How to find out child support amount

How Is Child Support Calculated?

Learn how child support is calculated under state guidelines, and when judges may allow support payments that are lower or higher than the guideline amount.

By E.A. Gjelten, Legal Editor

If you have minor children, you and the other parent share an equal, legal responsibility to support those kids. Usually, you'll fulfill that obligation by directly providing your children with food, housing, clothing, health care, and their other basic needs. But when couples are separated or divorced, the court will get involved by ordering one parent to pay child support (usually to the custodial parent). Even if you hope to reach an agreement on the issue rather than go to trial, you'll need to know how child support is calculated.

- How Child Support Is Calculated Under State Guidelines

- What's Counted as Income in Child Support Guidelines?

- Other Factors in Calculating Child Support

- Estimating Child Support Under the Guidelines

- When Child Support May Be Higher or Lower than the Guideline Amount

- Child Support Agreements and the Guidelines

- Getting Help With Child Support

- State Child Support Guidelines

How Child Support Is Calculated Under State Guidelines

Every state has its own guidelines for determining how much child support parents should pay. The guidelines start out with a formula for calculating a basic amount of child support. Although these formulas can be quite complicated in some states, they're all based primarily on parental income. The formulas in some states include both parents' income, while others only use the noncustodial parent's income.

When it's clear that parents are hiding income or purposefully earning less than they could in order to shirk their child support obligation, judges may calculate support based on what the parent could reasonably be earning.

What's Counted as Income in Child Support Guidelines?

The state guidelines will spell out what should be included as income in the formula. In addition to wages and salaries, gross income typically includes:

- irregular income like bonuses and severance pay

- self-employment and business income

- pensions

- interest and investment income

- alimony, and

- benefits like workers' compensation, social security, disability, and unemployment insurance.

The guidelines usually allow deductions from gross income for certain expenses, such as:

- taxes

- mandatory union dues and other required payroll deductions, and

- support payments for children from another relationship.

When it's clear that parents are hiding income or purposefully earning less than they could in order to shirk their child support obligation, judges may calculate support based on what the parent could reasonably be earning (a practice known as "imputing income").

Other Factors in Calculating Child Support

In most states, the formulas factor in some other items, such as:

- the amount of time the child spends with each parent

- the cost of health insurance and uninsured medical expenses for the child

- day care costs, and

- the child's age.

Estimating Child Support Under the Guidelines

When you have minor children and are filing for divorce, you'll normally have to fill out and submit a form with details of your financial situation. Some states also require parents to fill out a child support worksheet, which will allow you to calculate the basic support obligation.

Some states also require parents to fill out a child support worksheet, which will allow you to calculate the basic support obligation.

And if you want an estimate of the basic support amount before you start the divorce process, most states provide an online child support calculator (or "estimator"). The official state calculators should include all of the factors currently allowed under the state's guidelines.

When Child Support May Be Higher or Lower Than the Guideline Amount

The basic child support obligation, as calculated under your state's formula, won't necessarily be what you or your co-parent will actually pay. Typically, judges may order a higher or lower amount of support, but only if it would be unjust or inappropriate to apply the guideline amount.

When judges are deciding whether to allow a deviation from the guideline in any specific case, they usually must consider certain circumstances. Here again, those factors vary from state to state, but they may include items such as:

- the child's special needs, including extraordinary medical, psychological, or educational needs

- the standard of living that the child would have enjoyed if the parents continued to live together

- extraordinary travel costs for transferring the child between parents who live far apart

- a parent's lowered expenses or other benefits from living with a new spouse or partner

- a parent's extraordinarily high income, such that the guideline amount is more than the child needs

- a parent's extraordinarily low income or high expenses that make it impossible to pay the guideline amount of support.

Judges won't approve child support agreements unless they conform to the guidelines or meet the legal exceptions for deviations.

Child Support Agreements and the Guidelines

Most parents come to an agreement about how much child support one of them will pay. But they'll need to submit those agreements to the court. And judges won't approve child support agreements unless they conform to the guidelines or meet the legal exceptions for deviations (described above). Certainly, judges will closely scrutinize any agreement that provides for less child support that the guideline amount, and they'll almost never approve parents' agreement for zero child support.

Getting Help With Child Support

If you're hoping to reach a complete divorce settlement agreement, so that you can benefit from the advantages of an uncontested divorce, you and your spouse should be able to calculate the amount of support under your state's guidelines. After all, the guidelines are intended to make child support more consistent, help ensure that the support amount will actually meet children's needs, and reduce court battles over the issue.

After all, the guidelines are intended to make child support more consistent, help ensure that the support amount will actually meet children's needs, and reduce court battles over the issue.

Click on your state in the list below to learn more details about how the guidelines work where you live. Also, most state courts provide online self-help centers or at least the forms you'll need, including any child support worksheets that are used in your state.

However, if you or your spouse believes that a deviation from the guideline is appropriate in your case, and you can't reach an agreement, mediation might help you resolve the dispute. Otherwise, you might need to speak with a family law attorney.

Finally, if you aren't married to your child's other parent, or you have custody of a grandchild, you can get assistance from your local child support agency. In addition to obtaining child support orders, these agencies can also help with establishing paternity, locating missing parents, and collecting support.

State Child Support Guidelines

Select your state from the list below to learn more about local child support guidelines.

Talk to a Lawyer

Need a lawyer? Start here.

The Easiest Ohio Child Support Calculator

How many children? i

Your time with children as % i

Your monthly pay i

Other parent's pay i

Child support = $0 monthly i

Court will determine support amount if payor's income is less than $700.

Not in Ohio? Use your location's child support calculator.

Child support ensures both parents contribute financially to their children's care. Every family law case involving children includes a court order for child support.

A parent cannot refuse to pay child support if the other parent won't let them see their children. Similarly, a parent cannot stop the other parent from seeing their children as a consequence for missing child support payments.

Bring calm to co‑parenting. Agree on a schedule and plan. Be prepared with everything documented.

Calculate My Time Percentage Now

Basics of Ohio child support

In the vast majority of cases, one parent pays child support to the other parent each month until the child graduates high school or turns 19 (whichever happens later).

Usually, the nonresidential parent pays the residential parent. However, if they have nearly equal parenting time, the parent who earns less can petition the other for support, regardless of who's designated as "residential."

For each case, Ohio uses the same formula (outlined below) to determine the guideline child support award — the amount it recommends a parent pay. If a case has unique needs, judicial officers can, but don't often, stray from the guideline award.

To calculate your guideline award officially, use the child support worksheet for sole/shared custody (for most cases) or the child support worksheet for split custody (for rare cases in which each parent has custody of different children).

To estimate your guideline award, follow the steps below, use the calculator above or try Ohio's child support estimator.

The guideline support formula

Step 1: Determine combined annual gross income

First, add up your monthly taxable earnings from wages or salary, unemployment benefits, Social Security and other sources. This is your monthly gross income.

Combine your total with the other parent's monthly gross income and multiply by 12 to determine combined annual gross income.

Example: Consider the hypothetical case of parents Theresa and Sean. Theresa has a monthly gross income of $3,500. Sean has a monthly gross income of $3,000. Their combined annual gross income is $78,000.

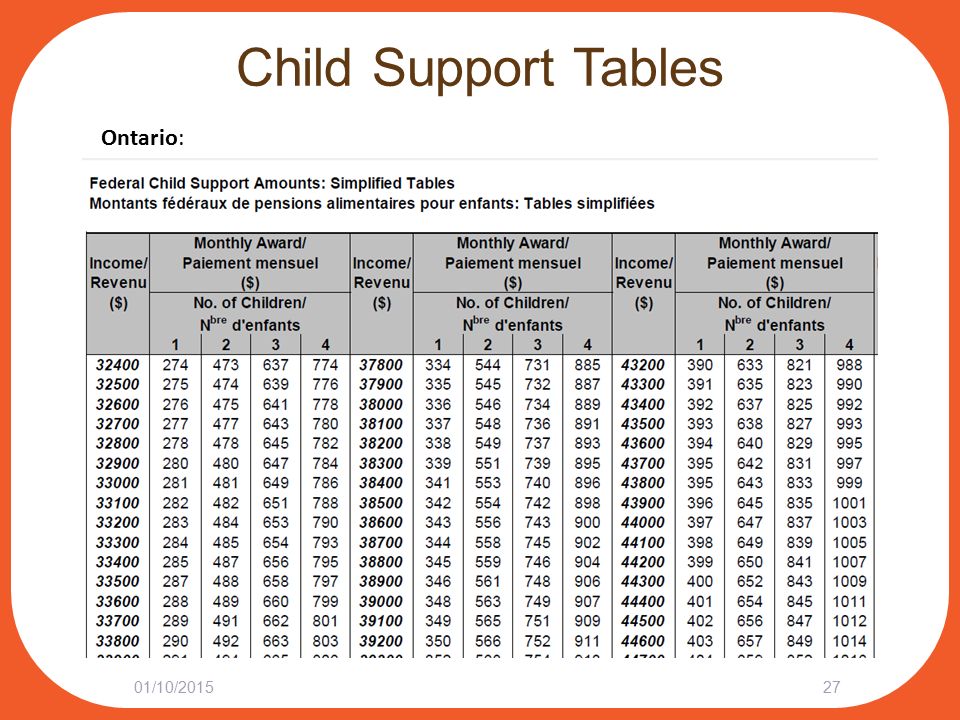

Step 2: Estimate combined basic support obligation

Look at the far left column of Ohio's child support calculation chart. Find the range your combined monthly gross income falls within, then look across that row to the column that corresponds with the number of children in your case. That amount is your combined basic support obligation.

That amount is your combined basic support obligation.

Example: Theresa and Sean have two children. The table shows their annual combined basic support obligation is $15,555.

Step 3: Determine your percentage of the combined annual gross income

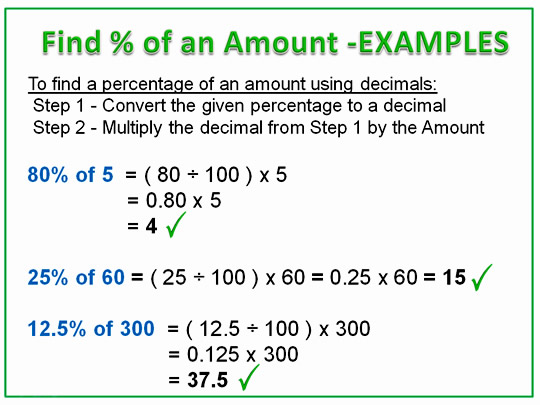

A parent's support obligation is proportionate to their percentage of the combined annual income. To find this percentage, divide your annual gross income by the combined gross income. Round to two decimal points.

Example: Theresa divides her annual gross earnings of $42,000 by the combined income of $78,000 and gets .54, or 54 percent. Sean divides his annual gross earnings of $36,000 by $78,000 and gets .46, or 46 percent.

Step 4: Calculate your individual basic support obligation

Now multiply the combined basic support obligation (from Step 2) by your percentage of the combined income (from Step 3). Round to the nearest dollar. The result is your individual basic support obligation.

In most cases, the court assumes the residential parent meets their basic support obligation during their time with the children. The nonresidential parent, on the other hand, must pay their obligation to the residential parent.

The nonresidential parent, on the other hand, must pay their obligation to the residential parent.

Example: Theresa multiplies the combined support obligation of $15,555 by .54. She, as the nonresidential parent, pays Sean $8,400 per year, or $700 per month.

Possible: Apply parenting time deduction

In Ohio, the nonresidential parent qualifies for a 10 percent deduction in their support obligation when they have 90 or more overnight visits a year with the children (at least 25 percent of parenting time).

If you don't qualify, skip this step.

If you do qualify, multiply your individual monthly support obligation by .10, then subtract the resulting number from your obligation.

Example: With parenting time every weekend, Theresa qualifies for the deduction. She multiplies her initial support obligation of $700 by .10, then subtracts the resulting amount ($70) from $700. With the deduction, Theresa's payment to Sean is now $630 per month.

Possible: Determine cash medical support

If neither parent has health insurance, the nonresidential parent pays cash medical support to the residential parent, in addition to regular child support. If the children receive Medicaid, the parent pays the state instead. Parents whose children are covered by a private health insurance plan skip this step.

If the children receive Medicaid, the parent pays the state instead. Parents whose children are covered by a private health insurance plan skip this step.

To determine cash medical support, multiply the annual cash medical amount (currently $388.70) by the number of children in this case. Multiply the result by the nonresidential parent's percentage of the combined monthly gross income (from Step 3). Then divide by 12 to get the monthly payment. Round to the nearest dollar.

Finally, if the children don't receive Medicaid, add the total to the nonresidential parent's guideline support obligation.

Example: The annual cash medical obligation for two children is $777.40. With 54 percent of combined income, Theresa's annual obligation is equal to $777.40 times .54, or $420. Her monthly obligation is $35.

In total, Theresa's estimated support payment to Sean is $665 monthly ($630 guideline support obligation plus $35 cash medical support).

Special circumstances

If paying the calculated amount would leave the nonresidential parent below the poverty line or unable to care for their other children, the court will make adjustments.

When parents' combined annual income exceeds $336,000, the court may deviate from the standard child support formula.

If a parent chooses to be unemployed or underpaid, the court may calculate child support based on what they could earn. Factors the court uses to determine this amount include:

- Education level

- Employment history

- Mental and physical abilities

- Average wages and salaries in the area

- Employment opportunities in the area

- The children's ages and unique needs

Applying for child support

Parents with a legal separation, paternity or custody-only case can apply for child support in their paperwork to open a case. A divorce case automatically includes child support.

To decide support separately from another case, file an Application for Child Support Services or, if you receive public assistance, contact your nearest Child Support Enforcement Agency.

Parents with a dissolution case or otherwise settling can name a child support amount they agree on, subject to a judge's approval. To instead ask the court to set the payment amount, parents with a dissolution case would use the forms above.

To instead ask the court to set the payment amount, parents with a dissolution case would use the forms above.

Modifying child support

Every three years, parents may complete a Request for Administrative Review of Support Order to have their child support adjusted.

If their support order was issued or reviewed less than three years ago, they must prove circumstances that justify a change. Qualifying circumstances include:

- Loss of employment

- Permanent disability that reduces earning ability

- Incarceration or institutionalization

- Change in income of at least 30 percent

- A child becoming ineligible to receive support

Don't guess or estimate your parenting time percentage

Estimating your parenting time can impact your support order by thousands of dollars a year.

Still, lawyers (and even the courts) usually estimate parenting time because manually calculating it is tedious and time consuming.

The Custody X Change app lets you quickly and accurately calculate your exact parenting time.

With Custody X Change, you can tweak your schedule to see how even little changes affect your timeshare. And you'll see how your parenting time changes each year due to holidays and other events.

Remember that a child support order is legally binding and must be taken seriously. If you fall behind on payments, the Child Support Enforcement Agency could take your income tax refunds. If you simply choose not to pay, a court can find you in contempt and even send you to jail.

Whether you are the one paying or receiving child support, make sure your parenting time calculation is exact. The number will affect you, your children and the other parent. It's not a job for estimation.

Bring calm to co‑parenting. Agree on a schedule and plan. Be prepared with everything documented.

Calculate My Time Percentage Now

Bring calm to co‑parenting. Agree on a schedule and plan. Be prepared with everything documented.

Calculate My TimeHow to find out arrears of alimony by last name - check the debt for alimony online

-

Bailiffs

-

Traffic police fines

-

Check taxes

Bailiffs

Full Name

Date of Birth

By clicking the "Check" button you accept the terms

Traffic fines

Check taxes

State payment

FSSP website

State services

How quickly will an entry in the FSSP database be deleted?

There are several ways to view the amount of child support debt. To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

State payment

State payment online service offers the easiest and fastest way to find out the amount of alimony debt for yourself or another individual. The service does not require registration. To start checking:

- Go to the State Payments website;

- Enter the last name, first name and patronymic of the debtor, his date of birth and region of residence. Click "Check";

- Next, enter the code from the picture and wait for the verification results.

The service will check the FSSP database and provide information about the amount owed by a particular person.

With the help of "Gosoplata" you can not only find out, but also immediately pay the debt using any bank card.

The service has the following benefits:

- Instant payment of legal, tax and other debts;

- Simple and intuitive interface;

- Convenient mobile application;

- Payment information is automatically transferred to databases;

- All transmitted data is securely encrypted;

- Payment receipt is sent to the payer's e-mail immediately after the payment is made.

FSSP website

To find out the debt for alimony through the official website of the FSSP, you need:

- Go to the site at the link: fssp.gov.ru;

- In the site menu, select the "Service" section, the "Database of Enforcement Proceedings" category;

- Next, you need to fill in all the fields marked with an asterisk (*):

- Territorial bodies;

- Last name, first name;

- Click the "Find" button to start checking. Next, the system will ask you to enter the code from the picture to confirm that the request is made by a person and not a robot.

If several debtors have the same first and last name, you need to enter the middle name and date of birth for a more accurate search.

As a result of the search, you will see a table where all the necessary information will be presented:

- amount of debt and enforcement fee;

- production number;

- court order number;

- territorial subdivision of the FSSP;

- name and phone numbers of the bailiff.

On the main website of the bailiff service, you can not only find out the debt for alimony, but also pay it. If necessary, you can pay the debt online through the State Services portal or generate a receipt and pay it through any bank.

Public services

To find out the amount of alimony arrears through the Gosuslug portal, you must first register.

Attention! The search for accruals is carried out according to the data from your personal account.

To see if you have a legal debt, log into your personal account and follow these steps:

- Select the "Services" section, then the "Authorities" subsection and the "FSSP of Russia" category;

- Next, open the "Territorial authorities" tab and select the name of the desired department from the list;

- Select the electronic service “Providing information…”;

- Next, select the service "Law Debt";

- Click "Get Service";

You can pay your debt in several ways:

- With any bank card;

- Through Google Pay or Samsung Pay;

- Using an electronic wallet WebMoney, Qiwi, Yandex.Money;

- From a mobile phone account.

You can also generate a receipt and pay it at the bank or at the post office.

How quickly will an entry in the FSSP database be deleted?

If you have fully or partially paid the child support debt, the entry in the Database will be deleted or changed no earlier than 3-7 working days from the date of payment. This is due to the fact that first the funds go to the account of the bailiff unit, and then to the account of the claimant. It takes at least 3 days to process and transfer funds. If the workload is high, it can take up to 7 days to delete or change an entry.

This is due to the fact that first the funds go to the account of the bailiff unit, and then to the account of the claimant. It takes at least 3 days to process and transfer funds. If the workload is high, it can take up to 7 days to delete or change an entry.

If you have any additional questions, you can personally contact the territorial division of the FSSP. You can make an appointment for a personal appointment through the official website of the bailiff service - fssp.gov.ru.

Kontselidze Ednary Emzarievich Legal Expert

How to find out the debt on alimony by last name

Published: 03/22/2019

- How to check child support debt online

Alimony debt is formed in case of late/incomplete/lack of payment of alimony. Not always the debtor deliberately evades payment. In some cases, the reasons may be:

⦁ lack of information from the payer about the location of the recipient, or its change;

⦁ errors in the payer's employer's accounting department;

⦁ unforeseen situations and other reasons.

In order to avoid unpleasant situations, especially before traveling abroad, it is better to check the child support debt.

You can find out the debt on alimony in two ways:

1. Personally, at the district bailiff's office.

2. Online via the Internet.

In order to find out the amount of the debt by the first method, you need to personally contact the bailiff department at the place of residence. You can find the address and other contact information on the website of the Federal Bailiff Service http://fssprus.ru/osp. You can read more about this in the article "How to find a bailiff".

In the district department of bailiffs, you can get a decision on the calculation of the debt by applying for it on the reception day with a document proving your identity. Only a participant in enforcement proceedings (a debtor, a recoverer, or a person acting on their behalf by proxy) has the right to receive such a decision.

There are several ways to check the child support debt online by last name.

1. Use the portal of public services of the Russian Federation https://www.gosuslugi.ru/10003

You will need to log in to the portal (a verified account on the public services portal is required), fill out an application electronically, wait for the application to be verified and registered, and receive response information in your personal account.

2. Use the Internet service to search for debts in the database of the Federal Bailiff Service of Russia https://oplata-fssp.ru, which contains all the debts of citizens to the FSSP of Russia. You only need to enter your last name, first name, patronymic, date of birth, and indicate the region in which you live.

Undoubtedly, this method is the most simple and convenient. You will receive information immediately after the results of the check in the "Data Bank of Enforcement Proceedings". An additional advantage of this method is that you can immediately pay off the debt discovered during the check.

An additional advantage of this method is that you can immediately pay off the debt discovered during the check.

3. If you know the number of the enforcement proceedings or the enforcement document, you can use them to find out the debt using the appropriate service on the FSSP website http://fssprus.ru/iss/ip.

In the "Data Bank of Enforcement Proceedings" on the site, it is also possible to search by the name of the debtor.

It is important to remember that the record of the debt in the "Data Bank of Enforcement Proceedings" of the FSSP will be deleted or changed (in case of incomplete repayment of part of the debt) within 3 - 7 days from the date of payment. Information about existing debts in newly initiated enforcement proceedings may also be entered into databases with a delay, so the presence of debts should be checked immediately before going abroad.

Restriction on leaving the Russian Federation is not the only trouble that can be encountered in the event of unfulfilled obligations on enforcement proceedings.