How to compute child tax credit

2022 Child Tax Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

For the 2022 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

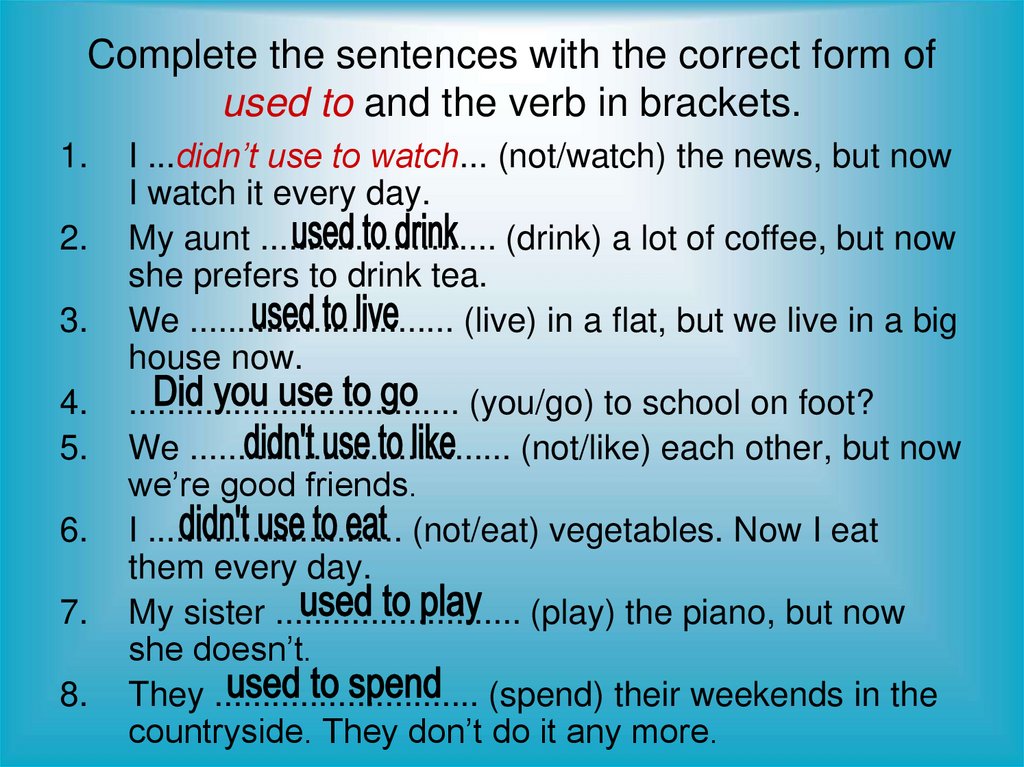

How to calculate the child tax credit

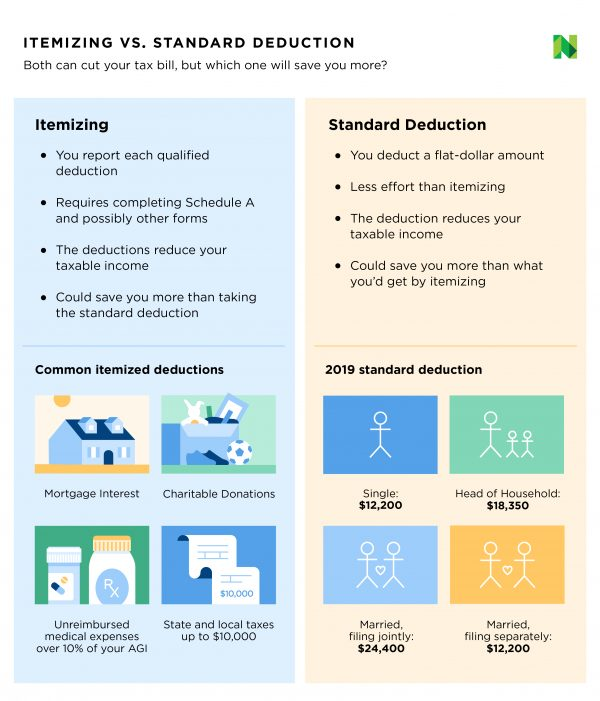

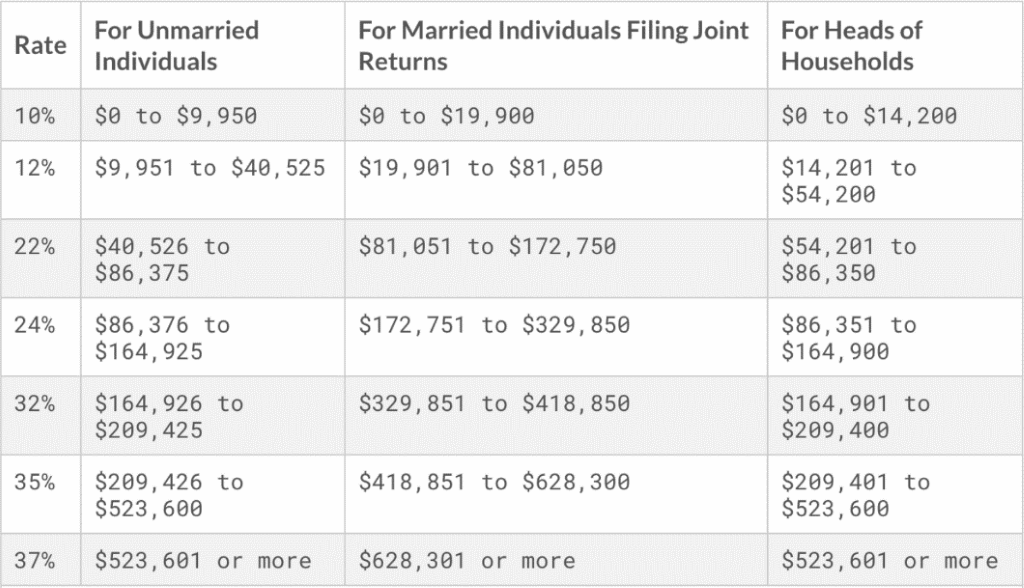

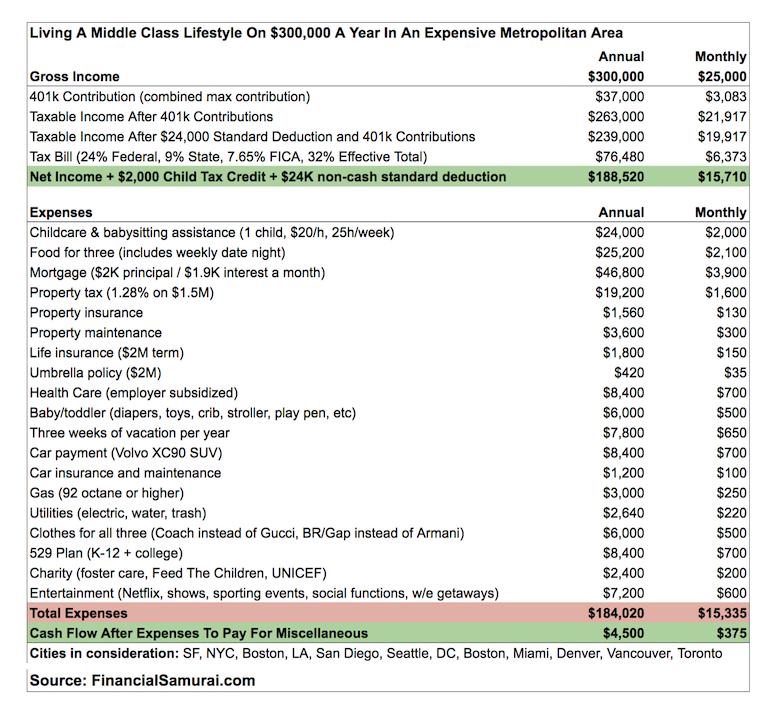

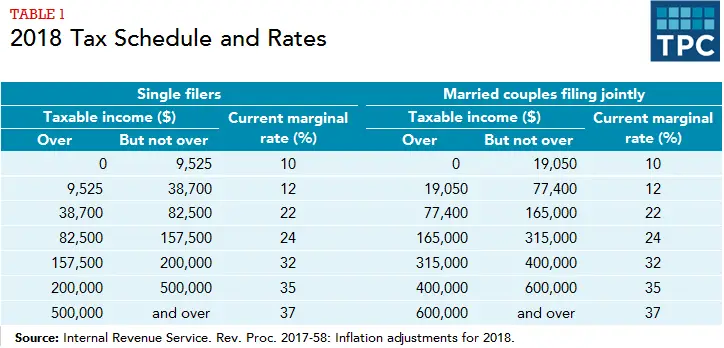

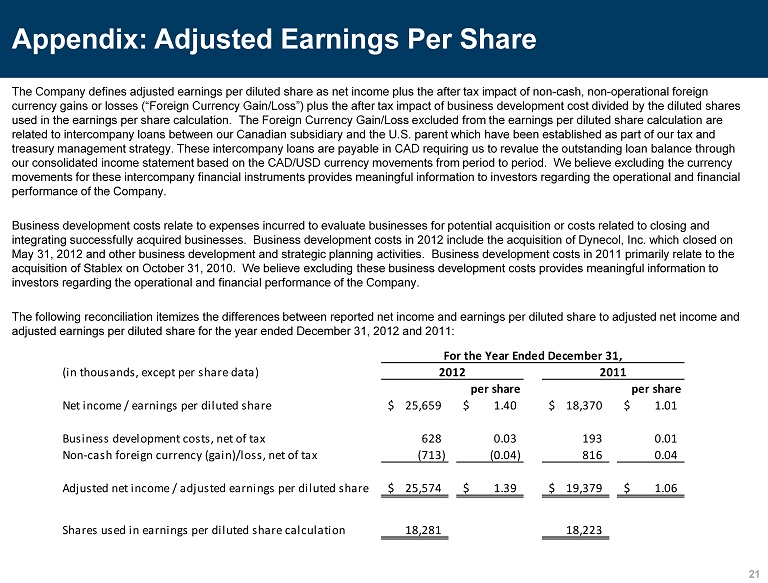

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

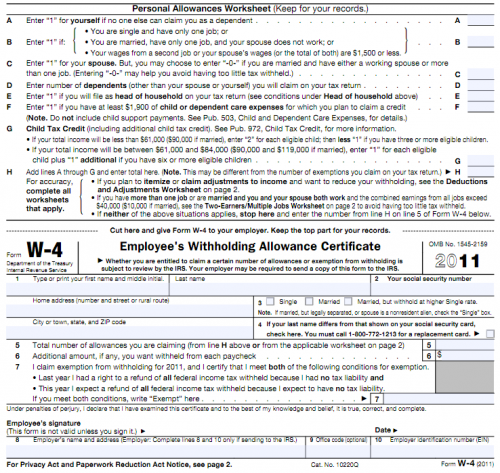

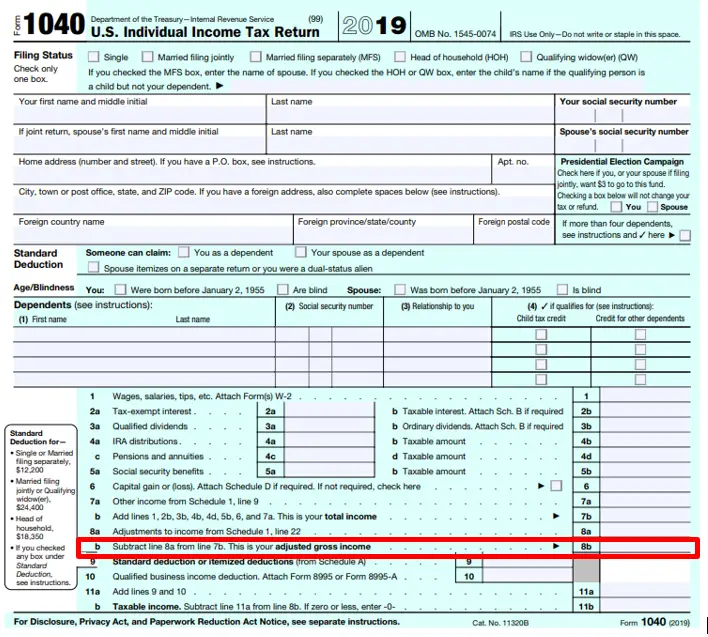

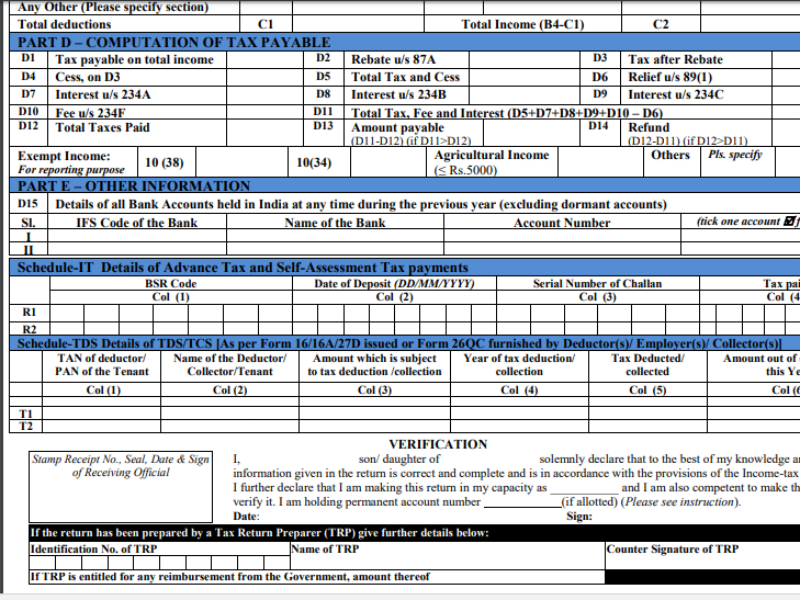

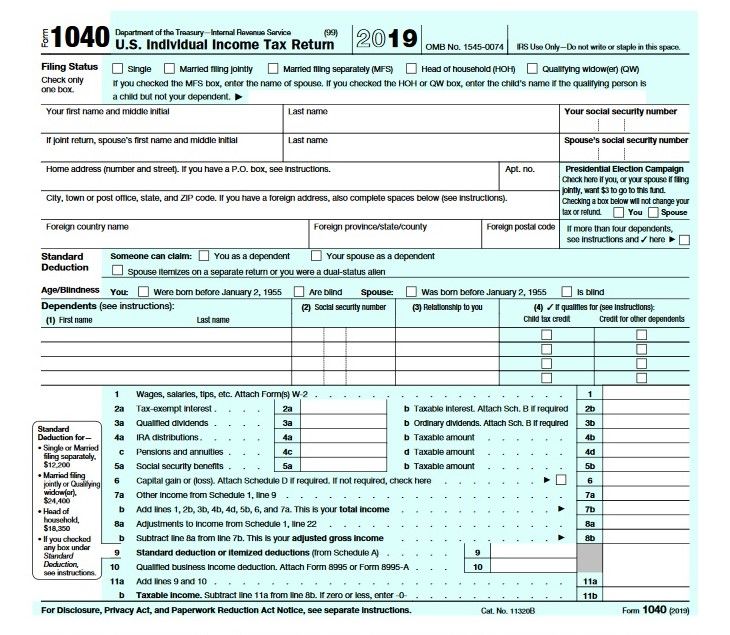

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

A word of warning: In the eyes of the IRS, you’re ultimately responsible for all information you submit, even if someone else prepares your return.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

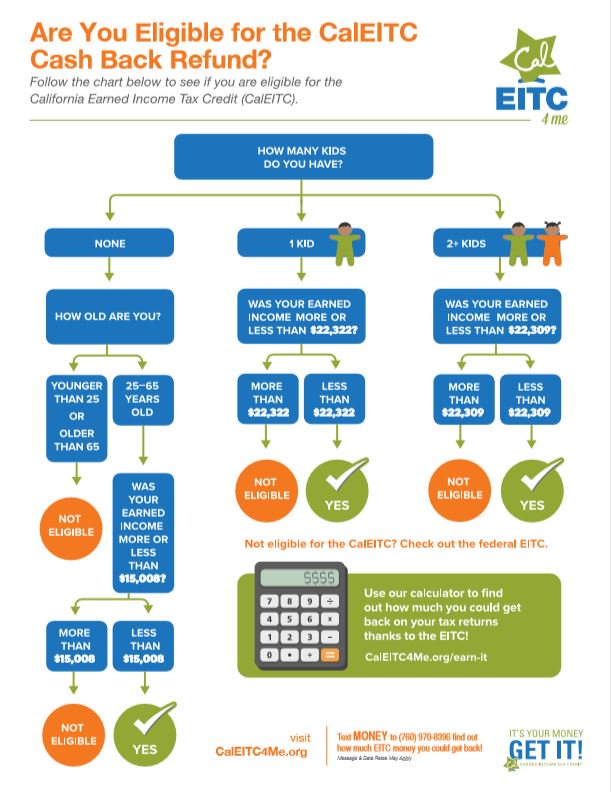

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

1. Does the CTC include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

2. I had a baby in 2022. Am I eligible for the CTC?

Yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

3. Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

4. Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

2021 Child Tax Credit Calculator

Big changes were made to the child tax credit for the 2021 tax year. The two most significant changes impact the credit amount and how parents receive the credit. First, the credit amount was temporarily increased from $2,000 per child to $3,000 per child ($3,600 for children 5 years old and younger). Second, it authorized advance payments to eligible families from July to December 2021. Half the total credit amount was paid in advance with the monthly payments last year, while the other half is claimed on the 2021 tax return that you file this year. (These changes only apply for the 2021 tax year.)

However, not everyone will get the additional credit amount. And some families won't get any child tax credit at all. That's because the credit is reduced – and possibly eliminated – for people with an income above a certain amount. In fact, there are two "phase-out" rules in play – one just for the extra $1,000 (or $1,600) amount and one for the remaining credit. That makes calculating the total child tax credit (and the monthly payments you should have gotten last year) very tricky.

And some families won't get any child tax credit at all. That's because the credit is reduced – and possibly eliminated – for people with an income above a certain amount. In fact, there are two "phase-out" rules in play – one just for the extra $1,000 (or $1,600) amount and one for the remaining credit. That makes calculating the total child tax credit (and the monthly payments you should have gotten last year) very tricky.

But don't worry – we've got you covered. If you want to see how large your credit will be, simply answer the four questions in the calculator below and we'll give you a customized estimate of (1) the amount you should have received each month last year from July to December, and (2) how much you can claim as a child tax credit on your 2021 tax return, which is due April 18, 2022, for most people. It's that easy!

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of Kiplinger’s expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of Kiplinger’s expert advice - straight to your e-mail.

(Note: Results assume you received six monthly child tax credit payments last year.)

Pre-2021 Child Tax Credit Amount

For the 2020 tax year, the child tax credit was $2,000 per qualifying child. It was gradually phased-out (but not below zero) for joint filers with a modified adjusted gross income (AGI) of $400,000 or more and for other taxpayers with a modified AGI of $200,000 or more.

(For purposes of the child tax credit, modified AGI is the amount of adjusted gross income shown on Line 11 of your 2020 Form 1040 or Line 8b of your 2019 Form 1040, plus any amount excluded from gross income on your tax return as foreign earned income; foreign housing expenses; or as income from sources within Puerto Rico, Guam, American Samoa or the Northern Mariana Islands.)

New Phase-Out Scheme for 2021

For 2021, the increase (i.e., the extra $1,000 or $1,600) is gradually phased-out for joint filers with a modified AGI of $150,000 or more, head-of-household filers with a modified AGI of $112,500 or more, and all other taxpayers with a modified AGI of $75,000 or more. However, the increase can't be reduced below zero (other limitations to this reduction will apply as well).

However, the increase can't be reduced below zero (other limitations to this reduction will apply as well).

After any reduction of the increased credit amount is calculated, the pre-existing phase-out is then applied to the remaining credit amount. So, for joint filers with a modified AGI of $400,000 or more and other taxpayers with a modified AGI of $200,000 or more, the credit is subject to an additional reduction – possibly to $0.

Reconciliation of Advance Payments

When you fill out your Form 1040 this year, you'll have to compare the total amount of advance child tax credit payments that you received in 2021 with the amount of the actual child tax credit that you can claim on your 2021 return.

For most people, the amount of the credit will exceed the advance payments you received. If this is the case, you can claim the excess credit on your 2021 return. However, if the IRS paid you too much in monthly payments last year (i.e., more than the child tax credit you're entitled to claim for 2021), you might have to pay back some of the money. Parents with 2021 modified AGI no greater than $40,000 (single filers), $50,000 (head-of-household filers), or$60,000 (joint filers) won't have to repay any child tax credit overpayments. However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

Parents with 2021 modified AGI no greater than $40,000 (single filers), $50,000 (head-of-household filers), or$60,000 (joint filers) won't have to repay any child tax credit overpayments. However, families with a modified AGI from $40,000 to $80,000 (single filers), $50,000 to $100,000 (head-of-household filers), or $60,000 to $120,000 (joint filers) will need to repay a portion of any overpayment. Parents with modified AGIs above those amounts will have to pay back the entire overpayment.

For more information on the 2021 child tax credit, see Child Tax Credit FAQs for Your 2021 Tax Return.

Stay on Top of Personal Finance Developments

Follow Kiplinger for the latest news and insights on important personal finance matters. Stay with us on:

email. Sign up free for our daily Kiplinger Today e-newsletter .

social media. Follow us on Instagram , Twitter and Facebook .

podcasts. Subscribe free to our weekly Your Money's Worth podcast on Apple Podcasts , Google , Spotify .

Baby gender calculator

On this page we present the most popular methods among the people. Of course, these methods are not based on serious scientific developments and do not give a 100% guarantee, so it makes sense to perceive such calculations more as entertainment.

The birth of a child is always a miracle. Whoever is born: a boy or a girl, for the parents it will be the most beloved person in the world. And yet, most potential mothers and fathers, planning the birth of a baby, would not refuse the opportunity to "program" the sex of the unborn child. nine0013

Calculation of the sex of the unborn child

Husband's Age

Age of the wife

Month of ConceptionJanuaryFebruaryMarchAprilMayJuneJulyAugustSeptemberOctoberNovemberDecember

Do you have children together? No Boy Girl Boy and girl Two boys Two girls

Does the spouse have siblings? NoBrotherSisterBrother and sisterTwo brothersTwo sisters

Intensity of sexual activity 1-2 times a week More often than 2 times a week Less than once a week

Your diet is dominated by Dairy products, vegetables and nuts Meat, mushrooms, potatoes, pickles Mixed diet

You are likely to have:

-

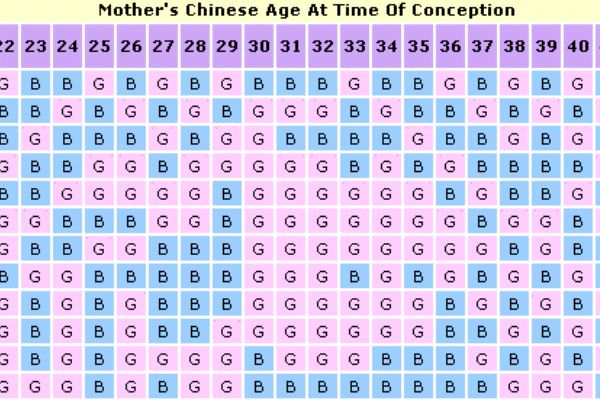

Chinese calendar

This calculator is based on the famous Chinese table and allows you to calculate the sex of the child by the date of conception and the woman's age. On our own behalf, we can add that the administration of the Nova Clinic website tested the effectiveness of the method by calculating the sex of children born in our center, and in most cases, oddly enough, received the correct answer from the calculator. nine0013

On our own behalf, we can add that the administration of the Nova Clinic website tested the effectiveness of the method by calculating the sex of children born in our center, and in most cases, oddly enough, received the correct answer from the calculator. nine0013

Enter the number of completed years between 18 and 55

Calculation of the sex of the unborn child

Mother's age18192021222324252627282930313233343536373839404142434445

Month of ConceptionJanuaryFebruaryMarchAprilMayJuneJulyAugustSeptemberOctoberNovemberDecember

Most likely you will have:

nine0014 This technique, which appeared in the second half of the 20th century, is based on the assertion that spermatozoa carrying the male Y chromosome are more mobile, but less viable. At the same time, germ cells that carry the X chromosome move more slowly, but at the same time they can survive in the female body for a longer time. Thus, if sexual intercourse occurs at the time of ovulation, the probability of having a boy increases, if a girl is born a long time before it. In addition, the change in the vaginal environment plays a role, which gradually changes from alkaline to acidic (that is, more aggressive and harmful to spermatozoa with the Y chromosome). nine0013

Thus, if sexual intercourse occurs at the time of ovulation, the probability of having a boy increases, if a girl is born a long time before it. In addition, the change in the vaginal environment plays a role, which gradually changes from alkaline to acidic (that is, more aggressive and harmful to spermatozoa with the Y chromosome). nine0013 It is believed that an active sexual life of spouses contributes to the conception of a son, and a more moderate one - to a daughter. We proceed from the fact that spermatozoa with a Y-chromosome are less tenacious. Thus, in the ejaculate of a man after prolonged abstinence, there is a greater number of spermatozoa with the X chromosome. In addition, rare sexual intercourse contributes to a decrease in sperm motility (which is why spermogram delivery requires some preparation, in particular, abstinence for no more than a week), which means that the chances that sperm carrying the X chromosome will be the first to reach the eggs increase even more. nine0013

-

French Diet

It was the experts from France, Jacques Laurent and Joseph Stolkowski, who came to the conclusion that the diet can have a direct impact on the likelihood of conceiving a female or male child. As a result of the research they have developed a special diet. According to this method, in order to conceive a girl, it is required to eat onions, eggplants, cucumbers, beets, carrots, green peas, capsicum, nuts and dairy products for at least 2 months before the alleged conception. Accordingly, those couples who dream of an heir should focus on meat dishes, mushrooms, potatoes and tropical fruits. In other words, in the first case, the body should receive a maximum of calcium and magnesium, in the second - sodium and potassium. According to unverified data, the effectiveness of this method is about eighty percent. nine0013

How to calculate the sex of the child "by the stars"? If you are planning the birth of a daughter, then at the time of conception, the Moon should be in any of the so-called female zodiac signs (Pisces, Taurus, Cancer, Virgo, Scorpio, Capricorn). Accordingly, if you dream of a son, wait until the Moon is in Aries, Gemini, Leo, Libra, Sagittarius or Aquarius.

Accordingly, if you dream of a son, wait until the Moon is in Aries, Gemini, Leo, Libra, Sagittarius or Aquarius.

If you believe the creators of this technique, then in the human body there is a cyclic renewal of blood, which has a direct impact on the sex of the unborn baby. Moreover, in men, the blood is updated every four years, and in women - once every three years. The calculation assumes that one of the parents, whose blood at the time of conception will be “younger”, will “transmit” their gender to the child. By the way, if a woman has a negative Rh factor, the result should be interpreted exactly the opposite. To find out the result, divide the age of a woman by 3, men - by 4. The authors also suggest taking into account the dates of serious blood loss (surgery, bleeding), and in this case, the countdown should be from this moment. It is logical to assume that sometimes the results of division may coincide. In this case, the authors state, you will have twins. nine0013

-

Medical methods

You can also determine the sex of the child using purely medical methods. However, these studies have nothing to do with forecasting and "programming". The most common and accurate is the determination of the sex of the child by ultrasound - after 20 weeks, in most cases, the doctor will be able to give you accurate information. Recently, a method is also gaining popularity that allows you to find out the sex of the child after the 7th week of pregnancy by analyzing the blood of a pregnant woman. The study is based on the fact that the mother's blood contains a small amount of fetal DNA, and if Y chromosomes are found, it can be argued that a boy is expected. During the IVF cycle, PGD can be performed - preimplantation genetic diagnosis. This method allows you to test embryos for the presence of certain chromosomal abnormalities and find out the sex of the unborn child. If there are sex-linked hereditary diseases in the family, embryos of only a certain gender are transferred into the uterine cavity. However, Russian law prohibits the choice of the sex of the child in the absence of medical indications.

However, these studies have nothing to do with forecasting and "programming". The most common and accurate is the determination of the sex of the child by ultrasound - after 20 weeks, in most cases, the doctor will be able to give you accurate information. Recently, a method is also gaining popularity that allows you to find out the sex of the child after the 7th week of pregnancy by analyzing the blood of a pregnant woman. The study is based on the fact that the mother's blood contains a small amount of fetal DNA, and if Y chromosomes are found, it can be argued that a boy is expected. During the IVF cycle, PGD can be performed - preimplantation genetic diagnosis. This method allows you to test embryos for the presence of certain chromosomal abnormalities and find out the sex of the unborn child. If there are sex-linked hereditary diseases in the family, embryos of only a certain gender are transferred into the uterine cavity. However, Russian law prohibits the choice of the sex of the child in the absence of medical indications. nine0013

nine0013

Atypical offshore: taxes in Hong Kong for individuals and legal entities

Hong Kong has become even more attractive for business from the Russian Federation in the last year, since, despite being on the offshore list, it is included in the list of friendly countries for the Russian Federation. This allows companies from Hong Kong to be used as a holding company for Russian companies, including for real estate ownership.

Also, for the resumption of supplies for export-import operations to and from Russia, Hong Kong allows not to include an additional tax burden - unlike Turkey, Kazakhstan, Armenia or Serbia. nine0013

Calling Hong Kong a "tax haven" is still impossible - it is a low-tax center with a favorable climate for doing business and living. Read more about benefits for the tech sector and other opportunities for entrepreneurs in the text.

Read more about moving a business to Hong Kong in the material

Contents:

- Taxes for individuals in Hong Kong

- Business taxes

- Stamp duty

- Tax incentives for tech companies and investment funds

Taxes for individuals in Hong Kong

Hong Kong has a double tax treaty with Russia.

The country has a territorial tax system. You will have to pay deductions if you:

- Stay in the territory for more than 180 days in one calendar year;

- Stay in the territory for more than 300 days in two consecutive years; nine0037

- Provide services in Hong Kong and the total number of days of the financial year spent in the territory exceeds 60.

Three pillars of income tax

Hong Kong has three separate income taxes instead of a single one. Income tax, payroll tax and property income (rent) tax are all calculated separately.

- Income tax is levied on unincorporated professional, trade or commercial income at a flat rate of 15%. You can choose a two-tier income tax system, in which the rate on the first 2 million Hong Kong dollars (HK$) is reduced to 7.5%. The rest of the profits are still taxed at 15%.

nine0037

nine0037 - Property letting tax is levied at a flat rate of 15% of rental income after a standard deduction of up to 20% (this includes all financial obligations and costs of the landlord, such as repairs).

- Payroll tax is levied on net accrued income (net income = income - deductions - benefits) at progressive rates ranging from 2% to 17% or at a flat rate of 15%, whichever calculation results in a lower tax liability . nine0037

| Net taxable income | Bid |

| 0 — 50 000 HK$ | 2% |

| HK$50,001—100,000 | 6% |

| HK$100,001-150,000 | 10% |

| HK$150,001—200,000 | fourteen% |

| Over HK$200,001 | 17% |

Vladimir Shchekin, Senior Advisor at Hill Consulting , says: “All of these rules apply if you, as a sole trader or individual, physically move to Hong Kong and stay there. If you receive earned income from outside of Hong Kong, these rules do not apply. Most Russian businesses use Hong Kong to operate without relocating staff and creating tax implications for individuals within Hong Kong.”

If you receive earned income from outside of Hong Kong, these rules do not apply. Most Russian businesses use Hong Kong to operate without relocating staff and creating tax implications for individuals within Hong Kong.”

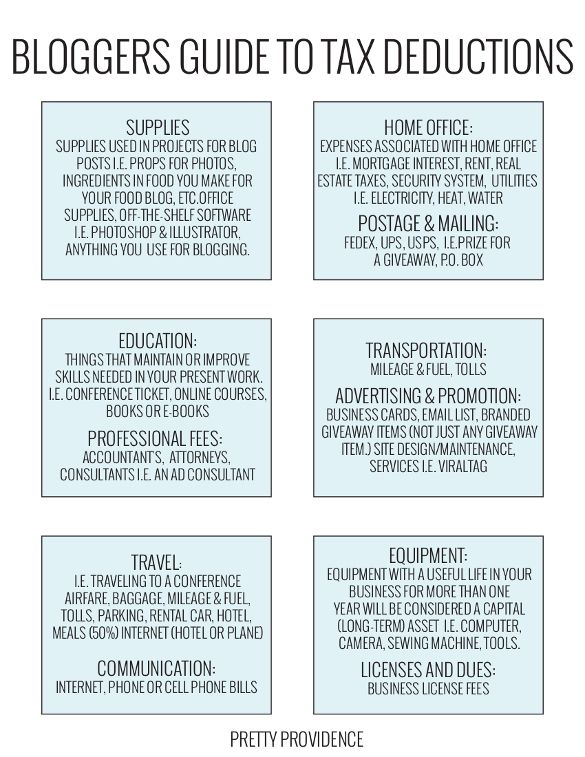

What tax deductions are available in Hong Kong

Mandatory Reserve Fund (MPF) contribution

MPF is Hong Kong's pension fund. The employee is required to contribute 5% of monthly income to it if it is more than 7100 HK$. Foreigners who enter Hong Kong for employment of no more than 13 months or are included in another overseas pension scheme are exempt from the MPF contribution.

Voluntary health insurance (VHIS) qualifying contributions

VHIS contributions are also deducted. The maximum deductible amount is HK$8,000.

Charity

Charitable donations made to approved institutions are eligible for deduction if the total contribution for the year is at least HK$100.

Expenses for self-education

Expenses for self-education may be deducted - courses related to professional activities. The maximum deduction allowed for each tax year is HK$100,000. nine0013

Subsistence minimums are also among the preferential items of expenditure:

| HK$132,000 HK$264,000 |

per child

| HK$240,000 120 000 HK$ |

For elderly dependent relatives

| 50 000 HK$ 25 000 HK$ |

| Disabled Dependent Benefit | 75 000 HK$ |

| disability benefit | 75 000 HK$ |

Payroll tax calculation example.

You:

- Are married to two children under the age of 18;

- Your spouse is not working. nine0037

- Your income consists of HK$650,000 salary and HK$50,000 bonus.

- You have deposited 18,000 HK$ in MPF.

- Made qualified charitable donations of HK$3,000 during the year.

| Total income | ||

| The salary | 650 000 HK$ | |

| Bonus | 50 000 HK$ | |

| Total | nine0148 700 000 HK$ | |

| Preferential deductions | ||

| Charitable donations | 3000 HK$ | |

| Contributions to the MRF | 18 000 HK$ | |

| net income | HK$679,000 | |

| Benefits | ||

| Benefit for a non-working spouse | 264 000 HK$ | |

| Child benefits nine0149 | 240 000 HK$ | |

| net income | 175 000 HK$ | |

| Tax at progressive rates | ||

| First HK$50,000 - 2% | 1000 HK$ | |

| Next HK$50,000 - 6% | 3000 HK$ | |

| Next HK$50,000 - 10% | 5000 HK$ | |

| Balance of 25,000 HK$ - 14% | 3500 HK$ | |

| The tax will be: | HK$12,500 | |

Business taxes

A company is considered a Hong Kong resident if:

- Registered in the country and operates on its territory.

- Registered outside of Hong Kong, but managed and controlled within Hong Kong.

But remember that Hong Kong has a territorial principle of taxation. This means that the income of Hong Kong companies is subject to taxation only in cases where the funds were received from a source in the territory of the country or the activity to generate such income was carried out in the territory of the country. nine0013

If the company did not conduct business in Hong Kong and did not receive income from sources within the state, it is not charged income tax.

In order to be exempt from income tax in practice, a company in Hong Kong must meet the following criteria:

- does not have a fixed place of business in Hong Kong, such as an office, a store, a place for employees to work;

- the goods it sells are not made in Hong Kong; nine0097 employees do not work in Hong Kong;

- contracts are concluded and executed outside the country;

- there are no suppliers and contractors on the territory of the state;

- transportation of goods is carried out between ports located outside the territory of Hong Kong;

- there are no contracts with counterparties from Hong Kong - even if these are the same extraterritorial companies registered in Hong Kong as yours.

Vladimir Shchekin, Senior Advisor at Hill Consulting, explains: “Opening an account in Hong Kong, unlike in Singapore, does not result in the company's territorial status in Hong Kong. However, Hong Kong banks require an office in Hong Kong to open an account, and it is such an office that can create a territorial, and therefore tax, status in Hong Kong. In this regard, ex-territorial companies registered in Hong Kong tend to open bank accounts outside of Hong Kong.” nine0013

Such companies cannot enjoy tax benefits under the DTT (double taxation treaty) with any country, due to the lack of a tax certificate.

Yana Shevchenko, Senior Associate at Uniwide Consulting , says: “Hong Kong, along with Turkey, the United Arab Emirates, Kazakhstan and other countries that have favorable relations with the Russian Federation, is a popular place for companies to land with Russian roots. Hong Kong has always been a popular jurisdiction among our clients. Among the advantages: a favorable tax system, understandable and transparent. And also - a good image of the jurisdiction itself, Hong Kong can be safely called the center of international trade. nine0013

Among the advantages: a favorable tax system, understandable and transparent. And also - a good image of the jurisdiction itself, Hong Kong can be safely called the center of international trade. nine0013

Corporate tax

Hong Kong has no value added tax (VAT), no capital gains tax, no tax on dividend or interest income. The only type of tax that is levied on companies is income tax, calculated on a two-tier system.

| Estimated profit | Corporations | Unincorporated businesses |

| First 2 million HK$ nine0149 | 8.25% | 7.5% |

| Over 2 million HK$ | 16.5% | fifteen% |

“If a foreigner sets up a company with an office in Hong Kong, staff and a bank account, he often reduces taxes due to the minimum markup on the purchase and sale. And the main margin remains outside Hong Kong in another low-tax jurisdiction,” says Vladimir Shchekin, Senior Advisor at Hill Consulting.

License fees

All Hong Kong companies are required to pay an annual business registration fee. There are two types of certificates:

- For one year - costing 250 HK$;

- For three years - 866 HK$.

Pension contributions

MPF contributes 5% of each employee's monthly income up to a maximum of HK$1,500 per person.

Environmental taxes

With the exception of plastic packaging used for food hygiene reasons, all plastic bags used for retail sales are subject to a fee of at least HK$0.50 each. nine0013

Stamp duty

This is a type of duty that is relevant for both individuals and legal entities. It is charged for financial and real estate transactions. If property or shares are transferred at a price below market value, stamp duty may be levied based on the market value at the date of transfer.

Investments

When trading in securities with a primary listing on the Hong Kong Stock Exchange, a financial transaction tax is levied - a stamp duty of 0.13%. The tax is paid on both the purchase and the sale and will be deducted automatically from the broker's commission upon conclusion of the transaction. nine0013

Property

If you are planning to buy or sell property in Hong Kong, you will also have to pay stamp duty:

- Purchase of residential real estate - a fixed rate of 15%.

- Purchase of residential property by a Hong Kong permanent resident who does not own any other residential property in the territory at the time of purchase - up to 4.25%.

- Purchase of non-residential property - up to 4.25%.

When you rent a room in Hong Kong, you also pay stamp duty. In this case, it is calculated at the specified annual rental rate and ranges from 0.25% (for a lease term of not more than one year) to 1% (for a lease term of more than three years). nine0013

In this case, it is calculated at the specified annual rental rate and ranges from 0.25% (for a lease term of not more than one year) to 1% (for a lease term of more than three years). nine0013

There is also a special stamp duty for the resale of residential property within 36 months from the date of purchase - from 10 to 20%. The longer the holding period, the lower the rate.

Tax incentives for tech companies and investment funds

Profit from mutual funds and trusts is not subject to taxation - if they are licensed and present in the country.

Vladimir Shchekin explains: “These benefits are relevant for the domestic market of Hong Kong, for local companies. For foreigners, the registration of such companies is difficult. It’s easier to register a foundation (an analogue of a trust in continental law), where the property is registered in the name of a legal entity that belongs to the client, and not to the manager. ” nine0013

” nine0013

Benefits and deductions for the tech sector:

- 100% write-off of expenses for plant operations and production equipment,

- 100% write-off of expenses for computer hardware and software owned by end users;

- Five-year write-off period for capital expenditures for the repair or reconstruction of commercial premises;

- 100% deduction of capital costs for environmental protection equipment and environmentally friendly vehicles; nine0037

- Tax deductions for the costs incurred by enterprises for the purchase of intellectual property rights: patents, know-how, copyrights, registered designs, registered trademarks and others.

- Deduction of qualifying expenses for research activities.

Calculation of deductions from the company's taxable income

Step 1: subtract invaluable profits

Profits that are not subject to assessment include:

- Capital from the sale of assets;

- Dividends or profits that are already subject to income tax;

- Interest income from deposits.

Step 2: subtract qualified business expenses

Such expenses include:

- Renting a building or land;

- Charitable donations;

- Costs for the purchase of patents, copyrights, trademarks and registered designs;

- Expenses associated with lending money;

- Foreign taxes paid on income;

- Expenses for repair, reconstruction and replacement of equipment;

- Research and development expenses;

- Contributions to the pension system;

- Expenses for registration of trademarks and patents.

Step 3: Subtract previously unaccounted for losses

Losses can be deducted either from the company's income in the same valuation year or from income in subsequent valuation years.