How much money do you get in taxes for a child

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

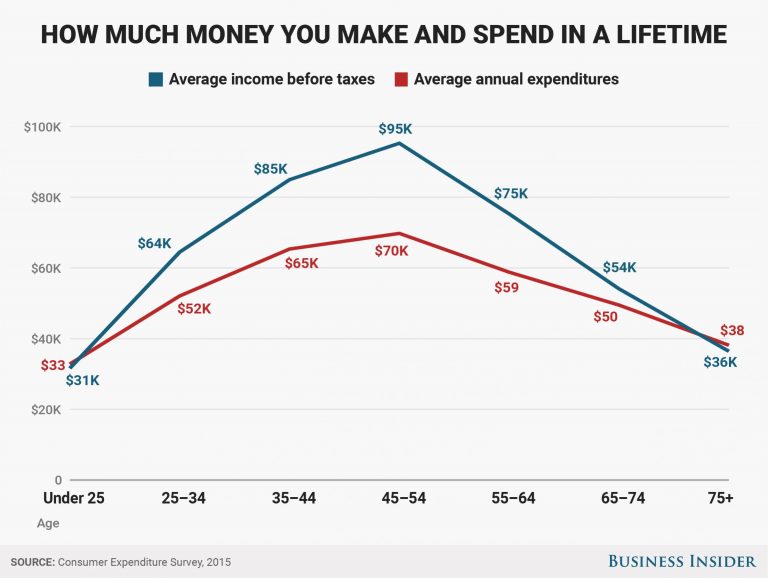

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

Tax return and notice of tax due

In Finland, taxpayers receive a pre-filled tax return (veroilmoitus) from the Tax Administration in March-April. The tax return contains information about income and tax deductions for the previous year. Most people also receive a notice of the amount of tax due (verotuspäätös) and a tax certificate (verotustodistus) along with the declaration. The tax administration sends the tax return through the OmaVero online service and by mail to the taxpayer's home address.

The tax return contains information about income and tax deductions for the previous year. Most people also receive a notice of the amount of tax due (verotuspäätös) and a tax certificate (verotustodistus) along with the declaration. The tax administration sends the tax return through the OmaVero online service and by mail to the taxpayer's home address.

- Tax return

- Notice of tax due

- Tax refund and residual tax

Tax return

The tax return (veroilmoitus) states information about income, taxes and tax deductions for the previous year. Check your tax return and correct erroneous or incomplete data via the OmaVero online service. If the information is correct, you don't need to do anything.

You can use the internet service if you have a Finnish internet bank account or mobile ID. You can correct any data in OmaVero. If you are filing on paper, make corrections on the separate forms that appear on your tax return for each item. Please note that the forms must be submitted to the Tax Administration no later than the date shown on the tax return.

Please note that the forms must be submitted to the Tax Administration no later than the date shown on the tax return.

External link Verohallinto

Tax return and notification of tax due External link The tax administration issues a part of the tax deductions automatically, but some must be processed independently. You can list deductions on your tax card or tax return.

Tax deductions include, for example:

- income-related expenses

- membership fees of the labor fund and the unemployment fund

- discount for travel between home and work

If you receive wages, the automatic tax deduction for income-related expenses is 750 euros. If your income expenses exceed EUR 750, list them on your tax return. Remote work can also be associated with expenses for which you can receive a tax deduction. Such costs include, for example, the cost of the office space, work tools and communications.

You can get a tax deduction for travel expenses that go to work and do work. The tax deduction for travel between home and work is calculated based on the cost of traveling by the cheapest available mode of transport. The membership fees of the labor fund and the unemployment fund are fully deducted from the income of an individual.

The tax deduction for travel between home and work is calculated based on the cost of traveling by the cheapest available mode of transport. The membership fees of the labor fund and the unemployment fund are fully deducted from the income of an individual.

External resource link Verohallinto

Tax credits External resource link

FinnishSwedishEnglish

Notice of tax due

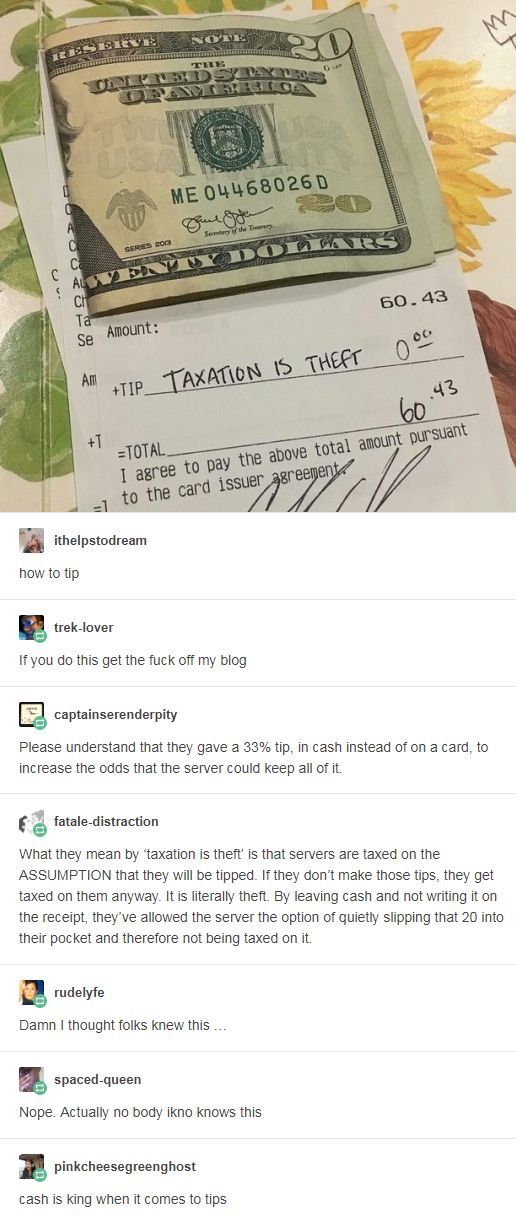

The total tax for the previous year is shown on your notice of tax due (verotuspäätös). If you make changes to your pre-filled tax return, or if the IRS receives information that affects your tax amount from some other source (such as an employer), you will receive a new notice of tax due. The tax due notice contains calculations of the total tax amount. You may need to be notified of the amount of tax due, for example, when you apply for a rental and when you are charged for your child's daycare.

Keep your pre-filled tax return, notice of tax due, and tax certificate. If necessary, you can also print them via the OmaVero online service.

If necessary, you can also print them via the OmaVero online service.

Tax Refunds and Residual Tax

The notice of tax due states whether you have paid enough taxes. If you have paid more taxes than were actually due, you will receive a tax refund (veronpalautus). If you do not pay enough taxes, you will need to pay the residual tax (jäännösvero).

Tax refunds are made to the bank account you specified. Provide your bank account number through the OmaVero online service or by completing a separate paper form. If the Tax Administration does not know your bank account number, the tax refund will be made in the form of a postal order or money order through Nordea Bank.

If you didn't pay the tax for the year, you will have to pay the residual tax. The notice of tax due and the OmaVero online service account contain all the information required to pay the residual tax.

05.05.2021

Such a certificate is needed if for some reason you terminated the insurance contract ahead of schedule and did not receive a tax deduction from the state. If you have a debt, a certificate will help you clear it.

If you have a debt, a certificate will help you clear it.

Why debt arises

If you did not receive a tax deduction, you do not need to pay the debt.

The appearance of debt is a standard security measure on the part of the state, so that those who receive the deduction immediately return it.

A certificate of non-receipt of a tax deduction can be obtained from the tax office in person or online.

Step 1

Get a certificate from the tax office

Step 2

Send information to us

How to get a tax certificate online

You can get help online in a few minutes. You must have an account on nalog.ru or on State Services.

- Log in to your personal tax office

- Go to the section "Life situations"

- Select the relevant certificate

- Fill in all fields of the application

Go to nalog.ru and log in to your personal account: using your login and password, using an electronic signature, or through your account on the State Services.

Next, find "All life situations" and click on "Request help and other documents. "

"

Click on "Get a certificate confirming the fact of receipt (non-receipt) of a social deduction.

It is important to fill out the application correctly - a sample of the correct certificate and how its fields should be filled in can be viewed here.

The tax office will send you a certificate in several files. Please send us all the files you receive from the tax office.

How to get a certificate from the tax office

You can get a certificate from the tax office at the place of residence ( it will take about 30 times longer than getting online help ).

There are often errors in certificates - check it after receiving it without leaving the tax office.

Sample certificate can be viewed here.

- Choose the nearest tax office

- Prepare document package

- Apply in person or by Russian Post

- Please wait until the help is ready

It is not necessary to apply to the inspection at the permanent registration address. Choose the nearest inspection to you.

Choose the nearest inspection to you.

Will need to submit:

- A copy of the life insurance contract - can be downloaded in your personal account

- A copy of payment documents confirming the payment of contributions - can be downloaded in your personal account

- A written application for a certificate - the form will be provided at the tax office

A package of documents can be sent by mail. Send them by registered mail with acknowledgment of receipt and a description of the attachment.

This takes some time. You will be told more about the terms in the tax service. After receiving the certificate, be sure to check it against this sample.

Send us a certificate in your Personal Account or Russian Post

- To send online:

Log in to the Renaissance Life Personal Account, go to the Applications and Documents section, click Apply.