How to get child support off your credit report

Can You Remove Paid-Off Child Support From Your Credit Report?

Credit Repair

How Does LendingTree Get Paid?

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

Written by

Updated on: December 11th, 2020

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Missed child support payments can tarnish your records with the credit bureaus like any other missed debt payment. Even if you pay off delinquent child support accounts, those negative marks don’t just disappear.

Overdue child support payments are required to be included on your credit report, and they remain there for up to seven years. That being said, if you have paid off your entire child support obligation and the account still appears in bad standing on your credit file, you can file a dispute with the credit bureaus to potentially have it updated. We’ll explain how it works.

How does child support affect your credit score?

In short, child support only affects your credit score if you’re late on your child support payments. If your child support account was never late, it will never appear on your credit report, explained Miranda Vance, a financial coach for AAA Fair Credit.

“Credit is only built by borrowing money and paying it back on time and in full,” said Vance.

That means monthly payments on things like auto insurance, utilities and phones do not typically build your score because you never actually borrowed money. But if you miss a payment on these accounts, they can appear on your credit report and drag down your score. Child support works the same way.

Once you miss a child support payment, that late payment can be reported to the credit bureaus and can remain on your credit report for seven years.

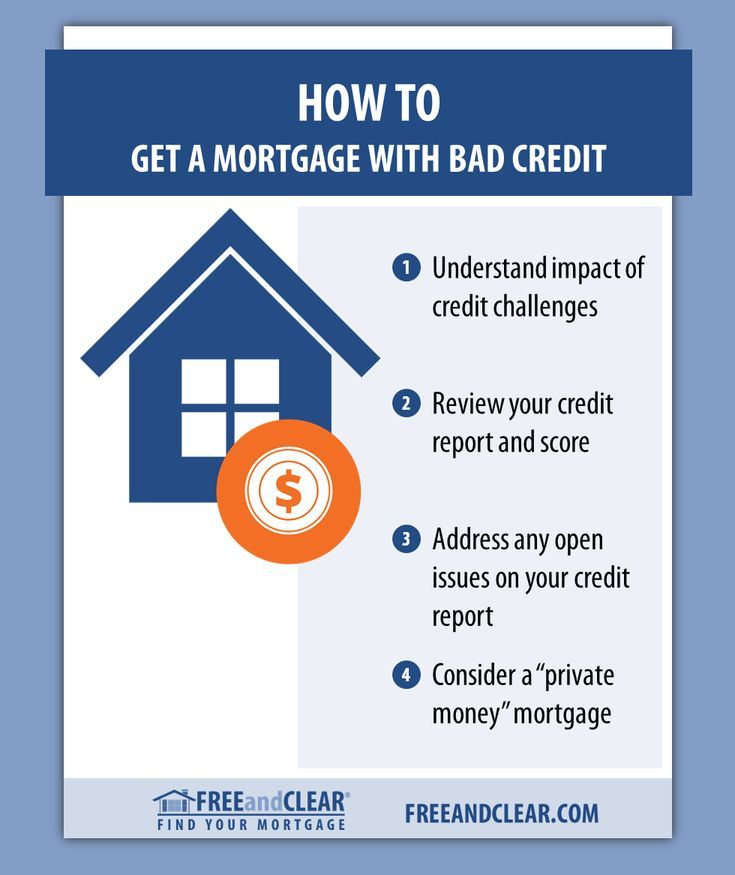

It’s also worth noting that even if you’re on time with child support payments, having to pay child support can make it more difficult for you to get approved for a mortgage or other loan. That’s because it contributes to your debt-to-income ratio, and signals you might have difficulty meeting the loan payments.

What happens when you pay off a child support account

Paying off a late child support payment won’t remove the derogatory mark from your credit report. However, it can help improve your credit score because the account should be marked on your reports as paid in full.

And because lenders care most about your recent credit activity, according to Martin Lynch, director of education and compliance manager at Cambridge Credit Counseling, recent marks showing an account was paid in full can offset the negative impact of older marks showing it was once overdue.

Can you remove paid-off child support from your credit report?

You cannot remove accurate information from your credit report. However, if you’ve paid off child support and it’s still showing up on your credit report as delinquent, you can dispute that error with the credit bureaus. Child support collections agencies collect and track your payments, but they sometimes fail to report your payments properly.

McKenzie Walsh, a certified financial counselor at the nonprofit AAA Fair Credit Foundation, said some credit reports she’s pulled don’t show updated child support payments from years ago. If that happens, she advised contacting the credit bureaus right way.

“It’s up to the consumer to report their payments” to all three credit bureaus, Walsh said.

In that situation, here’s what you should do to get the error fixed on your credit report:

Get proof that the account was paid off.

Before you reach out to the bureaus, get in touch with the child support collections agency you’ve been paying to ensure that the account is actually paid off. Then gather proof of those payments.

“Meticulous record-keeping is key,” said Val Kleyman, divorce lawyer and founding member of Kleyman Law Firm, as you’ll be required to provide documentation of your payments when it comes time to dispute incorrect information on your credit report.

If you haven’t been keeping receipts of your payments, you can request a report from your child support collections agency showing what you’ve paid.

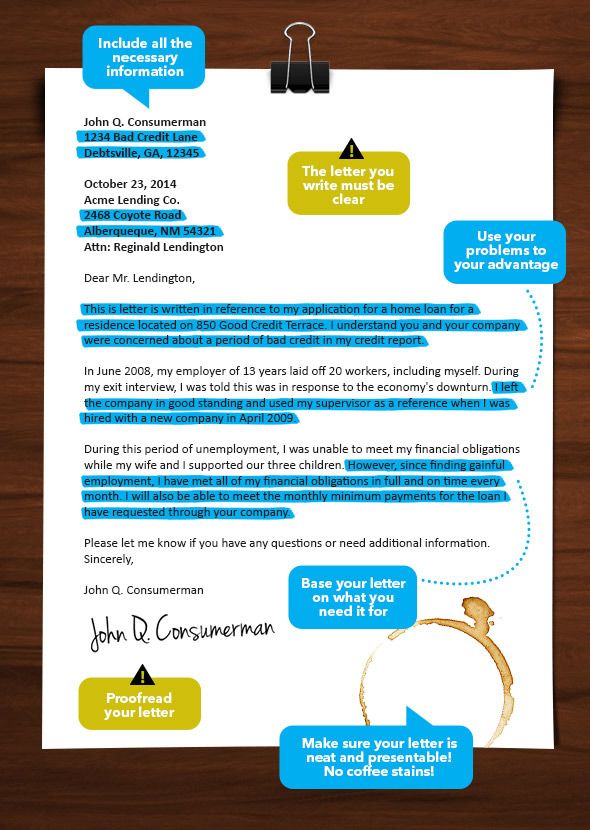

file a dispute WITH THE CREDIT BUREAUS.

Once you have documents proving the account is paid off, it’s time to dispute the delinquent account with the credit reporting agencies. You’ll need to notify all three major credit bureaus of the issue and contest it with them, which you can do through their websites, over the phone or by mail.

It’s wise to communicate with them in writing whenever possible so that you can keep records of those communications. When providing documentation to the credit bureaus, always send copies rather than originals.

In most cases, these credit reporting agencies will have 30 days to investigate your claim, after which you’ll receive a written statement of the results. If the dispute resulted in changes to your credit report, you’ll receive a free and updated copy.

The credit reporting agencies are also required to give you the contact information for the lender or collections agency that provided them with information regarding your account during the investigation. If you feel that your dispute wasn’t resolved correctly, you can contact this information provider — likely your child support collections unit — to go over your payment records.

Once the issue is resolved and the account is paid in full, any late payments will still show up on your credit report for seven years from the date of the original delinquency, but the child support account will now show up as paid in full. If you never actually missed any child support payments, then that account should come off of your credit report altogether once your dispute is properly resolved.

If you never actually missed any child support payments, then that account should come off of your credit report altogether once your dispute is properly resolved.

Improving your credit score

Two of the best things you can do to repair your credit are disputing inaccurate information and paying off delinquent accounts. Even if your credit history shows that you’ve missed payments on child support in the past, turning that around and showing that you’ve since paid off that account will undoubtedly help your credit by showing future lenders that you’re ready to be financially responsible.

Share Article

Looking for ways to increase your credit score? Get a free credit consultation today!

Advertising Disclosures

Recommended Reading

What is the Best Credit Utilization Ratio?

Updated November 2, 2022

Credit utilization ratio compares your current debt to your credit limits. Learn how to lower high utilization to protect your credit score.

Learn how to lower high utilization to protect your credit score.

READ MORE

Fair Credit Reporting Act: Understand Your Rights

Updated October 27, 2020

The Fair Credit Reporting Act is a federal law put into place in 1970 and amended extensively in 1996 and 2003. Learn more about FCRA here at LendingTree!

READ MORE

How a Missed Payment Affects Your Credit Score

Updated October 27, 2022

Missing one payment probably won’t kill your score, but it depends on how late that payment is. In this guide, we’ll cover the effects of a late payment.

READ MORE

How To Get Child Support On Credit Report Removed

Time to get that child support on your credit report removed ASAP. The divorce and child custody process is already a grueling and, sometimes, brutal process.

The divorce and child custody process is already a grueling and, sometimes, brutal process.

The last thing you want to deal with is a financial burden due to child support arrears.

Related: Boost Your FICO Score By 200 Points

But…

It happens doesn’t it.

Maybe your child support case wasn’t properly closed, a past due- maybe couple - or some sort of mistake that led to another, another and then more.

Again, it happens.

Now it’s time to clean up the mess, stop you loan interest rates from increasing and stop you credit score from decreasing. Especially, if it’s been on your report over 7 years.

So...

Related: How To Raise Your Score by 10 points fast

How Do You Get Child Support On Credit Report Removed?

Here are a few steps to getting this done, you’ll need debt validation letter for child support

If it’s simply an error because your account wasn’t closed properly, you should get a letter from the child support office, contact the credit bureau and ask to place the letter in your report.

That will let other creditors know that you are disputing the debt and allow them to read the explanation for the debt.

Then you must do the practical thing.

Work with the child support office to get the debt removed ASAP. Depending on what state you’re in, you may be able to get arrearages waived by consent of the parties or an order from the court.

Ask you local child support offices for the proper information/procedures in your state and get child support on credit report removed

Related: Can Lexington Law Remove Paid Collections?

Here are a few steps to get those Child Support Remove From Your Credit History

1. You have to contact your local child support agency. Do a quick google search, agency names are different depending where you’re located.

Share all the information, documents, files, emails, etc. that provide that the information that shows that the debt is incorrect.

Once proven that it is incorrect to get it in writing and if it has been over 7 years, make sure that is stated as well.

Need to clean up errors on your credit report? Click here to use this form to ask a creditor to take the necessary steps in order to clear up errors on your credit report.

2. Now, if your agency is unhelpful, appeal the child support amount. Every agency has their way about dealing with child-support arrears. So, you may have to:

- File an administrative appeal through the child-support enforcement agency

- Appeal to the court in the county in which the original child-support order was issued.

You may have to hire a lawyer to maximize your chances for success in your appeal if things get a little sticky

3. Get your credit history printed Experian, Transunion and Equifax (or some sort of copy). You may have to pay for it if you’ve gotten a copy in recent times.

You may have to pay for it if you’ve gotten a copy in recent times.

You are allowed one free credit report each year. Different bureaus may report slightly different information, and the child- support arrears may not appear on each bureau's report.

4. Fill out a dispute form on each site that reports the inaccurate information.

Provide any documentation you have from the child-support enforcement agency indicating that the debt does not exist or it has been 7 years or more (which is too old to be on your credit report).

It can take up to 30 days to have the information removed from your credit report.

Related: 101 Best Personal Finance Blogs

what is the history of loan payments

It is important for the borrower to regularly check the credit history to make sure that the entries made are correct. This will help to stop the fraud attempt in time or correct the lender's mistake.

This will help to stop the fraud attempt in time or correct the lender's mistake.

A credit history is a dossier on a borrower showing how he borrows, services and repays debts. You can also say that this is a characteristic designed to demonstrate the degree of conscientiousness of a person when communicating with creditors. On its basis, banks decide to issue a new loan, and its poor quality is the main reason for refusals. But not only banks are interested in credit history. nine0003

Many large companies, when hiring, ask for a job applicant's credit history to find out how conscientious he is in financial matters.

That is why every person should try to have only good records in the credit history.

Credit histories were originally created to facilitate checking the reliability of borrowers by banks.

- So that creditors know how accurately their potential client repaid debts, how often he applied for loans and what debts he currently has.

This helps to quickly (which is important when working with retail) and without serious costs evaluate a potential client and make the best decision - whether the risks of loan default are high, whether it is possible to approve the request or, on the contrary, it is better to refuse. nine0014

This helps to quickly (which is important when working with retail) and without serious costs evaluate a potential client and make the best decision - whether the risks of loan default are high, whether it is possible to approve the request or, on the contrary, it is better to refuse. nine0014 - The borrower, in turn, with the help of a credit history, gets the opportunity to make a loan on more favorable terms for himself, because if the lender sees that the client has fulfilled his previous obligations in good faith, he can reduce the interest rate, increase the loan amount, or find other ways to encourage.

It should be noted that a credit history can be created even if a person has never taken loans. For example, it is formed by a loan guarantor. Then all information about the guarantee is entered into the credit history, and in the event of a transfer of obligations, the fulfillment of the payment schedule is also noted there. nine0003

When credit histories appeared in Russia

The creation of the institution of credit histories began in 2004 with the adoption by the State Duma of the law "On Credit Histories". Already in 2005, the National Bureau of Credit Histories (NBKI) was created, which became the largest in Russia, accumulating the largest database. Today it includes more than 400 million records from 100 million individual borrowers.

Already in 2005, the National Bureau of Credit Histories (NBKI) was created, which became the largest in Russia, accumulating the largest database. Today it includes more than 400 million records from 100 million individual borrowers.

The main users of a credit history are banks and other lenders who make decisions on granting loans and borrowings based on it. However, by law, borrowers have the right to request their history twice a year free of charge. This must be done in order to check the correctness of the records that form it and to signal cases in which they need to be corrected. nine0003

What information is contained in the credit history

Alexey Volkov, Marketing Director of the National Bureau of Credit Histories, in an interview with the Borrow Urgent website:

It [credit history] contains information about how the borrower fulfills obligations under loan agreements, for example, about past and current loans, their amounts, how they were repaid, information about debts and delinquencies.It also contains information about creditors and data on who and when requested a credit history. nine0031

The law divides the document into four parts - title, main, additional (closed) and informational.

- The title part, information from which is transferred to the Central Catalog of Credit Histories of the Bank of Russia, includes the subject's identification data: last name, first name, patronymic, passport details, TIN and SNILS (if any).

- The main part includes information about existing debts and their repayment - amounts, deadlines for fulfilling obligations, collateral, information about debt repayment by the borrower, etc. If the subject acts as a guarantor, this is also reflected in the second part. nine0014

- The private part stores information about data sources - creditors and everyone who requested a credit history. Information is also entered here about to which person the rights of claim on the loan were assigned - for example, about a collection agency.

- The information part of the credit history includes information about requests for new loans, including those that were denied, with an indication of the reason for the refusal.

What to look for when reading a credit report

The credit history contains information about both repaid loans and active loans, for which the borrower retains obligations.

Therefore, when checking, you should pay attention to the following entries:

- Repaid loans. All of them must be closed, debts zeroed;

- Active loans. It is necessary to check the accuracy of the reflection of the payment schedule, the absence of unreliable delays;

- Applications for new loans. Check to which banks requests were made and the reasons for the refusal; nine0014

- Cases of bringing to responsibility. If there are debts for utilities or alimony.

In all cases of detection of incomplete or inaccurate information, you should immediately contact the creditor who acted as their source, or the BKI.

This will help to quickly correct the information and prevent negative consequences in the form of possible material losses.

You may also be interested in: How credit history is formed nine0031Personal credit rating as a tool for assessing credit history

From the beginning of the work of the first credit institutions, a big problem was the difficulty of understanding the information contained in the history by borrowers. And if it is still possible to understand whether the information presented corresponds to reality, then it is almost impossible to predict how it will affect the bank's decision on the application. To solve this problem and make it easier for borrowers to get acquainted with the credit history, the NBKI calculates the Personal Credit Rating (PCR). nine0003

What is RCC

The NBKI takes into account all credit history records and, based on a specially developed mathematical model, calculates a Personal Credit Rating for each borrower in the range from 1 to 999 points.

The higher the rating, the better the credit history of a person, the more chances he has to approve a loan on attractive terms. Accordingly, a low score means a higher cost of a loan or a loan refusal. nine0003

For greater convenience, the NBKI has introduced four color indicators of RCC quality, each of which will be assigned a certain range of the rating scale. Red (from 1 to 149 points) means poor credit quality, yellow (from 150 to 593 points) means medium quality, light green (from 594 to 903 points) means high, and bright green (from 904 to 999 points) — very high quality of creditworthiness.

This will make it easier for the borrower to understand the quality of their credit history. But at the same time, it should be borne in mind that a high rating only indicates an increased probability of approval of a loan application, but does not guarantee a positive decision, because in addition to credit history, banks look at a number of other parameters - for example, the size and stability of income, marital status, and some others.

nine0003

Personal

credit ratingGood indicator of RCC

it is the shortest way to the best credit!Learn RCC online It's free

The benefits of knowing your RCC

For potential lenders, the availability of a credit rating from a borrower helps to reduce costs, as it reduces the time for the initial processing of a loan application. Therefore, PCR holders have the right to count on improving lending conditions - for example, a reduction in the rate or an increase in the limit. And banks can make personal offers to borrowers with a high score, encouraging them with bonuses. nine0003

But this does not exhaust the benefits of RCC. Knowing your rating helps borrowers not only attract loans on favorable terms, but also improve financial discipline and encourages more responsible behavior.

In order to improve financial literacy, the National Credit Bureau has made a policy decision to provide an unlimited, free Personal Credit Rating to all individuals.

Each citizen can now request a rating and track its dynamics at any frequency convenient for him. This helps to better understand the mechanism for accruing rating points when servicing active loans - that is, to clearly see how responsible financial behavior affects the quality of a credit history. nine0003

Expert advice

It is important for the borrower to regularly check both the PKR and the credit history to make sure that the entries made are correct. This helps to stop a fraud attempt in time or correct a lender's mistake.

The latter also sometimes happens and leads to undesirable consequences - if, for example, the bank for some reason forgets to make a record of the loan repayment. To understand that a mistake has crept into your credit history, monitoring the RCC will also help. nine0003

How to improve your credit history?

Banks take a thorough approach to reviewing a loan application. They look at the credit history, evaluate the credit rating and debt burden of a potential borrower.

If something is not to their liking, the loan may be denied. We have studied the factors that can ruin your credit score and how you can improve it.

Credit history

The reputation of a borrower is made up of a credit history, i.e. a list of closed and active loans and dates of overdue payments, as well as a credit rating - an assessment in general for the entire time a person applied to banks. nine0003

In fact, a credit history is a document that does not contain any evaluation information, but is only a dry record of what loans the borrower took or planned to take and how he fulfilled his obligations.

Factors that reduce the quality of a credit history:

- delays (frequent and long)

- court decisions on debt collection

- record of the borrower’s bankruptcy proceedings

- frequent refusals of credit organizations to issue a loan

Gosuslugi will help you find out your credit history.

In order to view your credit history, you need to contact the Bank of Russia through your personal account.

The appearance of this notification on the screen means that within a day a response will come from the Bank of Russia - a list of credit history bureaus (CHBs) that have information about you.

You can send a request to provide your credit history to each bureau from the list.

You can order a credit report free of charge twice a year at each BCI, then ordering reports becomes paid. Each BCI has its own cost. nine0003

Credit rating

Personal credit rating (PCR), in contrast to credit history, contains analytical information on the assessment of the borrower's ability to fulfill debt obligations in a timely manner. The score is calculated based on the history of repayment of loans and the presence of delinquencies. The assessment is also affected by the level of debt burden, the number of requests for loans, the number of loans received from microfinance institutions (MFIs), etc.

Personal credit rating from the BCI report of the author of this article

The higher your personal credit score, the more likely you are to get a new loan.

The range of creditworthiness looks like this:

- Low: 1–149

- Medium: 150–593

- High: 594–903

- Very high: 904–999

a new loan will be approved, but a client with low creditworthiness is likely to be denied a new loan. nine0003

There are situations that do not directly affect the score, but are an additional factor that reduces the attractiveness of the borrower in the eyes of the bank. For example, repeated fast early repayments of loans or refusal of an already issued credit card. The repetition of such cases is assessed negatively by the bank.

Registration of a financial service and a quick rejection of it signals to the bank about the irrational financial behavior of the borrower. The unpredictability of the decisions made, which are reflected in the BCI, is one of the most negative signals for a credit institution about a potential borrower. Worse than it can only be a regular violation of obligations under the loan agreement.

nine0003

Marat Safiulin, Manager of the Federal Fund for the Protection of the Rights of Investors and Shareholders

A large number of applications to various credit organizations is also a risk factor, especially if there are pawnshops, MFIs, consumer credit cooperatives (CCCs) and agricultural consumer credit cooperatives among them ( SCPC). The refusal of one of the creditors may alert, after which the client begins to hastily sort out other options.

Many believe that having no loans guarantees a perfect credit score, as there have been no delinquencies or bankruptcies. This is not so: the complete lack of credit experience is the same negative factor for the credit rating as the debt load of the borrower. nine0003

If you have a lot of loans - this indicates the inability of the borrower to control their income and expenses, if they were not at all - for the bank you are an unpredictable client and it will treat this category of borrowers with caution (or approve a small limit for a short period or fail altogether).

Olga Zhidkova, Head of Banking Services Analysis at Banki.ru

How can installment plans ruin a credit rating?

Experts advise being wary of the installment plan offered by many hypermarkets and online retailers. It should be borne in mind that the store cooperates not only with banks, but also with microfinance organizations (MFIs). Often, when POS-lending, an application is submitted in a fan, i.e., to several credit organizations at once. The store is interested in buying goods, so it does not matter to him who exactly will be ready to provide the service. And the buyer often does not know or misunderstands in the hustle and bustle that he is taking a loan from an MFI. nine0003

Microfinance organizations have more loyal requirements for borrowers than banks, they are not so categorical about credit history and income level, and are also more focused on small loan amounts. How the presence of a microloan in the future will affect credit relations with banks depends on the particular credit institution.

Important!

Timely fulfilled obligations to MFIs do not formally worsen the rating. However, the very fact of a request to microfinance organizations, especially after refusals from banks, forms a negative characteristic of a potential borrower. nine0003

When agreeing to arrange an installment plan for goods in a store, it is important to carefully read the terms of the contract and be aware of who the loan is taken from.

How to improve credit history?

It is impossible to simply erase a bad credit history and improve your credit rating without any reason. This requires time, effort and a clear algorithm of actions. The first thing to do is to pay off delinquencies and non-credit debts (fines, taxes, utility bills, alimony, etc.).

Next, you should try to take a loan and avoid violations in its repayment. If the bank sees that the borrower has improved and become trustworthy, he will reflect information about this in the system. Over time, your credit score will improve.

Some banks offer special credit enhancement programs. As a rule, they involve issuing a credit card with small credit limits. After a certain period, the bank will be ready to provide a regular loan. The bank where the client already has a deposit or a salary project will be more willing to issue a loan. nine0003

Please note that such programs allow you to take loans from this bank. It is not at all necessary that after the successful completion of the credit rating restoration program, any other banks, except for the initiator of the program, will pay attention to this.

Marat Safiulin, Manager of the Federal Fund for the Protection of the Rights of Depositors and Shareholders

There are times when mistakes are made in the credit history. For example, a loan is indicated that a person did not take, or there is information about supposedly overdue loans. This can happen due to a mistake by the lender's employees or fraudulent actions of intruders.