What age should a child know how to count money

When Are Kids Developmentally Ready to Count Money?

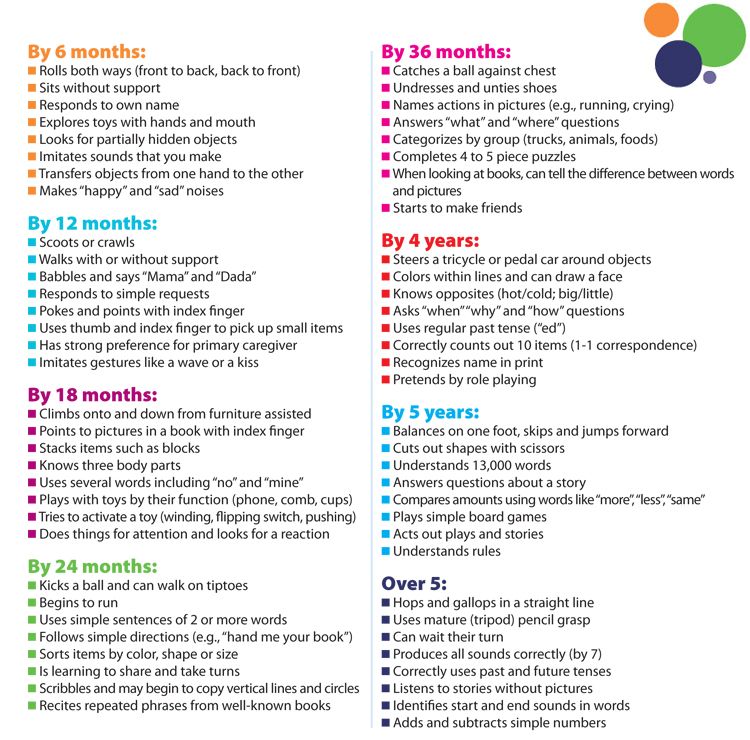

Children begin to form basic understandings of money as early as the toddler years, when a $20 bill falls out of a birthday card and everyone says, "Oooh!" A preschooler might hear his parents talking about paying the bills or how much money is needed to buy a certain item. These early experiences with money are important and can contribute to future financial success, but learning to count money comes a bit later. Counting money requires several prerequisite skills and basic math understandings that build upon one another in preschool and kindergarten. As their understandings grow, most children are ready to count money by first or second grade.

Basic Understandings

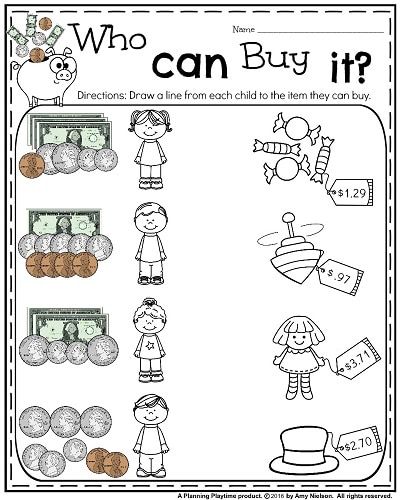

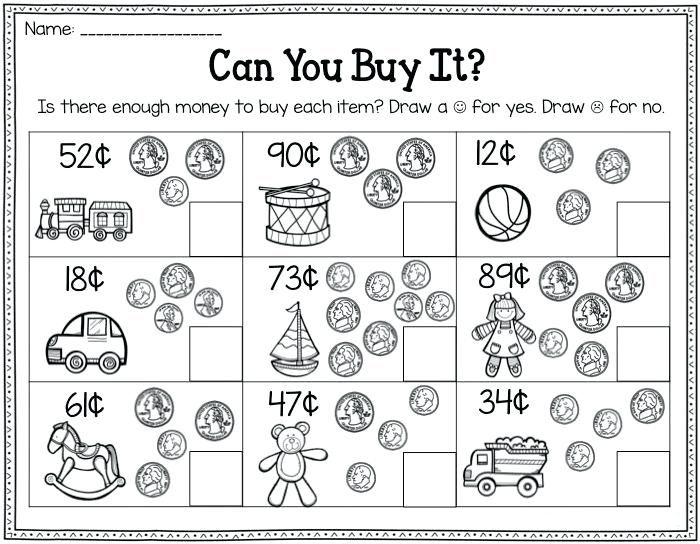

Most children are exposed to coins in preschool or kindergarten. They learn that coins are different sizes and colors and they have different names and values. Young children spend time sorting dollars and coins into like groups, identifying coins and dollars and learning their values. At this stage, most kids will count all coins or dollars by ones because they aren't developmentally ready to skip count. Children in preschool and kindergarten should also learn that money is used in exchange for goods or services.

Identifying Coins and Values

Once children become familiar with the different types of currency, they can delve a little deeper. The second stage of learning to count money involves being able to identify different coins or dollars and name their values. This takes time and practice, as many kids get thrown by the fact that dimes are worth more than nickels and pennies, even though they are smaller in size. Children can also work at making equivalent groups of coins. For example, ask your child to show 10 cents with pennies, nickels or a combination of both. Increase the difficulty as your child demonstrates her understanding of easier amounts first.

Skip Counting

In order to count money, children must be able to skip count by fives, tens, and in increments of 25 up to 100. This is a difficult skill to master and may take a couple of years of practice. Many children are exposed to skip counting in kindergarten and first grade but don't quite master it until second grade or later. Since quarters can be the hardest to grasp, begin by teaching your child to skip count by fives and tens. Give your child a small group of coins, including a couple of pennies, dimes and nickels. Teach him how to start with the coin of the highest value and count on. Add quarters into the mix once he has mastered the other coins.

This is a difficult skill to master and may take a couple of years of practice. Many children are exposed to skip counting in kindergarten and first grade but don't quite master it until second grade or later. Since quarters can be the hardest to grasp, begin by teaching your child to skip count by fives and tens. Give your child a small group of coins, including a couple of pennies, dimes and nickels. Teach him how to start with the coin of the highest value and count on. Add quarters into the mix once he has mastered the other coins.

Money Counting Strategies

Once children learn the basics of coins, values, skip counting and counting on, the sky's the limit. Show your child how you would count a pile of money, then ask her to count it and explain her thinking. As long as the end result is the same, a different method of getting there is fine. If your child struggles with a particular counting concept, take a step back and offer more opportunities for simple practice before pressing on. Use real-life opportunities to teach your child about money whenever possible, as this can be a real motivator to kids.

Use real-life opportunities to teach your child about money whenever possible, as this can be a real motivator to kids.

What to Teach Kids About Money at Every Age: A Guide

From the time your kid has their first toy related meltdown in a store to your first utterance of “money doesn’t grow on trees,” you’re building the foundation of your child’s relationship with money. For young kids, it can be a hard-to-understand concept. Money might not grow on trees, but they often see it ejected from ATMs and substituted for the simple swipe of a credit card. Considering the increasingly abstract ways in which money is earned and spent, and the diminishing safety nets that younger generations won’t necessarily be able to lean on, financial experts, child psychologists and even the American Psychological Association agree that kids need to develop their financial literacy skills sooner rather than later.

But where do you start? How do you tell a kindergartener that money is a finite resource without making them worry? How do you pass on the value of the dollar and the importance of saving without raising them to be materialistic or cheap? They key is starting the conversation early, keeping it age appropriate and ongoing, and showing your kids how you use your values to shape your spending. Here’s an age-by-age guide.

Here’s an age-by-age guide.

Ages 3 to 4: Introduce the Concept of Money and Exchanging It for Goods

The best time to start teaching your kids about money is the age they begin to count, says Joy Liu, a trainer at a financial planning company called the Financial Gym. Start by having them count and sort coins. Teach them to identify each coin, even if they can’t remember how much each is worth just yet. She also proposes setting up a fake store where kids exchange money for goods, introducing them to the basics of shopping.

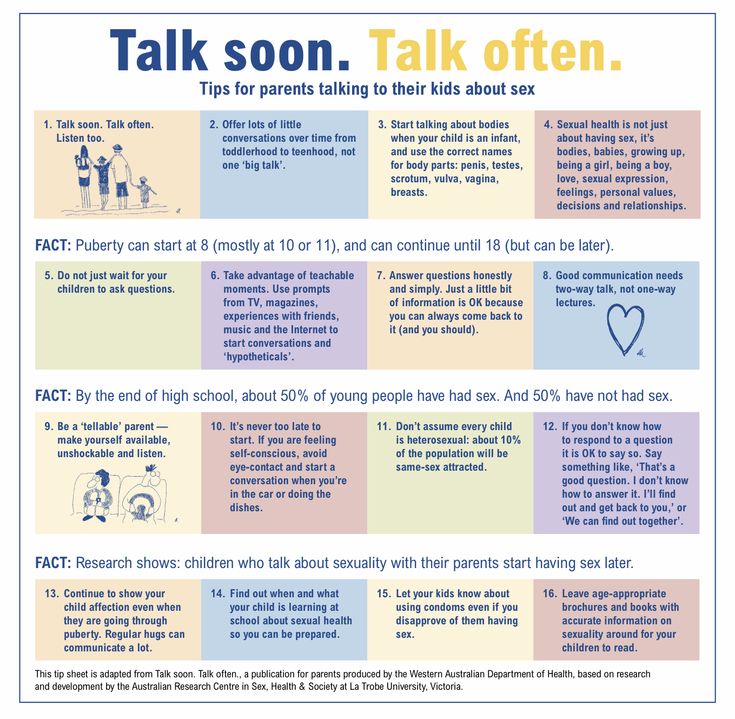

Dr. Matthew Pagirsky, neuropsychologist and certified New York State School Psychologist, suggests that starting at the preschool age, parents explain to their children what’s going on when they use an ATM, write a check, use a credit card, cut coupons, or comparison shop. At this age, the goal is to introduce the idea that you have to pay money to buy goods, and that money comes in different forms.

Ages 5 to 6: Teach the Value of Money and Cost of Goods

According to researchers at the University of Cambridge, this is the age where kids begin to understand the value of goods and set prices. Now’s the time to begin explaining how much different toys cost and how people earn money. Connect mom or dad going to work with spending money on toys or family outings. Play store again, this time attaching a price, preferably a whole number, to each item.

Now’s the time to begin explaining how much different toys cost and how people earn money. Connect mom or dad going to work with spending money on toys or family outings. Play store again, this time attaching a price, preferably a whole number, to each item.

Age 5 or 6 is also a good time to begin giving your child a small allowance, about the same dollar amount, per week, as their age. While it may seem young to be handing money to a kid who can’t even see over the checkout counter, introducing an income is an opportunity to teach money management and good saving habits. Plus, Pagirsky says that “research suggests children who receive allowance are more sophisticated about money than those who don’t.” The second they start interacting with money, says Liu, whether from allowance, earning money through chores, or receiving money on holidays, parents should explicitly teach kids to save or donate some portion. If saving is always what’s expected of kids, it will become second nature.

While it’s a good discussion to have at every age, this is an excellent time to discuss the effects of advertising with your child. Researchers believe it is not until between the ages of 7 and 9 that kids understand that ads are meant to persuade them, and not necessarily in their best interests, and yet children are targeted incessantly. One study found that time spent watching TV was directly related to how many items kids asked for at the grocery store. Combat this by explaining to your child why advertisements exist. When confronted with them, point out what goods are being sold to them and how. As they get older, identifying the tactics used to sell goods becomes more and more important. Their ability to do so will decide whether children accept the values being pushed on them (beauty equals value, thinness is something to strive for, wealth equals happiness) point blank, or examine them more critically.

Ages 7 to 8: Teach Them About Wants Versus Needs, and Smart Shopping

At age 7, kids will begin to understand not just quantities of money but their value. They’ll be able to differentiate between the value of a dime and a quarter, and comprehend that an amount of money can only buy so much.

They’ll be able to differentiate between the value of a dime and a quarter, and comprehend that an amount of money can only buy so much.

Capitalize on this by letting kids take a few dollars to the store to pick out an item of their choice. This will get them thinking about the value of the money (do they buy three pieces of candy, or one small toy) and help them understand that paying for an item means giving away the money permanently.

Pagirsky advises parents to set rules about shopping and discuss them before you enter a store. “Parents should not really wobble on family rules when it comes to money management. Kids need to have limits set on them and they need to understand that ultimately that parents are in control,” Pagirsky says. When you say no, use it as an opportunity to show how your values inform your spending. For parents worried about transferring their financial stress to their kids, or competing with peers, this is a particularly useful tactic. Pagirsky suggests the statement: “Our family is making a choice to use money in other ways that help our family do other things. ” It doesn’t necessarily have to be about lack of money, but that you choose to put your money elsewhere.

” It doesn’t necessarily have to be about lack of money, but that you choose to put your money elsewhere.

By age 8, kids can begin to differentiate between wants and needs (phew). They also begin to comprehend the future in a larger sense than whether tomorrow is a school day or a weekend. This is a good age to set up a savings account or a designated savings area for them at home. Liu suggests attaching the savings goal to something they want, like a new toy or outing.

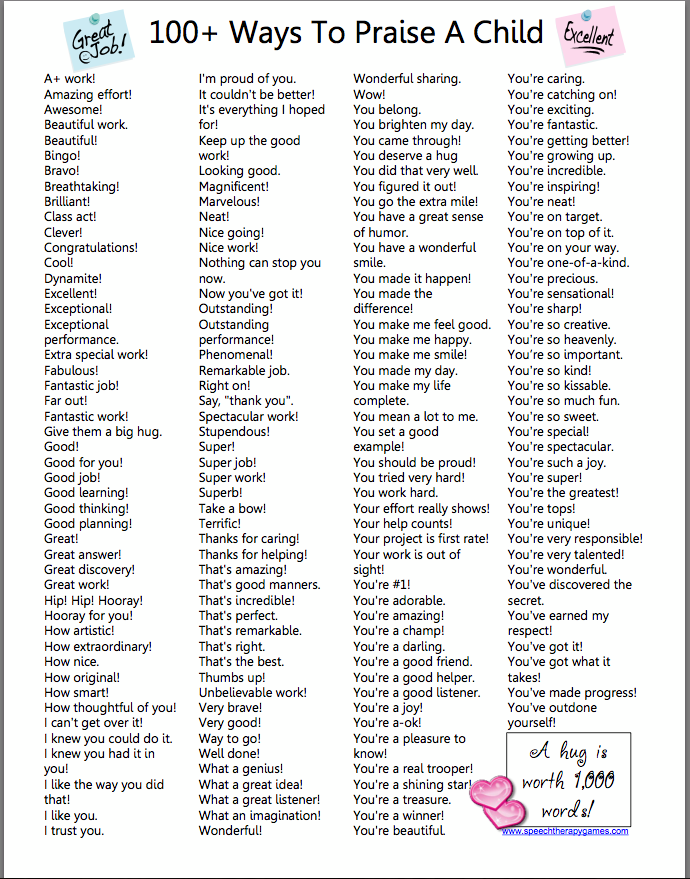

Financial advisor Rachel Stewart adds that to keep a child motivated, set short-term goals, like saving $5 each week, and regularly praising your child for staying on track. “Focus on the progress instead of the full goal,” she said. Then make it visual, either by keeping money in a clear container or showing your child their bank statement. Letting them watch as their money accumulates and gets closer to their goal, emphasizing when they smaller goals instead of focusing on how much further they have to go.

Ages 9 to 10: Introduce Saving, Spending, and Delayed Gratification

At this age, you can require kids to do more with their allowance. Instead of just setting some aside for savings, ask your child to divide it into spending, saving, charity, and investment. Actual investment.

Instead of just setting some aside for savings, ask your child to divide it into spending, saving, charity, and investment. Actual investment.

“Once they start interacting with brands and publicly traded companies that they like, take them to Disneyland or McDonald’s, ask them what do you think about this company? I think that’s an introduction to investing and being able to build wealth that way instead of always staying in that work-for-money, pay-for-stuff cycle,” Liu said.

It’s also important to include kids in family budget discussions. It may turn some parents off to introduce young kids to concepts like debt and mortgages, but including kids in decisions about budgeting for a family vacation or outings shows them how money can be leveraged to get things you want. Introduce them to the weekly grocery budget or show them how you trade in Friday night takeout for a family trip to the waterpark, or put aside a few dollars each month to eventually afford a vacation. It’s about being aware of where your money is going so that you choose to put it toward the things that you care about most.

Ages 11 to 12: Teach Them About Being a Smart Consumer, Deceptive Advertising, and the Fine Art of Budgeting

The precipice of teenage-dom is a good age to enlist your child in helping to plan an event. Whether it’s their birthday party or just a family dinner, showing kids how you choose where to spend (and letting them weigh in) gives them real world responsibility. They can help you comparison-shop online or clip coupons before going to the store. Ask them to explain their reasoning behind decisions about what’s worth buying and what you’ll skip.

This may be the age where children may start to come into contact with more money and want to spend it on higher-ticket items. Stick to your rules about money management. When it comes to designer items, Pagirsky suggest setting a budget (for say, a winter coat,) and letting kids pay or save up for the difference if they want to buy an item that exceeds the budget.

This is also a good time to revisit the advertising conversation, especially in terms of social media. Talk about what tactics ads use to try to sell a product, what type or social media stars are recruited to sell products, why that is, and whether your values are reflected in these choices. Often ads try and convince consumers that if only they use their product, they’ll not only be thinner or richer or better smelling, they’ll be happier and more successful, with more friends and a more loving family. Break down these myths.

Talk about what tactics ads use to try to sell a product, what type or social media stars are recruited to sell products, why that is, and whether your values are reflected in these choices. Often ads try and convince consumers that if only they use their product, they’ll not only be thinner or richer or better smelling, they’ll be happier and more successful, with more friends and a more loving family. Break down these myths.

Ages 13 to 14: Give Them Their First Taste of Financial Independence

Time to go to work. This is the age when you should let kids experience the independence of making and having their own money through small jobs. Babysitting. Shoveling snow. Raking leaves. While some experts warn about tying chores to allowance, as kids should learn to contribute to their family just because, you can save additional or tedious ones for compensation.

For occasions like bar and bat mitzvahs, when kids receive large sums, Pagirsky again emphasizes the importance of explicit communicating expectations ahead of time. Well before the day of, parents should tell kids what rules they’re expected to follow, whether it’s putting a certain sum aside in savings, donating to charity, or not having access to the money until they’re 18.

Well before the day of, parents should tell kids what rules they’re expected to follow, whether it’s putting a certain sum aside in savings, donating to charity, or not having access to the money until they’re 18.

With the introduction of non-allowance income, you may want to set them up with a checking account and debit card. This is a low-risk way to introduce them to plastic, knowing that they can only spend what they have. Show them how to check their account balance online before they make purchases, and have them practice making their income last.

Ages 15 to 16: Teach Them How to Build Credit and the Truth About Credit Cards

This is the age to give your child a starter credit card. Explain the concept of borrowing money, emphasizing that it always has to be paid back on time, and that you should never borrow more than you have. Explain the concept of interest, and how easily it can land you in debt, and how credit is built.

You can make you child a user on your credit card, or get them their own with a small credit limit. Liu recommends having your child use their first credit card for a subscription that gets paid automatically, and holding off on using it for more regular purchases. While Stewart cautions parents with poor credit history to hold off on introducing their child to one until they can be sure they’ll monitor it regularly, Liu says as long as kids receive all the information, there shouldn’t be problems. “There’s shame in it when they get one, and they get just part of the information of ‘Oh, you need to have one to build credit’ without understanding that you need to pay it back and that’s how interest works,” she says. Stewart adds that you can always meet with a financial advisor, even one specializing in debt management, to answer you and your child’s questions.

Liu recommends having your child use their first credit card for a subscription that gets paid automatically, and holding off on using it for more regular purchases. While Stewart cautions parents with poor credit history to hold off on introducing their child to one until they can be sure they’ll monitor it regularly, Liu says as long as kids receive all the information, there shouldn’t be problems. “There’s shame in it when they get one, and they get just part of the information of ‘Oh, you need to have one to build credit’ without understanding that you need to pay it back and that’s how interest works,” she says. Stewart adds that you can always meet with a financial advisor, even one specializing in debt management, to answer you and your child’s questions.

Ages 17 to 18: Use College as an Example of Real-World Financial Decisions

If your child plans on continuing their education, it’s best to begin devising a plan to pay for it sooner rather than later. “If you’ve always been open to talking to kids about money, talking about college can be a more rational conversation instead of an emotionally charged one,” Liu said. Comparison-shop at different schools, and try and land on an approximate amount that you’ll be able to contribute. Ultimately, the decision of where to go to school doesn’t only have to be about cost. “It’s a fine choice to say we’re gonna borrow,” Liu said. “We just have to make that choice that we’re going to do it this way, and make sure you’re doing all you can to get a job that will pay you enough to pay $200,000 back. But that conversation doesn’t get had because there’s so much emotion around going to the school that you want to go to.”

Comparison-shop at different schools, and try and land on an approximate amount that you’ll be able to contribute. Ultimately, the decision of where to go to school doesn’t only have to be about cost. “It’s a fine choice to say we’re gonna borrow,” Liu said. “We just have to make that choice that we’re going to do it this way, and make sure you’re doing all you can to get a job that will pay you enough to pay $200,000 back. But that conversation doesn’t get had because there’s so much emotion around going to the school that you want to go to.”

Stewart recommends bringing your child to speak with a financial advisor or other expert, since news may be better received by a teenager if delivered by a third party. Plus, it can also help to explain to the child the different channels through which college can be paid for, whether it’s savings, regular income, loans, grants, or part-time work.

You can also use online calculators to show how much and how long they’d be paying them back depending on how much school costs and what career they intend to pursue. If they choose that expensive private school, would they be willing to live at home for some time after graduation to save money (and are you willing?).

If they choose that expensive private school, would they be willing to live at home for some time after graduation to save money (and are you willing?).

Finally, find some sample budgets online and have them play around with adult budgets. What type of career will they need in order to sustain the lifestyle they have now? How much money will they have to spend on fun if they have a job at school versus if they don’t? Conditioning to think this way will prepare them for life in the future.

Teaching Kids About Money: A Few More Things to Keep in Mind1. No, It’s Not Too Early to Teach Them.

Some parents may worry that putting too much focus on money too early on will make their kids anxious. But Liu argues the opposite.“Keeping it in the dark can also cause more shame or guilt surrounding it. Especially if a family is having a hard time with money,” Liu said. Pagirsky agrees, noting that the keys to combating money-related guilt and anxiety is clear and consistent communication, weighing the costs and benefits of sharing certain information with your child, and being explicit about what you choose not to share.

While parents probably should be more discriminate in sharing information with an anxious child, it’s even more important that they explain why, as anxious kids tend to be good at assigning themselves blame, Pagirsky explains. “I think it’s important for parents to understand that if they choose to keep something concealed, or revealed, regardless, they’re implicitly socializing their children about money, and they can actually shape their child’s long-term privacy beliefs,” Pagirsky says.

2. Focus on the Positive.

By making it a normal point of discussion, money is just a tool that can be used to achieve goals. Liu urges parents to focus on the positive things money can do, and keep it solution-oriented. “Too often if you do talk to your kids about money it’s in a way that’s like, ‘Oh, we can’t do this because we don’t have enough money.’ So trying to instill an abundance mind-set rather than a scarcity mind-set,” Liu said.

3. Don’t Let Stale Platitudes About Money Deter You.

Shouldn’t we really be teaching kids that the best things in life are free? Well, yes and no. You want your kid to be smart with their money, but you can still weave your values into the discussion. Are you willing to pay more for a high-quality or ethically produced product? Do you regularly give away a certain portion of your income to charity? Do you use your money to support small businesses or marginalized entrepreneurs? Do you prioritize experiences, say a trip to the beach or a museum, over things like new clothes or toys. Point out when you choose to shop at the farmers market instead of the grocery store or gift a family outing over a new toy.

“Forgive yourself if you go off-track or if you’re starting late in the game. It will pay off in the end,” Stewart said.

4. Always Keep the End Goal in Mind.

The end goal is not to teach your kids that money is the most important thing, but that it can be used to reach your goals and support your values. It can buy experiences and education, support meaningful businesses and feed your family healthy food. The more you know about where your money is going, the better equipped you’ll be to put it where it matters most.

It can buy experiences and education, support meaningful businesses and feed your family healthy food. The more you know about where your money is going, the better equipped you’ll be to put it where it matters most.

At what age to start financial education of children? - portal Vashifinansy.rf

Olga Andreeva

At what age should children start financial education?

03/19/2020

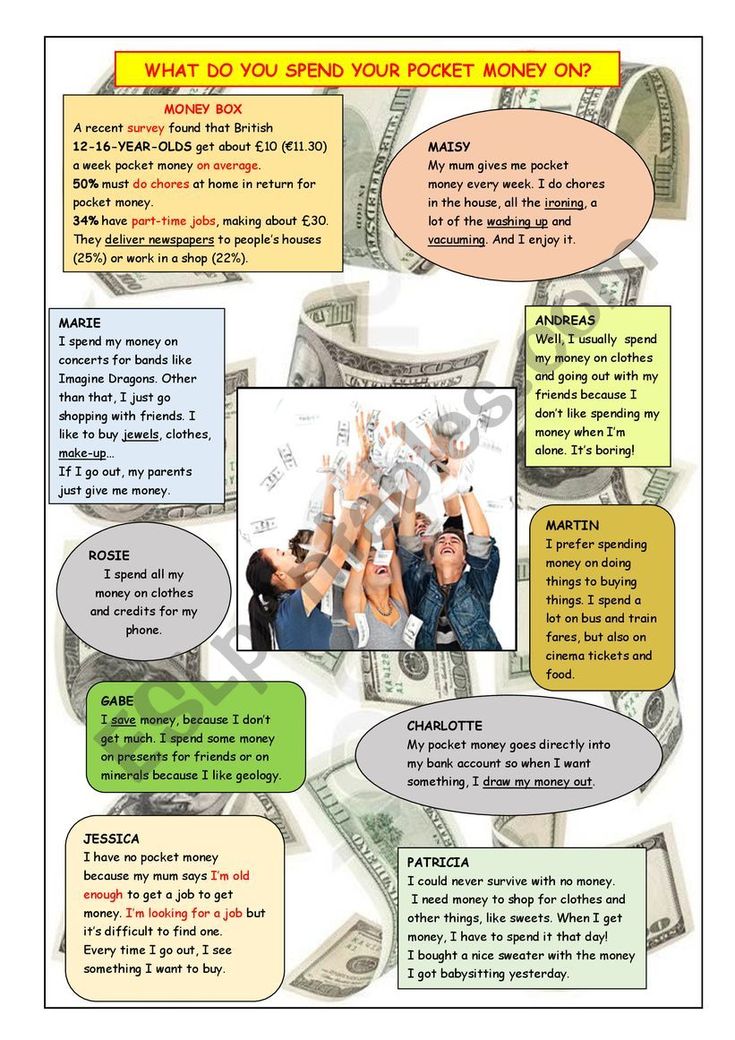

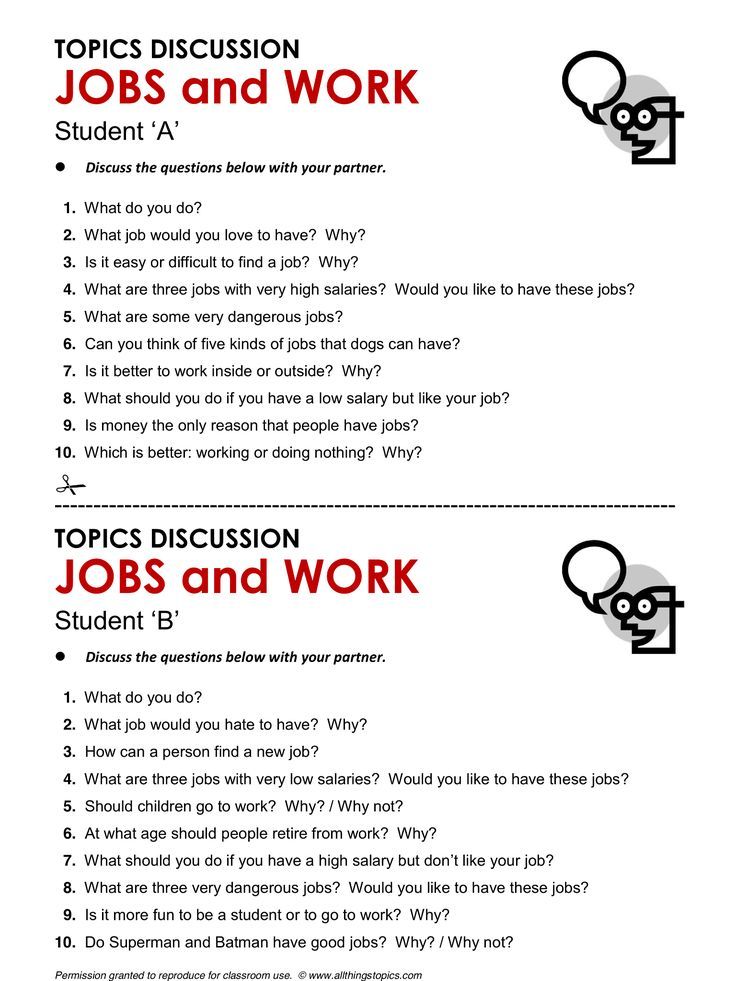

Quite often, tutors at parent meetings "Financial Education" hear questions about whether to give pocket money to children, from what age and what amounts. Let's talk about this in more detail.

First, decide what you want:

1. Instill in the child the right attitude towards money,

2. Teach him to handle money carefully,

3. To be able to fully control his spending?

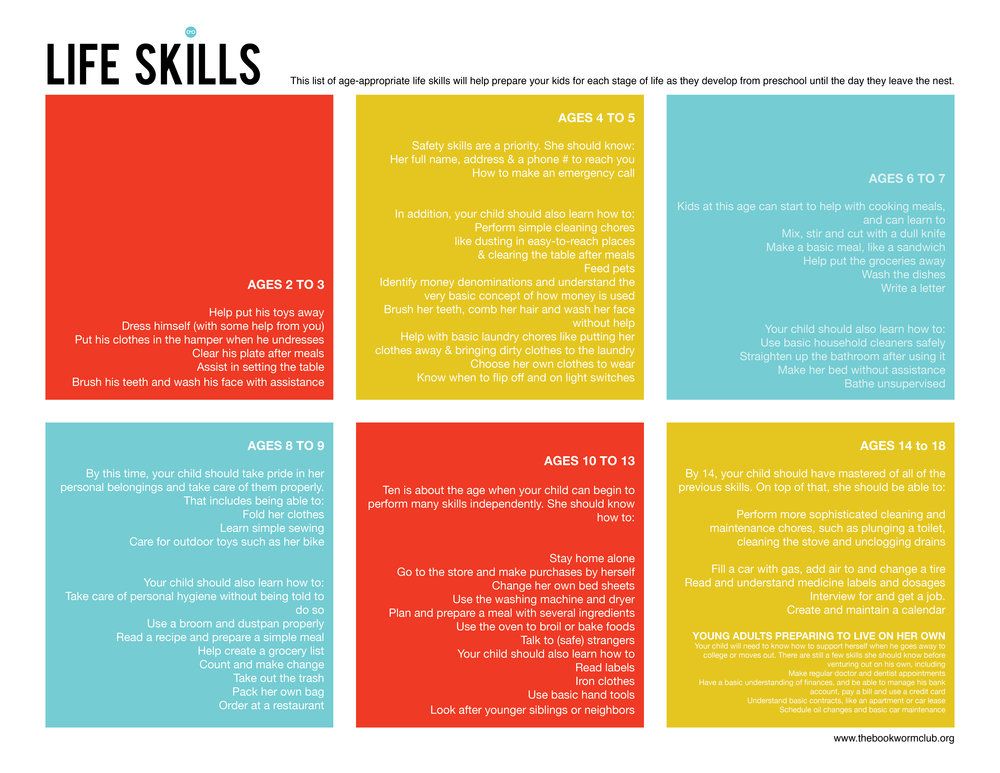

If you chose the first answer , then you should start at 6-7 years old. Even if the child is not yet able to make the first mathematical calculations, correlate purchase prices and the amount of money he has, he is already ready to take the first correct steps in the topic of finance, and he can do it with your careful help. It is more logical to give money in small amounts on the eve of the weekend in order to be able to discuss with the child what he wants to spend it on, in which store, and go with him together to help him at first navigate the prices and the final cost of his first purchases.

It is more logical to give money in small amounts on the eve of the weekend in order to be able to discuss with the child what he wants to spend it on, in which store, and go with him together to help him at first navigate the prices and the final cost of his first purchases.

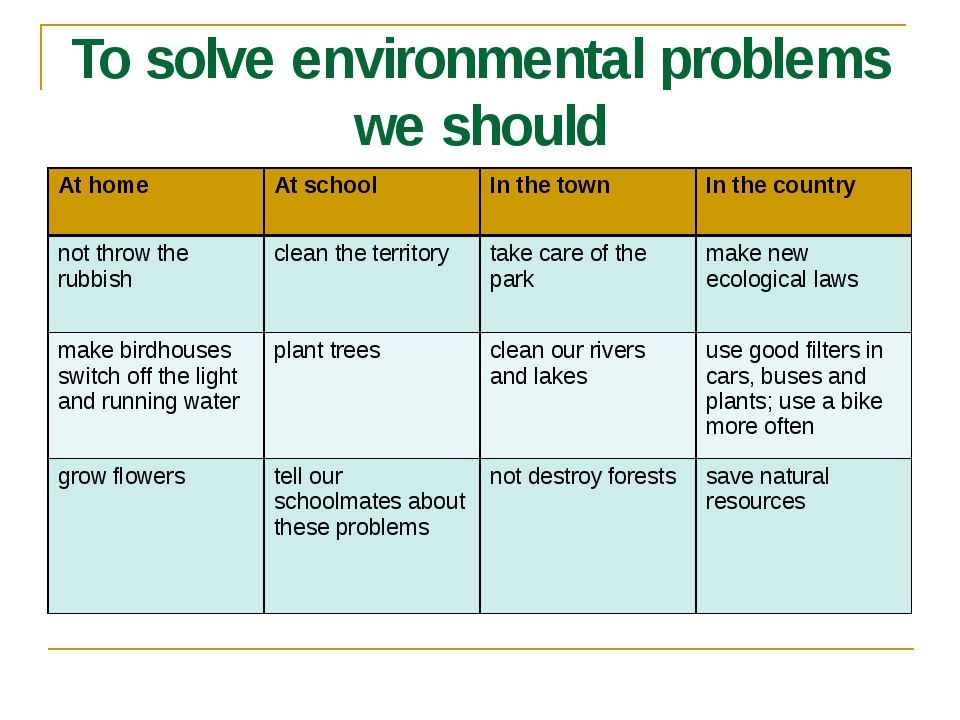

If you are going to the grocery store with the whole family, talk to your toddler about the groceries to buy. Set the right example by preparing a shopping list and talking about how your budget is limited. It will be good if you entrust the child with a responsible task: putting products from the list into the basket. Let your little helper understand that if an item is not on this list, it should be left on the store shelf.

If you start teaching your child financial literacy, then negotiate this with all family members. Often, grandparents, in a fit of love for their grandchildren, “help” them buy everything they want, but this way the child will not learn anything good.

The second goal is correctly and firmly interconnected with the first one. However, here you will have to let the child go “free floating” in the world of finance, because if he does not make his first mistakes, then our experience of caring for money will not be fully perceived. At the age of 8-10 years, many children spend money thoughtlessly, on pleasures, forgetting about the necessary things: stationery for education, small gifts for family and friends for the holidays, etc. Yes, they learn from their mistakes, but first you need to be patient and have some courage and allow them to make these mistakes so that you can then discuss the wrong steps in detail and point out a logical pattern of behavior.

However, here you will have to let the child go “free floating” in the world of finance, because if he does not make his first mistakes, then our experience of caring for money will not be fully perceived. At the age of 8-10 years, many children spend money thoughtlessly, on pleasures, forgetting about the necessary things: stationery for education, small gifts for family and friends for the holidays, etc. Yes, they learn from their mistakes, but first you need to be patient and have some courage and allow them to make these mistakes so that you can then discuss the wrong steps in detail and point out a logical pattern of behavior.

It would be correct to set a certain spending limit. This technique must be followed in families with any income, even in those where financial possibilities are unlimited. Again, do not forget that you need to teach by example, i.e. you, too, should be an example of careful attitude to finances for your children.

If you are most interested in the third question , then it is more logical to issue a debit card for a child of 9-14 years old, "tied" to the parents' card, so you can control his purchases and their volume. But what if the child withdrew cash and spent it at his own discretion, not considering it necessary to report to you? This is quite likely, because. this is the younger adolescence, when many actions are performed spontaneously, under the influence of emotions that the child himself is not quite able to explain either to you or to himself.

But what if the child withdrew cash and spent it at his own discretion, not considering it necessary to report to you? This is quite likely, because. this is the younger adolescence, when many actions are performed spontaneously, under the influence of emotions that the child himself is not quite able to explain either to you or to himself.

In this case, a preliminary conversation helps. Agree with him on what day you will give the child money. Over time, he will get used to planning his expenses. It is important not to postpone this day and not to delay the issuance of pocket money.

There is nothing wrong with asking your child what he plans to spend money on: entertainment, travel from home to school, all sorts of little things like cool pens and notebooks. It is very likely that at first the child will be afraid that he will not be able to manage money properly. Encourage him, praise him for the right purchases.

But remember, if you start demanding explanations from your child for every purchase, the experiment will fail.

As long as you see that money is being spent on things that are "right" from your point of view, try not to interfere with his spending.

After a few months of the experiment, you can try to sum up: ask the child if he likes everything, if he has enough for everything. Perhaps you forgot about some important expense (his friend's birthday, trips to competitions) when you counted the monthly amount - then it makes sense to count the amount of pocket money.

At parent meetings on financial literacy, we do not get tired of telling parents that "until the child has grown up, you have a chance to instill in him the right attitude towards money."

Olga Andreeva - Head of the Volgograd Regional Center for Financial Literacy, consultant on educational activities in the framework of the implementation of Financial Literacy Programs in the Volgograd Region.

Protect, save, achieve goals. How to teach a child to manage money wisely - YASIA

Financial literacy is the ability to use knowledge and skills to make good decisions about earning and spending. This knowledge affects all spheres of our life, because a person begins to handle money from childhood. Unfortunately, financial literacy is not taught in schools, so it is important for parents to take care of what knowledge and ideas about money their children will develop.

This knowledge affects all spheres of our life, because a person begins to handle money from childhood. Unfortunately, financial literacy is not taught in schools, so it is important for parents to take care of what knowledge and ideas about money their children will develop.

Yes, according to the head of the AEB retail business department Lyudmila Ushnitskaya , it is worth discussing with the child the rules for handling money from the age of 4-5: “I think that it is necessary to explain to the child what money is, where it comes from at about the age of his entry into the middle group of kindergarten.”

Head of the office of Almazergienbank in the Namsky district Ludmila Sharapova agrees with Lyudmila Ushnitskaya on the issue that a child should be able to count money and handle it from childhood.

“Unfortunately, I failed to teach this to older children from a very young age. But everything comes with experience, so we have already begun to instill this knowledge in the younger ones as early as possible. Of course, the child must understand that purchases, gifts, toys do not appear according to one desire, and that adults spend time and effort to earn. It must be explained that money tends to run out, therefore it is so necessary to correctly calculate your financial capabilities, compare them with desires, ” - said Lyudmila Ivanovna.

Of course, the child must understand that purchases, gifts, toys do not appear according to one desire, and that adults spend time and effort to earn. It must be explained that money tends to run out, therefore it is so necessary to correctly calculate your financial capabilities, compare them with desires, ” - said Lyudmila Ivanovna.

Almazergienbank, together with the portal "yourfinance.rf", gives advice on what financial lessons parents can teach their children during the period of growing up, what to teach them before handing over the first pocket money, and also what decisions regarding personal funds children can take on your own.

IF THE CHILD IS 5-9 YEARS OLD

At an early age, when the child is not yet in school, parents rarely give pocket money. But already during this period, the family should discuss different shopping options, for example, when going to the store. At the same time, parents need to explain to the child why such a choice of goods is the right one.

“Independence is instilled when a child pays for purchases himself, that is, approximately at the age of 7 years, when he goes to school. Having, for example, a school meal card, a child gets the skills to make online payments and the ability to save money. Parents also need to understand that the baby must first learn to buy, for example, products for the family, and then something for themselves with the permission of adults and mutual agreement, ” - said Lyudmila Ushnitskaya.

Indeed, at the age of 7 - 9 years, a child can already receive the first pocket money from his parents, so it is important to discuss the rules regarding the amount and timing of payments. The desires of children and parents will not always coincide, it is for this reason that you need to be able to negotiate and find a compromise. It is also imperative to make it clear to children that labor is money, to explain the links between work, earnings, expenses and savings. They will understand the value of money earlier and learn how to make financial decisions correctly.

Parents have the right to give advice, but it is up to the child to decide how to spend pocket money.

“Although adults may be asked to explain why the spending was the way it was. It is important to teach your child to save his money in case he wants to buy something more expensive, but for this he will have to be patient. The main thing is to correctly assess the forces and try to choose a goal for which you can save money within one to three months, experts say.

Head of the Yakutia Technopark Petr Gabyshev I am sure that some needs of the child should be met by parents, but you should not completely remove from him the opportunity to independently acquire things that the child dreams of: “To their children from a very young age I buy piggy banks, where they put their money saved or given for birthdays, as well as what they manage to somehow earn. It happens like this: if a child was given a toy, and, for example, he wants the same one, but in a different color in addition to this one, then I say: “So, stop, you can save up and buy this thing for yourself. From the realization that you yourself bought a toy, with your own money, its value for you grows many times. And so it turns out that the child will take care of the thing he bought on his own and use it longer. ”

From the realization that you yourself bought a toy, with your own money, its value for you grows many times. And so it turns out that the child will take care of the thing he bought on his own and use it longer. ”

In order to have a savings plan and to visualize and specify the goal, it is recommended to have a wish list for the child. To begin with, he can draw what he would like to acquire. Over time, he will be able to record in writing a list of purchases and their cost. The wish list will teach your child to prioritize, to separate the important from the insignificant, and he will also be able to compare the amount of accumulated and necessary money to make a purchase using it.

At a young age, it is important for parents to be open to the child so that he can always ask for advice on how best to manage funds or how to save them more efficiently. In addition, you can agree to increase the amount or change the frequency of payments.

IF THE CHILD IS 10-12 YEARS OLD

Between the ages of 10 and 12, your son or daughter should be allowed to sometimes make decisions that will affect not only themselves but also other family members. For example, going to the store for groceries or stationery, which means calculating how much money it will take.

For example, going to the store for groceries or stationery, which means calculating how much money it will take.

Also, experts believe that it is important to discuss with the child all the purchases intended for him, and make it clear that it is not always possible to buy everything at once, but even in the existing realities, he has the right to vote. At this age, adults need to explain and even show what else the family spends money on. For example, go together to pay for utilities, telephone and Internet.

“Always in the store, or better before going there, I ask what the child would like, we discuss this purchase, give reasons for and against, in the end, he chooses what he wants, and we take it. But, making a choice, he knows why he needs this thing, how it will help him and what it will be useful for. It’s not worth making spontaneous and thoughtless acquisitions in order to please the child, ” - Peter Gabyshev shares his point of view.

In addition, at this age it is necessary to teach how to keep track of spending pocket money, especially if your child is saving up for something. This will motivate the child to save money in order to achieve the goal as soon as possible.

This will motivate the child to save money in order to achieve the goal as soon as possible.

WHEN A CHILD IS 13 - 15 YEARS OLD

At 13 - 15 years old, a teenager can already get acquainted with financial instruments in more detail. For example, a child may ask parents to issue a debit card, to understand how a banking application works. At this time, he should be able to make more decisions regarding spending: on his own to buy some small things for personal use. To do this, the child may ask to review the amount that is allocated as pocket money, but it is important that he is ready to justify it.

At this age, the child already has to decide whether to borrow money from friends, parents or wait until the next payment date if there is not enough money for any purchase. To do this, he needs to explain that if he borrows money, he must be prepared for the fact that he will have to return this amount, which means that there will be less funds in the future.

Also from this period, the teenager must take part in the discussion of the family budget. This will allow you to understand the concepts of permanent and temporary categories of expenses, find out how much the family spends monthly, why these amounts change, and what the balance will be enough for.

This will allow you to understand the concepts of permanent and temporary categories of expenses, find out how much the family spends monthly, why these amounts change, and what the balance will be enough for.

At this time, you can increase savings from other sources: from the age of 14, it is allowed to earn extra money.

“I think that children should be given pocket money and the opportunity to earn extra money in the summer. So our guys save up and buy some things for themselves. If a little is missing, then I can help and add the necessary amount. This teaches them to count money, to achieve their goals. At the disposal of personal funds, I give them free rein, so we instill in them responsibility and independence”, - Ludmila Sharapova is sure.

Experts advise to encourage (including with the ruble) the financial success of the child and not to scold for mistakes and failures. If your son or daughter is not able to save the required amount, discuss with your child what the problem is.