, Vladimir Potanin declares that his children agree with his decision.

Popular practice

Experts working with the family fortunes of Russian clients assure that the use of trusts to solve inheritance problems is a fairly common practice.

Experts from the Imperia Private Banking division of Russian Standard note that the popularity of trusts is growing, as the institution of a trust helps to properly structure asset ownership and transfer of inheritance, but it all depends on specific cases, Dmitry Breitenbikher, Head of Premium Clients Department, Senior Vice -President of VTB, spoke in approximately the same vein: "The use of trusts or family funds is a standard practice for clients who own a variety of assets both in Russia and abroad. At the same time, the decision to establish a specific structure is made in each case individually, with taking into account all the existing features and wishes of the client, the type of assets, their geography, the legislative requirements of the country of their location, the composition of family members, the need for operational management, etc. ".

".

Defined the concepts

According to Dmitry Breitenbikher, such structures, as a rule, are created in jurisdictions with a transparent and understandable system of law, as well as well-established judicial practice on these issues.

Clients prefer to use traditional solutions to create trusts, registering them in Guernsey, Cyprus, Luxembourg and other jurisdictions, says Evgenia Tyurikova, head of Sberbank Private Banking. “The definition of trusts has just appeared in the Russian legislative field, and the system has not yet been worked out. To date, the best thing that the world has come up with in the field of transferring wealth is the Anglo-Saxon inheritance system. This system is at least 300 years old,” the expert comments on the current situation. “We still have an imperfect mechanism, but we are learning quickly.”

"Trusts are now in great demand. We receive requests from clients to create trusts and foundations (foundation) in foreign jurisdictions. Moreover, we see a clear request from clients to create such funds in Russia," says Evgenia Osinovskaya, Executive Director of URALSIB | Private Bank, - Many are waiting for changes in Russian legislation that will allow the creation of full-fledged trusts in our country."

Moreover, we see a clear request from clients to create such funds in Russia," says Evgenia Osinovskaya, Executive Director of URALSIB | Private Bank, - Many are waiting for changes in Russian legislation that will allow the creation of full-fledged trusts in our country."

Incomplete match

Dmitry Rusak, an expert practitioner in the creation of trusts and private Family Offices, is sure: “A trust is only an English system of law! There are no Dutch, Swiss, Luxembourg, Panamanian trusts. There may be some kind of formation, a mixture of Family Office and trust, but this not a trust, in its purest form, as there are no trust companies in Europe, with the exception of branches of real trust companies, but they have other tasks.What the Dutch call a trust company is actually a consulting company providing legal, consulting and accounting services All other so-called trusts are the Family Office with all the ensuing consequences, the main of which is the right of the Director of the Family Office to any operations with assets, and where he will hide them from you and how much he will “bite off” is another question. ”

”

"Real" trusts are those registered in such jurisdictions as Cyprus, Great Britain, Ireland, New Zealand, Australia, Malta and many offshore islands with the English system of law, Dmitry Rusak believes. - Trusts - where there is case law. All these countries have their own trust laws, somewhat similar to each other, but having differences. All trust companies are required to have a trust license."

According to the expert, there are trusts in Muslim countries as well. “Such a trust is called “waqf”, but it has its own nuances, moreover, when creating an ordinary trust for a Muslim, it is necessary to take into account the peculiarities of Sharia so that there will be no unpleasant surprise later,” Dmitry Rusak clarifies.

Trust or no trust?

Meanwhile, there is a definition that allows you to distinguish without a shadow of a doubt what is a trust and what is a Multi Family Office. "A trust is an agreement under which the founder transfers his assets to the trust company in legal ownership, and the trust company is obliged to manage these assets in favor of those beneficiaries indicated by the founder. The trust company does not have the right to use the client's assets in its own interests, it only owns and manages. After the trust transfer, the founder is not the owner of the assets. At the same time, for countries of other law, it is necessary to change the title to shares, real estate, etc.," says Dmitry Rusak.

The trust company does not have the right to use the client's assets in its own interests, it only owns and manages. After the trust transfer, the founder is not the owner of the assets. At the same time, for countries of other law, it is necessary to change the title to shares, real estate, etc.," says Dmitry Rusak.

“Trusts are a very structured structure, which for several hundred years of existence is well regulated to avoid fraud,” agrees Kirill Nikolaev, co-founder of NICA Multi Family Office (Geneva, Switzerland). “But Russian (as well as Chinese) clients open a trust in Russian. The nominal owner fronts the beneficiary, who is outside the perimeter of responsibility, that is, dangerous types of trusts are used.

Dmitry Rusak also says that it is risky to open a trust for a driver, friend or brother-in-law. In any case, nominee owners can step into the role and start disposing of "their" assets.

Kirill Nikolaev believes that "Russian-style trusts" are one of the most important reasons for the loss of family fortune. In his opinion, it is safer to bear the tax burden and pay a licensed professional to manage assets than to be blackmailed by a nominal owner and lose most of the state.

In his opinion, it is safer to bear the tax burden and pay a licensed professional to manage assets than to be blackmailed by a nominal owner and lose most of the state.

Issue price - 2%

When MFO banking executives talk about how many of their clients have "family" trusts, this usually means that such clients pay twice for asset management.

"Practically in any jurisdiction where English law operates, a trust can be made. But in a respected jurisdiction, such as New Zealand, its maintenance costs 1% of the assets brought to it. The "dump" jurisdiction is, of course, cheaper, but the difficulty of passing money increases, compliance,” explains Kirill Nikolaev, “If the client has both a trust and an MFO, their maintenance will cost him 2% per year.”

Nikolaev notes that the main value of the trust is the programming of restrictions when changing generations. The family cannot spend all the money: drink it, lend it, or go bankrupt. Also, the restrictions imposed by the trust can protect families from the fragmentation of the state - both with an increase in the number of heirs (or their appetites), and from the actions of fortune hunters of all kinds.

The Imperia Private Banking division of Russian Standard says that the transfer of property to family members is the second most popular type of Family Office service (in the first place are issues of long-term asset management of the client), since a significant part of the modern business elite has come to the age when it is time to think on the transfer of business to heirs. And the creation of trusts, as well as the transfer of assets to them, is a common way.

Sandbox for millions

“The main task of transferring assets to trusts is to preserve and increase their profitability. These capitals are either redistributed between different family members, or, conversely, accumulated on one or two persons,” the bank’s experts explain. “Another form is the inclusion of the heir’s children in the business structure "empires, officially transferring to them the shares of the company that they actually always owned. We have a number of examples of such companies where the sons already hold high positions and are co-owners. Thus, they inherit the business and take an active part in operational management."

Thus, they inherit the business and take an active part in operational management."

Dmitry Rusak, on the contrary, notes that of all the possible options for using trusts in the interests of the family directly to transfer business to heirs, they are used less often than others. The reason is that business in the Russian Federation is tied to working with administrative resources and the personality of the creator, when these paradigms change, the business becomes practically useless - with rare exceptions, therefore it is easier to sell it and transfer money to a trust, the expert assures.

A popular among Russian clients is a sandbox trust, a variant of a trust created by parents so that children can try their hand at business, said Dmitry Rusak. "In this case, the trust company gives out the agreed funds to run the business, controlling the companies, acting as a shareholder and corporate director," he explains.

The weaker sex went into defense

There is a new trend towards the creation of trusts by women, the expert says. "There are two directions here. In one case, trusts are created by women themselves - business owners or top managers in major corporations. In this case, they create trusts either in the interests of their children or when they get married, which allows them to resolve the issue of family assets without signing a marriage certificate. contracts. A very pragmatic approach, while the degree of protection in a trust is much better, - Dmitry Rusak believes. - The second option is when wives create trusts, and husbands fill them with existing assets or, say, buy hotels abroad and transfer them to a trust. This , as a rule, is done in the interests of children and wives in case of divorce, loss of business. Also, this approach removes the risks of sudden death in cases where a male businessman understands that the assets simply may not go to the family “thanks to” the efforts of his partners.

"There are two directions here. In one case, trusts are created by women themselves - business owners or top managers in major corporations. In this case, they create trusts either in the interests of their children or when they get married, which allows them to resolve the issue of family assets without signing a marriage certificate. contracts. A very pragmatic approach, while the degree of protection in a trust is much better, - Dmitry Rusak believes. - The second option is when wives create trusts, and husbands fill them with existing assets or, say, buy hotels abroad and transfer them to a trust. This , as a rule, is done in the interests of children and wives in case of divorce, loss of business. Also, this approach removes the risks of sudden death in cases where a male businessman understands that the assets simply may not go to the family “thanks to” the efforts of his partners.

According to the expert, Russian women mostly prefer trusts with passive investments or commercial real estate - as a rule, these are hotels or apartment buildings near European universities.