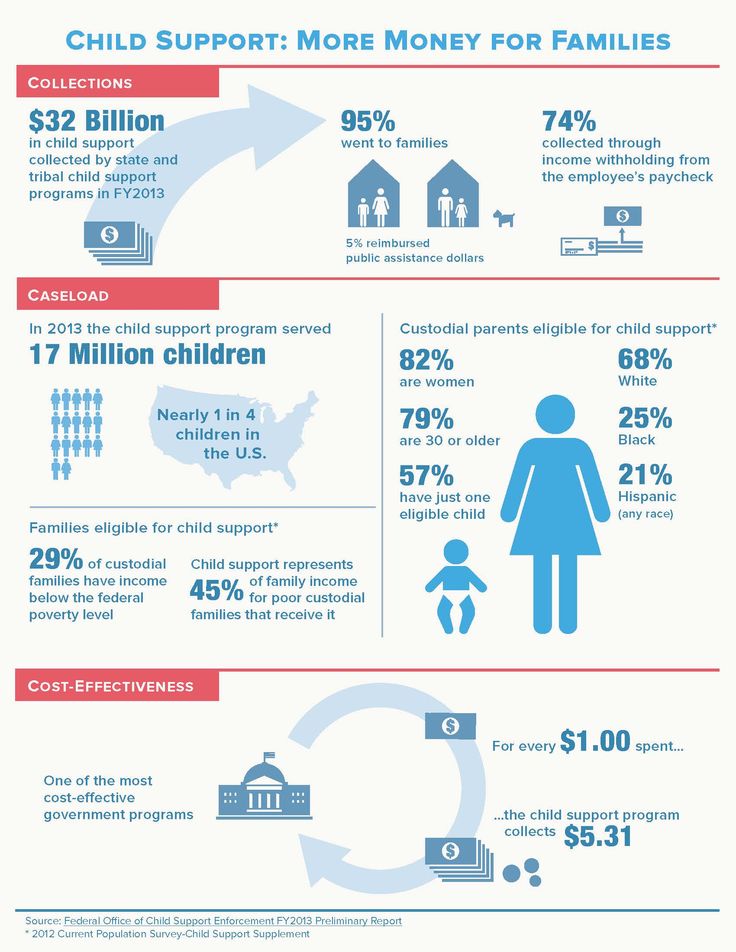

How states profit from child support

Learning from the United States’ Painful History of Child Support

The United States’ child support program served 13.2 million children in 2021, with the goal of collecting money from parents, including those who don’t live with their children. Since the program’s inception in 1975, it has been closely intertwined with America’s views on public assistance and race—its implementation shaped to respond to the backlash against inclusive economic support for poor families. In order to create an approach to child support that truly increases children’s economic stability, the federal and state governments must move beyond this backlash. This Father’s Day, policymakers must consider the history of the child support program and how best to ensure that it helps, not harms, families.

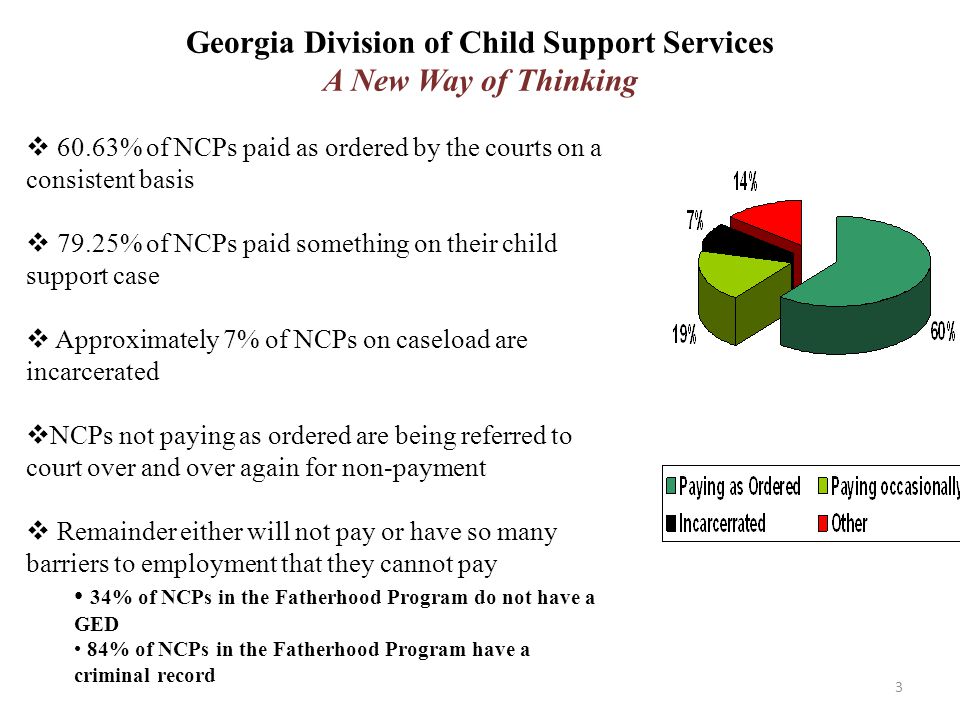

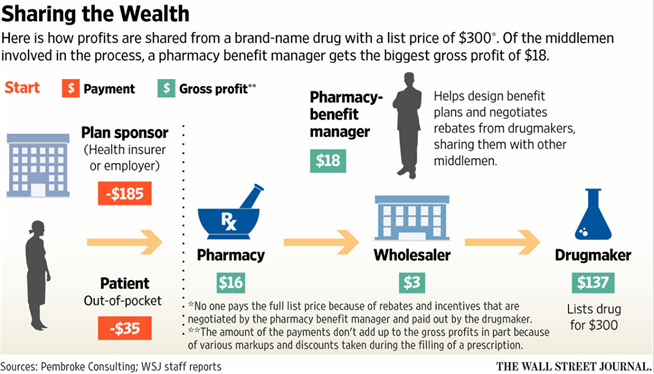

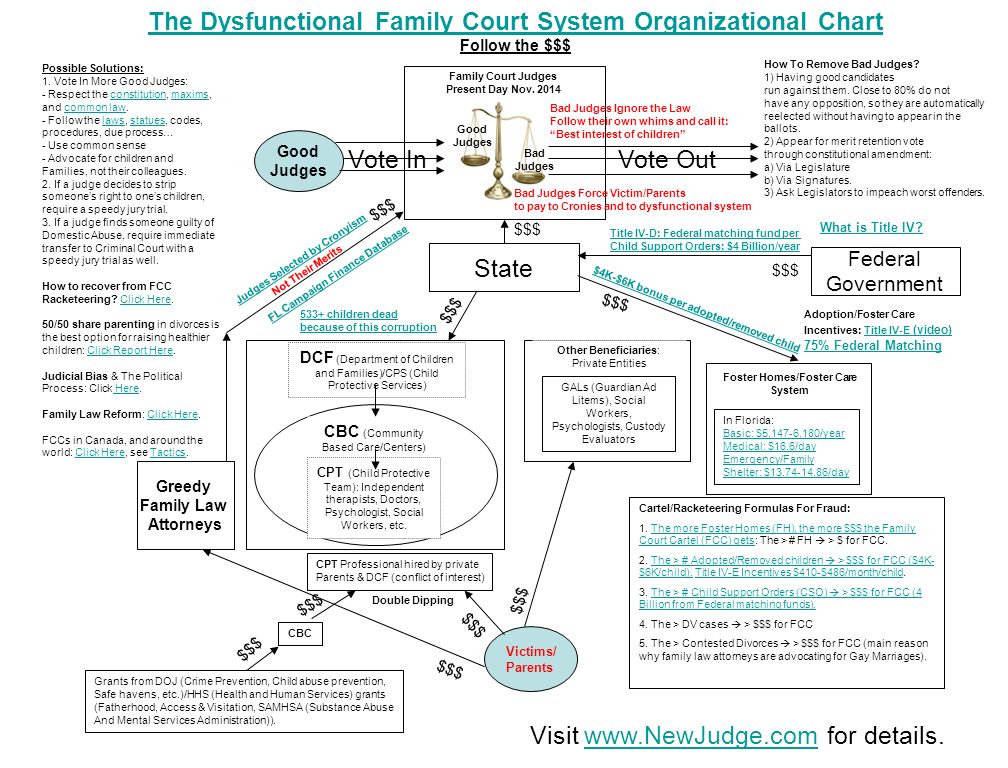

The child support program started off as a federal-state partnership, with a goal of reducing expenditures of the Aid to Families with Dependent Children (AFDC) program. From 1935 to 1996, AFDC was a primary vehicle for economic support to families with children. The child support program collected money from noncustodial parents, most of whom are fathers, whose children relied on AFDC benefits. But this support did not go to children; instead, it was used to reimburse the government for AFDC benefits. For example, if a court ordered a parent to pay $100 every month in child support to a household that received $100 in AFDC money, the state kept the entirety of that $100 child support payment and shared it with the federal government. This “welfare cost recovery” effort remains in effect today: Though many states do now pass through a portion of these payments to custodial parents and children, in 2021, the government kept an estimated $1.38 billion in child support. This approach to cost recovery essentially requires poor, noncustodial parents to repay the federal government for the minimal cash aid their children receive, providing neither parents nor children with economic security. States should end these policies and refocus enforcement efforts toward providing services such as job training and placement, thereby lessening the punitive targeting of low-income men—and Black men in particular—and increasing the likelihood that child support programs lead to actual economic benefits for poor children and families.

Receiving child support payments is often essential for custodial-parent families, considering roughly 25 percent of them live in poverty, but targeting and punishing people who cannot pay does not help anyone. For the most part, the law does not consider whether parents avoid paying child support because they do not want to or because they cannot afford to; the debt accrues either way. Nearly all who are in arrears over child support have very low incomes: In one study in California, 80 percent of those in arrears had annual incomes below $20,000, and 60 percent had annual incomes below $10,000. As debt grows and enforcement measures are used, employment, housing, and familial bonds are all put at risk. Ruining the credit scores and suspending the licenses of low-income noncustodial parents can make it harder for them to achieve the financial stability they need to provide for their children, while incarceration makes it impossible.

More on family economic security

The child support system is built on a troubled history

The current approach to enforcement of child support payments is linked to the racist cultural history surrounding the so-called deserving poor—which has typically excluded Black people. Over the course of the 1950s and 1960s, AFDC became more readily available to Black families, which brought increased scrutiny of the program and, in particular, Black mothers. In 1965, Daniel Patrick Moynihan, then serving in the U.S. Department of Labor as assistant secretary, spearheaded the release of “The Negro Family: The Case For National Action.” This federal report linked the abundance of women-led households in the Black population to high rates of poor school performance, crime, and welfare dependency, and would shift the narrative on poverty from tackling structural barriers to focusing on a dysfunctional family narrative for decades to come. Then-presidential candidate Ronald Reagan amplified this effect on the campaign trail in 1976: In an effort to gain support for defunding safety net programs, he villainized women who relied on public benefits.

Over the course of the 1950s and 1960s, AFDC became more readily available to Black families, which brought increased scrutiny of the program and, in particular, Black mothers. In 1965, Daniel Patrick Moynihan, then serving in the U.S. Department of Labor as assistant secretary, spearheaded the release of “The Negro Family: The Case For National Action.” This federal report linked the abundance of women-led households in the Black population to high rates of poor school performance, crime, and welfare dependency, and would shift the narrative on poverty from tackling structural barriers to focusing on a dysfunctional family narrative for decades to come. Then-presidential candidate Ronald Reagan amplified this effect on the campaign trail in 1976: In an effort to gain support for defunding safety net programs, he villainized women who relied on public benefits.

In 1986, CBS aired a special report titled “The Vanishing Family: Crisis in Black America,” in which host Bill Moyers spoke with separated Black parents in Newark, New Jersey, and highlighted the high rates of out-of-wedlock births in the community. One of the parents featured a man who had fathered multiple children with different women and did not support any of them, stating that the mothers could rely on welfare. The report’s inclusion of the man reinforced well-known stereotypes and gained national attention, winning numerous awards and being shown in public schools. It created enough outrage over so-called deadbeat dads to inspire congressional action in the form of the Bradley Amendment, which forbade forgiveness of child support debts.

One of the parents featured a man who had fathered multiple children with different women and did not support any of them, stating that the mothers could rely on welfare. The report’s inclusion of the man reinforced well-known stereotypes and gained national attention, winning numerous awards and being shown in public schools. It created enough outrage over so-called deadbeat dads to inspire congressional action in the form of the Bradley Amendment, which forbade forgiveness of child support debts.

With the federal government and popular culture explicitly linking poverty, the need for federal economic support, and the structure of Black families, the term “welfare” became racialized. In contemporary survey responses, majorities of white people respond that too much money is being spent on “welfare” and not enough on “assistance to the poor,” despite those two concepts being essentially synonymous—and the fact that most people lifted above the poverty line by the social safety net are white. The economic support for poor families that began earlier in the 20th century contracted as the policymakers of the 1970s, 1980s, and 1990s bought into the idea of restricting access to AFDC and punishing noncustodial fathers.

The economic support for poor families that began earlier in the 20th century contracted as the policymakers of the 1970s, 1980s, and 1990s bought into the idea of restricting access to AFDC and punishing noncustodial fathers.

Enforcement measures target Black men with economic and carceral punishment

From the 1970s to the 1990s, the federal government implemented multiple harsh enforcement measures within the child support program. These enforcement policies, which are still in effect today, range from garnishing up to two-thirds of noncustodial parents’ wages and suspending their driver’s and professional licenses to reporting their child support debt to credit bureaus and even incarcerating them. These policies have a long history of punishing people for being Black and poor. Overall, roughly 15 percent of all Black fathers in larger U.S. cities have been incarcerated at some point for nonpayment of child support, compared with 5 percent of fathers overall.

Some states and localities have taken enforcement even further. One example is Lee County, Mississippi’s Deadbeat Dad operation, in which a local newspaper compiled a list of the names of parents who owed child support, publicly shaming those who were behind on payments. Police apprehended a number of the parents who did not come forward, jailing them until they could make arrangements to pay. Unfortunately, raids like this happen across the country, often around Father’s Day.

One example is Lee County, Mississippi’s Deadbeat Dad operation, in which a local newspaper compiled a list of the names of parents who owed child support, publicly shaming those who were behind on payments. Police apprehended a number of the parents who did not come forward, jailing them until they could make arrangements to pay. Unfortunately, raids like this happen across the country, often around Father’s Day.

Child support priorities must shift to better serve families

The Obama administration made an attempt to begin moving away from this punitive system, issuing a 2016 final rule from the Office of Child Support Enforcement (OCSE). This rule required states to take more rigorous steps to consider noncustodial parents’ ability to pay when determining child support orders, as well as whether to file civil contempt cases for missing payments, which could result in jail time. It also opened opportunities for modifying how much incarcerated parents would pay. Given the varying interpretations of the final rule, states have since implemented a range of policies.

However, the rule did not go far enough to ensure that the child support program properly acknowledges and assists poor, noncustodial parents. The system’s heavy reliance on punitive enforcement measures keeps it from realizing its true potential as a family service. Black parents in or near poverty make up the majority of parents who are missing payments, and parents with low incomes are more likely to pay little or no child support. Efforts to increase collections for children should center around ways to provide more resources to parents so they have the ability to meet their obligations.

One way to do this is to emphasize providing employment services to parents in need of good jobs, which some states already view as the best path forward. These services have been shown, when they have sufficient resources, to increase noncustodial parents’ earnings, increase payment compliance, and even improve attitudes toward the child support program. Providing employment services would require reworking the funding rules at the OCSE to make sure all states get enough federal help to manage successful programs. Additionally, states should implement full pass-through policies to guarantee that all collections go to children, as well as disregard payments from income so that they do not affect custodial parents’ public assistance benefits, putting an end to the legacy of child support welfare cost recovery.

Additionally, states should implement full pass-through policies to guarantee that all collections go to children, as well as disregard payments from income so that they do not affect custodial parents’ public assistance benefits, putting an end to the legacy of child support welfare cost recovery.

It is time to recognize that noncustodial parents have endured decades of institutional violence that have trapped them, and therefore their children, in a spiral of economic deprivation.

Conclusion

The racist backlash to public assistance for families has informed child support policy for too long, and low-income parents, especially Black fathers, have had to face the consequences. It is time to recognize that noncustodial parents have endured decades of institutional violence that have trapped them, and therefore their children, in a spiral of economic deprivation. Policymakers must work to leave punitive enforcement efforts in the past and give children what they are owed, before another generation is forced to grow up in poverty.

The author would like to thank Arohi Pathak, Lily Roberts, Justin Schweitzer, Rachael Eisenberg, Marina Zhavoronkova, Nicole Lee Ndumele, Justin Dorazio, Rasheed Malik, Ashfaq Khan, and Anona Neal for their valuable support and feedback.

California keeps millions in child support while parents drown in debt

Lea este artículo en español.

Half of Stacy Estes’ pay disappears every month before it hits his bank account. Each check is about $500 lighter than it should be, intercepted in the name of child support — which he wouldn’t have a problem with, if it were going to his kids.

Instead, only $225 goes to his children. The rest is garnished to repay government debt he began accruing more than two decades ago when he first got behind on child support payments.

The 53-year-old Estes owes about $47,000 in child support debt, most of which is compounded by years of government-imposed interest, according to financial records reviewed by The Salinas Californian and CalMatters.

Federal data shows California is keeping an unusually high portion of the child support payments — more than 3½ times the national average, paying itself first at the expense of the very children it’s supposed to be looking out for. That’s because California is charging families millions of dollars in interest on past-due child support payments while penalizing low-income parents who fall behind, making it nearly impossible for many to land employment, support their children and pay off the debt, according to state records and expert analysis.

Experts argue these laws are arcane and racist, penalizing Black and brown fathers through predatory-like interest rates and driver’s license suspensions. They push parents struggling to make ends meet into even more precarious circumstances since the San Francisco Treasurer’s Office found the average noncustodial parent makes less than $15,000 a year. The same parents owe about $39,000 to both their children and the government, Department of Child Support Services spokeswoman Nicole Darracq told CalMatters.

In fact, the state’s own findings suggest nearly all of this debt is uncollectible because it’s owed by people with low incomes, people out of state or the debt is simply too old. Advocates urge lawmakers to erase uncollectible debt entirely, and guarantee that all child support paid goes straight to the children.

Stacy Estes with his fiancée in front of their home in Sacramento on April 7, 2021. Estes owes about $47,000 in child support debt to the state. Photo by Anne Wernikoff, CalMattersPoor lawCrafted through a series of federal legislation in the ‘70s and ‘80s, the laws that govern public child support have impacted parents across the nation for decades. Based on the notion that people who tap public assistance have an obligation to repay the government, parents who don’t keep up with payments face the same federally mandated penalties, like suspension of driver’s licenses. If states don’t recoup the money from parents, they become responsible for repaying the government aid out of their own coffers.

Just a few states pass through 100% of monthly child support payments to families, but only Colorado repays the federal government for aid to families out of its own pocket, with Washington waiving a small portion.

“This is a very old policy,” said Vicki Turetsky, who served as commissioner of the U.S. Office of Child Support Enforcement during the Obama administration. “It dates back to poor law: the idea that people who get public benefits from the government ought to pay them back. It’s a very old way of thinking about assistance to families.”

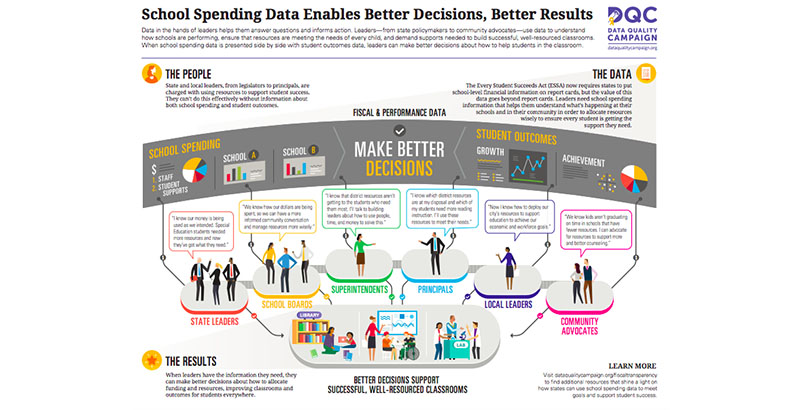

Disproportionate collectionsWhile the federal Office of Child Support Enforcement shows California is average in the amount of child support it collects, Turetsky calculated the state retained 14% of total collections, compared to a national average of 3.8%, meaning it retains a disproportionately large share as state revenue.

Only the District of Columbia retains more.

“California is an outlier in the proportion of support it retains to reimburse cash assistance,” she said.

Share of child support retained by states in 2019

Turetsky said this was because California has a larger cash assistance caseload, less restrictive eligibility rules for cash assistance, and it passes less support through to families than many states. State officials said they do not have discretion over how much child support collections it retains for recoupment of aid, and pegged the primary reason for the higher rate to a high welfare caseload in California. More than a third of residents are living in or near poverty.

California child support administrators agree that things need to change, but say they have limited power to make reforms. The most meaningful alterations that could provide parents relief — ditching high interest rates and suspension of driver’s licenses — are up to state and federal legislators, not the agency, said David Kilgore, director of California’s Department of Child Support Services. And besides, he added, sometimes those penalties are the only way to convince parents to come in and talk to them.

“I can see the argument on both sides,” Kilgore said. “This is a debt folks need to pay off.”

‘Get-tough policy’ failureIt starts with public assistance.

When custodial parents — in most cases, mothers — apply for government aid such as CalWorks, they must sign away their rights to child support they are already receiving to the government in repayment. That money, once considered private funds between two individuals, is now reclassified as public child support, collectible by the state to repay their aid.

The state continues to pass only a portion of the now-public child support to the mother and siphons off the rest, which advocates say is often a nasty surprise to both parents.

“Parents who have their child support taken by the state feel like they have to choose between supporting their children and paying their child support,” said Heather Hahn, a researcher with the Urban Institute.

While the number of California parents who owe child support wasn’t available, the outstanding balance is staggering. According to the Department of Child Support Services, California parents owe $11.6 billion in child support to their families and another $6.8 billion to the government.

According to the Department of Child Support Services, California parents owe $11.6 billion in child support to their families and another $6.8 billion to the government.

But last year, state calculated that more than $11 billion of the total child support owed was old debt.

California typically collects about $2.5 billion total from parents annually, one of the largest amounts by state, but proportionate to its population.

In 2020, about $2 billion of those funds went to custodial parents. Thanks to various pandemic relief efforts, the state intercepted not just parents’ paychecks, but their unemployment and stimulus checks too, driving the collected amount up. As a result, the state kept about $430 million of the $2.7 billion it collected in child support. Of that, kept $207 million for state coffers and divvied up the rest among the federal government, counties and other jurisdictions. Federal law states half the money intercepted or garnished goes to the federal government, another 47. 5% goes to the state, and 2.5% to the county the child lives in.

5% goes to the state, and 2.5% to the county the child lives in.

If noncustodial parents — in most cases, fathers — get behind on those child support payments in California, that debt is subject to a 10% interest fee, the second-highest rate in the nation according to the National Conference of State Legislatures. That racks up quickly, parents say.

The nonpayment penalties parents face are steep: The state can suspend driver’s licenses 180 days after falling behind on payments, to start, according to the department’s website.

California Department of Child Support Services Director David Kilgore. Photo courtesy of Department of Child Support ServicesDirector Kilgore said in many cases, suspending parents’ driver’s licenses can sometimes be the only tool his agency has to get parents to work with them so they begin to pay their child support back.

However, parent advocates add that suspending licenses as a get-tough policy has only made circumstances worse for struggling fathers.

“Licenses are essential in this economy,” said Mike Herald, director of policy advocacy for the Western Center on Law and Poverty, which advocates for the poor. “This has a really fatal flaw; we think we’re going to somehow get money out of people we’ve driven underground. How will this increase collections?”

Resistance to give up millionsIn recent years, California has taken small steps to give parents relief.

In 2017, a report out of the San Francisco Treasurer’s Office estimated that 70% of public child support debt in California was owed to the government, not to families. That figure has since dropped to 40% after a host of changes were implemented, such as the Compromise of Arrears Program, a debt reduction program that lets noncustodial parents discharge their full debt in exchange for a lump sum up front. For eligible parents, the program, which is still available, can be a lifeline.

However, advocates say the changes aren’t drastic enough. They urge lawmakers to erase uncollectible debt entirely, and guarantee that all child support paid goes straight to the children.

They urge lawmakers to erase uncollectible debt entirely, and guarantee that all child support paid goes straight to the children.

Gov. Gavin Newsom last year embraced increasing the amount of funds passed through to families in his budget, allowing families with one child on public assistance to receive $100 a month (up from $50) and families with two or more children to receive $200 a month of the child support.

But he vetoed Democratic Assemblymember Reggie Jones-Sawyer’s AB 1092, which would have ended the state’s practice of charging 10% interest on public child support debt. Newsom’s veto message read, in part, “I cannot support this bill as it would lead to an estimated revenue loss of millions of dollars.”

The state is running a surplus of $16.7 billion.

‘It’s punishment’Child support debt has particularly impacted Black and Hispanic/Latino people. U.S. census data shows they make up 47% of the state’s population, but about 60% of parents caught up in this cycle. Black people in particular are overrepresented, at 6.5% of the population but about 18% of parents who owe outstanding public child support debt, a 2017 report out of the San Francisco Treasurer’s Office shows.

Black people in particular are overrepresented, at 6.5% of the population but about 18% of parents who owe outstanding public child support debt, a 2017 report out of the San Francisco Treasurer’s Office shows.

Parent advocates say this rule perpetuates the racist myth of the welfare queen and the deadbeat dad, separating Black and brown families.

“The narrative…is that it is child support, and it is not,” said Mia Birdsong, author and Senior Fellow at the Economic Security Project. “It is the government extracting resources from Black fathers. It’s meant to cover overhead, but it’s punishment.”

It took years of making payments before Estes realized all the money being deducted from his paycheck wasn’t going to his kids, but rather to the government. As he fell behind on his child support payments, his debt ballooned under the state’s interest rates and he began to suffer additional penalties.

Stacy Estes drives DoorDash to keep up with child support debt owed to the state. Photo by Anne Wernikoff, CalMatters

Photo by Anne Wernikoff, CalMattersHis driver’s license has been suspended at least three times.

Each suspension made it that much harder to keep up with the payments he had fallen behind on, Estes said. He resorted to working under the table to supplement his income: driving DoorDash under his fiancée’s name or taking jobs that pay cash. Together, Estes and his fiancée bring in about $40,000 a year, but he lost his job as concert security during the pandemic, making things even tighter.

Even when his job comes back, he said, he won’t earn enough to wiggle out from under the crush of debt.

“How do you live on half of your makings, how do you even get a house or anything like that?” Estes said. “What about gas, electric, food? What about just living?”

A federal issue, tooJhumpa Bhattacharya, a vice president at the Insight Center for Community Economic Development, a nonprofit dedicated to building economic opportunity in vulnerable communities, said she’d like to see the state send all child support payments to kids and help noncustodial parents find ways to meet their payments instead of meting out punishment when they can’t.

“We’ve decimated all our social welfare systems and made them dehumanizing and demoralizing,” she said. “Black people have a tenuous relationship to the economy. They aren’t hired, or are shoved into low-paying, low-dignity jobs, so when they start to access this system, we punish them for it.”

But, she said, federal legislators need to be the ones to tackle the aid payback requirement.

“Why,” Bhattacharya asked, “should you have to pay back the government for helping you?”

In 2020, Maryland Democratic Sen. Chris Van Hollen introduced the Strengthening Families for Success Act, which would have ended recovery of cash aid for good. His measure died in committee and would need to be reintroduced. Calls to Van Hollen’s D.C. office were not returned.

Child support collection by states in 2019

An all-or-nothing programInstead of being a “wedge that pushes families apart,” Kilgore, California’s child support services director, says, he’d like to see federal changes that make it more of a pick-and-choose program. He believes there’s an opportunity for families to sign up for DCSS services on an as-needed basis, utilizing it just as a way to get child support payments without putting their ex in the way of potential license suspensions or even jail time.

He believes there’s an opportunity for families to sign up for DCSS services on an as-needed basis, utilizing it just as a way to get child support payments without putting their ex in the way of potential license suspensions or even jail time.

“We are, right now, an all-or-nothing program and we’d like to be more flexible and let people choose which services they’d like to implement,” Kilgore said.

The Newsom administration is looking at other ways to reduce the burden. The Compromise of Arrears Program is undergoing a revamp this spring, Kilgore said, making it easier for parents to tap the debt dischargement program. Rather than asking for 10% of the total debt, it will be based on their wages.

At the county level, directors would like to see certain changes made, as well.

“I wish we did not collect interest,” said Santa Clara County Department of Child Support Services Director Ignacio J. Guerrero. “It feels more punitive than anything else.”

Breaking down barriersAt least one county has led in removing such stigma. The Financial Justice Project in the San Francisco Treasurer’s Office launched a pilot program in recent years for 32 fathers saddled with prohibitive amounts of child support debt. Some had lost their driver’s licenses, jobs, and homes as a result.

The Financial Justice Project in the San Francisco Treasurer’s Office launched a pilot program in recent years for 32 fathers saddled with prohibitive amounts of child support debt. Some had lost their driver’s licenses, jobs, and homes as a result.

“We were creating huge barriers in people’s lives,” said the project’s director, Anne Stuhldreher. “If you can’t pay that government debt, a lot of really steep consequences set in.”

Anne Stuhldreher, director of The Financial Justice Project in the San Francisco Treasurer’s Office.Stuhldreher’s office wanted to see what would happen when noncustodial parents no longer owed that debt. The project raised enough to pay down 10% of these fathers’ child support debt, and utilizing the state’s debt reduction program, discharged the other 90%, leaving them debt-free.

After following these fathers for a year, Stuhldreher said they found many of their lives had improved in measurable ways. Fathers got housing, started making bigger, more consistent child support payments, and their credit scores rose. Their relationships with their children and their exes improved, too.

Their relationships with their children and their exes improved, too.

A control group of fathers in similar circumstances saw no improvements.

Estes said he has resigned himself to never fully paying off this debt. His youngest is 16, his oldest, nearly 30.

“There’s nothing I can do about it,” he said, from behind the wheel one evening, making DoorDash deliveries. He hit the turn signal; a steady tock-tock-tock beat. “I’ve beaten myself up over, you know, I can’t provide adequately. But my kids are older now, they understand.”

For the record, this story has been corrected to add that state lawmakers also share authority over penalties for falling behind on child support debt payments. In addition, the state can suspend driver’s licenses 180 days after a parent falls behind on child support debt payments. A previous version had the wrong grace period.

The Mercury News reporter Laurence Du Sault and CalMatters reporter Jackie Botts contributed to this story. This article is part of the California Divide, a collaboration among newsrooms examining income inequality and economic survival in California.

This article is part of the California Divide, a collaboration among newsrooms examining income inequality and economic survival in California.

Intercepted

- Part 1 California keeps millions in child support while parents drown in debt Welfare advocates say California places low-income and minority parents in insurmountable debt by garnishing child support payments and imposing high interest rates when they fall behind on payments, keeping a larger-than-average portion for itself. The director of the agency overseeing child support says state changes would require legislative action, but meaningful changes have failed to gain traction at the Capitol.

- Next: Part 2 Stimulus, unemployment checks help child support debt collection hit new high During the height of the pandemic, the state clawed stimulus and unemployment checks from parents who owe child support debt to the government.

The Newsom administration put a stop to the practice by the time the second stimulus checks went out, but California still retained a record $430 million in 2020.

The Newsom administration put a stop to the practice by the time the second stimulus checks went out, but California still retained a record $430 million in 2020. - Part 3 Legislature looks to halt child support debt collections — only for some Lawmakers propose to stop collecting child support debt owed to the government in cases where a parent’s only source of income comes from certain cash assistance programs. But advocates had asked the Legislature to go farther by forgiving old, uncollectible debt and to stop imposing a 10% interest.

We want to hear from you

Want to submit a guest commentary or reaction to an article we wrote? You can find our submission guidelines here. Please contact CalMatters with any commentary questions: [email protected]

The story you just read was funded by people like you.

CalMatters is a nonprofit newsroom and your tax-deductible donations help us keep bringing you and every Californian essential, nonpartisan information.

donate now

CalMatters is a window on events, trends and news about California that simply isn't found elsewhere.

Mark, Bakersfield

Featured CalMatters Member

Who is obliged to pay alimony?

home

Free legal assistance and legal information for the population

Legal information and legal education of citizens

Alimony obligations

Who is required to pay child support?

1. Parents

In accordance with Article 80 of the Family Code of the Russian Federation, parents are required to support their minor children.

Parents must pay child support

- minor children;

- children left without their care;

- Disabled adult children who need help.

Parents have the right to conclude an agreement on the maintenance of their minor children ( agreement on the payment of alimony ), which must be notarized. The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court.

The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court.

In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from parents in court.

In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other parental income.

In accordance with article 83 of the Family Code of the Russian Federation p in the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in a share of earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

The amount of a fixed sum of money based on is determined by the court from the maximum possible preservation of the child's previous level of his security, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Article 84 of the Family Code of the Russian Federation fixes that alimony for children left without parental care are collected only through the court . The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or custodian of the child, his adoptive parents or transferred to the account of the organization in which the child is (educational, medical organizations, social service organizations, etc.).

In accordance with article 85 of the Family Code of the Russian Federation, alimony in favor of disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied.

2. Able-bodied adult children

In accordance with Article 87 of the Family Code of the Russian Federation, able-bodied adult children are required to support their disabled parents who need help. An exception is made by parents deprived of parental rights, to whom children are not obliged to pay alimony.

Alimony can be paid either on the basis of a notarized agreement between parents and children, or on the basis of a court decision. The court sets the amount of alimony in a fixed amount of money , payable monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children.

3. Spouses, including former spouses

This issue is regulated by chapter 14 of the Family Code of the Russian Federation.

Spouses or ex-spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties.

If such support is refused and there is no agreement between the spouses on the payment of alimony, the right to demand the provision of alimony in court from the other spouse who has the necessary means for this, have:

- disabled needy spouse;

- wife during pregnancy and within three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I.

In accordance with Article 90 of the Family Code of the Russian Federation, the right to demand the provision of alimony in court from a former spouse who has the necessary funds for this has:

- ex-wife during pregnancy and within three years from the date of birth of a common child;

- a needy ex-spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I;

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of the dissolution of the marriage;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

In the absence of an agreement between the spouses (former spouses) on the payment of alimony, the amount of alimony collected on the spouse (former spouse) in a judicial proceeding is determined by the court based on the financial and marital status of spouses (former spouses) and other noteworthy interests of the parties in a fixed amount of money payable monthly.

4. Other family members who may be required to pay child support

- able-bodied adult brothers and sisters

In accordance with Article 93 of the Family Code of the Russian Federation, able-bodied adult brothers and sisters may be payers of alimony to the following persons:

- minor brothers and sisters, provided that they do not have the opportunity to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

- grandparents

In accordance with Article 94 of the Family Code of the Russian Federation, the following have the right to receive alimony in court:

- minor grandchildren in need of assistance in case of impossibility to receive maintenance from their parents;

- adult disabled grandchildren in need of assistance, if they cannot receive maintenance from their spouses (former spouses) or from their parents.

- tons able-bodied adult grandchildren

In accordance with Article 95 of the Family Code of the Russian Federation, able-bodied adult grandchildren may be payers of alimony disabled grandparents in need of assistance , provided that the latter are unable to receive maintenance from their adult able-bodied children or spouses.

- t able-bodied adult pupils

In accordance with Article 96 of the Family Code of the Russian Federation, able-bodied adult pupils (except for those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to disabled persons who carried out the actual upbringing and maintenance of pupils until they reach 18 years of age with provided that they do not have the opportunity to receive maintenance from their adult able-bodied children or from spouses (former spouses).

No or concealed earnings from alimony payments

A common problem for alimony recipients is that debtors conceal their real earnings or claim no earnings at all. Is there any way to deal with this? Alimony payers who have not provided the bailiff with information about the amount of their income may face a situation where the amount of a certain debt will be significantly higher than the income received. Can the debtor challenge the exchange of the accrued debt?

Based on what income is alimony calculated if the payer does not work or there is no information about his earnings?

In accordance with paragraph 3 of Article 169 of the Code of the Republic of Kazakhstan "On marriage (matrimony) and the family in cases where the debtor obliged to pay alimony did not work during this period or if documents confirming his earnings and other income are not submitted, debt on alimony is determined based on the average monthly salary in the Republic of Kazakhstan at the time of debt collection. For persons serving sentences in places of deprivation of liberty, if such a debtor did not work during this period, the debt is determined in the amount of one monthly calculation index (MCI).

For persons serving sentences in places of deprivation of liberty, if such a debtor did not work during this period, the debt is determined in the amount of one monthly calculation index (MCI).

How alimony payers hide their earnings and income

In order to avoid or reduce the amount of alimony paid, unscrupulous debtors use a number of tricks:

- hide their real place of work;

- indicate as the only place of work the organization where they have a small official income, hiding information about part-time work in several more places with unofficial income;

- underestimate, by agreement with the employer, official income in order to pay child support below the average level for the region or city;

- are engaged in entrepreneurial activities without registration and hide their income;

- re-register the business for nominees.

How to force to pay alimony from all income?

Withholding of alimony in accordance with Article 126 of the Law of the Republic of Kazakhstan "On Marriage and Family" is made from all types of wages (cash remuneration, maintenance) and other income that parents receive in monetary (national and (or) foreign) currency. This includes wages, additional payments and allowances, bonuses (fees), most of the cash compensation, commissions, amounts received for work performed under civil law contracts, royalties, pension payments, state social benefits and targeted assistance, scholarships, income from business activities, income from property rental, income from securities, etc.

This includes wages, additional payments and allowances, bonuses (fees), most of the cash compensation, commissions, amounts received for work performed under civil law contracts, royalties, pension payments, state social benefits and targeted assistance, scholarships, income from business activities, income from property rental, income from securities, etc.

The bailiff has the right to request information about the place of work and income of the debtor, and the employer is obliged to provide him with reliable information. Based on these data, the bailiff will recalculate the amount of alimony, based on the total income.

At the same time, the bailiff does not have the opportunity to identify all the alleged places where the unscrupulous alimony payer receives income, especially if these incomes are not declared.

Therefore, it is recommended that the claimant:

- To assist the bailiff in finding places of work or income for the non-payer of alimony, as well as to inform him in writing of all available information about such places.

- In case of doubts about the reliability of the information provided by the debtor about the place of work or the amount of earnings, contact law enforcement agencies with a statement about the forgery of documents. Information about the amount of salary, if it is underestimated, or that the debtor does not work in a certain organization is easily verified.

- For known cases of concealment of income from entrepreneurial activity, apply for an audit to the tax authorities.

- If the facts of reporting by the debtor of false information or the use of false documents by him are revealed, require the enforcement agent to take measures to bring the debtor to administrative or criminal liability.

The debtor does not agree with a certain amount of debt on alimony

Due to the fact that the law requires the bailiff to determine the debt of a debtor who did not work or did not submit documents confirming his earnings and other income, based on the size of the average monthly salary, such a debtor may find himself in an unpleasant situation when the amount of a certain debt is much more than their income.