How can you pay child support with no job

Do I Pay Child Support If I’m Unemployed?

Request a Consultation

Contact

Us Today

Despite being separated from your spouse, you love your children and want to do everything in your power to take care of them. So when you lose your job, it can shake your entire world and make providing for your family a huge source of stress. The reason for this is that child support orders are still effective if you, as the non-custodial parent, become unemployed.

When these payments start becoming impossible for you to pay, you’ll likely have many questions. Collins Family Law Group is accustomed to resolving confusion surrounding the matter of unemployment and child support. Here are some answers to regularly asked questions and concerns about paying child support when unemployed.

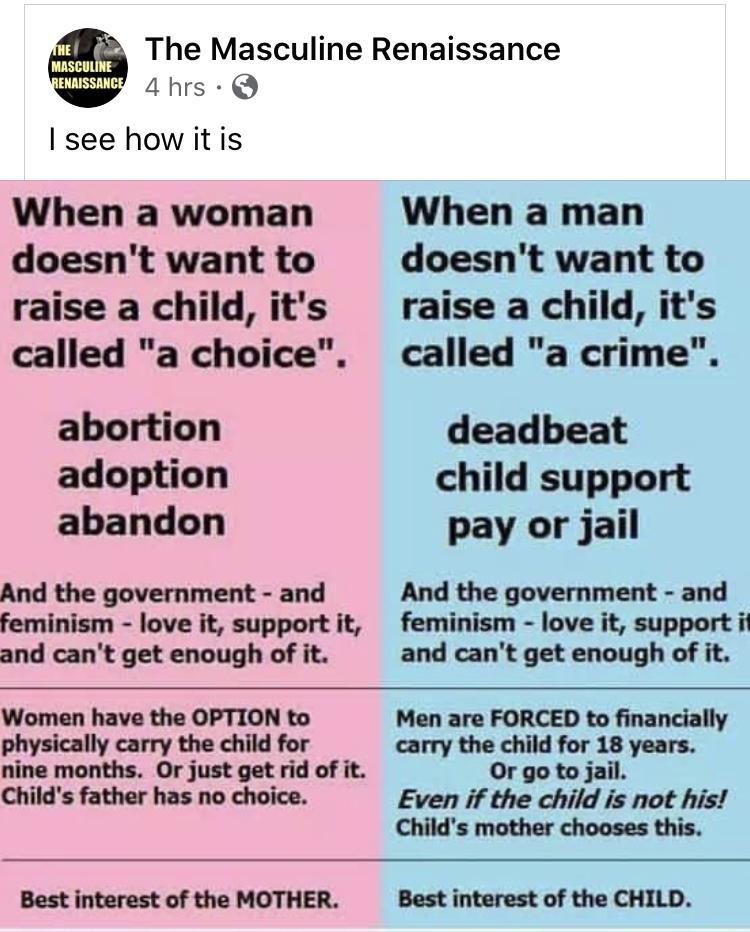

It’s common for parents to ask, “Does a father have to pay child support if he is unemployed?” The answer is a firm “yes. ” Under-employment and even unemployment do not invalidate a standing child support order; you are still expected to make these payments monthly. If you no longer have a steady flow of income and miss a payment, this payment is still owed and accrues interest. You could also incur fees or jail time, as courts do not consider favorably those who evade their responsibility, whether intentional or not.

You can request an adjustment to your child support order, but the court will base new child support amounts on your opportunity and ability to find similar-paying work using your previous employment as a benchmark for what you may be able to earn in the future. This is what the courts refer to as “imputed income.” In this case, child support payments are based on the parent’s ability, willingness, and opportunity to work as well as their earning capacity (past jobs, education level, skillset, etc.).

If the unemployed parent can work, has sufficient opportunity, and is earnestly seeking another job, the court can make an educated guess as to what kind of salary the person could earn, and impute the amount. If there’s insufficient evidence to determine how much the parent could potentially earn, the judge may impute the minimum wage. Each case will have a unique outcome based on the parent’s circumstances.

Many non-custodial parents who can’t afford their monthly payments sometimes turn to their ex-spouse to informally arrange to pay what they can, or worse, they do not pay at all. Both of these actions could put you in contempt of court and lead to fines or even litigation. The only safe way to renegotiate these payments is through a court-approved modification of child support. If your situation comes to this, you should speak with a child support attorney to discuss your circumstances. You may be eligible for unemployment benefits, which could help with paying child support when unemployed.

You may be eligible for unemployment benefits, which could help with paying child support when unemployed.

To find out if you qualify for unemployment benefits, you should check with the state of NC or SC and get in contact with the unemployment office to show them your outstanding child support payments. For those who are eligible, the state government will deduct these payments from your unemployment wages. If you are ineligible for unemployment benefits because you are intentionally avoiding work or are simply underemployed, the court will defer to the amounts you could be earning, or imputed income, to calculate your payments.

In the meantime, you are strongly advised to be highly proactive about finding a new job and maintaining intensive communication with the court during your search. Once you’ve secured employment, you must continue paying child support with physical checks until the payments can be taken directly from your wages. Be prepared for the payment amounts to increase to account for your time spent unemployed.

Be prepared for the payment amounts to increase to account for your time spent unemployed.

If you’ve found yourself truly unable to make anything work and simply cannot pay your child support, it is your responsibility to notify the court. Your child support order can only be changed upon your request for modification. A lawyer can help you file this promptly so you aren’t late on any payments.

In NC and SC, courts will usually allow you to amend your child support order if there has been a significant change in your financial standing since the order was issued. More specifically, these states require that your ability to pay must be diminished by 15% or more to qualify for child support adjustment. Modifications are usually made through mediation.

Consult With Qualified Child Support Lawyers in NC and SCIn any case, child support is all about your child’s best interests and courts always rule in favor of their needs. When you feel that you are no longer able to meet those needs, talk to one of our experienced attorneys. We’re available to answer your questions and help you with mediation if you qualify for a child support modification in NC or SC. Request a consultation today.

When you feel that you are no longer able to meet those needs, talk to one of our experienced attorneys. We’re available to answer your questions and help you with mediation if you qualify for a child support modification in NC or SC. Request a consultation today.

Liberty and Justice for Texas

Child support orders can be modified through a court hearing or through the CSRP (child support review process). The CSRP is typically faster than scheduling a court hearing and it works best when both parents can agree on the order.

Your child support order may be modified if:

- It has been three or more years since the order was established or last modified and the monthly amount of the child support ordered differs by either 20 percent or $100 from the amount that would be awarded according to child support guidelines; or

- A material and substantial change in circumstances has occurred since the child support order was last set.

IMPORTANT: The amount of child support you are ordered to pay can only be changed by obtaining a new court order. Informal agreements between custodial and noncustodial parents do not change the child support court ordered amount.

Generally, this means that at least one of these things has happened:

- The noncustodial parent's income has either increased or decreased,

- The noncustodial parent is legally responsible for additional children,

- The child(ren)'s medical insurance coverage has changed, or

- The child(ren)'s living arrangements have changed.

For some parents, military activation will mean a reduction in total monthly income. Being called to active duty is considered a material and substantial change in circumstances, and allows you to request a review of your child support order.

For some parents, military deactivation will mean a reduction in total monthly income or change in health insurance coverage for their child(ren). Returning from active duty is considered a material and substantial change in circumstances, and allows you to request a review of your child support order.

It is possible that your child support order could change to match your current income. If you are unemployed and have no source of income when our office reviews your child support order, we generally will calculate a modified child support amount that considers your past employment, your ability to work and earn an income, and the current federal minimum wage.

Noncustodial parents who lose their job or see their income decrease can complete a request for review and mail it to the office that is handling their case. Child Support Locations

Child Support Locations

IMPORTANT: Your child support ordered amount does not change until the court changes it. Keep making child support payments while your request for review is being processed.

Are you seeking employment? Check out our list of helpful web sites to find some employment resources available to you. In some instances, our office can provide a referral to the Texas Workforce Commission for assistance in finding employment.

Parents who have an OAG child support case can complete a request for review and mail it to the office that is handling their case. Child Support Locations

To apply for services, complete an online application. Parents must open a case with our office to request a review of their child support order.

Our office will need information about the noncustodial parent's income and health insurance coverage costs for the child(ren). Income information can include copies of pay-stubs, tax forms (e.g., Form W2) or a letter of intent to employ from a prospective employer that lists earnings.

Income information can include copies of pay-stubs, tax forms (e.g., Form W2) or a letter of intent to employ from a prospective employer that lists earnings.

Child support will be taken from your unemployment benefits through wage withholding. The Texas Workforce Commission withholds according to the child and medical support payment obligations. Up to 50 percent of the unemployment earnings can be withheld to satisfy the current monthly obligations.

If you were court ordered to carry medical insurance for your child(ren) but you are no longer able to carry medical insurance, then you can request a review of your child support order. There are several options for providing medical support for your child(ren), and our office can assist in modifying your medical support order to reflect your current circumstances.

For example: If insurance is available at a reasonable cost through the custodial parent, then a modification can be sought where you reimburse the custodial parent for your part of that coverage; or

If you find private insurance at a reasonable cost, your current medical support order can be modified to reflect that amount.

Generally, it is uncommon for temporary orders to be issued on child support cases processed by our office. However, because of the impact of the current economic downturn, our office is working with parents to issue temporary orders in some situations, as appropriate.

If a temporary order is issued by the court, our office will bring the case back to court at six months or when the noncustodial parent obtains new employment, whichever date is earliest. At that time, the case will be reviewed and a final order will be issued.

At that time, the case will be reviewed and a final order will be issued.

IMPORTANT: If a noncustodial parent fails to pay child support on a temporary order, an enforcement action will be taken.

If you are a noncustodial parent employed part-time, our office considers your past employment, your ability to work and earn income, and the current federal minimum wage to calculate child support. Ultimately, the court decides the actual amount of child support you will be ordered to pay.

In some instances the amount of child support ordered by the court is different (higher or lower) than the child support amount calculated by our office.

It is possible that the payments you are making on back child support be adjusted based on your new wages. Our office can review the child support arrears (debt) payment ordered by the court and determine whether the amount may be lowered through a modified (new) court order or by adjusting the wage withholding in place with your employer.

Our office can review the child support arrears (debt) payment ordered by the court and determine whether the amount may be lowered through a modified (new) court order or by adjusting the wage withholding in place with your employer.

IMPORTANT: Lowering the payment amount going toward child support debt may extend the time for a noncustodial parent to pay off his/her child support debt.

This is what we call an "interstate case." These cases can be complicated, so it is best to contact your local child support office for assistance. Generally, if the custodial parent lives in the state where the child support order was originally established, then the modification request will have to be made through that state.

There is no "average" or "typical" timeframe for modifications. Once our office receives your request for a review, we may need to obtain additional information from the other parent or other sources to complete the review process. Our office will work with both parents to schedule a Child Support Review Process (CSRP) where an agreed order can be worked out in the child support office. If an agreed order is not possible, the modification request will then have to be scheduled for consideration in court.

Once our office receives your request for a review, we may need to obtain additional information from the other parent or other sources to complete the review process. Our office will work with both parents to schedule a Child Support Review Process (CSRP) where an agreed order can be worked out in the child support office. If an agreed order is not possible, the modification request will then have to be scheduled for consideration in court.

IMPORTANT: The cooperation of both parents will significantly speed up the process.

Yes, it is possible that the amount of child support you are ordered to pay could go up. Modifications are based on the parent's current income. If you are making more money now than you were when the child support order was established or last modified, the court may increase the amount of child support you are ordered to pay.

Calculation of alimony the debtor does not work \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Calculation of alimony the debtor does not work

A selection of the most important documents upon request Calculation of alimony the debtor does not work (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of the spouses

- Alimony in 6-NDFL

- Alimony Alimony in a solid amount of

- Alimony of individual entrepreneur

- more ...

- Employment and employment:

- Alimony from the unemployed

- Vacant position on the staffing of

- A vacant position is

- Payments at the labor exchange

- Guarantees for pregnant women

- More...

Court practice : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days 2 days

Open the document in your system consultantPlus:

Selection of court decisions for 2020: Article 441 "Finding an application for applications for an application for an application for an application for an application for an application contesting the decisions of officials of the bailiff service, their actions (inaction)" Code of Civil Procedure of the Russian Federation

(LLC law firm "YURINFORM VM") Guided by Article 441 of the Code of Civil Procedure of the Russian Federation and establishing that alimony was collected from the administrative plaintiff for the maintenance of a minor child until his majority; on the basis of a court order, by a decision of the bailiff-executor, enforcement proceedings were initiated and a decision was made to calculate the debt on alimony, while the calculation of the alimony was made taking into account the partial payment of alimony and based on the fact that during the disputed period the debtor did not work, was not registered with the MCHN, the court justifiably refused to invalidate the ruling on the calculation of alimony arrears, taking into account information about the receipt by the plaintiff of a monthly compensation payment in connection with caring for a disabled disabled person, as well as the lack of information about his work activity and real income, having come to a reasonable conclusion about the legitimacy made by the bailiff-executor of the calculation of debt on alimony based on the average wage in the Russian Federation.

Register and get trial access to the ConsultantPlus system for free for 2 days

Open a document in your ConsultantPlus system:

Selection of court decisions for 2020 in the adoption of the CAC "Court issues" “Meanwhile, in violation of the requirements of Articles 226, 178, 180 of the CAS RF, these arguments of the administrative plaintiff were not checked by the court, they did not receive any legal assessment in the court decision, while they are important for the correct resolution of the present case, since by virtue of Parts 2, 3 of Article 102 of the Federal Law "On Enforcement Proceedings" the amount of alimony arrears is determined in the decision of the bailiff on the calculation and collection of alimony arrears based on the amount of alimony established by a judicial act or agreement on the payment of alimony, taking into account the amount of earnings and other income of the debtor for the relevant period of time and only to the extent In the second case, if the debtor did not work during this period of time or documents on his income were not submitted, the debt is determined based on the size of the average wage in the Russian Federation.

Articles, Comments, answers to questions : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Article the need to change the rules and practice of determining the amount of alimony for minor children

(Shelyutto M.L.)

("Law", 2018, N 6) and calculate child support based on estimated, not actual, income. It would seem that such an approach is similar to the rules on calculating the debt for alimony of a non-working debtor (as well as in the absence of information about the debtor's income) based on the average wage in the Russian Federation (clause 4 of article 113 of the UK, part 3 of article 102 of the Law on enforcement proceedings). However, the expected income is established by the court individually, depending on the personal potential of the debtor (his professional skills, qualifications, type of activity, earnings in previous years, health status, age, the presence of other barriers to employment or full employment, property security) and opportunities to receive income from taking into account these circumstances, as well as the local labor market. This is the amount of income that is reasonable to expect from the debtor in his particular circumstances.

This is the amount of income that is reasonable to expect from the debtor in his particular circumstances.

Register and get trial access to the ConsultantPlus system free of charge for 2 days

Open a document in your ConsultantPlus system:

Situation: How to collect child support from a non-working debtor?

("Electronic journal "Azbuka Prava", 2022) If the debtor does not work and has no other income (including if he is registered with the employment service, but does not receive unemployment benefits), alimony established as a share of income the bailiff calculates based on the size of the average wage in the Russian Federation at the time of collection of the debt on alimony, that is, on the day the bailiff issued the decision to calculate the debt. section "Statistics", then in the subsection "Official statistics" - the tab "Labor market, employment and wages" (clause 4 of article 113 of the RF IC; Letter of the Federal Bailiff Service of Russia dated 04. 03.2016 N 00011/16/19313-AP; Guidelines).

03.2016 N 00011/16/19313-AP; Guidelines).

Normative acts : Calculation of alimony debtor does not work

Register and receive trial access to the consultantPlus system free 2 days

Open the document in your system consultantPlis:

FSSP of Russia dated 04.03.2016 N 00011 / 16 / 19313-AP

"On the calculation of alimony arrears based on the average wage in the Russian Federation" In accordance with Part 3 of Article 102 of the Federal Law of 02.10.2007 N 229-FZ "On Enforcement Proceedings" (hereinafter referred to as the Law) and Article 113 of the Family Code of the Russian Federation, if the debtor obliged to pay alimony did not work or did not submit documents confirming his earnings and (or) other income, the alimony debt is determined based on the average salary in the Russian Federation at the time of debt collection.

How to collect alimony from the unemployed

If you are divorced and you have minor children, then the question arises about their maintenance, because the father (mother), who lives separately from the child, is obliged to participate in his upbringing and deduct alimony.

However, not all parents are responsible. Some deliberately do not pay alimony, referring to the lack of financial security, and then the money has to be collected through the court. If the parent (mother) is officially employed (on), then usually alimony is deducted from his (her) salary. But what if the father (mother) is unemployed (on)?

Family Law Attorney

Alexander Malik

Help collect child support

Sign up for a consultation: + 38 096 109 76 08

Is it possible to claim maintenance for the unemployed?

Yes, you can, because the lack of a permanent income does not dismiss the parent (mother) from supporting their child and providing him with a decent standard of living. In addition, a person can work unofficially, therefore, have a hidden income.

How to determine the amount of alimony if the parent (mother) does not work?

If a person does not officially work, the court will order alimony in a fixed amount of money. This means that the amount of alimony is fixed. By filing a lawsuit, you yourself prescribe the amount that is needed monthly to keep your child. But you can't just come up with that amount because you feel like it. You must justify why so much money is needed (for example, treatment or rehabilitation, etc.) and support this with evidence.

This means that the amount of alimony is fixed. By filing a lawsuit, you yourself prescribe the amount that is needed monthly to keep your child. But you can't just come up with that amount because you feel like it. You must justify why so much money is needed (for example, treatment or rehabilitation, etc.) and support this with evidence.

If you do not provide the court with evidence, or if there is not enough evidence, the court will order a smaller amount of child support. In this case, the court takes into account such factors as the state of health and financial situation of the alimony payer and the child, the presence of other children, disabled parents, the presence of movable, immovable property, intellectual property rights, funds, etc. in the alimony payer.

What is the minimum guaranteed and minimum recommended support amount?

The minimum guaranteed amount of child support is determined according to the age of the child and cannot be less than 50% of the living wage for a child of a certain age. For example, in 2022, the cost of living for a child under 6 years old is as follows:

For example, in 2022, the cost of living for a child under 6 years old is as follows:

- from January 1 to June 30, 2022 - UAH 2100;

- from July 1 to November 30, 2022 - UAH 2201;

- from December 1 to December 31, 2022 - 2272 UAH.

This means that the minimum guaranteed amount of maintenance for a child under 6 years old will be as follows:

- from January 1 to June 30, 2022 - UAH 1050;

- from July 1 to November 30, 2022 - UAH 1100.5;

- from December 1 to December 31, 2022 - 1136 UAH.

For children aged 6 to 18, the minimum guaranteed amount of alimony will be as follows: 1309 UAH (01.01 - 06.30.2022), 1372 UAH (01.07 - 30.11.2022), 1416.5 UAH (01.12 - 32.1).

Therefore, if the parent (mother) does not work, then the amount of maintenance cannot be less than the minimum guaranteed amount.

The minimum recommended amount of alimony is determined by the court if the alimony payer has sufficient earnings. This amount is equal to the subsistence minimum for a child of a certain age.

This amount is equal to the subsistence minimum for a child of a certain age.

However, even if the father (mother) is unemployed (on), the court will still investigate his (her) expenses. And if the expenses exceed the monthly income (for example, an apartment, a car, etc. was purchased), but he (she) cannot prove the source of the funds, the court takes this into account when determining the amount of alimony.

Family Lawyer in Vinnitsa

Call +38 096 109 76 08

I will advise. I'll take care of your business. I will protect your rights

Can I claim unemployment support?

Yes. If a parent (mother) is registered with an employment center and receives social assistance, then alimony is collected from her.

Is it possible to collect alimony for the time when the payer did not work?

Yes. If the child support payer was unemployed when the debt arose, but is now officially employed, then the debt will be paid from the wages he receives now.