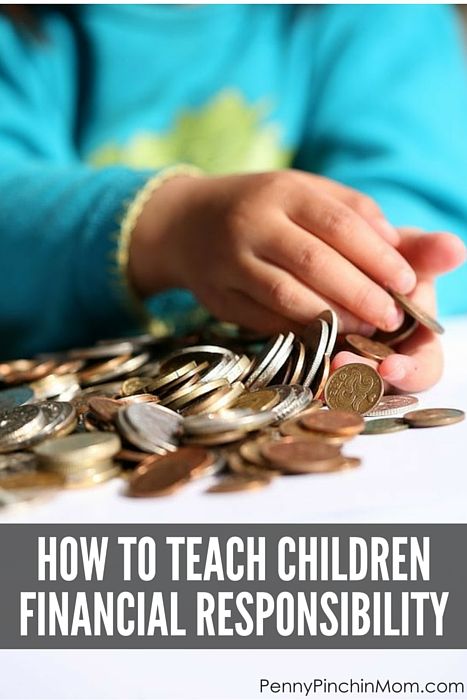

How to teach your child money management

15 Ways to Teach Kids About Money

By Ramsey Solutions

By Ramsey Solutions

If you don’t teach your kids how to manage money, somebody else will. And that’s not a risk you want to take! We’ll show you how to give your kids the head start you wish you had and set them up to win with money at any age.

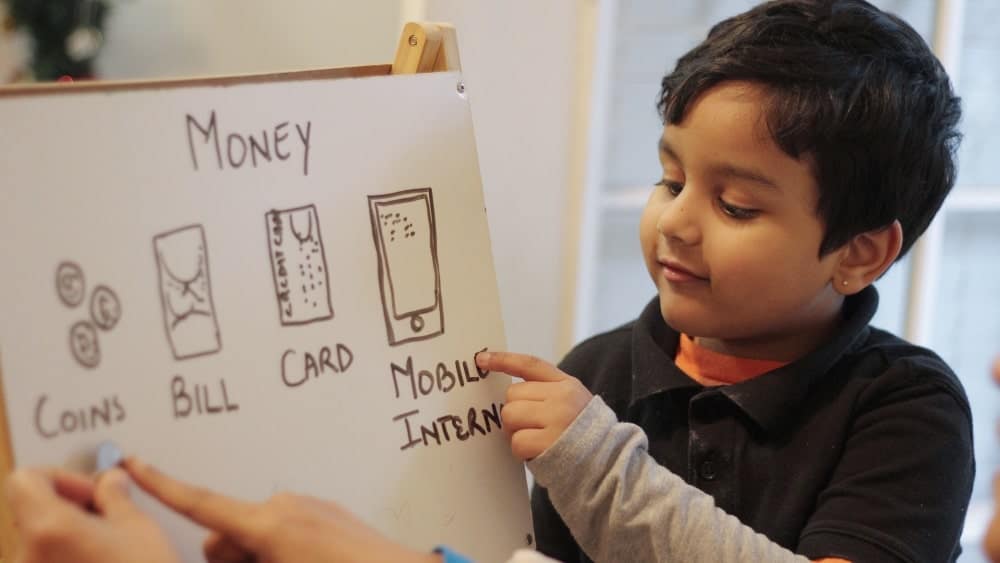

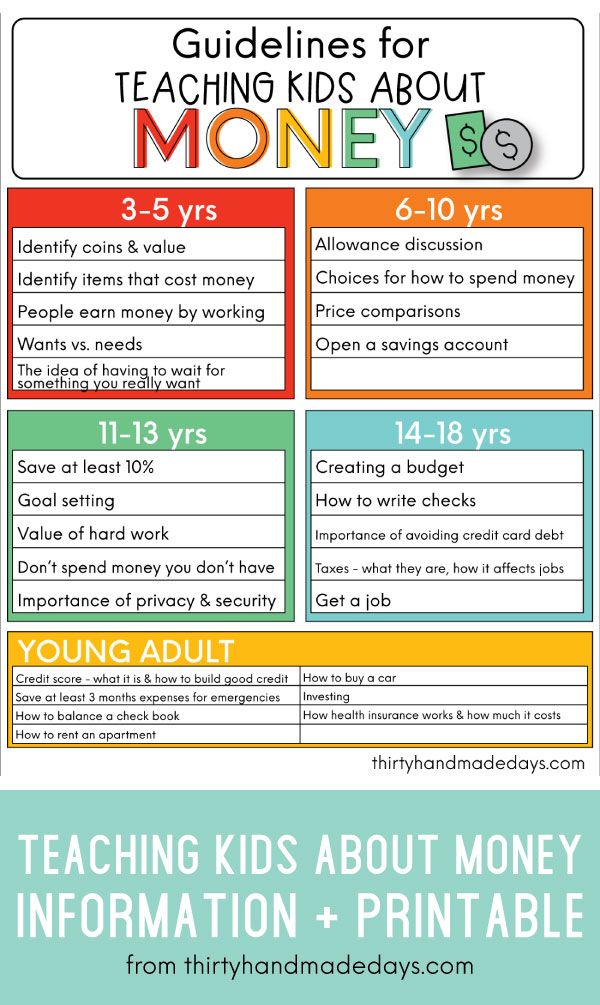

How to Teach Pre-Schoolers and Kindergartners About Money

1. Use a clear jar to save.

The piggy bank is a great idea, but it doesn’t give kids a visual. When you use a clear jar, they see the money growing. Yesterday, they had a dollar bill and five dimes. Today, they have a dollar bill, five dimes, and a quarter! Talk through this with them and make a big deal about it growing!

2. Set an example.

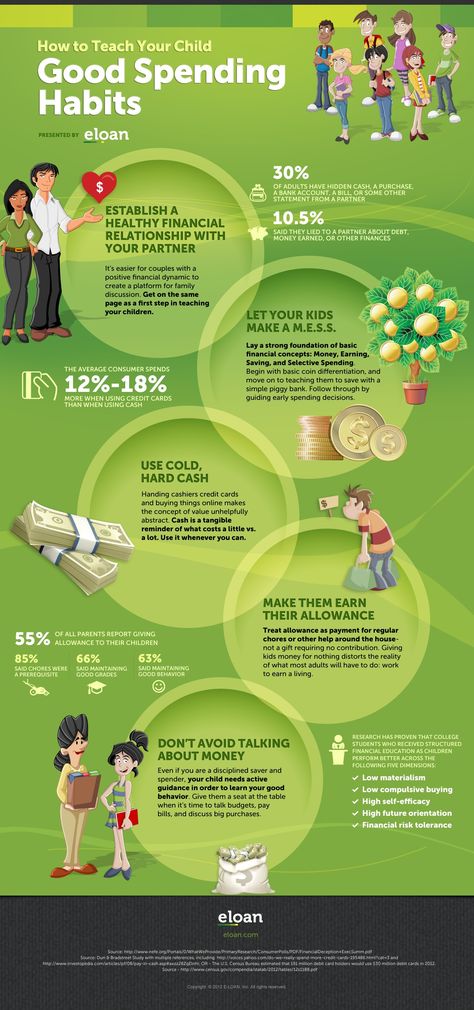

A study by the University of Cambridge found that money habits in children are formed by the time they’re 7 years old.(1) Little eyes are watching you. If you’re slapping down plastic every time you go out to dinner or the grocery store, they’ll eventually notice. Or if you and your spouse are arguing about money, they’ll notice that too. Set a healthy example for them and they’ll be much more likely to follow it when they get older.

3. Show them that stuff costs money.

You’ve got to do more than just say, “That pack of toy cars costs $5, son.” Help them grab a few dollars out of their jar, take it with them to the store, and physically hand the money to the cashier. This simple action will have more impact than a five-minute lecture.

How to Teach Elementary Students and Middle Schoolers About Money

4. Show opportunity cost.

That’s just another way of saying, “If you buy this video game, then you won’t have the money to buy that pair of shoes.” At this age, your kids should be able to weigh decisions and understand the possible outcomes.

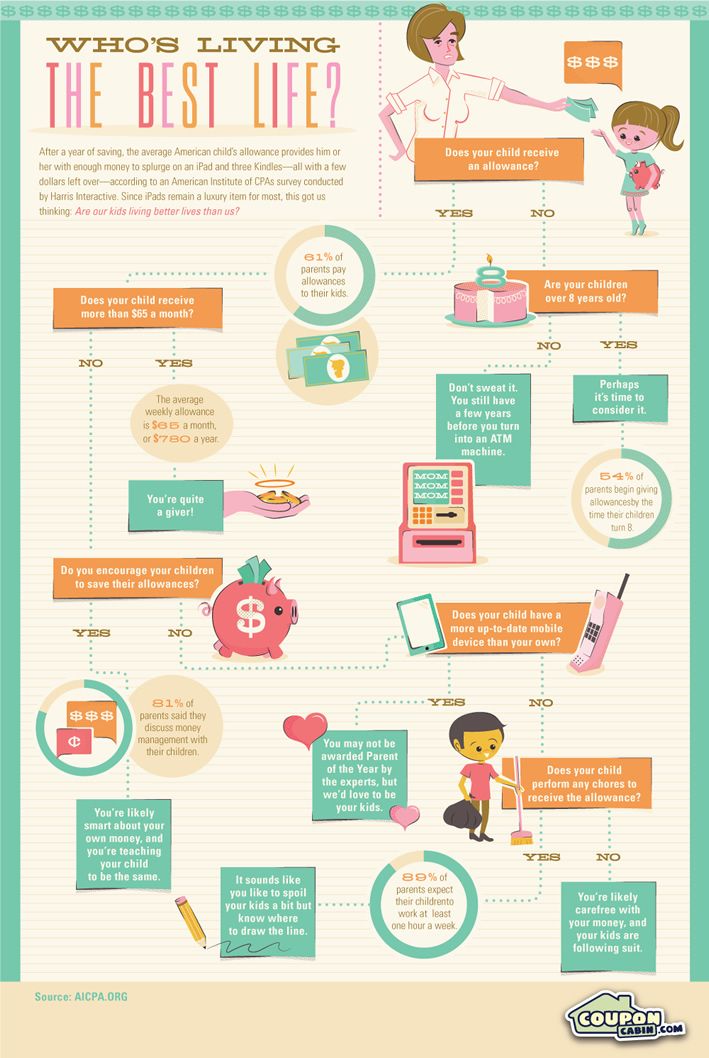

5. Give commissions, not allowances.

Don’t just give your kids money for breathing. Pay them commissions based on chores they do around the house like taking out the trash, cleaning their room, or mowing the grass. Dave and his daughter Rachel Cruze talk a lot about this system in their book, Smart Money Smart Kids. This concept helps your kids understand that money is earned—it’s not just given to them.

Dave and his daughter Rachel Cruze talk a lot about this system in their book, Smart Money Smart Kids. This concept helps your kids understand that money is earned—it’s not just given to them.

6. Avoid impulse buys.

“Mom, I just found this cute dress. It’s perfect and I love it! Can we buy it please?” Does this sound familiar? This age group really knows how to capitalize on the impulse buy—especially when it uses someone else’s money.

Use the best tools to teach your kids about money.

Instead of giving in, let your child know they can use their hard-earned commission to pay for it. But encourage your child to wait at least a day before they purchase anything over $15. It will likely still be there tomorrow, and they’ll be able to make that money decision with a level head the next day.

7. Stress the importance of giving.

Once they start making a little money, be sure you teach them about giving. They can pick a church, charity or even someone they know who needs a little help. Eventually, they’ll see how giving doesn’t just affect the people they give to, but the giver as well.

Eventually, they’ll see how giving doesn’t just affect the people they give to, but the giver as well.

How to Teach Teenagers About Money

8. Teach them contentment.

Your teen probably spends a good chunk of their time staring at a screen as they scroll through social media. And every second they’re online, they’re seeing the highlight reel of their friends, family and even total strangers! It’s the quickest way to bring on the comparison trap. You may hear things like:

“Dad, Mark’s parents bought him a brand-new car! How come I have to drive this 1993 Subaru?”

“Mom, this girl at school got to spend $10,000 on her Sweet 16 party. I want to do that too!”

Contentment starts in the heart. Let your teen know that their Subaru (although not the newest car on the block) is still running well enough to get them from point A to point B. And you can still throw a memorable, milestone birthday party without spending a chunk of your retirement savings funding it!

9.

Give them the responsibility of a bank account.

Give them the responsibility of a bank account.By the time your kid’s a teenager, you should be able to set them up with a simple bank account if you’ve been doing some of the above along the way. This takes money management to the next level, and will (hopefully) prepare them for managing a much heftier account when they get older.

10. Get them saving for college.

There’s no time like the present to have your teen start saving for college. Do they plan on working a summer job? Perfect! Take a portion of that (or more) and toss it in a college savings account. Your teen will feel like they have skin in the game as they contribute toward their education.

11. Teach them to steer clear of student loans.

Before your teen ever applies to college, you need to sit down and have the talk—the “how are we going to pay for college” talk. Let your teen know that student loans aren’t an option to fund their education. Talk through all the alternatives out there, like going to community college, going to an in-state university, working part-time while in school, and applying for scholarships now.

While you’re at it, get The Graduate Survival Guide for them. It’s a must-have resource to help your college-bound teen prepare for the next big step in their life.

12. Teach them the danger of credit cards.

As soon as your kid turns 18, they’ll get hounded by credit card offers—especially once they’re in college. If you haven’t taught them why debt is a bad idea, they’ll become yet another credit card victim. Remember, it’s up to you to determine the right time you’ll teach them these principles.

13. Get them on a simple budget.

Since your teen is glued to their mobile device anyway, get them active on our simple budgeting app, EveryDollar. Now is the time to get your teen in the habit of budgeting their income—no matter how small It is. They should learn the importance of making a plan for their money while they’re still under your roof.

14. Introduce them to the magic of compound interest.

We know what you’re thinking. You can barely get your teen to brush their hair—how in the world are they supposed to become investment savvy? The earlier your teen can get started investing, the better. Compound interest is a magical thing! Introduce your teen to it at an early age, and they’ll get a head start on preparing for their future.

Compound interest is a magical thing! Introduce your teen to it at an early age, and they’ll get a head start on preparing for their future.

15. Help them figure out how to make money.

When you think about it, teenagers have plenty of free time—fall break, summer break, winter break, spring break. If your teen wants some money (and what teen doesn’t?), then help them find a job. Better yet, help them become an entrepreneur! These days, it’s easier than ever for your teen to start up their own business and turn a profit.

Change Your Family Tree

Teaching your children about money at any stage is going to take time on your part. It won’t always be easy. But if you want your children to know how to successfully manage their money when they get older, taking the time now will be worth it.

One of the best ways to teach your kids about handling money is to give them a chance to make some of their own! With the Teen Entrepreneur Toolbox, you’ll get all the tools you need to help them start their own business and learn real-world skills.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Teach Your Kids Good Money Habits – Forbes Advisor

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations.

Getty

As a parent, you want the best for your children. This doesn’t necessarily mean you want them to have the best clothes, the latest toys or coolest gadgets. Most likely, it means you want them to be safe and secure. And you want to lay a foundation that they can build upon to do well in life.

And you want to lay a foundation that they can build upon to do well in life.

The question, then, is whether you’re teaching your children a key lesson that will impact whether they will do well. That lesson is about money.

“Without a working knowledge of money, it is extraordinarily difficult to do well in life,” says Sam X Renick, co-creator of Sammy Rabbit, a children’s character and financial literacy initiative. “Money is central to transacting life, day-in and day-out. Where we live, what we eat, the clothes we wear, the car we drive, health care, education, child-rearing, gift giving, vacations, entertainment, heat, air-conditioning, insurance—you name it, money is involved.”

Yet, plenty of parents aren’t helping their kids become financially literate. T. Rowe Price’s 11th Annual Parents, Kids & Money Survey found that nearly half of parents said they miss opportunities to talk to their kids about money and finances. And a quarter said they are very reluctant or extremely reluctant to discuss financial topics with their children.

Kids, on the other hand, are eager for their parents to share their wisdom. Half of the children surveyed said they wish their parents taught them more about money.

Even if you’re not teaching your kids, they will learn lessons about money one way or another. If you want to play a key role in shaping your children’s feelings, thinking and values about money, you need to give them the gift of financial literacy from an early age. Here’s how.

Disclosures: The Fidelity Youth Account can only be opened by a parent/guardian. Account eligibility limited to teens aged 13-17.

Limited Time Offer. Terms Apply. Before opening a Fidelity Youth Account, you should carefully read the account agreement and ensure that you fully understand your responsibilities to monitor and supervise your teen’s activity in the account.

Start With the Basics at a Young Age

Renick has been teaching kids about money through his Sammy Rabbit storybook character since 2001. He has found that the earlier you start a child’s financial education process, the better. Lessons should begin before age seven, he says, because research shows that money habits and attitudes are already formed by then.

He has found that the earlier you start a child’s financial education process, the better. Lessons should begin before age seven, he says, because research shows that money habits and attitudes are already formed by then.

Once your kids are old enough to know they shouldn’t be sticking pennies in their mouths, you should introduce them to coins and cash. Explain what money is and how it is used. Actually, showing them how money works is more effective. So let them see you making purchases with cash.

Even if you pay with a debit or credit card, explain to your kids that you’re using your money to make purchases. Chase Peckham, director of community outreach for the San Diego Financial Literacy Center, did this with his son and daughter when they were preschool age. When they shopped together, Peckham would show his kids receipts with the amount he paid. “By doing it over and over again, it became habit to them,” he says. “As they got older, they started to understand. That’s how we introduced money. ”

”

Peckham says that his son understood how money worked by the age of 4, thanks to the receipt strategy. He had more trouble getting through to his daughter. But, by being consistent, he knew that “the light bulb would turn on” for her—and it did.

Instill a Habit of Saving

Your kids’ early interactions with money will likely involve spending. They see you using it to purchase things, including things for them. So it’s important to teach them from a young age that money isn’t just for spending—they should be saving money regularly, too.

Learning to save isn’t just an essential money habit. “Saving teaches discipline and delayed gratification,” Renick says. “Saving teaches goal-setting and planning. Saving stresses being prepared. Saving builds security and independence.”

Help your kids get in the habit of saving by giving them a piggy bank or savings jar where they can deposit coins or cash. Then use short, simple messages to encourage your kids. Renick offers these examples:

- Saving is a great habit.

- I love to save.

- It feels good to save money and build my future.

With young kids, though, you’ll likely have more luck teaching them to save for short-term goals—such as a toy they really want—rather than for the future, says Tim Sheehan, co-founder and CEO of Greenlight, a debit card for kids with parental controls. The father of four says that encouraging his kids to set short-term goals when they were little helped them learn the value of delayed gratification. As they have gotten older, they are now able to save for longer-term goals.

Parents also can encourage their kids to save more by agreeing to match the amount they save dollar for dollar or by a certain percentage. If your children are old enough to advance from a piggy bank to a real bank, you could take advantage of a service such as Greenlight or FamZoo. These prepaid debit cards and apps allow parents to transfer money to their kids and pay them interest—at a rate of their choosing—on any of the money the kids choose to stash in savings.

Create Opportunities to Earn Money

Kids need to have money of their own so they can learn how to make decisions about using it. An allowance can accomplish that. However, you should consider requiring your kids to do certain chores to earn their allowance. “Just about everyone values money they earn differently than money they receive,” Renick says.

Both Peckham and Sheehan say they wanted their children to learn that money is earned. There are some chores the kids have to do without pay because they’re expected to help out as part of a family. But if they want to get paid, they have to complete certain tasks.

Sheehan says his two youngest children who are still at home get a weekly allowance in an amount equal to their ages. Peckham did that initially with his kids but says they now get a “salary” that is deposited directly into their bank accounts each month. His kids have negotiated raises for their salaries by agreeing to take on additional jobs around the house, he says.

Help Kids Learn to Make Smart Spending Decisions

In addition to wanting his kids to understand that money is earned, Sheehan introduced an allowance system so they could learn to live within a budget. His two youngest children, who are 16 and 11, would constantly ask for money and “spend like drunken sailors,” Sheehan says. When he started paying them an allowance, he told them that was all the money they would get and that it was up to them to manage it.

“Amazingly, it worked,” he says. They track how much they have coming in and going out and how much they’re saving using the Greenlight app. Learning how to budget now will help them when they enter the real world, Sheehan says.

Peckham has allowed his kids to make decisions about their money since they first started earning an allowance. He gave them three jars for spending, saving and giving. Peckham told his kids they had to put some of their allowance in each jar but didn’t specify how much. The decision was up to them.

Peckham also is teaching his kids that spending isn’t always about buying things you want. He wants them to learn that they will have to spend money on things they need when they’re adults and can make the choice to pay people to do things for them. So if his kids don’t do certain things they’re expected to do to help out around the house, it will cost them.

In essence, they’re paying their parents to do those things for them. And the money comes out of their allowance. “I wanted them to make decisions about what they were willing to pay for and what they weren’t,” he says. “I want them to realize, for every choice they make, there will be a repercussion. Personal finance is about decisions.”

Show Kids the Value of Giving

A key reason that it is important for you, as a parent, to teach your kids financial lessons is because you can share your money values through those lessons. If you value giving to others, you can instill that value in your children by helping make it a habit for them from an early age.

You could do as Peckham did with his kids when they were little and create spending, saving and giving jars. The Greenlight and FamZoo apps allow kids to create giving accounts. Or you could help your kids set up a special savings account for giving.

Then help your children plan their giving by discussing what groups or causes they want to support. They can visit CharityNavigator.org to find highly rated organizations.

Teach Kids How Their Money Can Grow

Saving money is a great habit. But if you want your kids to learn how to truly build wealth, teach them about investing, Sheehan says. “I’ve tried to pass on this knowledge and insight to my kids,” he says.

All four of his children have custodial investment accounts he set up for them (minors can’t open their own accounts). Sheehan started teaching his two oldest children, who are 20 and 18, when they were young about how they could invest their money and see it grow at a faster rate. He’s still working to get his younger two children to understand. “Some are ready for it at a young age,” Sheehan says. “Some maybe a little bit later.”

“Some are ready for it at a young age,” Sheehan says. “Some maybe a little bit later.”

If you don’t understand investing well, you could give your kids a book that explains how it works. Renick says his father introduced him to the personal finance classic The Richest Man in Babylon when he was 12 or 13. “That book really motivated me to want to invest and spend less than I earned,” Renick says.

You can help children get started investing by opening a custodial account with a brokerage such as Charles Schwab, E*TRADE, Fidelity or Stockpile. And Greenlight will start offering an investment option with its accounts later this year.

Model Good Financial Behavior

Just as important as the lessons you teach your kids about money are the ways you discuss and handle money when you’re around them. For example, if you complain about having to spend too much on certain things and then take your kids on a shopping spree, you’re sending mixed messages.

Instead, make sure you model the behaviors around money that you want your children to adopt. Renick says that not only would his father encourage him and his brothers to do work around the house, but also he would jump in and help them out.

Renick says that not only would his father encourage him and his brothers to do work around the house, but also he would jump in and help them out.

“Some of my favorite childhood memories are of having my father assist me washing cars and cutting grass,” Renick says. “He would also use those experiences to talk to my brothers and me about the importance of work and managing our money. He would share things like, ‘It is not how much you make, but what you do with what you make, that makes a difference.’”

If you want your children to develop good spending and saving habits, they need to see you making smart spending and saving choices. In short, practice what you preach. And preach with consistency. Educating your children about personal finance is a process that can take time. But if you put in the effort and continuously communicate a clear message about money, you will instill good habits that will serve your children well.

Was this article helpful?

Rate this Article

★ ★ ★ ★ ★

Please rate the article

Please enter valid email address

CommentsWe'd love to hear from you, please enter your comments.

Invalid email address

Thank You for your feedback!

Something went wrong. Please try again later.

More from

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

Cameron Huddleston is an award-winning journalist with nearly 20 years of experience writing about personal finance. She also is the author of Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances. Follow me on Twitter @CHLebedinsky

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. This compensation comes from two main sources. First, we provide paid placements to advertisers to present their offers. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. Second, we also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

Are you sure you want to rest your choices?

Children and money: how to teach a child to manage money wisely

Children's personal expenses grow in proportion to their age. Complaints of the older generation are often heard: children do not know how to compare their opportunities and expenses. Wealthy parents are sometimes ready to satisfy any whim of their children. But a child who knows nothing of refusal can grow into an irresponsible spender. Therefore, you should not let such an important matter as the skill of managing personal money go by chance.

Therefore, you should not let such an important matter as the skill of managing personal money go by chance.

Author:

Tatyana Yurievna Saprykina, financial director of CJSC Grant Thornton.

Children's personal expenses increase in proportion to their age. Complaints of the older generation are often heard: children do not know how to compare their opportunities and expenses. Wealthy parents are sometimes ready to satisfy any whim of their children. But a child who knows nothing of refusal can grow into an irresponsible spender. Therefore, you should not let such an important matter as the skill of managing personal money go by chance.

By replacing parental attention with money, you raise a child who does not understand the value of money. Experts say that such a situation in wealthy families is not uncommon. Parents often pay off their children with money instead of communication. Growing up, children often fall into apathy, they either want to earn big money right away, or they don’t want anything. Sometimes they have a fear of not being able to earn money on their own, so they don’t try, but simply spend their parents’ money. There is no single solution to the “money and children” problem. But it is possible to single out several areas for reflection.

Sometimes they have a fear of not being able to earn money on their own, so they don’t try, but simply spend their parents’ money. There is no single solution to the “money and children” problem. But it is possible to single out several areas for reflection.

Shopping visit. Psychologists assure that children can be sent shopping from the age of six. It trains useful skills. At the same time, when sending a baby for shopping, you can present it not only and so much as a household duty, helping mom / dad, but also as an element of learning financial literacy. If suddenly there is not enough change, then we can recommend you to be more attentive next time in the process of learning about real life.

Failures. An important educational moment, according to psychologists, is sometimes to refuse to buy a child. This should be done from 3-5 years for two reasons. Firstly, in order for the child to get used to the concepts of “no money”, “you need to earn it”, “you need to save it up”. Secondly, so that he understands that not all of his desires will be fulfilled immediately. Children from wealthy families often have no interest in life, they have nothing to strive for, because all their desires are fulfilled immediately.

Secondly, so that he understands that not all of his desires will be fulfilled immediately. Children from wealthy families often have no interest in life, they have nothing to strive for, because all their desires are fulfilled immediately.

Pocket money. Should a child have personal money? From what age? These questions concern many parents. Child psychologists say that children begin to perceive money as a universal equivalent only by the age of 6-7, before that they prefer barter, for example, one toy for another. If this is so, then it may not be worth giving money to an ordinary child before school. But then it is hard to imagine that a modern child does not have money in his pocket. Some have more, some have less. Some people get their money earlier, others later. The child must certainly feel like a full-fledged member of the school community, this is extremely important for him. For children over 12 years old, "own money" helps to prepare for adulthood, learn to manage their desires.

Student students may be given a fixed amount for out-of-home meals, entertainment. Of course, there are no single recommendations on the amount of pocket expenses. Families have different financial situations. Amounts that are natural for some may be perceived as unreasonable by others. According to the idea, a student should have enough pocket money for the most necessary things: transport, food outside the home, entertainment (cinema, computer games), etc. Many parents rightly fear large sums in their children's pockets and prefer to buy everything themselves. Whichever approach to financing parents choose, they should remember that

money creates needs and they need to keep track of exactly what needs they create in a child. Psychologists advise setting the amount of pocket money as part of planning the entire family budget. It is very good if children also participate in the “budget process”.

Control level. One parental extreme: if we play adulthood, then we play to the end - the child is free to spend his money on anything. Another extreme: be sure to find out what the money was spent on. Psychologists advise trusting children, avoiding petty nit-picking, but maintaining a constant dialogue. If you are aware of how the child spends money, then this is more likely to avoid unpleasant situations when someone constantly takes pocket money from the child or when he becomes involved in some near-criminal plots. When it comes to, say, raising money for a party and a child no more than 12-15 years old, it does not hurt to phone other parents.

Another extreme: be sure to find out what the money was spent on. Psychologists advise trusting children, avoiding petty nit-picking, but maintaining a constant dialogue. If you are aware of how the child spends money, then this is more likely to avoid unpleasant situations when someone constantly takes pocket money from the child or when he becomes involved in some near-criminal plots. When it comes to, say, raising money for a party and a child no more than 12-15 years old, it does not hurt to phone other parents.

The child must understand that money is the work of parents and should be treated with respect. A trusting relationship between children and parents in money matters is important. They help to nurture independence in financial decisions in the younger generation. The child must get used to the idea that money is an important aspect of our life, they must be managed wisely.

Children's earnings. Experts advise stimulating the child's desire to achieve what he wants, regardless of the presence of a lot of money in the family, from childhood to teach him to be responsible with money and instill: to maintain prosperity, you will have to work hard, not relying only on parental money. Otherwise, capital is easy to lose. In the West, many children from wealthy families earn extra money from the age of 7-10. Teenagers (13-19years) and students - almost without fail. This may be a job in street trading, fast food, looking after small children, etc. All this helps to understand not only business processes - “how money is made”, but also to find out the “value of money”. This approach, typical of Western education, is gradually beginning to spread in Russia, where it was previously customary to help children until retirement, which sometimes deprives them of motivation to earn their own money.

Otherwise, capital is easy to lose. In the West, many children from wealthy families earn extra money from the age of 7-10. Teenagers (13-19years) and students - almost without fail. This may be a job in street trading, fast food, looking after small children, etc. All this helps to understand not only business processes - “how money is made”, but also to find out the “value of money”. This approach, typical of Western education, is gradually beginning to spread in Russia, where it was previously customary to help children until retirement, which sometimes deprives them of motivation to earn their own money.

Financial planning for children. It is necessary to help the child understand the relationship between lifestyle and personal budget, between a rash act and unpleasant financial consequences. The process can be schematized in several steps. These steps require patience, but you want a better future for your child, don't you?

- Step One: Life Attitudes.

Invite the child to look into the future. Who would he like to become? Let the kid choose a profession and occupation, an occupation that provides his income. Will he have a car when he becomes an adult? What car does he dream of? How about an apartment or a house? We do not comment on all these “life attitudes”, but we outline them.

Invite the child to look into the future. Who would he like to become? Let the kid choose a profession and occupation, an occupation that provides his income. Will he have a car when he becomes an adult? What car does he dream of? How about an apartment or a house? We do not comment on all these “life attitudes”, but we outline them. - Step two: Personal balance. Now ask your child to search the Internet for information about the average income of people working in the field he has chosen. To do this, you can visit various job search sites. We will take the numbers found as a basis. Pay attention to the child: the salary of novice employees, as a rule, is much lower than that of experienced specialists. Many of the children will be shocked. The concept of “the salary of a person without work experience” is alien to children. It's time to show how it is with the financial aspect of choosing a life path.

- Step three: Financial report. To see how the dreams of a small person about a house, a jeep, travel and other benefits correspond to the real possibilities of a representative of a particular profession, continue the experiment.

Try to show your child what expenses await him when he begins to lead an adult, independent life. You can invite the child to contribute additional items of expenditure, for example, his personal hobby or hobby, which he plans to pursue in adulthood. Inform him about the amounts that today make up the main items of your expenses.

Try to show your child what expenses await him when he begins to lead an adult, independent life. You can invite the child to contribute additional items of expenditure, for example, his personal hobby or hobby, which he plans to pursue in adulthood. Inform him about the amounts that today make up the main items of your expenses. - Step four: Analysis of the results. What's left of your child's "earnings" after expenses are deducted? Maybe he went down the drain? Ask what monthly overpayments will lead to, how long can you live like this? Be sure to warn your child that not everything in life can be taken into account in advance: there are also such expenses as unexpected home or car repairs, medical treatment, care for aging parents, etc. The child must understand what adult life is, which seems so attractive to the child. Tell the children that the family may suffer from an economic crisis, loss of a job, or illness of someone close. But a serious attitude to finances gives a sense of security, even in such situations.

- Step five: Examples of budget items. Children are most often focused on the present, but they must be taught to look to the future. The task is to teach practical approaches to the realization of a dream. To do this, the child must think about what he can sacrifice for the sake of his most important dream, how to reduce expenditure items, make them correspond to income. Try to explain to your child that you can't learn how to save without knowing where the money goes. You need to be able to count money in order to have a clear idea of how much and what we need, and what we can do without.

- Step six: Changing lives now. Ask the child what kind of person can be called rich. The answer is simple: rich is the one who spends less than he receives, while satisfying all his needs. The balance received monthly can be invested so that it also works and makes a profit. Your child can start their journey to success right now. To do this, you just need to reconsider your lifestyle and start saving a small amount every month, which will be an investment in the future.

Invite your child to analyze his personal budget. Yes, he is a non-working person and his expenses and income are insignificant, but he can already begin to manage his finances.

Invite your child to analyze his personal budget. Yes, he is a non-working person and his expenses and income are insignificant, but he can already begin to manage his finances.

Only modern practical knowledge. Hundreds of other useful skills you can learn by compiling your curriculum from dozens of distance courses in our catalog, when studying in an individual program.

Study today

Also see

How to teach a child to manage money correctly?

Do you want your child not to pay interest by the age of thirty, but to live on it? Then start instilling in your child the right financial habits as early as possible. Here are some tips that might work for your family. And by the way, do not forget that it is best to raise children by example.

SPECIAL PROJECT "TIME TO SAVE"

HOW TO TEACH A CHILD TO MANAGE

MONEY CORRECTLY?

Tip 1.

Many children want sun e in a row. If your child is like this, teach him to form desires correctly

If your child is like this, teach him to form desires correctly

Does your child regularly throw tantrums in the toy store? What to do? No need to lose your temper, scold the child and, even more so, beat. What other ways are there? Ignore screams, try to lure out by cunning or bargain, promising something in return.

But the best way is to listen to all the "wishlists" and offer to jointly make a magical "wish list": younger children can draw all the objects they want, and older children can write a list in order from the most desirable item to the least desirable. The list should be hung in a conspicuous place, for example, on the refrigerator. After a couple of weeks, go back to the list with your child and decide what to buy.

In this way, you will help your child develop a healthy habit that will save him from impulsive and thoughtless purchases in the future.

Tip 2.

As soon as the child goes to school, give pocket money - a little, but regularly

Regularity is important. If you give a child a certain amount, for example, every Monday or every morning, he will eventually learn how to distribute money and "manage" it. Maybe even save up for a big purchase. And if the child receives money from time to time and in different amounts, it will be very difficult for him to plan expenses.

If you give a child a certain amount, for example, every Monday or every morning, he will eventually learn how to distribute money and "manage" it. Maybe even save up for a big purchase. And if the child receives money from time to time and in different amounts, it will be very difficult for him to plan expenses.

Tip 3.

If a child wants something expensive, offer him to save up

This way you will teach your child to better understand and control his desires. If you understand that the intentions are serious, the child refused some trifles for the sake of a big goal, you can offer to buy a thing in a pool and add the missing amount. Children with these skills achieve more in life.

In 1960, an experiment was conducted at Stanford University. The adults handed out a piece of marshmallow to the preschoolers, and then said that they would leave for a while. The guys who, until the return of the adult, endure and do not eat marshmallows, will receive another piece as a reward. Whoever eats will get nothing. As a result 90% of children ate their marshmallows and only 10% resisted the temptation.

Whoever eats will get nothing. As a result 90% of children ate their marshmallows and only 10% resisted the temptation.

After 50 years, the hypothesis of scientists was confirmed: those 10% of children who did not eat marshmallows, becoming adults, achieved high professional results. The rest became clerks or low-paid workers.

Tip 4.

If a child wants to earn money, don't forbid it. On the one hand, you are right, on the other hand, let him try if he wants to. And you better help find a job that you think is suitable. For example, your child can walk the neighbor's dog in the evenings or help you with something in the office. Discuss ideas together. Perhaps the child will quickly burn out, or maybe he will find his calling early.

Organize a trip to the bank for your child - make it an important family event. On the way, tell us why banks are needed, how the system works, and why you need to be careful with money. On this trip, you can open a deposit and explain why and how you need to save money. Perhaps a teenager will not understand 100% of the information, but you will surely be able to plant the seeds of financial literacy, and you will see the sprouts and even the harvest later.

On this trip, you can open a deposit and explain why and how you need to save money. Perhaps a teenager will not understand 100% of the information, but you will surely be able to plant the seeds of financial literacy, and you will see the sprouts and even the harvest later.

For this purpose, select the appropriate bank and banking product in advance. By the way, the legislation has recently changed in Kazakhstan. A new type of deposit has appeared - a savings deposit with a higher interest rate.

In connection with this, Tengri Bank has a new product - Tengri Maximum deposit with a maximum annual effective interest rate in tenge up to up to 13.9% and flexible terms. You can choose a convenient format for the financial capabilities and goals of your family. You can start with 10 thousand tenge. Interest will be capitalized or transferred to the current account on a monthly basis. You can also save in foreign currency. You can find out all these details either on the bank's website, or just during your trip-excursion to the bank.