Why should expectant parents make a budget

Creating a family budget | Pregnancy Birth and Baby

Creating a family budget can help you take control of your finances and spend less time worrying about money. This information will guide you through the steps.

Benefits of creating a family budget

A family budget is a plan to remind you how much you can spend on items over a period of time. It can cover both your regular spending, such as food or utility bills, as well as larger items, such as a family holiday.

By examining how much money you have coming in (income) and going out (expenses), you’ll be able to see if you are spending more than you can afford. This could help you make changes that will let you save for the things you need in the future and be better prepared for an unexpected emergency.

A budget can help you balance your spending and saving and avoid having to live from week to week. It will also help you sort out your financial goals and make it harder to overspend. Whether you’re a single parent, living off one or 2 incomes, or relying on Centrelink benefits, a budget can help you.

If you’re having a baby or young children, your spending will need to increase, and you may find you or your partner need to take time off work. Working out your budget beforehand can make it less likely that you go into debt and ensure you have enough for the things your family needs.

How to get a budget started

First, work out exactly how much money you have coming in and going out. You’ll need bank and credit card statements, pay slips, benefit statements, bills, or anything else that records how you currently use your money.

Look at the entire year because some things, like electricity, are more expensive at some times than at others.

To get you started, you could download an online planner like ASIC’s Moneysmart Budget Planner. Many banks also offer online budget planners to their customers.

What to include in a budget

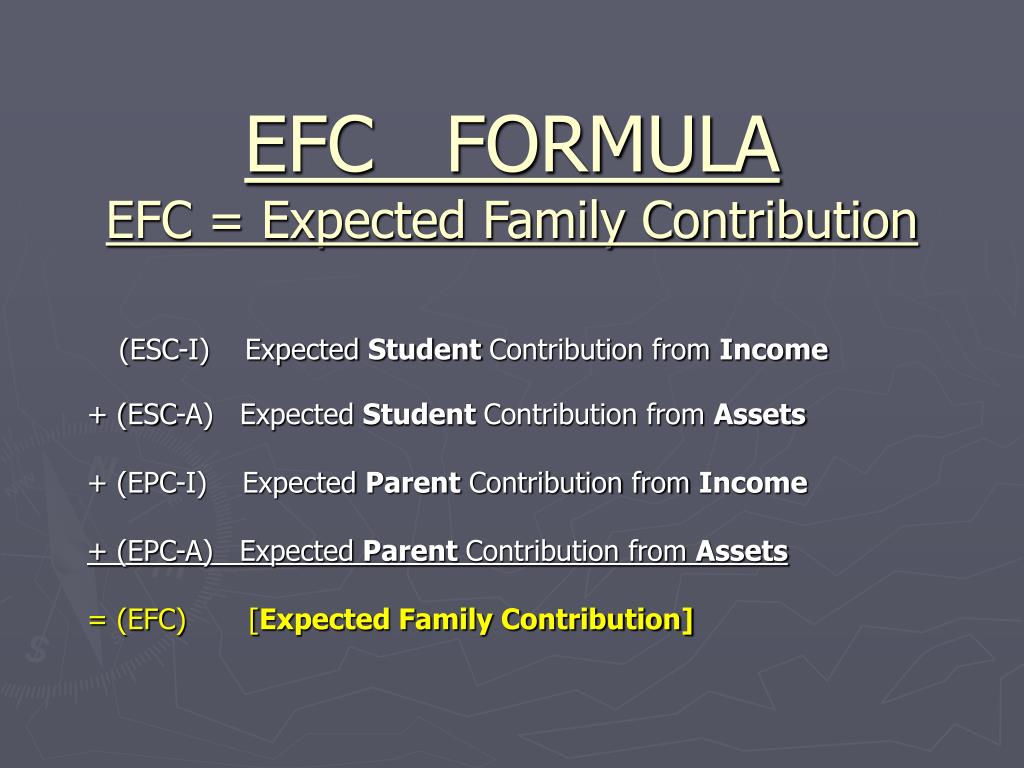

To work out your family budget you should think about your entire income, including take-home pay, overtime, bonuses, income from savings or investments, Centrelink benefits and any other money you have coming in.

Then work out how much you spend, including:

Spending on your home: Mortgage or rent, gas, electricity, water, rates, maintenance, internet, phones and pay TV.

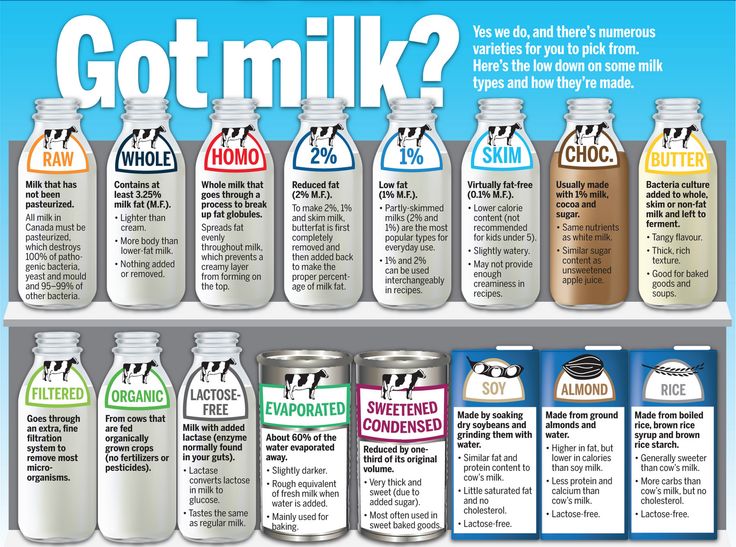

Groceries: Everything you spend at the supermarket or other food shops.

Insurance and financial payments: Car, home and contents, life, income protection, pet and car insurance. Also include payments on your car loan, any other loans or debts, credit card interest, and charity donations.

Medical costs: Medicines, doctors’ bills, pharmacy costs, glasses and health fund premiums, as well as veterinary bills. If you are having a baby, think about extra costs like private hospital, specialist fees and medical imaging.

Personal costs: Everything you spend on personal care and grooming, clothing, hobbies, computers, the gym and education.

Entertainment: Include money for eating out, going to the movies, holidays, buying gifts, books and magazines, and alcohol.

Transport: Train, bus or ferry, petrol, tolls, car registration, driver’s licence, fines, car repairs.

Children: Baby products, clothes, babysitting, childcare, preschool, children’s activities.

How to manage your budget

Now you know how much you are spending on each item, you can work out how much money you need each week.

If you spend more than you earn, it will now be easier for you to find areas where you can reduce your spending. If you are already spending less than you earn, you can start to think about a savings plan and developing some longer term goals for your money. This could include things that you want, but don’t necessarily need.

However, it’s a good idea to build a ‘buffer’ into the budget so there is always some money in an emergency.

Sticking to a family budget isn’t always easy. But if you work out where you can make savings – and how much you are willing to save – you will be in a much better position to set long term goals for your family.

Resources and support

If you have young children, you may be eligible for a range of government subsidies and benefits including Family Tax Benefit Part A, Family Tax Benefit Part B, parental leave, a Childcare Subsidy, Medicare and dental benefits for your children.

You can also get financial support if you are a teenage parent or live in a rural area. The Services Australia helps you calculate any benefits you might be entitled to.

There is plenty of advice available too. Speak to your bank about opening a fee-free bank account for savings, consider using a free Commonwealth financial counsellor, or speak to a private financial advisor.

ASIC’s Moneysmart website has plenty of tips on managing your money, and you can download their TrackMySPEND App to keep on top of your spending.

The Services Australia has a Financial Information Service to help you make decisions about your money.

Learn more here about the development and quality assurance of healthdirect content.

Financial Steps for Expecting and New Parents

Last Updated:

9/19/2022

Advertising & Editorial Disclosure

By

Jessica Sillers

|

quality verifiedQuality Verified

On This Page

Nothing changes your life like a new baby. You might be feeling all kinds of emotions, from excitement and joy to nervousness or even full-fledged anxiety. If you’ve lain in bed wondering, “Will I raise a good kid? Am I ready for this? I haven’t even decided between purees and baby-led weaning!” you’re not alone.

Not to mention the big question on many expectant parents’ minds: “How much money should I have saved before having a baby?”

While the U.S. Department of Agriculture projects that a middle-income family will spend an average of $233,610 raising a child from birth to age 17, don’t let this six-figure price tag send you into a panic. The real truth is that preparing financially for a baby takes some planning, but you’ve got time before and after your baby arrives to ease the financial transition into parenthood and prepare for the cost of having a baby.

The real truth is that preparing financially for a baby takes some planning, but you’ve got time before and after your baby arrives to ease the financial transition into parenthood and prepare for the cost of having a baby.

Financial Goals Before Your Baby Arrives

The first few days, weeks and months with a new baby in the house are a wonderful whirlwind, so if you take time now to make and meet some financial goals, the fewer things you’ll have to worry about when you’re busy changing diapers and waking up for 2:00 a.m. feedings. The following checklist can help you get started.

Understand Your Health Insurance

Even a birth experience with minimal medical intervention still requires some degree of professional healthcare.

COSTS OF HAVING A BABY WITHOUT INSURANCE

Birth Type

Cost If No Insurance

Vaginal birth, minimal intervention

$12,290

C-section, no complications

$16,907

Source: Fair Health

Fortunately, Under the Affordable Care Act (ACA), maternity care and childbirth are considered essential health benefits. That means ACA health insurance providers can’t refuse you coverage because you’re pregnant.

That means ACA health insurance providers can’t refuse you coverage because you’re pregnant.

Still, not all coverage is equal. Even with insurance, you could still end up owing thousands of dollars for prenatal care and delivery. On the plus side, some insurance plans cover additional services you might not expect, such as lactation consultant visits.

Now is the time to check with your health insurance provider to get answers to the following questions:

- What are my copays for prenatal visits and other services?

- What is covered under my policy’s prenatal care?

- What is my deductible?

- How is my deductible applied?

- Does my plan cover a hospital or NICU stay?

- Does my policy cover additional providers at the hospital, such as the anesthesiologist on staff?

- Does my policy cover a home birth or midwife services?

- Does my plan cover services such as a doula or lactation consultant?

- How do I add my baby to my health insurance plan?

- Does my policy cover equipment such as breast pumps?

- What breast pumps does my insurance plan offer? How do I get one?

- Does my plan cover chiropractic services, acupuncture or prenatal massage? Do I need any documentation (like a note from my OB-GYN) to get coverage for these services?

- What mental health services do you cover? Can you send me a list of mental health professionals in my area that accept this insurance?

If your hospital bill comes back higher than you expected, keep in mind that you have the right to request an itemized bill so you can check each expense. You can also dispute any charges you disagree with.

You can also dispute any charges you disagree with.

If your budget allows, try to put some money aside for health services you want that your insurance might not cover, such as a doula or birth coach, which can cost $800 to $2,500 (depending on region and experience), or prenatal massage, which can cost $75 to $100 per session.

Pay Down Debt

Americans aged 18–34 carry an average of $36,000 in debt and dedicate 34% of their monthly income to paying down this debt. These millennials report that their greatest source of debt comes from education loans credit card bills. Chances are good that if you’re having a baby, finances and debt weigh on your mind.

If you’re in a position to pay down some or all of your debt before the baby comes, great! You’ll know you’re on the right track if:

- You don’t need to drain savings to pay debt (being ready to cover an emergency is more important)

- You’re not taking on debt to pay other debt (e.g., paying utility bills late while you try to lower a credit card balance)

- You put your family’s basic needs (food, heat, rent, medical care) above debt payments

Whether or not you’re aiming to pay down your credit card or other debt, pay at least the minimum balance on time each billing period to avoid harming your credit. Then figure out how much you need to save to support a baby financially. A simple rule of thumb is to determine your budget for baby supplies, add the amount you need to cover any maternity or paternity leave, and divide that figure by the number of months until the baby arrives. From there, look at how much is left each month to pay down debt faster.

Then figure out how much you need to save to support a baby financially. A simple rule of thumb is to determine your budget for baby supplies, add the amount you need to cover any maternity or paternity leave, and divide that figure by the number of months until the baby arrives. From there, look at how much is left each month to pay down debt faster.

Build Emergency Savings

Setting up a general emergency savings fund is a solid way to ensure you’ve got a financial safety net to protect your family against unexpected expenses. Most financial professionals’ rule of thumb is that an emergency fund should cover three to six months’ worth of living expenses. If that’s not realistic, try to aim for a minimum of $1,200. That’s the median unexpected medical expense Americans faced in 2017.

Shop for a Life Insurance Policy

While it’s probably the last thing you want to think about as you prepare to welcome a new baby, if you haven’t thought about life insurance up until this point, now is definitely the time to start.

Term life insurance exists to protect your loved ones against the loss of your income if you die. Typically, insurance providers calculate your “human life value” as a multiple of your salary and years you have left to work (or a percentage of what your partner earns if you stay at home). The human life value can act as a guide to find the right level of coverage to replace your financial contribution to your family. Premium costs depend on your age, health and lifestyle, but some of the cheapest term life insurance policies are available for only a few hundred dollars per year.

Make a Parental Leave Plan

Some employers may provide paid or partially paid parental leave, but they are not required to do so by law. If you’ve worked at least 1,250 hours for your employer, held your position for at least 12 months and your company has at least 50 employees, you’re eligible for a leave of absence from your job for designated family and medical reasons through the Family and Medical Leave Act(FMLA).

The FMLA entitles you to up to 12 weeks of unpaid leave with continuation of group health insurance coverage. Upon your return to work after you’ve taken FMLA leave, your employer is required to return you to the same or an equivalent job position.

Not all expectant parents qualify for FMLA, and that’s why it’s important to discuss it with your employer well in advance of your baby’s arrival. You may even wish to negotiate for extra time if you feel comfortable doing so. If your job doesn’t fall under FMLA guidelines, you may need to explore a combination of sick days, vacation days or disability insurance offerings to provide income while you take time away from work to welcome the newest member to the family.

Update Your Household Budget

Your budget for baby supplies depends a lot on your taste, baby’s needs, how much you have to spend and how much loot you’ll receive as gifts from family and friends. If this is your first time with a new little one, you need to know a little secret: Babies don’t need much to be happy. A clean bottom, a full belly and lots of cuddles usually do the trick. Consider the following when determining how to financially plan for a baby in your regular budget.

A clean bottom, a full belly and lots of cuddles usually do the trick. Consider the following when determining how to financially plan for a baby in your regular budget.

Disposable diapers cost an average of about $0.24 each. A newborn can easily go through 10 diapers a day. Plan on spending around $60-$80 per month on diapers and wipes, depending on the brand you use. For cloth diapering, budget about $100 per month for a delivery service, or a total cost of around $450 to purchase and wash reusable diapers yourself for baby’s first year.

Formula will cost about $100–125 per month if you use it full-time, and specialized formula can cost even more. Breastfeeding is theoretically free, although many parents purchase nursing clothing, pillows, nipple cream and pumping supplies.

Clothes and toys can basically be as expensive or as cheap as you want, depending on your preference for used versus new items. You’ll most likely receive some of these items as gifts, so resist the urge to go overboard with buying these items until after the baby is born. If you use a baby registry, consider registering for big-ticket items such as car seats and strollers.

If you use a baby registry, consider registering for big-ticket items such as car seats and strollers.

Think Ahead for Child Care

In 2019, 70% of parents paid more for child care than the government’s “affordable” threshold. For most families, the biggest new cost in the budget is child care (or the income adjustment of having a parent opt to stay home). Finding quality care and making ends meet is a serious challenge families face.

If you anticipate needing child care beyond what family members can provide, you should start researching options as soon as you see a positive pregnancy test or make arrangements for adoption. Daycare centers can fill up or keep a long waiting list, so acting early is always a good idea.

Families that can’t afford sky-high daycare fees often turn to a mix of family and alternative care arrangements. Grandparents are a popular source of care, with 38% of grandparents taking on a babysitter/daycare role. Home-based care centers often charge less than a commercial daycare. Some families also use a “nanny share” system, splitting costs (and care schedules) with another family.

Some families also use a “nanny share” system, splitting costs (and care schedules) with another family.

Expert Advice On Financial Planning for Expectant Parents

Andrea Woroch is a mom of two little ones (ages 3 and 1) and a nationally recognized family finance expert, writer and frequent on-air contributor to hundreds of shows across the country, including “Today,” “Good Morning America,” “Dr. Oz,” “CNN,” “Inside Edition” and “ABC World News.” Her advice and articles have appeared in the New York Times, USA Today, Money, Cosmopolitan, Redbook, Forbes, Yahoo! and many more.

Here are Andrea’s three top money moves new parents should make when welcoming a new baby.

Financial Steps After Your Baby Arrives

Congratulations on your new arrival! You’re probably feeling sleep-deprived, flooded with love for your newest family member and a little overwhelmed. You’ve got some important tasks to do to welcome your baby into the world. Take them step by step, and you’ll be back to cuddling before you know it. Here are some additional financial things to do when you have a baby.

Here are some additional financial things to do when you have a baby.

Prepare Your Baby’s Paperwork

You should receive a birth certificate form to complete at the hospital. Make sure you give it to the nurse before discharge to avoid administrative headaches and possible late fees. If you have a home birth, your midwife or birth attendant may have the forms for you. If not, ask your pediatrician when you bring your newborn in for an exam in the first few days after birth

You can apply for your baby’s Social Security number in the hospital, too. If you forget, you’ll need to wait until you receive the birth certificate so you can prove your child’s age. A Social Security number is essential to claim a tax credit for your baby, open a bank account for your child, or apply for government services.

Planning to visit relatives outside the U.S. to introduce the newest member of the family? Your newborn needs a passport. Passports take up to 6 weeks to process, and you’ll need the birth certificate to apply. Allow yourself time before your trip, or be ready to pay to expedite birth certificate and passport processing.

Allow yourself time before your trip, or be ready to pay to expedite birth certificate and passport processing.

Add Your Child to Your Health Insurance Plan

You typically have only 30 days after your child’s birth to add him or her to the plan, or you’ll forfeit coverage. The same generally holds true when you add a child to your family via adoption. You can backdate the coverage to include your child’s birth, so the hospital stay and all eligible care received by baby should be covered. It’s important to check with your health insurance plan and make sure you understand what you need to do and when to ensure your child has health insurance from day one.

Set Up a College Fund

You may hesitate thinking about sending your baby off to college when he hasn’t even learned to roll over yet, but preparing for college early gives investments more time to grow. There are two main tax-advantaged education savings accounts: The Coverdell Education Savings account and the 529 plan. A Coverdell Education Savings account limits contributions to $2,000 per year. A 529 plan, on the other hand, typically has a six-figure annual contribution limit (each state sets its own plan’s limit).

A Coverdell Education Savings account limits contributions to $2,000 per year. A 529 plan, on the other hand, typically has a six-figure annual contribution limit (each state sets its own plan’s limit).

For a while, the advantage of a Coverdell account was the ability to use funds for early education, while the 529 plans only covered qualified higher education expenses. Recent laws have expanded how you can use 529 funds to include elementary, middle, and high school tuition as well as college. The Secure Act, which was passed by Congress in December 2019, also expanded eligible expenses to include apprenticeships and up to $10,000 of student loans. For any questions regarding college funds, always speak to your tax advisor for the final word on which plan is best for your family.

If your finances are stretched to the limit, this is one of the better plans to put on hold if you need to. You still have time to save for college if you start when your child is 2 or 3. Building an emergency fund can take priority over college savings.

When you’re ready to open a college fund, the easiest way to get started is to research your state’s 529 plan to learn how options work (each state except Wyoming has its own). You’re not required to open an account with your state’s plan, but many plans offer advantages for in-state residents. The best way to get started with a Coverdell account is to compare plan providers for options and fees.

Review and Update Your Beneficiaries

A beneficiary is someone who will inherit or receive something from you, most commonly a financial account or payout. Your life insurance and retirement accounts are common examples of financial accounts that require beneficiaries, and some people designate beneficiaries to inherit bank accounts or other assets as well. You may already have your spouse listed as a beneficiary, but it might also make sense to add your child as a contingent beneficiary or co-beneficiary. Again, it’s a good idea to talk with a qualified financial planner or attorney when it comes to setting up your estate.

Make a Plan for Returning to Work

Working versus staying home doesn’t determine whether you’re a “good” parent. We all want the best for our kids, and that often means facing tough decisions about household income, career advancement, and available time for family.

Adjusting work schedules can be one solution to minimize child care needs. Here’s an example: If you and your partner work 4-day weeks, with one of you home on Mondays and the other on Fridays, you can reduce your need for child care. You can also adjust daily schedules to work from 7:00 a.m. to 3:00 p.m. and 10:00 a.m. to 6:00 p.m. With a schedule like this, one parent can handle morning drop-offs to daycare and the other can handle pick-ups.

Telecommuting for part of your workweek is another viable option to explore with your employer. Remote work rates grew 159% between 2005 and 2017.

Staying on Track Financially as a Family

Financially preparing for a baby has several steps, and the cost of having a baby varies depending on your own personal situation. Look to your little one for inspiration on how to tackle pregnancy and baby finances. She’ll meet her developmental milestones one step at a time, and you’ll meet your financial milestones the same way.

Look to your little one for inspiration on how to tackle pregnancy and baby finances. She’ll meet her developmental milestones one step at a time, and you’ll meet your financial milestones the same way.

Start by identifying your top to-do items, such as:

- Arrange health insurance coverage

- Talk to your employer about family leave options

- Find qualified daycare in budget

- Write a will

- Build an emergency fund

- Reduce or eliminate debt

- Research or purchase a life insurance policy

- Update family budget

Still feeling unsure where to begin? Some pre-baby musts, like health insurance or maternity leave plans, should probably come before long-term priorities like opening a college fund. Once that’s handled, tackle the next step.

As your baby grows, take some time for you and your partner to reflect. How do you feel as new parents? Are you on the same page with bills and savings goals? Checking in even once a month can help you adjust your budget and plan the next steps. Before long, you’ll be in the swing of your “new normal” routine, building a secure home and financial foundation for your new family.

Before long, you’ll be in the swing of your “new normal” routine, building a secure home and financial foundation for your new family.

About the Author

sources

- AARP. "2018 Grandparents Today National Survey." Accessed January 30, 2020.

- Care.com Editorial Staff. "This Is How Much Child Care Costs in 2019." Accessed January 30, 2020.

- Federal Reserve. "Dealing With Unexpected Expenses." Accessed January 29, 2020.

- FindLaw. "FMLA Eligibility." Accessed January 29, 2020.

- Flexjobs and Global Workplace Analytics. "The 2017 State of Telecommuting in the U.S. Employee Workforce." Accessed February 6, 2020.

- Healthcare.gov. "Health Coverage If You’re Pregnant or Plan to Get Pregnant." Accessed January 29, 2020.

- Northwestern Mutual. "Among Generations, Millennials Have The Strongest Instinct To Plan Yet Feel The Most Anxious And Insecure They'll Get It Right." Accessed February 9, 2020.

- Office of the Surgeon General. "Breastfeeding: Surgeon General’s Call to Action Fact Sheet.

" Accessed February 6, 2020.

" Accessed February 6, 2020. - Real Diaper Association. "Diaper Facts." Accessed January 29, 2020.

- U.S. Department of Agriculture. "The Cost of Raising a Child." Accessed January 29, 2020.

- What to Expect. "What Is a Doula and Should You Hire One for Your Baby’s Birth?." Accessed January 29, 2020.

5 ways not to live paycheck to paycheck — Work.ua

Living paycheck to paycheck is a bad habit. To no longer face a lack of finances and a feeling of dissatisfaction, use the advice of our expert.

Financial consultant Lyudmila Veremeenko revealed to Work.ua 5 effective ways to finally break the vicious circle and stop living on one salary.

Lyudmila Veremeenko

financial advisor from OKA Credit

What does it mean to "live paycheck to paycheck"

Paychecks have two bad qualities - they run out very quickly and the money you receive is never enough.

Living paycheck to paycheck is a misguided financial strategy that has affected at least half of the country's population.

It is almost impossible to focus on long-term goals when pressing financial needs hit the pocket. Such a life makes peace of mind an elusive goal.

The main problem here is the discrepancy between a person's income and expenses. Very often, people have no idea what they are actually spending money on, and it is too easy to spend money that should have been saved. Even worse, many end up accumulating large debts solely to maintain their current lifestyle.

Until you start paying attention to where the money is spent, this cycle will never end. Here are some signs that you are living paycheck to paycheck:

- There is no habit of planning ahead.

- No financial airbag.

- You regularly borrow money from close friends or relatives.

- Income does not exceed expenses.

- Invest in what you need, not what you want - a gym membership, language courses, travel, routine health checks.

- Feeling anxious about parting with money.

How to break the vicious circle: 5 actionable tips

In order to change the situation, it is necessary to be aware of its seriousness and scale.

1. Deal with debts . It is impossible to establish a financial component being heavily in debt. Debt "eats" part of each salary. Start paying off your debts by recording all financial transactions on paper or on a computer. The appearance of reducing your debt will stimulate you and will not allow you to turn off the intended path.

2. Make sure that expenses do not exceed income . Developing percentage targets for household income is vital in improving financial health. This allows you to spend on the most necessary things without exceeding a certain amount. Make sure that the expenses in each specific category do not exceed the established percentage of the salary.

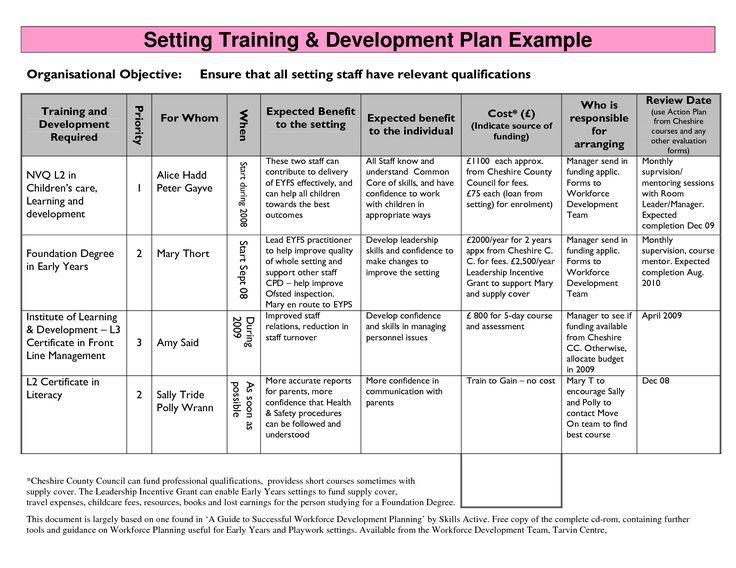

3. Keep track of the budget . Proper budgeting will help reduce unnecessary expenses and help you achieve your goals. Here is an example of budget distribution:

Here is an example of budget distribution:

- Rent or mortgage - 25-30% of income every month.

- Personal and grocery items - 12-25% monthly.

- Utility costs - electricity, telephone and gas - should cost no more than 2-10% of total income, if they are not already included in the rent.

- Transport and insurance: no more than 2-5% - maintenance costs; 2-5% - insurance.

- Debt, savings and other - the amount to pay off the debt should not exceed 15% of monthly income.

- Save 5-10% of your income every month and set aside 1-2% for unexpected expenses. And remember that it is not enough to make a budget, you also need to live on the basis of this budget.

4. Find a way to increase your income . One of the most direct ways to increase your income is to talk to your boss about a pay rise. However, before you think about how valuable your position in the company or business is, assess the relationship with the boss and the level of skills that you offer the company. To get additional income, you can take on additional freelance projects if your main job allows.

To get additional income, you can take on additional freelance projects if your main job allows.

5. Start saving . Based on the family budget chart, prioritize. In order to be able to save money, it is necessary to limit whims and include only the most necessary in expenses.

Learn to manage your finances. Record income and expenses from your budget - this will help you feel the movement of money.

Thanks to Lyudmila Veremeenko

Read also

- 5 easy ways to save money with work

- I have 5 reasons for this: why it is not possible to accumulate a fortune

- Financial Literacy: 10 Relevant Life Hacks

Follow us on Telegram

You must be logged in to leave a comment.

Family budget

Budget is a plan of your income and expenses. Half of your financial success depends on how correctly you compose it. The rest is willpower. This means that you need to not only create a budget, but also clearly and strictly follow it. According to sad statistics, more than a third of the population of Kyrgyzstan does not keep records of their income and expenses, and 20% of our citizens do not know at all how much money they received and spent.

The rest is willpower. This means that you need to not only create a budget, but also clearly and strictly follow it. According to sad statistics, more than a third of the population of Kyrgyzstan does not keep records of their income and expenses, and 20% of our citizens do not know at all how much money they received and spent.

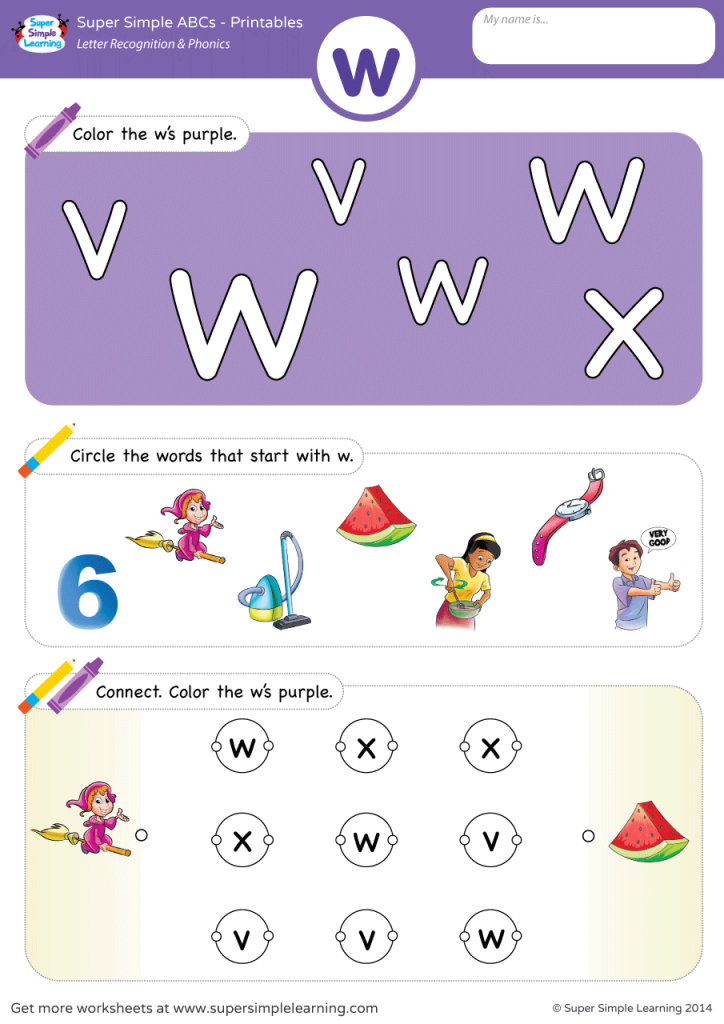

Drawing up and maintaining a family budget allows you not only to control your income and expenses, but also to increase family capital and achieve the planned goal. This is a joint work, where the participation of each family member is important. By teaching this to your children, you will give them a basis for managing their personal budget. At the same time, it is convenient to identify one family member who will keep a general record of the family's income and expenses, while the rest should regularly report to him how much and where the money was spent.

Before starting the preparation of a family budget, it is worth examining your current situation in detail. You will have to accurately and honestly calculate how much income your family receives per month and how much goes to expenses. To do this, you need to record all income received, as well as expenses of family members up to 1 som, within a month. This will make it easier for you to plan your family budget for the next month and help you achieve maximum accuracy in forecasts.

You will have to accurately and honestly calculate how much income your family receives per month and how much goes to expenses. To do this, you need to record all income received, as well as expenses of family members up to 1 som, within a month. This will make it easier for you to plan your family budget for the next month and help you achieve maximum accuracy in forecasts.

If you have a small business, we do not recommend mixing the family budget with the business budget, unless the business is the only source of family income. They should be kept separately, because this is the only way to see a clear picture of the family budget separately from the business and vice versa. For example, you should not include the income from your business in the income part of the family budget, and the cost of purchasing equipment in the expenditure part.

After you see exactly all your current income and expenses, it will become clear how to allocate money for the future in such a way that there is enough for everything. But remember that the main thing in the budget is to fill it regularly. You can do this using anything - a regular notebook, special programs on your phone or computer, a spreadsheet in Excel.

But remember that the main thing in the budget is to fill it regularly. You can do this using anything - a regular notebook, special programs on your phone or computer, a spreadsheet in Excel.

It is recommended to plan the family budget for a month, for a year and for several years.

The main elements of the family budget are income and expenses. Income is everything that goes into your budget. This can be the salary of all family members, cash gifts, income from renting real estate and more. If you like, you can classify income by family members who earn, or into the following two categories:

- permanent income - wages, income from the rental of real estate;

- variable income - income from business, additional earnings, cash gifts.

The second component of the budget is expenses, that is, your expenses. More attention should be paid to the classification of expenses, since the expenditure part in most cases is divided into many items.