How to find old child support records

Public Records Act Requests | CA Child Support Services

Guidelines for Access to Public Records

The Constitution of California (Art.I, sec.3) and the Public Records Act (Government Code sec. 6250 et seq.) provide a right to access public information in government records. These guidelines provide guidance to members of the public on how to access public records of the California Department of Child Support Services (Department).

Requesting Information About Your Case

Documents containing personal information about your case are confidential and are not public records. If you have a child support case managed by a local child support agency and seek information or documents on your own personal account, please contact the office as follows. You may send an email by logging into your personal Customer Connect account, you may call 1-866-901-3212 or you may make your request in person by visiting the local child support agency that manages your case. Office locations and contact information are available by clicking here.

Submitting or Making Public Record Requests

The primary recipient of public record requests within the Department is the Office of Legal Services. Written requests must be sent to the following mailing address:

California Department of Child Support Services Office of Legal Services P.O. Box 419064 Rancho Cordova, CA 95741

Requests for public records should be specific, focused and detailed so records can be identified, located, and retrieved sufficiently. Oral requests for public records may be confirmed in writing to clarify understanding of the request and to create a tracking record for the request. Please make sure you include contact information so that the Department can contact you about your request.

Search and Production of Records

Location or search of records will be conducted by appropriate divisions and units of the Department that are the holders of the requested records. If the search cannot be performed or completed immediately, the Department will notify the requester of the result of the search within the 10 days of receipt of the request if the records are readily accessible and they are not subject to specific exemptions from disclosure under the Department. Normal operational functions will not be suspended to permit inspection of records.

If the search cannot be performed or completed immediately, the Department will notify the requester of the result of the search within the 10 days of receipt of the request if the records are readily accessible and they are not subject to specific exemptions from disclosure under the Department. Normal operational functions will not be suspended to permit inspection of records.

If portions of the requested records require redaction, the Department may take reasonable time to provide the redacted records.

Responses to Public Record Requests

The primary responsibility of responding to public record requests lies with the division of the Department that is holder of the requested record. Determinations on producing records or denying disclosure of portions or entire records will be made by management personnel of the specific division involved. The Department may refuse to disclose any records or portions of records which are exempt from disclosure under the Public Records Act. Claiming of specific statutory exemptions for redaction of information or denying disclosure of records will be communicated to the requester through the Office of Legal Services, in writing.

Claiming of specific statutory exemptions for redaction of information or denying disclosure of records will be communicated to the requester through the Office of Legal Services, in writing.

Charges for Copies

The Department will charge fees for copies covering direct cost of duplication or a statutory fee, if applicable. Copying fees are ten cents ($0.10) per page for each black and white page copies on paper. Direct cost of producing a copy of record on color copier or in an electronic format will be determined on a case-by-case basis depending on the nature of the record requested. Copies of records will be provided after the receipt of payment. A requester may pay for records using a money order, check or cash. If payment is made by check, records may be withheld until after the check has cleared through the Department’s bank account. The requester is responsible for arranging and paying for the pick-up or delivery of the copies.

Florida Dept. of Revenue - public_records

Members of the public are entitled to be treated with respect, courtesy, and professionalism when interacting with the Department of Revenue.

Public records requests do not have to be made in writing, unless a specific statute requires otherwise. In that case, the statute imposing such a requirement shall be cited.

All public records requests shall be acknowledged promptly and in good faith as required by Section 119.07(1)(b), Florida Statutes.

Fees for production of public record documents shall not exceed the statutorily authorized fees and the statutory authority for such fee shall be cited.

The public has the right to receive an itemized invoice of proposed fees or fees charged.

The right to access public records and meetings is secured under Sections 119.07(1) and 286.011, Florida Statutes and Article 1, Section 24, Florida Constitution.

How to Request Public Records

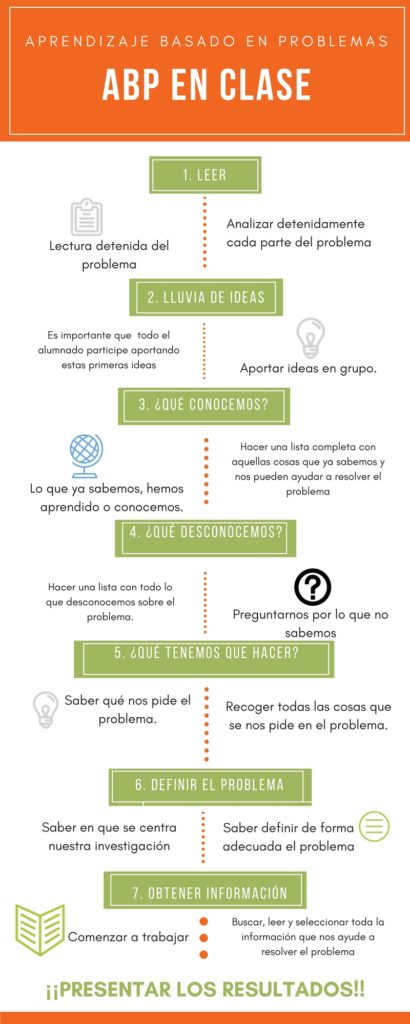

In an effort to assist you, the Department of Revenue has provided a few easy steps for you to consider when making your request.

1. Determine if what you are looking for is already available.

We are committed to making it easy for you to get the public information that we have, so we are always working to update and improve our web site. What you are looking for may be available right now. We invite you to visit our Home, Child Support, Property Tax, and other Florida Taxes web pages, or simply ask us your question.

2. Is the information you are looking for related to your own child support case or tax account? If so, contact the following:

Child support information - Call the Customer Contact Center at 850-488-KIDS (5437). Your case information is confidential. We will not talk about your case with anyone but you or someone you have authorized us in writing to talk to.

Property tax information - For information about your property value assessment contact your county

property appraiser. For information about your property taxes, contact your county

tax collector.

For information about your property taxes, contact your county

tax collector.

Florida tax account (except property) information - Call the Customer Contact Center at 850-488-6800. For copies of your own tax records , send a written request to:

Department of Revenue

Records Management Room 1-4364

5050 W. Tennessee St.

Tallahassee, FL 32399-0158

Written requests help us ensure your confidential information is protected. When submitting your request it should be on company letterhead and include: business Federal Employer Identification Number or owner's Social Security Number, physical location of your business, photo identification (for sole proprietor), records being requested (type of tax, dates, etc.), and the signature of the owner or a registered officer of the business.

3. Is the information you are requesting confidential?

The Department of Revenue maintains sensitive business and personal information for millions of people. Some of this information is exempt from disclosure under Florida's public records law. When responding to requests for confidential information, it is our policy to provide the information only when permitted by law.

Listed below is the most commonly requested confidential information for child support, property tax, other Florida taxes, and administrative and financial services.

Child Support - We cannot disclose:

- Information about applicants for or recipients of child support services and the children involved such as the address of residence

- Information gathered or used by the parent locator service

- Information in multi-subject documents that is unrelated to the public records requested

- Social security numbers and related records

- Federal taxpayer information

Property Tax - We cannot disclose:

- Ad valorem tax returns

- Financial records, including but not limited to federal income tax returns, wage and earnings statements, and sworn statements of gross income

- Social security numbers and related records

- Federal taxpayer information

Other Florida Taxes - We cannot disclose:

- Florida tax information related to specific taxpayers

Note: Some tax information can be disclosed, including: 1) statistical information that does not identify individual taxpayers and 2) verification of whether a specific person or business holds a valid registration, pursuant to Chapter 212, Florida Statutes (sales and use tax) and s. 206.27 (fuel tax).

206.27 (fuel tax). - Reemployment (formerly Unemployment) tax information regarding employers and employees

- Social security numbers and related records

- Federal taxpayer information

Administrative and Financial Services - We cannot disclose:

- Employees' medical and insurance records

- Certain employees' home addresses, date of birth, telephone numbers, and photos

- Procurement documents and bids before the vendor is chosen and the decision is posted

- Social security numbers and related records

4. How do I make a request for Public Records other than my own account?

Requests for records can be made in-person, by e-mail, by phone, or in writing. We will respond to your request promptly. Because e-mail sent over the Internet is not secure, please do not include your social security number or any other

confidential information in an e-mail. Listed below is the contact information for each of our programs for requesting public records.

Listed below is the contact information for each of our programs for requesting public records.

Child Support Records

Email:

Call:

Write:

[email protected]

850-488-KIDS (5437)

Child Support Program Director’s Office

P.O. Box 8030

Tallahassee, FL 32314

Property Tax Records

Email:

Call:

Write:

[email protected]

850-717-6570

Property Tax Oversight

Florida Department of Revenue

P.O. Box 3000

Tallahassee, FL 32315-3000

General Tax Records(excluding Property Tax)

Email:

Call:

Write:

taxpublicrecords@floridarevenue. com

com

850-488-6800

Department of Revenue

Records Management Room 1-4364

5050 W. Tennessee St.

Tallahassee, FL 32399-0158

Efax:

850-922-0861

NOTE: Do not request your own records through e-mail, rather call the numbers listed above. We must establish your identity (or that you are an authorized representative for the taxpayer) before we can discuss or release confidential information to you. To protect the confidentiality of taxpayer records, the requested records will be mailed to your address of record. Requests for confidential taxpayer records will not be responded to through e-mail and you may be required to provide written documentation before we can release the records to you.

Personnel Records

Email:

Call:

Write:

PersonnelPublicRecords@floridarevenue. com

com

850-617-8370

Department of Revenue

Office of Workforce Management

P.O. Box 10410

Tallahassee, FL 32302

Financial Records

Use to request contracts, procurements and budget records:

Email:

Call:

Write:

[email protected]

850-617-8430

Department of Revenue

Operational Accounting

P.O. Box 10669

Tallahassee, FL 32302

Revenue's Open Government Officer

Email:

Call:

Write:

Sarah Wachman Chisenhall

[email protected]

850-617-8347

Department of Revenue

Office of the General Counsel

P. O. Box 6668

O. Box 6668

Tallahassee, FL 32314-6668

5. I've made my request for public records, now what?

When we receive your public records request, we check to see if the Department of Revenue has the records requested, if the request includes confidential information, and if there will be a charge for responding.

Then we will promptly provide you with an accurate, clearly communicated response. This response may include the information requested or an explanation of when the information will be ready.

If part of the information you request is confidential and cannot be disclosed, we will provide you with redacted records. This means that confidential or exempt information in the records will be blacked out. If all, or part, of your request cannot be disclosed, we will provide you with an explanation and legal reference.

You will also receive an itemized invoice of proposed fees or fees charged. State law allows agencies to charge for filling requests that require extensive time and effort by staff (including time spent redacting confidential information) and a per-page charge of $0.15 for copies (Section 119.07(4), Florida Statutes).

State law allows agencies to charge for filling requests that require extensive time and effort by staff (including time spent redacting confidential information) and a per-page charge of $0.15 for copies (Section 119.07(4), Florida Statutes).

Arrests and penalties - Sberbank

How to monitor the status of a writ of execution after filing with Sberbank? 0321, ext. 950, 8-800-555-57-77 ext. 950, 8-495-66-55-777, ext. 950 (toll-free),

notification to the phone number on your application.

Tracking methods for those whose debtor is an individual:

Collectors who filed a writ of execution with the FSSP, and not directly with Sberbank, can get a certificate by calling the bailiff service at 8-800-250-39-32 (the call is free ).

How to start the collection process?

Debt collection is handled by the Federal Bailiff Service (FSSP). You can apply there with a writ of execution - it gives the right to execute a decision of a court or other body to collect a debt.

The FSSP will initiate enforcement proceedings and, if necessary, contact the bank.

The FSSP will initiate enforcement proceedings and, if necessary, contact the bank. If your debtor is a client of Sberbank, you can contact the bank directly, bypassing the FSSP. You can submit a writ of execution at any bank office, but we recommend that you contact the centers for receiving documents with the original writ of execution, passport and application according to the model:

-

from a legal entity or individual entrepreneur,

-

from an individual.

The claimant's representative can submit the application. Then you will also need a power of attorney certified by a notary. If the claimant is a legal entity, the head of the organization can certify the power of attorney.

How to revoke a writ of execution?

Bring to the Document Reception Center or any nearest bank office an application for revocation of the document. You need to take your passport with you. After checking the application, which takes up to seven business days, the bank will send the original of the executive document to the postal address indicated in the application.

Why can't I check the status of the executive document on the bank's website?

Is it possible to provide a copy of the executive document to Sberbank?

What to do if the bank refuses to fulfill the requirements?

How long does it take to collect a debt?

Why was the document executed, but the money was not credited to the account?

How to make sure that the debtor has an account with Sberbank?

What happens if there is not enough money in the debtor's account?

How to find out how much money was transferred under an executive document?

How should the Labor Dispute Commission Certificate be drawn up?

Why can't I check the status of the executive document on the bank's website?

Why can't I check the status of the executive document on the bank's website?

The reasons may be:

- you entered the document number incorrectly,

- one business day has not passed since the filing of the writ of execution,

- The last time the status of a document changed was more than 4 months ago — old documents are not stored in the database.

Is it possible to provide a copy of the executive document to Sberbank?

No, Sberbank only accepts originals of executive documents. The same rule applies to other banks. Therefore, you will not be able to contact several banks at the same time on your own.

Upon submission of a writ of execution to the bailiffs, the recovery will be carried out on all banks in which the debtor has accounts, until the requirements are fully met.

What to do if the bank refuses to fulfill the requirements?

The bank may refuse to fulfill the requirements if there is something wrong with the documents - for example, the application does not contain details or they are incorrect. In this case, you can correct the errors and submit the set of documents again.

The reason for refusal may also be that the debtor does not have an account with Sberbank. Then you should contact another bank or bailiff service.

You can find out the exact reason for the refusal on the bank's website in the service for checking the writ of execution, for this, in the search bar, in addition to the document number, you must enter the account number of the claimant or from the cover letter that the bank will send along with the original writ of execution.

How long does it take to collect a debt?

According to the law, the bank must immediately fulfill the demand and notify the claimant of this within three days. However, the bank has the right to delay execution for seven days in order to check the documents provided by the claimant or his representative. At the time of verification, the amount to be recovered is blocked on the accounts of the debtor.

Why was the document executed, but the money was not credited to the account?

Money does not always appear in the account immediately - it can take up to seven business days. If the money does not arrive for longer, you may have entered incorrect details on the application. Contact the Document Reception Center with a passport and an application that will contain the correct details.

How to make sure that the debtor has an account with Sberbank?

You can contact the bailiff. In addition, if you have a writ of execution in your hands, you can write a request to the tax service and find out if the debtor has any property, including money in bank accounts.

What happens if there is not enough money in the debtor's account?

The bank will transfer you only the available amount - and continue the collection when the debtor's account is replenished. If several claims are made against the debtor, they will be written off in order of priority. For example, first of all, alimony is collected and damage to life or health is compensated. The collection will continue until you receive the full amount due.

How to find out how much money was transferred under an executive document?

The amount can be found on the Sberbank website.

- Page for those whose debtor is a legal entity or individual entrepreneur.

- Page for those whose debtor is an individual.

Alternatively, you can contact your bank.

How should the Labor Dispute Commission Certificate be drawn up?

When presenting the Labor Dispute Commission Certificate, it is necessary to take into account the requirements of the legislation on enforcement proceedings and the Labor Code of the Russian Federation, namely:

The certificate must contain the dates of issue of the document, entry into force, decision by the commission, its number, address of the commission.

The certificate of the commission on labor disputes must be signed by an official of this commission (for example, the chairman or his deputy) and certified by the seal of the commission on labor disputes (Article 13 of the Law on Enforcement Proceedings, Article 384 of the Labor Code of the Russian Federation).

Labor dispute commission certificates can be presented to the Bank within 3 months from the date of issue. A certificate is issued within one month from the day the decision was made by the labor dispute commission, provided that such a decision was not executed voluntarily within three days after the expiration of ten days provided for its appeal.

The Bank has the right to refuse to execute a labor dispute commission certificate issued and/or presented in violation of the requirements of the law

What is the collection and seizure of money on the account?

Collection is the withdrawal of money from an account without the permission of its owner.

Arrest - prohibition of debit transactions on the account. When arrested, the money remains with the owner of the account, but it cannot be used.

Arrest - prohibition of debit transactions on the account. When arrested, the money remains with the owner of the account, but it cannot be used. What are the grounds for arrest or collection?

The bank collects money or terminates operations on the account when it receives a writ of execution. It gives the right to execute a decision of a court or other body on arrest or recovery.

Most often, the basis for arrest or collection is the decision of the bailiff. Often the basis is also an executive document that comes to the bank from the recoverer - an individual or legal entity. It is also possible to arrest and recover by order of the preliminary investigation bodies and on the basis of other documents.

What if I do not agree with the arrest?

In order to challenge, cancel or revoke a writ of execution, you must contact the initiator (the recoverer, the court, the FSSP) and provide supporting documents.

The recoverer or judicial authority revokes the writ of execution, the bailiff sends the decision to cancel to the bank.

The bank cannot unilaterally cancel the arrest or stop the recovery, this is stated in 229-FZ.

How to avoid arrests and penalties?

Pay taxes and fines on time, do not delay payments on loans, loans - in general, do not allow debts. If you make a payment after a court decision to seize or collect, notify him and provide supporting documents.

Where can I see if there are account limits?

In what order is money debited from the debtor's account?

What should I do if the money has been collected even though the debt has been paid?

How is an arrest removed?

Where can I see that there are account limits?

First of all, you need to find out the details. Sberbank Business Online will help with this.

On the main page and in section Invoices and payments next to the account there will be a note about restrictions. Click it.

Click it.

In the window that opens, click . You will see information about the executive document received by the bank, as well as about who imposed the restrictions.

This information can be used to find out details. For example, if you see that the decision was made by the arbitration court, you can find the details in the filing cabinet. And if you read that the document came from the bailiff service, contact its database.

How is money debited from the debtor's account?

If there is not enough money on the account to pay all the requirements, the debits will be processed in the order of priority.

- First of all, money is distributed for compensation for harm to life and health, as well as for alimony.

- Secondly, money is written off on executive documents related to severance pay, salaries and remuneration of authors of the results of intellectual activity.

- In the third place - according to payment documents for salaries and for transfers to the budget.

- Fourth turn - for payment of documents involving the fulfillment of other financial requirements.

- Finally, the fifth is needed to conduct financial transactions using other payment documents.

More details about each queue are in the text of the law. Within each queue, the write-off is made in the order of the calendar order of receipt of documents.

What should I do if the money has been collected even though the debt has been paid?

Contact the authority that issued the writ of execution. You can find out which body it was in Sberbank Business Online on the page of the account from which the money was debited. When contacting the authority, you will need to provide proof of payment.

How is an arrest removed?

The arrest will be removed if the writ of execution is revoked. To influence this, contact the person who sent the writ of execution to the bank or made the decision to arrest. The procedure and the set of documents that you will need may be different in each case. The bank cannot influence the decision on the arrest and its removal.

The bank cannot influence the decision on the arrest and its removal.

What is account suspension?

By law, the tax office may decide to suspend operations on the account of a legal entity or an individual entrepreneur. If such a decision is received by the bank, it is obliged to execute it.

Suspension means that the bank stops debit transactions on the account - in full or within the amount indicated by the tax service.

A suspension decision is made if you have unfulfilled obligations to the tax office. For example, if you did not submit a declaration on time or did not pay taxes, penalties or fines.

To unblock an account, you need to pay off the debt or submit the necessary reports to the tax office. The decision to cancel the blocking is made by the tax authority no later than the next working day after the submission of reports.

If you have a personal account of a taxpayer - a legal entity or an individual entrepreneur, through it you can send an appeal to cancel the suspension of operations on accounts and attach payment orders that confirm the payment of the debt.

If there is no personal account, you need to contact the tax service. The login and password for entering the taxpayer's personal account can be provided to you at any tax office, and not just at the place of residence.

Individual entrepreneurs can open an account using a personal account of an individual, confirmed in public services, or an enhanced qualified electronic signature.

If you urgently need to unblock your account, but you don't have a personal account, use the special service of the tax service "Prompt assistance: account unblocking" to contact the Tax Service Help Center for account rehabilitation. Within 24 hours, you will be contacted by the telephone number provided in the e-mail with information about the current status of the decision to suspend the account and the possibilities for canceling it.

Learn more

How to find out child support debt by last name - check child support debt online

You can check the amount of child support debt in several ways. To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

To do this, you can contact the MFC or come to an appointment with a bailiff. In addition, you can find out the debt by last name via the Internet. To do this, you need to use the main website of the FSSP, the State Services portal or the State Payment service.

State payment

The State Payment online service offers the easiest and fastest way to find out the amount of alimony debt from yourself or another individual. The service does not require registration. To start checking:

- Go to the State Payments website;

- Enter the last name, first name and patronymic of the debtor, his date of birth and region of residence. Click "Check";

- Next, enter the code from the picture and wait for the verification results.

The service will check the FSSP database and provide information about the amount owed by a particular person.

With the help of "Gosoplata" you can not only find out, but also immediately pay the debt using any bank card.

The service has the following benefits:

- Instant payment of legal, tax and other debts;

- Simple and intuitive interface;

- Convenient mobile application;

- Payment information is automatically transferred to databases;

- All transmitted data is securely encrypted;

- Payment receipt is sent to the payer's e-mail immediately after the payment is made.

FSSP website

To find out the debt for alimony through the official website of the FSSP, you need:

- Go to the site at the link: fssp.gov.ru;

- In the site menu, select the "Service" section, the "Database of Enforcement Proceedings" category;

- Next, you need to fill in all the fields marked with an asterisk (*):

- Territorial bodies;

- Last name, first name;

- Click the "Find" button to start checking. Next, the system will ask you to enter the code from the picture to confirm that the request is made by a person and not a robot.

If several debtors have the same first and last name, you need to enter the middle name and date of birth for a more accurate search.

As a result of the search, you will see a table where all the necessary information will be presented:

- amount of debt and enforcement fee;

- production number;

- court order number;

- territorial subdivision of the FSSP;

- surname and phone numbers of the bailiff.

On the main website of the bailiff service, you can not only find out the debt for alimony, but also pay it. If necessary, you can pay the debt online through the State Services portal or generate a receipt and pay it through any bank.

Public services

To find out the amount of alimony arrears through the State Services portal, you must first register.

Attention! The search for accruals is carried out according to the data from your personal account.

To see if you have a legal debt, log in to your personal account and follow these steps:

- Select the "Services" section, then the "Authorities" subsection and the "FSSP of Russia" category;

- Next, open the tab "Territorial authorities" and select the name of the desired department from the list;

- Select the electronic service “Providing information…”;

- Next, select the service "Law Debt";

- Click "Get Service";

You can pay your debt in several ways:

- With any bank card;

- Through Google Pay or Samsung Pay;

- Using an electronic wallet WebMoney, Qiwi, Yandex.Money;

- From a mobile phone account.

You can also generate a receipt and pay it at the bank or at the post office.

How quickly will an entry in the FSSP database be deleted?

If you have fully or partially paid the child support debt, the entry in the Database will be deleted or changed no earlier than 3-7 working days from the date of payment.