How much money should you save for your child

How much your kids could have by 18 if you invest for them now

Amy Engelsman | Twenty20

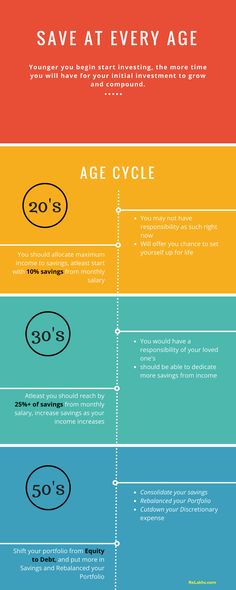

Thanks to the power of compound interest, the earlier you start investing, the easier it is to build wealth. And while we can't go back in time and start saving earlier ourselves, we can help our children by starting to invest on their behalf when they're young.

If you're a parent or planning to become one soon, you can take advantage of compound interest to set your child up for financial success.

"If given the choice between 20 years experience and expertise vs. 20 years extra time for compounding, I'd take the time," Josh Brown, CEO of investment advisory firm Ritholtz Wealth Management, said in a recent video on his YouTube channel.

More from Grow

3 books to help teach kids about money while they're still young

3 fun ways parents can teach kids about investing

Retirement calculator: How much money you need to have saved

Try our calculator below to see how much money your child could have by age 18 based on how much you invest and when you start. If you want see in more detail how time can help you grow your money, you can use our compound interest calculator.

Because of compounding, time can be more valuable than money, so even a little money can go a long way. For example, investing just $1 per day from birth can lead to more than $13,000 by the time your child turns 18 and may be ready to go to college or to start a career.

If you wait until your child is 5 years old to make the same investment, that total falls by almost half, to just $7,700, even though you've invested just $1,800 less.

So, while setting up a savings account for your child has perks, you will likely see a far greater return on your money if you put your funds in an investment account. Your options include a tax-advantaged 529 plan, "the primary vehicle of choice" for saving for college, according to Justin Halverson, a financial advisor at Minnesota-based Great Waters Financial, and a custodial brokerage account.

Currently, the best rate offered on a high-yield savings account is around 1%, while the annualized annual return of the S&P 500 over the past 50 years is about 10%.

Even if the stock market doesn't produce annual returns that strong over the next two decades, you are still likely to make more money off an investment than you would from a savings account.

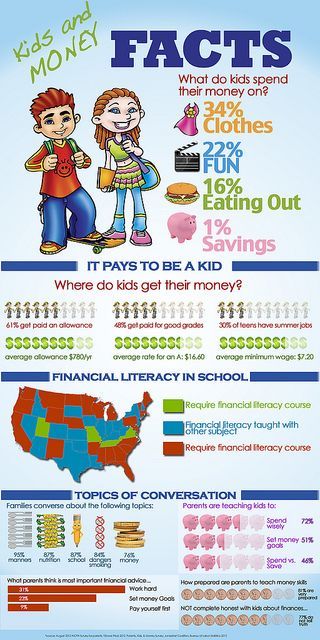

You can also use the account to help teach your child the importance of investing for the future. According to a report last year from Morning Consult, half of adults between the ages of 18 and 34 are not saving for retirement at all, and only 39% of those who are saving started in their 20s. By providing your children with a solid foundation in financial topics, you can give them a head start on reaching money goals throughout their lives.

If your children wind up not needing the money for educational or early career expenses, they could also benefit from leaving the investments to grow. A $5 daily investment from birth through age 18 could be worth $2 million by age 67. In other words, your child could eventually become a millionaire without even investing any of their own money.

The article "How Much Money Your Kids Could Have at Age 18 If You Invest for Them Now" originially published on Grow+Acorns.

Check out: CNBC Make It is NOW STREAMING on Peacock. Find our original programming in the Channels section.

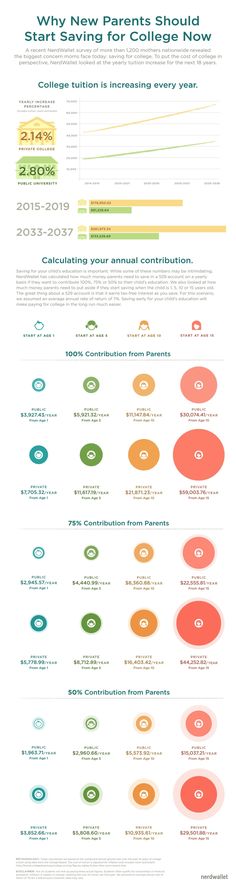

How Much Should You Be Saving for Your Child's College Education?

Seeing the price of college education today can cause sticker shock for a lot of parents, and rightfully so — if you're willing to spend money on attending a four-year public college, it will cost $10,560 on average per year, according to the College Board. The sticker price of one year at a four-year private college will cost you a whopping $37,650 on average. Though the average cost of attending college is less than the sticker price because of college scholarships and grant aid, paying for higher education is still no small feat.

It can be hard to know where to start, especially when you have more immediate financial priorities like paying for childcare and rent. However, having a plan and investing early is crucial in making sure that you or your child won't be forced to take out student loans and then be on the hook for paying off that debt down the line.

Select spoke to higher education expert and author of How to Appeal for More College Financial Aid Mark Kantrowitz about how much money parents should aim to invest for their child's education, when they should start and where they should put their money.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Start early and with whatever you can

The most important part of saving for college is investing as early as possible. Since compound interest is interest earned on both the initial investment and the interest you've accumulated, your gains will be much larger if you start investing at birth.

You can think about it like this: With compound interest, an initial investment of $1,000 will yield earnings of $100 after one year if there's a 10% interest rate that's compounded annually. Your second year, you'll earn an additional $110 because you'll be receiving 10% interest on the $1,100 you've accumulated.

Kantrowitz recommends the one-third rule as a rough guide for how much parents should be saving: one-third of the cost of a four-year college education will come from parent's income and financial aid, one-third from savings and investments and one-third from student loans. Once you decide what percentage of your child's college education you're willing to fund, you'll have to figure out how much that will cost you each month.

According to Kantrowitz, about one-third of your college savings will come from your investments if you start investing at birth. However, if you start investing when your child is in high school, only one-tenth of your college savings will come from your investments. In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

The cost of college rises by roughly a factor of three every 17 years, so if your child is a baby now, you should aim to invest the current cost of a four-year college education over the span of the next 18 years.

For example, if you want your child to attend a four-year in-state public college, the current cost of attendance (this includes tuition, fees and room and board) for one year is $26,820, according to the College Board. You'll have to invest roughly $300 every month starting at birth to send your child to a four-year in-state public college (assuming a 3% inflation rate), according to Kantrowitz. For a private non-profit college, you'll have to invest $600 a month.

If your investments yield a 6% rate of return each year, you'll earn roughly enough money to cover 1/3 of your child's total college costs once they're 18.

While this may seem like a lot, investing any amount of money each month is a good idea. Set up automatic transfers to your investment account so you don't have the temptation to spend the money once it's in your checking account. And if you can't put a lot away right now, over time, you can ramp up your monthly contributions — it's essential to start investing early to take advantage of compound interest.

Set up automatic transfers to your investment account so you don't have the temptation to spend the money once it's in your checking account. And if you can't put a lot away right now, over time, you can ramp up your monthly contributions — it's essential to start investing early to take advantage of compound interest.

Where should you invest your money?

If you're investing for college you should consider opening a 529 savings plan or a state-sponsored investment account exclusively used for investing for school. With 529 savings plans, individuals can use the money they withdraw for college and K-12 tuition and other qualified educational expenses without paying income tax on any investment gains.

529 savings plans contain a variety of different funds such as mutual funds, bonds funds and ETFs. They are generally recommended for investing for college because of the tax benefits people get from them: You can contribute up to $15,000 tax-free (for single tax-filers) and your earnings will grow tax-free.

States offer different 529 savings plans, and you don't need to be a resident of that state in order to qualify for an account. However, certain states may offer tax benefits for in-state contributions. For example, in New York, in-state residents have tax-deductible contributions, so residents can reduce the amount of their taxable income if they invest in a 529 savings plan.

You can also opt to invest for your child's education using a brokerage account or a 529 prepaid tuition plan. These, however, are less popular options.

If you opt for a 529 prepaid tuition plan, you pay for tuition at certain colleges at today's rate. By doing so, you're hedging against inflation and rising tuition costs. While you can transfer your funds if your child chooses to attend a different college, prepaid tuition plans have their drawbacks: there are only 18 state-sponsored plans that offer this, you have to be an in-state resident and they don't cover additional educational expenses like 529 savings plans do.

You might also consider investing your money in a brokerage account through companies like TD Ameritrade, E*TRADE or Vanguard. If you go this route, however, you'll forgo some of the tax benefits that you'd get if you invested in a 529 savings plan. Namely, you'll have to pay tax when you sell any of your funds or stocks that have grown in value.

Bottom line

There's no denying that the cost of college is rising rapidly — even the thought of paying it can be daunting for many parents. However, parents should start saving as early as they can so they can reap more profits from their investments.

Once parents determine what percentage of their child's college education they're willing to pay for, they can create a plan for their monthly contributions. They'll have the option of investing in a 529 savings plan, a brokerage account or a prepaid tuition plan, but they'll likely get the most tax benefits and flexibility from a 529 savings plan.

Catch up on Select's in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.

Read more

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

how to save a large sum for your child's 18th birthday

Why save money for the child's majority, of course, for example, to buy an apartment or to study at a university. The question is how exactly to save up in Russia and what needs to be done for this?

Evgeny BELYAKOV

Minor depositor

You can open a bank deposit in the name of a child at any age. Many banks offer this service. This deposit is almost no different from the usual ones. But there are limitations.

First, a child under 14 cannot use this money. Yes, and parents, as a rule, can withdraw funds only with the written permission of the guardianship authority. This is a requirement of the Civil Code.

This is a requirement of the Civil Code.

Secondly, after the age of 14, the child can manage the money himself (with the written permission of the parents and guardianship authorities). After the age of 18, he can use the accumulated money as he likes.

Separate account - per child

In order not to set artificial boundaries for themselves, many parents act differently. Open another bank deposit in the name of mom or dad. And they just know that this particular account belongs to the son or daughter and money is being accumulated on it for the child to come of age.

But this strategy has both pros and cons. On the one hand, in case of force majeure, money can be withdrawn without bureaucratic obstacles. On the other hand, there is a danger that the funds will be spent earlier and will not fulfill their purpose.

- It's usually easier to do just that, - says Vladimir Savenok, head of the consulting company "Personal Capital", author of the book "A Million for My Daughter". - Probably, it is better to draw up such an account for my mother: women are more responsible.

- Probably, it is better to draw up such an account for my mother: women are more responsible.

It's interesting

How to teach a child to handle money: 4 experiments that will help raise financial literacy

Dealing with experts on how to teach a child to handle money

| More |

When it's not too late to start

Depends on the stated goals. But the sooner the better. Then you can limit yourself to a small amount. And everything else will be done by compound interest and ... strict discipline. For example, to accumulate a large amount, you need to save a little bit, but regularly.

- Many parents start with enthusiasm, and then some money problems arise, and people forget to make the next installment, - says Vladimir Savenok. - Discipline is the main element. That's why I love mandatory, automatic programs. For example, you can instruct the bank to take money from your current account and transfer it to a savings account every month.

For example, you can instruct the bank to take money from your current account and transfer it to a savings account every month.

Insurance companies also have similar programs. Then the money will be debited automatically and invested in various investment instruments. A parent can take out a policy for himself, and a 100% beneficiary (in case of reaching the age of 18 or the death of a parent) will be a child.

How much to save

This question is individual. And rather it depends not on financial capabilities, but on the financial goals of the family. For example, if you want to give your child an apartment by the 18th birthday, this is one amount. And if you want to raise funds for his education in a cool university - another.

The calculation is easy. Take the current value of the target and multiply by the percentage of possible inflation in the future. Usually it is 5% per year. Then convert the received amount into monthly payments with approximately the same return on invested money. Online calculators to help you. Then you will understand how much money you need to save each month to get the desired amount.

Then convert the received amount into monthly payments with approximately the same return on invested money. Online calculators to help you. Then you will understand how much money you need to save each month to get the desired amount.

- If your goal is 10-15 years away, then I recommend saving money in dollars or euros, advises Vladimir Savenok. - If less, then it all depends on what currency your target is.

Roughly speaking, if we are talking about buying a one-room apartment in Moscow, then you can save in rubles. And if you want your child to study abroad, you need to save only in foreign currency, even if there are a couple of years left before the entrance exams.

The most important thing is that parents should be consistent. If they said that this is the money of a child, then that is what they should be. Even if the money is urgently needed for other purposes, they can be taken, but then it must be returned to the same account. And better with interest.

The sooner you start saving, the better! Photo: Ivan MAKEEV

It is also possible on the stock exchange

A period of 15 - 18 years is ideal for investments on the stock exchange. Any financial adviser will tell you this. During this time, the market will rise and fall several times. But it will still rise more often. If you believe the long-term statistics of the stock markets, the return on investment in the long term usually exceeds the return on bank deposits.

Therefore, a separate brokerage account can be opened for a child. Once a month, quarter or year, charge a certain amount there. And invest in a wide range of financial instruments. Best of all - index funds that invest in the shares of the largest companies in the country or even the world.

INSTALLATION QUESTION

What if the son is a spender?

It's good when the goal is clearly defined. Worse, when the money was simply saved for the age of the child. Then many parents are faced with a problem: the imagination of an 18-year-old teenager is usually only enough to buy a new iPhone, an outfit, or spend a large sum in a nightclub, treating all classmates beautifully.

What to do in this case? Experts advise not to rush to return the money and first discuss with the teenager his financial goals.

- Only a few adolescents at this age know exactly what they want to spend a large amount of money on. Others still have wind in their heads. Therefore, you can discuss with the child what exactly he wants. Alternatively, you can give a small amount as a gift. And let the rest continue to accumulate until the need arises for this money, advises Vladimir Savenok.

This is interesting

How to learn how to save money: 10 habits that prevent you from becoming richer

If you get rid of them, then learn how to save decent amounts and start accumulating money

| more | 9000

This means that if the financial markets are in a recession, the amount of money deposited will decrease only by the amount of the commission fee under the contract.

This means that if the financial markets are in a recession, the amount of money deposited will decrease only by the amount of the commission fee under the contract.  This means that if the worst happens, the Insurer (in the case of Swedbank, Swedbank Life Insurance SE) will pay the unpaid part of the savings instead of you according to the contract. Accordingly, in the worst case, you will make sure that the child receives the intended amount of savings.

This means that if the worst happens, the Insurer (in the case of Swedbank, Swedbank Life Insurance SE) will pay the unpaid part of the savings instead of you according to the contract. Accordingly, in the worst case, you will make sure that the child receives the intended amount of savings.