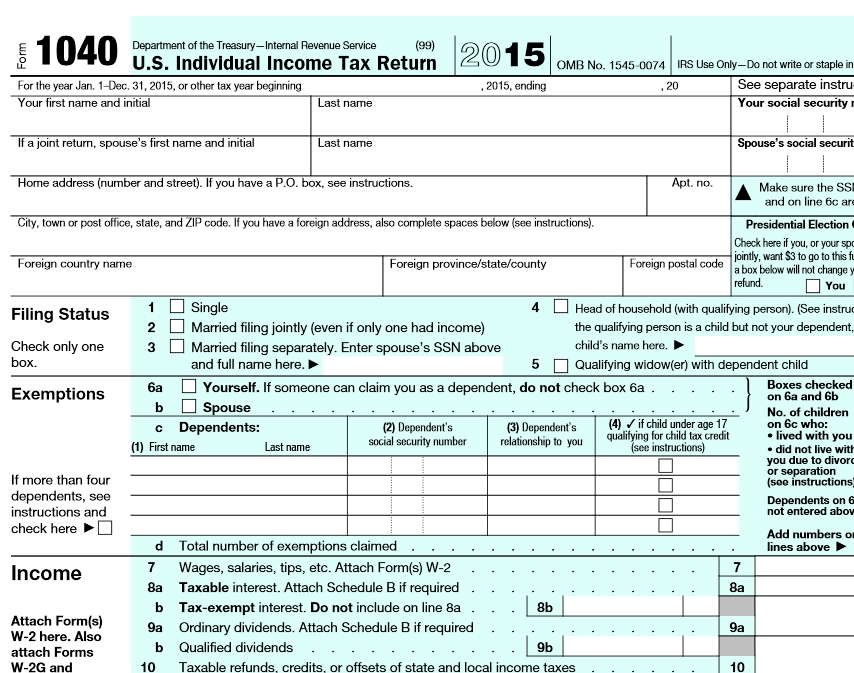

How much will i get for claiming a child on my taxes

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

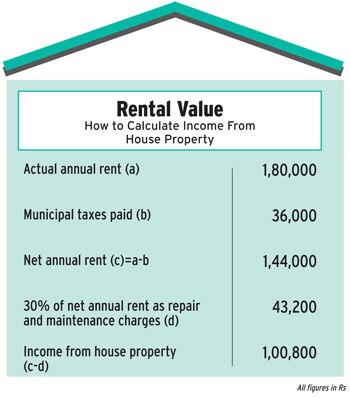

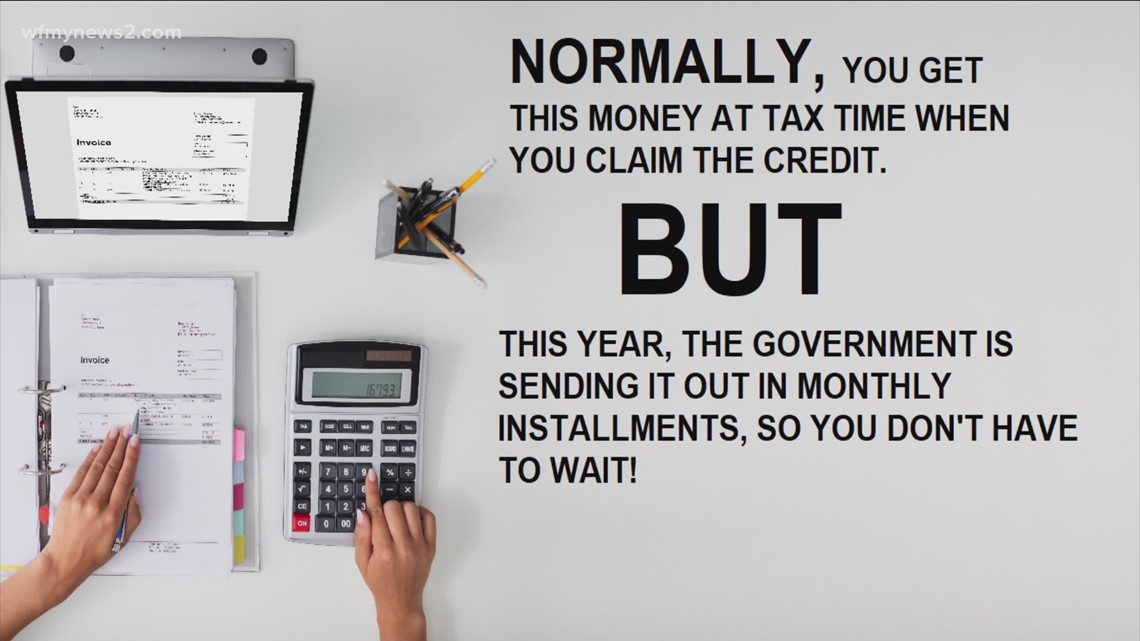

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

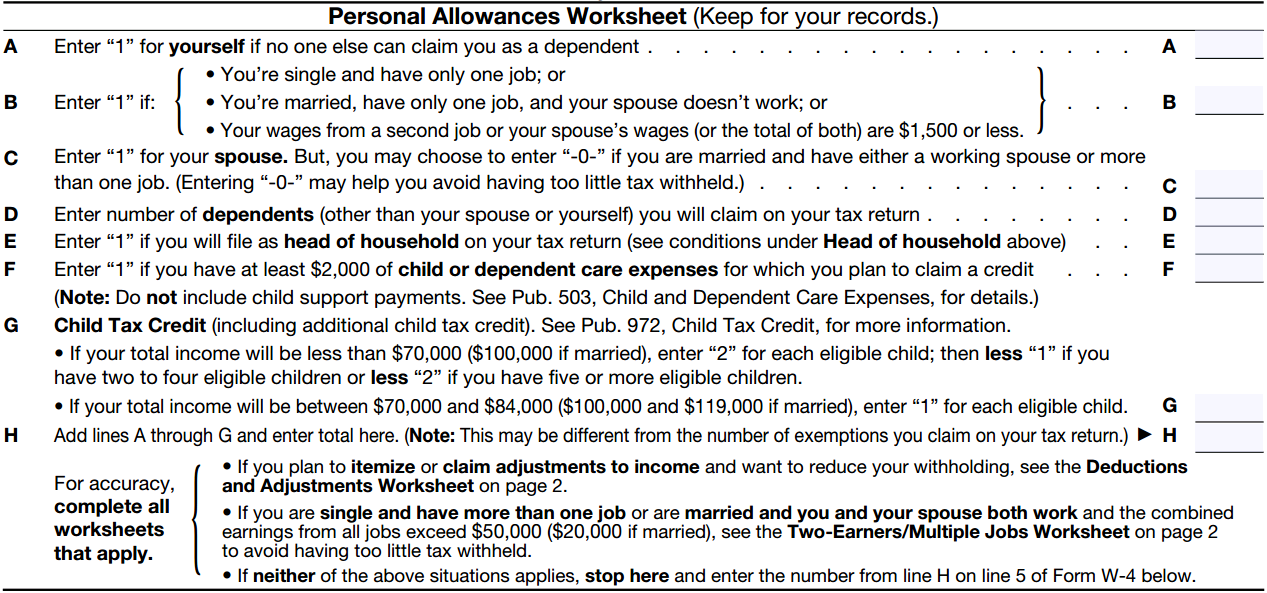

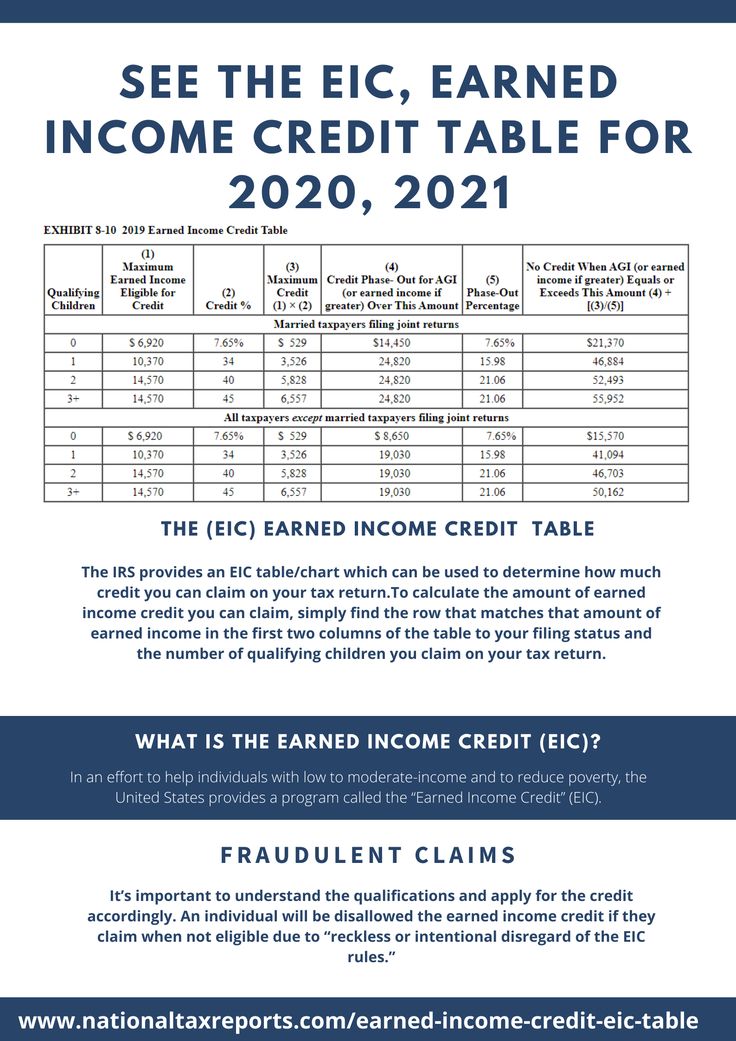

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”.

See below for details.

See below for details. - Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC. org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

2021 Child Tax Credit: Definition, FAQs & How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

The child tax credit has grown to up to $3,600 for the 2021 tax year. Here’s a primer on who qualifies, when to expect Letter 6419 and how to reconcile the advance credit on your taxes.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

Table of Contents

- What is the child tax credit?

- Who qualifies for the child tax credit?

- How much you can get per child

- How the child tax credit will affect your taxes

- Will you have to pay back the child tax credit?

- Estimate your child tax credit amount

What is the child tax credit?

The child tax credit, or CTC, is an annual tax credit available to taxpayers with qualifying dependent children. It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

It was first introduced as part of the Taxpayer Relief Act of 1997 and has played an important role in providing financial support for American taxpayers with children.

The tax credit — normally up to $2,000 per qualifying dependent — was expanded to a maximum of $3,600 in 2021 as part of the American Rescue Plan (the coronavirus relief package that took effect in March). And, for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December of 2021.

🤓Nerdy Tip

By the end of January, all recipients of the advance child tax credit payments should receive Letter 6419, which will provide a breakdown of all the advance payments disbursed to you. The IRS has asked taxpayers to use the letter to reconcile the credit on their 2021 returns. If you suspect your Letter 6419 states an inaccurate advance payment total, the IRS advises visiting your IRS online account for the most up-to-date information.

Who qualifies for the child tax credit?

For the 2021 tax year, you can take full advantage of the expanded credit if your modified adjusted gross income is under $75,000 for single filers, $112,500 for heads of household, and $150,000 for those married filing jointly.

The credit begins to phase out above those thresholds.

First phaseout: Income exceeds the above thresholds but is below $400,000 (married filing jointly) or $200,000 (all other filing statuses). Your total credit per child can be reduced by $50 for each $1,000 (or a fraction thereof). This phaseout will not reduce your credit below $2,000 per child.

Second phaseout: Income exceeds $400,000 (married filing jointly) or $200,000 (other filing statuses). The phaseout will continue docking $50 per each $1,000 and begin to reduce your credit per child below $2,000. You may be disqualified from the credit altogether.

Some of the other eligibility requirements for the child tax credit include:

You must have provided at least half of the child’s support during the last year, and the child must have lived with you for at least half the year (there are some exceptions to this rule; the IRS has the details here).

The child cannot file a joint tax return.

You must have lived in the U.S. for more than half the year (or, if filing jointly, one spouse must have had a main home in the U.S. for more than half the year).

The IRS has a tool to check your eligibility.

How much you can get per child

For the 2021 tax year, the child tax credit offers:

Up to $3,000 per qualifying dependent child 17 or younger on Dec. 31, 2021.

Up to $3,600 per qualifying dependent child under 6 on Dec. 31, 2021.

If you took advantage of the advance payments, the IRS most likely sent half of the credit in the form of monthly payments from July through December of 2021. Those with qualifying dependents 17 or younger might have received up to $250 monthly per qualifying dependent and those with children 5 or younger might have received up to $300 monthly per qualifying dependent.

» MORE: See who qualifies as a tax dependent

How the child tax credit will affect your taxes

For the 2021 tax year, the CTC is fully refundable — that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to get a tax refund check for anything left over. How much of the credit you claim on your 2021 return will depend on whether you opted in for advance payments, how much you received as an advance, as well as your tax-filing circumstances.

If you received advance payments

Letter 6419 contains a detailed summary of the money you received from the advance CTC payments. It also confirms the number of qualifying dependents the IRS used to calculate those advance payments. This information will help you to reconcile the credit when you file your return.

If you opted out of advance payments

If you opted out of the advance payments before the first one was disbursed in July, claiming the credit on your return will likely be much simpler. When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

When you file, you'll simply confirm that you're eligible for the credit and then claim the full amount you're entitled to based on your 2021 income and number of qualifying dependents.

If you don't normally file taxes

Low-income families who may not normally file a tax return had the option to sign up for advance payments using the IRS's non-filers sign-up tool. To claim the balance (or the full credit if you didn't receive the advance payments), you'll need to file a return this year.

» MORE: Learn more about IRS Free File — plus other ways to get free tax prep or help

Will you have to pay back the child tax credit?

First, some good news. The child tax credit is not considered taxable income. It's a credit, which means it can lower your tax bill or potentially result in a refund. However, things get a little tricky if it turns out that you were overpaid on your advance payment.

The advance payments were a prepayment of the 2021 tax credit you would normally claim in full during filing season. But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

But because half of the credit was sent out early, the IRS likely used your most recent tax return (2020 or older) to determine how much of an advance to send you each month. So, if your financial or personal circumstances (such as your filing status, income, custody arrangements or residency status) have changed in 2021, there's a chance you might have received more of an advance than you're actually eligible for. A few ways this could play out:

Let's say you received advance payments totaling $1,500 for your qualifying dependent based on your 2020 income. However, your income has increased significantly in 2021, making you eligible only for a reduced credit. The excess paid out to you is considered an overpayment.

Another example: You're a single filer with one dependent who lived in the U.S. in 2020. The IRS then sent you advance payments based on that information, which you accepted. However, in 2021, you actually lived outside of the U.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

S. for more than half the year, making you ineligible for the child tax credit. Accepting the payment would also be considered an overpayment.

If it turns out that you were given more of an advance than you were eligible for, you’ll need to report it as additional income tax to the IRS on your 2021 return. That additional income tax will either reduce your refund or potentially increase your tax bill.

Some people who were overpaid may also be eligible for repayment protection, meaning they won't need to repay the IRS. You can learn more about who qualifies on the IRS website. If you're unsure how to reconcile your credit or believe you may have been overpaid, quality tax software or working with a professional tax preparer can help you to reconcile your credit before the tax-filing deadline.

» MORE: How to find a tax preparer near you

Frequently asked questions

I had a baby in 2021. Am I eligible for the CTC?

Yes. Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

Parents of newborns in 2021 are eligible for the child tax credit. You can claim the credit when you file your 2021 return.

The child tax credit update portal shows that a payment was issued, but I didn't receive it. What steps do I take?

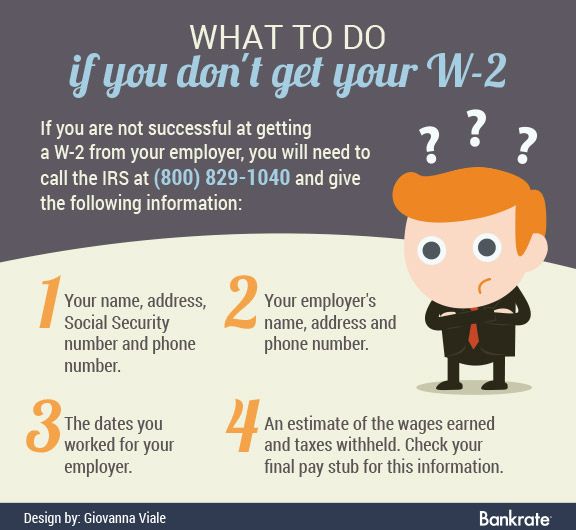

If the child tax credit update portal and your IRS online account show that you were issued a payment that you did not actually receive, you can call the IRS to report the missing payment and request a trace at 800-908-4184 (7 am to 7 pm local time).

The agency urges you to have the following information on hand when you call: the payment date, payment method, status, and the amount listed in the CTC update portal.

If the IRS determines that the payment was not received by you or returned to the agency, the IRS will update its records, and those who are eligible can claim the missing amount on their 2021 return.

Are the advance child tax credit payments permanent?

No. Legislation to extend the enhanced credit amount and advance payment structure has not been passed. For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

For now, the child tax credit for the 2022 tax year will revert back to its original max of $2,000 per qualifying dependent.

Is the child tax credit taxable?

No, the child tax credit is not considered income and therefore is not taxable. However, if the IRS overpaid you (i.e., the amount you received is more than you can claim), you may need to reconcile the overpayment on your 2021 tax return.

Estimate your child tax credit amount

Promotion: NerdWallet users get 25% off federal and state filing costs. | |

Promotion: NerdWallet users can save up to $15 on TurboTax. | |

|

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

FAQ

What should I do if I make a mistake while filling out the application?

If you made a mistake when filling out the application, the fund, without making a refusal, will return it to you for revision, which takes 5 working days.

What is the procedure for providing this benefit? What documents and where should the parent send in order to receive the payment? Does the employer participate in this process?

To receive benefits, you only need to submit an electronic application through the State Services portal or contact the client service of the Pension Fund of Russia at the place of residence, you can also apply through the MFC.

You will need to provide additional information about income only if the family has military, rescuers, police officers or employees of another law enforcement agency, as well as if someone receives scholarships, grants or other payments from a scientific or educational institution.

Can I receive benefits only on the Mir card?

Yes, the new payment will be credited to families only on Mir bank cards. It is important to remember that when filling out applications for payment, it is the details of the applicant's account that are indicated, and not the card number.

How long does it take to receive payment after applying?

Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days. If the payment is denied, a notification of this is sent within 1 business day.

Funds are paid out within 5 working days after the decision on the purpose of the payment is made. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

How do I get benefits?

In most cases, when applying for a payment, you only need to submit an application through your personal account on the State Services portal, in the PFR customer service at the place of residence or at the MFC. The Fund independently collects information about the income of the applicant and his family members as part of the program of interagency cooperation.

You will need to submit documents only if one parent (guardian, trustee) is a military, rescuer, police officer or employee of another law enforcement agency, as well as if someone in the family receives scholarships, grants and other payments from a scientific or educational institution .

When applying in person, you will need to present an identity document.

Reception at the PFR client services is carried out by appointment. Appointments can be made on the Foundation's website. The service is available to all citizens, including those not registered on the Unified Portal of Public Services. To do this, on the main page of the website of the Pension Fund of Russia, select the "Citizen's Personal Account" item. At the bottom of the page, in the blue field, click on "Make an appointment".

Who is entitled to the monthly payment?

The payment is assigned to low-income families raising children from 8 to 17 years old, subject to the following conditions:

- monthly income per person in the family does not exceed the regional subsistence minimum per capita;

- family property does not exceed the requirements for movable and immovable property;

- the applicant and children are citizens of the Russian Federation permanently residing in the Russian Federation.

A parent, adoptive parent or guardian of a child can apply.

From what date can I apply for the payment?

You can apply from May 1, 2022 and anytime thereafter.

Payment is established for 12 months, but not more than until the child reaches the age of 17 years.

Can I receive payment via Russian Post?

Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for payment, as well as indicate the address of the recipient and the number of the post office.

Can I receive a payment if I already receive child support for single parents aged 8 to 17?

Yes, you can apply for a payment if, after calculating the average per capita income of the family, the new payment turns out to be more profitable in terms of amount, you will be assigned a new payment in an increased amount, that is, 75 or 100% of the regional subsistence minimum, taking into account the paid amounts of the previous allowance . In this case, the payment of the previous benefit will automatically stop.

In this case, the payment of the previous benefit will automatically stop.

You submitted an application before May 1, why is there still no payment?

According to the rules, applications for new benefits are processed within 10 working days. In some cases, this period may be longer, up to 30 working days. An extension of the period is usually necessary if the organizations did not submit information to the Pension Fund on time confirming the family's right to payment. If after this period there is no answer to the application, you should contact the Pension Fund. This can be done in person at the PFR customer service where the application was submitted, or by calling the PFR hotlines: www.pfr.gov.ru/contacts/counseling_center/reg_lines

What should I do if I receive a denial of payment due to property that does not actually exist?

In this case, you need to contact the PFR client service or an organization that can document the absence of property in the family's property. For example, in Rosreestr or the Ministry of Internal Affairs. Since it is such organizations that inform the Pension Fund about the presence of a family of this or that property. The document issued by the organization must be submitted to the client service of the Pension Fund at the place of residence. Pre-registration is not required for this. After confirming that the property does not own the property for which the refusal was made, the decision will be reviewed.

For example, in Rosreestr or the Ministry of Internal Affairs. Since it is such organizations that inform the Pension Fund about the presence of a family of this or that property. The document issued by the organization must be submitted to the client service of the Pension Fund at the place of residence. Pre-registration is not required for this. After confirming that the property does not own the property for which the refusal was made, the decision will be reviewed.

What to do if the payment is refused due to the lack of documents that were submitted to the Pension Fund?

In this case, you need to contact the branch of the Pension Fund, where the application was submitted, so that the specialists check the information again. To do this, you can contact the Pension Fund in person or by calling the reference numbers of the fund's departments: www.pfr.gov.ru/contacts/counseling_center/reg_lines.

When can I submit a new application if I am denied?

A new application may be submitted at any time after the reason for the denial has been resolved. There is no point in submitting a new application earlier.

There is no point in submitting a new application earlier.

Do I need to apply for a new payment if I am already receiving child benefit from 8 to 17 years as a single parent, but my income is still less than the living wage?

Yes. If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving payment at an increased amount, i.e. 75 or 100% of the regional living wage instead of 50% as before. In this case, the payment of the previous benefit will automatically stop.

My son turned 8 in February 2022 will I receive benefits for this period?

No, the allowance is granted from the child's 8th birthday, but not earlier than April 1, 2022.

The Presidential Decree says that the allowance is established from April 1, if applications can only be submitted from May 1, then how to get money for April?

For applications submitted before October 1, 2022, the money will be paid for the period from April 1, 2022, but not earlier than the month the child reaches the age of 8 years.

This means that if a family applies for a new payment in the first days of May, then the first payment in May will be for two months at once - for April and May. If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

Is it possible to receive benefits without Russian citizenship?

No

What payment details do I need to provide when applying?

The application must indicate the details of the applicant's bank account: the name of the credit institution or the BIC of the credit institution, the correspondent account, the applicant's account number. The payment cannot be transferred to the account of another person. If the application was submitted with another person's bank details, you can submit a new application with your own bank details.

Payment will be credited only to Mir bank cards.

Does the payment apply to children who are already 17 years old?

The payment is only for children under 17 years of age.

Monthly allowance for each child?

Yes, the allowance is paid for each child from 8 to 17 years old in the family.

The family has two children aged 8 to 17 years. Do I need to write an application for each child?

No, if there are two or more children aged 8 to 17 in a family, one general application is completed for each of them to receive a monthly payment. Two or more applications are not required in this case.

My application was returned for revision, how long will it take to process it?

The term for consideration of the application is 10 working days. In your case, it has been suspended. If the revised application is received by the Fund within 5 working days, its consideration will be restored from the date of submission.

What happens if I don't submit the revised application or documents within 5 business days?

In this case, the payment will be denied and you will need to reapply.

How can I find out if a payment is due or not?

When submitting an application through the Public Services Portal, a notification about the status of its consideration will appear there.

If the application was submitted in person at the client service of the Pension Fund of Russia or at the MFC, in case of a positive decision, the funds will be transferred within the period established by law without additional notice to the applicant.

In the event of a denial, the applicant will be sent a notice within 1 business day stating the reason for the denial.

How long is the payment?

The allowance is granted for one year and extended upon application. Its review takes 10 working days. In some cases, the maximum period will be 30 working days.

In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

How long can I receive the payment?

The benefit is paid from the age of eight until the child reaches the age of 17.

Does the payment depend on family income?

Yes, the payment is due to families whose monthly income per person does not exceed the subsistence level per capita in the region of residence. To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

What is the zero income rule?

The "zero income rule" implies that the allowance is granted if the adult family members have earnings (stipends, income from work or business activities or pensions) or the lack of income is justified by objective life circumstances.

Will the money be withheld if I have a debt under an executive document?

No

I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Yes, they will.

Will a car bought on credit be considered in the property appraisal?

Yes.

Does the payment apply to children left without both parents?

Yes. The payment applies to orphans. In this case, their guardian (custodian) has the right to a monthly allowance, but only if the child is not fully supported by the state.

To assign benefits, guardians must personally submit an application to the client service of the Pension Fund of Russia at the place of residence or at the MFC.

I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Yes, you can.

In my place of residence there is a local subsistence minimum. Will it be taken into account when calculating benefits?

Yes.

How can I verify my actual place of residence if I do not have a residence registration?

The place of actual residence is determined by the place where the application for the allowance was submitted.

At what subsistence level will my income be calculated if I have two registrations - at the place of residence and at the place of temporary residence?

In this situation, the subsistence minimum at the place of temporary residence will be taken into account.

In our region, the area standard for one person is 18 square meters. meters, and the rules for assigning benefits say that no more than 24 square meters are taken into account. How many square meters per person should be in my case?

In your case, the standard of 24 square meters is taken into account. meters.

Our family lives in a house that was provided as social support to a large family. Do I have to provide documents that state this?

No, the FIU will request these documents independently within the framework of the system of interdepartmental interaction.

When calculating income, will the received alimony be taken into account?

My family owns an apartment and a residential building, in total their area exceeds the standard of 24 sq. m. m. per person, will I be denied benefits?

No. Restrictions on square meters apply if the family owns several apartments or several residential buildings. When owning one type of residential property, its area is not taken into account.

I registered with the Pension Fund the care of my husband's 86-year-old grandmother and I receive an allowance for caring for citizens over 80 years old. Will this allowance be taken into account when calculating my income?

Yes.

In what order are district coefficients applied in determining the amount of benefits?

The district coefficient is not applied when assigning the allowance, since the amount of the allowance is set depending on the subsistence minimum per capita, in which the district coefficient is already taken into account.

Do I have to report to the Pension Fund information about changes in family composition and income if they occurred after the application was submitted?

No. Beneficiaries are not required to report changes in income to the Pension Fund during the benefit period.

Can I get benefits only for children aged 8 to 17?

No, not only. There are also payments for low-income families for pregnant women who registered early, benefits for children from 0 to 3 years old, as well as benefits for children from 3 to 8 years old.

Will the payment be indexed?

Yes. The monthly payment will be indexed annually from January 1st.

Where can I contact if I have any questions about the purpose of the payment?

If you have any questions about this payment, you can call the Unified Contact Center at 8-800-600-00-00, in addition, you can ask your question on the official social networks of the Pension Fund of Russia or contact any fund client service.

Large family allowance - frequently asked questions

1.

Which families will receive the large family allowance?

Which families will receive the large family allowance?

The right to receive the allowance for a large family is one of the parents, guardian or caregiver who brings up three or more children in the family who meet the conditions for receiving child allowance. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying - until he reaches 19years. If the child turns 19 in the current school year, the child allowance is paid until the end of the school year.

2. Is the allowance for a large family paid monthly or only once?

The allowance for a large family is paid monthly.

3. If our family already has three children, will our family receive this benefit?

Yes, one of the parents, a guardian or trustee who is raising three or more children in the family receiving child allowance as of 07/01/2017 has the right to receive allowance for a large family

4.

Is this benefit exclusively for families who are just expecting a third child?

Is this benefit exclusively for families who are just expecting a third child?

No, one of the parents, a guardian or trustee who is already raising three or more children in the family receiving child allowance as of 07/01/2017 has the right to receive benefits for a large family. Is the allowance for a large family paid automatically, or will it be necessary to apply?

If before 01.07.2017 the family has three or more children for whom one person receives child allowance, no application is required.

If the third child is born in the family after 01.07.2017, in this case, it is required to submit an application for family benefit for the newborn and at the same time indicate the desire to receive the allowance for a large family.

The application can be submitted on the self-service portal of the Social Insurance Board. Application for parental benefit, family benefits and supplementary contributions to the mandatory funded pension.

6. To whose current account and on what date is the money transferred?

The money is paid automatically on the 8th day of each month to the person to whose current account child allowances have been transferred so far.

If you want to change the beneficiary of benefits, another person submits an application for granting benefits. The person who has received benefits so far gives his or her consent to withdraw from receiving benefits.

7. Are beneficiaries of parental benefit also entitled to family allowance?

Yes, receiving parental benefit does not limit the right to receive benefits for families with many children.

8. If my spouse and I have 2 children from a joint marriage, and at the same time the spouse has one child from a previous life together, are we entitled to receive benefits for a large family?

The purpose of family allowances is to partially cover the costs associated with raising a child, so the allowance is paid to the parent who takes care of the child on a daily basis. Thus, it is important here that these parents bring up all three children on a daily basis. If there is a situation in which the same parent receives child allowance for a child from a previous marriage and for two children born in a new marriage, that parent will automatically receive the allowance for a large family.

Thus, it is important here that these parents bring up all three children on a daily basis. If there is a situation in which the same parent receives child allowance for a child from a previous marriage and for two children born in a new marriage, that parent will automatically receive the allowance for a large family.

It is important that the child allowances for all three children are issued to the same person.

9. Mother and father have 2 children in common. In addition, the mother / father has a child from a previous life together, who lives half the time in one family and half in another, while his hobby groups / clothes, etc. paid equally by parents. At the same time, the mother's/father's previous life partner(s) has two more children. What will happen in such a situation?

When determining family allowances, all children brought up in a family who are entitled to receive child allowance are taken into account. The family does not include children who live separately from this particular family with the other parent.

An exception is the situation in which, when the parents separate, the child lives equally in two families. In this case, the parents agree on which family the child is included in.

The Social Insurance Board does not have the authority to decide which family a child should be included in.

The right to receive the allowance for a large family is one of the parents who brings up three or more children in the family who meet the conditions for receiving child allowance. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying, up to the age of 19. If the child turns 19 in the current school year, the child allowance is paid until the end of the school year.

10. Is it possible to share between parents the receipt of child allowance and allowance for a large family?

No, the recipient of the child allowance and the family allowance must be the same person. The payment of child allowances and allowances for a large family is made to one current account chosen by the person.

11. Is it possible for one parent to receive child benefits for three or more children, while the other parent receives child benefits for a large family?

No, one of the parents, a guardian or custodian, or another person who is eligible for child benefits for three or more children is eligible to receive Large Family Allowance.

12. If the third child is born, for example, on July 15, 2017, from what time does the right to receive benefits for a large family arise?

The right to receive benefits for a large family will arise from the moment of the birth of the third child, i.e. from 07/15/2017

13. Will the large family allowance affect the living allowance paid by the social welfare department of the place of residence?

Yes, it will. The allowance for a large family is included in the family income when calculating the subsistence allowance. Therefore, in the future, this family may not qualify as a recipient of a subsistence allowance, or the amount of the assigned subsistence allowance may decrease.

14. If my spouse and I have 3 children for two, while the spouse has 2 children from a previous life together, and I have 1 child. We do not have common children. All three children live with us, which means daily expenses on our part. Are we eligible for family allowance?

If the parents are legally married, then one of the spouses will be entitled to receive the large family allowance, despite the fact that there are no common children in the family.

15. If there are three children in a family and one of them, aged sixteen, has graduated from basic school and is going to study at a gymnasium in autumn, will the payment of benefits for a large family begin in July or in autumn? If the child is studying at a gymnasium, is there information about this or is special confirmation required?

In this case, the payment of the allowance for a large family will begin in July. Children under the age of 16 are entitled to receive child allowance, and in the case of a child studying, up to the age of 19. If the child turns 19 in the current academic year, the child allowance is paid until the end of the academic year. The beginning of the academic year is considered September 1st, and the end is August 31st, in case of graduation from the gymnasium - June 30th.

If the child turns 19 in the current academic year, the child allowance is paid until the end of the academic year. The beginning of the academic year is considered September 1st, and the end is August 31st, in case of graduation from the gymnasium - June 30th.

If the child is studying in Estonia, a study certificate is not required. We obtain information about studies from the Estonian Education Information System (EHIS). If the child is studying abroad, a certificate of study must be submitted annually to the Social Insurance Board.

16. My husband works in Finland and receives child benefits there for our children. I am a housewife, I live with children in Estonia. When will the allowance for a large family begin to be paid, how will our family allowances be paid in the future?

If the total amount of family benefits in Finland is less than the total family benefits in Estonia, Estonia will have to pay an additional benefit equal to the difference between the family benefits in Estonia and Finland.