How to get proof of child support income

Child Support Forms | Office of the Attorney General

These forms allow parents, families, and employers to provide the Child Support Division with additional information so we can better serve you.

All child support forms are categorized and linked below as downloadable files. Select the category you need to see the corresponding forms.

- Paternity

- Military

- Paying or Receiving Child Support

- Safety

- Child Support Administrative Review

- Child Support Enforcement

- License Suspension

- Medical Support

- State Directory of New Hires

- Release of Information

Paternity

Parent Survey on the Acknowledgement of Paternity (AOP)

This form is to be completed after the AOP has been signed or a person has declined to sign the AOP.

View the form in English

View the form in Spanish

Application for New Birth Certificate Based on Parentage

The VS-166 - Application for a New Birth Certificate based on Parentage form is used to add, remove, or replace information regarding the parents listed on the original birth certificate. Click on the link to find the form on the Texas Department of State Health Services website.

View the form

Military

Military Affidavit

This form is used as proof to the court that a custodial or noncustodial parent is in the military.

View the form

Paying or Receiving Child Support

Arrears Payment Incentive Program

This form is used by a delinquent noncustodial parent to reduce amounts owed to the State of Texas.

View the form in English

View the form in Spanish

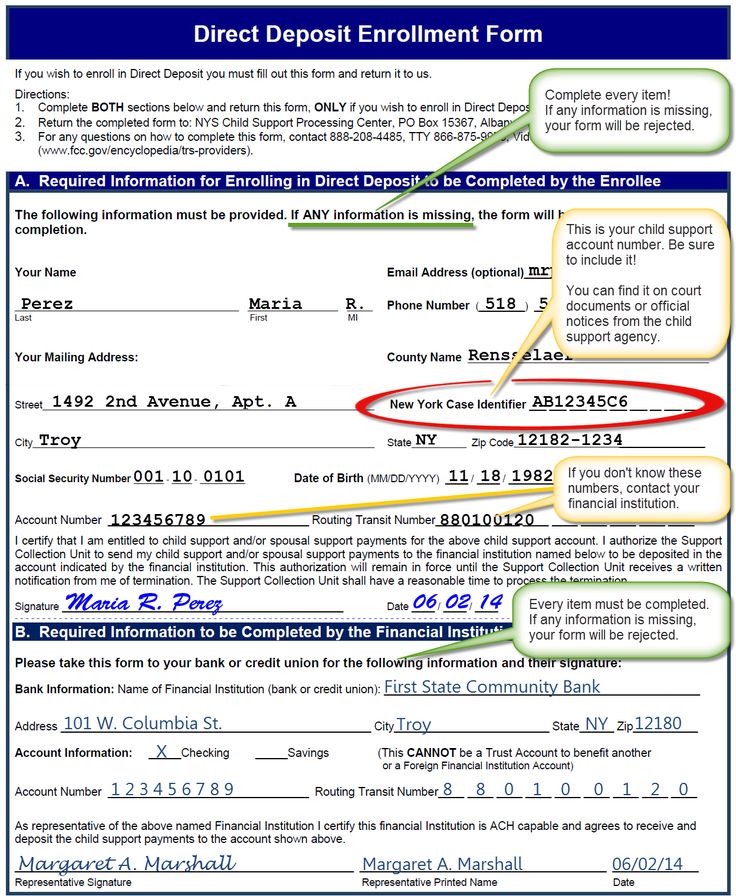

Direct Deposit Authorization Form (1TAC 55.803)

This form is used to set up direct deposit for child support payments.

View the form in English

View the form in Spanish

Request for Warrant Cancellation

This form is used to stop payment on a warrant (check) that has been lost or damaged.

View the form in English

View the form in Spanish

Child Support Review Questionnaire

This form provides the Child Support Division information about a custodial or noncustodial parent when a case review is requested.

View the form in English

View the form in Spanish

Custodial Parent’s Certification of Direct Payments

This form is used to document child and medical support payments made directly to a custodial parent by a noncustodial parent (in any form).

View the form in English

View the form in Spanish

Noncustodial Parent’s Certification of Direct Payments

This form is used to document child and medical support payments a noncustodial parent makes directly to the custodial parent (in any form).

View the form in English

View the form in Spanish

Safety

Request for Nondisclosure

This form is used to report a parent’s safety concerns on a child support case and request the Child Support Division not disclose any identifying information to the other parent.

View the form

Child Support Administrative Review

Request for Administrative Review (1 TAC 55.101(f)(2))

This form is completed by a noncustodial parent to contest a claim of past-due child support and request a review of their case.

View the form in English

View the form in Spanish

Administrative Review - Distribution of Child Support Payments (1 TAC 55.141(e))

This form is used by a custodial parent, who is a current or former Temporary Assistance for Needy Families (TANF) recipient, to request an Administrative Review hearing to resolve disputed issues concerning distribution of payments.

View the form in English

View the form in Spanish

Child Support Enforcement

Notice of Application for Judicial Writ of Withholding (1 TAC 55.111)

This form is used to notify an employer to withhold wages from a noncustodial parent when they have past-due child support.

View the form

Motion to Stay (1 TAC 55.112)

This form is used by noncustodial parents to contest a Judicial Writ of Withholding.

View the form

Employer's Motion for Hearing on Applicability of Income Withholding for Support (1 TAC 55.115)

This form is used by an employer to request judicial determination about an employee’s wage withholding.

View the form

Notice of Administrative Writ of Withholding - (1 TAC 55.116(a))

This form is sent to the noncustodial parent by the Child Support Division to inform them that withholding has begun and to provide information on how they can contest the withholding.

View the form

Request for Issuance of Income Withholding for Support (1 TAC 55 .117)

This form is used to request the issuance of income withholding for support.

View the form

Federally Mandated Income Withholding for Support (IWO) (1 TAC 55.118(b))

This form is used to notify an employer of a specified amount of child support to be paid by withholding income from an employee's paycheck. This form (provided by the Office of Child Support Enforcement OCSE) is used to notify an employer of a specified amount of child support to be paid by withholding income from an employee's paycheck. This form is federally mandated for use in IV-D and non IV-D cases. (OMB 0970-0154)

View the form

Notice of Lien (1 TAC 55.

119(a))

119(a)) This form serves notice that a custodial parent has placed a lien on a noncustodial parent’s property for unpaid child support. The lien shows a right to keep possession of property belonging to the noncustodial parent until they pay their owed child support.

View the form

Release of Child Support Lien (1 TAC 55.119(b))

This form is used to lift the lien on a noncustodial parent’s property after they have paid their owed child support.

View the form

Partial Release of Child Support Lien (1 TAC 55.119(c))

This form is used by a custodial parent to lift the lien only on the specific property of the noncustodial parent, as listed on the form. It does not prevent action to collect from other property owned by the noncustodial parent.

View the form

Record of Support Order(1 TAC 55.121)

This form is used by counties to provide the record of support data needed by the state case registry.

View the form

Record of Support Order with Application (1 TAC 55.

121)

121)This form is used by counties to provide the record of support order data needed by the state case registry. Effective September 1, 2021, this form must be used by the following counties that participate in the Integrated Child Support System: Bexar, Cameron, Dallas, Ector, El Paso, Gregg, Harris, Harrison, Hidalgo, Lubbock, Midland, Panola, Smith, Tarrant, Taylor, Travis, Webb, and Wichita.

View the form

License Suspension

Administrative Notice of Filing of Petition to Suspend License (1 TAC 55.203(a))

This form notifies a noncustodial parent who owes past due child support that an action to suspend their driver’s license has been filed.

View the form

Notice of Filing of Petition to Suspend License (1 TAC 55.203(f))

This form is sent to a noncustodial parent alerting them that an action to suspend their license has been filed.

View the form

Administrative Petition to Suspend License (1 TAC 55.203(b))

This form is used to outline a noncustodial parent’s court-ordered child support repayment schedule that must be followed before their license is reinstated.

View the form

Petition to Suspend License (1 TAC 55.203(f))

This form shows a noncustodial parent’s court-ordered child support repayment schedule that must be followed before their license is reinstated.

View the form

Notice of Filing of Petition to Suspend License (1 TAC 55.203(f))

This form is sent to a noncustodial parent alerting them that an action to suspend their license has been filed.

View the form

Request for Hearing (1 TAC 55.203(c))

This form is used by a noncustodial parent to request a hearing to contest a petition to suspend their license.

View the form

Notification to Licensing Authority Order Suspending License (1 TAC 55.203(d))

This form is sent by the Office of the Attorney General to the licensing authority to request action is taken to suspend a noncustodial parent’s license.

View the form

Notification to Licensing Authority Order Vacating or Staying Suspension of License (1 TAC 55.

203(e))

203(e))This form is sent by the Office of the Attorney General to the licensing authority to notify them that a noncustodial parent’s license may be reinstated.

View the form

Medical Support

National Medical Support Notice (1TAC 55.120(a))

This form notifies an employee that they are obligated by a court or administrative child support order to provide health care coverage for the child identified.

View the form

Request for Review of National Medical Support Notice (1 TAC 55.120(b))

This form is used by an employee to contest withholding based upon a mistake of fact.

View the form

Termination of National Medical Support Notice (1 TAC 55.120(c))

This form notifies employers when there is no longer a judicially or administratively ordered obligation for an employee to provide health care coverage for the listed child(ren).

View the form

State Directory of New Hires

Texas Employer New Hire Reporting (1 TAC 55.

303(c)(1)(B))

303(c)(1)(B))This form is used by employers to report the details of newly hired employees.

View the form

Release of Information

Authorization for Release of Information (1 TAC 55.803)

This form is used to authorize another party to receive information about your child support case or payments on your behalf.

View the form in English

View the form in Spanish

Revocation of Authorization for Release of Information (1 TAC 55.803)

This form is used to revoke an existing authorization to release information and/or child support payments to another party.

View form in English

View the form in Spanish

Kentucky Child Support Website

Help Use your browser's print function to print

Home > Frequently Asked Questions

Skip this Navigation Element

General information

- Frequently Asked Questions

- Services Provided

- Child Support Forms

- Laws and Legislation

- Locate Child Support Agency

- Child Support Estimation Calculator

- Useful Links

Program Information

- FIDM

- Voluntary Acknowledgement Program

- KY's New Hire Program

- Division of Family Support

- Medicaid Program and Services

- Private Wage Withholding

- Vital Statistics

- Civil Rights Brochure

- What services are provided by the Agency?

- Who can apply for child support services?

- Can I apply for child support services before the birth of my child?

- Can I apply for child support services if the father of my child lives in another state or country?

- Can I apply for child support services if I am not sure which man is my child’s father?

- How do I apply for child support services?

- Is there a fee to receive child support services?

- How long does it take to get child support after I apply?

- Does the child support attorney handling my case represent me?

- What is paternity?

- How is paternity established?

- How is genetic testing performed?

- How much does a genetic test cost?

- When child support is established or changed, how is the amount determined?

- How do I request an increase or a decrease in the child support amount?

- Will my child support stop when my child turns 18?

- If I go to jail or prison, will my child support obligation stop?

- Must the child(ren) be covered by health insurance?

- Which parent is responsible for health care coverage?

- What is reasonable cost?

- What is an income withholding?

- What kinds of income can be withheld?

- What sources of income are exempt from income withholding?

- Is it possible to collect child support from sources other than wages?

- What is the maximum amount that can be withheld each pay period from my income?

- How long does it take for the income withholding to start?

- I am the noncustodial parent and I have changed jobs, how can I report this?

-

My caseworker tells me that I have to know where the noncustodial parent is working in order for income withholding to be started.

Shouldn’t Child Support Enforcement be able to find that information?

Shouldn’t Child Support Enforcement be able to find that information?

- My employer sent payments to Child Support Enforcement but they have not been posted to my account. What do I need to do?

- What can the Child Support Enforcement Office do when the noncustodial parent does not pay his/her child support?

- How far does the noncustodial parent have to fall behind before the Child Support Office takes enforcement action?

- Why are you taking my child support from my unemployment benefits when I have been making my child support payments?

- How much of my unemployment check can you take?

-

My passport has been denied.

What can I do?

What can I do?

- My license has been suspended. What can I do?

- How can I remove a lien that has been placed on my property?

- Why has my bank account been frozen?

- What can be done when the noncustodial parent's payments are due on the first of the month, but they are always late?

- How can Child Support Enforcement collect child support if the noncustodial parent is paid in cash?

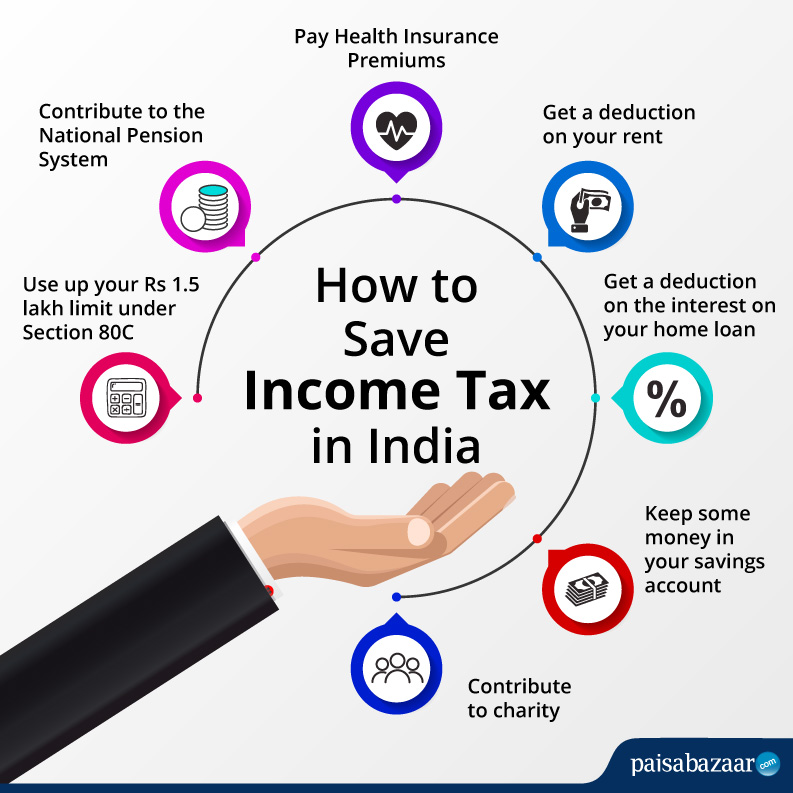

- What is tax intercept?

- Why are intercepted federal tax refunds held for 6 months?

- Can the tax refund holding be released early?

What is Child Support?

Child support is a payment made by a noncustodial parent for the care of his or her child.

Top ↑

Who is the Noncustodial Parent?

The Kentucky Child Support Program refers to a parent who does not have physical custody of a child(ren) as the noncustodial parent (NCP). A noncustodial parent is ordered to provide child and/or medical support for the children.

Top ↑

Who is the Custodial Parent?

The Kentucky Child Support Program refers to the person who has physical custody of the child as the custodial parent (CP). Although this is typically a parent, a custodial parent could also be a relative or other caretaker of the child(ren). A custodial parent is the one that receives the child and/or medical support for the child(ren).

Top ↑

What if my address changes?

At the time the address of the custodial or noncustodial parent changes, Child Support Enforcement must be notified. You may contact your local child support office (Locate Office) or update your address through “My Account”. A custodial parent can also report address changes for the noncustodial parent in his or her case. Failure to promptly notify the Child Support Enforcement office could result in payments being sent to an incorrect address, closure of the child support case or the parties not receiving notice of actions being taken on the case.

You may contact your local child support office (Locate Office) or update your address through “My Account”. A custodial parent can also report address changes for the noncustodial parent in his or her case. Failure to promptly notify the Child Support Enforcement office could result in payments being sent to an incorrect address, closure of the child support case or the parties not receiving notice of actions being taken on the case.

Top ↑

What is the difference in a IV-D case and a Non-IV-D case?

IV-D Case: This type of case requires an application for services. Child Support Enforcement provides services to locate the noncustodial parent, establish paternity, establish child and medical support, modify obligations, and enforce and collect the child support obligation. Full cooperation from the applicant is required to receive these services.

Non-IV-D Case: In this type of case, Child Support Enforcement does not have a role in establishing or enforcing child support. This type of case may also include previous IV-D cases closed by the custodial parent. Child support payments on Non-IV-D cases are processed and then distributed based on the court information on record. It is the responsibility of the custodial parent, noncustodial parent, or private attorney handling the case to provide file-marked copies of orders to establish a case or update the court information on record to the NIVD office (Private Wage Withholding).

This type of case may also include previous IV-D cases closed by the custodial parent. Child support payments on Non-IV-D cases are processed and then distributed based on the court information on record. It is the responsibility of the custodial parent, noncustodial parent, or private attorney handling the case to provide file-marked copies of orders to establish a case or update the court information on record to the NIVD office (Private Wage Withholding).

Top ↑

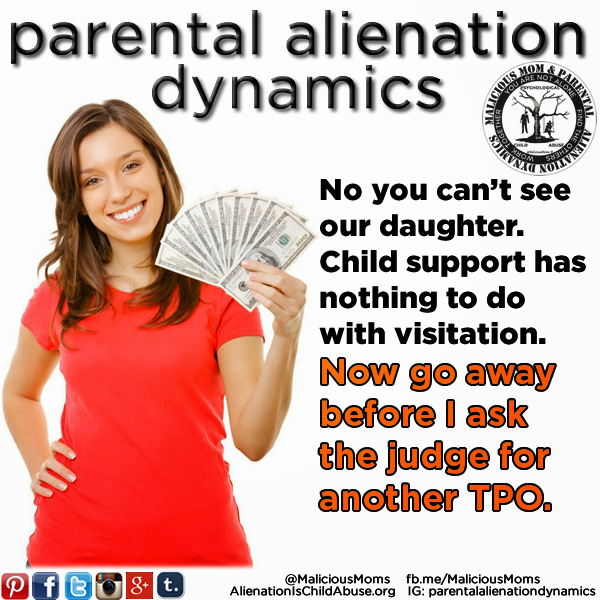

Can the Child Support Enforcement Office assist me with visitation and custody issues?

No. Federal regulations do not allow the Division of Child Support Enforcement to provide services to establish or enforce visitation or custody. To discuss visitation or custody matters, contact a private attorney or the Custody and Visitation Hotline operated by the Louisville Legal Aid Society at 1-844-673-3470, Monday through Friday.

Top ↑

How do I close my child support case?

If the custodial parent is not receiving public assistance for the child, he/she may stop IV-D child support services at any time by sending a written request to the local child support office requesting a discontinuance of services. If there is an income withholding in effect, Non-IV-D payments will continue to be directed through the Centralized Collection Unit as required by State and Federal laws.

Top ↑

The Child Support Enforcement Agency provides the following services:

- Location of noncustodial parents

- Location of the custodial parent for establishment of paternity in a putative father case

- Establishment of paternity, including genetic testing

- Establishment of child and/or medical support orders

- Enforcement of child and/or medical support orders

- Collection and enforcement of current and past-due child support obligations

- Enforcement of medical support, specifically ensuring health insurance coverage is obtained when ordered

- Collection and enforcement of medical expenses when there is a Judgment for the actual amount of expenses owed

- Collection and enforcement of current and/or past-due spousal support when a spousal support order exists, child is living with the spouse/ex-spouse, and Child Support Enforcement is collecting support for the child

- Review for possible modification of child/medical support obligations

Top ↑

Anyone who has physical custody of a child and needs help establishing the identity of the father of the child, establishing a child support order or collection of current or past-due child support is eligible to receive child support services. This includes a parent who is separated from his or her spouse even if no divorce action has been filed. A man who believes he is the biological father of a child born out of wedlock may also apply for services.

This includes a parent who is separated from his or her spouse even if no divorce action has been filed. A man who believes he is the biological father of a child born out of wedlock may also apply for services.

Top ↑

No. Child support services cannot be requested until after the birth of the child.

Top ↑

Yes. Your local child support office can work with the other state/country to establish paternity or a child support order. Child Support Enforcement might have to request the assistance of the other state’s or country’s Child Support Enforcement Agency when performing whatever case action is needed and this could delay the processing of your case. While child support agencies in other states/countries cooperate with each other when handling such requests, establishing or enforcing a court order in another state/country is not a simple matter and not all countries participate in these types of cases.

Top ↑

Yes. After receiving the application for services, the local child support office will determine the best course of action based on the circumstances of the case.

Top ↑

An application for child support services is required. The application can be obtained from your local child support office, by applying and submitting through the KCSI website (KCSI home page), or you can complete the application on the internet. Once the application obtained from the local child support office or from the internet has been completed, it then has to be either hand-delivered or mailed to your local child support office.

Top ↑

An annual fee of $35.00 is charged on all child support cases in which the custodial parent has never received cash assistance (KTAP/AFDC/KINSHIP CARE). The fee is only assessed when the total payment amount sent to the custodial parent during the federal fiscal year (October 1 – September 30) reaches $550.00. Once this requirement is met, Child Support Enforcement will deduct the $35.00 fee from the next child support payment received after the first $550.00 has been sent to the custodial parent. In those cases where custody of the child(ren) has changed and there is past-due support owed to the inactive custodial parent and current support owed to the current custodial parent, the fee of $35.00 will be taken after the active custodial parent receives $550.00, regardless of how the money disburses on the case.

The fee is only assessed when the total payment amount sent to the custodial parent during the federal fiscal year (October 1 – September 30) reaches $550.00. Once this requirement is met, Child Support Enforcement will deduct the $35.00 fee from the next child support payment received after the first $550.00 has been sent to the custodial parent. In those cases where custody of the child(ren) has changed and there is past-due support owed to the inactive custodial parent and current support owed to the current custodial parent, the fee of $35.00 will be taken after the active custodial parent receives $550.00, regardless of how the money disburses on the case.

Top ↑

The length of time depends upon the unique circumstances of each case. Some cases are more complicated and require more time. Providing additional information when requested helps the child support agency in obtaining a child support order in a timely manner. Factors contributing to the complexity of the case can include difficulty in locating the noncustodial parent; paternity establishment; multiple potential fathers; or noncustodial parents living in another state/country.

Factors contributing to the complexity of the case can include difficulty in locating the noncustodial parent; paternity establishment; multiple potential fathers; or noncustodial parents living in another state/country.

Top ↑

The Child Support Enforcement attorney assigned to the case represents the state’s interest in seeing that the children are financially cared for, but not the interest of the custodial or noncustodial parent.

Top ↑

Paternity is the legal establishment of a child’s biological father.

Top ↑

Paternity can be established by Voluntary Acknowledgment of Paternity or through court.

A voluntary acknowledgment of paternity form can be completed by hospital staff at the time of the child’s birth or at a later date through the health department or local child support office. This form should only be completed if genetic testing is not needed. Once completed, this form is sent to the Office of Vital Statistics and recorded. The court can establish paternity for a child in several ways. If paternity is not contested, an agreed order can be signed by the alleged father and entered by the court. On the other hand, if paternity of the child is disputed and genetic testing is requested, the court will order genetic testing. If the genetic testing results prove the alleged father is the biological father of the child, the court will enter an order of paternity.

The court may also enter a default judgment of paternity declaring paternity of a child when the alleged father is served with the paternity action and fails to respond within 20 calendar days.

Top ↑

Genetic tests require a DNA sample from the mother, alleged father and from the child. The sample is taken by rubbing a buccal swab (like a sponge swab) on the inside of the mouth. The DNA samples are sent to a lab for analysis and the results are usually back within a month but sometimes may take longer.

The DNA samples are sent to a lab for analysis and the results are usually back within a month but sometimes may take longer.

Top ↑

Prior to July 14, 2018, CSE paid the cost of genetic testing and recouped the cost of the testing from the alleged father when paternity was established. After July 14, 2018, CSE pays the cost of genetic testing and does not pursue recoupment from the alleged father when paternity is established.

Top ↑

All Kentucky orders are calculated using the Kentucky Child Support Guidelines. The guidelines are based on the principle that both parents are financially responsible for the support of their child(ren) (Child Support Estimation Calculator).

Top ↑

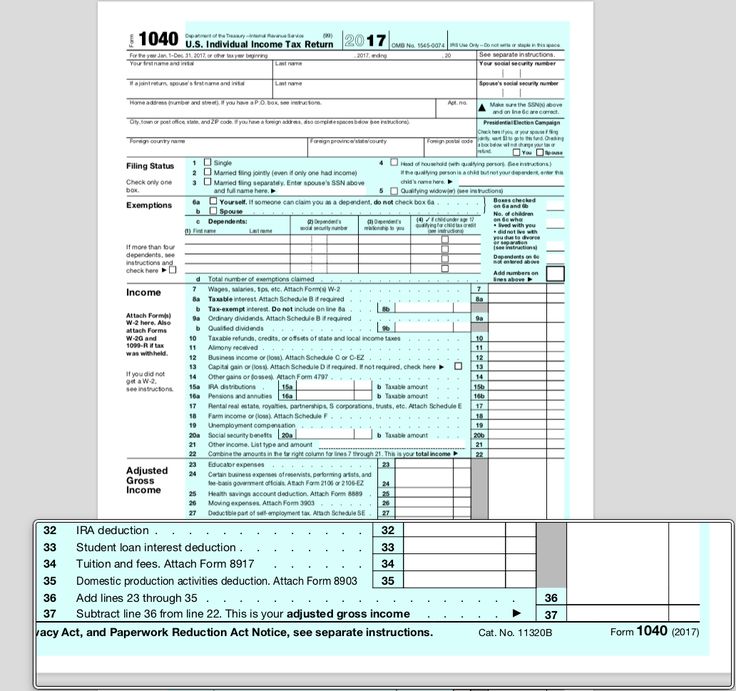

A written request for a review must be submitted to the local child support office handling your case, along with income information such as W2s, tax returns, and pay stubs. Proof of day care expenses and health insurance costs should also be provided with the review request whenever possible. There must be a substantial and continuing change that results in the support obligation going up or down by 15% or more before the local office will file a legal action to change the amount. If a participant on a case requests an increase in child support and it is found that the new child support amount actually qualifies for a decrease, the child support office may then proceed with action to decrease the child support. The same applies when a participant requests a decrease and the case actually qualifies for an increase.

Proof of day care expenses and health insurance costs should also be provided with the review request whenever possible. There must be a substantial and continuing change that results in the support obligation going up or down by 15% or more before the local office will file a legal action to change the amount. If a participant on a case requests an increase in child support and it is found that the new child support amount actually qualifies for a decrease, the child support office may then proceed with action to decrease the child support. The same applies when a participant requests a decrease and the case actually qualifies for an increase.

Top ↑

For Kentucky child support orders, the child support order ends when the child turns 18, unless he or she is still enrolled in high school, in which case child support would continue through the school year in which the child turns 19. Under certain circumstances, child support may continue past the child turning 18 (or 19 if still in high school) if ordered by the court. If the support order is for more than one child, the support obligation will not automatically end when one of the children reaches 18 (or 19 if still in high school) unless that child is the youngest child or the child support order listed a separate amount of child support for each child. If neither of these conditions exists, a request for a review of the child support obligation must be submitted before any change in the obligation amount can be made.

If the support order is for more than one child, the support obligation will not automatically end when one of the children reaches 18 (or 19 if still in high school) unless that child is the youngest child or the child support order listed a separate amount of child support for each child. If neither of these conditions exists, a request for a review of the child support obligation must be submitted before any change in the obligation amount can be made.

Top ↑

No. The child support obligation does not end when a parent becomes incarcerated. When released from incarceration, the parent will need to contact the local child support office handling the case to provide an updated address, employment information and make payment arrangements.

Top ↑

Yes. Health insurance must be included in any child support order. Even if it isn’t available immediately, the court will order the insurance to be provided when it does become available. This applies to all cases.

This applies to all cases.

Top ↑

The court can order either parent, or both, to provide health care coverage. If health care coverage is not accessible and reasonable in cost, the order shall provide for cash medical support by ordering payment of extraordinary medical expenses (expenses not covered by insurance).

Top ↑

Reasonable cost means the cost of providing health care coverage for the child(ren) does not exceed 5% of the responsible parent’s gross income.

Top ↑

Child support payments can be paid on the KCSI website, by phone with a debit or credit card (by calling your caseworker), or by mail.

All payments mailed must clearly list the name and social security number or IV-D number of the noncustodial parent. The check or money order must be made payable to Kentucky Child Support Enforcement and mailed to

Centralized Collection Unit

P. O. Box 14059

Lexington, KY 40512

O. Box 14059

Lexington, KY 40512

Top ↑

Yes. The check or money order can include payments for more than one child support case; however, there must be clear instructions written on or attached to the check or money order that includes the IV-D case number for all cases and the amount that is to be applied to each case. If this information is not provided, the payments will be percentage-allocated among all of the noncustodial parent’s child support cases.

Top ↑

Custodial parents can choose to receive their payments by electronic deposit to a checking or savings account or the Kentucky Way2Go Card. Click here for more information about the Kentucky Way2Go Card.

Top ↑

An Authorization for Electronic Deposit of Child Support Payments must be completed and returned to the address or fax number listed on the form, or the form can be completed on the KCSI website and submitted electronically.

Top ↑

To change your bank account information or request a Kentucky Way2Go Card, complete the Authorization for Electronic Deposit of Child Support Payments (An Authorization for Electronic Deposit of Child Support Payments) and return to the address or fax number listed on the form or submit it electronically through the KCSI website.

Top ↑

Custodial and noncustodial parents can manage their child support case online to find out payment and account balance information, provide address and employment updates, learn of upcoming appointments or court dates, update direct deposit information and more. To sign up, CSE must have the email address you will be using to create your online account on file in our system and your correct date of birth. You will also need your individual child support identification number. Please call (800) 248-1163 today to verify and obtain this information then review the instructions provided here before beginning the enrollment process. Already registered? Go to My Account.

Already registered? Go to My Account.

Top ↑

Payments are processed and disbursed within two business days of receipt. The custodial parent will receive his/her payment within three business days from the date Child Support Enforcement disburses the payment.

Top ↑

If the check is not received within 10 business days of the date the payment was disbursed to you, call your local child support office. The payment will be researched and if the check has not been returned or cashed, a stop payment is placed on the original check and a new check is reissued. If the check has been cashed, further research must be done. It could take 2 to 3 weeks to determine the status of the original check before a new check can be reissued.

Top ↑

If the custodial parent in a non-public assistance (NPA) is receiving child support payments to a checking or savings account or Kentucky Way2Go Card it can take up to three business days from the date the payment is disbursed for the custodial parent to receive the payment. If the payment is made online, the timeframe increases to 5 - 10 days. If the custodial parent is receiving public assistance, the payment generally is kept to reimburse the state for the public assistance paid.

If the payment is made online, the timeframe increases to 5 - 10 days. If the custodial parent is receiving public assistance, the payment generally is kept to reimburse the state for the public assistance paid.

Top ↑

An Authorization for Electronic Deposit of Child Support Payments must be completed and returned to the address or fax number listed on the form, or the form can be completed on the KCSI website and submitted electronically.

Top ↑

Income withholding is the deduction of the current and past-due support, child support, child care support, medical support or spousal support obligation from a noncustodial parent’s wages or other sources of income.

Top ↑

The law permits the withholding of most kinds of income. Examples include:

- Salaries/wages

- Unemployment Compensation

- Worker’s Compensation

- Social Security retirement or disability benefits

- Veteran’s retirement benefits

- Job retirement benefits

Top ↑

- Public Assistance (TANF, KTAP, AFDC, KINSHIP CARE)

- Supplemental Security Income (SSI)

- Federal Black Lung Benefits

- Federal grants and fellowships

- Veteran’s Disability Benefits

Top ↑

Yes. Child support can be collected from other types of assets. Examples include:

Child support can be collected from other types of assets. Examples include:

- Tax refunds

- Insurance settlements

- Unemployment compensation

- Worker’s Compensation

- Property

- Lottery winnings

- Bank accounts

Custodial parents should inform their caseworker of any assets that the noncustodial parent has. Top ↑

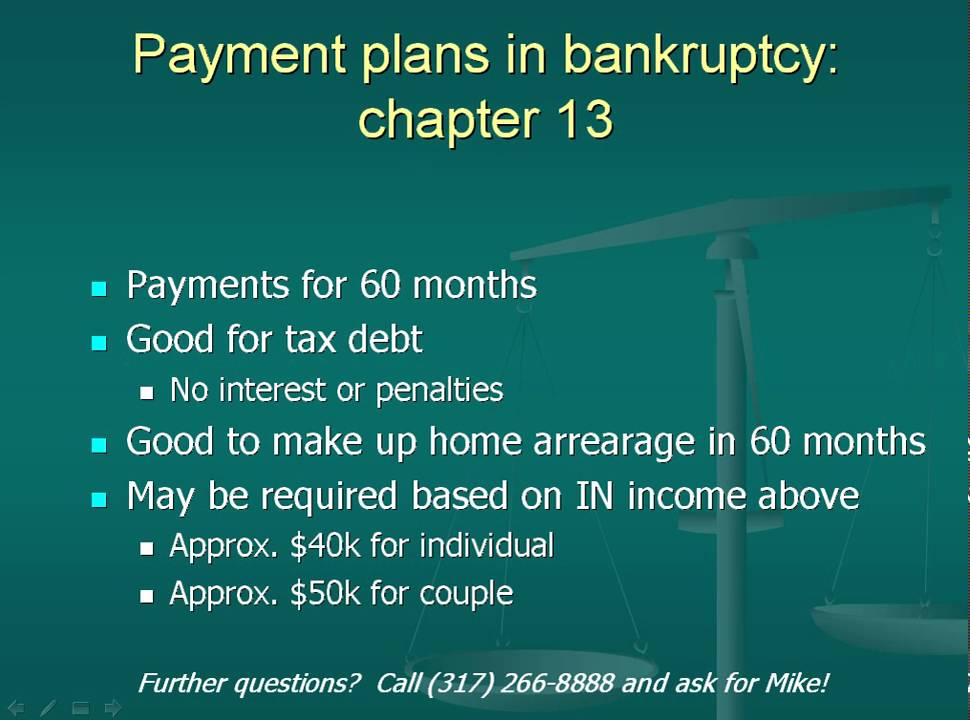

The percentage of disposable income (after taxes) that can be withheld cannot exceed:

- 50% of a person’s disposable earnings if the person is supporting a second family (a spouse and/or dependent child)

- 55% of a person’s disposable earnings if the person is supporting a second family and owes an arrearage that is 12 weeks or more past-due

- 60% of a person’s disposable earnings if the person is not supporting a second family

- 65% of a person’s disposable earnings if the person is not supporting a second family and owes an arrearage that is 12 weeks or more past due

Top ↑

The employer has 14 days from the date the income withholding order is received to begin withholding. The employer must send the payment to Child Support Enforcement within 7 days of withholding it from the employee’s pay. The employer is not required to change their pay cycle to accommodate the income withholding frequency. For example, if the order requires support to be paid at the rate of $50 per week and the employee is paid bi-weekly, the employer may send in bi-weekly payments of $100 each.

The employer must send the payment to Child Support Enforcement within 7 days of withholding it from the employee’s pay. The employer is not required to change their pay cycle to accommodate the income withholding frequency. For example, if the order requires support to be paid at the rate of $50 per week and the employee is paid bi-weekly, the employer may send in bi-weekly payments of $100 each.

Top ↑

New employment information must be reported. This can be done by contacting the local child support office or updating the information on the KCSI website. Once the information is received, an income withholding order will be sent to the new employer. The noncustodial parent is responsible for making child support payments until the income withholding begins.

Top ↑

Employers are legally required to report when they hire a new employee; however, they do not always comply in a timely manner. When an employer does report this information, it is sent to the child support agency and forwarded to the caseworker. This process can take months. When a custodial parent is able to provide employment information, it helps expedite the wage withholding so payments can begin sooner. Also, the noncustodial parent is sometimes self-employed or on contract and for these types of situations, an income withholding would not apply.

When an employer does report this information, it is sent to the child support agency and forwarded to the caseworker. This process can take months. When a custodial parent is able to provide employment information, it helps expedite the wage withholding so payments can begin sooner. Also, the noncustodial parent is sometimes self-employed or on contract and for these types of situations, an income withholding would not apply.

Top ↑

This needs to be reported as soon as possible to identify the problem. The employer can contact the local child support office or the local child support office can contact the employer. The child support office will need to know if the payment was sent by EFT or paper check and the check date, check number and amount sent. Once the caseworker receives this information, they can research the payment.

Top ↑

There are many enforcement remedies that can be used to enforce and collect a child support obligation. The type of action chosen depends on the circumstances of the case. Some of the remedies that Child Support Enforcement can use to enforce a child support order are:

The type of action chosen depends on the circumstances of the case. Some of the remedies that Child Support Enforcement can use to enforce a child support order are:

- Court action resulting in jail time

- Interception of tax refund

- Passport denial

- Liens

- Driver’s, professional/occupational or wildlife (hunting/fishing) license revocation/denial

- Levying financial institution (bank) accounts

- Withholding of unemployment benefits

Top ↑

The noncustodial parent must be behind by the amount equal to one month’s obligation.

Top ↑

When Child Support Enforcement is notified that a noncustodial parent is receiving unemployment benefits, action is immediately taken to notify the unemployment agency to withhold child support.

Top ↑

Child Support Enforcement can withhold up to 50% of the unemployment check amount or the child support obligation, whichever is less.

Top ↑

If a noncustodial parent owes past-due child support in an amount exceeding $2500, Child Support Enforcement reports this information to the U.S State Department. Once this information is received, the U.S. State Department will refuse to issue a passport. The passport can only be released under the following conditions:

- The noncustodial parent pays the past-due amount in full

- The noncustodial parent provides documentation on company letterhead verifying that travel is necessary for employment purposes and alternate acceptable payment arrangements have been made

- The noncustodial parent provides proof that travel is necessary due to extenuating circumstances, such as a death in the family or medical emergency

Once the passport denial agency has been notified, it can take 7-10 business days for the passport to be released. Top ↑

Top ↑

Child Support Enforcement may deny, suspend or revoke a license or certificate if the noncustodial parent owes past-due support that equals or exceeds the amount owed for 6 months of nonpayment, or if the noncustodial parent fails to cooperate with a subpoena or warrant relating to a paternity or child support case. A noncustodial parent may have his/her license reinstated by meeting one of the following requirements:

- Paying the past-due child support amount in full

- Making a payment and entering into a payment agreement

- Cooperating with a subpoena or warrant

Top ↑

A lien will only be released when the noncustodial parent pays the child support arrearage in full plus any interest and penalties that may be owed.

Top ↑

When a noncustodial parent owes past-due support, Child Support Enforcement has the authority to issue a notice to withhold and deliver funds in a bank account.

Top ↑

The current month’s payment is not considered delinquent until 30 days have passed and the amount that is owed equals or exceeds one month’s obligation. Once the payments are past-due 30 days, enforcement action can then be taken.

Top ↑

Income withholding might not be effective if the noncustodial parent is paid in cash. If payments are not made, other enforcement remedies can be taken.

Top ↑

Child Support Enforcement can intercept the federal and/or state tax refund of a noncustodial parent who owes past-due child support. For federal tax intercept, the noncustodial parent must owe at least $500 in past-due support for his/her cases in which the custodial parent is not receiving Public Assistance or at least $150 for his/her cases in which the custodial parent is receiving Public Assistance. For state tax intercept, the noncustodial parent must owe at least $150 in past due support in his/her cases whether or not the custodial parent is receiving Public Assistance. Intercepted federal tax refunds are used to pay the child support debt owed to the state first. Custodial parents cannot receive tax intercept payments unless the noncustodial parent has filed taxes and is eligible for a tax refund. Noncustodial parents might not be eligible for a tax refund if they owe past-due taxes or did not pay enough taxes during their employment to qualify for a refund. Any funds that remain after the noncustodial parent’s past-due child support is paid off are returned to the noncustodial parent.

For state tax intercept, the noncustodial parent must owe at least $150 in past due support in his/her cases whether or not the custodial parent is receiving Public Assistance. Intercepted federal tax refunds are used to pay the child support debt owed to the state first. Custodial parents cannot receive tax intercept payments unless the noncustodial parent has filed taxes and is eligible for a tax refund. Noncustodial parents might not be eligible for a tax refund if they owe past-due taxes or did not pay enough taxes during their employment to qualify for a refund. Any funds that remain after the noncustodial parent’s past-due child support is paid off are returned to the noncustodial parent.

Top ↑

When the noncustodial parent files a joint tax return, some of that tax refund could be owed to his/her present spouse. Child Support Enforcement is required to place a 6-month hold on these types of refunds in order to allow the spouse to file a claim for his/her share of the refund.

Top ↑

No. Joint returns are held for 6 months and single returns are held for 30 days.

Top ↑

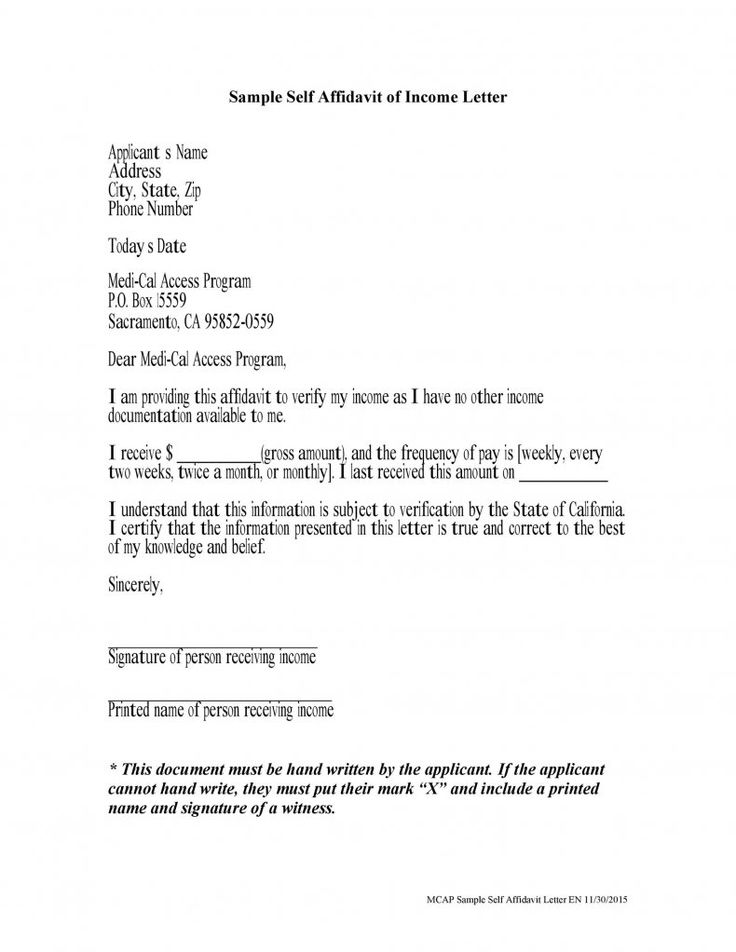

Where can I get a certificate that I do not receive child support?

Where can I get a certificate that I do not receive child support? You can get a certificate of non-receipt of alimony at bailiff service .

You can get a certificate on the absence of alimony payments at the FSSP branch, where enforcement proceedings were opened to recover alimony . To issue certificate , a citizen will need to write an application.

In order to receive child benefits I need a certificate stating that I do not receive alimony, my husband and I are registered at different addresses, which specialist can I get it from? Answer from user Elena A certificate of non-receipt of alimony can be issued at bailiff service .

Where can I get a certificate stating that I do not receive alimony?

Galina, A certificate stating that you do not receive alimony is issued by bailiffs. Come to them with divorce papers + documents for a child, and they issue a certificate that they have no case in the proceedings for the recovery of alimony for your child.

How to get a certificate that the husband does not pay alimony?

To calculate the debt for alimony or to receive a certificate of the presence of debt and non-receipt of alimony to apply for benefits, you need to apply in writing to the bailiff at the location of the executive document.

How long does it take to get a certificate that I do not receive alimony?

The certificate is made 7 working days after you submit an application to the office of the SSPI department. However, if you approach the bailiff in person and warn that you have submitted a statement to her name, maybe she will deal with it faster. 7 days is the standard of the Law, make reference case 10 minutes.

However, if you approach the bailiff in person and warn that you have submitted a statement to her name, maybe she will deal with it faster. 7 days is the standard of the Law, make reference case 10 minutes.

How to write a statement that I do not receive child support?

Go to the FSSP at the place of residence of your former spouse, write an application for the issuance of such a certificate, and it will be issued to you. Application is written in an arbitrary form with a request to issue a certificate on volume that in the indicated department the bailiff service and enforcement proceedings for the recovery of alimony were not initiated.

What should I do if my father avoids paying child support?

If the father evades the payment of alimony, he can be deprived of parental rights. To do this, the mother must collect evidence that the father is not involved in the upbringing of the child. Often the father of is given a chance for correction. If he continues to continue not to pay child support , you can file a second claim for deprivation of his parental rights.

Often the father of is given a chance for correction. If he continues to continue not to pay child support , you can file a second claim for deprivation of his parental rights.

How to terminate the parental rights of the child's father if he does not pay child support?

Many women wonder if parental rights can be taken away from the father , if he does not pay child support . Possible . Deprivation of parental rights is carried out only in court. The process involves the prosecutor, a representative of the guardianship and guardianship.

Where can I get a maintenance certificate?

You can get a certificate through the bailiffs, if they are engaged in withholding alimony , or from the debtor's employer. Uniform certificate is not approved by law, so the document is issued in an arbitrary form.

How long does it take to prepare a maintenance certificate?

64.1. Federal Law of October 2, 2007 N 229-FZ 'On Enforcement Proceedings'. In accordance with this article, within 3 days from the date of receipt of the application to the bailiff service, it is transferred to the appropriate official for execution.

Can I apply for child support without a maintenance certificate?

➡️ Benefit can be assigned, as in the presence of enforcement proceedings for the recovery of alimony , and without of it. ➡️ If there is enforcement proceedings in the application, you must indicate its number. If there is no enforcement proceeding, the details of the court decision.

How to get a social security certificate?

How to get a certificate without leaving home?

- Enter your personal account through the State Service portal.

- In the search bar, enter the name of the service "Providing certificate on receipt (non-receipt) of social support measures.

"

" - Press the button " Get service".

How to write a statement to the bailiffs about the recalculation of alimony?

How to write an application for a maintenance certificate?

I ask you to issue me certificate on the amount of alimony payments collected for the period from _________________ to ____________ on the execution of a court decision dated _________ No. __________, issued by ______________, on the recovery of alimony from ______________________________________________ in favor of __________________________________, for

How to write an application for receiving alimony?

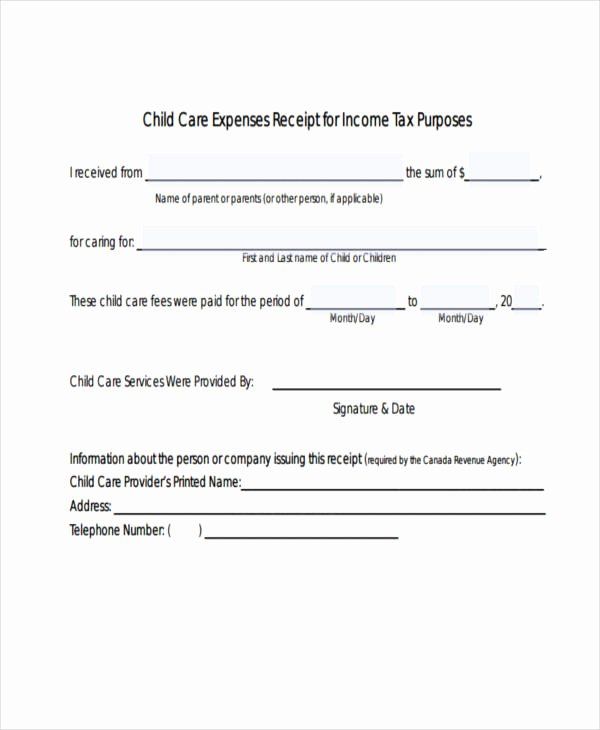

Rules for drawing up a receipt for receipt of alimony

- Name (the word "receipt" at the top center of the sheet).

- Place of compilation (city).

- Compilation date (actual date of procedure).

- Payer and recipient personal data:

- Personal data of a third party (if the receipt is drawn up in the presence of a witness).

What if child support is paid unofficially?

- What if child support is paid unofficially? In some instances, they require from the parent who maintains a minor or an adult disabled child a certificate of the amount of alimony received on him. Where can I get such a document, how to write an application for a certificate and where can I get a sample of it?

How to order a child support certificate through the State Services, types of certificates

To receive benefits, you must provide information about income. Among other documents, you will need proof of receipt of funds from your ex-spouse. You can order a certificate of alimony through the "Gosuslugi".

Features of requesting documents online

The online portal of public services provides the ability to remotely generate the necessary documents. On the site you can also get an electronic certificate confirming the fact of receiving alimony.

To request information, you must create an account on the Gosuslug website. The initial registration procedure is quick: all you need is a phone number and email. However, please note that there are several types of account on the portal:

The initial registration procedure is quick: all you need is a phone number and email. However, please note that there are several types of account on the portal:

- simple;

- standard;

- confirmed.

Simplified registration does not require personal identification, but most services will not be available. Standard registration opens up more opportunities for using the service; for this, passport data, SNILS and TIN are indicated. A full range of documents is opened upon confirmation of identity at the Service Centers and the MFC.

Most services are provided free of charge by law, except in cases that require the payment of a government fee. You can get a sample receipt here, on the Gosuslug Internet portal, and pay online.

Ordering certificates of alimony at the "State Services"

Material maintenance of the child is a civil debt of one of the spouses after a divorce by a court decision. Certificates of its implementation may be required to be submitted to the social security authorities. To do this, you need to confirm the income of each of the family members, including minor children. You can get a certificate of alimony through the "State Services", which make a request to the FSSP.

Certificates of its implementation may be required to be submitted to the social security authorities. To do this, you need to confirm the income of each of the family members, including minor children. You can get a certificate of alimony through the "State Services", which make a request to the FSSP.

After requesting through the portal, within two weeks you will receive a notification in an SMS message about the readiness of the certificate. The document is issued in the personal account also in electronic PDF format with a confirmed signature of an authorized employee of the competent authority. After that, it remains only to print the official paper on the printer. If necessary, the document can also be notarized.

If the readiness message does not arrive, it is necessary to clarify on the Gosuslug portal or in the FSSP why the delay occurs. If it is not possible to receive an answer in any instance, the citizen has the right to write a complaint to the prosecutor's office.

There are several types of certificates of maintenance, the choice depends on the specific purposes for which such a document may be needed:

- on payment;

- on receipt;

- about absence;

- about debt.

You can order a certificate of alimony through the "Gosuslugi" of any type for subsequent submission to social services.

Proof of payment

Proof of payment is required to show that the parent of a minor child does not evade obligations following a court-ordered divorce. To obtain an official paper, you will need a notarized agreement on the payment of alimony and a writ of execution.

After filling in the required fields on the Internet portal, you need to wait a few days. The paper will indicate the specific amounts of payments by months for the last six months. A certificate of alimony through the "Gosuslugi" for social protection, after confirmation by an electronic qualified signature, will be available in your personal account.

On receipt

The document is similar in form to the previous one, but its content is slightly different. A certificate of receipt of alimony is provided under certain conditions. A voluntary agreement on the material maintenance of minor children must be signed between parents. Reliable information about the former spouse is needed: his place of work or study, address.

If the parent is unemployed and not registered with the employment center, there is no agreement between the mother and father, it will not be possible to order a certificate of receipt. The same situation is with the document of non-payment of funds. If there are no obstacles, you can request a certificate of alimony through the "State Services".

On the absence of alimony

If the parent did not apply for payments from the former spouse, to confirm income and receive social benefits, you must order a certificate of the absence of alimony from the State Services. The document confirms the fact that the parent did not receive funds from the former spouse.

The document confirms the fact that the parent did not receive funds from the former spouse.

About debt on alimony

To obtain a loan or preferential charges, travel abroad, exchange a driver's license, a citizen needs confirmation of the absence of debt obligations. Such a document can serve as a certificate of debt on alimony, which is convenient to order through the "Gosuslugi". The official paper shows all the latest accruals for a six-month period.

Upon receipt through the Internet portal, a certificate of alimony debt is confirmed by a unique electronic signature of a civil servant. The certificate has a certain expiration date, since a citizen can pay the debt at any time. Usually the document is valid for about a month.

Other documents

In addition to the above certificates, you can order a certificate of non-receipt of alimony through the "Gosuslugi". It is required when applying for child benefits, to recognize a family as poor and receive benefits. Also, a citizen is required to obtain a document when moving abroad for permanent residence.

Also, a citizen is required to obtain a document when moving abroad for permanent residence.

A certificate of non-receipt of alimony through the "State Services" can be issued if there are related evidence: alimony agreement and a writ of execution. It is also important to consider that the validity of the official paper is limited. It must be submitted within one month from the date of issue.

A certificate of non-payment of alimony through the "Gosuslugi" is required for a citizen to receive a monthly allowance for a child. This applies to cases when the parent of a minor who is obliged to pay funds evades or hides, does not get in touch. It also happens that a person cannot support a child due to unemployment, or illness and being in a specialized medical institution, or while serving a sentence by a court decision.

Production time

Certificate of alimony through the "Gosuslugi" is issued after five working days.