How much savings are you allowed on child tax credits

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

and

Tina Orem

Tina Orem

Assistant Assigning Editor | Taxes, small business, retirement and estate planning

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for over 15 years, and was a senior writer and spokesperson at NerdWallet before becoming an assigning editor. Previously, she was a researcher and reporter for leading personal finance journalist and author Jean Chatzky, a role that included developing financial education programs, interviewing subject matter experts and helping to produce television and radio segments. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. She is based in Charlottesville, Virginia.

Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. She is based in Charlottesville, Virginia.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Nerdy takeaways

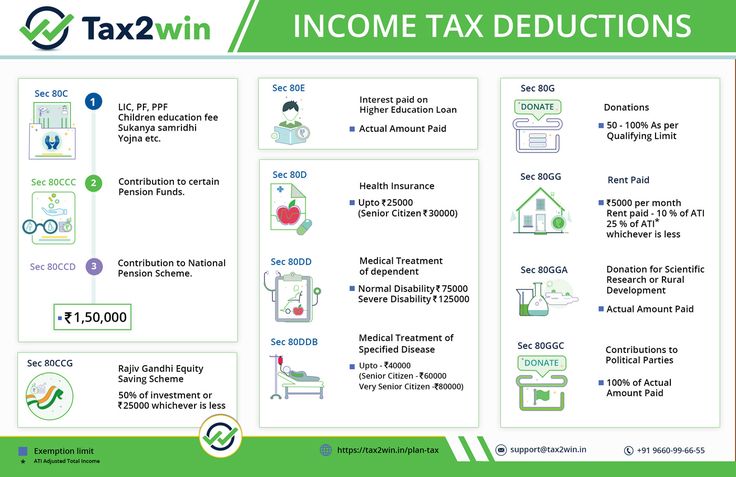

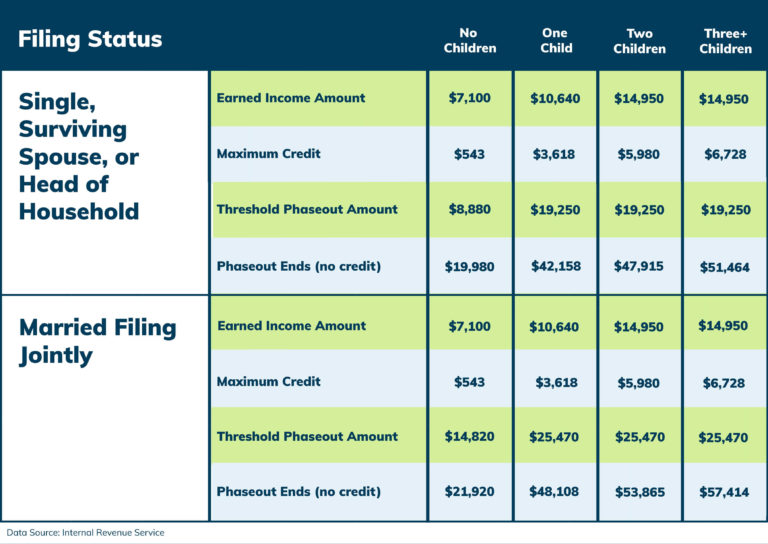

For tax returns filed in 2023, the child tax credit is worth up to $2,000 per qualifying dependent under the age of 17.

The credit is partially refundable. Some taxpayers may be eligible for a refund of up to $1,500.

The credit amount decreases if your modified adjusted gross income exceeds $400,000 (married filing jointly) or $200,000 (all other filers).

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Child tax credit vs. child and dependent care credit

Though similar sounding, the child tax credit and the child and dependent care credit are not the same thing. The child tax credit is a tax incentive for people with children, while the CDCC is another tax credit for working parents or caretakers designed to help offset expenses such as day camp or afterschool care. Both credits have different rules and qualifications.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

Tax Planning Made Easy

Take the stress out of tax season. Find the smartest way to do your taxes with Harness Tax.

Visit Harness Tax

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable tax credit; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

This partially refundable portion is called the “additional child tax credit” by the IRS.

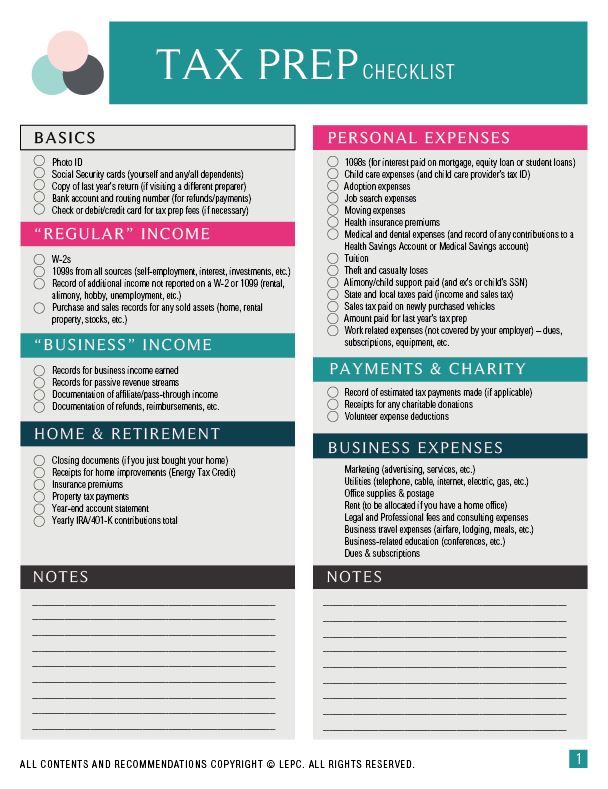

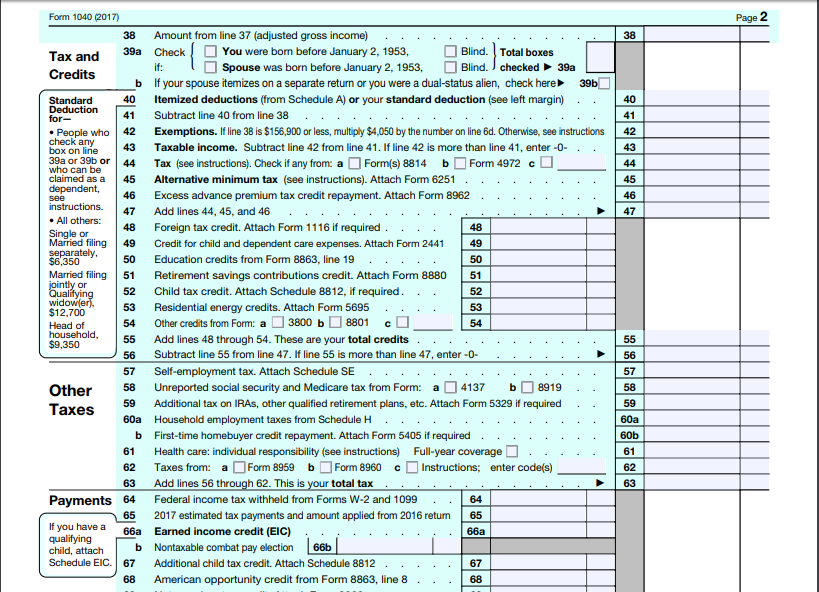

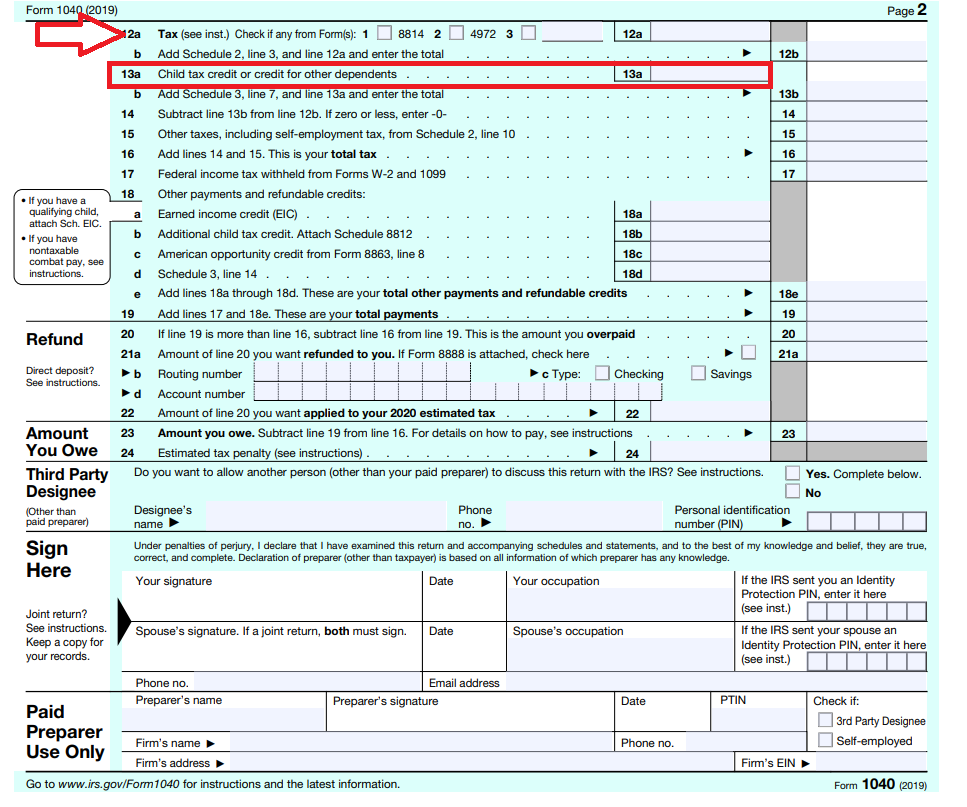

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

When to expect your CTC refund

The IRS cannot release an additional child tax credit refund before mid-February. Per the agency, early filers who selected direct deposit as their refund method, e-filed, and submitted an error-free return could begin seeing refunds hit their accounts by February 28. If you want to check on the status of your return before then, the "Where's My Refund" tool will begin showing updated statuses for early filers by February 18.

If you want to check on the status of your return before then, the "Where's My Refund" tool will begin showing updated statuses for early filers by February 18.

Internal Revenue Service

. When to Expect Your Refund if You Claimed the Earned Income Tax Credit or Additional Child Tax Credit.

View all sources

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

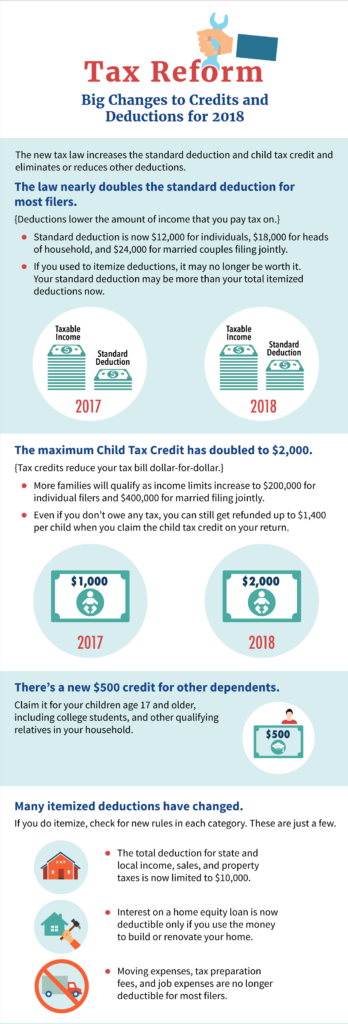

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. The child and dependent care credit covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll also need to make sure your child has a Social Security number by the due date of your 2022 return (including extensions).

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Page not found - portal Vashfinansy.rf

Moscow

Your city:

Moscow

PartnersFor media

Rus Eng

Financial Literacy Week

2021 Check your financial literacy level

Learn to manage

personal finance Learn

how to protect your

rights Financial

calculators How to

talk to children

about money

Starting October 1, 2021, you can read up-to-date materials on financial literacy on the website

MOIFINANCE. RF

RF

The page you requested is not on our site.

You may have mistyped the address or followed the wrong link.

- check spelling;

- use the main page;

- use the search above;

- use the site map.

- Contacts

- Site Map

- Terms of use of materials

- introductory course

- home bookkeeping

- Debts and loans

- Finance and Housing

- Work and salary

- family and money

- Rights and obligations

- Unseen circumstances

- Secure old age

- Save and increase

- Glossary of financial terms

- Question? Answer!

- Expert opinion

- life hacks

- Consumer loan calculator

- Personal Savings Plan Calculator

- Mortgage Calculator

- Deposit calculator with interest capitalization

- Emergency Loan Calculator

- Financial arithmetic for schoolchildren

- Financial Literacy for Students

- Financial Literacy for Adults

- How financially literate are you?

- Literary classics

- Tests of the site "I want to know"

- Parents

- For teachers

- Researchers

- Children and youth

- financial institutions

- Adults

- Pensioners

- For project participants

- Methodological centers

- Federal methodological center for financial literacy of the system of general and secondary vocational education

- Federal Network Methodological Center for Advanced Training of University Teachers and Development of Financial Literacy Programs for Students

- Federal Consulting and Methodological Center for Improving the Financial Literacy of the Adult Population

- materials

- Parents

- Teachers

- Researchers

- Children and youth

- Financial institutions

- Adults

- Pensioners

- For project participants

- For teachers

- Events calendar

- Magazine "Befriend

with Finance" - Strategy

- New

UMK- Description

- Final release

- Media publications

- TV stories

- Media Gallery

- Teaching materials for students in grades 2-3

- Teaching materials for 4th grade students

- Teaching materials for students in grades 5-7

- Teaching materials for students in grades 8-9

- Methodological materials for students in grades 10-11

- Educational and methodological materials for students in grades 10-11 of the socio-economic profile

- Teaching materials for students of secondary vocational education

- Educational and methodological materials for pupils of organizations for orphans and children left without parental care

- Materials for

regional

and city

portals- Students and young professionals

- Adult Compilation

- For pensioners and citizens of pre-retirement age

- Information about COVID-19

- Library

- rural

financial

festival - Rating

Regions of Russia

- Press center

Tax benefits in Hungary for individuals and companies - deductions, allowances

Tax benefits for individuals

Family tax allowance

First marriage benefits

Disability benefits

House/apartment buyer benefits

Tax advantages for entrepreneurs

Tax preferences for legal entities

Investments are profitable!

Tips in conclusion

Hungary has good conditions for international trade and intellectual property transactions. Tax on corporate income is the minimum in the EU - 9%, attractive income rates, reduced VAT for some types of business, simplified fiscal schemes for entrepreneurs.

Tax on corporate income is the minimum in the EU - 9%, attractive income rates, reduced VAT for some types of business, simplified fiscal schemes for entrepreneurs.

We have already written about the country's tax system, rates and types of budget collections. Now we will tell you how to save with the help of tax incentives for individuals and legal entities.

There are two forms of tax relief in Hungary:

- Tax deduction is the amount by which taxable income is reduced.

- Direct (tax) credit - the amount that is deducted from the accrued tax.

Tax credit: throughout the year, the taxpayer lends to the state - pays tax on income without taking into account the prescribed benefits. At the end of the year, he fills out and submits a declaration, after which the state returns part of the money to him.

Personal Tax Credit

- Child Loan (families with 3 or more children) - monthly up to 4,000 Ft/child.

- Loan to a resident - up to 18% of salary. Condition - income per year is not more than 1 million Ft.

- 20% tax credit for children's expenses (clothes, toys, kindergarten, etc.), up to Ft 150,000 for each parent. Deductions for university studies, housing, etc.

- 20% tax credit for pension/insurance fund payments, up to Ft 150,000 per annum. Options are to a voluntary pension fund, to a NYESZ retirement savings account, and to a financial institution under a retirement insurance scheme.

- 20% tax credit to pay off a residential mortgage loan.

- Staff training costs - 6,000 Ft per month per person.

- Charity to state institutions and churches - up to 1% tax.

Not subject to income tax:

- Some government benefits for minors.

- Interest on deposits, including savings.

- Subsidies for the purchase of housing.

- Interest on government and corporate securities.

- Food vouchers for employees (limited amount).

- Erzsébet government vouchers for pensioners.

- Income received on the Hungarian and European stock exchanges.

- Insurance payments (subject to the terms of the contract).

- Scholarships (under certain conditions).

- Proceeds from the sale of real estate owned for at least 15 years.

- Dividends paid to a foreign (non-Hungarian) company.

- Payments of debt interest, royalties and payments for services (advertising, leasing, intermediary, etc.) to countries without a double taxation treaty.

Most Hungarian families know almost nothing about the tax benefits and subsidies they are entitled toHungarian legislation prevents double taxation. Relevant agreements have been signed by 79 countries, including the EU and the CIS. Non-residents pay tax in Hungary on income (for example, from the rental of real estate) received in its territory. At home, you do not need to pay this tax again.

Do you receive income from one source? You have the right to apply to the tax office of your place of residence for free assistance in completing the annual return.

Family tax allowance

Once a month or at the end of the financial year (when filing a declaration), a family with children and other dependents (students, disabled people, etc.) is entitled to a tax deduction (Családi adókedvezmény).

In 2018, its amount was:

- If the family has 1 child / dependent - 66 670 Ft per month.

- 2 children/dependants - Ft 116,670 per month.

- 3 or more children/dependants - Ft220,000 per month.

- If disabled dependent, additional Ft 100,000 per month (since 2017).

Attention! If the woman is pregnant, the family is also entitled to a tax deduction starting from the 91st day of pregnancy until the date of birth of the child.

The tax deduction reduces the income tax of the payer with children and therefore increases the salary by:

- 10,000 Ft (with one child/dependent).

- Ft 17,500 (for each of two children/dependants).

- Ft 33,000 (for each of three or more dependents).

Calculate your allowance yourself with the National Revenue and Customs Service online calculator. Informational help - in the brochure with all the tax benefits of Hungary ↗.

- In addition to spouses, single parents and registered partners who have lived together for at least a year are entitled to family allowance.

- Taxpayers of the same family can receive benefits in turn (application).

- Divorce entitles each parent to only half of the allowance.

Junk food has no chance of benefits! “Chips tax” in Hungary is paid by all lovers of fast food in the package - cookies, cakes, chips and even energy drinks.Example. There are two children in the family - one of which is in college or one of the first courses of the university. Both are considered dependents when calculating the tax benefit. However, money will be paid only for one - 116,670 Ft.

This tax is among the ten most ridiculous in the world

This tax is among the ten most ridiculous in the world Nuance. Would you like to receive Family Tax Benefit every month, at the same time as your salary? File a joint application with your spouse/partner once a year with your employer (not the IRS!). Preferably by mid-January.

First marriage benefits

For the first two years after the wedding, newlyweds (at any age), if it is the first marriage for one or both of them, are entitled to a total tax deduction of Ft 5,000 per month, that is, for two years a total of Ft 120,000. One of the spouses can receive it.

The deduction automatically increases the beneficiary's net earnings by Ft 33,335 per month. A couple can use it:

- Monthly (application to the employer) or at the end of the year (in the declaration).

- Regardless of the presence of children.

- Even if one of them is a foreigner (you need to get an identification code in Hungary).

- Maximum - within 24 months from the date of marriage (but no later than the date of divorce).

Disability benefits

Some serious illnesses, such as diabetes, Crohn's disease, hearing or vision loss, entitle people with disabilities to an individual tax deduction (személyi kedvezmény) of 5% of the minimum monthly wage (havi minimálbér).

- In 2018, the minimum wage is Ft 138,000 - the benefit is Ft 6,900 (€22) per month.

- A complete list of diagnoses is given in Government Decree 335/2009. (XII.29.).

- For details on the deduction, see art. 40 of the Income Tax Law (1995. évi CXVII).

Attention! If the diagnosis was made many years ago, but the patient has just learned about the tax credit they are entitled to, they have the right to change the tax returns for previous years and claim the tax for the entire period starting in 2011.

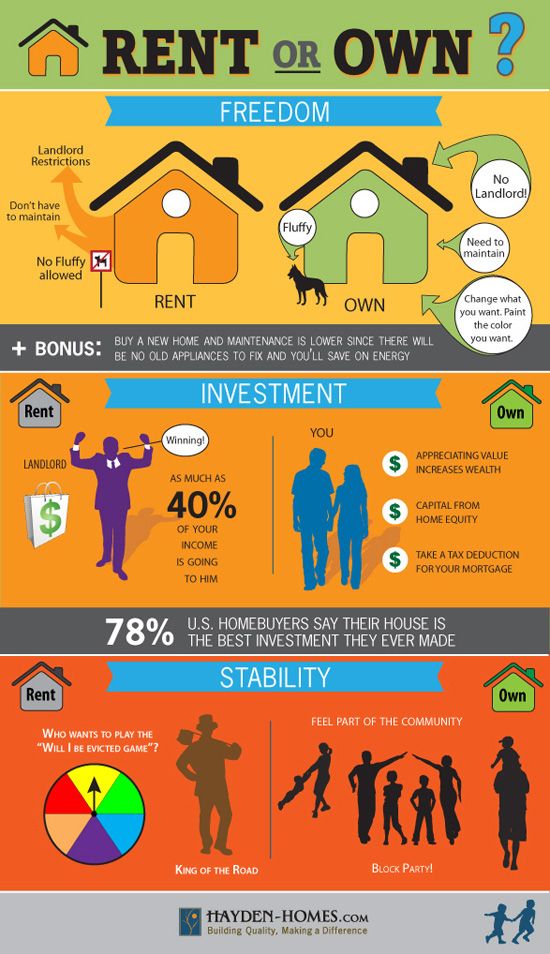

Benefits for the buyer of a residential house/apartment

Those who decide to buy real estate in Hungary are also entitled to tax breaks:

- For the purchase of a new house with a plot (at least with a completed roof).

- To replace housing (sale of one and purchase of a new one during the year). The tax is levied on the difference between the sale and purchase price.

Tax benefits for entrepreneurs

Hungarian laws provide for a simplified tax regime for representatives of creative professions and athletes.

- Writers, journalists, artists, directors, actors, musicians, circus performers - if the total income is not less than 60 million Ft.

- Athletes and coaches with at least 1 year of experience - if the total income is not less than 250 million Ft.

Entrepreneurs of these professions are exempted from income tax, insurance social and medical contributions. Their tax base is the income of an individual entrepreneur (19.5% tax for entrepreneurs-employers, 15% for non-employed workers, 11.1% for pensioners).

VAT reduced to 5% on a number of products, goods and services (including medical equipment).

Tax preferences for legal entities

Legal entities in Hungary are entitled to tax benefits.

- Deductions (art. 7 of law 1996. évi LXXXI) - their amount is deducted from the company's taxable income (adózás előtti eredményt).

- Incentives, benefits and tax credits - reduce the amount of tax liability.

No profit? You still have to pay corporate tax, from the minimum tax base (usually 2% of total revenue). Additionally, include the cost structure on your tax return.

Tax deductions

There are a number of reasons why a legal entity, regardless of the country of residence, is entitled to tax deductions.

- Compensation for losses from previous financial years.

- Reserve for future expenses, including income from the use of the reserve of previous years (condition - the presence of at least two accounting reports). An exception is the reserve formed under the Law on Joint Stock Companies.

- Unscheduled depreciation reserve, which increased the tax base in previous years.

- Income for the reporting year received in the form of assistance (without obligation and return).

- Royalties and license income (other than the sale of intangible assets).

- Dividends and interest other than from a controlled foreign company.

- Dividends paid to non-residents.

- Capital gain from the sale of a registered equity participation (shares, stake in a business) at a price exceeding the nominal value.

- Direct costs associated with R&D and/or R&D (research and development) services from non-residents.

- Investment in filling stations.

- Rental housing for employees by the employer.

- Buying a car for more than 6 million Ft, etc.

Types of tax benefits (rebates)

- Investment allowance for small/medium enterprises.

Small and medium-sized businesses have the right to reduce taxable profits by the amount of investments attracted during the year. Conditions:

Conditions:

- At the end of the financial year.

- If the founders are only individuals.

- For investments in new assets not capitalized during the year.

- If the amount of the deduction does not exceed profit before corporate tax.

Important! According to the Hungarian Corporate and Dividend Tax Law (art. 1, 1996. évi LXXXI), if the actual purpose or content of the company's legal transaction is only to obtain a tax advantage, its amount is not considered an expense, and therefore is not taken into account when calculating tax benefits. At the slightest suspicion of such a transaction, the tax office has the right to check and take appropriate measures - fines, etc.

- Business Development Allowance

Any business can set aside funds for future investment in assets. The amount of the reserve is deducted from the taxable base at the end of the year. Restrictions:

Restrictions:

- The allowable reserve amount is up to 50% of taxable income, but not more than 500 million Ft (€1.6 million).

- The asset investment reserve must be used within 4 years following the year in which the tax benefit was used.

- Investment in historic buildings

Up to €100 million (in Ft equivalent) can be saved on taxes on an investment project related to cultural heritage, monuments, buildings registered as historical values, as well as property residing under the special protection of the state. The cost of repair/reconstruction is deducted from the tax base of the investor.

- Compensation % on loan for the purchase or production of fixed assets. The amount of corporate tax is reduced by the amount of interest paid by the company (including small and medium-sized businesses) to the bank for the reporting year.

Maximum - 40% of the amount spent per year, but not more than 6 million forints for each financial year.

Maximum - 40% of the amount spent per year, but not more than 6 million forints for each financial year. - Energy efficiency investment allowance

30-50% of actual investment costs, up to a maximum of €15 million (Ft equivalent). You can use the benefit in the year of investment or in the next 5 years.

- Corporate tax on income from the use of intellectual property rights.

The tax is reduced to 5% on the use of patents, trademarks, industrial rights, know-how, etc. The sale of intellectual property rights purchased or created by a Hungarian company after January 1, 2012 is not taxed if the buyer within 60 days will notify the tax service about the transaction.

- Development tax credit.

The request for a loan is submitted to the Minister of National Economy (adópolitikáért felelős miniszter). The deadline for filing is within 13 years, starting from the year of capitalization of investments or from the next one after it. However, no later than the 16th year after the submission of the request.

However, no later than the 16th year after the submission of the request.

Tax credit conditions for the investor company

| Minimum investment amount, Ft | Purpose of investment | Special conditions |

|---|---|---|

| Any | As a result of investments, the headcount will increase by 150 people. (in underdeveloped regions - by 75), and the average salary increases by at least 600 times (300 times - for underdeveloped regions) compared to the minimum | |

| 1 billion and more | region | |

| To existing facilities for the production of food of animal origin | ||

| 100 million or more | Environmental protection, R+D (R&D), broadband internet, film and video production, purchase of securities in the first 3 years after registration on the stock exchange and any investment in the free economic zone | |

| Any | Associated with the creation of jobs | |

| 500 million or more | Any. Investor - small / medium-sized enterprise Investor - small / medium-sized enterprise | Over four years, the number of employees will increase by 20 people. (small business) or 50 people. (average). The average salary will increase by 50 times (small enterprise) or 100 times (medium enterprise) compared to the minimum wage |

Investment information is indicated in a special report-attachment to the declaration.

Investment is profitable!

Investing in sports

Financing the five most popular team sports in Hungary (football, handball, basketball, water polo and ice hockey) saves twice:

- Investments in sports are recognized as expenses of the company and reduce its tax base by this amount.

- Corporate tax is reduced (up to 70%).

In fact, the taxpayer returns 110% of the amount of sports funding!

Charity in the Arts

Official funding for creative projects (through the Arts and Performances Authority) reduces corporation tax (up to 70%). It is allowed to use the benefit only in the first 4 years, including the year of donation.

It is allowed to use the benefit only in the first 4 years, including the year of donation.

Film and video production benefits

Filming and related video projects are an opportunity to reduce corporate income tax by 20%. The tax allowance is calculated only on those expenses that have been officially approved by the Hungarian Film Authority. The right to benefit is valid for 3 years after the year of investment.

Hungary is the best EU country for IP transactionsSalary of scientists and researchers

Up to 10% (up to 15% for small and medium-sized enterprises) of direct labor costs in research and development, basic research and applied development, including software. The amount of the tax benefit is subtracted in equal parts from the amount of tax for the current year and the next three.

The maximum benefit amount is 70% of the accrued tax.

Tips in conclusion

Doing business in Hungary is a great opportunity to minimize taxes and profitably trade not only in the EU, but all over the world. The country has flexible taxation comparable to that of Cyprus. Particularly profitable are investments, schemes with dividends, loans and royalties.

The country has flexible taxation comparable to that of Cyprus. Particularly profitable are investments, schemes with dividends, loans and royalties.

However, the following nuances should be taken into account:

- Legislation and tax procedures in countries are changing rapidly - business preferences are purposefully growing and the tax burden on consumers is increasing. When making a decision, check whether the benefit is still valid and to what extent.

- In the regions, municipalities may levy local taxes (tourist, communal, land, construction, etc.) and, accordingly, provide additional fiscal discounts.

- In the coming years, the authorities will continue to increase the amount of benefits for families with two children. However, you can still claim your tax benefit retroactively, up to 5 years after filing your tax return.

Do you have a question about taxes or the procedure for applying for a particular benefit? Need a loophole in the law or expert advice? Ask questions or write in the comments.