How long do you get child tax credits for

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

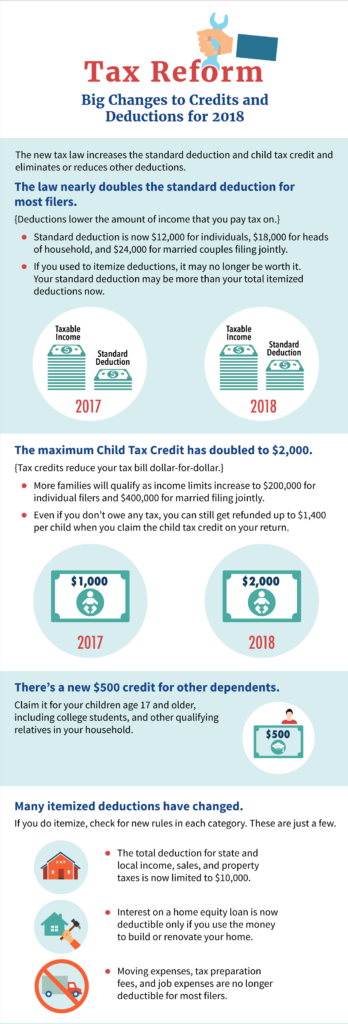

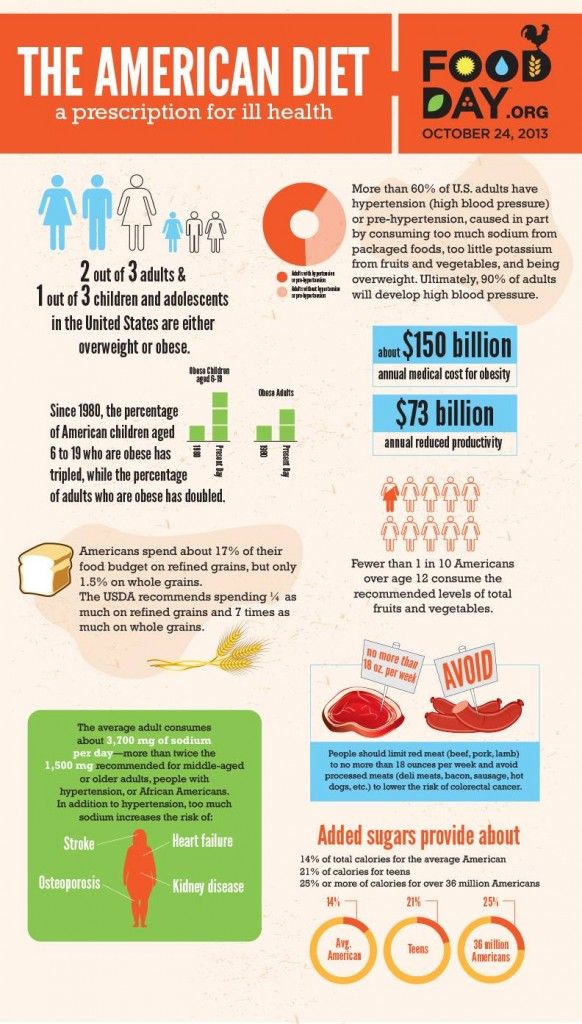

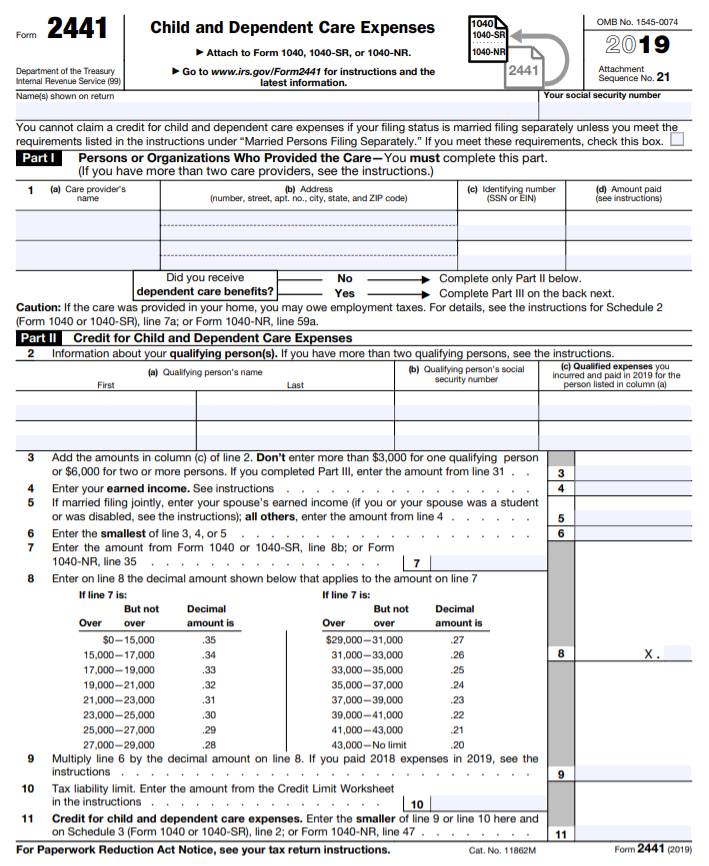

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

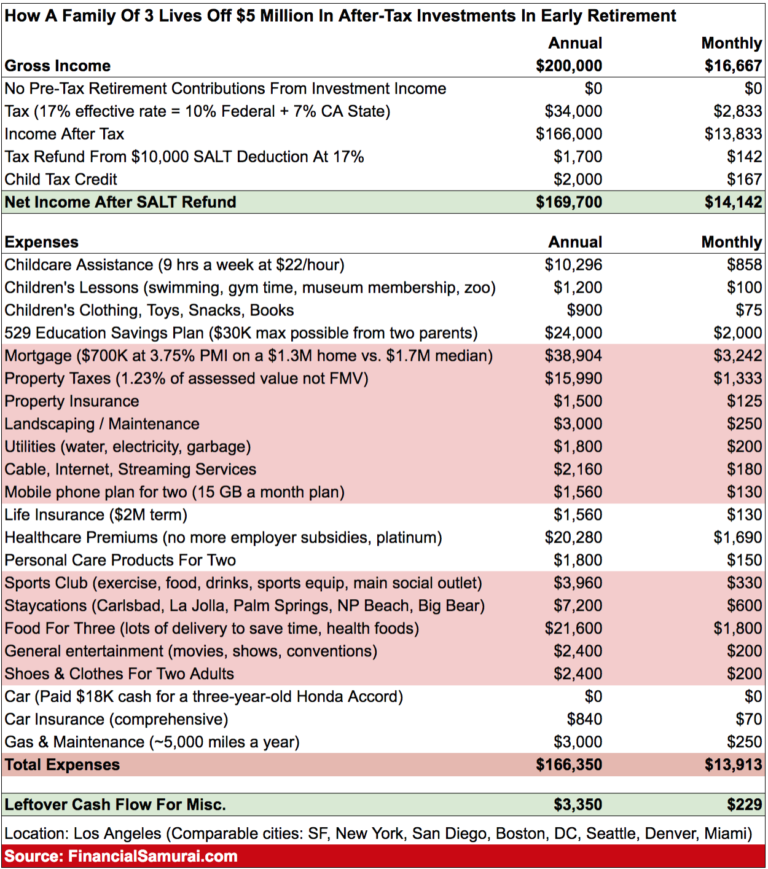

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

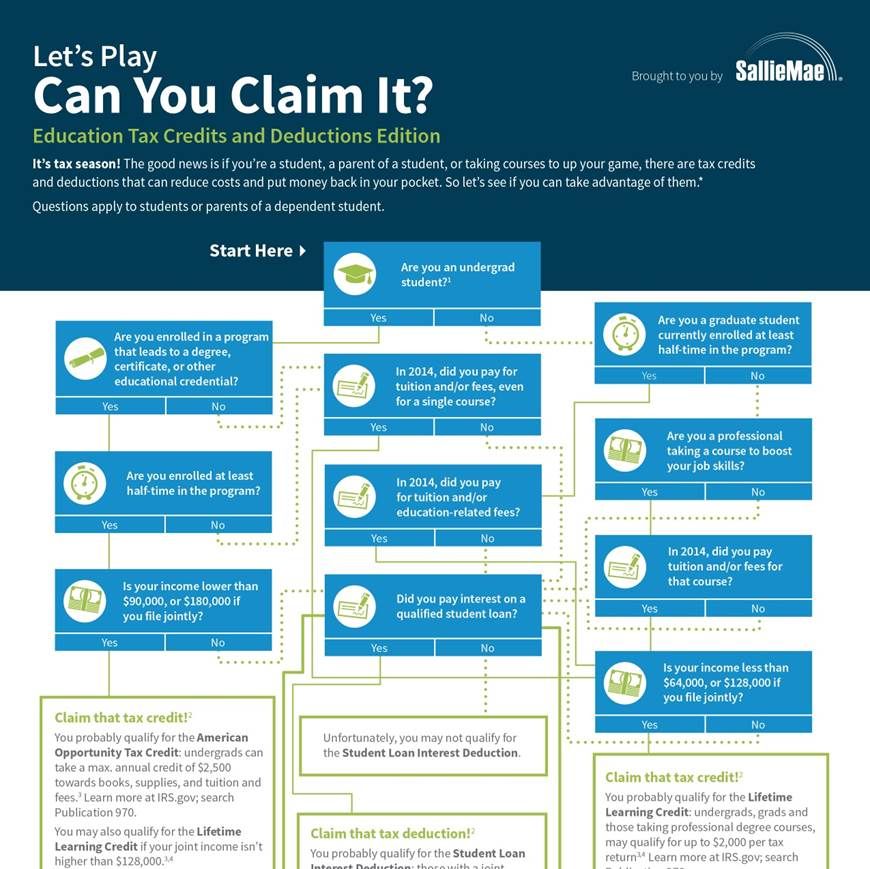

- How much can I get with the CTC?

- Am I eligible for the CTC?

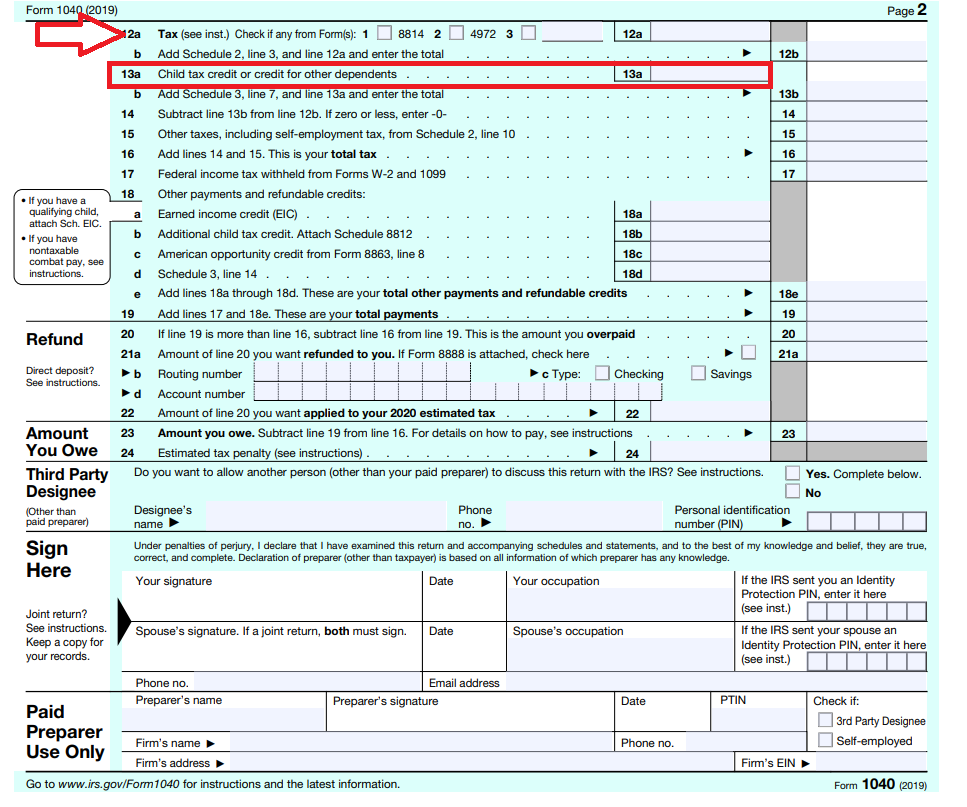

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

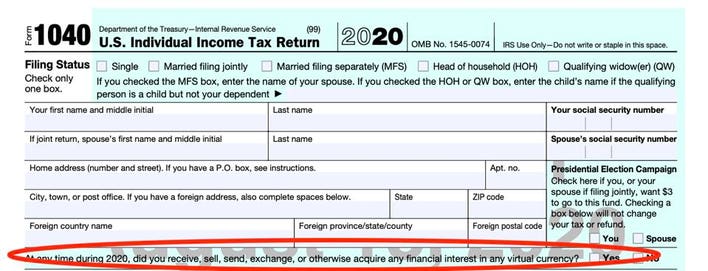

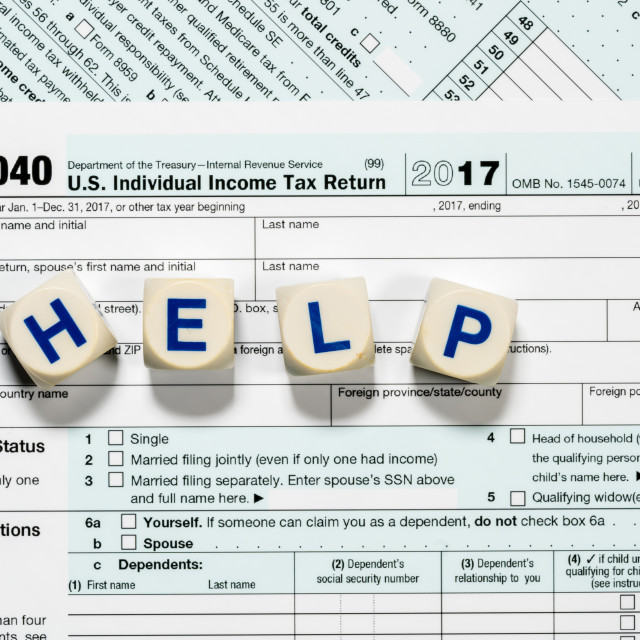

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

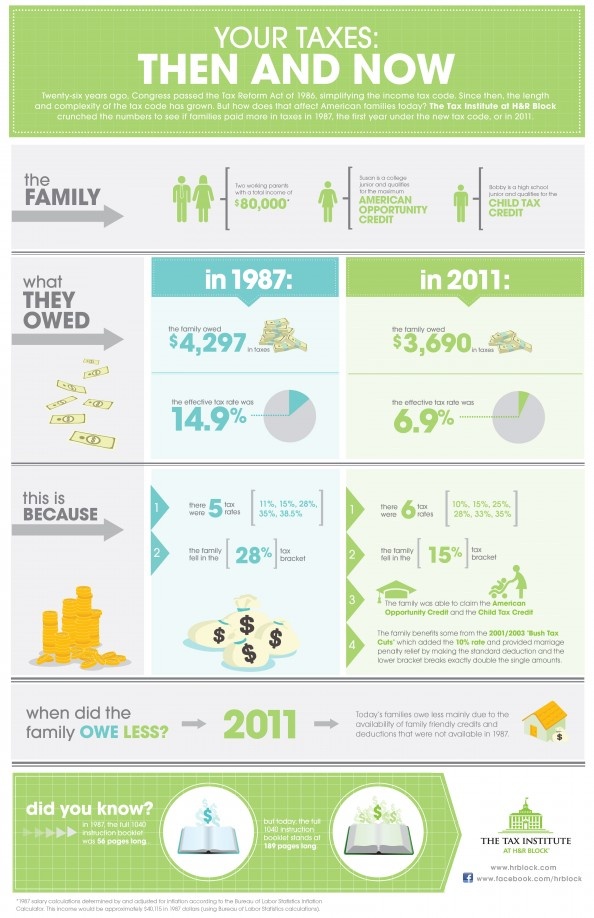

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids.

She’ll receive the rest next spring.

She’ll receive the rest next spring.- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

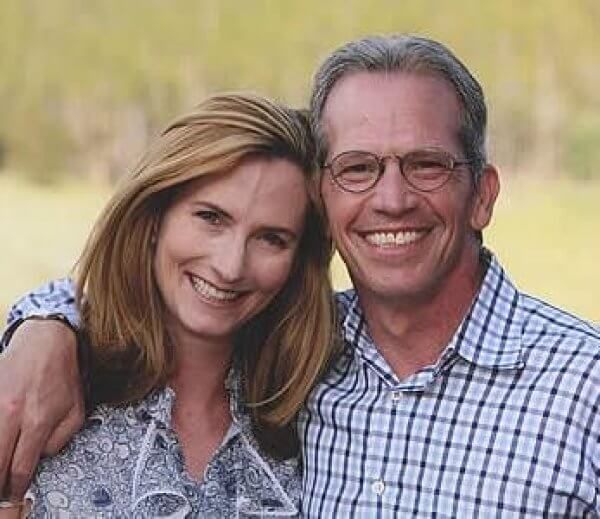

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes. If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Accounting for tax-free income

Since your tax-free income decreases as your income increases, it is important to know how wages, pensions, benefits, and other types of income affect your tax-free income.

Knowing the amount of your income, you have the opportunity to account for tax-free income in the correct amount already during the year and thus avoid the obligation to pay additional income tax by October 1 of the next year.

How does it affect the amount of tax-free income...

If you receive monthly wages from several employers in excess of 1200 euros, then you should add up all the amounts received for work.

Since the employer does not know about your other income (for example, wages from other employers) and cannot take them into account when determining tax-free income, you yourself must notify one of the employers of the refusal to apply tax-free income or on the application of tax-free income in the amount of less than 500 euros.

Example

If you earn 1,000 euros per month with two employers, then you have the right to apply the full tax-free income (500 euros) in one workplace, and income tax will be withheld at this workplace only from the remaining 500 euros. At another workplace, tax-free income will not be taken into account and income tax will be deducted from 1000 euros.

Based on your annual income statement, your annual income will be 24,000 euros, the tax-free income calculated by the formula will be 666.62 euros per year and you will have to pay additional income tax by October 1 of the following year.

To avoid this situation, you must tell your employer that you are waiving tax-free income or that you allow tax-free income to be counted, for example, only in the amount of 55 euros per month.

NB!

- There is a right to apply tax-free income only at one workplace.

If your monthly salary with several employers exceeds 2,100 euros, then the tax-free income for the year will not be applied to your income.

Ask the employer who has previously accounted for your tax-free income to apply the €0 tax-free income, or do not submit an application for tax-free income in the future. - If you work for several employers at the same time, then the employer who has chosen you to apply tax-free income when withholding income tax must pay social tax at the annual monthly rate. Therefore, when you have more than one employer, it is important to submit an application for the application of tax-free income, even if you ask the employer to take into account the tax-free income of 0 euros.

If you expect your salary to fluctuate throughout the year, or if you are eligible for bonuses, performance bonuses, etc., then it pays to be conservative when determining tax-free income.

Even when the calculated tax-free income per month can be applied in the amount of 200 euros, it makes sense to submit an application to the employer for applying as tax-free income only, for example, 100 euros per month. In this way, you will avoid having to pay additional income tax on the basis of the annual income tax return by October 1st.

In this way, you will avoid having to pay additional income tax on the basis of the annual income tax return by October 1st.

But if you paid more income tax during the year, then after filing your annual return by April 30, the overpaid income tax will be returned to you. Income tax will also be refunded if you ask your employer to deduct tax-free income.

If you are a working pensioner and in addition to your salary you also receive a pension from the Social Insurance Department (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements) and your monthly income exceeds 1200 euros, then you have to add up the gross amounts of wages and pensions.

A working pensioner who receives both a pension and a salary of less than 500 euros has the right to apply tax-free income in two places, and to submit an application indicating the specific tax-free amount, both to the Social Insurance Board and employer.

It is important to note that a working pensioner can distribute tax-free income between the employer and the Social Insurance Board in the amount of 500 euros.

Example

A person's pension is 416 euros and salary is 300 euros.

A person has the right to submit an application for the application of tax-free income in the amount of 416 euros to the Social Insurance Board, and an employer to submit an application for the application of tax-free income in the amount of 84 euros.

If, however, you have unexpected income during the year, such as from the sale of real estate or securities, then you can submit a lower amount on your application for tax-free income. In this way, you can avoid the obligation to pay additional income tax by October 1 of the following year.

NB!

Disability pension paid by the Social Insurance Board is included in the annual income and affects the amount of tax-free income.

Disability allowance paid by the Unemployment Insurance Fund is not taken into account in determining annual income and does not affect the amount of tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

If you are a pensioner and there is no other income apart from your pension (including old-age pension, survivor's pension, disability pension, reduced pension and pension supplements), then your total tax-free income is applied to your pension ( 500 Euro).

The amount of non-taxable income depends on the income of working pensioners and persons receiving special preferential pensions, whose monthly income exceeds 1200 euros per month.

NB!

It is important that you submit an application to the Social Security Department for exemption. The application can be submitted via the portal eesti.ee or on site at the Social Insurance Board.

More information

Social Insurance Board website "Income tax on benefits and pensions"

If you are on parental leave and receive parental benefit, parental benefit is your taxable income. If the parental benefit is less than 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the parental benefit is more than 1200 euros per month, then tax-free income is applied in accordance with the Income Tax Law.

If the parental benefit is less than 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the parental benefit is more than 1200 euros per month, then tax-free income is applied in accordance with the Income Tax Law.

NB!

If you have filed an exemption application with the Social Insurance Department and you have no other income, then the Social Insurance Department will apply the correct formula-based tax-free tax and you will have no additional tax liability.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

State benefits paid by the Social Insurance Board (including child allowance, childbirth allowance, child care allowance, etc.) are not subject to income tax and are not declared in the income tax return.

NB!

Tax-free benefits do not count towards annual income and do not affect tax-free income.

Additional information

Website of the Social Insurance Board "Income tax on benefits and pensions"

Disability and unemployment benefits are tax-free benefits that are not declared on your income tax return. Disability benefits and unemployment benefits are not taken into account in determining the amount of tax-free income.

Disability benefits and unemployment benefits are not taken into account in determining the amount of tax-free income.

NB!

There is a difference with the disability pension, which is taxable income, is taken into account in determining annual income and affects the amount of tax-free income.

If you receive unemployment benefits from the Unemployment Insurance Fund, this is your taxable income.

If the insurance benefit does not exceed 1,200 euros per month, then you are entitled to tax-free income of 500 euros per month. If the insurance indemnity exceeds EUR 1200, then tax-free income is applied in accordance with the provisions of the Income Tax Law.

NB!

If you have submitted an application to the Unemployment Insurance Fund for the application of tax-free income and you have no other income, then the Unemployment Insurance Fund will apply the correct tax-free tax calculated according to the formula and you will not have additional tax liabilities.

If you receive dividends during the year taxed at the company level at the ordinary tax rate of 20/80, then this is your income, which is taken into account in determining the annual income.

In the income statement, the amount of dividends transferred to you, or the money you receive (table 7.1) is taken into account as annual income, and this affects the amount of tax-free income.

At the same time, if you receive dividends from abroad, from which income tax is withheld or paid in a foreign country, then the so-called gross amount of dividends is taken into account as annual income, i.e. received dividends together with income tax withheld or paid in a foreign country.

If you receive dividends during the year that are taxed at company level at a lower tax rate of 14/86 and from which income tax of 7% has been withheld, then this is your taxable income, which also affects the amount of non-taxable income.

The amounts transferred to the business account, from which a part of the social tax has been deducted, are taken into account in the annual income and affect the amount of your tax-exempt income.

Additional information

Entrepreneur account

If during the year you receive income, for example from the sale of property (from the sale of real estate, from the sale of securities, from the sale of timber or from the alienation of the right to cut down a growing forest), then this income is taxable and affects the amount tax-free income.

If you know in advance that in addition to wages and/or pensions you will also have income from the disposal of property, you can notify the employer or the Social Insurance Board, i.e. the one to whom the application for the application of tax-free income was submitted , that you waive the application of tax-free income in whole or in part.

NB!

Tax-free income from the sale of one's place of residence or income from the sale of movable things that are in personal use are not declared in the annual income statement and are not taken into account in determining annual income for determining tax-free income.

The taxation of the funded pension payment depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the web page "Taxation of pensions from January 1, 2021".

Tax-free mandatory funded pension payments are not declared in the income statement of an individual, are not taken into account in his annual income and do not affect the amount of tax-free income.

State pension (I pillar) paid by the Department of Social Affairs and mandatory funded pension (II pillar) paid by the Pension Center or an insurance company, taxed at 20% or 10%, are taxable income, which is also declared in the declaration on the income of an individual, but with the difference that the state pension is included in the annual income and affects the amount of tax-free income, while payments under the mandatory funded pension (II pillar) are not included in the annual income and do not affect the amount of non-taxable income. taxable income.

taxable income.

Links

Examples of calculating total tax-free income

It is still possible to deduct contributions to the supplementary funded pension, or III pillar, up to 15% of a person's taxable income in Estonia, or up to 6,000 euros per year.

The taxation of the payment of additional funded pension depends on the conditions of payment and can be either tax-free or subject to income tax at a rate of 20% or 10%.

Read more on the webpage " Taxation of pensions from January 1, 2021 ".

Tax-free supplementary funded pension payments are not declared in the income tax return of an individual, are not taken into account as annual income and do not affect the amount of tax-free income.

Supplementary funded pension payment (III pillar) from the Pension Center or an insurance company, taxed at 20% or 10%, is taxable income, which is declared in the income tax return, except that the payment, taxed at 20% is included in annual income and affects the amount of tax-free income, and the taxable payment of 10% is not included in annual income and does not affect the amount of tax-free income.

Links

Examples of calculating total tax-free income

Child allowance (Kindergeld) | Handbook Germany

Updated 11/15/2022

Diapers, toys, clothing, school supplies, hobbies and education. Raising children costs a lot of money. In order to somehow help parents, in Germany there is a so-called “child benefit” or in German “Kindergeld”. Such financial support should help them provide their child with a full life and a good future.

Listen

What should I know?

Child allowance (Kindergeld) should help parents support their children. It doesn't matter if it's a hobby or going to university. All of this, and even your child's typical weekday, will cost money. In order for children in Germany to be provided with everything necessary, their parents receive such an allowance. It doesn't matter if they work or not.

It doesn't matter if it's a hobby or going to university. All of this, and even your child's typical weekday, will cost money. In order for children in Germany to be provided with everything necessary, their parents receive such an allowance. It doesn't matter if they work or not.

You can receive child benefit (Kindergeld) if the following conditions are met:

- your child is under 18. Child allowance (Kindergeld) can in some cases also be received by adults. For more information on this, see the section “My child is already 18 years old. Can I get Child Benefit (Kindergeld)?”

- your child lives with you and you support him. Important: the child does not have to be your own. He may be adopted, from another marriage, in temporary custody, or your grandson/granddaughter.

- your child lives in Germany, the European Union, Norway, Iceland, Switzerland or Liechtenstein. Important: what citizenship the child has does not matter.

In addition, one of the following conditions must be met:

- you have German citizenship.

- you have the citizenship of one of the EU countries or Norway, Iceland, Switzerland or Liechtenstein.

- you have a residence permit (Aufenthaltserlaubnis) in Germany with which you can work for at least 6 months. It doesn't matter if you work or not. The main thing is that you have the right to do so.

- you have the citizenship of Algeria, Bosnia and Herzegovina, Kosovo, Morocco, Montenegro, Serbia, Tunisia, Turkey and you are officially employed in Germany or receive an Arbeitslosengeld I or Krankengeld allowance.

Please note: Deportation deferral holders (Duldung) are generally not eligible for child support (Kindergeld). An exception is the holders of a postponement of deportation in connection with work (Beschäftigungsduldung). If this is your case, you can claim Child Benefit (Kindergeld) regardless of your country of origin. Holders of a suspension of deportation due to study (Ausbildungsduldung) are not subject to this rule.

Holders of a suspension of deportation due to study (Ausbildungsduldung) are not subject to this rule.

More information can be found in the special manual in German.

You will receive child benefit (Kindergeld) until your child is 18 years old. If he is registered as unemployed (arbeitslos) or looking for a job (arbeitssuchend), you can receive benefits until he is 21 years old. If your child goes to school, learns a new profession (Ausbildung), studies at a university or volunteers in a recognized voluntary service (Freiwilligendienst), you will be able to receive benefits until he turns 25 years old.

Child benefit (Kindergeld) can be claimed immediately after the birth of a child or after you have arrived in Germany and meet the above requirements.

You can apply for benefits online at the Bundeagentur für Arbeit website. You can also download, print and fill out the application by hand. On the site arbeitsagentur.de you will find the necessary forms "Antrag auf Kindegeld" and "Anlage Kind zum Hauptantrag Kindergeld" in different languages, including Ukrainian.

The taxpayer identification number must be included in the application. Yours and your child. What it is and how to obtain it, you will learn from the section “What is a taxpayer identification number (Steueridentifikationsnummer)?” of our chapter “The German tax system”. If your child was born abroad or currently resides in another EU country, you will also need to send a copy of his birth certificate issued abroad.

You must send the application and the required documents (eg birth certificate of the child) to the family insurance fund (Familienkasse) responsible for you. You can find it on arbeitsagentur.de by entering your postal code.

Upon receipt of your application, the Office will review it and contact you if it has questions or if any documents are missing.

You will receive an answer within the next 6 weeks. If this does not happen, then you can call the free number 0800 4 555530 and find out in German how long it will take to process your application.

Child benefit (Kindergeld) can only be claimed by one person. That is, if you are supporting a child with your partner or with your partner, then you must decide in advance on whose behalf you will apply. Be sure to read the section “What is the amount of Child Benefit (Kindergeld)?” before doing so.

Please note: If the child's parents live separately, the parent with whom the child lives longer will receive the allowance. If one of the parents pays child support, it will be reduced by exactly half the amount of child support (Kindergeld).

Child benefit (Kindergeld) you will receive by transfer to your bank account. If you have several children, then you will receive a monthly transfer for all of them at once.

Which day this happens depends on the last digits of your Kindergeldnummer. On the website arbeitsagentur.de you will find exact information on which days you will receive benefits.

As a rule, for each child you will receive at least 219euro per month. If you have more than two children, then starting with the third, this amount will increase.

If you have more than two children, then starting with the third, this amount will increase.

You are currently entitled to 219 euros per month for your first and second child. For the third - already 225 euros. For four or more - 250 euros each (data from February 2022).

Important: You will not be able to receive Child Benefit (Kindergeld) for children who do not live with you. But when applying, you can list them as the so-called “Zählkinder”. When calculating the benefit, they will also be taken into account, which, in turn, will increase its total amount.

Case study: You have three children and only two of them live with you. The third, the oldest, lives with his other parent. You will not be able to receive benefits on it, but you can indicate it when applying. After that, your remaining two youngest children will be counted as a second and third child, which in turn will increase your total child benefit amount.

You can also receive child benefit (Kindergeld) retroactively. But only in the last 6 months. Therefore, it is very important to apply on time.

But only in the last 6 months. Therefore, it is very important to apply on time.

Yes. You must notify your family insurance fund (Familienkasse) immediately of any changes that may affect child support (Kindergeld). For example, if:

- you or the other parent took a job abroad,

- you, the other parent or your child moved abroad,

- your child receives any family allowance in another country,

- you separated or divorced your spouse or partner,

- the child no longer lives with you,

- you or the other parent got a job in the public service,

- you are moving,

- you have changed your bank account.

If you receive an allowance for a child who is already 18 years old, you will also need to inform your family fund (Familienkasse) about the following changes:

- your child got a job,

- your child has received a place in a new profession (Ausbildung) or entered a university,

- your child interrupted the development of a new specialty (Ausbildung) or university studies, or changed course/faculty/university,

- Your child is pregnant and is on maternity leave (Mutterschutz).

Please note: German law requires you to share important changes in your life with the family fund. If you do not, then you are committing an administrative offense, and in some cases even a crime.

The Family Insurance Fund (Familienkasse) regularly checks whether you still meet the conditions for child benefit (Kindergeld). For this, you receive a special questionnaire from her.

In it, for example, you can find questions such as:

- Are you still in Germany?

- Does your child still live with you?

- Is your child still in school or learning a new trade (Ausbildung)?

In addition, you will be asked to send some documents or confirmations from, for example, your child's school.

Please note: It is very important to respect the deadlines set by your family health insurance. If you respond late, your child support (Kindergeld) may be stopped. If you are unable to respond within the deadlines, ask your family benefit in advance for an extension.

If there are changes in your life, for example your child has completed a new occupation (Ausbildung), this may also affect the amount of the child benefit (Kindergeld). In this case, you will receive an "Aufhebungsbescheid" (cancellation notice) or an "Erstattungsbescheid" (refund notice).

If you have been overpaid by this time, you will need to pay that amount back. Your family fund (Familienkasse) will inform you about this and ask for the overpayment back. In this case, it will need to be paid at the Inkasso-Service of the federal employment agency.

If you have any questions about the "Aufhebungsbescheid" or "Erstattungsbescheid", you can ask your family fund. You can find it on arbeitsagentur.de with your postal code.

If you do not agree that you owe a portion of your benefits back, you can appeal the decision. This can be done in writing or orally on the spot at your family fund. Important: even if you dispute the decision of the department, you still need to return the required amount back without delay. If it is decided that this was not necessary, then you will later return this money. For more information on how to challenge a decision, see the “How can I challenge an agency decision?” section.

If it is decided that this was not necessary, then you will later return this money. For more information on how to challenge a decision, see the “How can I challenge an agency decision?” section.

If your child allowance (Kindergeld) is less than you expected, first find out the reason from your family fund (Familienkasse). This can be done in writing or orally on the spot in the department itself. You can find it on arbeitsagentur.de with your postal code.

If you do not agree with the decision of the family fund, you can appeal against it. This must be done within one month of receiving it. You can do this in writing or orally on the spot at the department itself. You will find information about who exactly you need to address the letter to in the decision that you received. You don't need to pay for this. For more information on how to challenge a decision, see the “How can I challenge an agency decision?” section.

If your protest is denied, you can challenge the decision in court. You also have exactly one month from the date of receipt of the refusal for this. Litigation costs money. At the same time, people with low income can receive special support to pay for it - Prozesskostenhilfe. Be sure to consult with experts on this issue. You can find them, for example, in the Youth Migration Service. Its employees speak different languages.

You also have exactly one month from the date of receipt of the refusal for this. Litigation costs money. At the same time, people with low income can receive special support to pay for it - Prozesskostenhilfe. Be sure to consult with experts on this issue. You can find them, for example, in the Youth Migration Service. Its employees speak different languages.

If your application for child benefit (Kindergeld) was rejected, first find out the reason from your family insurance fund (Familienkasse). This can be done in writing or orally on the spot in the department itself. You can find it on arbeitsagentur.de with your postal code.

If you do not agree with the decision of the family fund, you can appeal against it. This must be done within one month of receiving it. You can do this in writing or orally on the spot at the department itself. You will find information about who exactly you need to address the letter to in the decision that you received. You don't need to pay for this. For more information on how to challenge a decision, see the “How can I challenge an agency decision?” section.

For more information on how to challenge a decision, see the “How can I challenge an agency decision?” section.

If your protest is denied, you can challenge the decision in court. You also have exactly one month from the date of receipt of the refusal for this. Litigation costs money. At the same time, people with low income can receive special support to pay for it - Prozesskostenhilfe. Be sure to consult with experts on this issue. You can find them, for example, in the Youth Migration Service. Its employees speak different languages.

If you think that the family fund (Familienkasse) has made a mistake, you can appeal against its decision, pointing out that its assessment of your current situation was wrong. You have one month for this. The countdown begins three days after the date printed on the envelope in which you received the agency's decision. If the third day is a Saturday, Sunday or a holiday, then the countdown starts from the first working day. If you do not agree with the decision, you must inform your family benefit in writing by mail or fax. Or personally inform the department and ask to record your disagreement in the protocol.

Or personally inform the department and ask to record your disagreement in the protocol.

The letter must contain at least your name, surname and address, as well as the address of the family insurance fund responsible for you and the number of the decision (Aktenzeichen) you received. It is not necessary to indicate the reason why you want to appeal the agency's decision, but it is recommended. If you cannot find the reason within the time limit, you can provide it later. You can find a sample letter on the Kindergeld.org website. If you need help with its preparation, you can contact the Youth Migration Service.

Important : You do not need to pay for the fact that you decide to appeal the decision of the department. You also do not need to hire a lawyer.

The main rule is that anyone who does not pay taxes in Germany cannot receive child support (Kindergeld) in the country.

If you live abroad, you can only receive child support from Germany if you meet the following conditions:

- your tax liability in Germany is unlimited.

That is, you work abroad for a company or organization from Germany and pay taxes in Germany,

That is, you work abroad for a company or organization from Germany and pay taxes in Germany, - your children live in Germany or another EU country,

- you have German citizenship.

If you live abroad and your tax liability in Germany is limited, you can receive child support (Kindergeld) as state aid. To do this, you must meet one of the following conditions:

- you are insured by the federal employment agency (Bundesagentur für Arbeit).

- you work as an expert for developing countries (Entwicklungshelfer*in) or you are a missionary.

- you are employed or self-employed in Germany and receive a pension from Germany and you are an EU citizen and live in the EU.

Please note: may also mean that a child is eligible for benefits in more than one country. In this case, the state in which his parents work is responsible for him. Or the one in which the child lives. As a rule, in this case, only the responsible country pays the child benefit.

You can read more about this in German at arbeitsagentur.de.

Everyone who has income in Germany must pay taxes. To ensure that parents have enough money to support their children, there are special tax benefits for them. They can receive up to 8.388 euros per year (data from 02.2022), without paying taxes on this amount. This is the tax-free minimum for children (Kinderfreibetrag or also Erziehungs- oder Betreuungsfreibetrag).

Child benefit (Kindergeld) also serves this purpose. And it's also tax-free. The difference between it and the non-taxable minimum for children is that you receive the allowance monthly in your bank account, and the minimum is taken into account when filing a tax return. It will be deducted from your annual income, thus you will have to pay less taxes.

Important: You can either receive child support or have a tax-free minimum for children (Kinderfreibetrag). After you submit your tax return, the tax office (Finanzamt) will check which option is more beneficial for you. This will be done automatically, you do not need to ask the department about it. If your total child support amount exceeds the amount you can save with the child tax exemption, you will continue to receive benefits. Otherwise, the tax office will take into account in your declaration the non-taxable minimum for children.

This will be done automatically, you do not need to ask the department about it. If your total child support amount exceeds the amount you can save with the child tax exemption, you will continue to receive benefits. Otherwise, the tax office will take into account in your declaration the non-taxable minimum for children.

Please note: even if you are absolutely sure that the best option for you is the tax-free minimum for children (Kinderfreibetrag), you should still apply for child support (Kindergeld). When examining a tax return, the financial inspectorate always bears in mind that all parents in Germany receive child support and automatically take this amount into account in their calculations, regardless of whether this is true or not.

This tax credit can be used until the child is 18 years old. If your child is learning a new specialty (Ausbildung) or studying at the university - until he is 25 years old.

The “Kinderzuschlag” or KIZ for short is given to parents who earn enough to feed themselves but not enough to support their family members.

You can receive a maximum of 209 euros per child per month (data from 11.2022). How much you will receive depends on your personal situation. The more you earn, the lower the child allowance will be. Your child's income, such as alimony or orphan's pension, will also affect its amount.

In addition to the child allowance, you can also receive social assistance “Bildung und Teilhabe“. These are, for example, a free lunch for your child at school or kindergarten, or a supplement for the purchase of school supplies, etc. Recipients of the Kinderzuschlag child supplement are also exempt from paying kindergarten fees.

To receive the Kinderzuschlag child allowance, you must meet the following conditions:

- your child must be under the age of 25 and unmarried,

- you must receive child support (Kindergeld),

- You must earn at least €600 per month before taxes if you are a single parent and €900 per month before taxes if you are a couple.

You can find out if you qualify for the Kinderzuschlag child allowance with KiZ-Lotse.

The child supplement must be requested in writing from your Family Health Insurance Fund (Familienkasse). The application can be filled out online at arbeitsagentur.de.

The child allowance will be calculated together with the child allowance (Kindergeld). For more on this, see the section just above “How will I receive Child Benefit (Kindergeld)?”

Similar articles

Kindergarten

How much does a place in kindergarten cost? What to do if you do not have enough money for this? Can a child not be admitted to an institution? Answers[.