How to claim a foster child on your taxes

Tax Breaks for Foster Parents

In this article:

- Who Is Considered a Foster Parent?

- What Tax Benefits Are Available to Foster Parents?

- More Financial Help for Foster Parents

Have you brought a foster child into your home? If so, you know the rewards―and the expenses―that come with raising a child. The federal government offers a variety of potential tax benefits to foster parents, just as they do for all parents. Find out how these tax breaks may apply to you and your family, and what you need to do to qualify.

Who Is Considered a Foster Parent?

For tax purposes, a foster parent is someone who has had a child placed with them by either a court order, judgment or authorized placement agency (such as a state or local government organization). Taking in a family member or a neighbor's child, even for an extended time, does not make someone a foster parent in the eyes of the IRS.

If you qualify as a foster parent, you may be able to claim your foster child as a dependent on your tax return. To qualify as a dependent, a foster child must meet these basic IRS guidelines:

- The child is under age 19 (or 24 if they're a full-time student) by the end of the year.

- The child is younger than you and your spouse, if you're married and filing jointly.

- The child has lived with you for more than half the year.

- The child receives more than half of their support for the year from you (and not the government or the agency that placed them).

- The child did not file a joint tax return for the year.

- The child is not claimed as a dependent on anyone else's tax return.

Claiming a foster child as your dependent doesn't get you an additional deduction on your taxes; these personal exemptions were eliminated as part of the Tax Cuts and Jobs Act in 2017. If you're single, however, having a dependent may enable you to file as head of household, which offers a higher standard deduction, and may help qualify you for a range of tax benefits, such as those listed below.

Keep in mind that claiming a foster child as your dependent does not enable you to file as a qualifying widow or widower with a dependent child. Also, you may be able to claim a dependent relative who is not technically a foster child if they meet the IRS guidelines for qualified dependents.

What Tax Benefits Are Available to Foster Parents?

Some significant tax benefits may be available to you as a foster parent, though it's important to check guidelines for each to make sure you qualify. Here's a quick list of potential tax benefits:

1. Non-Taxable Foster Care Payments

Whether you receive foster care payments from the government or a child placement agency, support payments are not taxable and do not need to be reported on your tax return.

2. Child Tax Credits

Child tax credits—including 2021 expanded credits of up to $3,600 under the American Rescue Plan Act—may be available. To qualify for expanded child tax credits, a foster child must have been under 18 at the end of 2021, claimed as a dependent on your tax return and meet other IRS requirements. Foster parents must also adhere to maximum income requirements. Foster families who don't qualify for expanded child tax credits may be eligible for regular child tax credits of up to $2,000 per qualifying child.

Foster parents must also adhere to maximum income requirements. Foster families who don't qualify for expanded child tax credits may be eligible for regular child tax credits of up to $2,000 per qualifying child.

3. Recovery Rebate (Stimulus) Credit

If your dependent foster child qualified you for a stimulus payment in 2021 but you haven't received payment for this, you might qualify for a Recovery Rebate Credit, which means you can claim the missing amount on your 2021 tax return.

4. Child and Dependent Care Credits

Child care expenses for your foster child may qualify you for Child and Dependent Care Credit, which allows working parents to get a credit for up to 50% of qualifying child care expenses. For the 2021 tax year, the maximum benefit is $4,000 for one qualifying child or up to $8,000 for two or more children.

5. Earned Income Tax Credit

An eligible foster child may help you qualify for the earned income tax credit, which offers relief to low- and moderate-income working people in the form of refundable tax credits. Adding a dependent child generally qualifies you for a larger credit.

Adding a dependent child generally qualifies you for a larger credit.

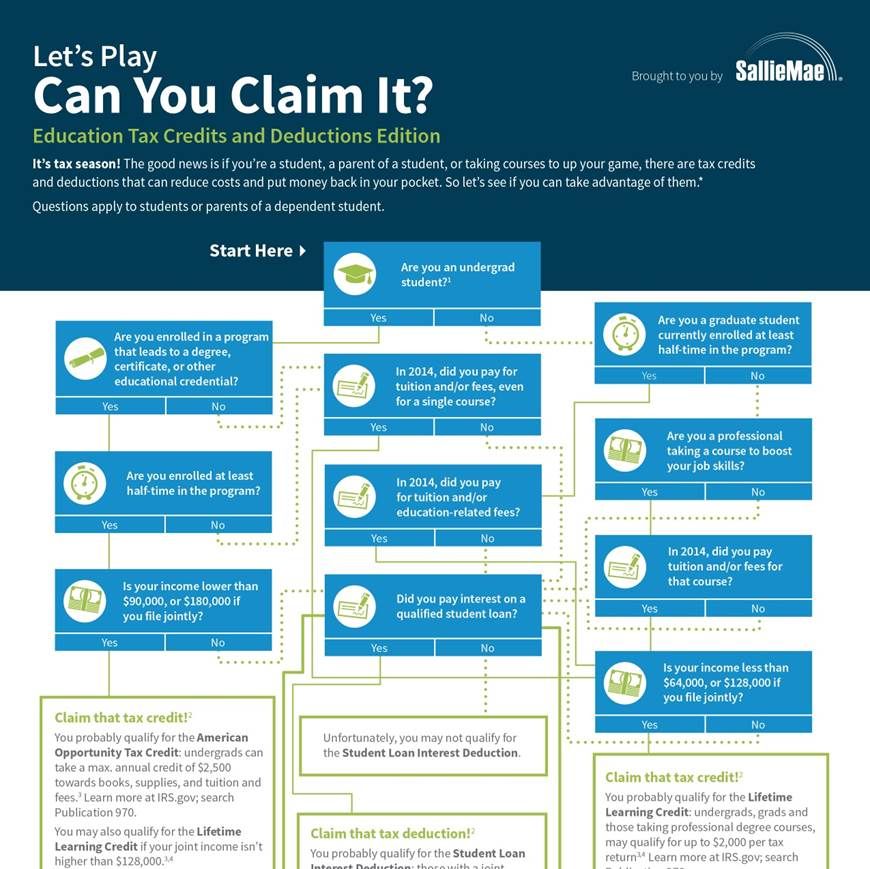

6. American Opportunity Tax Credit

The American Opportunity Tax Credit provides tax breaks to help cover expenses during the first four years of post-secondary education. If your foster child qualifies and you meet income guidelines, you may be eligible for up to $2,500 in tax credits.

7. Deductible Expenses

Some of your foster care expenses may be deductible on your taxes as charitable donations if you itemize your deductions and if the agency that provides support is a qualified charity. If you receive foster care payments from a government agency, this deduction is not for you. These expenses must go toward basic support—food, clothing and care. Any unreimbursed expenses that aren't tax deductible can be used to help meet the requirements of claiming your foster child as a dependent.

More Financial Help for Foster Parents

Tax breaks are meant to help foster families offset the high cost of raising children. If your family can use additional financial help making ends meet, you may be able to find resources that offer income assistance, medical benefits or food.

If your family can use additional financial help making ends meet, you may be able to find resources that offer income assistance, medical benefits or food.

How to Claim Foster Credits and Savings

Foster

Child

A foster child from an income tax point of view is not the same as a child or dependent in the traditional sense. Unlike a child or dependent that legally belongs to you either by birth or relation (your son, daughter, grandchild, etc.) or adoption, a foster child is placed with you by either a court order, judgement, or authorized placement agency (such as a state or local government organization). However, you can still claim a foster child on your taxes if they qualify as your dependent. The one exception to this is the qualifying widow(er) with dependent child filing status as you cannot claim a foster child as a dependent for this status.

If you later adopt a foster child and it is finalized in a tax year and they live with you for at least half the year, you may be eligible for the Adoption Tax Credit. For tax purposes, both foster children and adopted children are treated the same as biological children.

For tax purposes, both foster children and adopted children are treated the same as biological children.

To quickly determine the eligibility of a potential dependent, use the free eFile.com DEPENDucator or dependent tax tool.

When you take care of a foster child, you may be eligible for various tax savings for dependents. Child dependents can help lower your taxes as the IRS provides programs for parents or guardians in order to offset some of the many costs of raising children.

Here are a few key points about foster children and your income taxes:

- If you receive government foster care payments, these are considered nontaxable income and thus do not need to be reported on your tax return.

- Foster care expenses may be deductible as charitable expenses.

- If you adopt the foster child, you can claim the Adoption Tax Credit.

- If a foster child is claimed as a dependent, you can claim the Child and Dependent Care Credit if you pay for daycare for your foster child.

- You can also claim the Child Tax Credit and a higher Earned Income Tax Credit as applicable; since there is no specific foster child tax credit, you can instead claim regular dependent-related credits and deductions.

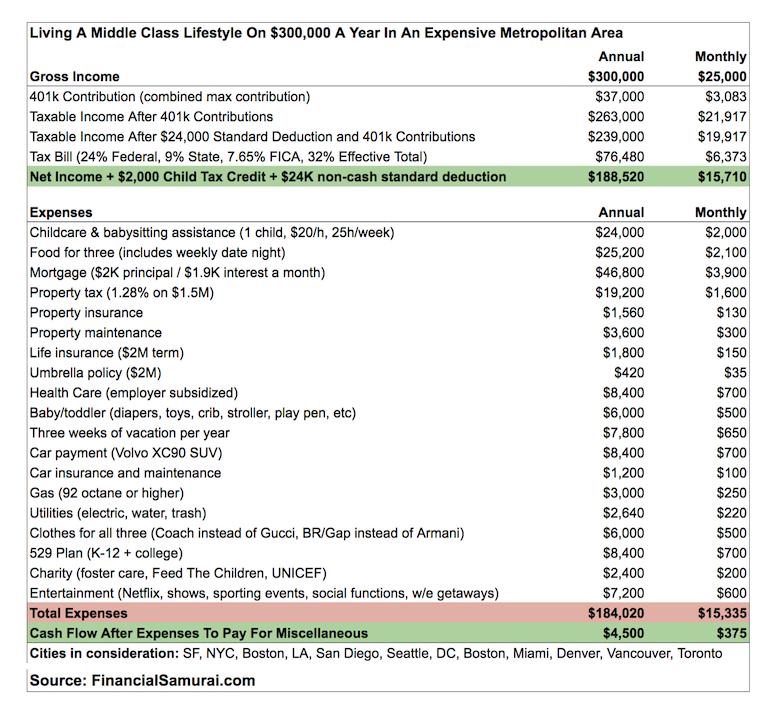

Review the chart below to compare tax deductions and tax credits you may be able to claim on your 2022 Tax Return via eFile.com for having children/dependents or foster children. Claiming foster kids on your taxes is easy on eFile.com; add your dependent information to your account and eFileIT by April 15, 2023.

Deduction/Credit

Child/Dependent or Foster Child

Foster Care Payments

A foster care payment is only related to having a foster child; it can be a payment or series of payments from your state or local government or from a child placement agency. A foster care payment is nontaxable income because the payment is only for supporting the foster child. You do not have to pay taxes on the payment, so this is a valuable way to save on your next tax return. However, you should keep detailed records of your foster care payments and other expenses relating to your foster child.

However, you should keep detailed records of your foster care payments and other expenses relating to your foster child.

Foster Care Expenses

If you itemize deductions, you may be able to deduct foster care expenses as a charitable donation if they are unreimbursed. The expenses must be out-of-pocket and used to clothe, feed, and care for the foster child. However, this only applies if the organization or agency who placed the child with you can receive charitable donations. If they cannot accept the donations, any unreimbursed expenses may qualify as support you provide. You may qualify to claim the foster child as a dependent as long as you provide at least half of the child's support and meet other requirements for claiming a dependent.

Claiming Dependents for Deductions

You can add a foster child to your return as a dependent in the same way you claim a child as a dependent. To do this, add the Child or Other Dependent screen in your eFile.com account and select "Foster Child" as the relationship. The eFile tax app will automatically add the dependent to your return if you qualify. Find out if your child or foster child qualifies as your dependent by using our free DEPENDucator or dependent tax tool.

The eFile tax app will automatically add the dependent to your return if you qualify. Find out if your child or foster child qualifies as your dependent by using our free DEPENDucator or dependent tax tool.

Adoption Tax Credit

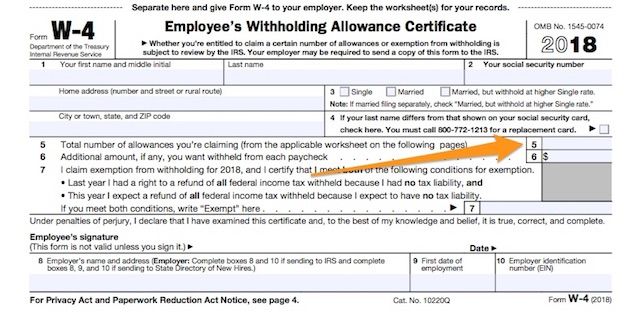

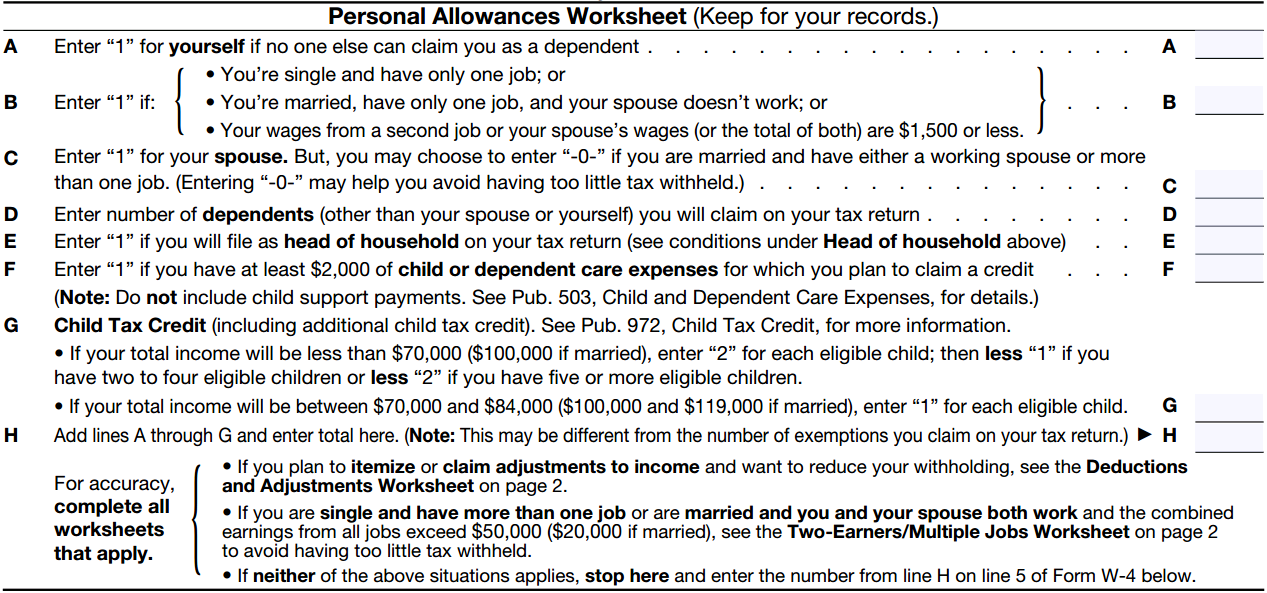

You can only claim this tax credit for adoption if you have an adopted child or dependent; it cannot be claimed for foster children. If you later adopt your foster child, you can then claim the Adoption Tax Credit. This credit can offset your taxes owed when you file; if you anticipate adopting a child, you should consider submitting a new W-4 to your employer so you can take full advantage of this nonrefundable credit.

Child Tax Credit

You can claim this tax credit if you have a child dependent or a foster child which will help you offset the many expenses of raising a child. Find out of you qualify for the credit by using our free CHILDucator Child Tax Credit tax tool. This popular tax credit can be worth up to $2,000 per qualifying dependent, meaning you could claim it for multiple foster children, a foster child plus a child you raised from birth, and other combinations.

Child and Dependent Care Credit

This credit allows you to save taxes on childcare expenses you paid for your child dependent or foster child. Use our CAREucator tax tool to discover if you can claim the credit on your tax return. You may be able to claim up to $2,100 on your next tax return.

Earned Income Tax Credit

This refundable tax credit supplements the income you earned through working, either for yourself (as self-employed) for another person. Your credit amount increases when you claim one or more child or foster child as a dependent. To find out if you can claim the Earned Income Tax Credit, try out our EITCucator tax tool.

If you have a foster child to claim on your taxes, add them to your eFile account by answering all applicable questions. As you enter information, the eFile app will continuously add, calculate, and adjust credits and deductions based on your dependents, filing status, income, and expenses.

Start Federal and State Tax Returns

Additionally, if the foster child can be claimed as a dependent and they are enrolled in school, you may be eligible for various school-related tax deductions and education tax savings, such as The American Opportunity Tax Credit. Dependents on your tax return can help save you money when you earn taxable income and spend it on keeping up a home for your child and paying for their expenses.

Dependents on your tax return can help save you money when you earn taxable income and spend it on keeping up a home for your child and paying for their expenses.

See more details on these IRS publications:

- IRS Publication 501 - Dependents, Standard Deduction, and Filing Information

- IRS Publication 503 - Child and Dependent Care Expenses.

How to Claim a Foster Child on a Tax Return

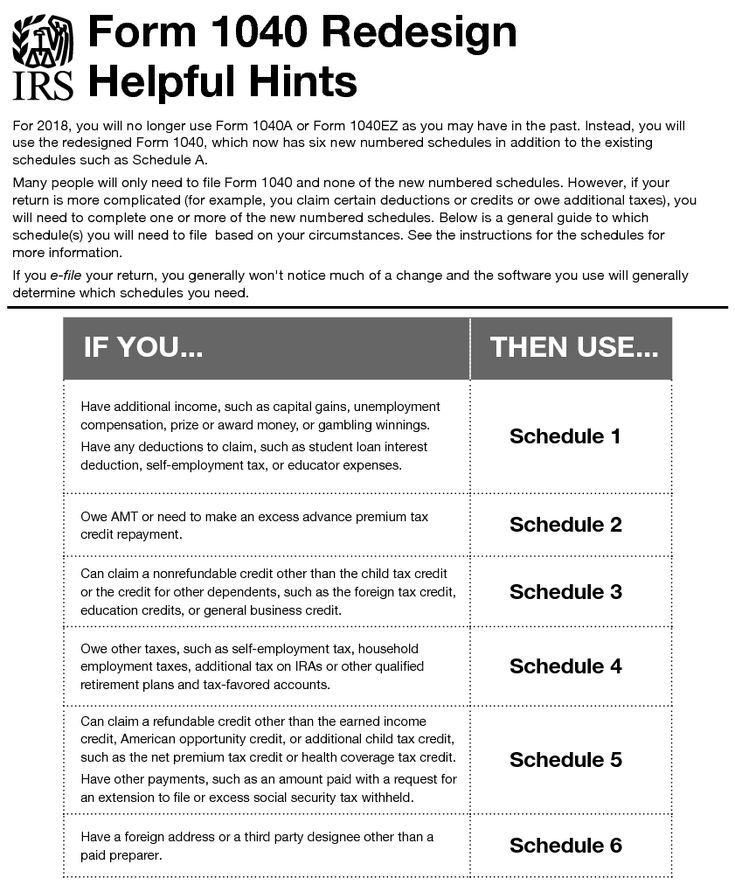

When filling out Form 1040 to file your income tax return, dependents are claimed on the first page by filling in their identifying details. Additional child or dependent forms include the Schedule 8812, Form 2441, and others - eFileIT these forms. Instead of filling in complicated forms to claim your foster child or other dependent, use eFile.com to prepare your return. The 1040, Schedule 8812, and all other applicable dependent tax forms are generated and filled out for you as you enter information. Does your foster child qualify as a dependent?

It's easy to claim your foster child on your tax return on eFile. com. Simply answer the questions about your dependent when you add them to your return and we will tell you what deductions and credits you qualify for. Contact an eFile.com Taxpert if you have further questions or concerns about tax breaks related to foster children.

com. Simply answer the questions about your dependent when you add them to your return and we will tell you what deductions and credits you qualify for. Contact an eFile.com Taxpert if you have further questions or concerns about tax breaks related to foster children.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

What is a child tax credit? – Campaign for Working Families Inc.

Skip to contentPrevious Next

What is a child tax credit?LEARN MORE

Raising children is expensive, but if you qualify for the child tax credit, your children can actually save you money!

Children can cost up to $2,000 each - in taxes, that is. If you have children and earn less than $400,000 as a married couple or $200,000 as an individual, the Child Tax Credit will save you money in taxes this year.

yes, you read that right - your kids could mean you pay less taxes!

The Child Tax Credit is a tool that helps reduce the amount you pay in taxes. Whatever amount of tax credit you receive is deducted from your tax bill, which can significantly reduce the amount you pay .

Parents or guardians with qualifying incomes can claim the full amount of the child tax credit for each of their dependent children. Tax preparation can be confusing and complex, but qualifying working families and individuals in Southern Pennsylvania and Southern New Jersey can receive free, professional help.

How much exactly can you claim?

The child tax credit is $2,000 per child in 2019.

Couples filing jointly $400,000 per year and singles, Head of Household, or married couples filing separately who earn less than $200,000 per year will be able to take $2,000 for child as a child tax credit.

For example, if you are a single parent who makes $28,000 a year and has three children, you can deduct $6,000 for the child tax credit.

Are there income limits for the child tax credit?

For 2019, its $200,000 for modified adjusted gross income. Married taxpayers who jointly file an adjusted gross income of $400,000 or less may receive a full credit.

Outside of basic income, there are a few more conditions for eligibility for the child tax credit. In addition to knowing your income, you should double check the IRS dictated requirements listed below to make sure you qualify for all or part of the child tax credit..

- Citizenship

Eligible children must be US citizens or residents who can be claimed as dependents by the taxpayer. - Communication

Children can be your natural children, grandchildren, stepchildren, and/or adopted children. Foster children also fall under this category if they lived in your home during the entire year in question.. - Dependency

You must declare the child a dependent. You must declare that the child is a dependent on your federal taxes in order to be eligible for the loan.

You must declare that the child is a dependent on your federal taxes in order to be eligible for the loan. - Residence

The child must live with you. in fact, the child must have lived in your home for at least half of the tax year, although some exceptions apply.

We may argue or disagree on issues like politics and religion, but almost every American is united in their desire for lower taxes. Who wants to pay more taxes than necessary? No one. Nobody, of course!

Bottom line

It's worth repeating: If you have children and make less than $400,000 as a married couple or $200,000 as an individual, the Child Tax Credit will save you money in taxes in 2019.

Contact us to find out if do you fit!

Up

Memo to guardians, custodians, foster parents on collecting alimony for the maintenance of wards

I. Sequence of actions.

1) In accordance with art. 60 of the Family Code of the Russian Federation, the child has the right to receive maintenance from his parents. In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from the parents in a judicial proceeding. In accordance with Art. 148 of the Family Code, children under guardianship (guardianship) are entitled to the alimony due to them.

In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from the parents in a judicial proceeding. In accordance with Art. 148 of the Family Code, children under guardianship (guardianship) are entitled to the alimony due to them.

It should be borne in mind that, by virtue of Art. 71 and 74 of the Family Code of the Russian Federation, deprivation of parental rights or restriction of parental rights does not relieve parents from the obligation to support their child.

Art. 145 of the Family Code of the Russian Federation regulates that guardianship or guardianship is established over children left without parental care for the purpose of their maintenance, upbringing and education, as well as to protect their rights and interests.

Thus, in order to protect the property rights of minors, the guardian (trustee), as the legal representative of the child, is obliged to control the fulfillment by parents of the obligation to pay child support. Therefore, if at the time of the establishment of guardianship (trusteeship) alimony from the parents of the ward child was not collected and paid on a voluntary basis, then the guardian (custodian) must file an application with the court for the recovery of alimony. This category of cases is considered by magistrates both at the place of residence of the guardian (custodian) and at the place of residence of the parents (one of them).

Therefore, if at the time of the establishment of guardianship (trusteeship) alimony from the parents of the ward child was not collected and paid on a voluntary basis, then the guardian (custodian) must file an application with the court for the recovery of alimony. This category of cases is considered by magistrates both at the place of residence of the guardian (custodian) and at the place of residence of the parents (one of them).

2) In accordance with art. 33 of the FEDERAL LAW dated 02.10.2007 N 229-ФЗ "ON EXECUTIVE PROCEEDINGS" enforcement actions are performed by a bailiff at the place of residence, place of residence of the debtor.

The recoverer is a citizen in whose favor or in the interests of which a writ of execution has been issued. The debtor is a citizen who is obliged by an executive document to pay alimony.

Thus, the original writ of execution for the recovery of alimony is submitted by the recoverer to the department of the bailiff service at the place of residence (at the place of residence) of the debtor, or at the last known place of residence of the debtor,

In accordance with Art. 429 of the Civil Procedure Code of the Russian Federation for each court decision, only one writ of execution is issued. In order to prevent the loss of the writ of execution, you must first make a copy and mark the bailiff service on the acceptance of the writ of execution directly on its copy. It is also necessary to write an application with a request to initiate enforcement proceedings and attach to it a copy of the savings book opened in the name of the child.

429 of the Civil Procedure Code of the Russian Federation for each court decision, only one writ of execution is issued. In order to prevent the loss of the writ of execution, you must first make a copy and mark the bailiff service on the acceptance of the writ of execution directly on its copy. It is also necessary to write an application with a request to initiate enforcement proceedings and attach to it a copy of the savings book opened in the name of the child.

3) In accordance with Art. 84 of the Family Code of the Russian Federation for children left without parental care, alimony is paid to the guardian (custodian) of the children or their adoptive parents.

Thus, if guardianship is appointed after the issuance of a writ of execution on the recovery of alimony from parents deprived of parental rights, then in accordance with Art. 44, 203 of the Civil Procedure Code of the Russian Federation, it is necessary to apply for a change in the procedure and method for executing a court decision. This application is submitted to the court that issued the decision on the recovery of alimony. The court issues a ruling on the replacement of the recoverer, which is sent to the parties in the case. This determination must be submitted to the department of the bailiff service, in whose production enforcement proceedings have been initiated.

This application is submitted to the court that issued the decision on the recovery of alimony. The court issues a ruling on the replacement of the recoverer, which is sent to the parties in the case. This determination must be submitted to the department of the bailiff service, in whose production enforcement proceedings have been initiated.

4) After submitting the application and the original writ of execution to the bailiff service, the bailiff initiates enforcement proceedings, which is issued a "Decree on the initiation of enforcement proceedings", which is sent to the parties ..

5) You need to know that in accordance from Art. 50 of the FEDERAL LAW dated 02.10.2007 N 229-FZ "ON EXECUTIVE PROCEEDINGS", the parties to enforcement proceedings have the right to familiarize themselves with the materials of enforcement proceedings, make extracts from them, make copies of them, submit additional materials, file petitions, participate in enforcement actions, give verbal and written explanations in the process of performing enforcement actions, give their arguments on all issues arising in the course of enforcement proceedings, object to the petitions and arguments of other persons participating in enforcement proceedings, file challenges, appeal against the decisions of the bailiff, his actions (inaction ).

6) At the request of the party in the enforcement proceedings, the bailiff issues a ruling on the calculation of alimony arrears. As necessary, in accordance with the plan for the protection of the rights of the child, a copy of the resolution on the calculation of arrears of alimony must be submitted to the personal file of the ward

II. Alimony has not been received for a long time - what to do?

In accordance with the legislation of the Russian Federation, the main task of bailiffs is the enforcement of a court decision that has entered into legal force. In order to implement the above task, the bailiff requests from the tax inspectorate, the pension fund and other organizations information about the debtor's earnings and other income, bank accounts or property that can be foreclosed. Thus, if alimony is not received on the child’s account for a long time, this means that the bailiff cannot find the debtor, or his income or property, which can be foreclosed.

In this case, the law provides for certain opportunities for the bailiff, however, as a rule, these actions are performed by the bailiff only at the request of the claimant.

1) If the bailiff cannot find the debtor (the debtor does not live at the place of residence or at the place of the last known place of residence).

In this case, the bailiff, on his own initiative or at the request of the recoverer, issues an order to search for the debtor, which is approved by the senior bailiff.

2) If the bailiff cannot find the income or property of the debtor.

If the bailiff cannot find the income or property of the debtor, on which it is possible to foreclose - this can only mean that the debtor deliberately hides from the obligation to pay alimony. In this case, the legislation of the Russian Federation provides for some restrictive measures, as well as the liability of the debtor for failure to comply with the court decision.

In accordance with art. 67 of the FEDERAL LAW dated 02.