How to claim a foster child on taxes

What You Need to Know – Alternative Family Services

With the 2021 tax season filing deadline approaching, here are three things you should know about foster care and taxes.

Note: This article should not be construed as legal advice. The purpose of this article is to provide general guidance. For any specific questions on your tax return, please contact a licensed attorney or other certified tax expert. Any information provided may not be construed as the giving of legal advice to any person about a particular legal matter and should not be relied upon as the basis for taking a particular action or refraining from taking a particular action in any legal matter.

With the 2021 tax season filing deadline approaching, here are some things you should know about foster care and taxes.

1) Foster Parents Can Claim Foster Children On Their Taxes – But Note The Fine Print

Both nationally and specifically in California, foster children can be viewed as the same as biological children – at least for tax purposes. As H&R Block has noted, “You can claim a foster child dependent or adopted child dependent if the child was placed with you by one of these:

- An authorized placement agency

- Judgment, decree, or other court order

You can claim an adopted child if the adoption has been legally finalized.

Adopted and foster children are treated the same as biological dependents for tax purposes.

Here, an authorized placement agency can refer to either a government agency such as a county social services department or an authorized foster care agency like Alternative Family Services.

At the national level, the U.S. Internal Revenue Service has noted that a foster child may be considered a qualifying child – at least for tax year 2021. To see if you are eligible for the Advance Child Tax Credit or the Earned Income Tax Credit, head here: https://www.irs.gov/credits-deductions-for-individuals.

To see if you are eligible for the Advance Child Tax Credit or the Earned Income Tax Credit, head here: https://www.irs.gov/credits-deductions-for-individuals.

With the IRS, the qualifying child must:

- be a child under the age of 18

- must have resided with the person or people claiming them for at least half of the calendar year

Further, the IRS stipulates that filing status is also a key consideration in order to claim the credit, as the “individual does not file a joint return with the individual’s spouse for tax year 2021 or files it only to claim a refund of withheld income tax or estimated tax paid.”

At the federal level, certain resource parents may also qualify for the Child and Dependent Care Credit. Follow this link to learn more: https://www.irs.gov/newsroom/child-and-dependent-care-credit-faqs.

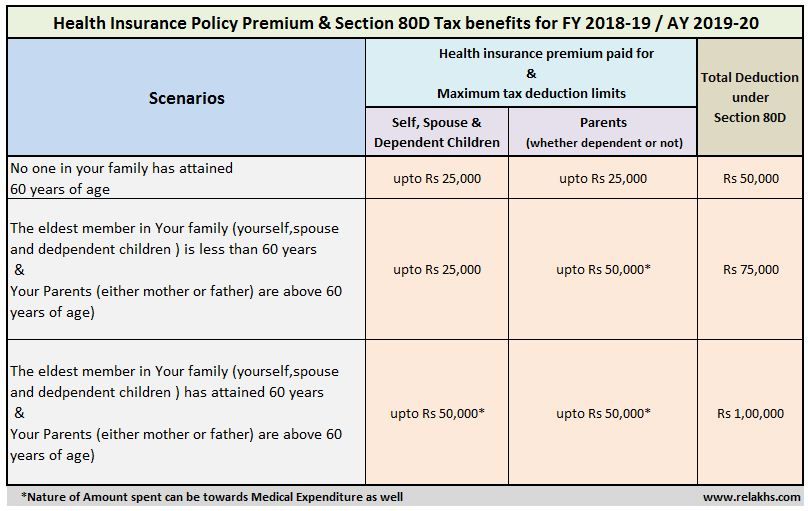

Additionally, at the state level, the State of California Franchise Tax Board notes that resource parents can qualify specifically for the Child and Dependent Care Expenses Credit. This credit can cover some foster care expenses so long as “you paid someone to take care of” the foster youth in your care and you earned income. To qualify for this particular state-level credit, the foster child needs to meet the following criteria:

This credit can cover some foster care expenses so long as “you paid someone to take care of” the foster youth in your care and you earned income. To qualify for this particular state-level credit, the foster child needs to meet the following criteria:

- Age: Are under 13 years old

- Residency: Lived with you for more than 1/2 the year

- Support: Did not provide more than 1/2 of his/her own support

- Joint Return: Did not file a joint federal or state income tax return

- Citizenship: Are a U.

S. citizen, national, or resident of Canada or Mexico

S. citizen, national, or resident of Canada or Mexico

It is important to note that states may define dependents differently than the IRS. For example, in relation to age, the State of California Franchise Tax Board says that qualifying children “must be younger than the taxpayer and either a) under the age of 19 at the end of the tax year, or b) under the age of 24 if a full-time student for at least 5 months of the year. A permanently and totally disabled child may be included at any age.”

Note that the above definition is specifically for the California Earned Income Tax Credit and/or Young Child Tax Credit. To learn more about these credits, head to https://www.ftb.ca.gov/file/personal/credits/california-earned-income-tax-credit.html.

What about when a foster child lives with multiple families in a given year? The State of California Franchise Tax Board has noted that, “The child only qualifies for one return. If the child can be claimed by more than one taxpayer, the child’s qualification goes to the taxpayer who is the child’s parent. If more than one taxpayer is the child’s parent, the child’s qualification goes to the parent with whom the child lived for the greatest amount of time during the year. If the child’s time was split equally between parents, the child’s qualification goes to the parent with the highest adjusted gross income (AGI). If no taxpayer is the child’s parent, the child’s qualification goes to the taxpayer with the highest AGI.”

If more than one taxpayer is the child’s parent, the child’s qualification goes to the parent with whom the child lived for the greatest amount of time during the year. If the child’s time was split equally between parents, the child’s qualification goes to the parent with the highest adjusted gross income (AGI). If no taxpayer is the child’s parent, the child’s qualification goes to the taxpayer with the highest AGI.”

In order to claim a foster child on your taxes, however, you will need to have their Social Security number or Individual Taxpayer Identification Number (ITIN).

2) How To Think About Foster Care Payments

According to the website eFile.com, resource parents who itemize deductions “may be able to deduct foster care expenses as a charitable donation if they are unreimbursed. The expenses must be out-of-pocket and used to clothe, feed, and care for the foster child. However, this only applies if the organization or agency who placed the child with you can receive charitable donations. ”

”

Further, “any foster care payments you receive from a child placement agency, the state government, or your local government are considered nontaxable income. The money is for the support of the foster child and isn’t just going into your pocket, the way other income would. You don’t have to report support payments on your taxes,” according to 1040.com.

3) Charitable Donations To Foster Care Agencies Are Tax Deductible

Many foster care agencies are registered nonprofits, and therefore any donations made to them may be tax deductible. With registered nonprofits, donations of money, services and physical items may be tax deductible. For any specific questions, be sure to discuss details with the organization in kind you are considering donating to or that you have already donated to in the past year.

Please note that this article was written in 2022, with information primarily on the 2021 tax year. State and federal laws and guidelines change, so please note that some of this information may become outdated over time.

How to Claim Foster Credits and Savings

Foster

Child

A foster child from an income tax point of view is not the same as a child or dependent in the traditional sense. Unlike a child or dependent that legally belongs to you either by birth or relation (your son, daughter, grandchild, etc.) or adoption, a foster child is placed with you by either a court order, judgement, or authorized placement agency (such as a state or local government organization). However, you can still claim a foster child on your taxes if they qualify as your dependent. The one exception to this is the qualifying widow(er) with dependent child filing status as you cannot claim a foster child as a dependent for this status.

If you later adopt a foster child and it is finalized in a tax year and they live with you for at least half the year, you may be eligible for the Adoption Tax Credit. For tax purposes, both foster children and adopted children are treated the same as biological children.

To quickly determine the eligibility of a potential dependent, use the free eFile.com DEPENDucator or dependent tax tool.

When you take care of a foster child, you may be eligible for various tax savings for dependents. Child dependents can help lower your taxes as the IRS provides programs for parents or guardians in order to offset some of the many costs of raising children.

Here are a few key points about foster children and your income taxes:

- If you receive government foster care payments, these are considered nontaxable income and thus do not need to be reported on your tax return.

- Foster care expenses may be deductible as charitable expenses.

- If you adopt the foster child, you can claim the Adoption Tax Credit.

- If a foster child is claimed as a dependent, you can claim the Child and Dependent Care Credit if you pay for daycare for your foster child.

- You can also claim the Child Tax Credit and a higher Earned Income Tax Credit as applicable; since there is no specific foster child tax credit, you can instead claim regular dependent-related credits and deductions.

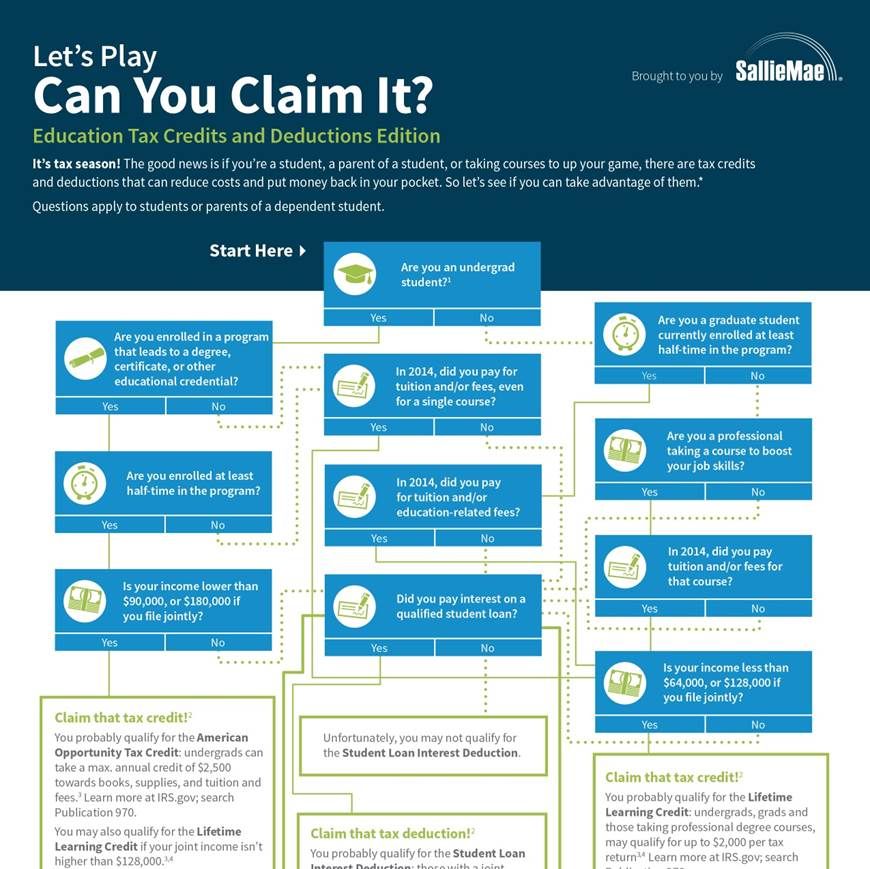

Review the chart below to compare tax deductions and tax credits you may be able to claim on your 2022 Tax Return via eFile.com for having children/dependents or foster children. Claiming foster kids on your taxes is easy on eFile.com; add your dependent information to your account and eFileIT by April 15, 2023.

Deduction/Credit

Child/Dependent or Foster Child

Foster Care Payments

A foster care payment is only related to having a foster child; it can be a payment or series of payments from your state or local government or from a child placement agency. A foster care payment is nontaxable income because the payment is only for supporting the foster child. You do not have to pay taxes on the payment, so this is a valuable way to save on your next tax return. However, you should keep detailed records of your foster care payments and other expenses relating to your foster child.

Foster Care Expenses

If you itemize deductions, you may be able to deduct foster care expenses as a charitable donation if they are unreimbursed. The expenses must be out-of-pocket and used to clothe, feed, and care for the foster child. However, this only applies if the organization or agency who placed the child with you can receive charitable donations. If they cannot accept the donations, any unreimbursed expenses may qualify as support you provide. You may qualify to claim the foster child as a dependent as long as you provide at least half of the child's support and meet other requirements for claiming a dependent.

The expenses must be out-of-pocket and used to clothe, feed, and care for the foster child. However, this only applies if the organization or agency who placed the child with you can receive charitable donations. If they cannot accept the donations, any unreimbursed expenses may qualify as support you provide. You may qualify to claim the foster child as a dependent as long as you provide at least half of the child's support and meet other requirements for claiming a dependent.

Claiming Dependents for Deductions

You can add a foster child to your return as a dependent in the same way you claim a child as a dependent. To do this, add the Child or Other Dependent screen in your eFile.com account and select "Foster Child" as the relationship. The eFile tax app will automatically add the dependent to your return if you qualify. Find out if your child or foster child qualifies as your dependent by using our free DEPENDucator or dependent tax tool.

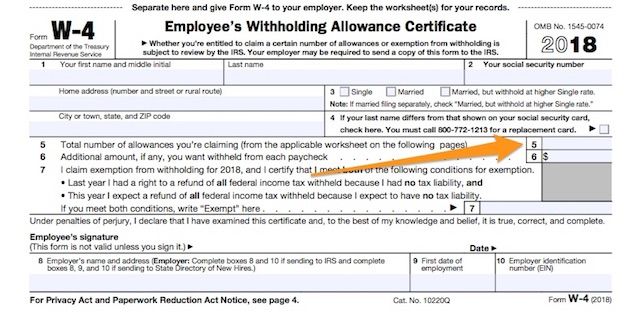

Adoption Tax Credit

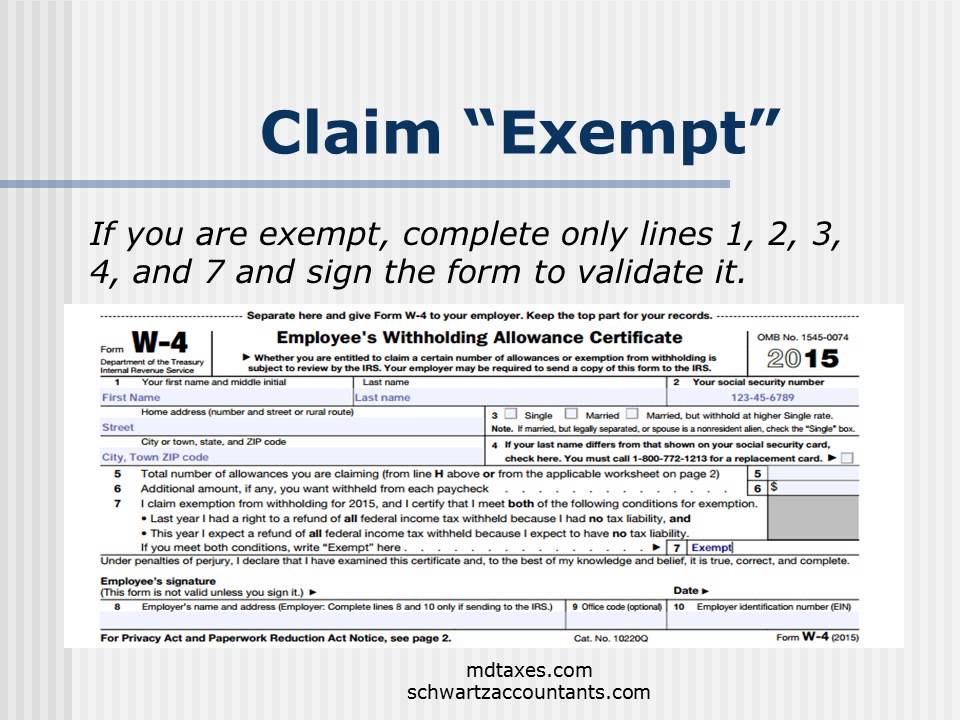

You can only claim this tax credit for adoption if you have an adopted child or dependent; it cannot be claimed for foster children. If you later adopt your foster child, you can then claim the Adoption Tax Credit. This credit can offset your taxes owed when you file; if you anticipate adopting a child, you should consider submitting a new W-4 to your employer so you can take full advantage of this nonrefundable credit.

If you later adopt your foster child, you can then claim the Adoption Tax Credit. This credit can offset your taxes owed when you file; if you anticipate adopting a child, you should consider submitting a new W-4 to your employer so you can take full advantage of this nonrefundable credit.

Child Tax Credit

You can claim this tax credit if you have a child dependent or a foster child which will help you offset the many expenses of raising a child. Find out of you qualify for the credit by using our free CHILDucator Child Tax Credit tax tool. This popular tax credit can be worth up to $2,000 per qualifying dependent, meaning you could claim it for multiple foster children, a foster child plus a child you raised from birth, and other combinations.

Child and Dependent Care Credit

This credit allows you to save taxes on childcare expenses you paid for your child dependent or foster child. Use our CAREucator tax tool to discover if you can claim the credit on your tax return. You may be able to claim up to $2,100 on your next tax return.

You may be able to claim up to $2,100 on your next tax return.

Earned Income Tax Credit

This refundable tax credit supplements the income you earned through working, either for yourself (as self-employed) for another person. Your credit amount increases when you claim one or more child or foster child as a dependent. To find out if you can claim the Earned Income Tax Credit, try out our EITCucator tax tool.

If you have a foster child to claim on your taxes, add them to your eFile account by answering all applicable questions. As you enter information, the eFile app will continuously add, calculate, and adjust credits and deductions based on your dependents, filing status, income, and expenses.

Start Federal and State Tax Returns

Additionally, if the foster child can be claimed as a dependent and they are enrolled in school, you may be eligible for various school-related tax deductions and education tax savings, such as The American Opportunity Tax Credit. Dependents on your tax return can help save you money when you earn taxable income and spend it on keeping up a home for your child and paying for their expenses.

Dependents on your tax return can help save you money when you earn taxable income and spend it on keeping up a home for your child and paying for their expenses.

See more details on these IRS publications:

- IRS Publication 501 - Dependents, Standard Deduction, and Filing Information

- IRS Publication 503 - Child and Dependent Care Expenses.

How to Claim a Foster Child on a Tax Return

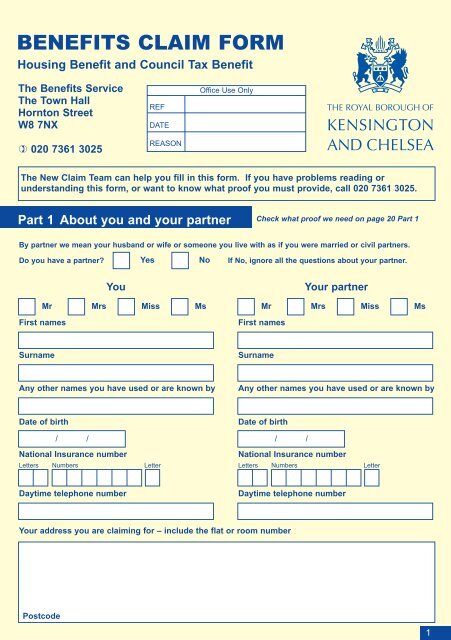

When filling out Form 1040 to file your income tax return, dependents are claimed on the first page by filling in their identifying details. Additional child or dependent forms include the Schedule 8812, Form 2441, and others - eFileIT these forms. Instead of filling in complicated forms to claim your foster child or other dependent, use eFile.com to prepare your return. The 1040, Schedule 8812, and all other applicable dependent tax forms are generated and filled out for you as you enter information. Does your foster child qualify as a dependent?

It's easy to claim your foster child on your tax return on eFile. com. Simply answer the questions about your dependent when you add them to your return and we will tell you what deductions and credits you qualify for. Contact an eFile.com Taxpert if you have further questions or concerns about tax breaks related to foster children.

com. Simply answer the questions about your dependent when you add them to your return and we will tell you what deductions and credits you qualify for. Contact an eFile.com Taxpert if you have further questions or concerns about tax breaks related to foster children.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Memo to guardians, custodians, foster parents on collecting alimony for the maintenance of wards

I. Sequence of actions.

1) According to Art. 60 of the Family Code of the Russian Federation, the child has the right to receive maintenance from his parents. In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from the parents in a judicial proceeding. In accordance with Art. 148 of the Family Code, children under guardianship (guardianship) are entitled to the alimony due to them.

In accordance with Art. 148 of the Family Code, children under guardianship (guardianship) are entitled to the alimony due to them.

It should be borne in mind that, by virtue of Art. 71 and 74 of the Family Code of the Russian Federation, deprivation of parental rights or restriction of parental rights does not relieve parents from the obligation to support their child.

Art. 145 of the Family Code of the Russian Federation regulates that guardianship or guardianship is established over children left without parental care for the purpose of their maintenance, upbringing and education, as well as to protect their rights and interests.

Thus, in order to protect the property rights of minors, the guardian (custodian), as the legal representative of the child, is obliged to control the fulfillment by parents of the obligation to pay child support. Therefore, if at the time of the establishment of guardianship (trusteeship) alimony from the parents of the ward child was not collected and paid on a voluntary basis, then the guardian (custodian) must file an application with the court for the recovery of alimony. This category of cases is considered by magistrates both at the place of residence of the guardian (custodian) and at the place of residence of the parents (one of them).

This category of cases is considered by magistrates both at the place of residence of the guardian (custodian) and at the place of residence of the parents (one of them).

2) In accordance with art. 33 of the FEDERAL LAW dated 02.10.2007 N 229-ФЗ "ON EXECUTIVE PROCEEDINGS" enforcement actions are performed by a bailiff at the place of residence, place of stay of the debtor.

The recoverer is a citizen in whose favor or in the interests of which a writ of execution has been issued. The debtor is a citizen who is obliged by an executive document to pay alimony.

Thus, the original writ of execution for the recovery of alimony is submitted by the recoverer to the department of the bailiff service at the place of residence (at the place of stay) of the debtor, or at the last known place of residence of the debtor,

In accordance with Art. 429 of the Civil Procedure Code of the Russian Federation for each court decision, only one writ of execution is issued. In order to prevent the loss of the writ of execution, you must first make a copy and mark the bailiff service on the acceptance of the writ of execution directly on its copy. It is also necessary to write an application with a request to initiate enforcement proceedings and attach to it a copy of the savings book opened in the name of the child.

It is also necessary to write an application with a request to initiate enforcement proceedings and attach to it a copy of the savings book opened in the name of the child.

3) In accordance with Art. 84 of the Family Code of the Russian Federation for children left without parental care, alimony is paid to the guardian (custodian) of the children or their adoptive parents.

Thus, if guardianship is appointed after the issuance of a writ of execution on the recovery of alimony from parents deprived of parental rights, then in accordance with Art. 44, 203 of the Civil Procedure Code of the Russian Federation, it is necessary to apply for a change in the procedure and method for executing a court decision. This application is submitted to the court that issued the decision on the recovery of alimony. The court issues a ruling on the replacement of the recoverer, which is sent to the parties in the case. This determination must be submitted to the department of the bailiff service, in whose production enforcement proceedings have been initiated.

4) After submitting the application and the original of the writ of execution to the bailiff service, the bailiff initiates enforcement proceedings, about which a “Decree on the initiation of enforcement proceedings” is issued, which is sent to the parties ..

5) You need to know that in accordance from Art. 50 of the FEDERAL LAW dated 02.10.2007 N 229-FZ "ON EXECUTIVE PROCEEDINGS", the parties to enforcement proceedings have the right to familiarize themselves with the materials of enforcement proceedings, make extracts from them, make copies of them, submit additional materials, file petitions, participate in enforcement actions, give verbal and written explanations in the process of performing enforcement actions, give their arguments on all issues arising in the course of enforcement proceedings, object to the petitions and arguments of other persons participating in enforcement proceedings, file challenges, appeal against the decisions of the bailiff, his actions (inaction ).

6) At the request of the party in the enforcement proceedings, the bailiff issues a ruling on the calculation of alimony arrears. As necessary, in accordance with the plan for the protection of the rights of the child, a copy of the resolution on the calculation of arrears of alimony must be submitted to the personal file of the ward

II. Alimony has not been received for a long time - what to do?

In accordance with the legislation of the Russian Federation, the main task of bailiffs is the enforcement of a court decision that has entered into legal force. In order to implement the above task, the bailiff requests from the tax inspectorate, the pension fund and other organizations information about the debtor's earnings and other income, bank accounts or property that can be foreclosed. Thus, if alimony is not received on the child’s account for a long time, this means that the bailiff cannot find the debtor, or his income or property, which can be foreclosed.

In this case, the law provides for certain opportunities for the bailiff, however, as a rule, these actions are performed by the bailiff only at the request of the claimant.

1) If the bailiff cannot find the debtor (the debtor does not live at the place of residence or at the place of the last known place of residence).

In this case, the bailiff, on his own initiative or at the request of the recoverer, issues an order to search for the debtor, which is approved by the senior bailiff.

2) If the bailiff cannot find the income or property of the debtor.

If the bailiff cannot find the debtor's income or property that can be seized, this can only mean that the debtor is deliberately hiding from the obligation to pay alimony. In this case, the legislation of the Russian Federation provides for some restrictive measures, as well as the liability of the debtor for failure to comply with the court decision.

In accordance with Art. 67 of the FEDERAL LAW dated 02. 10.2007 N 229-FZ "ON EXECUTIVE PROCEEDINGS" if the debtor fails to fulfill the requirements for the recovery of alimony, the bailiff has the right, at the request of the recoverer or on his own initiative, to issue a decision on a temporary restriction on the debtor's departure from the Russian Federation. Thus, if the court decision on the recovery of alimony is not executed for a long time, and also if this decision is not executed in full (i.e. there is a debt in paying alimony), then it is necessary to write an application to the department of the judicial service bailiffs with a request to temporarily restrict the debtor's departure from the Russian Federation.

10.2007 N 229-FZ "ON EXECUTIVE PROCEEDINGS" if the debtor fails to fulfill the requirements for the recovery of alimony, the bailiff has the right, at the request of the recoverer or on his own initiative, to issue a decision on a temporary restriction on the debtor's departure from the Russian Federation. Thus, if the court decision on the recovery of alimony is not executed for a long time, and also if this decision is not executed in full (i.e. there is a debt in paying alimony), then it is necessary to write an application to the department of the judicial service bailiffs with a request to temporarily restrict the debtor's departure from the Russian Federation.

In addition, the legislation of the Russian Federation provides for criminal liability of debtors for malicious evasion from paying alimony.

Thus, in the event of a long-term (usually more than 6 months) non-payment of alimony for the maintenance of a ward child, the guardian (trustee) must submit an application to the bailiff service with a request to consider the issue of bringing the parent (parents) to criminal liability.

In what cases is it possible to cancel the adoption - Legal advice

Andrey Izotov (Sayansk) 01/11/2017 Heading: Family

When we got married, my wife had a son. She made a condition that she would not give birth to a common child until I adopted her child. Motivated by the fact that after the birth of our common child, her son will have her last name. I adopted him. We got divorced because we had no common children. I got married a second time, I had a son. Suddenly, the ex-wife will file for alimony? The child is not mine, I do not want to pay child support for someone else's child. Can I opt out of adoption?

Alimony, Minor

Alexander Dyadishchev

Consultations: 63

Divorce in itself is not grounds for annulment of an adoption, but the law allows you to go to court to annul an adoption. The court has the right to cancel the adoption of the child even in the absence of your guilty behavior, when, due to circumstances both dependent and beyond your control, the relationship necessary for the normal development and upbringing of the child did not develop. On the basis of a court decision to cancel the adoption, information about the cancellation of the adoption is entered into the entry of the adoption act and the initial information about the last name, first name, patronymic, place and date of birth of the child, as well as information about the child's parents in the entry of the birth certificate is restored. The previously issued birth certificate is canceled, and a new birth certificate is issued, taking into account the changes made to the record of the birth certificate (Article 46 of the Federal Law of November 15, 201997 N 143-FZ "On acts of civil status").

On the basis of a court decision to cancel the adoption, information about the cancellation of the adoption is entered into the entry of the adoption act and the initial information about the last name, first name, patronymic, place and date of birth of the child, as well as information about the child's parents in the entry of the birth certificate is restored. The previously issued birth certificate is canceled, and a new birth certificate is issued, taking into account the changes made to the record of the birth certificate (Article 46 of the Federal Law of November 15, 201997 N 143-FZ "On acts of civil status").

According to Art. 142 of the Family Code of the Russian Federation, the right to demand the cancellation of the adoption of a child has his parents, adoptive parents of the child, an adopted child who has reached the age of 14, the guardianship and guardianship authority, as well as the prosecutor.

According to paragraph 1 of Art. 141 of the RF IC, the adoption of a child can be canceled in cases where the adoptive parents evade the fulfillment of the duties of parents assigned to them, abuse parental rights, abuse the adopted child, or are ill with chronic alcoholism or drug addiction.

In accordance with paragraph 2 of Art. 141 of the RF IC, the court has the right to cancel the adoption of a child on other grounds, based on the interests of the child and taking into account the opinion of the child.

In paragraph 19 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated 20.04.2006 N 8 "On the application by the courts of the law when considering cases of adoption (adoption) of children" it is explained that the court, based on paragraph 2 of Art. 141 of the Family Code of the Russian Federation, has the right to cancel the adoption of a child even in the absence of guilty behavior of the adopter, when, due to circumstances both dependent and independent of the adopter, the relations necessary for the normal development and upbringing of the child did not develop. These circumstances include, in particular:0005

lack of mutual understanding due to the personal qualities of the adopter and (or) the adoptee, as a result of which the adopter does not enjoy authority over the child or the child does not feel like a member of the adoptive parent's family;

detection after adoption of mental disability or hereditary deviations in the state of health of the child, which significantly complicate or make impossible the process of upbringing, about the presence of which the adoptive parent was not warned during adoption.