How to file for child support in arkansas

Child Support in Arkansas | DivorceNet

To calculate child support in Arkansas, judges consider the parents' incomes and the number of children to be supported, and use the state's guidelines to reach a final amount.

Both parents, whether married to one another or not, have a continuing duty to financially support their children. Most states—including Arkansas—have specific rules for calculating the financial responsibilities of single, separated, or divorced parents, and for ensuring that parents pay support.

Although parents can enter into agreements about child support, such agreements must, at a minimum, meet the guidelines set by law and receive court approval. This is because the right to receive support belongs to the child and not the child's parents. Parents can't waive their child's right to child support.

- Arkansas's Child Support Guidelines and Calculator

- Calculate Each Parent's Income

- Combine the Parents' Income

- Apply the Combined Income to the Arkansas Family Support Chart

- Who Pays the Child Support in Arkansas?

- How Joint Custody Can Affect Child Support Amounts

- Adjustments for Additional Expenses

- Adjustment for Health Insurance

- When You Can Deviate From the Arkansas Child Support Guidelines

- How to Apply for Child Support in Arkansas

- Modifying a Child Support Order in Arkansas

- How Is Child Support Paid and Received in Arkansas?

- How to Make Child Support Payments in Arkansas

- How to Receive Child Support Payments in Arkansas

- When Does Child Support End in Arkansas?

Arkansas's Child Support Guidelines and Calculator

The Arkansas Supreme Court has set child support guidelines all courts in the state must follow to determine the amount of child support one parent may be required to pay to the other. Arkansas calculates basic support as a percentage of a noncustodial parent's net income.

You can use Arkansas's Child Support Estimator to enter in information about your financial situation and get an estimate of how much child support you might be entitled to (or have to pay).

Calculate Each Parent's Income

The first step in a court's determination of child support is to calculate each parent's income. Courts interpret "income" broadly to cover the widest range of resources available to benefit children. Types of income that Arkansas courts typically consider include:

- salaries, wages, and tips

- earnings generated from a business or self-employment

- military pay

- passive income such as dividends, pensions, social security benefits, and unemployment insurance benefits

- tips and gratuities

- gambling and lottery winnings

- nonmonetary perks such as housing, meals, room and board, and

- other assets available to generate income for child support.

(Ark. Sup. Ct. Admin. Order 10, § III (2022).)

After examining each parent's sources and amounts of income, the court then computes their individual income by calculating the parent's:

- actual monthly income for at least one month, or

- imputed monthly income based on the income of a person with comparable education, training, and experience (see the discussion below for more information about imputing income).

In order to assist the court in calculating support, both parents are required to submit an Affidavit of Financial Means and a Child Support Worksheet.

Imputing Income for Child Support

A parent can't evade their child support obligation by refusing to work. So when a parent can't provide evidence of current or average income, or is underemployed (meaning they have the potential to make more), the court can assign an imputed (assumed) monthly gross income to the parent. In doing so, the court must consider the circumstances of both parents. This includes factors such as the parents':

This includes factors such as the parents':

- assets

- residence

- employment and earnings history

- job skills

- educational attainment

- literacy

- age and health

- criminal record and other employment barriers, and

- record of seeking work.

The court must examine these factors in light of community factors, too, such as the local job market and the prevailing wages of others doing similar work in the area. (Ark. Sup. Ct. Admin. Order 10, § III.8 (2022).) The court can then decide on a fair income amount to impute to the parent.

Combine the Parents' Income

After calculating each parent's income, the court combines the two amounts. The court then determines what percentage of the total income is attributable to each parent.

EXAMPLE: Pat makes $2,000 per month. Jordan makes $3,000 per month. Their combined gross monthly income is $5,000. So Pat's income makes up 40% ($2,000/$5,000) of the total, and Jordan's income makes up 60% ($3,000/$5,000).

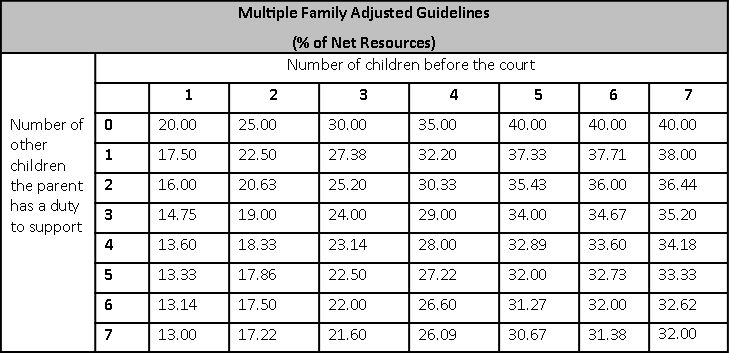

Apply the Combined Income to the Arkansas Family Support Chart

Using the parents' combined income and the number of children to be supported, Arkansas courts use a chart to determine the total basic monthly child support amount. (Ark. Sup. Ct. Admin. Order 10, § V.1 (2022).)

EXAMPLE: Pat and Jordan have two children. Looking up Pat's and Jordan's combined income of $5,000 on the chart, the base monthly child support amount is $1,081.

Each parent's share of the monthly support amount is based on their percentage of the combined income.

EXAMPLE: Jordan is responsible for 60% ($648.60) of the base monthly child support obligation. Pat is responsible for 40% ($432.40).

Who Pays the Child Support in Arkansas?

Even though each parent is responsible for a share of the total child support obligation, both parents won't be making monthly payments to each other. Instead, in most cases, the noncustodial parent becomes the "payor," and pays the custodial parent (the "payee") a proportionate share of the base support.

The Arkansas child support guidelines assume that the payor parent has the child overnight in their residence less than 141 overnights per calendar year. (Ark. Sup. Ct. Admin. Order 10, § II (2022).) The calculations are different if the parents have joint custody.

How Joint Custody Can Affect Child Support Amounts

When the parents have joint custody of the children—in other words, when they both have responsibility for the child for at least 141 overnights per calendar year—the parties must (like all other parents) complete a Child Support Worksheet and Affidavit of Financial Means. The court considers these forms as well as the amount of time each parent spends with the child, and will, if necessary, adjust the amount determined by the guidelines.

In particular, the court will consider any disparity between the income of the parties as well as which parent is responsible for the majority of one-time expenses for the child (such as basic clothing costs, extracurricular activity fees, and school supplies). The court will also take into account any significant time periods on separate days when the child is in a parent's physical custody but doesn't stay overnight.

The court will also take into account any significant time periods on separate days when the child is in a parent's physical custody but doesn't stay overnight.

(Ark. Sup. Ct. Admin. Order 10, § V.2 (2022).)

Adjustments for Additional Expenses

Arkansas courts can adjust parents' child support obligations if there are other monthly child-rearing expenses, such as extraordinary medical expenses or childcare.

Adjustment for Health Insurance

The court can require parents to obtain health insurance for the child at a reasonable cost. In Arkansas, health insurance coverage is considered reasonable if the cost of coverage for the child doesn't exceed 5% of the net income of the parent who has to provide such coverage. The court can order an adjustment to the base support when necessary to cover costs of health insurance. (Ark. Sup. Ct. Admin. Order 10, § IV.1 (2022).)

The court will also determine the parents' responsibility for paying uninsured and unreimbursed medical expenses.

When You Can Deviate From the Arkansas Child Support Guidelines

Courts presume that the amounts listed in the current Child Support Charts are appropriate, but a judge who finds these amounts to be unfair in light of the circumstances of a particular case may order a different amount.

There are many factors a court might consider in making adjustments. Under Arkansas law, the court should consider:

- educational expenses (such as private school tuition)

- the cost of procuring life insurance, dental insurance, or other insurance for the child's benefit

- extraordinary expenses for court-ordered visitation

- the creation or maintenance of a trust fund for the child

- the support given by a parent for minor children in the absence of a court order

- extra time the payor parent spends with the child

- additional expenses incurred because of natural or adopted children living in the home

- payment for work-related childcare, and

- any other factors that warrant a deviation from the guidelines.

Judges must write in the order their reasons for deviating from the guidelines. (Ark. Sup. Ct. Admin. Order 10, § II.2 (2022).)

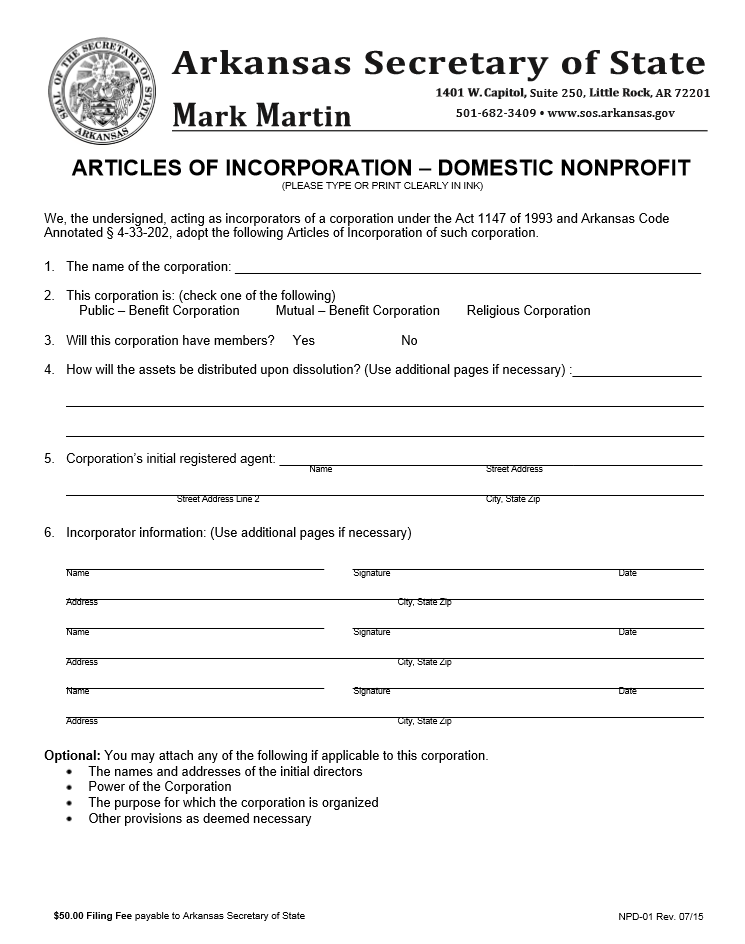

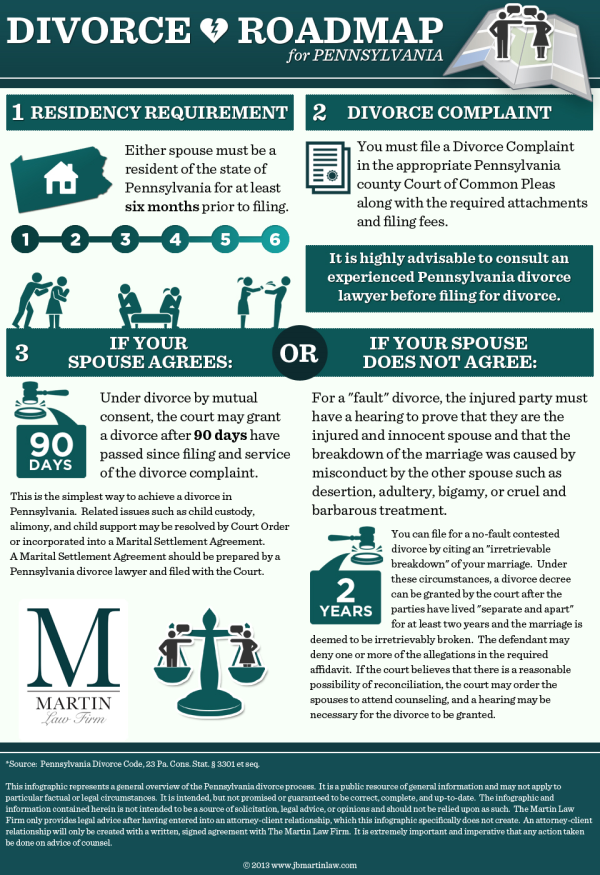

How to Apply for Child Support in Arkansas

Often, parents request child support as part of the process of filing for divorce in Arkansas. However, the issue of child support also comes up in situations where the parents never married. Children are entitled to support regardless of their parents' marital status.

Outside of a divorce proceeding, parents can apply to establish a child support order through the Arkansas Office of Child Support Enforcement (OCSE).

Families receiving Temporary Assistance to Needy Families (TANF) benefits or Medicaid benefits are automatically referred to OCSE and don't have to fill out an application.

OCSE can also help you locate an absent parent and establish paternity if necessary, and it's responsible for enforcing Arkansas child support orders.

Modifying a Child Support Order in Arkansas

Arkansas courts won't recognize an agreement between the parents to change the amount of child support—instead, you must get court approval to modify your child support order. Courts don't modify child support orders lightly; there must be a material change of circumstances that makes it in the child's best interest to modify the order.

Courts don't modify child support orders lightly; there must be a material change of circumstances that makes it in the child's best interest to modify the order.

Most often, parents request a modification of child support due to a change in financial circumstances. A change of either parent's income—either up or down—by 20% is considered a material change of circumstances that would warrant a review of the child support order.

Even if there's no material change in your circumstances, you can petition for an adjustment to the order once every three years.

(Ark. Code § 9-14-107 (2022).)

How Is Child Support Paid and Received in Arkansas?

Child support is paid through the Arkansas Child Support Clearinghouse, a division of the Arkansas Office of Child Support Enforcement. The clearinghouse receives, records, and disburses child support payments. You might hear the clearinghouse referred to as the "state disbursement unit" or the "SDU."

How to Make Child Support Payments in Arkansas

Most Arkansas child support orders require your employer to automatically withhold (and pay on your behalf) child support payments from your paycheck. If you're self-employed or don't have an employer, you can choose one of the following methods to pay child support in Arkansas:

If you're self-employed or don't have an employer, you can choose one of the following methods to pay child support in Arkansas:

- online payments (through MyCase)

- via MoneyGram, or

- by mail.

How to Receive Child Support Payments in Arkansas

You can receive your child support payments either through a prepaid card or direct deposit. Payments are received by the clearinghouse and sent out within two days of receipt.

When Does Child Support End in Arkansas?

In Arkansas, the obligation to support a child ends when the child turns 18 years of age. But if the child is still attending high school at age 18, support continues until the child's high school graduation or the end of the school year after the child reaches 19, whichever is earlier. Child support also terminates when a child is emancipated by the court; marries; or dies. (Ark. Code § 9-14-237 (2022).)

A child support obligation may continue longer if a child is disabled and not capable of self-support.

Common Child Support Questions in Little Rock, AR

Why do I need to have a child support order?

Parents have a financial obligation to support their children, and under Arkansas law when there is a divorce, legal separation, or if the parents were never married, this is accomplished through a child support order. The noncustodial parent or the parent that has a higher income in joint custody situations, makes regular child support payments to the custodial or other parent in order to meet that financial obligation. Click here to learn more about child support.

If the divorce is uncontested, do we still need a child support order?

Yes; it is in the best interest of both the child and the parents to establish a child support order even if the divorce is not contested. If the parties do not initially take the initiative to establish child support, the court can establish child support on its own volition if it sees fit.

Can child support be determined through mutual agreement?

Yes—the parents may mutually agree on the amount of child support that should be set. However, that does not stop the court from being able to change the amount of child support to be more suitable or to be in line with Administrative Order Number 10.

However, that does not stop the court from being able to change the amount of child support to be more suitable or to be in line with Administrative Order Number 10.

What if the child’s mother has filed for child support, but I don’t think I am the father?

If the child’s mother has filed for child support and believes you are the father who should be paying it, but you are not convinced you are the father, you may seek out DNA paternity testing. This can be accomplished through Office of Child Support Enforcement or a paternity action with private testing.

In order for the paternity test to be valid under Arkansas law, it must be performed by a certified lab rather than an at-home test and is typically completed through a cheek swab saliva test. Find out more about establishment of paternity in Arkansas here.

How do I know that the amount of the child support order?

Arkansas courts use charts, provided for under Administrative Order 10, as a guideline for determining child support and the noncustodial parent’s income. The guidelines do change over time so it is important to be aware of this as you, your attorney, the child’s other parent, and their attorney discuss how child support and other family law issues will be determined.

The guidelines do change over time so it is important to be aware of this as you, your attorney, the child’s other parent, and their attorney discuss how child support and other family law issues will be determined.

What is child support like if we share custody?

If the parties share true joint custody and have similar income levels, the court may not require child support to be paid by either party. However, if there is a large income disparity between the parties, then the court will typically perform an offset of child support. When this happens, the court considers each party’s income for child support purposes, and will offset the higher income by the lower income to determine the appropriate amount of child support. Click here to learn about joint custody.

Although the courts may deviate from child support guidelines on a case by case basis, including parental time sharing and other reasons for deviation, child support is based on income and the needs of the child.

What happens at a hearing for child support?

At a hearing for child support, the child support is calculated based on Administrative Order Number 10. The judge uses the guidelines to advise their decision-making. However, he or she may take other factors into consideration if they feel the noncustodial parent should pay less or more based on those guidelines.

What if the other parent is not paying what the court ordered?

Under Arkansas law, child support can only be enforced once an Order for Child Support is filed with the court. If the other parent is not paying the court-ordered child support, then you or your attorney can file a motion for contempt.

However, the court may also use other methods to attempt to collect child support, such as an income withholding order or wage garnishment. More severe penalties may follow if child support remains unpaid.

How do I change the child support order?

Child support orders may be changed if the paying parent’s gross income changes by 20 percent, or more than $100 per month, or there is a material change in the child’s needs. The needs of the child and the ability of the noncustodial parent to pay them are the paramount considerations when setting and modifying child support.

The needs of the child and the ability of the noncustodial parent to pay them are the paramount considerations when setting and modifying child support.

Although this may be seem like a straightforward change, some parents may have multiple jobs or streams of income, and the courts can decide whether or not the change warrants a modification of the child support order based on this and other factors.

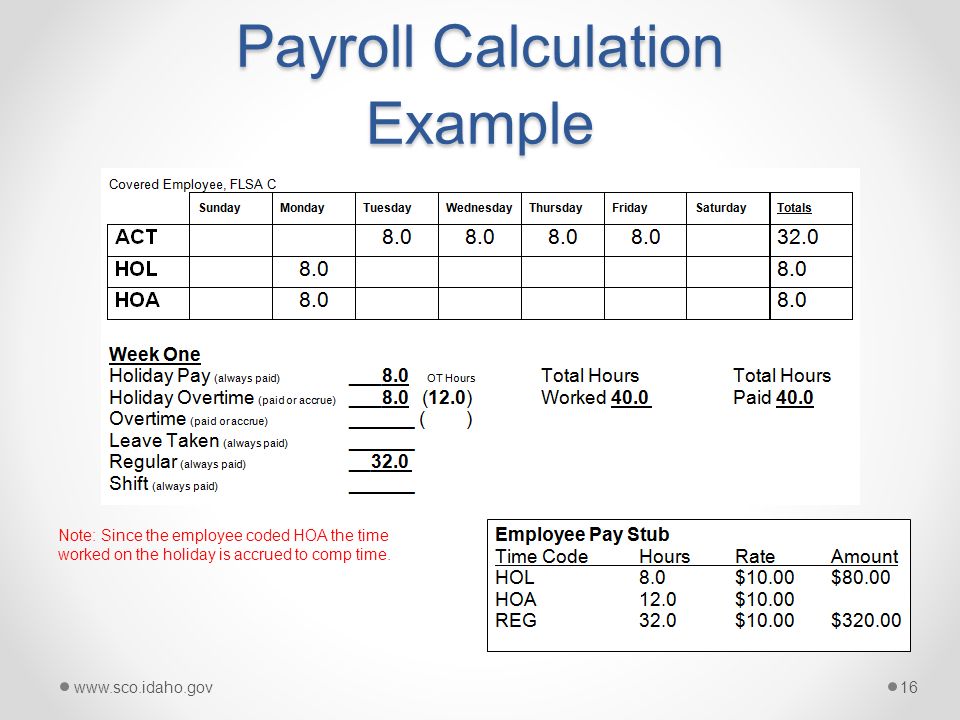

child support faq graphic

What does the court do if the other parent is incarcerated?

A court-ordered financial obligation to the child does not stop simply because the other parent becomes incarcerated. If they are unable to pay due to being in jail, then the child support accrues. Once the parent is released, child support collection efforts can proceed. Click here to learn about sole custody.

What if the court records show that I owe more child support than I think I do?

If you believe you owe more child support than you should, contact an experienced family law attorney to discuss next steps. They can provide guidance on this and other issues related to family law.

They can provide guidance on this and other issues related to family law.

If I’m being denied visitation, can I stop paying child support?

No, your obligation to pay child support does not stop even if you are denied visitation. Likewise, court-ordered visitation does not stop just because child support payments stop. Both parties must adhere to the court’s orders. It is even possible in some instances related to custody that the noncustodial parent may owe child support even when the children begin to live with them.

How to Collect Alimony From a Foreign Citizen?

In order to collect alimony from a foreigner, in any case, it is necessary to apply to a foreign court . The plaintiff may apply to a Russian court with a claim drawn up in accordance with the laws of the Russian Federation. An application is made for the recovery of alimony from a foreigner. Having received the writ of execution, the conclusion of the court must be legalized in the country of residence of the defendant.

To recover alimony from a foreign citizen , you should apply to the court of the state where he lives, or to a Russian court if the plaintiff lives in Russia. Collection of alimony is possible if an agreement (agreement) has been concluded between the countries on the recognition and enforcement of court decisions.

If you decide to collect alimony from a foreign citizen, you can apply to the court of the foreign state where this citizen lives, or to the court of the Russian Federation.

How to accept alimony from foreign citizens?

In the Russian Federation, alimony is collected from foreign citizens in the following ways: Peaceful (voluntary). It is applied in case of conclusion of a voluntary agreement between the mother of the child and the foreign father.

Which countries have signed the Convention on the Recovery of Support Abroad?

More than 60 countries belong to the countries participating in the convention on the recovery of alimony abroad , including: Australia, Argentina, Belgium, Belarus, Brazil, Great Britain, Greece, Denmark, Turkey, Kazakhstan, Moldova, the Netherlands, Norway, Poland , Portugal, Romania, Slovakia, Hungary, Finland, France.

How to collect alimony from a foreigner in Russia?

To recover alimony from a foreigner , the following documents must be submitted along with the claim:

- A copy of the passport and identification code of the plaintiff;

- A copy of the child's birth certificate;

- Original certificate of residence;

- Information about the place of registration of the defendant - foreigner abroad.

How to receive alimony if the husband lives in another country?

According to the rules of jurisdiction in force at Ukraine , the plaintiff, when filing a lawsuit for alimony , has the right to file it at his place of residence. Therefore, an application to the court can be filed both in our country , and in that country where the debtor lives, unless otherwise specified in the international agreement.

How to apply for child support through public services?

How to apply for child support online through Public Services in 2022?

- Register on the State Services, go to the portal and enter in the search " alimony ";

- The portal will display a list of available services.

- If this service is available, then you can proceed to filling out the application;

How to apply for alimony for a citizen of Ukraine?

You will have to file a new statement of claim at the place of residence of the defendant in order to collect alimony from a citizen of Ukraine . That is, according to Ukrainian laws and with the help of Ukrainian lawyers. Some special benefits in case the father of the child does not pay alimony , Russian laws, unfortunately, do not provide.

When does the alimony debt expire?

According to Article 107 of the Family Code, the limitation period for maintenance debts is 3 years.

Do I need to sue for child support?

Parents are required to support their minor children. If they cannot peacefully resolve the issue of the maintenance of their common child, the mother or father with whom the minor lives must contact court for the enforcement of alimony .

How to avoid paying child support?

5 ways not to pay child support

- Method 1. Entry into full legal capacity of a minor

- Method 2. Lump sum payment or provision of property

- Method 3. Relocation of the child to the payer of maintenance

- Method 4: Exclude paternity of a child

- Method 5.

Can I apply for alimony at the defendant's place of residence?

The plaintiff, when filing a claim for the recovery of alimony in a different amount than previously determined by the court decision, acts as a recoverer of alimony and, therefore, has the right to sue as at the defendant's place of residence and at his place of residence .

How much does a father have to pay child support?

The amount that the father has to pay as child support depends on the number of minor children. From Article 81 of the RF IC it follows: The amount of monthly payments for the maintenance of minor children is: a quarter of the income of the father - for one child, a third of the income - for two children, and half of the income for three or more children.

How to apply for alimony if the ex-husband lives in another city?

on the initiative of one of the parents under the rule of alternative jurisdiction (to the court at the defendant's place of residence or at his place of residence) by filing with the world court:

- a statement of claim for the recovery of alimony ;

- applications for issuance of a court order.

What documents do I need to apply for child support in 2021?

What documents are needed

- parents' passports;

- documents that give the right to receive alimony , for example, a child's birth certificate, a marriage or divorce certificate;

- family composition certificates;

- income statements;

- certificates from the place of residence;

- copies of the application itself;

- calculation of the amount alimony ;

How to apply for maintenance?

The court will need the following documents:

- Application for recovery of alimony - original and copy.

- Copy of birth certificate for each child.

- A copy of the marriage registration or divorce certificate, if the divorce has already taken place.

- Income statements from both parties.

- Certificates from the place of residence of the child and parents.

Is it possible to apply for maintenance remotely?

Can sue child support online? No. Despite the fact that almost all courts have official websites with subsections called "Appeals", the action is carried out in a "natural" form, i.e.

Is it possible to recover alimony from an emigrated to the USA if his address is not available?

Ludmila Abapolova

Lawyer, Orsk

Expert

Dear Daria!

Russian law allows the collection of alimony for the maintenance of a minor child (children) regardless of the nationality of the father. If at the moment paternity has not been established (a dash in the birth certificate in the column “father” or the father is recorded from the words of the mother), then along with the requirement for the recovery of alimony, it is necessary to file a claim with the court to establish paternity.

Art. 29 of the Code of Civil Procedure of the Russian Federation, claims for the recovery of alimony, the establishment of paternity can be filed both at the place of residence of the defendant and at the place of residence of the plaintiff (at the choice of the latter). A claim only for the recovery of alimony is filed with a justice of the peace, and if a claim is also made to establish paternity, to the district (city) court.

Once a child support order has been received, it must be enforced in the child's father's country of residence. Enforcement problems may arise if there is no legal assistance program (agreement, international treaty, etc.) in the field of family law between the Russian Federation and the country of residence of the father.

Execution of a decision of a Russian court on the territory of a foreign state is possible only if there is an international agreement between the Russian Federation and a foreign state that provides for the possibility of mutual enforcement of court decisions, and also after the issuance of a permit for enforcement by the relevant authorities of a foreign state (similar to the FSSP in the Russian Federation).

If there is no such interaction between countries, then it is pointless to apply for alimony to the Russian court, since it will not be possible to execute the court decision. Then it makes sense to file a claim for the recovery of alimony directly to the court abroad at the place of residence of the father.

Tatyana Zyryanova

Lawyer, Krasnoyarsk

Good afternoon! You can apply for child support. In this case, you will need to indicate the last known place of residence of the father of the child in the Russian Federation. The application is submitted to the Magistrate's Court at your place of residence. That is, legally, you will receive a court order for the recovery of alimony without any problems.

However, it will be quite difficult to get the money (if the child's father has no property in Russia). Firstly, you do not know where the father of the child lives, so it is not clear where to send the writ. Secondly, there is no Legal Assistance Treaty between the US and Russia. Thus, this decision will be mandatory on the territory of the Russian Federation, but the question remains how the US authorities will react to the decision of the Russian court. Since different states have their own procedure for recognizing the decisions of foreign courts.

Secondly, there is no Legal Assistance Treaty between the US and Russia. Thus, this decision will be mandatory on the territory of the Russian Federation, but the question remains how the US authorities will react to the decision of the Russian court. Since different states have their own procedure for recognizing the decisions of foreign courts.

Timur Akhmadeev

Lawyer, Moscow

Yes, of course you can recover, but there will be problems with the recovery of alimony.

Nadezhda Frolova

Lawyer, Moscow

Hello!

Russian law allows you to collect maintenance for the maintenance of a minor child, regardless of the nationality of the father. According to Art. 81 RF IC:

1. In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents on a monthly basis in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other parental income.