How does child support work with unemployment

Child Support and Unemployment - Questions and Answers

What authority does the Arizona Department of Economic Security, Division of Child Support Services (DCSS) have to take my Unemployment Insurance (UI) benefit?

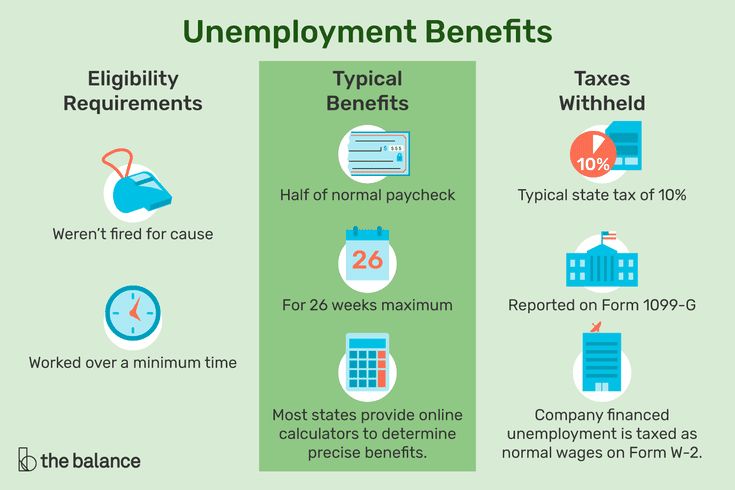

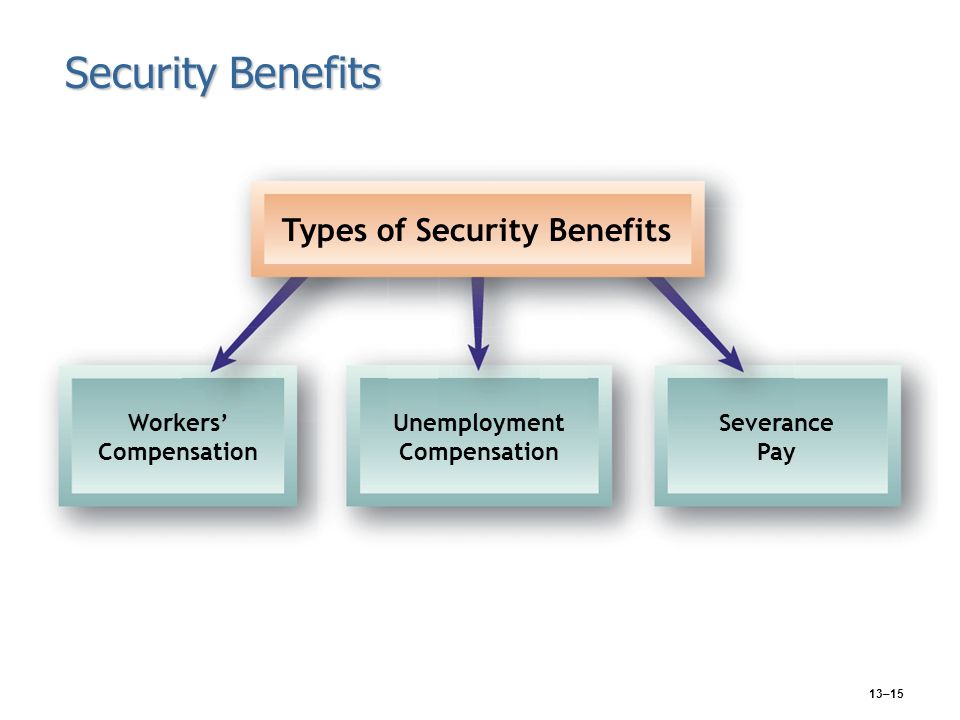

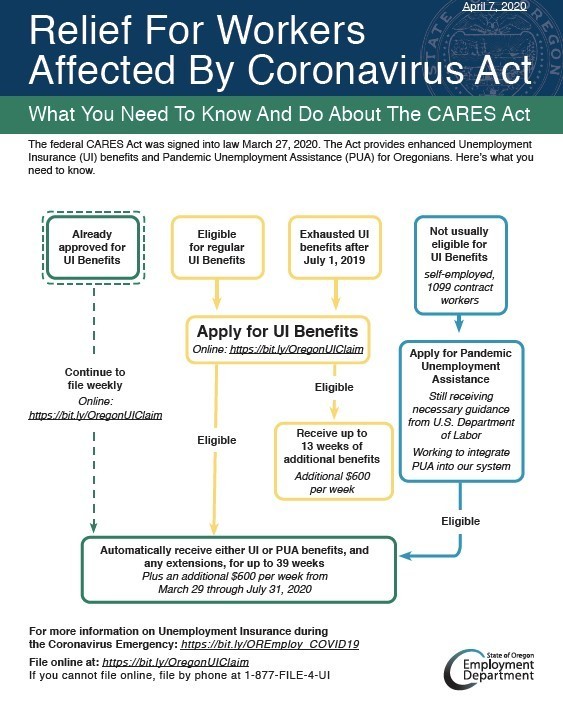

For parents involved in child support through the State’s IV-D program, DES is required by statute to deduct their child support obligation from UI benefit payments: A.R.S. § 23-789. DES Child Support receives an electronic notification when the parent owing child support applies for UI. DES will enforce an obligation by deducting child support from unemployment compensation up to 50 percent of the total UI benefit amount.

What if I lose/lost my job?

Child support is designed to help parents fulfill their responsibility for their child’s well-being and help to ensure the child’s needs are met. The parent who is court-ordered to pay child support (aka paying parent or obligor) is still obligated to pay child support when unemployed. If the paying parent were to skip payments, or be unable to pay, he/she will accrue arrears and interest. We encourage both paying parents and parents receiving child support to visit www.azui.com to apply for unemployment insurance benefits as soon as possible after losing employment. Parents should also contact DCSS by visiting our website https://des.az.gov/dcss when there are any changes that may impact their child support case(s).

How much child support will be deducted from my unemployment insurance payment?

The DCSS will deduct up to 50% of the unemployment insurance benefit to apply towards any child support obligation owed. This amount includes the additional $600 and $300 from the extension of the unemployment insurance benefit that a claimant may receive as a result of COVID-19.

A child support payment was withheld from my Unemployment Insurance (UI) Benefit, but I already paid my full obligation for the month. What do I do?

The Social Security Act requires states to have automated processes for withholding child support payments from UI benefits. Up to 50 percent of the total benefit amount or the total amount of support owed, whichever is less, may be withheld. If you are receiving UI benefits, you should only make additional child support payments if your total obligation is not met by the withheld amount. If you made your payment and your obligation has been met prior to the withholding, your case will be reviewed, and you will receive a refund in the amount of excess funds received. The process may take up to 5 business days. We encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

If you are receiving UI benefits, you should only make additional child support payments if your total obligation is not met by the withheld amount. If you made your payment and your obligation has been met prior to the withholding, your case will be reviewed, and you will receive a refund in the amount of excess funds received. The process may take up to 5 business days. We encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

A child support payment was withheld from my Unemployment Insurance (UI) Benefit, but I already had a payment withheld from my paycheck for this month. What do I do?

If DCSS withheld a child support payment from your UI benefits and it exceeds the amount owed on your case including any past due support (arrears), your case will be reviewed, and the excess amount will be refunded to you. The process may take up to 5 business days. You do not need to do anything to initiate this process. If you still have questions about your case, we encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

You do not need to do anything to initiate this process. If you still have questions about your case, we encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

A child support payment was withheld from my regular Unemployment Insurance (UI) Benefit. Will additional money be withheld from the additional $600 and $300 extension of the Federal Pandemic Unemployment Compensation (FPUC) if I am eligible for the payment?

Yes. Fifty percent (50%) will be withheld from your Federal Pandemic Unemployment Compensation (FPUC) payments. If past-due support (arrears) is owed on the child support case, the additional money collected will apply to the current support debt and then to other child support debt obligations. If a paying parent is current on their child support case with no outstanding debt, the result of the weekly UI payments, additional retroactive UI payments, FPUC or additional sources of payments may result in an overpayment of child support. If this occurs, your case will be reviewed to determine if a refund is appropriate. This process does not require action or input from the paying parent to receive a refund. The process may take up to 5 business days. We encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

If this occurs, your case will be reviewed to determine if a refund is appropriate. This process does not require action or input from the paying parent to receive a refund. The process may take up to 5 business days. We encourage clients to access the AZ Child Support Portal to conduct services online, via email or by calling Customer Service at 1-800-882-4151 Monday - Friday 7:00 a.m. to 5:30 p.m.

For example: A paying parent owes $500 per month in current support, in addition to the $8 handling fee, and a $50 payment on arrears, which totals $558 for the monthly obligation. However, the paying parent is also $5,000 in past due support (arrears).

The paying parent is receiving an UI benefit payment of $320 per week. The deduction from the DCSS is 50% of the weekly UI amount, which equals $120 per week, totaling $480 (for four weeks). As a result, the monthly obligation is not fully met with the UI benefit. $558-$480 = $78 remaining due.

Note: If additional sources of money are withheld (from an employer, federal offset, or additional payment of FPUC, etc. ) and applied to a case, the monthly obligation could be met very quickly.

) and applied to a case, the monthly obligation could be met very quickly.

The paying parent was also eligible for FPUC. As a result, an additional $300 (fifty percent (50%) of the $600 weekly benefit amount) is withheld from the UI benefit amount and applied to the case

- After one weekly FPUC payment, the monthly obligation is exceeded ($480+$300=$780).

- After four weekly payments of FPUC the amount is even greater ($480+1,200 = $1,680).

The $558 monthly obligation is now met; and $1,122 is applied to other child support debt (resulting in $1,122 being paid towards past due support).

In the scenario, if there is no past due support (arrears) due, the additional money withheld would be refunded back to the paying parent.

Now that I lost my job, what about health insurance?

The child support order specifies who is responsible for providing health insurance coverage. If there has been a significant change in circumstances, either party may contact DCSS for additional information, including a request for modification of the child support order. For additional questions related to your child support case, please contact DCSS Customer Service at 1-800-882-4151, Monday through Friday from 7:00am-5:30pm. DES is committed to providing assistance to DES communities during the COVID-19 outbreak to meet their basic needs. For additional information related to medical assistance, visit https://www.healthearizonaplus.gov/ or call (855) 432-7587.

For additional questions related to your child support case, please contact DCSS Customer Service at 1-800-882-4151, Monday through Friday from 7:00am-5:30pm. DES is committed to providing assistance to DES communities during the COVID-19 outbreak to meet their basic needs. For additional information related to medical assistance, visit https://www.healthearizonaplus.gov/ or call (855) 432-7587.

Will my unemployment benefit amount be increased if I owe child support?

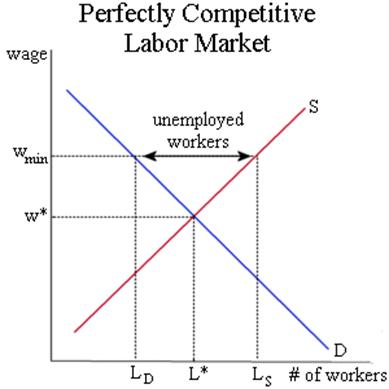

The State of Arizona calculates your unemployment insurance benefit based on your previous income and not based on your monthly expenses. Since child support payments are expenses, your child support obligations will not increase your unemployment insurance benefit amount. Child support will be deducted from your unemployment insurance benefits up to 50% as child support payments are necessary to help ensure that the child's needs are met.

If I am not meeting my child support obligation, am unable to pay, do not qualify for unemployment insurance benefits or am not able to find employment as a result of COVID-19, what actions will the DCSS take?

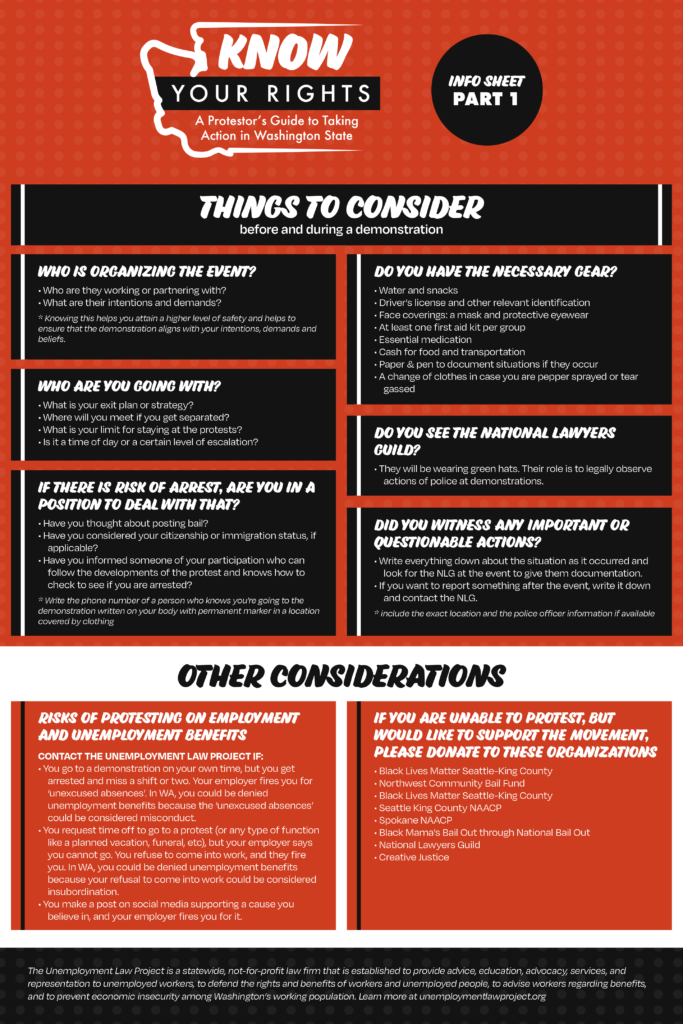

The paying parent or obligor should continue to work with the child support program, family court and the child's other parent during their unemployment. The unemployed parent should document his or her ongoing job search in addition to any other relief or programs that are assisting with the impacts of COVID-19. Every effort should be made to stay compliant with the child support order. Visit the DCSS child support website for payment options and frequently asked questions regarding modifications. Additional resources on assistance and programs available in Arizona can be found at the Arizona Together website.

The unemployed parent should document his or her ongoing job search in addition to any other relief or programs that are assisting with the impacts of COVID-19. Every effort should be made to stay compliant with the child support order. Visit the DCSS child support website for payment options and frequently asked questions regarding modifications. Additional resources on assistance and programs available in Arizona can be found at the Arizona Together website.

Now that I am not earning the same income and my employer is no longer garnishing my wages, can I change my current child support order?

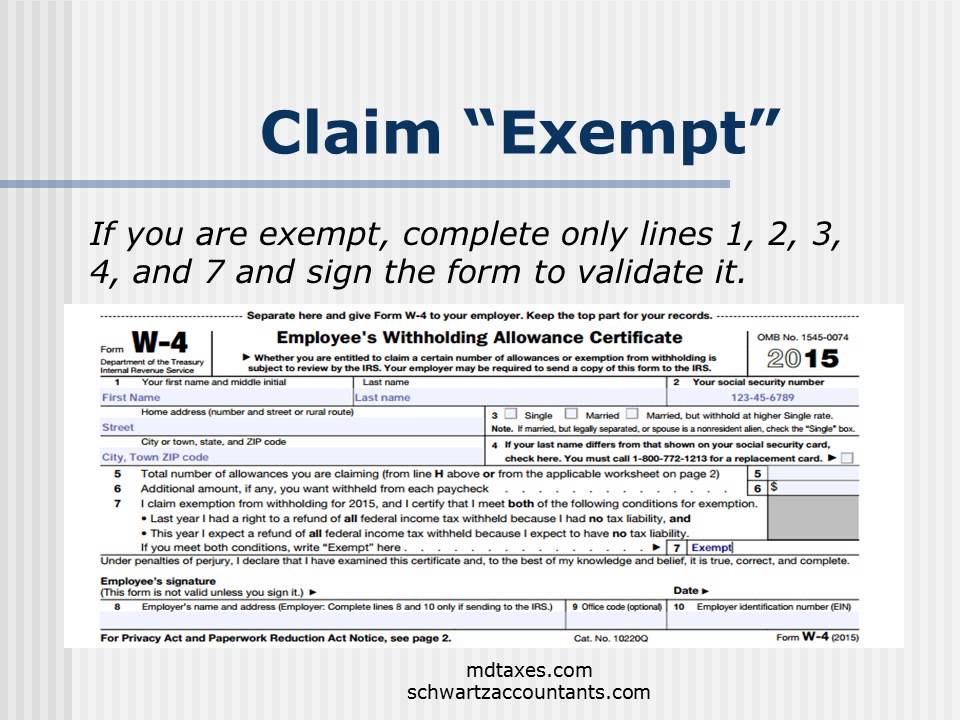

A child support order will only be altered if a parent seeks modification. If you are unemployed, receive a reduced salary, or have some other involuntary loss of income, the best course of action is to contact DCSS and request a modification. Since child support obligations are established by court order, requests for a modification of the amount must be filed with the courts. A temporary order may be granted by the courts due to COVID-19 related unemployment. Until the court modifies the child support order, the parent is responsible for continuing to pay the currently ordered amount. Before seeking to modify your child support order, you should obtain information on what unemployment insurance benefits will be available to you. Unemployment insurance benefits are considered income for the purposes of child support. Arizona’s Child Support Guidelines require the inclusion of unemployment benefits received. The court will need this information to determine if a modification is warranted. Additional information on child care expenses and medical insurance expenses can

Until the court modifies the child support order, the parent is responsible for continuing to pay the currently ordered amount. Before seeking to modify your child support order, you should obtain information on what unemployment insurance benefits will be available to you. Unemployment insurance benefits are considered income for the purposes of child support. Arizona’s Child Support Guidelines require the inclusion of unemployment benefits received. The court will need this information to determine if a modification is warranted. Additional information on child care expenses and medical insurance expenses can

also affect the child support obligation and may affect the outcome of a modification request.

Does the state pay child support if the paying parent does not pay as a result of a lost job?

No, child support is paid by the paying parent and not the state. Additional resources on assistance and programs available in Arizona can be found at the Arizona Together website.

If I already receive child support payments by electronic pay card (EPC), how will I receive my unemployment insurance benefit payment?

Your unemployment insurance benefits and child support payments are deposited into the same debit card. If a debit card is already active for child support payments, a second debit card will not be issued.

How Does Unemployment Affect Child Support?

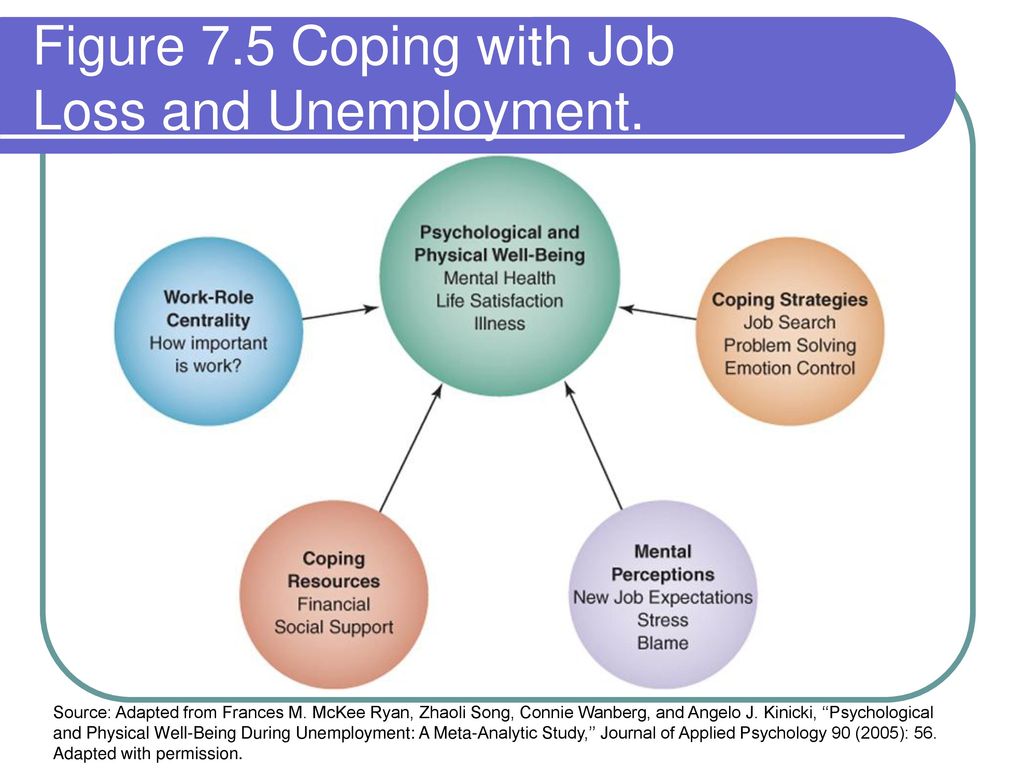

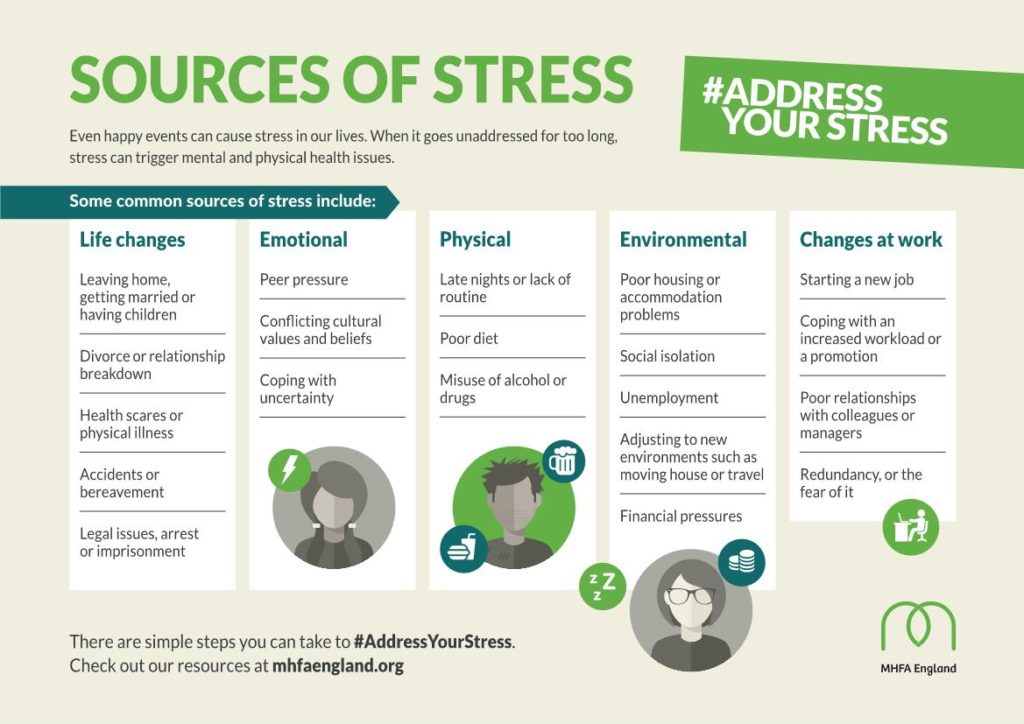

Unemployment is a scary situation for anyone to face. Unfortunately, it has affected millions of Americans over the past year and a half. If you are a divorced parent who either pays or receives child support, unemployment presents special challenges.

Whether on the giving or the receiving end of child support, it’s vital to understand how unemployment affects child support calculations. In this article, we want to help answer some frequently asked questions on this topic, including:

- Do I still have to pay child support if I become unemployed?

- Will my child support calculation change automatically if I lose my job or become unemployed?

- If I receive unemployment benefits, will those be factored as income into my child support calculation?

These same questions could also be asked from the perspective of the parent on the receiving end of the child support.

The divorce and child custody attorneys at Joseph, Hollander & Craft hope to alleviate some of the tension associated with child support proceedings by shedding light on these important issues and answering several frequently asked questions below.

How does child support work?

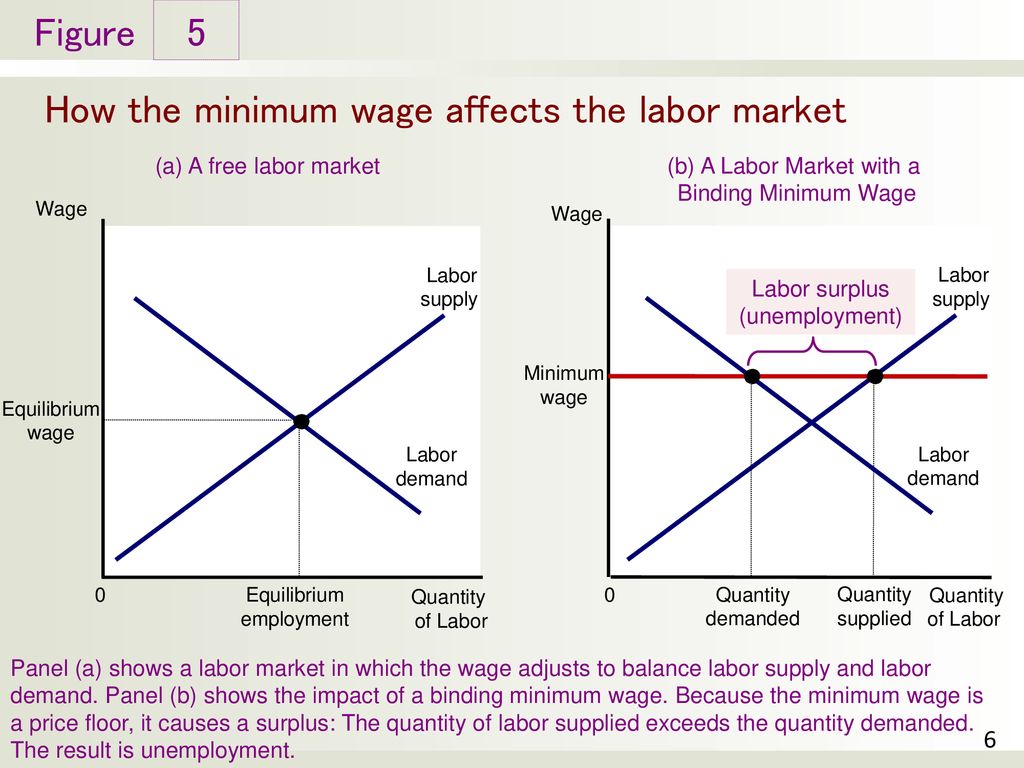

Kansas law requires that both parents financially support their children. When the parents decide to obtain a divorce, the court may order one parent, typically the nonresidential parent or the parent with less custody, to pay child support to the other. The child support is to be used to support only the child financially.

When deciding whether child support should be applied and the amount to be paid, the court applies complex guidelines. Once child support is ordered, the parent paying child support must follow the court’s ruling and make timely payments as scheduled.

What happens if I don’t pay child support?

If the parent required to pay child support does not pay, then they are deemed non-compliant and are in arrears (i. e., unpaid child support). A parent who is non-complaint may then be subject to sanctions or be found in contempt of court. Sanctions may include withholding the non-compliant parent’s income, garnishing bank accounts, or creating a lien on personal property, such as vehicles or boats. In more severe cases, the court may also subject the non-compliant parent to jail time and/or fines. It is important for the custodial parent during this time to continue visitation of the children with the non-compliant parent, even if they are failing to pay child support.

e., unpaid child support). A parent who is non-complaint may then be subject to sanctions or be found in contempt of court. Sanctions may include withholding the non-compliant parent’s income, garnishing bank accounts, or creating a lien on personal property, such as vehicles or boats. In more severe cases, the court may also subject the non-compliant parent to jail time and/or fines. It is important for the custodial parent during this time to continue visitation of the children with the non-compliant parent, even if they are failing to pay child support.

In general, once the child support order is issued, the child support can only be changed if one of the parties files for a modification. In Kansas, child support may also cease when the child reaches the age of majority, 18 years old. However, if the child turns 18 while still in high school, then the child support automatically continues until the end of the school year.

If my income changes, will child support change automatically?

After an order has been issued finalizing child support, the only way to reduce or change the child support amount is to file a motion with the court to request modification of the order. If the modification is filed within three years of the previous child support order or modification, then the court will only modify it if there is a showing of a material change in circumstances.

If the modification is filed within three years of the previous child support order or modification, then the court will only modify it if there is a showing of a material change in circumstances.

A material change in circumstances usually requires the parent seeking the modification to show that the change in income would result in a ten percent adjustment of the child support. Therefore, it is important to allege a significant change in income when filing a motion for modification of child support. If you are filing a motion that is past three years from the previous modification or order, then a showing of a material change in income is not required.

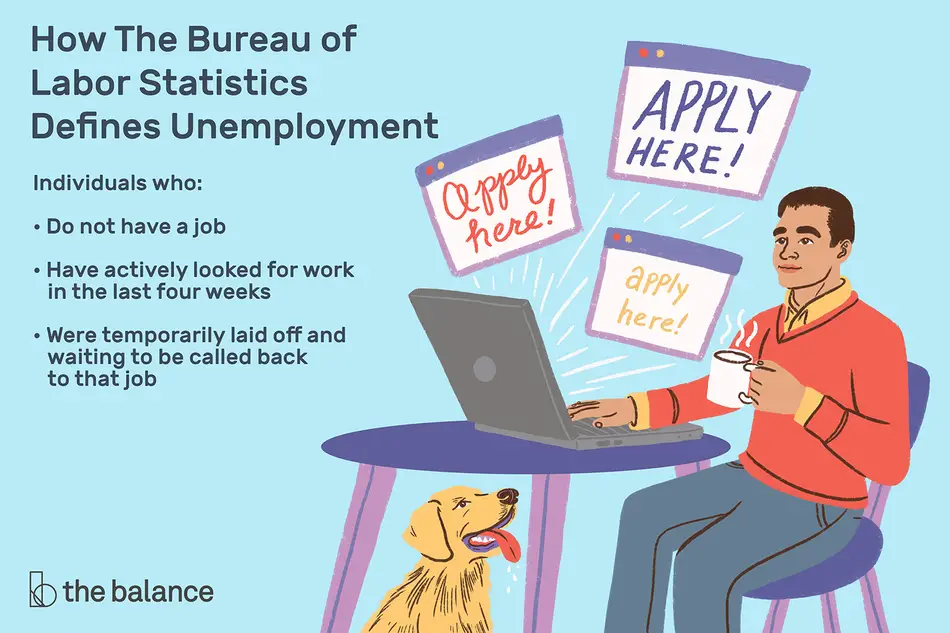

If I become unemployed do I still have to pay child support? If my ex or former partner is now unemployed do they still have to pay child support?

Simply put, yes. Becoming unemployed does not change your or an ex/former partner’s obligation to pay child support. When calculating child support for an unemployed parent, the court will base its calculation on the unemployed parent’s imputed income rather than their actual income.

The court typically will determine imputed income by what the parent could have earned if they were working based on their employment history, job skills, past earnings, current opportunities for employment in the area, and their education. Typically this computes to the average minimum wage in that given area.

Child support is then calculated and ordered based on the supporting parent’s imputed income. If the parent does not want imputed income to be applied in determining child support, the parent will need to provide evidence to contest its application, such as showing they have attempted to retain employment through going to interviews or are maintaining contact with an unemployment agency.

Need Help With Your Divorce or Child Support Matter? We Are Here to Help.

Divorce is a complex domestic legal matter that can often tie into other areas of our lives including our jobs and families. Having an experienced attorney who knows how to navigate foreseen or unforeseen unemployment and child support matters will not only ease the process, but ensure you are adequately represented.

The family law attorneys at Joseph, Hollander & Craft are available to help you with your child support and divorce matters. Please reach out for a consultation today.

Alimony from the unemployed \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Alimony from the unemployed

A selection of the most important documents on request Alimony from the unemployed (regulations, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of the spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

- Employment and employment:

- Vitle position

- Vitant position is

- Labor exchange payments

- Guarantees for pregnant women

- Guarantees for pregnant women during employment

- More.

..

..

Judicial practice : Alimony from the unemployed

Register and receive trial access to the ConsultantPlus system Free 2 days

Open the document in your system consultantPlis:

Cassation ruling for the administrative collegium for the Verdian court of the Russian court Federation dated 11/11/2020 N 4-КАД20-14-К1

Demand: On recognizing as illegal the decision of the bailiff on the calculation of arrears in the payment of alimony, imposing the obligation to cancel the resulting debt.

Circumstances: The debtor refers to the fact that he did not evade paying alimony, since the child lived with him for the entire period of time specified in the decision and was fully supported by him.

Decision: The claim was satisfied in part, since the collection of alimony was not carried out through no fault of the debtor, therefore, the alimony arrears could be calculated for the past time only within the three-year period preceding the presentation of the writ of execution. clarification of the reasons for this circumstance is not the basis for applying the provisions of paragraph 2 of Article 113 of the Family Code of the Russian Federation to those that arose between the administrative plaintiff and the recoverer, who voluntarily withdrew the executive document in April 2014, living with the child until 2018 in the apartment of the debtor and his mother.

clarification of the reasons for this circumstance is not the basis for applying the provisions of paragraph 2 of Article 113 of the Family Code of the Russian Federation to those that arose between the administrative plaintiff and the recoverer, who voluntarily withdrew the executive document in April 2014, living with the child until 2018 in the apartment of the debtor and his mother.

Articles, Comments, answers to questions : Alimony from the unemployed

Register and receive trial access to the ConsultantPlus system Free 2 days

Open the document in your system consultantPli:

Article: On the need to change the need to change rules and practice for determining the amount of alimony for minor children

(Shelyutto M.L.)

("Law", 2018, N 6) Calculation of alimony based on estimated, not actual income. It would seem that such an approach is similar to the rules on calculating the debt for alimony of a non-working debtor (as well as in the absence of information about the debtor's income) based on the average wage in the Russian Federation (clause 4 of article 113 of the UK, part 3 of article 102 of the Law on enforcement proceedings). However, the expected income is established by the court individually, depending on the personal potential of the debtor (his professional skills, qualifications, type of activity, earnings in previous years, health status, age, the presence of other barriers to employment or full employment, property security) and opportunities to receive income from taking into account these circumstances, as well as the local labor market. This is the amount of income that is reasonable to expect from the debtor in his particular circumstances.

However, the expected income is established by the court individually, depending on the personal potential of the debtor (his professional skills, qualifications, type of activity, earnings in previous years, health status, age, the presence of other barriers to employment or full employment, property security) and opportunities to receive income from taking into account these circumstances, as well as the local labor market. This is the amount of income that is reasonable to expect from the debtor in his particular circumstances.

Normative acts : Alimony from the unemployed

"Family Code of the Russian Federation" dated 12/29/1995 N 223-FZ

(as amended on 08/04/2022)

(as amended and supplemented, effective from 01/09/09) .2022)1. In the absence of an agreement between the parents on the payment of maintenance for minor children and in cases where the parent obliged to pay maintenance has irregular, changing earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in proportion to the earnings and (or) other income of the parent is impossible, difficult or significantly violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

How to collect alimony from the unemployed

If you are divorced and you have minor children, then the question arises about their maintenance, because the father (mother), who lives separately from the child, is obliged to participate in his upbringing and deduct alimony.

However, not all parents are responsible. Some deliberately do not pay alimony, referring to the lack of financial security, and then the money has to be collected through the court. If the parent (mother) is officially employed (on), then usually alimony is deducted from his (her) salary. But what if the father (mother) is unemployed (on)?

How to determine the amount of maintenance if the parent (mother) does not work?

If a person does not officially work, then the court assigns alimony in a fixed amount of money. This means that the amount of alimony is fixed. By filing a lawsuit, you yourself prescribe the amount that is needed monthly to keep your child. But you can't just come up with that amount because you feel like it. You must justify why so much money is needed (for example, treatment or rehabilitation, etc.) and support this with evidence.

But you can't just come up with that amount because you feel like it. You must justify why so much money is needed (for example, treatment or rehabilitation, etc.) and support this with evidence.

If you do not provide the court with evidence or there is not enough evidence, the court will order a smaller amount of support. In this case, the court takes into account such factors as the state of health and financial situation of the alimony payer and the child, the presence of other children, disabled parents, the presence of movable, immovable property, intellectual property rights, funds, etc. in the alimony payer.

What is the minimum guaranteed and minimum recommended support amount?

The minimum guaranteed amount of child support is determined according to the age of the child and cannot be less than 50% of the subsistence minimum for a child of a certain age. For example, in 2022, the cost of living for a child under 6 years old is as follows:

- from January 1 to June 30, 2022 - UAH 2100;

- from July 1 to November 30, 2022 - UAH 2201;

- from December 1 to December 31, 2022 - 2272 UAH.

This means that the minimum guaranteed amount of support for a child under 6 years old will be:

- from January 1 to June 30, 2022 - UAH 1050;

- from July 1 to November 30, 2022 - UAH 1100.5;

- from December 1 to December 31, 2022 - 1136 UAH.

For children aged 6 to 18, the minimum guaranteed amount of alimony will be as follows: 1309 UAH (01.01 - 06.30.2022), 1372 UAH (01.07 - 30.11.2022), 1416.5 UAH (01.12 - 32.1).

Therefore, if the parent (mother) does not work, then the amount of maintenance cannot be lower than the minimum guaranteed amount.

The minimum recommended amount of maintenance is determined by the court if the maintenance payer has sufficient earnings. This amount is equal to the subsistence minimum for a child of a certain age.

However, even if the father (mother) is unemployed (on), the court will still investigate his (her) expenses. And if the expenses exceed the monthly income (for example, an apartment, a car, etc. was purchased), but he (she) cannot prove the source of the funds, the court takes this into account when determining the amount of alimony.

was purchased), but he (she) cannot prove the source of the funds, the court takes this into account when determining the amount of alimony.

Family Lawyer in Vinnitsa

Call +38 096 109 76 08

I will advise. I'll take care of your business. I will protect your rights

Can I claim unemployment support?

Yes. If a parent (mother) is registered with an employment center and receives social assistance, then alimony is collected from her.

Is it possible to collect alimony for the time when the payer did not work?

Yes. If the child support payer was unemployed when the debt arose, but is now officially employed, then the debt will be paid from the wages he receives now.

Maintenance debt can be collected even if the payer was not working at the time of its occurrence and is not working now. In this case, the debt will be paid at the average wage in a particular locality.