How to calculate overnights for child support

Calculate Parenting Time and Overnights Instantly with Software

Custody X Change instantly calculates your exact parenting time for any period, past or future.

Custody X Change is software with a visitation timeshare calculator.

Calculate My Parenting Time Now

The data is crucial throughout your custody process.

- As you build a custody calendar, the time per parent updates with each click, helping you compare arrangements and reach your ideal percentage.

- When you present a schedule to the other parent or a judge, providing a breakdown of time informs the discussion, plus demonstrates your preparedness.

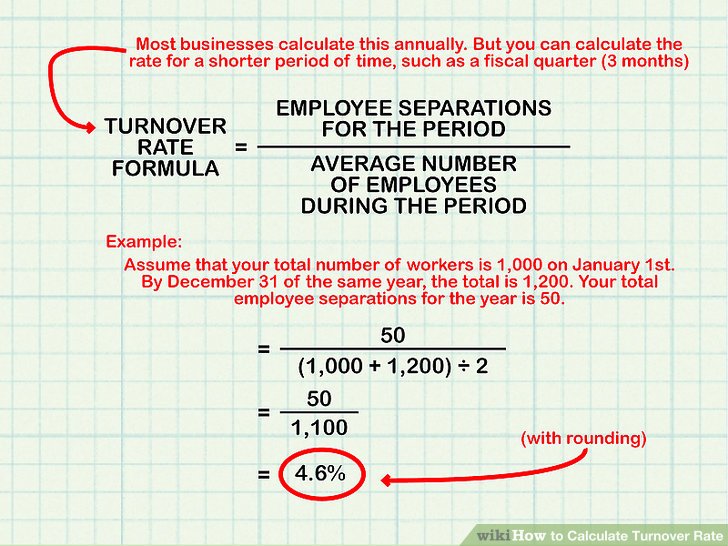

- To calculate child support, most state formulas require parenting time percentages. An exact figure can benefit you by thousands of dollars each year.

- If you settle, detailed parenting time information adds an element of professionalism to your agreement, increasing the likelihood of it getting approved.

- Even after you have a custody order, a parenting time calculator keeps you in compliance with the timeshare awarded, so you stay in good standing with the court.

Without software, there's no way to get accurate numbers. Even lawyers without software have to estimate, which can be a costly mistake. Let Custody X Change do the work, with features like:

Visual reports

Your Custody X Change parenting time report uses graphs and charts to show how parents divide caretaking during any period. The level of detail and variety of calculations can bolster proposals you make in negotiations, a settlement filing or a trial.

Continuous calculations

Your timeshare data updates continuously in your report and above your calendar, so you can see instantly how even small schedule adjustments — like moving exchange times, adding holidays, etc. — affect your parenting time. No more redoing tedious math every time you tweak the calendar.

Customizations

Choose any time period to calculate, past or future. Decide whether to count by hour or by overnight visit. Assign each parent a color for the graphics in the report. You can make countless customizations like these until the parenting time calculations meet your distinct needs.

You can make countless customizations like these until the parenting time calculations meet your distinct needs.

Nonparent time

Most children have moments when they're not with a parent: during school, visits to grandparents, etc. Mark these as third-party time to remove them from parenting time calculations. You'll be surprised how marking just a few instances of third-party time can affect your timeshare significantly.

Actual parenting time

In addition to planned parenting time, Custody X Change calculates actual parenting time, which takes into account instances when parents strayed from the schedule. Use the actual time report — which demonstrates visually how off-schedule parents have gotten — to discuss schedule changes with the other parent, motivate them to stick to the plan better, or ask the court for a modification.

Testimonials

Here's what some of our customers have said:

The software was very easy to use and … spared us from having to do the tedious task of counting days on a calendar. I would recommend this product to any parent who has to establish a custody schedule.

I would recommend this product to any parent who has to establish a custody schedule.

Chimena Taylor – San Diego, CA

It has saved several hours of pushing a pencil and rearranging days back and forth. The best part is that it figures out the ... time with each parent each month. Well worth the money, do it yourself and hand it to your attorney.

Ruth Ballard – Standish, ME

It breaks the time share down so you can come up with a true shared parenting schedule. It helped me so much and I was pro se against a family law specialist.

Stacie Staples – Arroyo Grande, CA

Custody X Change is software with a visitation timeshare calculator.

Calculate My Parenting Time Now

Custody X Change is software with a visitation timeshare calculator.

Calculate My TimeWisconsin Child Support Calculators & Worksheets 2023

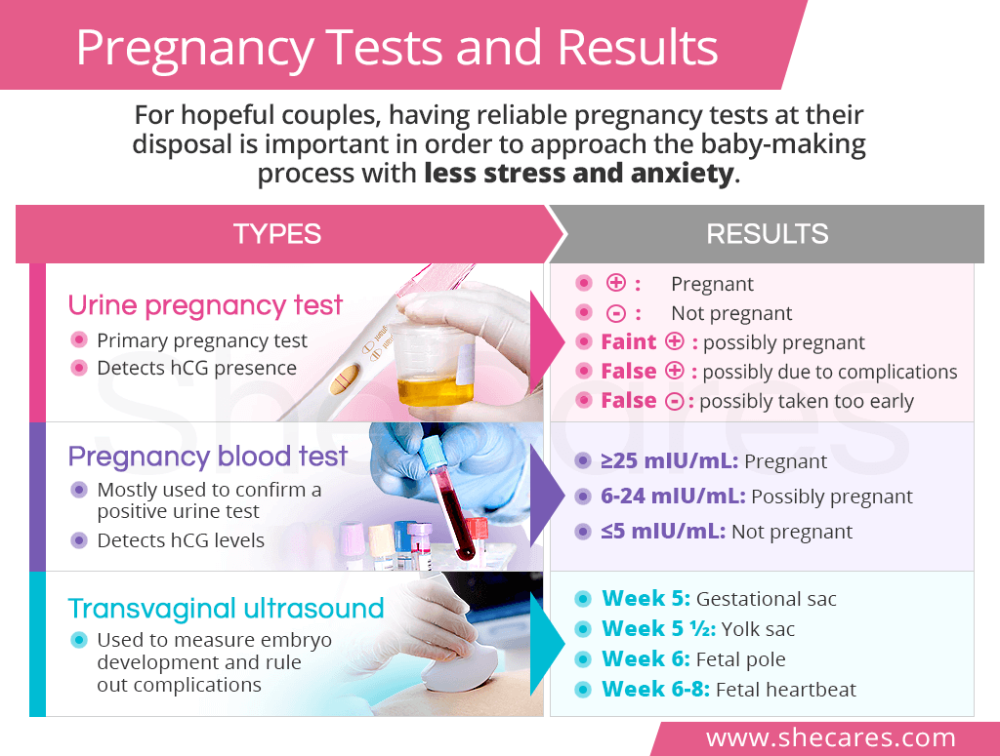

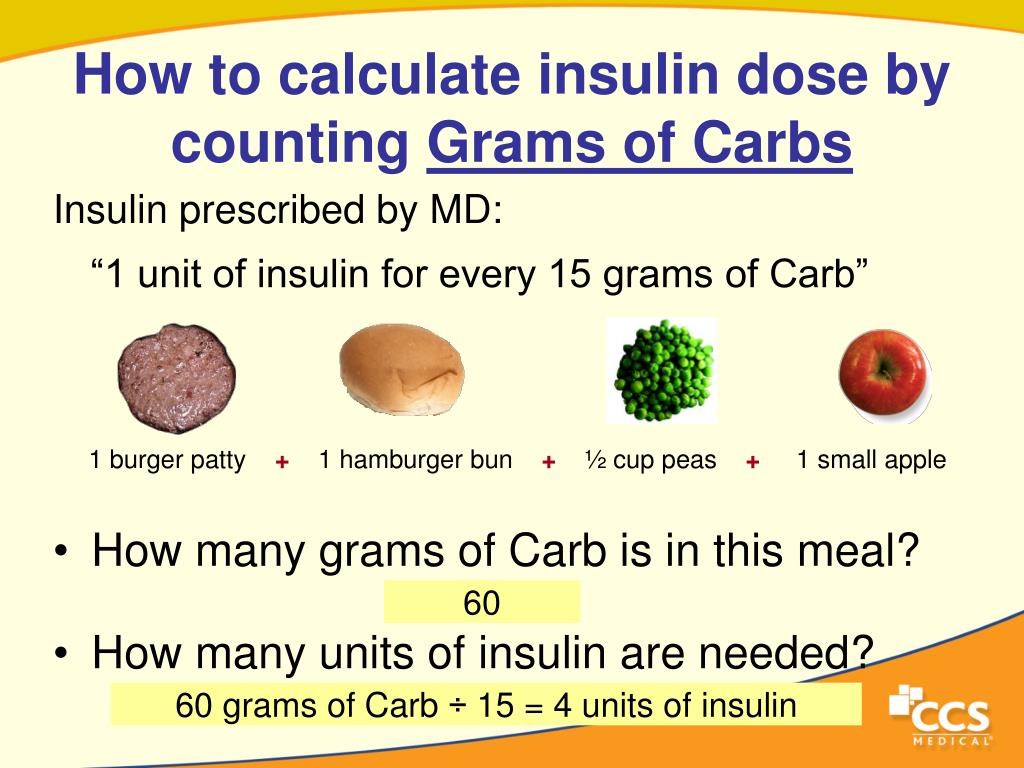

Wisconsin uses overnights, or where the children sleep, to determine how much child support should be paid by the non-residential parent. Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Book My Consult

Calculate Child Support

Use the calculators below to estimate child support payments.

Shared Custody Child Support Calculator

Sole Custody Child Support Calculator

Be aware when using the phrase, child custody, legally we are not talking about spending time with the child(ren) nor does child custody impact child support payments. The phrase child custody from the court's perspective is defined as decision-making responsibility. The correct legal term for time with the child(ren) is placement. Placement or time spent with the child(ren) does directly impact child support obligations, while child custody or decision-making does not impact child support obligations.

How To Calculate Child Support in Wisconsin

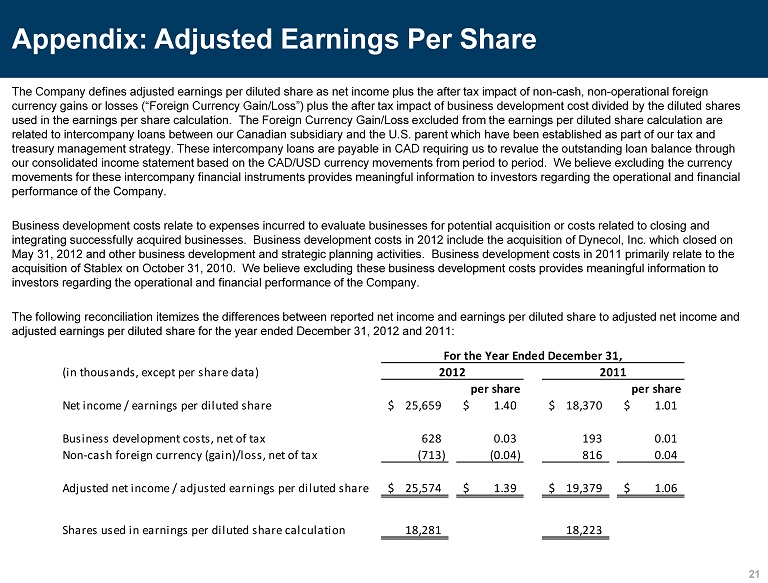

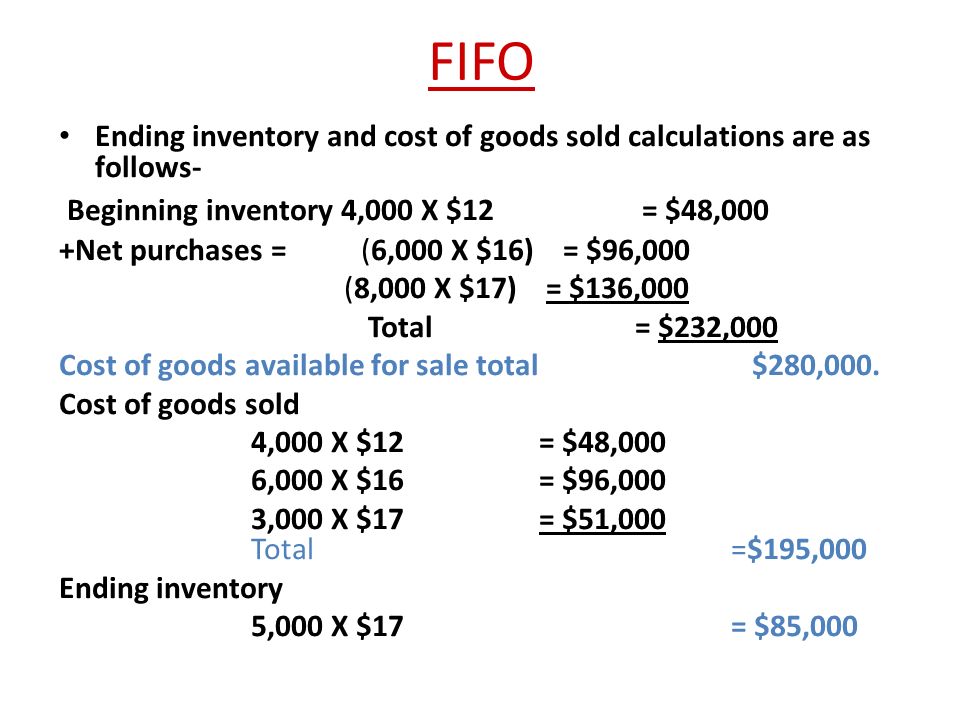

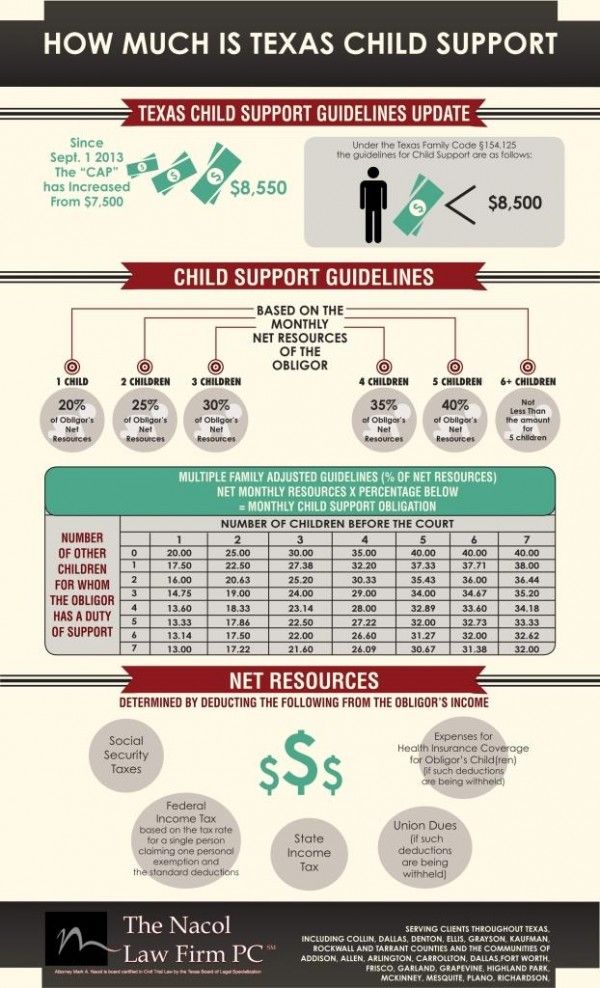

Every state has set child support guidelines as well as several different child support worksheets you can fill out. There are also options when determining child support. In Wisconsin, our support order guidelines help determine the amount due from one spouse to the other in the event of a divorce or legal separation. Below you will find the type of information you need to as well as the percentages required for payment based on Wisconsin DCF 150. First, we need to calculate the paying party's net income. To determine net income we need to add up monies considered income like the following:

- Wages

- Overtime work

- Commissions

- Tips

- Bonuses

- Rental income

- Interest income

Once the gross income is determined the court will determine the net income of the paying party. This is not done by using tax returns rather the court will deduct social security taxes, federal income taxes based on the tax rate for a single person claiming one personal exemption and the standard deduction, state income tax, union dues, and expenses for the cost of health insurance for the child. It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

Wisconsin Child Support Guidelines for Shared Custody

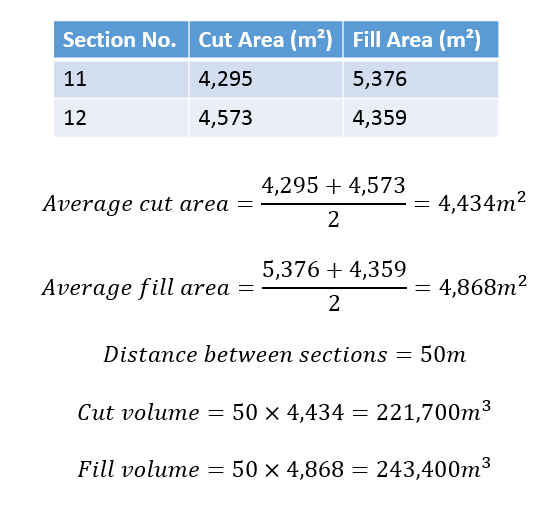

Yes, one parent will be obligated to pay child support unless both parents spend the exact amount of time with the child and earn the exact same income, which is rare. Wisconsin child support laws say that a shared placement formula can be used if certain guidelines are met. Typically the court will approve the use of this formula when:

- if the parenting plan states that both parents will have the children at least 92 overnights per year

- if the parenting plan states each parent will pay for the child’s basic needs proportionately to the time each parent has placement of the child.

The Wisconsin 50/50 Child Support formula is based on the Percentage Standard guideline in conjunction with the time spent with each parent. The Percentage Standards guidelines are as follows:

For a detailed worksheet on how the Wisconsin Shared-Placement formula works download the worksheet here.

To refer directly to DCF 150 review the section labeled DCF 150.035(2)(b) Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Wisconsin Shared Custody Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter Parent A's YEARLY gross income (before taxes)

Income Parent A *

Enter Parent B's YEARLY gross income (before taxes)

Income Parent B *

Parent A Zero Out Subtotal

Parent A Child Support Percentage

Parent A Obligation Subtotal

Parent B Zero Out Subtotal

Parent B Child Support Percentage

Parent B Obligation Subtotal

How many minor children? * 1 Child2 Children3 Children4 Children5+ Children

Percent of time the Children spend with Parent A * 25%30%35%40%45%50%55%60%65%70%75%

Percent of time the Children spend with Parent B * 75%70%65%60%55%50%45%40%35%30%25%

150 Multiplier

Parent A: 274 Overnights

Parent B: 91 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A: 255 Overnights

Parent B: 110 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 237 Overnights

Parent B: 128 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 219 Overnights

Parent B: 146 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 200 Overnights

Parent B: 165 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 183 Overnights

Parent B: 182 Overnights

Example: Alternating weeks where the first week parent A has three overnights (i.e. Wednesday, Thursday & Friday night) and during the second week four overnights (i.e. Wednesday, Thursday, Friday & Saturday night).

Parent A: 165 Overnights

Parent B: 200 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 146 Overnights

Parent B: 219 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 128 Overnights

Parent B: 237 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 110 Overnights

Parent B: 255 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 91 Overnights

Parent B: 274 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A's Estimated Payment to Parent B

Parent B's Estimated Payment to Parent A

Subtotal A-B Zero Out

Subtotal A-B

Estimated Monthly Support Payment

Subtotal B-A Zero Out

Subtotal B-A

Estimated Monthly Support Payment

* Required

Are you ready to move forward? Call

(262) 221-8123

to schedule a strategy session with one of our attorneys.

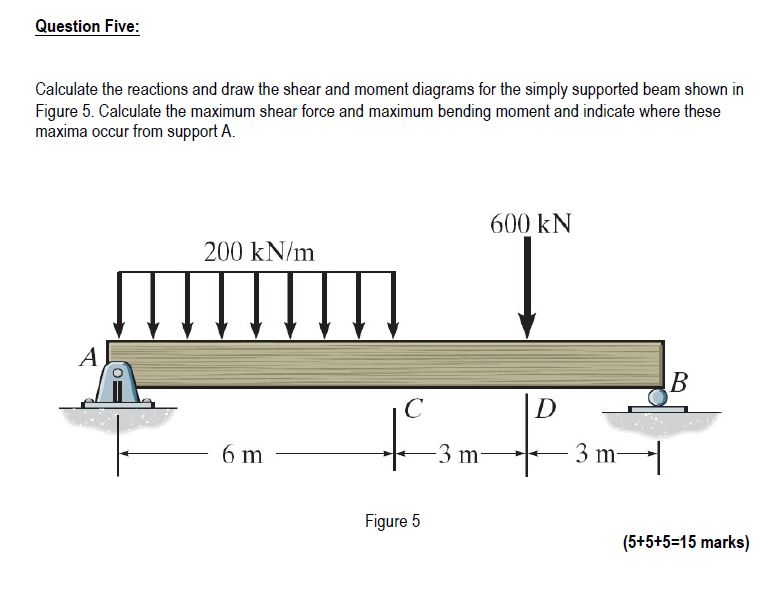

Wisconsin Child Support Guidelines for Sole Custody

The court will then use a standard percentage model based on the number of children when one parent has the children for less than than 92 overnights throughout the year. A typical example of this type of arrangement is every other weekend. When these placement arrangements are in place the court will use the percentage standard model shown below.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Sole Custody Child Support Examples

| Monthly Income | 1 child (17%) | 2 children (25%) | 3 children (29%) | 4 children (31%) | 5 children (34%) |

|---|---|---|---|---|---|

| $1,500 | $255 | $375 | $435 | $465 | $510 |

| $2,000 | $340 | $500 | $580 | $620 | $680 |

| $2,500 | $425 | $625 | $725 | $775 | $850 |

| $3,000 | $510 | $750 | $870 | $930 | $1,020 |

| $3,500 | $595 | $875 | $1,015 | $1,085 | $1,190 |

| $4,000 | $680 | $1,000 | $1,160 | $1,240 | $1,360 |

For more examples download the pdf here.

To refer directly to DCF 150 review the section labeled DCF 150.03 Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

Wisconsin Sole Custody

Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter the non-custodial parent's YEARLY gross income (before taxes) *

How many minor children with the custodial parent? * 1 Child2 Children3 Children4 Children5+ Children

Subtotal1

Subtotal

Subtotal

Monthly Support Payments

$0

* Required

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Frequently Asked Questions

How do you calculate child support in Wisconsin?

To calculate child support in Wisconsin first the type of custody needs to be determined.

If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments.

If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

What is child support percentage in Wisconsin?

The percentage of child support paid in Wisconsin is determined by the type of custody arrangement. If the custody arrangement is sole custody, then the following are the percentages used to calculate child support payments.

- 17 percent of gross income for 1 child

- 25 percent of gross income for 2 children

- 29 percent of gross income for 3 children

- 31 percent of gross income for 4 children

- 34 percent of gross income for 5 or more children

If the custody arrangement is joint custody, meaning both parents have the child more than 92 overnights a year, then child support payments are determined based on gross income and time spent with both parents.

The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Does a father pay child support with 50/50 custody?

In a shared custody scenario, where both parents have the children 182.5 overnights per year and both parents make the same gross income no child support payments would be required.

However, if one parent makes substantially more than the other parent in the same scenario where both parents have 182.5 overnights then the higher-earning parent will pay child support to the other parent.

The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Is child support based on gross income or net income?

In the State of Wisconsin, child support is determined using estimated annual gross income.

Can child support take your whole paycheck?

In the State of Wisconsin, law limits the amount that can be garnished for a child support order as follows. 50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance.

50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance.

The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes. Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

References: Child Support Guidelines Wisconsin, DCF 150.03 Support Orders, DCF 150.035(2)(b) Support Orders

How is the amount of alimony determined? | Juristaitab

From now on, the subsistence minimum is separated from the so-called minimum wage, which has raised the subsistence minimum every year until now. HUGO lawyer Vahur Kõlvart explains the nature of the new system below.

In the future, minimum child support will have five different components.

A base amount of at least 200 euros per child, indexed annually to the previous year's consumer price index (which will be officially published by Statistics Estonia on 1 April). After indexation, the base amount resulting from indexation in the previous year is considered the base amount for the next year. nine0003

3% of the country's average monthly gross salary for the previous year is added (which is also officially published by Statistics Estonia on 1 April).

Number of children supported in one family - in this case, the amount of maintenance for subsequent children is reduced by 15 percent compared to the amount of maintenance for the first child. The amount of maintenance is not reduced in the case of twins/twins and in the case of children with a difference in age of more than three years. nine0003

Family allowances - in comparison with the past, the law clearly states that the parent is not obliged to support the child to the extent that the needs of the child can be met by the child allowance and the multi-family allowance. If the benefit claimant receives these benefits, half of the benefit is deducted from the allowance for each child. However, if the recipient of the benefit is a payer, this amount is added to the alimony.

Child living together - if the child lives with the parent who pays support for an average of at least 7 days per month per year, the amount of support is reduced in proportion to the time spent with the obliging parent. Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents. nine0003

Therefore, if the child lives equally with both parents, maintenance can only be collected if this is due to the greater needs of the child, a significant difference in the income of the parents, or an uneven distribution of expenses related to the child between the parents. nine0003

Example:

The child lives with the mother, stays with the father for an average of 10 days per month, and a child allowance of 60 euros is paid to the account of the child's mother. The minimum allowance per child is 70.43 euros.

Base amount: 200 euros 3% of the average salary for the previous year: the average gross salary in 2020 was 1448 euros per month, of which 3% is 43.44 euros.

Family allowances: half of the child allowance is deducted from the parent's maintenance obligations (60/2=30), then the amount of maintenance is 213.44 euros (243.44-30). nine0009 Cohabitation: If the child lives with the parent in charge of maintenance between 7 and 15 days per month, the amount of maintenance may be further reduced according to the number of those days. The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66.7% of the required time (10/15) with the parent responsible for child support. Subtracting the necessary time from the maintenance of one parent, we get 70.43 euros (216.59-(216.59*0.667)).

The basis is how many percent of the time the child spends with the parent responsible for child support. 15 days count as half a month. In this example, the child spends 10 days or 66.7% of the required time (10/15) with the parent responsible for child support. Subtracting the necessary time from the maintenance of one parent, we get 70.43 euros (216.59-(216.59*0.667)).

Using the Department of Justice's child support calculator, each parent can calculate the minimum amount of child support the court is likely to award in their case.

Read in Issue 4: What is the procedure for paying for night work?

On February 17, the 4th issue of the magazine “Chief Accountant. Salary".

Read the latest issue:

0051 ALIMENT

Parents are required to support their minor children. When calculating child support, you need to correctly determine the earnings from which they are withheld. The material discusses the procedure for calculating alimony for two children, if the employee has been paid material assistance and temporary disability benefits.

The material discusses the procedure for calculating alimony for two children, if the employee has been paid material assistance and temporary disability benefits.

Situation. The procedure for calculating alimony if the employee was paid financial assistance in connection with the death of a close relative and sick leave

Sick Leave

- TWO Sick Leaves IN ONE MONTH AND THE CALCULATION IS DIFFERENT

The worker fell ill himself, and later took care of a sick child. The calculation of temporary disability benefits is different in these situations. In the material, we will consider 2 cases of grant assignment.

Situation. Temporary disability of an employee and caring for a sick family member

- 0052

Women on parental leave up to 3 years old can also get sick. In this case, the child is cared for by the father or another person. In the material, we will consider who is entitled to temporary disability benefits in a similar situation.

In the material, we will consider who is entitled to temporary disability benefits in a similar situation.

Situation. VL allowance for the care of a child under 3 years old to the father

INCOME TAX

- GIFTS BY MARCH 8 MUST BE TAXED WITH INCOME TAX, BUT NOT ALWAYS

Any gift is an employee's income from which taxes must be withheld and paid. We will consider gifts for women by March 8: these are fresh flowers, gift certificates and other valuable gifts. Let's figure out how in such cases you need to pay income tax.

Situation 1. Bouquets of fresh flowers in a festive atmosphere will be presented to women by March 80052

Situation 3. The cost of gifts given to women by March 8 does not exceed 4 basic units

CALCULATION OF AVERAGE EARNINGS WHAT CALCULATIONS DO THE ACCOUNTANT PERFORM?

A conscripted employee may be called up for military training. Since the legislation provides for guarantees and compensations for these persons, we will consider the obligations of the employer that arise in this case. nine0070

Since the legislation provides for guarantees and compensations for these persons, we will consider the obligations of the employer that arise in this case. nine0070

Example. Calculation of the average earnings kept for the period of being on the camp

PAY HISTORY

- WHAT IS THE PROCEDURE FOR PAYING FOR NIGHT WORK?

Working at night is almost always a forced measure. At the same time, the employer must ensure compliance with all legal norms governing the involvement of employees to work at night. In the material, we will consider the following nuances of night work: who is forbidden to be involved in work at night; what is the payment procedure for working at night; how to make a surcharge for the night; how to document the involvement of an employee to work at night. nine0070

Q&A

- STANDARD TAX REDUCTIONS FOR UNmarried Father

- HOLIDAYS FOR THE TIME OF PASSAGE OF CLASSES AND TRAINING COLLECTIONS

- CREATION OF THE RIGHT TO SUPPLEMENTARY PROFESSIONAL PENSION

- PAYMENT OF ADDITIONAL PROFESSIONAL PENSION

- SUBMISSION OF INFORMATION ON PAYMENTS TO FOREIGN EMPLOYEES TO THE TAX AUTHORITY

- PROCEDURE FOR PAYING INCOME TAX WHEN PAYING INCOME TO AN ILLEGALLY DISMISSED WORKER

- SOCIAL DEDUCTION WHEN REFUNDING THE EDUCATIONAL INSTITUTION FOR THE EDUCATION OF THE CHILD

BENEFITS

- CHILD ABROAD: THERE MAY BE PROBLEMS IN THE PAYMENT OF BENEFITS FOR CHILD CARE UNDER 3 YEARS

If a child for whom child care allowance is paid until the age of 3 travels abroad for more than 2 months, the payment of the allowance is terminated. In the material, we will consider on what circumstances the term for terminating the payment of benefits depends. nine0070

In the material, we will consider on what circumstances the term for terminating the payment of benefits depends. nine0070

situation 1. The woman reported to work that

situation with the child, the woman did not say that the woman is traveling with the child

Salary

- employee WITH SUMMATED WORKING TIME I SICKED: HOW TO CALCULATE THE EMPLOYEE FOR JANUARY

How to pay for labor and take into account its features when calculating temporary disability benefits for employees with a summarized account of working hours, the author tells in the article. nine0070

Situation. An employee who has a summarized working time record has submitted a sick leave

- USING THE CORRECT TERMINOLOGY IN PAYMENT FROM 2020

Changes in the remuneration of employees of budgetary organizations indirectly affected the established procedure for calculating the wages of employees of commercial organizations.