How to get child support lowered in tn

Child Support Modification in Tennessee

Tennessee child support modification law, forms, review, retroactive, guidelines, credits, retroactive support orders, significant variance, deviations, exceptions, and income documentation. How to raise, lower, increase, decrease, reduce, modify or otherwise change Tennessee child support.

https://youtube.com/watch?v=SE1o1choZ10Video can’t be loaded because JavaScript is disabled: How to Modify Child Support in Tennessee (https://youtube.com/watch?v=SE1o1choZ10)

How to Modify Tennessee Child Support / Child Support Review in Tennessee

How to Modify Child Support in Tennessee

In Tennessee child support modification law, support cannot be modified unless the person seeking to modify the monthly amount owed can prove that there has been a significant variance. The Child Support Guidelines very specifically define what is meant by “significant variance.” In general, to qualify for this child support review in Tennessee, there must be a 15% change. But, there are important details as part of this process which may prevent a review for modification.

For more detailed examples, Tennessee’s Court of Appeals issues legal interpretations of law and many of these cases are discussed in our Tennessee Family Law Blog’s Child Support Modification category.

What are the Guidelines for changing child support in Tennessee?The best source of law on modifying, or changing, child support is the Child Support Guidelines themselves. Section .05 discusses modification. A complete set of the Guidelines is available to you, but be sure to always check the current version of the Guidelines. Although this page was written in 2015, do be aware that important changes in the law could have occurred in the time since then.

How can Tennessee child support be modified?- How do I change my Tennessee child support order?

- How can I reduce my child support payments?

- How do I increase my TN child support?

- How can I change child support payments?

Below is a step-by-step analysis to determine if you or your child’s other parent can qualify for a modification of child support – that is, increasing or decreasing an existing, current child support obligation. Understand that the steps described below are not contained within the Guidelines, but are offered here to help you navigate through the Rules. Know that ARP stands for “Alternative Residential Parent” while PRP stands for “Primary Residential Parent.”

Understand that the steps described below are not contained within the Guidelines, but are offered here to help you navigate through the Rules. Know that ARP stands for “Alternative Residential Parent” while PRP stands for “Primary Residential Parent.”

The first step in Tennessee child support modification is obtaining income information from the other parent. Most current parenting plans have explicit provisions for exchanging financial information. Read your parenting plan. Ask the other parent for the information that your parenting plan requires be exchanged between the two of you. Employer-issued W-2s are usually out by January 31 of each year, but you may also want to see the rest of the other parent’s tax return. Even when your parenting plan does not require the exchange of income information, you may still request it. If you are working with an attorney, then discuss your options for obtaining income information early in the child support modification process.

When you do not have the other parent’s income information, for whatever reason, you should still go through the analysis, guessing about the other parent’s income. If there may be a significant variance, then you can choose to request the income information or, in the alternative, file a motion or petition to change child support and ask the court to compel production of the other parent’s income information as part of that legal action. You may even send a subpoena to the other parent’s employer.

To learn more about what is “gross income” for child support purposes, see Child Support FAQs on this website. You will find discussions about a number of different situations, including imputing income to a parent, assigning income to a parent without proof of income, and what may be required to prove that the other parent is voluntarily underemployed or unemployed. Know that investment income, interest and dividend income, and other non-employment income can be included in determining a parent’s gross income for purposes of calculating child support.

The second step is to determine the percentage change in income and see if it qualifies as a significant variance. Based on the income of both parents, the number of parenting nights each enjoys, and the childcare and health insurance costs for the children, you will need to calculate the new prospective child support amount utilizing the child support worksheets. Then you will need to compare the new prospective amount to the current amount.

How does the new prospective amount compare with the old amount? Here is where to start:

(c) For all orders that were established or modified January 18, 2005 or after, under the income shares guidelines, a significant variance is defined as at least a fifteen percent (15%) change between the amount of the current support order (not including any deviation amount) and the amount of the proposed presumptive support order . . . .” Rule 1240-2-4-.05(2)(c).

.” Rule 1240-2-4-.05(2)(c).

There is also an exception for a low-income provider.(That exception is discussed below.)

Importantly, if the current child support order was established or modified before January 18, 2005, then the following provision applies:

(b) For all orders that were established or modified before January 18, 2005, under the flat percentage guidelines, and are being modified under the income shares provisions for the first time, a significant variance is defined as:

- At least a fifteen percent (15%) change in the gross income of the ARP; and/or

- A change in the number of children for whom the ARP is legally responsible and actually supporting; and/or

- A child supported by this order becoming disabled; and/or

- The parties voluntarily entering into an agreed order to modify support in compliance with these Rules, and submitting completed worksheets with the agreed order; and

- At least a fifteen percent (15%) change between the amount of the current support order and the proposed amount of the obligor parent’s pro rata share of the BCSO if the current support is one hundred dollars ($100) or greater per month and at least fifteen dollars ($15) if the current support is less than one hundred dollars ($100) per month.

…” Rule 1240-2-4-.05(2)(c).

…” Rule 1240-2-4-.05(2)(c).

Again, there is an exception for the low-income provider (see below).

Step Three: Health Care Needs Exception in Changing Tennessee Child SupportThe third step is to determine whether the child’s healthcare needs provide an exception allowing for modification of child support.

(a) … [T]he necessity of providing for the child’s health care needs shall be a basis for modification regardless of whether a modification in the amount of child support is warranted by other criteria.” Rule 1240-2-4-.05(a).

Regardless of whether or not child support will result in a significant variance, if there is an issue with a child’s healthcare needs requiring additional support, then the court will consider the modification.

A difficult situation arises when the child’s healthcare situation also affects educational needs, which may not be grounds for a modification. For example, is the child’s ADHD diagnosis requiring medication a healthcare need or an educational need? The ADHD medication sounds like a medical condition. But counseling with an educational expert may not qualify as healthcare because its purpose is educational. Often, the only person who may know the answer is the trial judge hearing the evidence.

But counseling with an educational expert may not qualify as healthcare because its purpose is educational. Often, the only person who may know the answer is the trial judge hearing the evidence.

The fourth step requires ruling out whether the person seeking a modification of child support is or is not a low-income provider. If that parent is a low-income provider, then different rules apply. For purposes of modification of orders, a low-income provider is a person who:

- Is not willfully and voluntarily unemployed or underemployed when working at his/her full capacity according to his/her education and experience; and

- Has an Adjusted Gross Income at or below the federal poverty level for a single adult.

(i) As of the effective date of the rules, the federal poverty level for a single adult is ten thousand four hundred dollars ($10,400) annual gross income, which shall remain in effect until updated by the Department.

(ii) Updated information regarding the federal poverty standards will be available on the Department’s website at www.state.tn.us/humanserv.” Rule 1240-2-4-.05(d).

Step Five: Ignore Previous Deviations in Tennessee Child Support ModificationThe fifth step in Tennessee child support modification requires ignoring previously ordered deviations. Deviations in child support relate to specific situations in which the presumed amount owed is adjusted upward or downward based upon a special circumstance. Under Tennessee child support law, all deviations must be in writing and contain specific findings by the court ordering the support. Specifically, the Guidelines say:

(3) To determine if a modification is possible, a child support order shall first be calculated on the Child Support Worksheet using current evidence of the parties’ circumstances. If the current child support order was calculated using the flat percentage guidelines, compare the existing ordered amount of current child support to the proposed amount of the ARP’s pro-rata share of the basic child support obligation. If the current child support order was calculated using the income shares guidelines, compare the presumptive child support order amounts in the current and proposed orders. Do not include the amount of any previously ordered deviations or proposed deviations in the comparison. If a significant variance exists between the two amounts, such a variance would justify the modification of a child support order unless, in situations where a downward modification is sought, the obligor is willfully and voluntarily unemployed or underemployed, or except as otherwise restricted by paragraph (5) below or 1240-2-4-.04(10) above.” Rule 1240-2-4-.05(2)(d).

If the current child support order was calculated using the income shares guidelines, compare the presumptive child support order amounts in the current and proposed orders. Do not include the amount of any previously ordered deviations or proposed deviations in the comparison. If a significant variance exists between the two amounts, such a variance would justify the modification of a child support order unless, in situations where a downward modification is sought, the obligor is willfully and voluntarily unemployed or underemployed, or except as otherwise restricted by paragraph (5) below or 1240-2-4-.04(10) above.” Rule 1240-2-4-.05(2)(d).

The Guidelines also say this about deviations:

(5) Upon a demonstration of a significant variance, the tribunal shall increase or decrease the support order as appropriate in accordance with these Guidelines unless the significant variance only exists due to a previous decision of the tribunal to deviate from the Guidelines and the circumstances that caused the deviation have not changed. If the circumstances that resulted in the deviation have not changed, but there exist other circumstances, such as an increase or decrease in income, that would lead to a significant variance between the amount of the current order, excluding the deviation, and the amount of the proposed order, then the order may be modified.” Rule 1240-2-4-.05(5).

If the circumstances that resulted in the deviation have not changed, but there exist other circumstances, such as an increase or decrease in income, that would lead to a significant variance between the amount of the current order, excluding the deviation, and the amount of the proposed order, then the order may be modified.” Rule 1240-2-4-.05(5).

The sixth step acts as a bar to modification. If a child support obligor, or ARP, is intentionally behind on child support, then the court has authority to deny a modification of child support that, otherwise, could be modified. However, just because an obligor is behind with support payments, also described as being “in arrears,” that alone is not grounds for a denial of modification. The obligor’s non-payment must be intentional. For the exact provision, see Rule 1240-2-4-.05(4).

Step Seven: Significant Variance in Child Support Reduction or Increase in TennesseeThe seventh step in modification deals with changes related to the number of children for which a parent is legally responsible, parenting time adjustments, and work-related childcare. If any of these three grounds are asserted as a basis for modification of child support, then there still must be compliance with the significant variance requirement described above. For the exact provision, see Rule 1240-2-4-.05(6).

If any of these three grounds are asserted as a basis for modification of child support, then there still must be compliance with the significant variance requirement described above. For the exact provision, see Rule 1240-2-4-.05(6).

The eighth step only applies to split parenting when both parents have 50/50 parenting time. The rule states that:

(7) Modification of Orders in Split Parenting Cases and Cases Where Parenting Time is Divided on a 50/50/Equal Basis.

(a) If an order was established or modified under the Income Shares guidelines between January 18, 2005 and April 1, 2005, in a case with split parenting or a case in which parenting time is divided on a 50/50/equal basis, the order may be modified without compliance with the significant variance requirement only for the purpose of correcting a calculation error resulting from application of the rules implemented on January 18, 2005.

(b) Any arrears which may have accumulated under any such order as originally established or modified under the Income Shares guidelines may be recalculated consistent with the amount of the child support obligation as modified pursuant to this part.” Rule 1240-2-4-.05(7).

Step Nine: Filing Petition Required for Change Prior to Modifying Tennessee Child SupportThe ninth step limits modification only after “an action for modification is filed and notice of the action has been mailed to the last known address of the opposing parties.” For every month child support is due, it is a judgment and cannot be modified retroactively. It cannot be changed. For the exact provision, see Rule 1240-2-4-.05(8).

No. Ongoing child support cannot be modified retroactively. The only exception might be negotiating with the other parent and qualifying for reduction of an arrearage for back support. To learn more, see Back Child Support Now Waivable Due to Change in Tennessee Child Support Law.

The tenth step in modifying child support deals with what is called the “hardship” exception. The hardship exception allows courts to prevent a modification of child support that would drastically reduce the amount of support only because the new Income Shares Method was applied. Discuss this with your lawyer. See the Guidelines for more details and to determine whether the hardship exception might apply to your situation. In general, courts are reluctant to apply the hardship exception unless, one, there is strict compliance with the Rules and, two, the trial judge really thinks the reduction in support will cause a very real hardship. The reason why this provision is so specific and strictly applied is that every reduction in child support could arguably create a hardship.

These ten steps are just the beginning. Even though the Rules described herein are very specific and, arguably, overly stringent in some circumstances, there are legal arguments that can be made regarding a potential modification of child support. Arguments that are not covered here.

Arguments that are not covered here.

For determining gross income, there are many court decisions that deal with very specific situations. For example, if an employee received a large bonus in one particular tax year, but the bonus related to more than one years’ performance with the employer or company, then arguably that income may be allocated over the number of years to which that performance related. If a person owns a minority interest in a partnership, for instance, and is taxed on the earnings of the company and not on the amount distributed in earnings, then gross income may be the amount of distributions rather than taxable income. In other words, there are many, many situations requiring specific research and analysis – even for experienced Tennessee family lawyers. Child support modification is a very challenging aspect of Tennessee family law. Seeking a modification is not to be taken lightly.

MODIFYING TENNESSEE CHILD SUPPORT DUE TO A CREDIT

Changing Child Support in Tennessee

Can the Alternative Residential Parent obtain a modification in child support just because the obligor qualifies for a credit under the Tennessee Guidelines?The Guidelines say no. You still must have a significant variance to modify child support. The Tennessee Court of Appeals explained some of the history behind modification law and the succession of changes in this area’s child support rules:

You still must have a significant variance to modify child support. The Tennessee Court of Appeals explained some of the history behind modification law and the succession of changes in this area’s child support rules:

The new Guidelines defined the term “significant variance” as “(a)t least fifteen percent (15%) change in the gross income of the ARP (alternate residential parent) … ,” a change in the number of children for whom the ARP was responsible and supporting; a supported child become disabled; or the parties’ agreement to modify support and at least a 15% change between the current support order and the proposed order, using the income shares worksheet. Subsection (7) of this regulatory provision stated that, beginning January 1, 2006, the above definition of “significant variance” would be eliminated. After that, a parent seeking modification would merely have to show a 15% difference between the current support order and the proposed child support order using the income shares worksheet.

On October 14, 2005, the Tennessee Department of Human Services (“DHS”) promulgated an emergency rule, repealing subsection (7) of Rule 1240-2-4-.05, which would have changed the definition of “significant variance” to require only a showing of a 15% difference between the current and the proposed child support orders. DHS also published a “Statement of Necessity” for this emergency rule. In the Statement of Necessity, DHS noted concerns that the changes would result in significant increases or decreases in existing child support obligations based solely on the new methodology for calculating the support. DHS was also concerned that Tennessee courts would be “subject to an unusually high volume of requests for modification by parents seeking to improve their respective financial positions” by receiving a reduced child support obligation under the new income shares guidelines. To address these concerns, DHS decided to eliminate the new subsection (7) definition of “significant variance” and maintain the existing definition of the term, in order to “limit the availability of modifications. …” Hill v. Hill, No. M2006-0273-COA-R3-CV (Tenn. Ct. App., Dec. 17, 2007) (Citations omitted).

…” Hill v. Hill, No. M2006-0273-COA-R3-CV (Tenn. Ct. App., Dec. 17, 2007) (Citations omitted).

For many reasons, whether or not a parent may modify child support remains a confusing topic for judges and lawyers alike. Application of the child support guidelines to a particular situation is not easily predictable. Definitely see an experienced Tennessee family lawyer to inquire about your situation. Why? Because this complex area of Tennessee child support law may have been interpreted differently by the Tennessee Court of Appeals. Talk to your lawyer.

TENNESSEE CHILD SUPPORT MODIFICATION FORMS

Are there child support modification Tennessee forms in Tennessee?Not really. There are no official, state-wide, Supreme Court of Tennessee approved forms for a parent to complete in order to request that the court review an existing, current child support order to determine if a modification is warranted. However, it is possible that some Tennessee county clerk’s office (or State of Tennessee agents for child support collection and enforcement) may have developed certain child support modification forms for use in a given locality. Consider checking your court clerk’s website or calling the court clerk’s office to find out. In general, to request that a court modify child support, a parent’s lawyer will draft a petition to modify child support alleging the necessary factual and legal requirements, will file that petition in the applicable court clerk’s office, and will then have that petition served on the other parent.

Consider checking your court clerk’s website or calling the court clerk’s office to find out. In general, to request that a court modify child support, a parent’s lawyer will draft a petition to modify child support alleging the necessary factual and legal requirements, will file that petition in the applicable court clerk’s office, and will then have that petition served on the other parent.

- Tennessee Child Support Laws

- Tennessee Child Support Law Answers to FAQs

- Tennessee Child Support Calculator & Links to App

- Tennessee Parenting Plans and Child Support Worksheets: Building a Constructive Future for Your Family

- For analysis, updates, commentary and case law summaries, view the Child Support Modification category of our MemphisDivorce.com Tennessee Family Law Blog.

The Reasons & Ways You Can Modify Child Support in Tennessee

We all have times when life deals us unexpected situations and those situations can have a direct effect on our financial well-being. We look at our balance sheet for ways to either reduce expenses or increase income. If you’re a divorced couple with children, one of those budget items will likely be child support. Whether you’re the parent paying the money or the one receiving it, you may wonder if you can arrange to modify child support.

We look at our balance sheet for ways to either reduce expenses or increase income. If you’re a divorced couple with children, one of those budget items will likely be child support. Whether you’re the parent paying the money or the one receiving it, you may wonder if you can arrange to modify child support.

It is possible to modify child support in Tennessee, whether you are the payor or the payee. You need to demonstrate to a court that there has been a change that is both substantial and material since the time the original support plan was implemented. The variance test--a specific mathematical formula--will be used by a Tennessee family court to determine if the changes in financial condition are, indeed, substantial and material.

How Tennessee Determines Child Support

Perhaps the best way to start an understanding of how support modification requests are viewed by a court is by reviewing all considerations that went into the original support plan.

The state of Tennessee has issued Child Support Guidelines that judges are to rely on. Everyone’s case is different, but the guidelines at least allow for some level of standardization. The fact that each judge is at least considering all the same factors makes it easier to understand, not only how a support plan is drafted, but what changes might warrant modification.

Everyone’s case is different, but the guidelines at least allow for some level of standardization. The fact that each judge is at least considering all the same factors makes it easier to understand, not only how a support plan is drafted, but what changes might warrant modification.

The Support Guidelines call on family court to look at each party’s income. That includes wages and salaries. It includes self-employment income. It also includes commissions and tips if you or your spouse are compensated on that basis. The court considers the value of stock portfolios, 401(k) plans and bank accounts. The value of any benefits paid out under Social Security, workers’ comp or other government programs are factored in.

In short–if it’s money that’s going on your IRS form in any way, it’s going to be included as a consideration in the final child support agreement.

The support plan that derives from this initial calculator is considered to be “correct” in the eyes of the court, but also “rebuttable. ” What that means is that either spouse can bring up factors they believe should result in a different payment schedule, but the burden of proof will lie on that spouse to prove their case.

” What that means is that either spouse can bring up factors they believe should result in a different payment schedule, but the burden of proof will lie on that spouse to prove their case.

Medical expenses that are higher than the norm (i.e., routine office visits and an occasional trip to the ER with a badly sprained ankle) might be used to rebut the presumption that the initial plan is accurate. Special education needs are another. These are expenses that must be shared equitably between the spouses.

Courts will also give appropriate consideration to whether a spouse has additional children to support. If the person paying the support also has children through another relationship, this might be used as the basis for establishing a lower support payment than the guidelines would otherwise indicate.

Once all of this has been taken into consideration, a child support plan is put in place as part of the broader divorce settlement agreement. If anyone wishes to change this plan, it will now require a modification order. The courts must be shown that a change in circumstances has taken place, one that is causing hardship to one of the parents. The key legal vehicle used to make this decision will be the variance test.

The courts must be shown that a change in circumstances has taken place, one that is causing hardship to one of the parents. The key legal vehicle used to make this decision will be the variance test.

The Variance Test in Tennessee

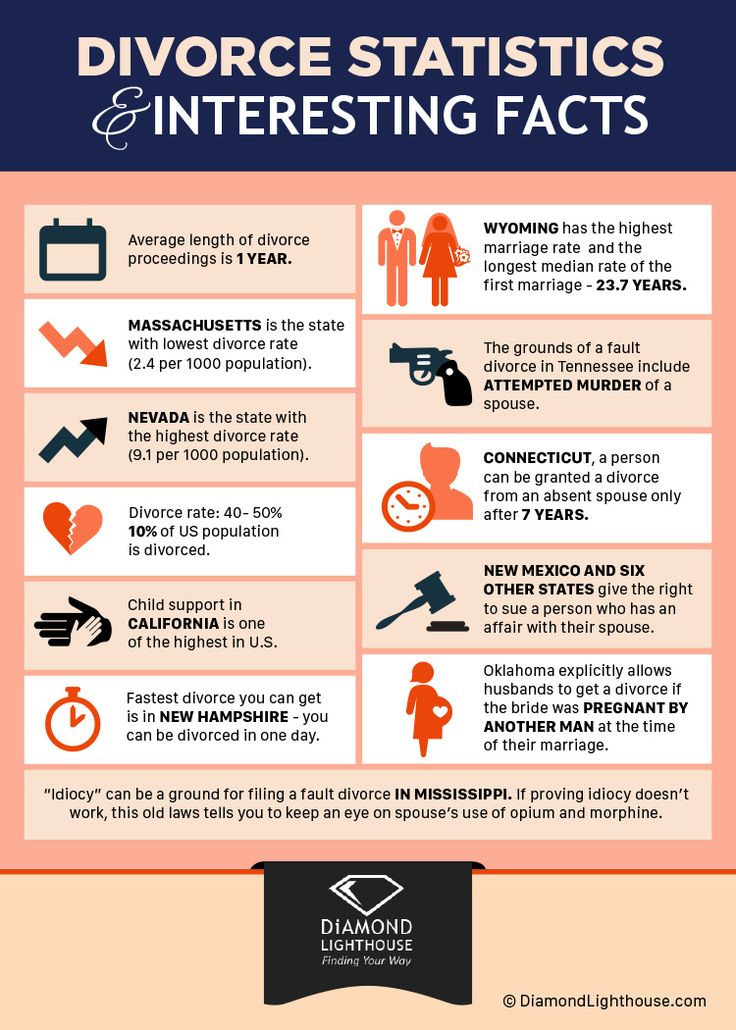

The number the courts will key in a support modification request is 15%. That means there should be a 15% change in either parent’s monthly income. That can come when the parent making the payments receives a significant promotion at work. Or it can come when new medical or education expenses—ones not able to be considered at the time of the original order—are a burden on the parent receiving the payments.

15% is the standard variance test measure, but for parents on tighter budgets, even small variances can have a big impact on the monthly budget. The state of Tennessee recognizes this and cuts the variance test in half, to 7.5%, in certain cases.

To qualify for the lower variance test measure, the parent must be unemployed or underemployed (based on their education and experience) and their income must be at or below the federal poverty line.

A parent seeking either the 7.5% variance rate, or a child support modification in general, because of unemployment or underemployment must be in that situation involuntarily. A parent cannot quit their job and expect child support payments to change. A parent cannot take a lower paying, but more fulfilling, job and expect their child support payments to change.

If either of these situations do occur and result in a modified support order, it’s possible a judge could order the relevant parent to provide proof of effort to find a job that will enable them to return to the original payment schedule.

When Changed Circumstances Are Harder to Measure

A change that is both material and substantial can also come in ways that are less measurable. Let’s say the paying parent remarries. By itself, this does not alter the original support plan. But if the paying parent has another child, it can be considered a substantial change in circumstance and result in reduced payments.

Furthermore, child support is just one part of the overall program of child custody. What happens if the visitation schedule changes? The parent receiving the payments is usually the primary custodial parent as well (the legal term for defining the parent whom the kids stay with most of the time). What if they seek a restriction on visitation and get it? The reasons why such a restriction might be granted are beyond the scope of our discussion here, but one ripple effect might be the court also reducing support payment amounts.

The paying parent having to serve jail time is quite the significant change in circumstance. In 2020, the state of Tennessee passed legislation that included a provision where anyone subject to 180 days of prison time (approximately six months) could request a child support modification on that basis.

How to Get a Child Support Modification Order in Tennessee

Perhaps you and your child’s other parent both agree on the need for a changed payment plan. That’s terrific and it can certainly make the legal process of modification less contentious. But make sure that the legal process is a part of this.

That’s terrific and it can certainly make the legal process of modification less contentious. But make sure that the legal process is a part of this.

It’s not uncommon for divorced parents with children to have figured out an amicable way to share in the raising of their children. So, if one of the kids suffers a serious injury that requires a lot of medical treatment and rehab, the paying parent may well see the need to step in with more money to help. Or, if the paying parent gets laid off, the parent who is home with the kids might be able to take less money for a little while.

Those agreements are great, but they do not have the binding force of law. Either parent could renege at any point and there is no recourse. Courts cannot enforce what they never issued or approved. Private agreements between spouses are meant as a starting point, not a finish line.

The real finish line comes with a formal request to a Tennessee court for a modification of child support payments. This process can include discovery–where each parent turns over all relevant information, financial and other, to the other parent’s attorney.

This process can include discovery–where each parent turns over all relevant information, financial and other, to the other parent’s attorney.

This process has benefits that go beyond having a binding agreement. The parents know exactly where each other stands financially, thus reducing the chance of either making accusations of deception later.

The legal process also allows a judge to look at the entire agreement and make an assessment regarding the best interest of the child. We know parents can find this frustrating–after all, who knows your child’s best interests better than you? The answer is no one, but a neutral third party might still see issues that someone else may not. Getting validation of your agreement by a judge is something else that can reduce the chances of disputes further down the road.

Connor & Roberts, PLLC Can Help

Seeking out a change in your child support plan is a sensitive area and requires an attorney who understands the law, the process and combines that with real human compassion for their client and the children involved. Connor & Roberts, PLLC has been serving the good people of the Tennessee Valley for a combined 40 years. Reach out to us by phone at (423) 299-4489 or contact us online today.

Connor & Roberts, PLLC has been serving the good people of the Tennessee Valley for a combined 40 years. Reach out to us by phone at (423) 299-4489 or contact us online today.

Alimony - Help for paying parents

This guide will answer questions about child support that a non-custodial parent may have. The information below is useful for both custodial parents and non-custodial parents

Definitions of key terms

Custodial Parent (kas-TO-di-al PER-ent): Parent who lives with the child.

Non-custodial parent : Separated parent.

Why did I get documents telling me that I have to appear in court?

Someone filed a petition (pe-ti-shan) to the court to force you to pay child support. A petition is a written appeal to the court.

Who is eligible to petition for child support?

Petition for child support can be filed by:

- The person who cares for the child

- New York City if the child is or has received public assistance (welfare)

- Child (however, this usually only applies to adult children)

What happens when I go to court?

On the day of the hearing, you will meet with the welfare magistrate (sup-PORT MAD'J-is-trate) who will hear the case and issue a child support order (OR-der for child sup-PORT) . The court's decision is a piece of paper detailing the amount you owe, how often you must pay, and where to send the money. The welfare magistrate is like a judge and has the power to decide on alimony and paternity (pe-TURN-and-tee) . A paternity case is a case to establish who is the real father of a child.

The court's decision is a piece of paper detailing the amount you owe, how often you must pay, and where to send the money. The welfare magistrate is like a judge and has the power to decide on alimony and paternity (pe-TURN-and-tee) . A paternity case is a case to establish who is the real father of a child.

When does child support end?

In New York State, a child may receive child support until the age of 21. Sometimes child support payments may end earlier; for example, this can happen if the child joins the army or gets married.

Can I use a lawyer for my child support case?

In child support cases, the family court is not required to provide a lawyer to the parents, except in cases where the non-custodial parent faces jail time for failure to pay; however, you are free to hire a lawyer if you wish. The welfare magistrate may appoint a lawyer for the child, called a legal guardian or child advocate, to ensure that the best interests of the child are protected. It doesn't happen in every case.

It doesn't happen in every case.

What happens if I don't show up on court day?

If you do not appear on the day of the hearing, the welfare magistrate may issue a default decision (de-FOLT D'JAD'J-mant) . A default judgment is an order issued if the defendant fails to appear in court. In child support cases, the default decision automatically becomes a child support order against the non-custodial parent. This court decision is based on information provided by the custodial parent.

If you wish to contest this decision, you must file a motion to set aside the default decision (MO-shan tou WEI-cate e de-FOLT D'JAD'J-ment) . This is a written petition to the court asking for the annulment of the decree. You must give the court a good reason for not appearing in court.

How is the amount of maintenance determined?

Support amount based on Support Standards Act . First, the court establishes total combined income of for both parents. Total income is the sum of all money earned before taxes. (For incomes of $143,000 or more, the court sometimes applies different rules.) Some special expenses (ex-PEN-ses) will reduce your income for child support. Ordinary expenses are expenses that you pay on a regular basis, such as electricity bills, credit cards, or living expenses. These costs do not reduce your child support income. After the court determines both parents' income, it uses the following formula to determine the amount needed for child support:

Total income is the sum of all money earned before taxes. (For incomes of $143,000 or more, the court sometimes applies different rules.) Some special expenses (ex-PEN-ses) will reduce your income for child support. Ordinary expenses are expenses that you pay on a regular basis, such as electricity bills, credit cards, or living expenses. These costs do not reduce your child support income. After the court determines both parents' income, it uses the following formula to determine the amount needed for child support:

1 child 17% of your income

2 children 25% of your income

3 children 29% of your income

4 children 31% of your income

5 children or more 35% of your income

help.

You may be asked to pay an extra amount for government and child care. Or you may be assigned to include the child in your health insurance.

What if the child support has not yet been paid?

The court may also order the payment of retroactive child support (re-tro-ek-tiv sup-PORT) for the maintenance of the child. This means that you must pay child support from the time the petition is filed, even if it is long before you appear in court. Retroactive child support usually does not accrue from the date the child was born, but this can happen if the petition was filed as soon as the child was born. Accrual occurs from the time the custodial parent first files a petition for child support.

This means that you must pay child support from the time the petition is filed, even if it is long before you appear in court. Retroactive child support usually does not accrue from the date the child was born, but this can happen if the petition was filed as soon as the child was born. Accrual occurs from the time the custodial parent first files a petition for child support.

If you do not pay child support, you will have debt (e-RIRS) . Debt means non-payment of alimony. If you become indebted, the court may add a set amount to your child support until the entire amount owed is paid.

What if my income is unofficial?

If you work informally or do not receive a stable salary, the court may determine your income based on the following:

- How much did you earn in the past

- How much does the court think you could earn

- What are your family's standards of living

The amount determined by the court is called conditional income (im-PYU-ted In-kam) . The court then uses the amount of conditional income to determine the amount of support you will have to pay.

The court then uses the amount of conditional income to determine the amount of support you will have to pay.

What should I bring to court?

- Carefully completed Financial Disclosure Affidavit

- Proof of your income, such as check stubs from your paycheck

- Documents showing Social Security or disability payments, workers' compensation, unemployment benefits, veterans' benefits, pension funds, investment, bursaries, or annuities.

- Information about the “SSI,” “Medicaid,” “Home Relief,” or “Food Stamps,” you get.

- Proof of expenses such as FICA and city taxes. These expenses will be deducted from your income before the court determines the amount of child support.

- If you are paying support for another child, bring a copy of the court order and proof of payments you have already made. As proof, you can use money order receipts, voided checks, or paycheck stubs showing support was paid.

What if I am not the father of the child?

If you were married to the mother when the child was born, the law implies that you are the child's father. If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

Will the court give me a lawyer for my paternity case?

If someone opens a paternity case against you and you are unable to hire a lawyer, you can ask the magistrate to appoint a lawyer for you free of charge. You can also hire your own lawyer. If you open a paternity case, the court may not provide you with a lawyer, even if you are unable to pay for one.

How can I pay child support?

You can pay directly to the other parent or through Child Support Collection Unit (SCU) at the address below. If the custodial parent receives public assistance, SCU will automatically deduct child support from it. SCU services are free and they will keep track of all payments.

Please remember: Always include the case number on your SCU payments to ensure your payment is recorded. Don't use cash - especially if you're paying directly to the other parent! Always pay by money order or check.

What if the SCU makes a mistake?

You need to go to the SCU office (located at 151 West Broadway, 4th floor in Manhattan) and speak to a customer service representative. You can also call the Support Enforcement Office at (888) 208-4485.

How long is the benefit order valid?

Once a benefit order is issued, it remains in effect until someone asks the court to reverse it, your child is 21, or your child is independent (e-MAN-C-Pay-ted) . Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

If you pay through SCU, they automatically review your case every three years. When they review the case, the SCU may add a living wage allowance (COLA). SCU is free to do so without going to court. If they make changes, they will send you an email.

What if I do not agree with the allowance order?

You have the right to tell the court if you disagree with the order. This is called objection (ob-D' JEK-shan) . If you receive a copy of the order on the day the order was issued, you have 30 days to file a written objection. However, if the order was mailed, you have 35 days (from the date the letter was sent) to file a written objection. You can file an objection through the clerk of the Family Court where the decision was made. The judge will decide on your case. You may not have to go to court for a new hearing, but you must continue to pay child support until the court changes the order. The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

If you lose your job or are unable to pay for another reason—for example, your income changes or you go to jail—the court will not automatically change your child support amount. If you are unable to pay child support, you must immediately tell the Family Court where the decision was made and file a Petition for Change for Deterioration shan) . This is a written request to the court to reduce the amount of your child support. To convince the court to reduce your child support, you must provide to the court evidence of a significant change in circumstances (sig-NIF-i-kant change of ser-kam-STEN-ses) that have occurred in your life since the magistrate on the allowance made the final decision.

- An example of a significant change in circumstances would be imprisonment, provided that the imprisonment is not related to non-payment of support or a crime against the custodial parent or child.

- You can also ask for a change in your child support amount if it has been 3 years since the last order was made.

- Also, if your or the custodial parent's income has changed (up or down) by 15% or more since the last instruction, you can petition for a change due to the downside.

Learn more about what to do if you can't pay

When you go to court, you must show evidence of a significant change in your income. You must ask the court to reduce your child support from the date of the petition. Until the court decides otherwise, you must continue to pay the original amount of support.

The court may look at your previous earnings and determine that you can earn more than you currently earn. In this case, the court may leave the order unchanged.

What happens if I don't pay?

If there is a court order for child support, you must pay. If you don't pay, your debts will continue to pile up. This debt WILL NOT DISAPPEAR, even if your child turns 21. Declaring bankruptcy will also not cancel the payment of debt.

Declaring bankruptcy will also not cancel the payment of debt.

The SCU can force you to pay in a variety of ways.

- SCU can force your employer to calculate child support from your wages/cheque. (Your employer is required by law to do this, but they can't fire you for it.) This is called withholding your paycheck (GAR-nish-ing yor WAID'J-es).

- SCU can collect your federal and state tax refund before you receive it. SCU can also take money directly from your bank account.

- If your debt exceeds a few months, SCU may suspend your driver's license or other professional licenses until you pay off the debt.

- If you owe a very large amount of money and the SCU or custodial parent asks the court to check for willful violation (WIL-full-and WAI-0-lay-ting) of child support payments, you may be SENT IN JAIL for up to 6 months. Intentional violation means willful disobedience to a court order.

What if I support my children?

Make sure you keep all receipts for any child support payments. Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt.

Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt.

Who gets the money if my children get public assistance and I pay child support?

If the custodial parent receives public assistance, SCU will automatically collect support. If you are not in debt, $100 of your monthly payment will go to the custodial parent. This $100 per month is for the maintenance of the household, not for each child. If you are in debt, the alimony will go towards paying off the debt in the first place. The city will continue to pay child support even if you give money directly to the custodial parent. The city may also reduce the child support budget to account for the extra money received by the family.

Can I withdraw my child from public assistance?

A non-custodial parent cannot withdraw their child from public assistance. Only the custodial parent who started the public assistance case can do so.

Why might a custodial parent want to remove their child from public assistance?

If your income is high enough, your children may receive more cash assistance from you than from government assistance. For example, if you are the father of all the children in your mother's house, and she can certify that you support them, there should be no problem getting the children off state aid. If a mother has children from other fathers in her public assistance budget, the process will be more complicated. The state wants all children in the home to have the same income. Therefore, it is possible that the mother will not be able to remove only your children from public assistance.

If I pay child support, can I also get visitation?

Optional. Alimony and visits (vi-zi-TAI-shan) are not related. If you are not allowed to see your children, you must file a petition to visit with the court. Whether you see your child or not, you remain responsible for paying child support. For more information about visiting, read the Family Legal Care booklet Custody and Visits.

For more information about visiting, read the Family Legal Care booklet Custody and Visits.

What if there is no child support case, but I want to support my child?

Non-custodial parent cannot start a support case. If you want to support your children but don't know where they are, you can save money in a separate bank account.

Where else can I go for help?

If the SCU is involved in your case, you can contact 151 West Broadway, 4th floor, Manhattan to speak with a customer service representative.

You can also call the Support Enforcement Office at (888) 208-4485.

This document does not replace legal advice. Family Legal Care recommends that all people facing the Criminal Court or Family Court systems consult with a lawyer.

Reduction of alimony in a fixed amount \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Reduction of maintenance in fixed amount

A selection of the most important documents upon request Reduction of alimony in a fixed amount of money (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children for the maintenance of parents

- Maintenance obligations of spouses

- Alimony in 6-personal income tax

- Alimony in a solid amount of

- Alimony of an individual entrepreneur

- more ...

Judicial practice : Reducing alimony in a solid monetary amount

Register and receive trial access to the consultantPluss system free 9000

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 83 "Collection of alimony for minor children in a fixed amount of money" of the RF IC

(R.B. Kasenov) The court refused to satisfy the plaintiff's claims against the defendant to change the procedure for collecting alimony. As the court pointed out, a change in the debtor's marital status, namely the payment of alimony to them for children from a second marriage, in itself is not an unconditional basis for reducing the amount of alimony, which is consistent with the explanations of paragraph 57 of the Decree of the Plenum of the Armed Forces of the Russian Federation of December 26, 2017 N 56 At the same time, the fact that the debtor has a permanent job does not exclude the possibility of paying alimony in a fixed amount of money, in particular, when the amount of official wages clearly does not correspond to the actual expenses of the debtor. Such circumstances fall under the cases expressly provided for in paragraph 1 of Art. 83 of the Family Code of the Russian Federation as a basis for establishing alimony in a fixed amount of money, when the recovery of alimony as a share of earnings significantly violates the interests of one of the parties.

Such circumstances fall under the cases expressly provided for in paragraph 1 of Art. 83 of the Family Code of the Russian Federation as a basis for establishing alimony in a fixed amount of money, when the recovery of alimony as a share of earnings significantly violates the interests of one of the parties.

Articles, Comments, answers to questions : Reducing alimony in solid cash amount

Register and receive trial access to the ConsultantPlus system Free 2 days

Open the document in your system Consultant Plus:

Article: Article: Article: Article: Article: Article: Article: Article: Article: "Alimentary" particles

(Danilov S.)

("Practical Accounting", 2021, N 3) As a rule, alimony is assigned as a percentage (as a share) of the debtor's income, but this is not always fair. The Plenum reminds the courts of the flexibility of the approach and clarifies when it is possible to collect alimony in a fixed amount, increase or decrease the size of the share, or collect additional money on top of the amount due. Attention is paid to very large and very small amounts of support for children. Previous clarifications on such a mass category of disputes date back to 1996 year.

Attention is paid to very large and very small amounts of support for children. Previous clarifications on such a mass category of disputes date back to 1996 year.

Register and receive trial access to the ConsultantPlus system Free 2 days

Open the document in your consultantPlus system:

"Directory for proving in the civil proceedings"

(7th edition, supplemented and processed)

) (under the editorship of I.V. Reshetnikova)

("Norma", "INFRA-M", 2021) So, disputes about changing the agreement on the payment of alimony may relate to the establishment of a different amount of alimony (increase or decrease), method (in shares of earnings or a fixed amount of money) and the procedure (transferring part of the alimony to an account opened in the name of a minor child in a bank) for their payment.

Normative acts : Reduction of alimony in a fixed amount of money

"Review of judicial practice in cases related to the recovery of alimony for minor children, as well as for disabled adult children"

(approved by the Presidium of the Supreme Court of the Russian Federation on 13. 05.2015) If child support was awarded in shares of the defendant's earnings and (or) other income, the amount of payments when satisfying a claim for a decrease (increase) in the amount of alimony should also be determined in shares, and not in a fixed amount of money, with the exception of the recovery of alimony in cases provided for in Article 83 of the RF IC.

05.2015) If child support was awarded in shares of the defendant's earnings and (or) other income, the amount of payments when satisfying a claim for a decrease (increase) in the amount of alimony should also be determined in shares, and not in a fixed amount of money, with the exception of the recovery of alimony in cases provided for in Article 83 of the RF IC.

"Review of the judicial practice of the Supreme Court of the Russian Federation for the fourth quarter of 2013"

(approved by the Presidium of the Supreme Court of the Russian Federation on 06/04/2014) include executive documents that contain requirements and obligations for a lump sum payment by the debtor of amounts (in particular, notarized agreements on the payment of alimony in a fixed amount paid at a time, or writ of execution on a lump sum recovery of alimony from a person leaving for permanent residence in a foreign state; sheets on the award of lump sum payments in compensation for harm caused by a decrease in the ability to work or the death of the victim; writ of execution on the recovery of a lump sum of the sum insured; writ of execution on the recovery of a lump sum in respect of the execution of obligations debtor's agency).