How to stop child support in alabama

Terminating Child Support in Alabama

Financial support obligations stemming from an Alabama divorce are rarely intended to be life-long.

Whether it’s child support or spousal support, most obligations have an expiration date. For example, child support typically ends at the age of majority, which is 19-years-old in Alabama. Spousal support usually only lasts two to five years, unless an order for permanent alimony is issued.

There are circumstances under which the courts will allow early termination of support obligations. But you have to ask.

The Birmingham child support lawyers of Alabama Divorce & Family Lawyers, LLC are well-versed in the process of requesting and obtaining termination of support obligations. In each case, our experienced legal team conducts a thorough analysis of the facts prior to filing the request to ensure there is a good chance the court will grant it and clients aren’t wasting time and money.

Let’s start with termination of child support obligations.

Termination of Child Support

Generally speaking, child support obligations in Alabama will be owed until the child reaches the age of 19. That is considered the age of majority in this state.

Child support is paid to the custodial parent by the non-custodial parent in order to ensure the children receive financial support from both parents in the event of separation. It may also come in the form of health insurance premium payments and division of financial responsibilities for the child’s daily care, education and various extracurricular activities.

Absent an out-of-court agreement between the parents, these payments are ordered by a judge in accordance with Rule 32, Alabama Child Support Guidelines. The final decision factors in each parent’s income and earning capacity, the number of children involved and the best interests of the children.

Prior to the child turning 19, these payments can be modified at the request of either parent on various grounds. However, termination of child support payments is tougher to obtain. In general, this can happen in one of the following circumstances:

However, termination of child support payments is tougher to obtain. In general, this can happen in one of the following circumstances:

- Child reaches the age of majority

- Child dies

- Paying parent obtains physical custody

- Paying parent loses/forfeits his or her parental rights

- Paying parent requests the child be emancipated

The first two are fairly straightforward, and will likely be granted without issue.

In the case of a paying parent obtaining physical custody, it’s likely the court will terminate or at least amend support obligations at the same hearing at which the new custody arrangement is decided. However, it’s important for the attorney representing that parent to be sure of it. It may also be necessary for that parent to request for child support payments from the newly non-custodial parent.

If a parent loses or forfeits his or her parental rights (called termination of parental rights), he or she will no longer be obligated to financially support that child. Most courts will not allow parents to abandon his or her financial obligation simply because he or she chooses to do so. The courts will usually seek a finding that the parent is somehow unfit and that termination of parental rights is in the best interest of the child. Alternatively, a parent may agree to termination of parental rights if there is someone else (i.e., a stepparent, grandparent, etc.) who wants to legally adopt the child.

Most courts will not allow parents to abandon his or her financial obligation simply because he or she chooses to do so. The courts will usually seek a finding that the parent is somehow unfit and that termination of parental rights is in the best interest of the child. Alternatively, a parent may agree to termination of parental rights if there is someone else (i.e., a stepparent, grandparent, etc.) who wants to legally adopt the child.

Finally, child support obligations may be terminated if the paying parent requests emancipation. This would be reserved for cases wherein the child may be under the age of 19, but is functioning as an independent adult. An example might be an 18-year-old who joins the military. These requests are carefully weighed by the court on an individual basis, and grant of such requests are by no means guaranteed.

It’s worth noting that after the 2013 Alabama Supreme Court decision in Christopher v. Christopher, parents are no longer obligated to pay college tuition costs as a part of child support payments. Some marital agreements may include such a provision where both sides come to a mutual agreement about it, but it can no longer be ordered as an extension of child support.

Some marital agreements may include such a provision where both sides come to a mutual agreement about it, but it can no longer be ordered as an extension of child support.

Termination of Alimony

Alimony, also known as spousal support, is financial assistance paid from one former spouse to another in order to aid their economic recovery or allow them to avoid impoverishment after divorce.

Usually, unless the divorce decree specifies the need for permanent alimony, this support is not continued indefinitely. However, there are some circumstances under which spousal support may be terminated early. All include a material change in circumstance.

The most common is specifically spelled out in Ala. Code. 30-2-55. This allows for termination of alimony upon either remarriage or cohabitation. That is, if your former spouse to whom you are paying alimony is remarried or now living with a new boyfriend or girlfriend, the law allows for termination of spousal support.

The burden of proof upon filing a petition rests with petitioner. In the case of a remarriage, public records can easily establish this fact. However, proof of cohabitation may be a bit trickier. It typically involves presenting proof of:

In the case of a remarriage, public records can easily establish this fact. However, proof of cohabitation may be a bit trickier. It typically involves presenting proof of:

- Financial interdependencies (ie., does the couple share a residence, utility bills, grocery bills, household chores, etc.?)

- Social interdependencies (i.e., is it an exclusive relationship, do they include their respective children in activities and events, etc.).

Sometimes people present the court with evidence gleaned from social media (i.e., photographs, vacations, messages, posts, etc.). Other times, it can be established by a change in financial habits.

Other reasons for termination of support may be:

- Death of either former spouse;

- Financial windfall by receiving spouse;

- Loss of employment or income by paying spouse.

No matter what the situation, call us today to learn more about your rights, obligations and the likelihood of success in filing such a petition.

Contact Alabama Divorce & Family Lawyers, LLC at (205) 255-1155, or reach out online.

Child Support in Alabama: The Definitive Guide

This is the definitive guide to child support in Alabama.

In this guide, we’ll cover how child support is calculated, what counts as income, how long child support lasts, enforcement for non-payment, and a slew of other issues.

Let’s get started.

How is child support calculated in Alabama?

Alabama recognizes that both parents have an obligation to support their children, whether the parents are married or not. The amount each parent is obligated to pay is based on a complex formula that uses several factors.

Specifically, Alabama uses the Income Shares Model to determine child support.

Under this model, each parent should contribute the same proportion of their income as if the parents were still living together. Under this scenario, the parent with the higher income will end up paying a larger percentage of support than the parent with lesser income.

The Income Shares model uses a four-step process:

Step 1: Add the incomes of the two parents together to determine the combined total gross income.

Step 2: Apply the total income amount to the Alabama Schedule of Basic Support Guidelines. You will need to match the total income with the number of children to come up with the total child support obligation.

Step 3: Adjust the total child support obligation by adding additional expenses such as extraordinary medical costs, work-related child care expenses, and health insurance.

Step 4: Take the final support obligation calculation and divide it proportionally between the two parents based on their percentage of the income.

Key Takeaway: Alabama uses the Income Shares model, a four-step process to determine each parent’s child support obligation.

If one parent earns 60% of the total gross income, they are responsible for 60% of the total child support payment. The other spouse is responsible for 40%. Allowances are made for the child living with the custodial parent. It is assumed that the custodial parent will spend their percentage of support payments directly on the child.

The other spouse is responsible for 40%. Allowances are made for the child living with the custodial parent. It is assumed that the custodial parent will spend their percentage of support payments directly on the child.

What income sources of income are counted for purposes of determining child support?

Sources of income that must be included in gross income amounts are clearly defined by Rule 32. Income sources can include:

- Salaries or wages

- Commissions

- Severance pay and pensions

- Gifts and prizes

- Interest

- Disability insurance and benefits

- Annuities and capital gains

- Social security benefits

- Pre-existing periodic alimony

- Workers’ Compensation Benefits

- Unemployment insurance benefits

The Alabama Child Support Calculator

To assist in determining how much child support you may need to pay, there are several sources that will provide you with an Alabama Child Support Calculator. Go here to plug in numbers that will determine your obligation.

Go here to plug in numbers that will determine your obligation.

The figures that are determined by using the calculators are for assistance purposes only and not legally binding. Only the court can approve a legally binding child support agreement. These calculators are designed to give you guidelines of what to expect.

An example of how child support works in Alabama

Let’s assume Richard and Teresa are getting a divorce in Alabama. They have one child and childcare expenses are $400 per month. For simplicity’s sake, we’ll also assume that Richard’s employer covers health insurance and that there are no other extraordinary expenses to note.

If Richard makes $4,000 per month and Teresa makes $2,000 per month, together they would earn $6,000 gross each month.

Based on the Basic Child Support Obligations Chart, there would be an obligation of $818 per month. The total child support amount each month would be $1,218 after childcare expenses are added in.

With this figure in hand, the amount each parent must pay is then prorated. Richard’s income is $4,000 per month or 66.6% of the total. Teresa’s amount is $2,000 or 33.3% of the total.

Richard’s total obligation would be $812.40 ($1218 x 66.6%) and Teresa’s obligation would be $405.60.

This does not account for any deviations from the Income Shares model which can be the case.

At what age does child support stop in Alabama?

In most cases, child support ends when a child graduates from high school, reaches the age of 19, or becomes emancipated.

The exception is if the child is attending college and if he or she is not working, the non-custodial parent is still obligated to pay support.

If a child is disabled, the court may also order both parents to continue support when he or she becomes an adult.

Parents can also mutually agree to extend support if they so desire.

Alabama Child Support FAQs

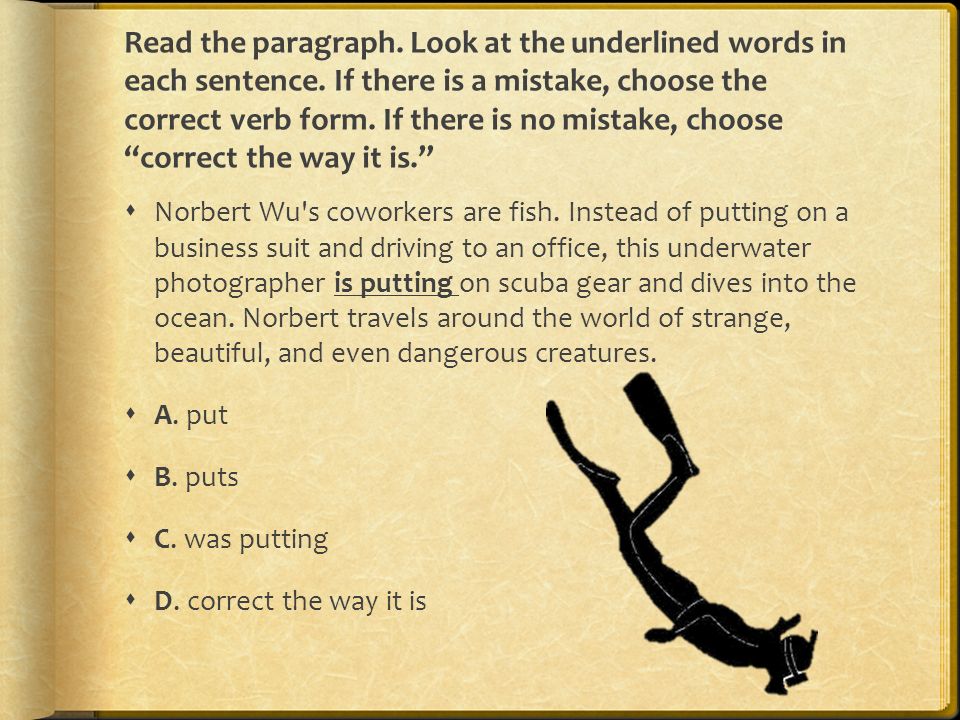

Can the court deviate from the child support guidelines?

Yes. Under Alabama Child Support Rule 32, which sets the basis for the amount of money that is paid for child support in the state, also allows for deviations and exceptions.

Under Alabama Child Support Rule 32, which sets the basis for the amount of money that is paid for child support in the state, also allows for deviations and exceptions.

These can be enacted by a fair and written agreement between parents that established a different amount which also states the reasons for the deviation. The court can also make the determination to deviate, based on the evidence presented or if the guidelines would be manifestly unjust or inequitable.

Specifically, reasons for deviating from the guidelines may include, but are not limited to:

Shared physical custody or visitation rights providing for periods of physical custody or care of children by the obligor parent substantially in excess of those customarily approved or ordered by the court.

- Extraordinary costs of transportation for purposes of visitation are borne substantially by one parent.

- Shared physical custody or visitation rights with periods of physical custody or care of children substantially in excess of those customarily approved or ordered by the court.

- Expenses of college education incurred prior to a child’s reaching the age of majority.

- Assets of, or unearned income received by or on behalf of, a child or children.

- Other facts or circumstances that the court finds contribute to the best interest of the child or children for whom child support is being determined.

Courts are not required to deviate if one or more of these reasons are present, but they are allowed to use these reasons to consider the matter.

Can the court impute income if a parent quits their job?

Child support is viewed as a top priority by the court and you will still need to pay even if you don’t have a job. If you can’t afford to pay, then support payments will pile up in “arrears” until you have an income and can afford to pay what you owe.

If you lose your job, it does not matter if you were fired, quit or lost it through misconduct.

The court will impute income based on the earning capacity of the parent who owes support, and consistent with the best interests of the children.

When a parent quits a job, the court usually imputes income they had been making and use that amount to calculate child support.

Similarly, if a parent administering child support quits his or her job as a way to try and gain more child support, the court will impute that parent’s income and probably award little or no extra support payments.

Can child support arrears be dropped in Alabama?

In certain cases, child support arrears can be dropped.

If the parent who owes the child support is unemployed, self-employed or is judgment proof, a recipient may choose to sign a release of judgment.

If you are the parent forgiving the support payments, you’ll need to draft a statement to that affect and that you are partially releasing the other parent from their obligation. You can choose to either release a specific amount or as of a particular date.

After the document is drafted, you’ll need to have it signed in front of a Notary Public. Then you will submit the signed, notarized and original copy to the Superior Court Clerk in the county where the child support judgment was entered.

Can child support orders be reviewed and adjusted?

Yes. There is a Review and Adjustment process used to determine if the support amount is still appropriate. The review can also take place to determine if medical support needs to be added to an existing order.

Typically, a review will take place only once every 36 months, unless there is a significant financial windfall or a medical crisis that takes place.

An attorney can submit the appropriate paperwork to the court and schedule a hearing for your case to be heard. In some cases, when both parties agree to a modification, a court hearing won’t be necessary. When there is a disagreement, a judge will render a final decision.

What actions can be taken if I’m having trouble finding a non-custodial parent?

Before child support payments can take place, a noncustodial parent must be located to ensure they will comply with a child support order. Verifying a current address and/or employer is an important part of the child support process.

The noncustodial parent must be served with specific court documents to legally make sure a case can go forward. The Alabama State Department of Human Resources can use a variety of sources to track down the noncustodial parent. These sources can include:

- Internal Revenue Service and State Income Tax records

- Family Assistance and Food Assistance records

- Social Security Administration

- Military records

- Motor vehicle registration and driver license records

- Department of Corrections records

- United States Postal Service

- Current and previous employers

- Quarterly wage and Unemployment Compensation claims data

- Law enforcement agencies, parole and probation offices

The state can also utilize the Federal Parent Locator Service in Washington to aid in location if certain information is known. The best information to provide is a Social Security number, but other information can also prove valuable as well, such as:

- Names and nicknames

- Social Security Number

- Date and place of birth

- Last known home address

- Last known employer

- Photograph

- Relatives’ names and addresses

- Military records

- Assets (home, business, cars, boats, etc.

)

) - Enforcement of Court Ordered

- Child Support Payments

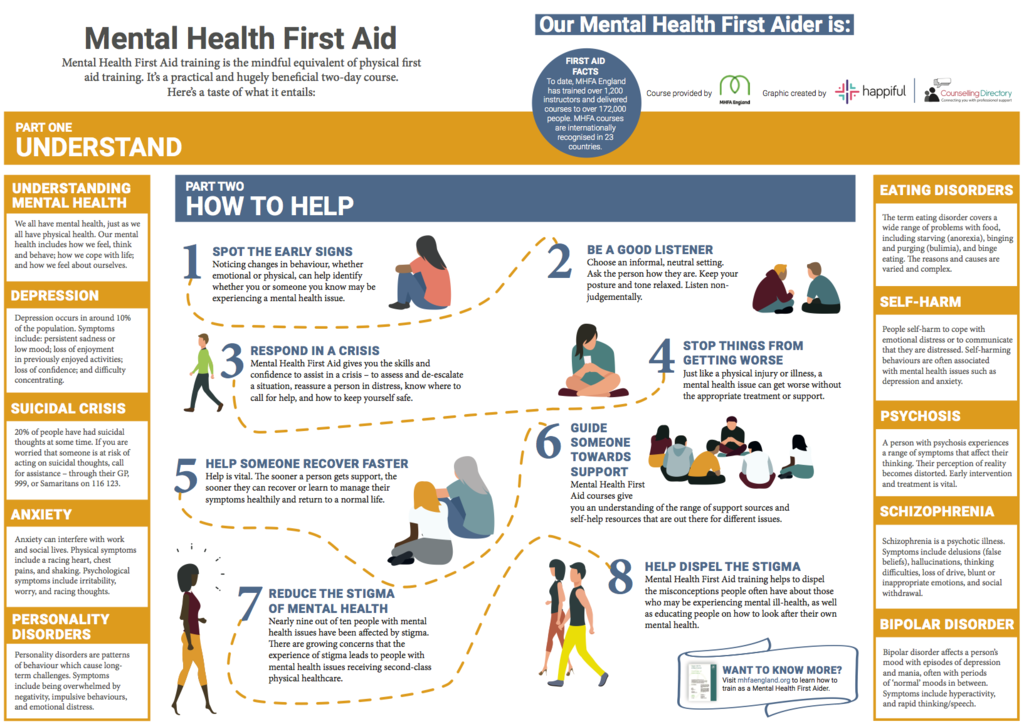

What is the Alabama Child Support Enforcement Program?

The Alabama Child Support Enforcement (CSE) Division is a joint federal and state effort to help families work through a variety of child support issues with the ultimate goal of helping them achieve self-sufficiency. It is administered by the State of Alabama Department of Human Resources.

People who are currently receiving Temporary Assistance for Needy Families (TANF) are automatically eligible for assistance in the Child Support Enforcement Program.

Others can apply for assistance by making an appointment with any county Department of Human Resources office in Alabama.

You will need to complete the following forms when you apply:

- Application for Child Support Services

- Case Information Worksheet

- Affidavit of Income

Depending on your income, you will have to pay a $5 or $25 fee when you apply for services. If you receive Medicaid, you don’t have to pay the fee.

If you receive Medicaid, you don’t have to pay the fee.

The Application Process

You will need to complete an Application for Child Support Services, a Case Information Worksheet, and an Affidavit of Income. In most cases, you will also need to pay a small fee when you apply.

The CSE works with child support attorneys throughout the state to provide legal services. The attorney is required to pursue legal remedies to establish and enforce child support obligations. The attorney will not represent you. They represent the State of Alabama only.

Also, the attorney only deals with child support issues. If you need other legal assistance related to custody, visitation or anything other than support, you will need to seek legal assistance through other resources.

The CSE can provide assistance with the following child support issues:

Child Support Order Establishment. This includes court actions to obtain an order for child support, medical support or possibly retroactive support. Alabama Child Support Guidelines based upon Alabama State Law (Rule 32 of the Alabama Rules of Judicial Administration) are followed to make fair and consistent support orders.

Alabama Child Support Guidelines based upon Alabama State Law (Rule 32 of the Alabama Rules of Judicial Administration) are followed to make fair and consistent support orders.

Separation Cases. When the parents of a child(ren) are married but separated, and the non-custodial parent is not providing support for the child(ren) and has no court order to do so.

Paternity Cases. When paternity is established, orders must also be issued that address support, medical support and an order for Income Withholding.

Acknowledgment of Paternity Cases. Assistance is provided when the mother and the alleged father complete an Acknowledgment of Paternity at the hospital or at the Department of Human Resources Office.

Divorce Cases. When the parents of children are divorced and there is no provision for child support or medical support in the divorce order.

Related: A Guide to Divorce Laws in Alabama

Foster Care Cases. Cases where children are in the custody of or are receiving out-of-home care from a State agency.

Cases where children are in the custody of or are receiving out-of-home care from a State agency.

CSE will provide collection, distribution and the allocation of child support payments for each of these issues.

Who Can Apply for Assistance

A parent can apply for assistance if they are:

- A custodial parent

- A legal custodian

- A person having care and control, but not legal custody of the child(ren)

- Alleged fathers wanting to establish paternity

- A representative of an agency holding custody of a child by order of the court

- Custodial parents with emancipated children who are owed arrears that accrued under a court order while the children were minors

- Non-custodial parents

Types of Enforcement Actions

There are several things the State of Alabama can do to collect child support, spousal support or medical support payments from an individual. These enforcement actions include:

Income withholding. A court or administrative order can direct the non-custodial parent’s employer to deduct child support from his/her wages.

A court or administrative order can direct the non-custodial parent’s employer to deduct child support from his/her wages.

Reporting to credit bureaus. If the parent’s child support payments are more than $1,000 in arrears, this information is automatically submitted to credit reporting bureaus. Once the balance reaches zero, an addendum is reported to the bureaus as well. However, the debt notice will remain on the parent’s credit file for 7 years.

Passport denial. If the parent’s arrears are greater than $2500, they may be eligible for a federal passport denial, revocation or restriction.

Liens. A legal hold can be placed on a parent’s property so that a child support debt must be paid before the property can be sold or refinanced. This can extend to real estate, vehicles, bank accounts, insurance settlements or other similar assets.

Suspension of licenses. When a parent does not pay, in some cases, their driver’s license, professional, sporting or recreational licenses can be suspended or revoked.

Employing Financial Institution Data Match (FIDM). This identifies accounts in financial institutions that belong to parents who are delinquent in their child support obligations. Once identified, these accounts are subject to liens and levies.

Certifying debts for income tax offsets. If a parent owes back support of at least $150, the state can report the parent to the Internal Revenue Service and the State Department of Revenue. Support payments will then be deducted from federal or state tax refunds.

Possible federal prosecution. It is a federal crime to cross state lines to avoid paying child support. You could be prosecuted under federal law if you violate this statute.

IRS Full Collection. This is a last resort that involves asking the Internal Revenue Service for action to collect back support of at least $750.

To apply, you will need to initially complete a Child Support Enforcement Division application, a case information worksheet and an affidavit of income.

What are my rights when I am engaged in child support services through the State of Alabama?

According to the Alabama DHR website, when you receive child support services from the State of Alabama, you have the following rights:

Full and Fair Treatment

You have the right to receive all the services necessary and appropriate in your case to get or collect child support. You have the right to receive those services regardless of your sex, color, race, national origin, or any handicap or disability. Notices are posted in all of our offices telling you what to do if you think you are being treated unfairly.

Confidentiality

You have the right to confidential treatment of all the private information that you give us or that we find in our investigation about your case. This means that the agencies involved will not tell any outside agency or individual what we know about you or your family unless we must do so in order to collect child support for your child. Even then, we will tell only what is absolutely necessary in your case.

Even then, we will tell only what is absolutely necessary in your case.

Notification

You have the right to be told about all important actions concerning your case. We will tell you about the progress of your case whenever you ask us. We will also tell you whenever there is going to be a court hearing in your case, and whenever we get an order or determine that we cannot get an order in your case.

If you receive TANF, we will continue to provide child support services when your TANF payments stop, unless you ask us to no longer provide services. We will tell you upon request how much money we have collected in your case and how we have distributed it. Finally, we will tell you when we plan to close your case.

Participation

You have the right to participate in any court actions involving your case. You have the right to ask for and participate in the review of your support order.

Due Process

Your involvement in the Alabama Department of Human Resources Child Support Enforcement Program gives you the right to request a review of any action or inaction by the agency.

You have three options:

- You may request a conference with the child support worker who has been handling your case.

- You may request a review of your case at the county level without a conference with the worker.

- You may request an administrative hearing at the State Office level of Child Support Enforcement.

Your request for any of these three options must be submitted in writing to the County Department of Human Resources that is handling your child support case. An administrative hearing request may be sent to the county office and/or to the State Office of Child Support Enforcement at 50 North Ripley Street, Montgomery, AL 36130.

All programs of the Department of Human Resources are administered in accordance with the Civil Rights Act of 1964, the Rehabilitation Act of 1973, and the Americans with Disabilities Act of 1990, and all other Federal and State Civil Rights Laws.

Where can I find child support payment information online?

The State of Alabama has published Child Support: A Guide to Services in Alabama that will provide you with a comprehensive overview of the state’s child support services.

You can also visit the State’s Department of Human Resources website, call an automated Hotline at 1-800-284-4347 or if you’re out of state, you can call 1-334-242- 0210.

Where can I find Alabama child support forms?

You can find Alabama child support forms on the Alabama Department of Human Resources website located here.

How to Cancel Child Support?

It is necessary to file an application with the court to determine the place of residence of the child with the father and cancel Alimony .

To stop paying child support legally, you must apply to the court in an action or writ proceeding to obtain a court decision or order to cancel child support . An executive document must be submitted to the bailiff service to stop the collection of alimony payments. nine0007

Child support can be canceled by court order or by agreement of the parents . At the same time, it is necessary that the property interests of the child are not violated. Therefore The cancellation procedure is controlled by the court or notary.

At the same time, it is necessary that the property interests of the child are not violated. Therefore The cancellation procedure is controlled by the court or notary.

Can single parent support be cancelled?

In the case when a child changed his place of residence from one parent who received child support to the one who paid them, the issue of canceling the calculation of alimony can be resolved. The same should be done if the mother and child have left in an unknown direction and there has been no news from them for several years. nine0007

How is fixed child support determined?

Child support in a fixed amount is assigned as a multiple of the subsistence minimum for children in the region of residence of the recipient of the alimony, and in the absence of such an indicator in the subject of the country, the corresponding subsistence minimum for children established in the whole of the Russian Federation is used.

How to cancel child support?

For to cancel child support legally, the ex-father needs to go to court. The application must be accompanied by documents confirming the renunciation of paternity and the adoption of the child by another person. After the adoption of the court decision, the obligation to support the minor is removed. nine0007

How to write an application to terminate the payment of alimony?

An application for the cancellation of alimony for a child is filed with the district court at the place of residence of the recipient of alimony in cases of adoption or inaction of a bailiff or employer if there are grounds for terminating the collection. The amount of the state duty is determined based on the totality of the remaining payments for no more than a year.

Is it possible to cancel alimony from bailiffs?

Presentation of a writ of execution for collection alimony is the right, not the obligation of the claimant, and nothing prevents or not to file Writ of execution at all or to withdraw it in the future.

How to suspend child support payments?

In order to stop paying alimony , it is enough for a parent to prepare an evidence base and apply to the appropriate court with an application to stop collecting alimony (go to the sample). From the moment the court makes a decision, the parties cease to depend on each other, and maintenance payments cease. nine0007

Can child support payments be cancelled?

To stop paying child support legally, you must apply to the court in an action or writ proceeding to obtain a court decision or order to cancel child support . An executive document must be submitted to the bailiff service to stop the collection of alimony payments.

How can alimony be canceled if the child lives with the father?

To father no longer pay alimony for the maintenance of child , who lives with him and is supported at his expense, he needs to file Statement of Claim to the court for exemption from paying alimony .

What do you need to withdraw child support?

You can refuse alimony : Through the court Through a bailiff Through a notary

To certify the agreement, parents during a visit to the notary must have with them:

- Own passports

- Birth certificate of the child (or children)

- All documents confirming the transfer of property

- Previous agreement (if any)

Can a child support court order be overturned?

It is possible to cancel the decision on the recovery of alimony

Judges of the peace have samples of applications for its issuance. As as a rule, women write an application according to the model. The issued court order can be canceled if the debtor under maintenance payments received objections within 10 days from the date of receipt of its copy.

How to stop paying child support after 18 years?

A parent who makes maintenance payments has the right to apply to the accounting department with an application for termination of payments in connection with the acquisition of full legal capacity by the child. A copy of the document that recognizes the child as fully capable should be attached to the application.

How to revoke a writ of execution from bailiffs? nine0021

To revoke writ of execution , you need to provide an appropriate application to the special unit of the bailiff , which conducts enforcement proceedings, the application is also called - on the withdrawal of writ of execution .

Can I sue for child support again?

What to do if the bailiffs have arrested the alimony account?

What to do , if alimony is arrested ?

- Administratively. In this case, a complaint is filed with the head of the bailiff , who made the decision to arrest alimony on your account.

Usually the complaint is written to the head of the department.

Usually the complaint is written to the head of the department. - In court. Through the court, to cancel the decision FSSP to arrest alimony is longer and more expensive.

How to get rid of alimony arrears?

There are several ways to formally refuse from alimony:

- with the help of a maintenance agreement;

- in court during a divorce or resolution of an issue related to alimony ;

- by contacting the bailiff.

When is the father exempt from paying child support?

Exemption from the payment of alimony occurs automatically when the child reaches the age of majority (if after reaching the age of 18 he is not a disabled person of 1 or 2 groups), as well as in connection with the death of the payer or recipient. nine0007

How can I avoid paying maintenance for my ex-wife?

A man not is obliged to support his wife after a divorce, if:

The former spouse behaves immorally towards her husband and children. These are betrayals, lack of care for children, neglect of maternal duties. The court recognizes Marriage as short-lived and cancels alimony . Usually in such cases, the duration of the marriage exceeds a year.

These are betrayals, lack of care for children, neglect of maternal duties. The court recognizes Marriage as short-lived and cancels alimony . Usually in such cases, the duration of the marriage exceeds a year.

Can I stop paying child support? nine0021

- But you can stop paying child support only when the court decision on adoption comes into force. The child was emancipated. Emancipation is the possibility of obtaining full legal capacity for a child aged 16 to 18 years. To use it, the child must work under an employment contract, apply for an individual entrepreneur or marry.

When, after the collection of maintenance payments, did the child move to the upbringing and maintenance of the father?

- If, after the collection of maintenance payments, the child for some reason transferred to the upbringing and maintenance of the father, the latter must apply to the court.

In this case, Claim for exemption from payments in connection with a change in the place of residence of the child. At the same time, evidence of the child's residence with the father must be submitted to the court:

In this case, Claim for exemption from payments in connection with a change in the place of residence of the child. At the same time, evidence of the child's residence with the father must be submitted to the court:

Stop collecting child support due to death \ Acts, samples, forms, contracts \ ConsultantPlus

- Home

- Legal resources

- Collections

- Stop collecting child support due to death

A selection of the most important documents on request Stop collecting child support due to death (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Alimony obligations of children for the maintenance of parents

- The alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more .

..

..

9001 Stop collecting alimony due to death

Register and get trial access to the ConsultantPlus system free of charge to 2 days

Open a document in your ConsultantPlus system:

it follows that property rights and obligations not related to the personality of the testator are part of the inheritance (inheritance property). At the same time, both the rights to the inherited property and the obligations to pay off the relevant debts of the testator, if they existed on the day of his death, simultaneously pass to the heirs. The heir of the debtor, subject to the acceptance of the inheritance, becomes the debtor of the creditor of the testator within the value of the inherited property transferred to him. They are not inherited and from the moment of the debtor's death, obligations to pay alimony cease for the future, as obligations inextricably linked with the personality of the debtor.0007

Register and receive trial access to the ConsultantPlus system Free for 2 days

Open the document in your consultantPlus system:

Selection of court decisions for 2019: Article 120 "Continuation of Alimony obligations" of the RF

(R. B. Kasenov) The court satisfied the claims of the plaintiff, acting in the interests of a minor, to the defendants for the recovery of alimony arrears. As the court pointed out, the father of the minor, whose paternity was established by court decision, died. By a court decision, alimony was collected from the father of the minor. On the date of the death of the testator, the alimony debt remained outstanding. The heirs of the deceased are his daughters and wife - defendants. In paragraph 2 of Art. 120 of the Family Code of the Russian Federation provides that the payment of alimony, collected in court, is terminated by the death of the person receiving the alimony, or the person obliged to pay the alimony. At the same time, a court ruling providing for the recovery of alimony from an obligated person imposes on him the obligation to pay a certain amount of money every month, the non-payment of which entails the occurrence of a monetary debt (monetary obligation). Such a monetary obligation is a debt not related to the personality of the deceased debtor, and therefore the obligation to pay it passes to the debtor's heir, which the latter, subject to acceptance of the inheritance, is obliged to repay within the value of the inherited property that has passed to him.

B. Kasenov) The court satisfied the claims of the plaintiff, acting in the interests of a minor, to the defendants for the recovery of alimony arrears. As the court pointed out, the father of the minor, whose paternity was established by court decision, died. By a court decision, alimony was collected from the father of the minor. On the date of the death of the testator, the alimony debt remained outstanding. The heirs of the deceased are his daughters and wife - defendants. In paragraph 2 of Art. 120 of the Family Code of the Russian Federation provides that the payment of alimony, collected in court, is terminated by the death of the person receiving the alimony, or the person obliged to pay the alimony. At the same time, a court ruling providing for the recovery of alimony from an obligated person imposes on him the obligation to pay a certain amount of money every month, the non-payment of which entails the occurrence of a monetary debt (monetary obligation). Such a monetary obligation is a debt not related to the personality of the deceased debtor, and therefore the obligation to pay it passes to the debtor's heir, which the latter, subject to acceptance of the inheritance, is obliged to repay within the value of the inherited property that has passed to him. nine0007

nine0007

Articles, Comments, answers to questions : Stop recovering alimony due to death

Register and receive trial access to the ConsultantPlus Free 2 days 9000

Open the Consultant Pluss:

Question : The organization deducts alimony from the employee's salary on the basis of a notary agreement with the former spouse. Is it necessary to stop withholding child support if the employee brought a death certificate of the former spouse dated January 5? If so, how to calculate child support for an incomplete month (January)? nine0265 (Expert consultation, 2020) Question: The organization deducts alimony from the employee's salary based on a notary agreement with the former spouse. Is it necessary to stop withholding child support if the employee brought a death certificate of the former spouse dated January 5? If so, how to calculate child support for an incomplete month (January)?

Regulations : Stop collecting alimony due to death

"Review of the judicial practice of the Supreme Court of the Russian Federation N 4 (2019)"

(approved by the Presidium of the Supreme Court of the Russian Federation on December 25, 2019) The payment of alimony, collected in court, is terminated by the death of the person receiving the alimony, or the person obliged to pay the alimony (paragraph six, clause 2, article 120 of the RF IC).