Family allowance how much per child

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

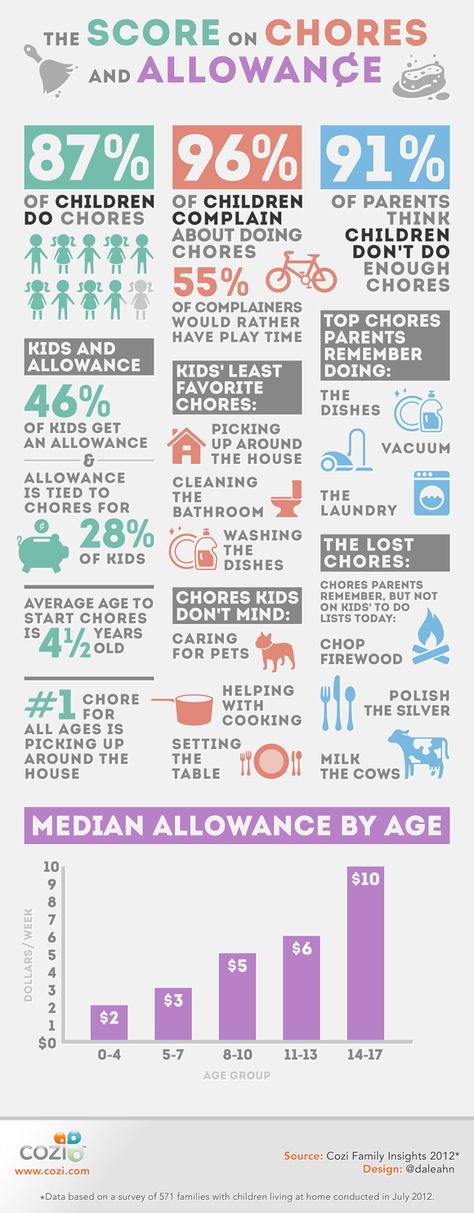

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

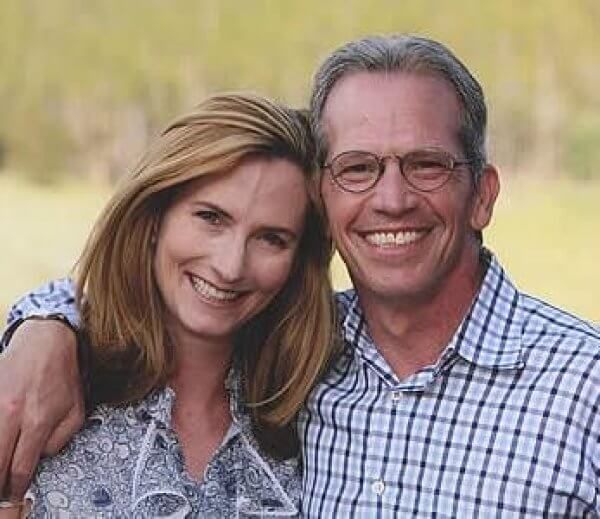

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Why the US is launching a $300 monthly child benefit

Published

Image source, Getty Images

By Lora Jones & Natalie Sherman

BBC News, New York

The US will start paying child benefits monthly for the first time - a seismic shift for the country that has some of the highest rates of child poverty in the developed world.

Monthly payments of up to $300 (£216) per child are due to start hitting Americans' bank accounts on 15 July, running until the end of the year.

Some Democrats have praised the newly-expanded tax credit, saying a monthly source of income is more reliable for families.

But anti-poverty advocates, who have pushed for a monthly benefit for years, hope introducing such a programme temporarily will lay the groundwork for longer-lasting change.

So how exactly does the tax credit work, and what impact is it expected to have?

How does the monthly credit work?

The update to the child tax credit is part of the American Rescue Plan, a $1.9tn economic relief package signed into law in March.

The bill increased the existing benefit for the 2021 tax year to a maximum of $3,600 per child under the age of six, or $3,000 for those up to the age of 17.

Under the expanded scheme, half of the credit will be paid directly to parents in monthly instalments of up to $300 per child.

From 15 July through to 15 December, deposits will be made monthly into accounts on file with the US's Internal Revenue Service (IRS). Cheques or debit cards may be issued in some instances.

The remaining amount can be claimed on 2021 tax returns, although families can choose to opt out of the monthly payments and receive one lump sum later instead.

The White House has said that about 90% of families will receive the benefit automatically, although eligibility and the amount paid out is dependent on income.

What was wrong with the old system?

Most developed countries, including the UK, have for decades offered some form of monthly child allowance to offset the costs of having children.

Image source, EPA

Image caption,One in six families with children reported lack of suficient food during the pandemic

But the US, where fears that social welfare programmes discourage work have a long political history, has relied on an annual tax credit to offset those expenses.

First introduced in 1997, how much money a family gets depends on how much a family makes - and therefore owes in tax - a design that critics say leaves out those who need it most.

Research has previously found that roughly a third of children - who are disproportionately poor, black or Hispanic - did not receive the full benefit. About 10% were completely ineligible - the vast majority because their families earned less than $2,500 a year.

About 10% were completely ineligible - the vast majority because their families earned less than $2,500 a year.

"There's just a lot of kids that don't get the credit," says Katherine Michelmore, a professor of public administration and international affairs at Syracuse University's Maxwell School, who has studied the issue.

Under the new (temporary) child tax credit, the poorest families with no and low incomes will qualify for the full amount this year, even if they don't typically file tax returns.

What impact could the changes have?

According to the Treasury Department and the IRS, the monthly payments will cover about 88% of children in the US.

Supporters on the left say expanding the benefit and making deposits more frequent could cut the child poverty rate - which was roughly 15% before the pandemic - by more than 40%, lifting four million children out of poverty.

Image source, The Boston Globe via Getty Images

They point to countries like Canada, where the introduction of a child benefit prompted poverty to drop in the first years of the programme.

James Sullivan, economics professor at the University of Notre Dame, said that families near the poverty line could see their income increase by more than 25% in the second half of the year.

"Such families tend to spend additional resources on necessities such as food, housing (i.e. paying back rent), and clothing," he said, adding that any additional income could also provide the cash to make a down payment on bigger-ticket items, such as cars, that may typically be out of reach.

US conservatives that put forward their own proposals for a monthly child allowance, such as Senator Mitt Romney, described it as a family-friendly policy - and defence against America's falling birth rate, which has hit a record low.

That is in part "because too many young adults think having and raising kids is too expensive", says Brad Wilcox, senior fellow at the Institute for Family Studies, pointing to rapid increases in child-related expenses like education.

Is it likely to be extended?

Lawmakers have periodically expanded the child tax credit in the past.

President Biden is keen to extend these latest changes through to 2025. On Thursday, he described them as a "reflection of my belief that the people who need a tax cut aren't those at the top.

"It's the folks in the middle, and the folks who are struggling," he wrote on Twitter.

Other Democrats would like to see them made permanent. Despite that, critics have pointed out that the changes are set to cost the government more than $110bn this year.

Experts have also warned that increased consumer spending could lead to higher prices in the shops.

"Given the massive amount of prior stimulus, coupled with an opening economy, I do expect a large amount of this to be spent," says Cedarville University economics professor Jeffrey Haymond.

"This may be a worthwhile social goal to help families with child expenses, but it should have been coupled with reductions in spending elsewhere as the economy is not currently in need of additional stimulus - what it needs is for workers to go back to work. "

"

To extend the changes for another four years, law-makers would need to pass the American Families Plan, which also includes investments in pre-school and recruiting more teachers.

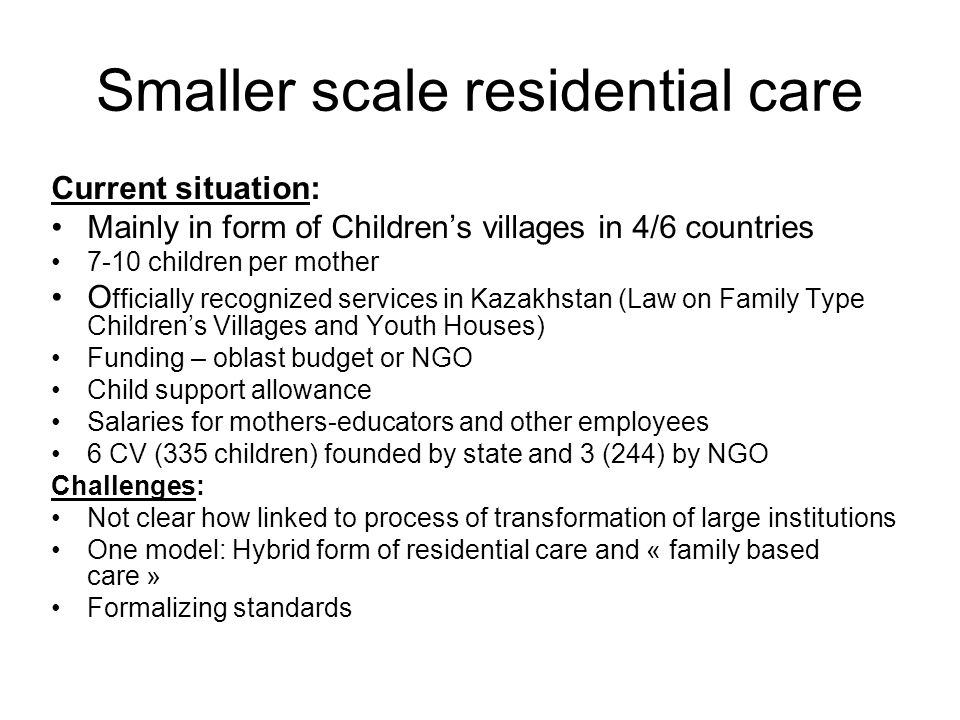

How does this compare globally?

Megan Curran, a research at Columbia University's Center on Poverty and Social Policy, says the monthly benefit brings the US in line with global norms.

Image source, Reuters

Image caption,President Joe Biden wants to cut the child poverty rate - which was about 15% in 2019 - in half

The UK, for example, offers monthly payments of as much as £84.60 for the first child, and £56 for those after, with benefits starting to phase out at incomes of £50,000.

In Canada, the allowance can be as high as C$563.75 (£321; $443) monthly for children under the age of six and up to C$475.66 (£271.27; $374.19) for children under 18, but start shrinking at incomes of C$30,000.

Other countries provide payments regardless of income, such as Ireland, where the monthly stipend is E140 (£122. 80; $169.30) per child.

80; $169.30) per child.

But Ms Curran cautions that the US, which routinely ranks near the bottom when it comes to family support policies, still lags behind in other ways, such as parental leave and childcare.

"The child allowance is not a silver bullet," she says. "It does a lot of the heavy lifting ... It can help meet the cost of children's needs and make sure that it smoothes some of these costs from month-to-month, but there are many other pieces of the puzzle that the US needs to address."

- US economy

- Child poverty

- US politics

- United States

Types of family benefits | Sotsiaalkindlustusamet

You are here

Home Children, families Applicants for family benefits Types of family benefits

If a child is born dead or die within 70 days

Parents have the right to birth benefit and parental compensation if the child is born dead or die in within 70 days.

Childbirth allowance

One of the parents is also entitled to childbirth allowance in case of stillbirth from the 22nd week of pregnancy. The allowance is one-time, in the amount of 320 euros. The right to receive childbirth allowance arises on the day the child is born.

Parental benefit

If the mother works and is entitled to compensation for temporary disability

From April 1, 2022, a working mother is entitled to maternity leave and parental benefit to the mother for 100 consecutive calendar days starting from the 22nd week of pregnancy if the child is stillborn or dies within 70 calendar days. During this period, the mother is covered by health insurance.

If a mother started exercising her right to mother's parental benefit before the child was stillborn, she is entitled to mother's parental benefit and maternity leave for a total of 100 calendar days. For example, if a mother took maternity leave 70 calendar days before the birth of a child and started exercising her right to parental compensation to the mother after the birth of the child. dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

dead, she is entitled to an additional 30 calendar days of maternity leave and parental benefit, for a total of 100 calendar days. If a mother took leave, for example, 30 calendar days before the birth, she is entitled to another 70 calendar days of maternity leave and parental compensation to the mother after the stillbirth of the child, for a total duration of 100 calendar days.

An exception is also made here for mothers who, by the day of the child's death, have already used the mother's parental benefit in the amount of more than 70 calendar days. In this case, the mother is entitled to the mother's parental benefit additionally within 30 consecutive calendar days from the day following the day of the child's death. This means that no matter how many days the mother managed to use the mother's parental benefit by the day of the child's death, 30 calendar days of parental leave and parental benefit are guaranteed from the day of the child's death.

If the child dies at the time when the mother has managed to start using the already distributed parental benefit, the mother is re-registered as a recipient of the mother's parental benefit.

If the mother is not working

From April 1, 2022, a non-working mother is entitled to receive mother's parental benefit within 30 consecutive calendar days from the day following the day of the child's death, i.e. parental benefit cannot be received distributed by day over a long period of time, but if desired, you must use all 30 days in a row. During this period, the mother is covered by health insurance.

Fathers

From April 1, 2022, the father is entitled to paternity leave and father's parental benefit for 30 consecutive calendar days after the death of the child, regardless of whether the father used the right to paternity leave and father's parental benefit before the estimated date of birth of the child or before the death of the child. Father's parental benefit cannot be received on a daily basis over a long period of time, but if desired, all 30 days in a row must be used. In the case of fathers, there is no difference between granting and paying parental benefit, regardless of whether the father is working or not.

In order to receive family benefits, parents do not need to contact us and apply themselves. The Department of Social Insurance automatically obtains stillbirth information by exchanging data between the health information system and the social protection information system so that it is also possible to proactively offer family benefits to bereaved parents.

Additional parental paternity benefit is a type of benefit paid to fathers to enable them to take a greater part in the upbringing of their children. For working fathers, this is also accompanied by a 30-day leave from the employer.

For how long is compensation paid and for how long should it be scheduled?

You can receive additional parental benefit for a father for a total of 30 days, and not necessarily in a row (that is, the benefit can be received in installments). Supplemental parental benefit to the father can be received both during the period when the mother receives the parental allowance or the birth allowance (30 days before the expected date of birth of the child), and later.

The father is entitled to additional parental benefit until the child reaches the age of 3 or until the father receives regular parental benefit. Paternity leave cannot be separated from the receipt of compensation. If the father wishes to receive regular parental benefit without receiving additional parental benefit but does not notify us of the waiver of paternity leave, the Social Insurance Board will not be able to grant parental benefit until the father confirms his wish to waive paternity leave or use his. To fully waive paternity leave, you must submit an application to us.

Employment during paternity leave

While on paternity leave, the father must take a break from work at all his employers. The period of vacation use is entered in the Employment Register. During paternity leave, the father should not work and receive income! The principle of regular parental benefit does not apply, so the amount of parental benefit is not reduced when a maximum of half of the compensation has been received.

In accordance with the Law on Employment Contracts, an employer may refuse to grant leave if the notice of the desire to receive it is less than 14 days and for a period of less than 7 calendar days. Supplementary parental benefit to the father within the meaning of the Employment Contracts Act is a normal rest period, therefore, being on paternity leave does not adversely affect the calculation of annual leave and these days are considered working days when determining annual leave. Like being on vacation, parental leave does not reduce seniority.

Non-working fathers (including also self-employed persons (FIE) or representatives of the so-called liberal professions (e.g. notaries, bailiffs, sworn translators, auditors, bankrupt bailiffs), as well as persons working on the basis of a contract assignments and work contracts, etc. under the law of obligations, or members of the governing body of a legal entity) also receive additional parental benefit to the father for 30 calendar days. It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

It can be used at any appropriate time from 30 days before the child's due date until the child reaches 3 years of age. The father can decide for himself whether he wants to receive the compensation in full at one time or in installments.

How to apply?

Be sure to talk to your child's mother and, if you have an employment relationship, also to your employer before applying. It must be borne in mind that the employer may refuse to grant a vacation of less than 7 days if you notify him less than 14 days in advance. If the employer agrees, there are no restrictions on our part - you can go on vacation from any day.

The application for additional parental benefit is made through the self-service environment. If you wish to take advantage of the leave until the birth of the child, you must indicate the personal code of the child's mother and the expected date of his birth. After the baby is born, you will find a pre-filled offer in the self-service environment. If you are unable to use the self-service environment, please contact us at [email protected].

If you are registered in the Employment Register as a person with a valid employment relationship, you will need to provide your employer's email address. You should also include the email address of the mother of the child. The self-service system will send them a notice of your leave application and put it on hold for 5 days. You don't need to do anything else.

The employer and the child's mother have 5 working days to tell us if they disagree with your leave application. If your employer or the child's mother does not submit their objections, the system will automatically enter a leave note in the Employment Register after 5 working days.

We will calculate the amount of your compensation and pay it to you at the beginning of the next month (the payout date is the 8th of each month).

How is paternity leave calculated?

Additional parental benefit to the father is calculated according to the same rules as regular parental benefit.

To calculate the benefit, we first subtract the 9 full calendar months prior to the birth of the child (i. e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

e. the average length of pregnancy, whether the child was born on time, premature or postterm) and calculate the parental benefit based on income for the previous 12 calendar months. If the father takes a vacation in installments over several months, the average income for those calendar months is divided by the number of days in the month and then multiplied by the number of days the benefit is received.

The amount of compensation depends on the amount of social tax paid on the income received. Since the income is calculated based on the social tax paid during the 12 months of the reporting period, the amount based on the reporting period may differ from the exact income received at that time, so it is worth paying attention to the social tax paid during this period. You can read more about how parental benefits are calculated here. You can also use the parental benefit calculator (informative).

The minimum rate of parental benefit is the minimum wage rate of the previous calendar year in effect on 1 January (584 euros in 2022). The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

The maximum amount of parental benefit is three times the average salary in Estonia calculated on the basis of the law for the previous year (4043.07 euros in 2022).

Example 1: During the period taken as the basis for the calculation, the father earned 1,500 euros per month. He went on paternity leave from January 14, 2021 to February 13, 2021, thus being on paternity leave for 30 consecutive days. Consequently, he was on parental leave for 17 days in January and 13 days in February. In January, the amount of his additional parental benefit amounted to (1500/31×17) 822.58 euros, in February - (1500/28×13) 696.43 euros.

Example 2: During the period taken as the basis for the calculation, the father earned 1200 euros per month. He took one week of paternity leave in January 2021, two weeks in February and the remaining 9 days in March. Thus, the amount of his additional parental benefit amounted to (1200/31×7) 270.97 euros in January, (1200/28×14) 600 euros in February and (1200/31×9) 348. 39 euros in March .

39 euros in March .

Other things to remember:

If several children were born in a family after 1 July 2020 at short intervals, then the right to 30 days of paternity leave and / or additional parental benefit to the father arises in connection with each child. Compensation / leave for each child should be used at different times - leave cannot be received at one time for all children, nor can multiple compensation be received in one period.

Twins are subject to one period, regardless of the number of twins.

If the family wants the father to receive both regular parental allowance and additional parental benefit to the father in succession, the first 30 days are always considered to be the period of additional parental benefit to the father. The father can start receiving regular parental allowance from the day when the child is at least 70 days old and the mother's maternity sheet is closed.

If you are on sick leave, it is recommended that you interrupt your paternity leave by notifying the Social Insurance Board as soon as possible. If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

If you interrupt your paternity leave, the unused days are kept by you and can be used after your sick leave is closed.

Starting on September 1, 2019 no longer assigned a child care fee

- due to children who were born on September 1, 2019, , , child care fee is no longer charged for a newborn baby or any other child growing up in the family . The state will gradually link the available funds with the new parental benefit system in the period 2020-2022.

- For all families where a child is born no later than August 31, 2019, we assign and pay a child care fee on the previous basis.

- Also for those who have already been assigned a childcare allowance as of August 31, 2019, we will continue to pay benefits .

We will continue paying the child care allowance until it ends, but no later than August 31, 2024.

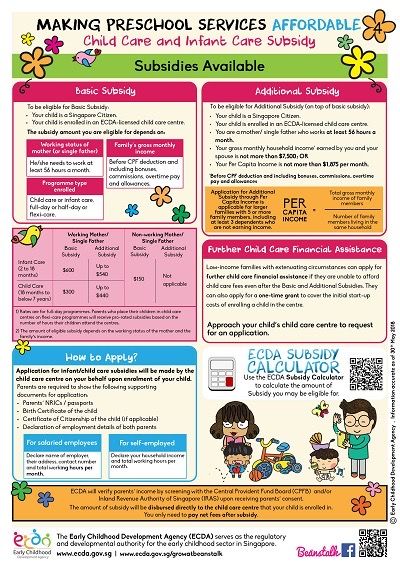

At the same time, only one parent in the family is entitled to child care allowance (after the end of receiving parental benefit), if the family grows:

- child under 3 years old – EUR 38.36 per month for each child under 3 years old.

In addition, we pay a lower childcare allowance for children aged 3 to 8 if:

- from 3 to 8 years - 19.18 euros per month also for a child aged 3 to 8 years;

- There are 3 or more children in the family receiving child benefit – EUR 19.18 per month for each child aged 3 to 8 years.

If your child turns 8 in first grade, we will pay child care until the end of first grade, which is August 31st. If the child turns 8 in the second grade, or if the child is not in school, we will pay Child Care Allowance until the end of the month in which the child's birthday is.

Being on parental leave and receiving childcare allowance may be someone else instead of the child's parent. However, there is a rule that the amount of child care allowance paid to such a person cannot exceed 115.08 euros per month in total.

Example . The family has three children: aged 2 years, 3 years and 6 years. For a 2-year-old child, a child care allowance is paid in the amount of 38.36 euros per month. For a 3- and 6-year-old child, child care allowance is paid under the condition that in a family with three or more children, all children under the age of 8 will receive child care allowance. The amount of the child care allowance paid for both a 3-year-old and a 6-year-old child is 19,18 euros per child.

In total, the child care allowance is paid to the family in the amount of 38.36 + 19.18 + 19.18 = 76.72 euros per month.

In addition, such a family is paid a child allowance for each child, which is 60 euros for the first and second child, and 100 euros for the third child, for a total of 220 euros per month. Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

Thus, the family receives child allowance and child care allowance totaling 296.72 euros per month .

The right to receive child care allowance arises after the end of receipt of parental benefit . However, we still recommend that you apply for child care allowance or agree to receive it as soon as you submit your initial application for family benefits. In this way, after the end of the payment of the parental benefit, we will be able to immediately begin the payment of the child care allowance.

However, keep in mind that if one of the parents leaves his job for parental leave, he is also entitled to the childcare allowance. Parental leave can be obtained from the employer.

The state pays social tax for the recipient of the child care allowance, and thus health insurance is provided by the state to the parent to whom we pay the child care allowance! You can read more about health insurance HERE.

Parental benefit and child care allowance are not paid simultaneously to the same family. This means that if we pay parental benefit for one child, during this period we suspend the payment of childcare allowance for all children growing up in the family.

This means that if we pay parental benefit for one child, during this period we suspend the payment of childcare allowance for all children growing up in the family.

Also, for the time you are already receiving maternity benefit or adoption allowance, we will not pay child care allowance for that child. Child care benefits received for other children are not affected by these benefits.

Summary of family allowances | Sotsiaalkindlustusamet

You are here

0005

After the birth of a child

Registration of the birth of a child

The birth of a child must be registered with the local government of the place of residence within the first month of the child's life. For good reason, the period for registering a birth may be extended up to two months.

The birth of a child can be registered in the population register.

For more information on registering a child's birth, please visit the Birth Registration and Name Selection page of the State Portal.

Birth allowance from the local government

Local governments pay new “citizens of the world” a childbirth allowance, either in one lump sum or divided into several installments. In order to receive benefits from a local government at the birth of a child, it is generally a prerequisite that at least one of the parents must be registered in the same local government before the birth of the child for a minimum period of six months to a year.

Each local government has its own conditions for the payment of the allowance and its amount. To learn more about the conditions, please contact the local government in your place of residence.

Childbirth allowance

Childbirth allowance is a one-time allowance provided by the state for each child. You can read more here.

You can apply in the self-service environment of the Social Insurance Board

Child allowance

We pay child allowance for each child from the moment of his birth until he reaches the age of 16. After your child turns 16, we will pay you child support if the child is in school.

After your child turns 16, we will pay you child support if the child is in school.

Read more here.

You can apply for the self-service environment of the Social Insurance Board

Child care allowance

One of the parents is entitled to receive child care allowance if the family has a child under the age of three or several children aged three to eight years old.

Read more here.

You can apply in the self-service environment of the Social Insurance Board

Parental benefit

We pay parental benefit in order to maintain your previous income, as it decreases due to raising children. Until the child reaches 70 days of age, the mother of the child is entitled to parental benefit. After the child reaches the age of 70 days, one of the parents who is on parental leave is entitled to compensation - the child's father can also apply for compensation. We pay parental allowance for 435 days or until the child reaches one and a half years of age.

Read more here.

You can apply in the self-service environment of the Social Insurance Board

Together with parental allowance, we pay the difference between parental benefit and maternity benefit if your previous child is less than two years and six months old, and the amount of maternity benefit for one day less than the amount of parental allowance for one day.

Read more here.

Paternity leave

Find out more about the father's additional parental allowance

Allowance for triplets or more children born at the same time

Starting from 01.03.2018, one of the parents, a parent in a foster family or a guardian is entitled to receive the allowance for the birth of triplets or more children raising triplets or more children born at the same time. The right to receive benefits is available until the day the children reach the age of 18 months. The allowance is 1000 euros per month. You do not need to apply separately for the allowance for the birth of triplets or more children.