How to create a trust fund for my child

4 Biggest Mistakes Parents Make

Setting up a Trust Fund might be the best thing you ever do for your little ones. However, if you don’t do it properly, you may inadvertently make things extremely difficult.

Learn about the biggest mistakes parents make when setting up a Trust Fund, and how you can avoid them. Best of all, we’ll even walk you through the best practices on how to set up your Trust Fund the right way, so you have the most protective plan possible in place for your loved ones’ financial future.

Should You Set Up a Trust for Your Child?

How to Set Up a Trust Fund for a Child

The 4 Biggest Mistakes Parents Make When Setting Up a Trust Fund

Should You Set Up a Trust for Your Child?

First, let’s address the elephant in the room. There’s a huge misconception out there that Trust Funds are only for extremely wealthy families, for children who will one day inherit extreme wealth. This could not be further from the truth. While the stereotype may have, at one time, been somewhat accurate, there are multiple reasons why a Trust Fund can be beneficial, regardless of how significant your wealth is.

Smart Estate Planning revolves around using the vehicles and tools you have to best protect your legacy, both now and in the future - and setting up a Trust Fund for your children can do many things, including:

Potentially reduce estate taxes in the future

Potentially reduce gift taxes in the future

Keep your estate out of probate

Allow you to protect loved ones with special needs

Offer protection from lawsuits or creditors

For more information about Trust Funds and different types of Trusts, check out our in-depth article What Is a Trust in Estate Planning?

How to Set Up a Trust Fund for a Child

The process of setting up a Trust Fund for your children doesn’t have to be complicated, time consuming or expensive. It really can be simple and streamlined. Follow these steps, and you’ll be done in no time!

It really can be simple and streamlined. Follow these steps, and you’ll be done in no time!

Specify the purpose of the Trust

Clarify how the Trust will be funded

Decide who will manage the Trust

Legally create the Trust and Trust Documents

Transfer assets into and fund the Trust

1. Specify the purpose of the Trust

Before you open the Trust Fund For your children, you should have a clear idea about what the purpose of the Trust will be. Decide who the Trust will benefit - one, or all of your children? If certain assets will go to specific beneficiaries, that needs to be clearly defined.

Trust Funds can be set up for a number of purposes like providing college funds, as a way to hand down real estate, or as a tool to pass down other inheritances and assets. Trust Funds are also great ways to set up financial security for a loved one with special needs.

2. Clarify how the Trust will be funded

Setting up a Trust is only half the battle. After that’s done, a Trust needs to be funded so it can hold assets, offer protection and one day be distributed. As soon as you decide on the purpose of the Trust Fund, the next step is to figure out which assets the Trust should hold. Trusts can be funded through investments, real estate or straight cash.

After that’s done, a Trust needs to be funded so it can hold assets, offer protection and one day be distributed. As soon as you decide on the purpose of the Trust Fund, the next step is to figure out which assets the Trust should hold. Trusts can be funded through investments, real estate or straight cash.

3. Decide who will manage the Trust

Deciding on a Trustee (the person who will manage the Trust Fund) might be the most important part of the entire process. Obviously you need to choose someone trustworthy, as they’ll have the great responsibility of overseeing the management and distribution of the Trust on behalf of the beneficiaries (likely your children).

4. Legally create the Trust and Trust documents

Once you’ve made all the decisions about who the Trust will benefit, how it will be funded and who should manage it, it’s time to actually legally create your Trust Fund.

This can be accomplished by going the traditional, expensive route of meeting with an Estate Planning attorney. Or, if you’re looking for an equally effective, but substantially more affordable and accessible route, using a trusted online service like Trust & Will can be an excellent option.

Or, if you’re looking for an equally effective, but substantially more affordable and accessible route, using a trusted online service like Trust & Will can be an excellent option.

5. Transfer assets into the Trust

Remember! You’re not finished until the Trust is funded. Funding a Trust essentially means you make the Trust the owner of any assets you want it to hold. If you transfer any real property into it, you’ll need to have a new deed executed that uses Trustee language. Other assets like accounts, investments or policies will need to be retitled to be Trust-owned as well. This is a simple process that you can complete by contacting financial institutions directly.

Once the Trust is fully funded, the Trustee you named can then begin to manage all the assets inside of it on behalf of your children. If you’ve named yourself as Trustee, you want to also name a successor Trustee who can step in when the time comes. The Trustee’s responsibilities include managing and distributing the Trust’s assets per the terms stated in the Trust.

The 4 Biggest Mistakes Parents Make When Setting Up a Trust Fund

While everyone goes into this process with the best of intentions, there are a few mistakes that we see fairly often. It’s easiest to avoid these common blunders by understanding them before you make them.

1. Not choosing the right Trustee

Choosing the wrong Trustee is a common mistake parents make. It happens honestly, and often stems from the fact that we just don’t want to think about the reality of us not being there, so we rush into the decision. It might feel easy to choose a close family member, because you know they’ll have your children’s interest at heart, but you need to think about some pretty realistic problems that can occur if you choose someone just because they’re related to you.

It’s important to take into account things like:

The Trustee’s health

How far they live from you

How old they are

How old they’ll be when your children are set to gain control of the Trust

Are they trustworthy

What their basic judgment skills have shown to be in the past

It’s so important to take the time to make the right choice about who’ll manage your children’s Trust Fund. Choosing the wrong person can result in a number of complicated issues with real consequences (like the Trust being mismanaged). And unfortunately, the worst part is there’s a good chance you won’t be around to fix things if the Trustee isn’t doing the job you envisioned.

Choosing the wrong person can result in a number of complicated issues with real consequences (like the Trust being mismanaged). And unfortunately, the worst part is there’s a good chance you won’t be around to fix things if the Trustee isn’t doing the job you envisioned.

Want to learn more about the role of Trustees? Find helpful information about what they do and how to choose the right one in our in-depth article “What Is a Trustee - Everything You Need to Know.”

2. Not being clear about the goals of the Trust

If you have the wrong goals, or if you’re not clear about what your goals are, you may open the door to young adult children having access to money that may do more harm than good. Thinking through how and when your children should gain access to their money is key to successfully setting up the most beneficial Trust possible for their financial futures.

Do you want your adult children to get money every year? Every three years? At a certain age? At the completion of a major life milestone or goal (like graduating college or getting married)?

Being thorough and thoughtful about how (and when!) your children get the money inside their Trust Fund is a key element to setting up a useful Trust.

3. Not including asset protection provisions

A major benefit to any Trust is the asset protection it can offer if you set it up the right way. Including spendthrift provisions inside a Trust Fund can prevent beneficiaries from making financially disastrous missteps that could result in a significant loss.

Another important component of having a Trust is setting up a system that serves as a sort of checks and balances. Checking in on assets over time can ensure they’re protected in the long run.

4. Not reviewing the Trust annually

Reviewing your Trust annually is so important. Things change in life, and your Estate Plan needs to change with them. Having an outdated plan can be as disastrous as not having a plan at all.

Consistently reviewing your Trust gives you the opportunity to reassess things like:

Who you’ve selected for the role of Trustee

Have you included every beneficiary you should?

Are there any beneficiaries who should not be included any longer?

Have there been births in the family that would result in a need to update your Trust?

Have there been any deaths?

Has your designated Trustee had a change in mental or physical health?

Remember that when you set up a Trust (or any part of your Estate plan) through an online service like Trust & Will, reviewing your plan becomes simple and incredibly affordable. No longer do you need to set up an appointment and meet in person with a lawyer, which takes both time and usually a significant amount of money.

No longer do you need to set up an appointment and meet in person with a lawyer, which takes both time and usually a significant amount of money.

Knowing how to set up a Trust Fund for a child can be a surefire way to provide for their financial future. And as you’ve seen, you don’t need to have millions for a Trust Fund to be beneficial. You just need to have a desire to protect your children, and the passion to set them up for a financially responsible future. If you have these things, a Trust Fund may be the next logical step for you to take.

Is there a question here we didn’t answer? Reach out to us today or Chat with a live member support representative!

How to Set Up a Trust Fund

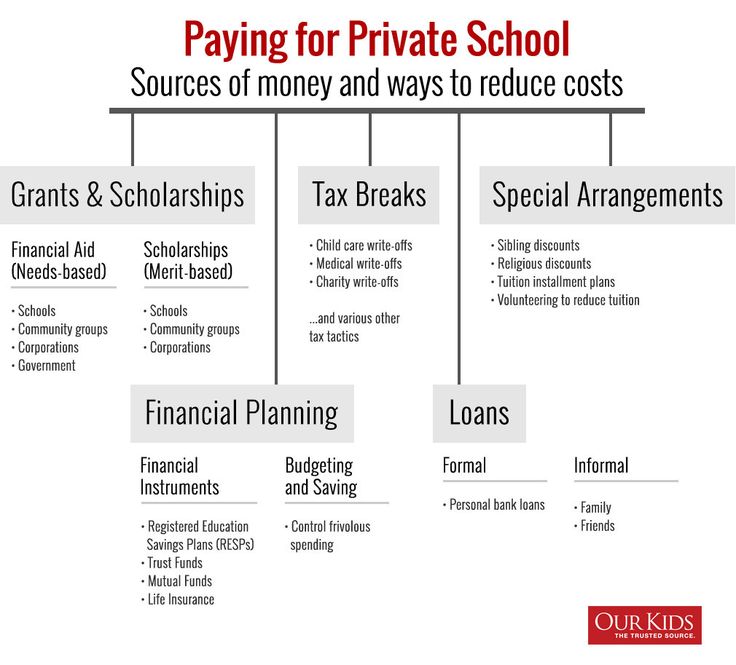

Many people view trust funds as tools to protect the wealth of the very rich or to provide their heirs—sometimes derided as “trust fund babies”—with independent incomes, freeing them from the need to earn a living. However, trust funds vary in complexity and purpose—preserving assets designated for charities, retirement funds, public works, and more.

Trust funds may be used by individuals, even some of modest means, who wish to set aside assets for specific purposes. For example, affluent, but not necessarily ultra-rich parents and grandparents create college trust funds to pay for children’s postsecondary education. To avoid potential family conflicts, widowed and divorced couples entering second marriages may use trust funds to hold property for children of their first marriages.

Key Takeaways

- Grantors create trust funds for various purposes: charitable, business, and especially personal goals such as providing future financial support for children and grandchildren.

- Grantors of irrevocable trusts retain no termination or other rights over the trust; they no longer own the trust fund assets, owe no taxes on trust fund income, and the trust property is excluded from their estates.

- Although many families use college trust funds to pay for children’s educational expenses, it can be simpler and less expensive to employ other arrangements, such as section 529 plans.

- The tax code and state laws facilitate the creation of "special needs" trusts and ABLE accounts to assist disabled individuals.

- Trusts are managed by their trustees, who may be individuals or trust departments of banks and other financial institutions

Structure and Operation

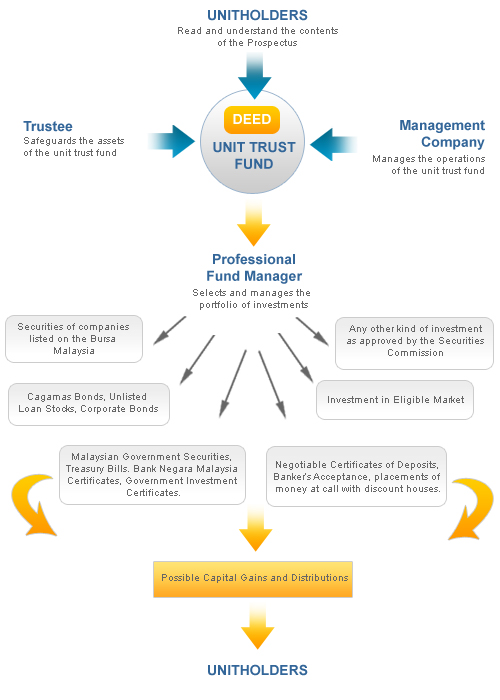

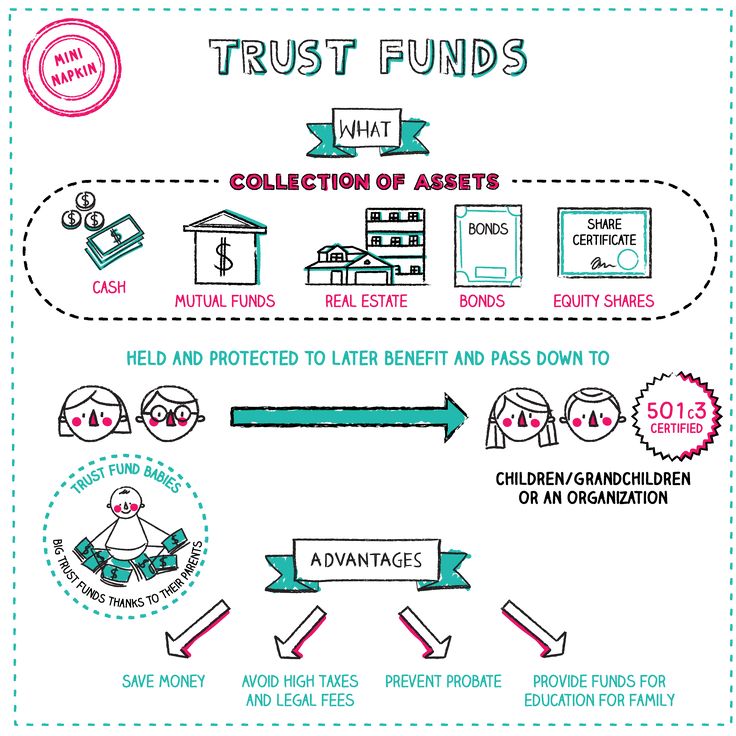

Regardless of their size and purpose, all trusts have the same basic structure and terminology. The terms “trust” and “trust fund” are often used interchangeably. Although closely related, they have different technical meanings.

The term “trust” refers to the legal arrangement evidenced in a written agreement transferring property from a “grantor” to a “trustee” for specified purposes. The trustee has the fiduciary responsibility to hold and manage the property in accordance with the directions in the agreement and in the best interests of the trust’s beneficiaries.

A “trust fund” refers to the property transferred by the grantor to the trustee, the "corpus" of the trust. Though the word “fund” suggests a trust is comprised of financial assets, almost any type of property—including real estate, art, patents, or copyrights—can comprise all or part of a trust fund.

Though the word “fund” suggests a trust is comprised of financial assets, almost any type of property—including real estate, art, patents, or copyrights—can comprise all or part of a trust fund.

Revocable Grantor Trusts: Ownership Retained

In some circumstances, grantors designate themselves the trustee and retain ownership and control of trust assets. Such a grantor trust may be used to avoid the cost, time, and potential publicity associated with the probate of an estate. In addition, a grantor may create a “revocable trust” by limiting the term that the trust remains in effect or retaining the right to end the arrangement. Grantor trusts serve a variety of purposes but do not offer tax savings.

In the case of a trust that is revocable by the grantor, the grantor continues to be liable for any taxes due on trust income, and the assets may be available to the grantor’s creditors. Employers create grantor trusts to identify and segregate assets to back future liabilities for employee retirement benefits. Some public officials transfer stockholdings and other investments to “blind trusts” to be managed by a third party without the officials’ knowledge during their tenure in office, in order to avoid potential conflicts of interest.

Some public officials transfer stockholdings and other investments to “blind trusts” to be managed by a third party without the officials’ knowledge during their tenure in office, in order to avoid potential conflicts of interest.

Irrevocable Trusts

When the grantor permanently transfers ownership and control of property pursuant to a trust agreement to a third-party trustee, the trust is irrevocable. The grantor of an irrevocable trust no longer owns the transferred assets and is not responsible for taxes due on the income from or the disposition of the assets, and the trust assets cannot be claimed by the grantor’s creditors. These trusts—which are widely designed as college trust funds and to provide financially for children and grandchildren—also allow grantors tax- and estate-planning benefits.

Trusts for Individuals

Frequently, irrevocable trusts are used to hold assets for the benefit of family members, usually children or grandchildren. These arrangements can also provide tax- and estate-planning advantages. Grandparents often appoint a parent as trustee of a trust for grandchildren. As a trustee, a parent must comply with the trust’s directives. A trust may grant the trustee limited discretion with respect to some actions, provided the actions are in the beneficiaries’ best interest and not for the trustee’s benefit.

These arrangements can also provide tax- and estate-planning advantages. Grandparents often appoint a parent as trustee of a trust for grandchildren. As a trustee, a parent must comply with the trust’s directives. A trust may grant the trustee limited discretion with respect to some actions, provided the actions are in the beneficiaries’ best interest and not for the trustee’s benefit.

Depending on the terms of the arrangement, beneficiaries may receive income and/or assets from the trust fund during the lifetime or after the death of the grantor. For example, the trustee of a college trust fund may be directed to use trust income to pay tuition expenses directly to the school and to pay or reimburse the beneficiary for college living expenses. Distributions also might be scheduled upon attainment of a specified age or a particular event. Beneficiaries’ use of the trust distributions may be limited to specific purposes (such as medical expenses or a down payment for a home) or left to the beneficiaries’ choice.

The biggest drawback to a trust is the cost and time to administer the account. In addition, trusts may have complex structures, intricate processes, trust-centric formation as the trustor's assets may be controlled by trustees.

How Are Trusts Managed?

Trusts are managed by their trustees, who may be individuals or trust departments of banks and other financial institutions. Trustees are obliged to carry out the grantors’ directives set forth in the trust agreement. Typically, their responsibilities include the collection of income, disposition and replacement of assets, and distributions to beneficiaries. Distributions may be required on a prescribed schedule, such as monthly, annually, or for specific purposes such as tuition and educational expenses.

Trustees are compensated for their work unless—as sometimes occurs with family member trustees—the fees are waived. The management of trust assets includes record-keeping and reporting, and legal and tax compliance. Creating and documenting a trust with a limited amount of financial assets and simple, clear directives usually entails legal fees of a few thousand dollars and low annual expenses. Expenses increase and could become very significant, the greater the value and variety of trust fund assets and the complexity of a trust’s terms.

Creating and documenting a trust with a limited amount of financial assets and simple, clear directives usually entails legal fees of a few thousand dollars and low annual expenses. Expenses increase and could become very significant, the greater the value and variety of trust fund assets and the complexity of a trust’s terms.

In addition to trustee fees, trusts may incur expenses for financial and investment advisors, attorneys, accountants, property managers, brokers, and other necessary professionals for the trust. Financial institutions’ trust departments generally charge annual fees of 1% to 2% of the value of trust assets, with the rate declining as values increase. Some large investment firms—especially those that offer mutual funds for retirement and other personal accounts—offer standardized, relatively low-cost trust services.

With some firms, individuals who use online services for banking and investment accounts may establish trust fund accounts directly online. However, a substantial trust, particularly one with varied assets, will likely incur significant costs from its formation through its operation and ultimate termination. Thus, when deciding whether to establish a trust, it’s important to consider its costs in relation to the anticipated benefits and the availability of alternative arrangements that might cost less.

However, a substantial trust, particularly one with varied assets, will likely incur significant costs from its formation through its operation and ultimate termination. Thus, when deciding whether to establish a trust, it’s important to consider its costs in relation to the anticipated benefits and the availability of alternative arrangements that might cost less.

Estate Planning and Trusts for Children

Trusts can help parents and grandparents plan for their offspring’s financial needs and, at the same time, complement their own tax and estate planning. For many families—not just the wealthiest—trusts can be effective tools. However, those considering creating trusts should investigate whether there are simpler and less expensive alternatives for their purposes.

Parents whose total estate values exceed—or seem likely to appreciate to—values that eventually exceed the estate tax threshold, set at $12.06 million in 2022 and $12.92 million in 2023, can remove assets from their estates by transferring ownership to trusts. With the gift tax exemption set at $16,000 for 2022 and $17,000 in 2023, each parent and grandparent can make a gift of up to the exemption limit annually per recipient without incurring gift tax.

With the gift tax exemption set at $16,000 for 2022 and $17,000 in 2023, each parent and grandparent can make a gift of up to the exemption limit annually per recipient without incurring gift tax.

If the value of a gift exceeds that amount, the excess is taxable, but the tax isn’t due until the total of “excess” gifts exceeds the estate tax threshold. Only then are the excess gifts added back to the value of the remaining estate and taxed.

Affluent families with “spare” assets may take advantage of trusts to limit the value of their estates and to reduce a high rate of tax on their annual taxable income to the rate imposed on their children’s income, which is generally lower. Any appreciation in the transferred asset ultimately belongs to the beneficiaries.

For example, assume an investor bought 100 shares of Apple stock in 1980 at its Initial Public Offering (IPO) price of $22 per share for a total price of $2,200 and immediately transferred the shares to a trust for a newborn child. If the trust held onto the shares through five stock splits, as of May 20, 2022, the trust for the now 41-year-old child would own 22,400 shares of Apple at a value of $137.59 per share, for a total value of $3,082,016. The trust would pay capital gains tax on the gains on its disposition of appreciated shares.

However, if the trust distributes the appreciated stock to the beneficiary, there is no tax on the transfer; the beneficiary will be liable for any tax due when the stock is later sold. The original $2,200 gift to the trust would have been below the 1980 gift tax exemption of $3,000 and would not count against the parent’s estate tax exemption.

Also, if assets paying dividends or interest are transferred to an irrevocable trust, the grantor will not owe tax on the income. Instead, the trust must pay tax, at rates from 10% to 37% on annual income for 2021 that is not distributed during the year. Annual income distributed to a grantor’s child can be taxed under the "kiddie tax" at rates lower than the grantor’s presumably higher rates.

Be mindful of state tax legislature for trusts. Though some trusts may be exempt from Federal reporting, the accumulated income of a trust that has a specific beneficiary residing in a certain state may be subject to that state's income tax.

Alternatives to Trusts for Education

Trusts can help parents and grandparents plan for children’s future financial needs. Though some trusts for children might be established principally to deal with tax and estate planning, financing a child’s education, especially college expenses, is probably the most common reason that families consider creating trusts. For many, trusts can be effective tools. However, for families who are not ultra-rich, there are alternative vehicles that can be more efficient than college trust funds.

When planning to sets aside funds for future college costs, it is important to evaluate additional vehicles and strategies that may provide equal or greater tax benefits for parents or grandparents and to consider the potentially adverse impact of trusts and other resources on students’ eligibility for scholarships and loans.

The most common alternatives to college trust funds are direct payments to the college on behalf of a grandchild, contributions to a section 529 plan, or setting up either a Uniform Gifts to Minors Act (UGMA) account or a Uniform Transfer to Minors Act (UTMA) account. Section 529 plans and UGMA and UTMA accounts can be set up through banks and financial institutions and thus can be less costly and involve less personal administrative and management responsibility than independently established trusts.

Research the fees charged by different 529 plan sponsors before choosing one. Some investment firms sponsor plans that have no upfront or management fees; other brokers and advisors charge relatively high fees that lower the plans’ returns.

Another option is a Coverdell Education Savings Account (ESA). These can be established for children under age 18 for qualified elementary, secondary, and postsecondary educational expenses. Unlike the other two options, there are income limitations: A contributor to a Coverdell ESA must have a modified adjusted gross income (MAGI) of less than $220,000 for a joint return and $110,000 for a single return.

Section 529 Plans

Section 529 plans are programs established by states or their agencies that enable a contributor to prepay—or contribute to an account to prepay—a beneficiary’s qualified educational expenses. Contributions are not tax-deductible but earnings and distributions for qualified expenses are tax-free. Funds may be used to pay tuition and necessary expenses for both postsecondary and K-12 schools. Funds can also be used to repay student loans up to a lifetime limit of $10,000. In the case of K-12 education, an annual limit of $10,000 of expenses may be paid with funds from the section 529 plan. The beneficiary can generally exclude the earnings and distributions from taxable income.

Generally, these 529 plans offer investment options that are limited and conservative. Before investing in a 529 plan, fees charged by different plan sponsors should be compared. Some investment firms sponsor plans that have no upfront or management fees; their earnings are based on the charges for the mutual fund investments that they offer and manage for the plans. However, some brokers and advisors charge relatively high fees that lower the plans’ returns.

However, some brokers and advisors charge relatively high fees that lower the plans’ returns.

Parents and grandparents establishing section 529 funds can maintain control over the accounts and distributions, and even change the beneficiary. Contributions to a section 529 plan can be front-loaded. Five years of annual gifts of up to the 2022 gift-tax limit of $16,000 would equal $80,000, while five years of annual figfs up to the 2023 gift-tax limit of $17,000 would equal $85,000.

Because contributions can be substantial, especially if front-loading is chosen, establishing these accounts for young children can result in significant tax-free savings for college. However, in some cases, these plans—or the distributions from them—will negatively affect an otherwise qualifying student’s ability to obtain need-based financial aid.

UGMA and UTMA Custodial Accounts

Custodial accounts can be established for underage beneficiaries under the Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA). Both entail irrevocable transfers of assets to accounts for minors. Transfers are nontaxable to the beneficiary up to the annual gift tax limit. The assets must be transferred from the custodial account to the beneficiary upon an attaining age set by state law, generally 18 or 21 years. Although not limited to educational financing, these vehicles are often used as a simplified form of college trust fund.

Both entail irrevocable transfers of assets to accounts for minors. Transfers are nontaxable to the beneficiary up to the annual gift tax limit. The assets must be transferred from the custodial account to the beneficiary upon an attaining age set by state law, generally 18 or 21 years. Although not limited to educational financing, these vehicles are often used as a simplified form of college trust fund.

Earnings on these accounts up to the child’s annual taxable income ceiling are taxable at the beneficiary’s tax rate, which is generally lower than parents’, grandparents’, or other contributors’ tax rates. Income above the ceiling is taxed at the parents’ rate. UGMA accounts are limited to money and financial securities, while UGTA accounts can hold tangible and even risky assets, such as art and real estate. As savings vehicles, these accounts can provide funds to beneficiaries for any purpose, not just educational expenses.

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs can be established for children under age 18 for qualified elementary, secondary, and postsecondary educational expenses. Contributions must be made in cash and are not tax-deductible. The maximum total of contributions for a beneficiary cannot exceed $2,000 per year. Earnings are not taxed; distributions also are tax-free provided they are used for qualified educational expenses. A contributor to a Coverdell ESA must have a modified adjusted gross income (meaning a generally adjusted gross income plus excludible non-U.S. earnings and housing allowances) of less than $220,000 for a joint return and $110,000 for a single return.

Contributions must be made in cash and are not tax-deductible. The maximum total of contributions for a beneficiary cannot exceed $2,000 per year. Earnings are not taxed; distributions also are tax-free provided they are used for qualified educational expenses. A contributor to a Coverdell ESA must have a modified adjusted gross income (meaning a generally adjusted gross income plus excludible non-U.S. earnings and housing allowances) of less than $220,000 for a joint return and $110,000 for a single return.

Other Trusts

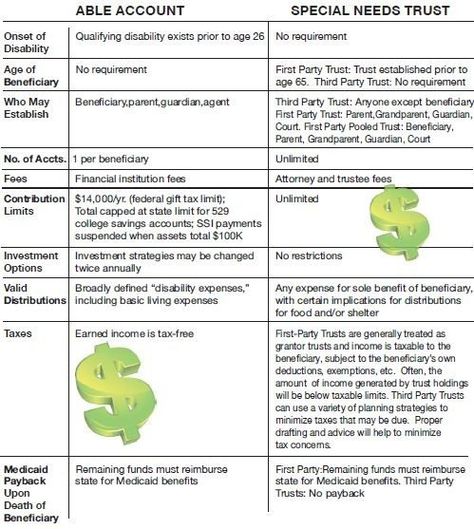

Only imagination and law limit the uses of trusts. Federal and state laws expressly recognize and provide benefits for trusts that help individuals with disabilities. In particular, special needs trusts and ABLE program accounts enjoy legal recognition.

Special Needs Trusts

A special needs trust is a legal arrangement to provide financial assistance for an individual with disabilities while maintaining that person’s eligibility for government benefits that are based on needs, for example Medicaid and Supplemental Security Income. These trusts must be operated for the sole benefit of the beneficiary, who must be under the age of 65 when the trust is created. It pays for costs that are not covered by Medicare or Medicaid.

These trusts must be operated for the sole benefit of the beneficiary, who must be under the age of 65 when the trust is created. It pays for costs that are not covered by Medicare or Medicaid.

If the trust is established with assets owned by the individual with disabilities, it generally must be irrevocable and must provide that Medicaid will be reimbursed upon the beneficiary’s death or the trust’s termination. Specialized professional advice is important in the creation and operation of these arrangements because state laws impose varied, complex requirements.

ABLE Programs

The tax code also provides benefits for persons experiencing disabilities or blindness through tax benefits for state-sponsored savings programs established under the Achieving a Better Life Experience Act of 2014 (ABLE). Contributions to ABLE accounts must be in cash and are not tax-deductible. Earnings and distributions for qualified disability expenses are tax-free and the accounts do not count against eligibility for other federal assistance programs.

Is There a Difference Between a Trust and a Trust Fund?

The term “trust” refers to the legal arrangement evidenced in a written agreement transferring property from a “grantor” to a “trustee” for specified purposes. A term “trust fund” refers to the property transferred by the grantor to the trustee.

Who Owns a Trust?

When the creator of a trust, the grantor, retains the right to terminate a trust and control its assets, the trust is a revocable trust and for tax and other purposes is treated as owned by the grantor. However, a irrevocable trust—which is not terminable or controlled by the grantor—is an independent entity that is managed by a trustee in accordance with the trust, the document directing its management by a fiduciary trustee for the benefit of specified beneficiaries.

Is a College Trust Fund a Good Way to Plan for Educational Expenses?

A college trust fund can help pay beneficiaries’ college expenses and might assist its grantor’s tax and estate planning. However, in some cases, particularly for families who are not ultra-rich, there are alternative options for financing education—for example, 529 plans, UGMA and UTMA accounts, and Coverdell Education Savings Accounts—that may be simpler and more cost-effective.

However, in some cases, particularly for families who are not ultra-rich, there are alternative options for financing education—for example, 529 plans, UGMA and UTMA accounts, and Coverdell Education Savings Accounts—that may be simpler and more cost-effective.

The Bottom Line

Trusts can be extremely useful arrangements for designating assets for specific purposes. Differences in legal structure and terms significantly affect trusts’ tax impact, asset protection, and benefits. In some cases, alternative vehicles that can be more efficient and less costly may be preferable. Careful evaluation is critical, and professional advice may be necessary. Moreover, because of a history of abuse of trust structures for tax evasion, the proper structuring and operation of trusts are essential.

Family trust - how to create a trust fund in Russia

This article will be of interest to wealthy Russians and residents of the CIS who need to create a trust fund. It describes a very simple way to quickly create a reliable family trust abroad.

This can be done in just a few days with the help of a special financial contract, detailed below. This decision will immediately protect the family's financial assets from claims by third parties, increasing the capital created year after year.

It is also important that this contract allows you to effectively pass on the inheritance to the next generations of the family. And at the same time, what is important - without paying inheritance taxes.

Finally, the contract allows you to make partial withdrawals of funds from the created fund at any time. These may be occasional withdrawals, or regular annuities to meet the family's running expenses. And even so, the capital in the trust is able to grow. Detailed calculations can be found in the article below.

Why you need a family trust

How to create a dynastic trust in Russia

Trust fund for children with Manulife Global Generation

Financial parameters of a family trust

How to deposit money into a trust

Sources of capital growth

How you can use the money of a trust

How does a trust fund work when investing an amount of 1. 000.000 USD

000.000 USD

How to start a family trust fund MGG

Wealthy people have long sought a solution to two important problems. And the first task is to secure your assets.

After all, creditors, business partners, former spouses and the state, for various reasons, can claim the assets that a person owns. And if you somehow refuse to own assets, while retaining control over them, then it will be impossible to foreclose on these assets.

The second important task is the transfer of assets to the next generations of the family. Children, and then grandchildren and great-grandchildren.

It is these two tasks that the classical trust fund solves. To do this, the founder transfers assets to the trust, and thereby ceases to own them. This is how the first task of protecting assets is solved. You cannot deprive a person of what does not belong to him.

The trustee will then manage the trust. And he will carry out this management in the interests of the beneficiaries, who were appointed by the founder of the trust.

And when the trust terminates, then all the property constituting it passes into the possession of the beneficiaries. Thus, solving the problem of transferring assets to the next generations of the family.

However, the classical implementation of this approach is not so simple. Because the legislation on trust funds is very complicated.

In addition, the work of family trust must be paid for. This can be quite a decent amount of fixed, annual expenses - which will have to be paid for decades. And in this regard, the question arises - is there an easier way to create your own trust fund in Russia?

Yes, there is a way. And it is suitable for those cases when it is necessary to transfer the capital of the family to the family trust. Let me emphasize that we are talking about financial resources. Different solutions will be needed to protect and transfer physical property to children.

An easy-to-implement trust fund to protect family wealth and pass it on to the next generation - described later in this article.

You can use a special insurance contract to create a family trust. Which was specifically designed to protect and increase the financial assets of the family. And also - to most effectively transfer the accumulated wealth to the next generations of the family.

This contract is offered by the renowned Canadian company Manulife. It is one of the largest financial companies both in Canada and worldwide. Which has high ratings from leading rating agencies. To isolate, protect and increase the family capital, Manulife has developed a special contract, which is called the Manulife Global Generation (MGG).

Play my video about how this contract allows you to create a family trust:

Let's look at the main features of this contract to understand how it allows you to create a family trust fund.

Manulife Global Generation is a life insurance contract. After the opening of the contract, its owner contributes to the plan those funds that he would like to place in the family trust fund.

After the opening of the contract, its owner contributes to the plan those funds that he would like to place in the family trust fund.

Manulife pays annual dividends on the funds contributed to the contract. Since quite significant amounts usually come into the family trust, over time, the capital in the contract begins to grow noticeably.

This is due to the constant accrual of dividends on invested funds. Which over time begin to increase capital exponentially. This is how the problem of increasing the funds that make up the family fund is solved.

How is family wealth protected in a trust fund for children? Legally, the Manulife Global Generation contract is a life insurance policy. Therefore, funds in this policy cannot be foreclosed due to third party claims. This ensures the protection of financial assets belonging to the family.

And most importantly, if we are talking about generational planning. How can this tool be used to transfer assets to future generations of the family?

The Manulife Global Generation contract has a unique option for this. It allows you to change the insured person. And the number of such replacements is not limited. What does this mean for long-term financial planning purposes?

It allows you to change the insured person. And the number of such replacements is not limited. What does this mean for long-term financial planning purposes?

Let's say at 45 the head of the family opened the MGG plan. And he contributed a large amount there to create a trust fund for children and grandchildren. 30 years have passed - and during this time the invested capital has grown many times (below, the draft contract with real numbers is discussed in detail).

And then, at the age of 75, the father decided to give his son the funds accumulated in the family trust. As well as the management of this capital.

To do this, the father only needs to give an order to change the insured person. And when the son becomes insured instead of the father, he will already become the full owner of all the funds accumulated in the contract. And he will appoint his son as the beneficiary of the family trust - who is the grandson of the original owner of the contract.

Having become the owner of the contract, the son will be able to manage the created capital and spend it if necessary. And when the son becomes mature, he will be able to transfer ownership of the policy and the accumulated capital to the grandson of the original owner of the contract. To do this, the son will replace the insured person in the contract with the grandson. Which in turn will change the beneficiary to a great-grandson.

And when the son becomes mature, he will be able to transfer ownership of the policy and the accumulated capital to the grandson of the original owner of the contract. To do this, the son will replace the insured person in the contract with the grandson. Which in turn will change the beneficiary to a great-grandson.

So, placing family capital in a special Manulife Global Generation policy allows you to protect capital from third-party claims, increase capital through accrued dividends and interest on them - as well as effectively transfer the inheritance to the next generations of the family.

Such a contract can last 121 years. Please note that 121 is NOT the maximum age for the person who originally opened the contract. This is the maximum duration of the contract from the date of its opening.

Thus, the capital of the family can be reliably protected by this contract for more than a century, passing by inheritance from father to son. And increasing due to accrued dividends and interest on invested funds.

A policy can be passed down many times from generation to generation. And for the 121-year period of its existence, to meet the needs of three, four - and maybe five generations of the family.

Let's take a closer look at how this happens.

You can see the most important financial parameters of this contract on the slide below - and then I will comment on them:

basic parameters of the MGG family trust plan

The contract has a minimum contribution amount, as well as a maximum investment in the contract. The minimum contribution to this plan is 500,000 USD. This amount can be paid in a lump sum. Or - at the request of a person, it is divided into 5 or 10 annual payments into a contract.

The maximum plan contribution for a one-time payment is $7,500,000. If a person plans to make annual contributions to the contract, then the total contribution should not exceed 20,000,000 USD.

The policy can only be opened in US dollars. The age of a person at the time of issuing the policy with a lump-sum payment should be from six months to 75 years. For 5-year installments, the age of the applicant must be from 6 months to 70 years, and for 10-year installments, the age of the contract holder must be from six months to 65 years.

The age of a person at the time of issuing the policy with a lump-sum payment should be from six months to 75 years. For 5-year installments, the age of the applicant must be from 6 months to 70 years, and for 10-year installments, the age of the contract holder must be from six months to 65 years.

There are three ways to contribute to your Manulife Global Generation Family Trust. The first option is a one-time contribution of the entire amount of capital to the contract. Along with this, installment payments for 5 years, or for 10 years are possible.

For example, the contract owner would like to set up a trust fund for children and contribute $1,000,000 to it. If this amount is already available, then it can be contributed to the plan by a single transfer of a million dollars to your insurance contract.

If the entire amount is not available at the moment, then a person can open a contract with contributions in installments for 5 years. And each year contribute 200,000 USD to your contract.

Finally, you can choose a 10-year installment plan. And then in the next 10 years it will be necessary to contribute 100,000 USD annually to the plan.

Fee payment scheme must be selected before contract issuance. Once the policy is issued, it will no longer be possible to change the funding option of the policy.

Manulife Global Generation is a participating life insurance policy. The term "participating" means that Manulife distributes the profit received from the investment of contributions among clients in the form of insurance dividends.

Dividends are accrued in accordance with Canadian law on profit-sharing accounts under life insurance. According to the law, in the form of insurance dividends, the insurer is obliged to distribute among customers 97.5% return on investment. And only 2.5% of declared dividends can be used for administrative expenses of the insurer.

It should be noted that the contract does not guarantee the amount of insurance dividends. Therefore, the amount of dividends may vary from year to year due to the current level of interest rates, the situation in the financial markets and the results of Manulife's investments.

Therefore, the amount of dividends may vary from year to year due to the current level of interest rates, the situation in the financial markets and the results of Manulife's investments.

The current insurance dividend is around 4% in US dollars. Which is quite a lot compared to interest rates on deposit accounts, which actually tend to zero.

Dividends are declared annually. And after the accrual of dividends, the profit received becomes part of the savings of the insurance contract.

In addition to dividends, the owner of the contract also receives interest on the paid dividends, which also increases the amount of savings in the family trust fund. Interest is accrued on all dividends that are accumulated in the policy.

Finally, the policy provides for a terminal bonus. The amount of this payment is not guaranteed, and it is made at:

- expiration of the policy (121 years have passed since the issuance of the contract), or

- cancellation of the policy - the person decided to terminate his policy and take all the savings in the contract, or

- the death of the insured.

The terminal bonus also increases the final savings in the contract. And as an indicative value, because this parameter is not guaranteed, the terminal bonus is indicated in the draft contract. Which we will discuss below.

Easily implemented through a Manulife Global Generation contract, the Family Trust Fund provides several options for accessing the funds placed in it.

Over time, the MGG policy has the potential for very significant savings. And you can use these tools in the following ways.

- Withdrawals from accumulated dividends

Dividends accrued annually are the most important source of growth in the cash value of the policy. If desired, the owner of the contract can withdraw all or part of the accrued dividends. And use these tools to solve current problems.

- Loans against the cash value of the policy

The policyholder may at any time request a loan from the company against the cash value of the policy. And then a certain percentage will be charged on the loan taken.

And then a certain percentage will be charged on the loan taken.

The difference from the previous method is that when taking a loan, a person does not reduce the amount of accrued dividends in his policy. And therefore, interest will be charged by the insurer on all dividends accumulated in the policy. But at the same time, the owner of the contract will need to pay interest on the use of the loan taken from the insurance company.

The interest rate on a loan varies over time and may change at any time. Loans and their interest rates are reflected in the cash value of the policy. However, this will in no way affect the payment of dividends and their accumulation.

- Partial Withdrawals

The policyholder may also make partial withdrawals from his contract. In this sense, a policy is a lot like a bank account. Part of the funds contributed to the insurance policy can be withdrawn without terminating the contract.

The minimum amount of a loan or partial withdrawal from the policy is 10,000 USD.

- Cancellation of the policy

Finally, the contract holder can cancel the policy at any time and receive all the money accumulated in the policy. However, it is worth remembering here that in the first few years after the policy is issued, its redemption amount may be less than the contributions made to the contract.

Let's look at an example of how a family trust fund created with the help of Manulife Global Generation can work with a one-time investment of $1,000,000. I explain the numbers below in detail in my video - include my story:

Prior to the issuance of the contract, each client receives a draft policy, which reflects the guaranteed values and expected parameters of the policy.

The project below is for a 45 year old:

Let's briefly review the tenth year of the plan. This line is underlined in red.

The first two columns are guaranteed plan parameters. The company is required by law to provide them to the customer. The company guarantees that the contract will work no worse than these values. Which are calculated in the most negative scenario - financial markets are falling, interest rates are extremely low, investments bring minimal income.

In this scenario, the guaranteed amount of savings in the tenth year of the policy is 1.046.805 USD. And the payment on the death of the owner of the contract this year will be exactly the same. Above, these numbers are highlighted in blue.

In fact, the probability of such a scenario is extremely small. It is most likely that the contract will work as described on the right side of the table. Manulife calculates the expected savings in the contract based on the results of previous years. Assuming that similar results will be obtained in the future. However, it must be remembered here that the results of the right-hand side of the calculation are only assumed. And they are not guaranteed by contract.

And they are not guaranteed by contract.

So, assuming that after 10 years of the contract, the amount accumulated in the contract will already be 1.344.302 USD. And the payment at the death of the owner of the contract this year will be exactly the same amount. In the calculations above, these numbers are marked with a green rectangle.

However, 10 years for such contracts is a very short time. After all, it is intended for several generations of the family. And so we would be interested to see how the plan works for longer periods:

We see that after 20 years the money put into the contract more than doubles. And now let's see what capital will be created in the policy by the 75th anniversary of the person who opened the contract:

We see that this capital will presumably amount to 3.772.868 dollars. Which, without paying inheritance taxes, a person can easily and quickly transfer to his child. Simply by changing the insured in your Manulife Global Generation contract.

This money will never leave the family. They are in a family trust fund. Which is managed by the person who is currently the insured person.

Let's not forget that the money accumulated in the policy can be used. For example, the contract owner can withdraw the necessary amount from the plan at a time. Or create an annuity to secure a retirement income. Which, if we wish, will not end with the death of the original owner of the contract. This will happen if he passes the policy to the next generation in advance.

A similar scenario is shown on the slide below:

A person opened a trust fund with Manulife Global Generation and invested a one million dollar lump sum into the plan at one time. After that, 21 years passed, and the owner of the contract ended his career.

And starting from the 22nd year of the contract, the person began to withdraw from the plan an amount of 118,048 dollars annually. To secure your retirement annuity. Later, at some point, the person passed this contract to his child. And from that moment on, the child is already the beneficiary of the family trust.

And from that moment on, the child is already the beneficiary of the family trust.

When the father passed away, the child continued to withdraw funds from the contract in the amount of $118,048 annually to pay for current needs. And so it went on for 70 years (!) in a row - from the 22nd to the 92nd year of the existence of the policy. Then the withdrawals from the contract ceased.

Thus, during these 70 years, 8,263,360 dollars were withdrawn from the policy by the family. As a result, by the end of the 92nd year of the policy in the contract, even with such significant withdrawals, it is expected that 10,824,073 dollars will be accumulated. Which in 20 years, by the end of the policy, will turn into 28.121.664 dollars of savings belonging to the family.

That's what an invincible cash flow can create for your family with proper financial planning, and the use of modern financial tools.

As already mentioned, Manulife Global Generation is legally a life insurance policy. This contract is opened in a standard way by submitting an insurance application to Manulife.

This contract is opened in a standard way by submitting an insurance application to Manulife.

There is a very important and positive moment here. The Manulife Global Generation application does not include any questions about the health status of the prospective client. How is it that life insurance companies always ask their future clients about their health status?

The fact is that life insurance in our usual sense is not actually in the contracts of Manulife Global Generation. This contract is designed to manage the wealth of the family for many generations. And it is clothed in the legal form of life insurance because this form of contract is most convenient for solving the tasks facing it.

After all, the payment on the death of the insured is actually equal to the capital that has already been created in the contract. Therefore, Manulife Insurance does not bear any financial risk in connection with the death of the owner of the contract. And in this regard, the future client does not need to answer questions of a medical nature, as well as undergo a medical examination before issuing a Manulife Global Generation contract.

In fact, when opening a contract, its owner opens a special account in an insurance shell for a period of 121 years. And puts on it funds that will pass from generation to generation of the family. Therefore, the age and health of the account holder does not play any role here.

In this regard, the parameters of the contract will not depend on the age of the insured. The figures in the draft policy for both the baby and the mature person will be the same.

And since no medical examination is required before the policy is issued, the contract is issued very quickly. The processing of the submitted application takes 2-3 days, and then within a maximum of 5 working days the company will decide on the issuance of the policy. Thus, the creation of a family trust will take approximately 7 working days.

And a few words about the cost of setting up a family trust fund with Manulife Global Generation. To create a family trust, you only need to apply to Manulife. And then deposit the desired amount into the contract at a time or in installments.

And then deposit the desired amount into the contract at a time or in installments.

Let me remind you that the contribution to the contract can range from 500.000 USD to 20 million USD. At the same time, all the funds contributed to the plan constitute the savings of the family, on which dividends and interest are accrued year after year.

There are no additional costs associated with this approach to establishing a family trust.

To sum it up

Manulife Global Generation is a handy tool for quickly and at virtually zero cost to create a family trust fund to protect and grow wealth - and to pass it on to the next generations of the family. I hope that by the end of the article you already understand how to create a trust fund in Russia for a child.

Manulife Global Generation gives you the opportunity to plan for the future of the family for several generations to come. And allows wealth to accumulate under the protection of the policy. The transfer of assets to the next generation is accomplished by simply replacing the insured. There are no inheritance taxes involved. There is no limit to the number of such replacements, so family wealth can be passed on to many subsequent generations.

There are no inheritance taxes involved. There is no limit to the number of such replacements, so family wealth can be passed on to many subsequent generations.

The cash value of the policy increases significantly over the years. And the family has several ways to use these funds. This may be the withdrawal of accrued dividends, a loan secured by the cash value of the policy, partial withdrawals from the contract, or cancellation of the policy with the receipt of all funds accumulated in the contract.

This is a very convenient solution for wealthy people who are interested in generational planning and the transfer of created assets to children and grandchildren. With the help of the Manulife Global Generation contract, you can instantly create a family trust with a significant cash fund. And to ensure its protection, as well as reliable investment of funds - so that capital grows in the interests of future generations.

And if you need advice on the topic and a draft contract, just write to me in a convenient messenger to arrange our online meeting:

Vladimir Avdenin,

financial consultant

The article uses materials from Joseph Lazerson ( Joseph Lazerson)

Read more:

How to create a trust?

In recent years, the creation of a trust has become an increasingly popular way to protect cash and other financial assets. In the realm of financial planning, registering a trust can be one of the most important steps in terms of securing and distributing assets. In today's material, we will consider the main aspects of creating a trust fund and the features of its functioning.

In the realm of financial planning, registering a trust can be one of the most important steps in terms of securing and distributing assets. In today's material, we will consider the main aspects of creating a trust fund and the features of its functioning.

What is a trust?

You can register a legal entity as a trust company, but it is important to enlist the support of lawyers in this process. To do this, it is necessary to establish an LTD, the purpose of which will be the storage of funds and asset management.

Registration of a company under a trust requires taking into account a number of legal aspects, the legislation of the chosen country, as well as competent planning of the trust's activities.

This form allows you to transfer the property of one person to the trust management of another (trustee), while imposing certain restrictions and conditions on the property. The property is owned and managed by the trustee, while remaining in the ownership of the person who transferred the property.

A trust may be used to settle property relationships and includes the relationship between the trustee and the beneficiary. For a trust to be valid, it must have three characteristics (or certainty):

- certainty of intent - the settlor must disclose the intent to create a trust;

- certainty of the subject - the trustee must own the property;

- credibility of objects – it should be possible to identify the beneficial owners of the trust.

Therefore, in any document (whether it be an official trust document or a declaration of trust) the main parts must be indicated: the settlor, the property, the trustee and the beneficiary.

In some countries, a trust also refers to a legal contract between at least two parties: the settlor and one or more trustees. It can also be argued that a trust is a fiduciary arrangement that allows a third party or trustee to hold assets on behalf of the beneficiary or beneficiaries. Trusts can be organized in a variety of ways and can specify exactly how and when assets pass to beneficiaries. A trust may refer to the amount of money, investments and other financial assets set aside to form a legal entity separate from the rest of the estate from which those assets have been removed.

A trust may refer to the amount of money, investments and other financial assets set aside to form a legal entity separate from the rest of the estate from which those assets have been removed.

If you need to draw up a trust deed, you can contact our subject matter experts for the necessary consulting and support services.

Read also: Setting up a trust in Bermuda

Registration of a trust: Types of trusts

There are many different types of trusts, each with different rules and different benefits. The following types are usually distinguished:

1. "Living" trusts

Living trusts are also known as revocable trusts. In these trusts, the settlor can change beneficiaries and assets during his lifetime. The overall purpose of a living trust is the efficient transfer of assets to the beneficiaries. A living trust contributes to this goal because it does not include the operation of a will, which may give rise to litigation to distribute assets after the settlor's death.

Renunciation of a will can save time and legal costs and potentially reduce inheritance taxes for beneficiaries. Revocable trusts are not subject to inheritance. This means that the assets in the trust pass to the beneficiaries without having to go through probate. This trust provides more privacy than a will. Living trusts are "revocable" and "irrevocable".

Revocable trusts allow you to retain control of all of the assets in the trust, and you can revoke or change the terms of the trust at any time. In the case of an irrevocable trust, you cannot make changes without the consent of the beneficiary. Once you place the assets in a trust and name the beneficiary, it becomes permanent. The advantage of irrevocable trusts is that you can reduce inheritance taxes because the assets in an irrevocable trust are not technically owned by the settlor and the trust owns it.

2. Testamentary trusts

This type of trust comes into effect only after the death of the settlor. The trust acts in accordance with the instructions of the settlor in his will. Testamentary trusts are created by the desire to provide a greater level of control over the distribution of assets to the beneficiaries. There are also tax benefits available through testamentary trusts, making them an effective estate planning tool.

The trust acts in accordance with the instructions of the settlor in his will. Testamentary trusts are created by the desire to provide a greater level of control over the distribution of assets to the beneficiaries. There are also tax benefits available through testamentary trusts, making them an effective estate planning tool.

Two types of testamentary trusts are commonly used: discretionary and protective testamentary trusts. In the case of a discretionary trust, the executor gives the beneficiary the opportunity to accept part or all of his or her inheritance through a testamentary trust. The primary beneficiary has the power to remove and appoint the trustee, and they can appoint themselves to administer their estate within the trust. In the case of a protective testamentary trust, the beneficiary must receive his or her inheritance through the trust and does not have the ability to appoint or remove trustees. This option can be useful when the beneficiary is not able to responsibly manage their inheritance due to age, disability, etc.

3. Pure trusts

This is the simplest type of trust and is sometimes referred to as a simple trust. This type of trust gives the named beneficiary an immediate and absolute right to the capital of the trust and the income derived from the trust. Pure trusts are a useful legal tool for transferring assets to minors, such as where trustees manage a trust until the beneficiaries are 18 years of age.

4. Interest in holding trusts (Share in ownership)

This type of trust entitles the beneficiary to the income from the trust and, in some cases, the right to occupy property. Often this is done on a fixed time frame. However, the trust is usually created for the benefit of the beneficiary throughout their lifetime, in which case they are known as life tenants. In the event of the death of a life tenant, the capital of the trust passes to the other named beneficiaries. This type of trust is suitable for people who have remarried but have children from a previous marriage.

5. Cumulative trusts

This type of trust allows trustees to determine how the trust's income, its capital, and how each named beneficiary should benefit from the trust are free to determine. The legal basis of this trust allows the trustees to assist each beneficiary when needed, instead of giving each beneficiary a fixed income on a regular basis.

6. Mixed trusts

As the name implies, a mixed trust will include several elements of different types of trusts.

7. Charitable foundations

The establishment of a charitable foundation provides a tax-efficient basis for targeted and effective charitable activities. In fact, a charitable foundation is itself a charitable organization.

This is a standard trust, but the beneficiaries must be charities.

A charitable foundation may be suitable if you want to make regular donations to charitable causes or want to ask others to contribute to the foundation.

In addition to these broad categories, there are a number of different specialized trusts, such as "A" trusts, Credit Shelter trusts, and so on. You can find out more detailed information on the type of trust fund you are interested in at a personal consultation with our experts.

Read also: How to register a trust in the Seychelles?

Setting up a trust : What is a trust agreement?

When a trust is created, the person who invests the assets in it, known as the settlor, sets out the basic rules of operation in a document called a deed of trust (deed of trust), which describes how the assets are to be used. When establishing a trust, the settlor also specifies the other main parties involved: trustees and beneficiaries. Once the settlor has placed his assets in a trust, the trustees become the legal owners of those assets and must hold them on behalf of the beneficiaries and according to the rules set out in the trust deed.

Beneficiaries are individuals who the settlor intends to ultimately benefit from the assets of the trust. It can be an individual, a family, or another group of people. The beneficiaries receive either income or capital (or both) in accordance with the rules set by the settlor in the trust deed.

Trusts are irrevocable, which means that property cannot be returned to the settlor unless the trust document specifically states that it is revocable.

Thus, a trust agreement is a document that allows the settlors to legally transfer ownership of assets to another person (the trustee), which will be held for the beneficiaries. This can be done for a number of reasons: to promote wealth management, to obtain tax advantages (some trusts are not subject to inheritance tax), to protect property, and to transfer inheritances. The trust deed specifies the beneficiary and the trustee, and contains instructions on what benefits the beneficiary will receive.

A Trust Deed is usually a lengthy document that sets out all the terms of the agreement, such as:

- The assets controlled in the trust.

- Powers and restrictions of the trustee.

- Compensation to the trustee.

- How the beneficiaries' shares will be distributed to them.

- Duration of the trust.

The trustee has a fiduciary duty to administer the assets for the benefit of the beneficiaries. Their specific roles will be specified in the trust and may include managing assets, selling and buying property, investing, paying bills, filing taxes, keeping records, distributing assets, and more.

How to create a trust?

Setting up a trust in the EU, US or Asia usually requires the assistance of a lawyer who will advise you on legal, financial and tax matters, as well as provide information on important aspects of the trust and prepare the documents required in order to make a trust agreement legally binding.

However, there are many steps to take before contacting a specialist. The first steps to create a trust should be:

- Identification of the assets to be transferred to the trust. A detailed listing of all assets and their prices will save time when it comes to determining trust ownership.

- You must also select the people you want to appoint as managers. Ideally, 2-4 managers should be selected. If the trust is created under your will, you may also include standby trustees.

- The next step will be the selection and appointment of beneficiaries. You should consider how much of the assets or income will go to each beneficiary.

- Consider the terms of the trust.

You can put almost any asset into a trust, including cash, stocks, bonds, insurance policies, real estate, art and more. The assets you choose to put into a trust will largely depend on your goals. For example, if you want a trust to generate income, you should transfer income-producing assets, such as bonds, to your trust.